Learn to Invest in the Stock Market with our FREE Courses

Wall Street Survivor gives you the tools you need to learn to invest.

Register for FREE and get a virtual $100,000 in a brokerage account, and read through our short, concise stock courses to help you learn the basics. Then practice trading while you learn. If you are looking for a bit more instruction, try our free investing course for beginners site at Investing101.net

As seen on:

Learn How to Get Started Investing in Stocks for FREE!

Why invest in the stock market? Because it’s the only way to build real wealth over time. Start educating yourself by reading our free stock market courses. It’s easier than you think!

Investing Basics

These courses will help you skip the rookie mistakes, so you know how and where to buy your first few stocks.

Beginner Investing: 10 Steps to Start Investing the Right Way

Don’t know where to start? Follow these 10 steps to get your finances on track today.

Stock Market for Beginners

What happens when you click “buy”? We strip away the noise and explain how the market works.

Stocks for Beginners

Don’t be afraid of stocks. We’ll show you proven and safe strategies for building your first portfolio.

Best Stock Broker for Beginners

We reviewed the top brokers so you can pick the one that fits your style and start investing today.

The First Stock Everyone Should Buy

Skip the hours of research. Here is the most reliable way to start growing your money.

How to Invest with Little Money

Stop waiting to be “rich enough.” Here is how to start investing, even on a tight budget.

Stock Market Terminology

We explain the vocabulary of Wall Street in plain English so you stop feeling lost.

How to Pick Stocks for Beginners

How do you know if a stock is a “good” buy? Learn how to filter the winners from the losers.

Best Dividend Stocks

Want to get paid just for owning a stock? Learn how dividends work for passive income.

Beyond the Basics

You’ve made your first trade. Now learn the specific strategies and assets Wall Street pros use to build wealth that lasts.

Dollar Cost Averaging Explained

Stop trying to time the market—you will lose. Use this simple strategy to turn market volatility into your friend.

The Truth About Mutual Funds

Instant diversification sounds great, but hidden fees can eat your profits. Learn the pros and cons before you buy in.

What are Bonds and How Do they Work?

Stocks are for growth, but bonds are for stability. Learn why smart investors use debt to protect their capital from crashes.

Socially Responsible Investing

You don’t have to invest in things you hate. Here is how to build a portfolio that aligns with both your values and your financial goals.

How to Invest like Warren Buffett

You don’t need a high IQ to beat the market. You just need patience and the specific habits that made Buffett a billionaire.

Value Investing for Beginners

Stop chasing the hype. Learn the contrarian strategy of buying high-quality companies when everyone else is panic selling.

What are Discounted Cash Flows?

Price is what you pay; value is what you get. We explain the formula pros use to calculate what a stock is actually worth.

When to Sell Your Stocks

Buying is the easy part. Learn the specific exit strategies that lock in your gains and limit the damage during a downturn.

How to Trade Crypto Safely

Curious about crypto? We explain how to spot the scams and trade volatile coins without losing your shirt.

Advanced Investing Strategies

You know the basics. Now let’s look under the hood to see how to go beyond surviving Wall Street to thriving on it.

How to Read a Balance Sheet

Here is how to check the financial health of a business so you don’t get caught holding the bag.

How to Read Cash Flow Statement

Discover the secret to analyzing a company’s ability to survive hard times and fund future growth.

Income Instatement Example

Stocks are for growth, but bonds are for stability. Learn why smart investors use debt to protect their capital from crashes.

What are Stock Market Bubbles?

History is full of booms and busts. Learn how to keep a cool head and protect your hard-earned money while others are panic selling.

How to Make Money When Prices Drop

We explain the mechanics of “Short Selling” and how investors bet against companies. Warning: not for beginners!

Option Trading for Beginners

Used correctly, options can actually protect your portfolio from losses. We explain, Puts, Calls & how to trade them safely.

Stock Charts: Technical Analysis & Trading Patterns

We explain the visual patterns traders use to predict where a stock price might move next.

Penny Stocks

We expose the dangers of the OTC markets so you don’t get scammed by “pump and dump” schemes.

How to Invest in Gold & Silver

We break down the pros and cons of each metal so you can diversify into precious metals

Personal Finance

Take control of your financial life by learning how to manage debt, boost your income, and secure a wealthy future.

How to Pay off Debt

Break the debt spiral for good. Learn to hold yourself accountable, tackle your biggest expenses, and boost your income to achieve financial freedom.

How to Earn Passive Income

Whether you have capital to invest in real estate or just a talent for photography, there is a passive income strategy here that can help you stop trading time for money.

How much Money to Save in Your 20s

Stop wondering where your paycheck went and start building real wealth with the simple rule that balances paying bills, investing, and actually enjoying your life.

How to Earn Money as a College Student

From flipping thrift store finds to hacking credit card rewards, learn the smart ways to pad your bank account while you’re still in school.

How to Retire a Millionaire by 40

The path to a seven-figure nest egg isn’t paved with easy choices, but you can successfully quit the rat race while you are still in your prime. Here’s how.

How to Plan for Retirement

Build a fail-proof retirement plan with guaranteed income by comparing top US annuity providers to find the perfect fit for you.

How to Use Debt to Your Advantage

Is all debt bad? Not if you know how to play the game. Find out how savvy investors use margin and mortgages to turn borrowed money into profit.

How to Refinance Your Student Loans

Don’t let high interest rates dictate your future. Explore how to refinance your student loans step-by-step and start keeping more of your hard-earned money today.

How Much Life Insurance Do I need?

From term to whole life, discover which policy fits your goals and see how much coverage you really need to secure your loved ones’ financial future.

Learn the Stock Market Basics

Our stock market courses follow a unique multimedia teaching approach. We created a few short, informative videos for each of the free investment courses to keep your learning experience as enjoyable and engaging as possible. And then we provide actionable tips to help you make more money in the stock market like our reviews of the best stock market services like these:

- Take advantage of Robinhood’s free stock promotion and learn how to get up to $1,700 when you open a Robinhood account.

- See is the Motley Fool is worth it for a year of their stock picks for only $79

- Read our reviews of the best stock newsletters to find the best stock picks. HINT: One stock service has outperformed ALL others for 4 years in a row!

Practice Trading

In addition to the Wall Street Survivor stock market game, you’ll also be able to make trades from within a stock market investment course! With a virtual $100,000, buying and selling stocks risk-free in one of our stock trading courses for beginners is the best way to build confidence before investing in the real markets.

Master Our Finance and Investment Courses

Saving sucks. It’s a lot like dieting. It takes a bunch of discipline and a whole lot of sacrifice. If you stick to the plan, though, you will see results. It’s inevitable. Once you understand the power of compound interest, once you reap those long-term stock market returns… you’ll be transformed.

- Option Trading for Beginners

- Short Selling – Growing Your Portfolio on Falling Prices

- Stocks for Beginners

- Beginner Investing: 10 Steps to Start Investing the Right Way

- Dollar Cost Averaging Explained

- How to Pick Stocks for Beginners

- Stock Portfolios Explained (And How to Build Them)

- How to Invest with Little Money: Is It Possible?

- Stock Market for Beginners: Here are the Basics

- Millionaire Crash Course

- Socially Responsible Investing

- How to Value a Stock

- How to Invest Your First $1000

- Value Investing for Beginners

- Stock Ratings: How to Know What Stocks to Invest in

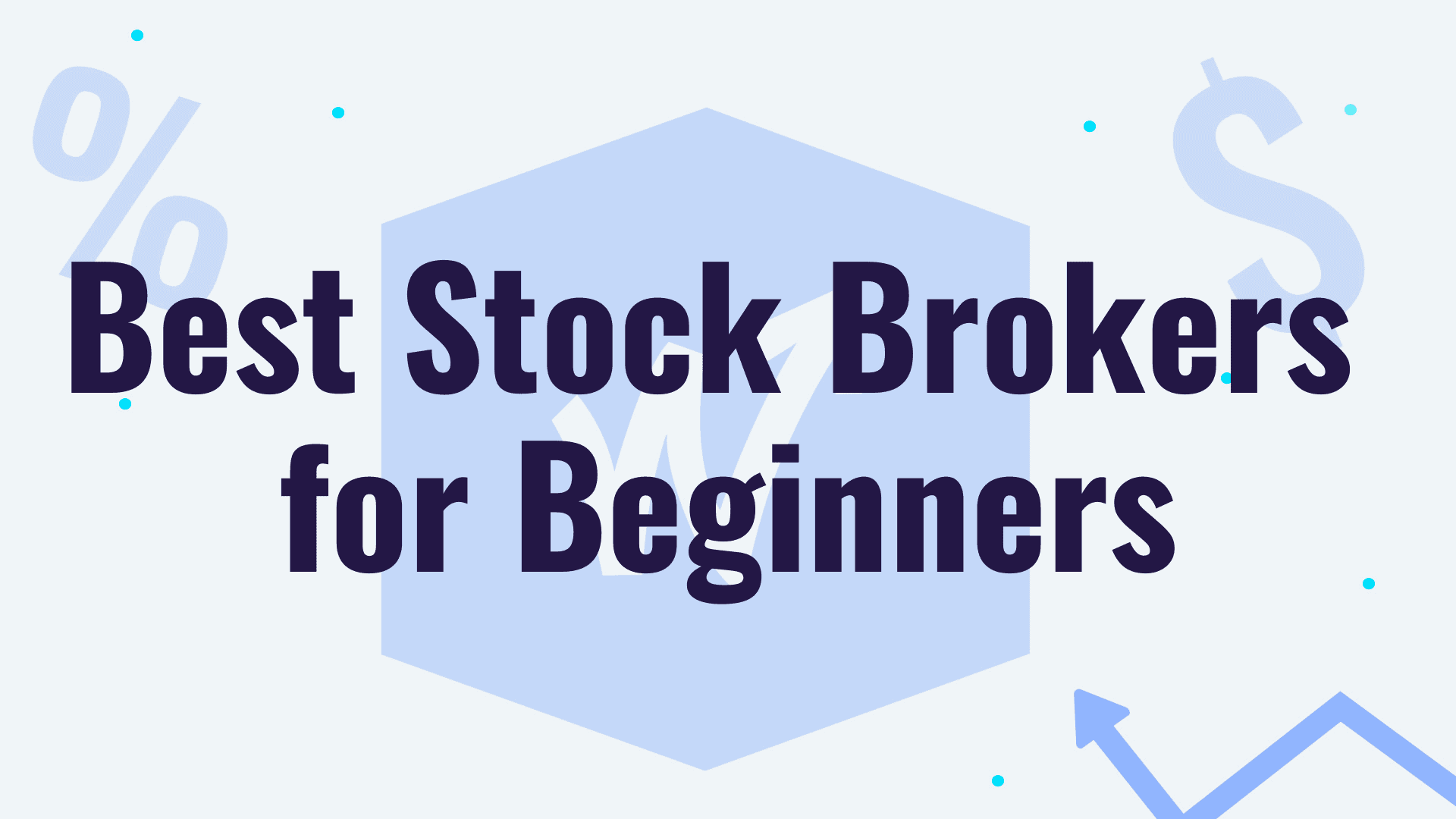

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | February SALE: SAVE $50 NOW |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||