SeekingAlpha.com promotes itself as “the world’s largest investing community powered by the wisdom and diversity of crowdsourcing.”

Since their launch in 2004 they have become one of the most popular stock research sites with over 20 million visits per month. Given that amount of growth and traffic, it’s safe to say they’re doing something right.

I was a free member of Seeking Alpha for over 10 years before upgrading to Seeking Alpha Premium in 2020.

I also became a subscriber to their stock recommendation service “Alpha Picks” when that was launched in July 2022. This Alpha Picks service has done so well that I started buying every one of their picks and I will show you some of these trades in my Etrade account below.

In this review, I’ll explain both of these premium services in detail and share my experience with each. This will help you answer the question of whether Seeking Alpha is worth it.

Hint: We just updated our rankings of the best performing stock newsletters for 2025. Seeking Alpha is ranking as the best stock performing newsletter over the last 3 years of ALL the newsletters we follow. It also ranked #1 for its 2024 picks.

For starters, you need to know that Seeking Alpha’s analytical model “Quant Rating” was recently validated by finance professors at the University of Kentucky:

Academic Study of Seeking Alpha’s Quant Rating: An April, 2024 independent study by professors at a major university found that Seeking Alpha’s proprietary rating system Seeking Alpha Quant Ratings “strongly predict” future returns and offer “pronounced benefits” to investors.

Dr. Jame and Ph.D. Candidate Yuling Guo, Gatton College of Business & Economics, University of Kentucky

That’s impressive as I don’t recall ever seeing an academic study support any stock recommendation service.

Like most sites these days, some of Seeking Alpha’s information is available for free; but the valuable information like their Quant Rating and the ability to link your portfolio is only available to paid or Premium users.

They have 3 paid products. Here is a brief summary of each:

- Seeking Alpha Premium — This was their first paid service and allows you full access to all of their features, including their proprietary “Quant Rating” on any stock you choose. You can also link your brokerage account so that when you login to Seeking Alpha Premium you can see the Quant Rating on all of your stocks AND get alerts when the Quant Ratings drop. I have found this service to be super valuable to help me get out of positions before they start to decline in value. Keep reading to learn more about this “Quant Rating” and see their “proof” that it is a very reliable indicator, and see the research by the University of Kentucky professors verifying the Quant Rating works. This Seeking Alpha Premium service is for investors who want to do their own stock research and better manage their own stock portfolios.

- Seeking Alpha Pro — This is Seeking Alpha’s top-tier paid service designed for experienced and serious investors. You’ll get access to all Premium features, plus coverage from analysis and access to top analyst insights, both extremely helpful if you’re looking for expert analysis. You’ll also get daily access to upgrades and downgrades to help you stay on top of changes in the market. Finally, you’ll get access to short ideas from Seeking Alpha analysts.

- Alpha Picks — This service is their stock recommendation newsletter service for those investors that are looking for ideas of stocks to buy. It is for people that don’t want to do their own research on stocks and would rather just get specific stock recommendations and analysis.

- Twice a month they release a stock recommendation that has one of their highest “Quant Ratings.”

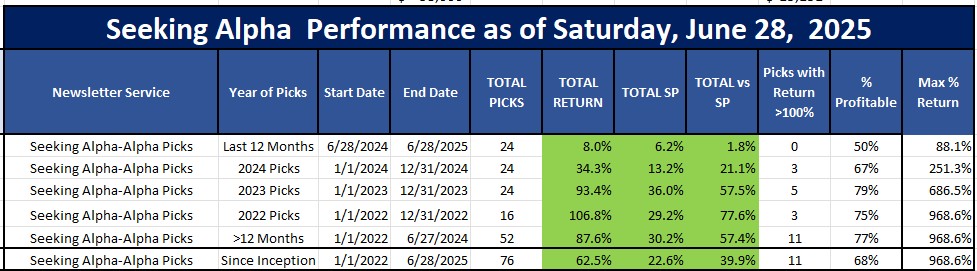

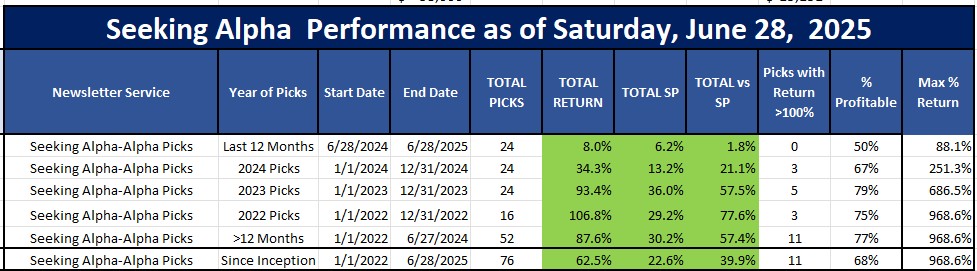

- This service is performing extremely well since its launch (see the ALPHA PICKS’ PERFORMANCE chart below) and is easily beating the S&P 500.

- In just 3 years, 11 of their 74 stock picks have doubled or more:

- 1 (SMCI) was picked and sold when it was up over 900%

- Their APP pick (November 2023) is already up 686%

- CLS is up 459% since October 2023

- MOD was sold after 20 months with a 348% return

- POWL is up over 290% since May 2023

- STRL is up 271% since August 2023

- MHO was sold for a 228% return

- EAT is up 251% in just 12 months

- MHO was sold with a 228% profit

- UBER is up 144%

- RCL is up 140% in 15 months

- SFM is up 118% in just 11 months

- They have sold 37 of their 74 picks

- And 70% of all these picks have been profitable

The Seeking Alpha platform is powered by information, ideas, research, analysis, and opinions crowdsourced from its users.

This means that their users submit their thoughts and research on U.S. stocks, ETFs, mutual funds, commodities and cryptocurrencies. But this is no simple “message board” – their posts are well thought-out, detailed research reports that are reviewed by the Seeking Alpha editorial staff to make sure the content passes a quality review.

They have over 7,000 writers and publish 10,000 stock opinions per month. Each author is carefully vetted by the Seeking Alpha team to make sure that they are credible and don’t have any conflicts of interest with the stocks they’re discussing.

In addition to all their crowdsourced stock research, Seeking Alpha also provides a variety of stock ratings. These ratings include a Quantitative Analysis Rating, a Seeking Alpha Author Rating, and a Wall Street Rating. These ratings have proven to be valuable at predicting future performance. But here’s the catch. The Wall Street Ratings are available to free members, while the Quant and the Author Ratings are only available to Premium members.

I have become such a believer in Seeking Alpha that I started buying every Alpha Picks each month in my ETrade account. My personal results of these trades, which I share below, gave me proof that their model works, just like the academic study found. Keep reading our Seeking Alpha review 2025 to get all the information you need to choose the right Seeking Alpha subscription for your needs.

Seeking Alpha Paid Services Summary

Here’s a quick comparison of the major characteristics of the two services and their bundle:

| Seeking Alpha Premium | Alpha Picks | Seeking Alpha Bundle | |

|---|---|---|---|

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type & Strengths | Full access to all their research; link your brokerage account to get Quant Ratings on your stocks and alerts of when to sell. | 2 stock picks a month that have highest Quant Rating and most likely to outperform the market. | Includes both services. |

| Strengths | Strong Buy Quant Rating stocks have 5x the market since 2010. Quant Rating now verified by academic study. 250,000+ Premium members. | Beating the market by 40% in just 3 years; 11 picks have already doubled; 70% of picks are profitable. Quickly sell losers as half of picks have already been sold. | Get both to monitor your portfolio & get the best picks to buy. |

| Best for | Self-directed investors who want to easily optimize their portfolio’s return. | Investors wanting specific stock recommendations each month. | Both. |

| Retail Cost | $299 a year | $499 a year | $798 a year |

| Current Promotion: | July, 2025 Sale: Save $30, get 7-day free trial | July, 2025 Promo: Save $50 & get access to all their recent stock picks. Next pick comes out July 30th. | July, 2025 Promo: Get Premium AND Alpha Picks for just $639 |

| Link to Promo Page: | Save $30, get 7-day FREE trial to Alpha Premium on THIS promo page. | Save $50 on Alpha Picks on THIS promo page. | Try Both and save $159 now. |

Act Today; Offer Ends Soon

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They are currently offering a big discount that only runs for a limited time.

Here's you chance to get free trial, save 10% AND get their Top Stocks for the 2nd Half of 2025 report.

- 7 Day Free Trail & Save $30 on Seeking Alpha Premium; usually

$299now only $269/year — Learn more.- Save $50 on Alpha Picks; usually

$499now only $449/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

My Favorite Seeking Alpha Premium Tool

As mentioned above, I subscribe to both of these Seeking Alpha services, and many more from other stock services. I don’t plan on canceling either of my Seeking Alpha’s subscriptions any time soon. For me, both Seeking Alpha Premium and Alpha Picks are absolutely worth the membership fee.

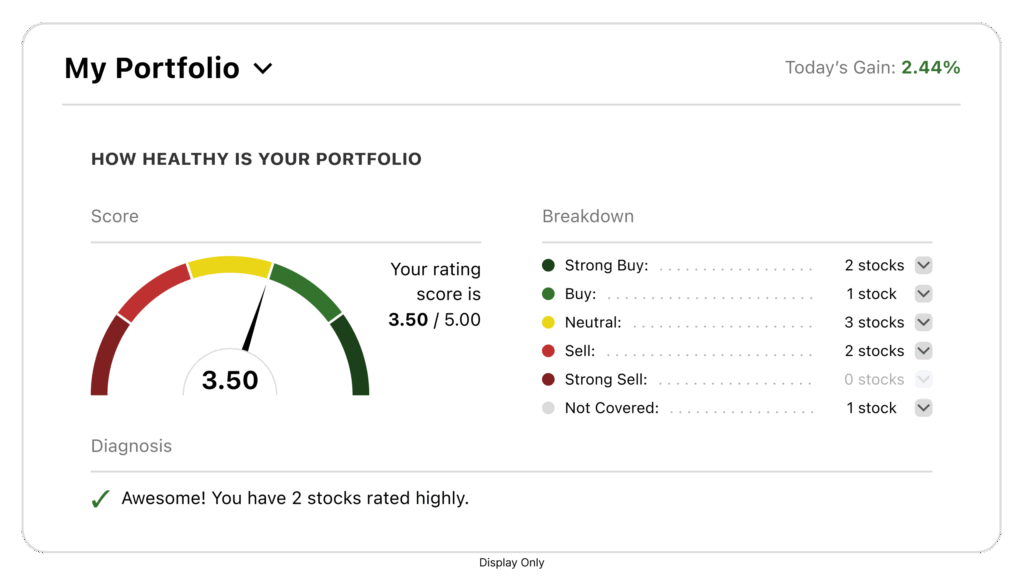

My absolute favorite tool is this My Portfolio feature that summarizes the Quant Ratings on my stocks.

I use Seeking Alpha Premium to link to my brokerage accounts and now I am able to monitor the Quant Rating on all of my stocks in one quick snapshot. This is how I get alerts to sell, or at least put stop-loss orders, on the stocks in my portfolios when their Quant Ratings drop to Sell or Strong Sell. It looks like this…

The second reason is that I have had great success buying their Seeking Alpha Picks too and they are easily beating the market as I will show you in various ranking tables.

How Does Seeking Alpha Perform?

Now, let’s break down Seeking Alpha’s performance and see how Seeking Alpha stock picks have performed.

Stock Picks Recent Performance

Let me get right to the key data that most of you want to know–Will Seeking Alpha help you make more money in the stock market?

The week ending June 29, 2025 saw their 76 picks from 2022-2025 reach an average return of 63% vs 23% for S&P500 (so their picks are beating the market by 40% in just 3 years). Their recent picks of SFM, EAT, MOD, APP, CLS, ANF, POWL, and STRL all surged in recent weeks. Yes, they recommended SMCI in November 2022 when it was only $85 and then sold it when it was over $900.

What is really impressive is that their 52 stock picks that are at least 12 months old are extremely profitable as they are up 88% and beating the market by 57%.

So between their marketing data, the University of Kentucky study, and my personal experience, it seems their “Quant Rating” is definitely valid and working to help find stocks that are most likely to outperform the market (AND telling you which ones to avoid).

Or more specifically, how are the top Quant Rated stock picks performing lately?

Like I said above, I subscribe to a both of their services. Alpha Picks was launched in July, 2022 and this service releases 2 stock picks a month–on the 1st and the 15th of each month. Here is my summary of Alpha Picks’ recent performance as of June 28, 2025 (yes, I try to update this weekly or at least monthly).

As you can see above, Seeking Alpha’s Alpha Picks are doing exactly what they are supposed to do. They are up 62% and providing EXCESS return (ALPHA) of 40% which means they are easily beating the S&P500 and all the other newsletters and most mutual funds over this time period. In fact, since inception, they are almost tripling the SPY return.

What this means is if you saved $1,000 a month and bought just $500 of each of those 76 picks your $38,000 would now be worth $61,734. If you bought the SPY ETF you would have only $46,583.

So Alpha Picks gave you a profit of $23,734 and an EXCESS profit OVER the SPY of $15,151 in just 35 months on your $1,000 a month investment. No other newsletter comes close to this.

So is Alpha Picks worth $499 a year? The answer is YES–as long as you are investing at least $200 a month and investing equal amounts in each of their stock picks you should build a portfolio that beats the market.

Notice that any way I look at the Alpha Picks’ performance–by results of their last 12 months of picks, their 2024 picks, by their 2023 picks, by their 2022 picks, and by picks at least 12 months old….their picks are profitable AND they are easily beating the market. ELEVEN of these picks have already doubled; and picks at least 12 months old have an average return over 88% and are BEATING the market by over 57%. These picks are almost tripling the SPY.

Also, they have sold 37 of their stock picks already. Several because of acquisitions and several as stop losses.

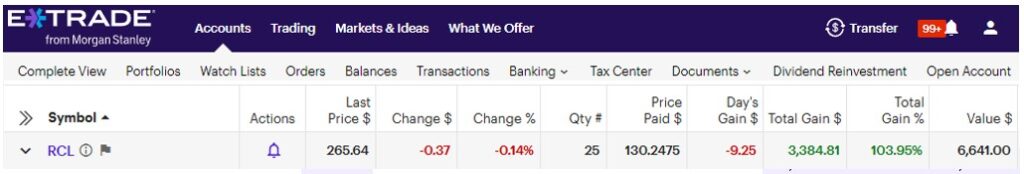

Their picks are doing so well, I started buying about $1,500-$3,000 of each of their Alpha Picks. Here is my ETrade account (June 27, 2025) with their RCL pick that is up 103% for me since they recommended it in March 2024. I have a $3,384 profit already on my $3,000 investment. So is it worth $499? Since their picks are easily beating the market the answer is clearly ‘yes’.

And here is another trade I made based on a Alpha Picks recommendation. Here I am up 357% with a $7,028 profit on a $1,700 investment I made in October, 2023.

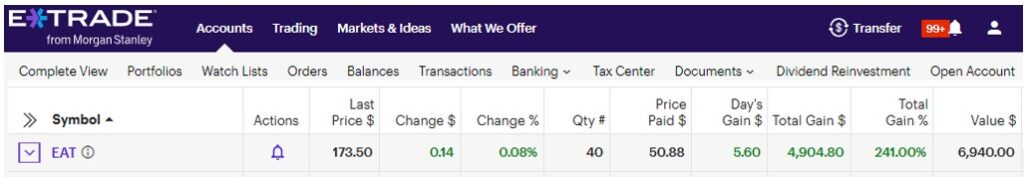

Here is another screenshot of my ETrade account just to prove it. Their EAT pick from April 2024 is up 241% (June 7, 2025) for me for $4,904 profit on a $2,000 investment in just 13 months.

My favorite feature of Seeking Alpha, and the reason their Alpha Picks are doing so well, is their Quant Rating. This is their key component (ie, their “secret sauce”) of both of their paid services. This is why it is worth paying for. What’s so special about it?

How Does Seeking Alpha Compare to Other Newsletter Services?

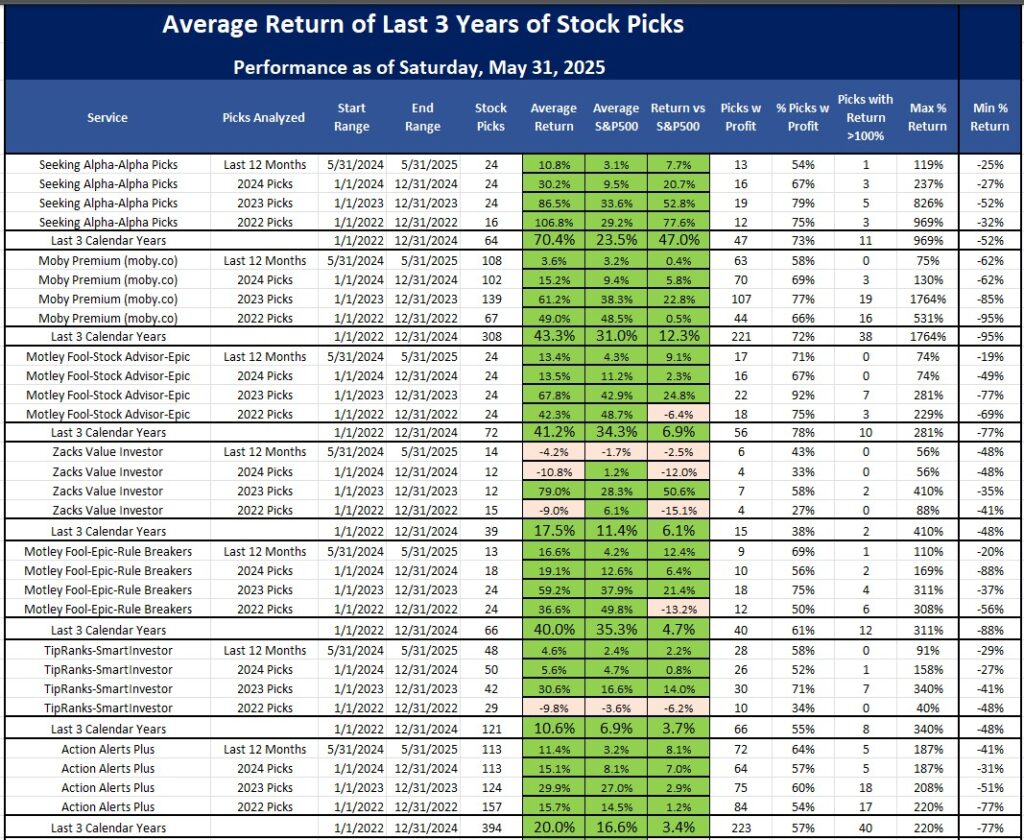

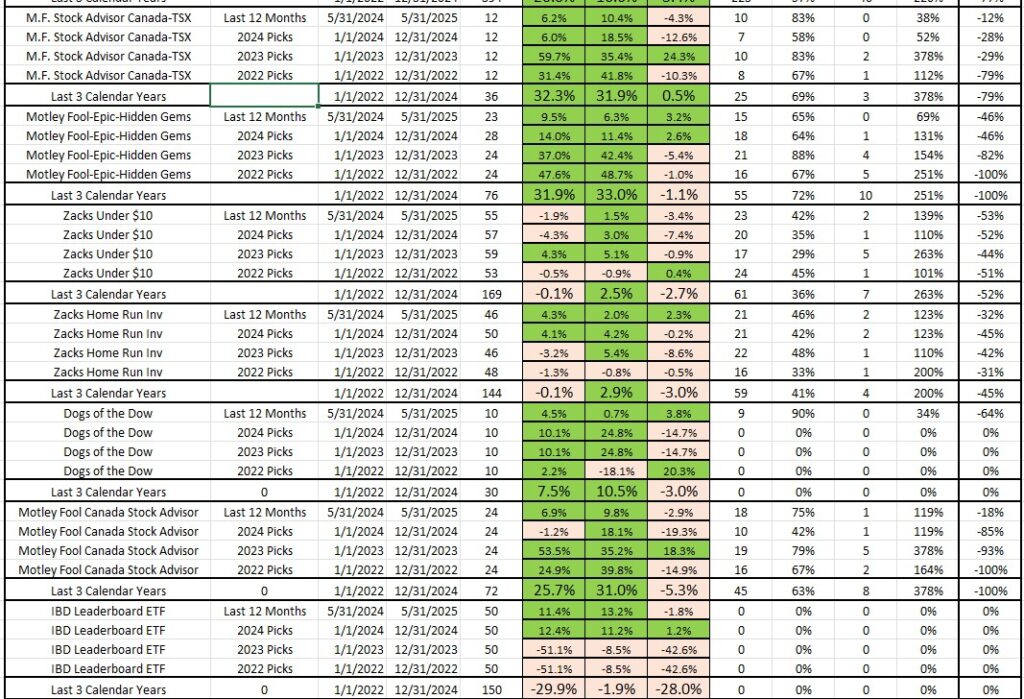

You may be asking yourself “well, that is impressive, but how are they doing against other stock newsletters the last 3 years?”

I asked myself that too. And here is my analysis of a dozen services that I subscribe to, as of the date below, ranked by average performance vs the S&P over the last 3 years.

I am getting more and more confidence in their Quant Rating because of its consistent performance, especially compared to other popular services.

If you’re interested in learning about how Seeking Alpha stacks up against Benzinga Pro check out our article Seeking Alpha vs Benzinga Pro!

Here is my analysis of all my newsletters based on performance through the date below for their 2022-2025 stock picks listed in descending order of average return of all their picks from over the last 3 years:

So, as you can see, not only is Seeking Alpha’s Alpha Picks easily crushing the market, on average, for the last 3 years, they are also beating their nearest competitor by a WIDE margin.

Their picks are outperforming the Motley Fool, Moby, Zacks, Cramer’s Action Alerts Plus, Investors Business Daily, TipRanks, and even the Dogs of the Dow strategy.

Based on this data, it appears that Seeking Alpha’s Quant Rating really works.

If you are unsure about how Seeking Alpha actually works and how to best use it, check out my latest article on how to use Seeking Alpha for beginners.

Seeking Alpha Quant Rating Back-Tested Results

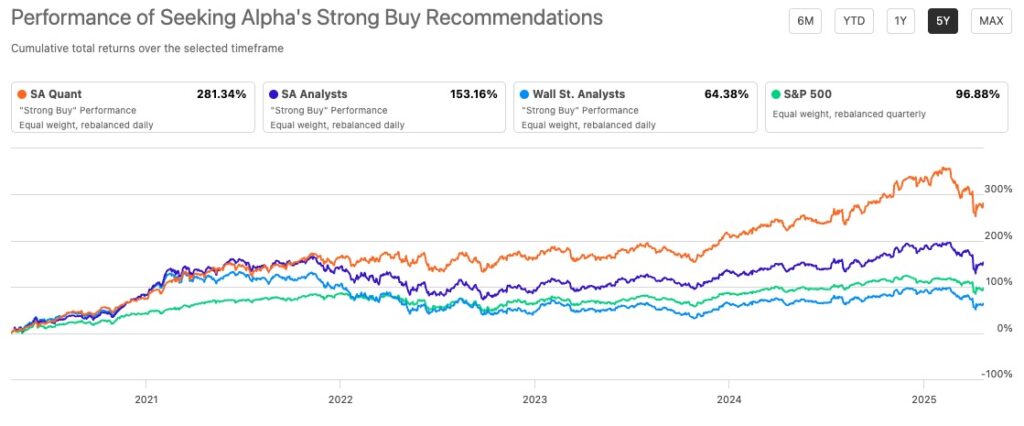

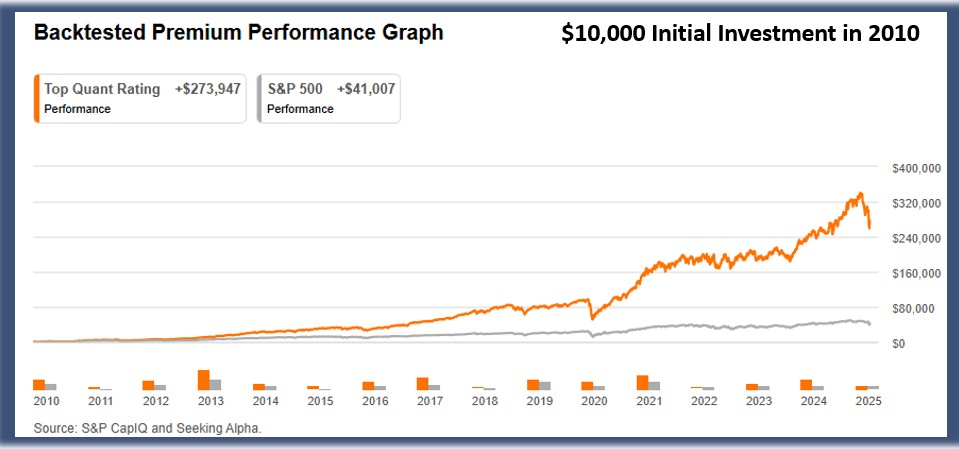

Here’s the most compelling data point about Seeking Alpha Quant Rating. Since 2010, stocks that have had their “Strong Buy” rating have outperformed the market by nearly 5x. (If you want to do a deep, deep, deep dive into this read our Seeking Alpha Quant Rating Review).

Do you see that? Investing just $10,000 in Seeking Alpha’s Strong Buy stocks would give you a $277,019 Total Return in mid October, 2024 compared to the S&P 500’s return of $57,238. That is almost a factor of 5x the market’s return; and an average annualized return of 26%.

Here’s another analysis that I found on the Seeking Alpha site “proving” the value of their Strong Buy Quant rated stocks as of April 23, 2025. Over the last 5 years, including the crazy start to 2025, their Strong Buy stocks are up 281% vs the market’s 96%.

And this is exactly what I am experiencing with their Seeking Alpha Picks subscription service.

From their webpage, they explain their Quant Rating system as follows:

- Seeking Alpha’s ‘Strong Buy’ quant ratings are the result of powerful computer processing and our special ‘Quantamental’ analysis.

- From nearly all U.S. securities, our quant algorithm picks stocks with the strongest collective value, growth, profitability, EPS Revisions, and price momentum metrics vs. the peer sector.

- These attributes are assigned grades that are then weighted to maximize the predictive value. The best stocks are awarded a ‘Strong Buy’ rating.

- Over the last 14 years, the backtested strategy has delivered very impressive returns, beating the S&P 500 every single year.

- What’s more, if we look at the performance since inception (December 2009 onwards), our ‘Strong Buy’ stock picks have delivered a staggering return, as you can see above.

But I’m getting ahead of myself. I provide more information on Quant Ratings below, but let me backup for a minute first and tell you why I think Seeking Alpha is worth it and provide more context about Seeking Alpha’s platform.

Features of Seeking Alpha Premium

Seeking Alpha Premium is essentially the “upgraded” version of the platform’s Basic membership.

You get access to lots of features you don’t get with a basic plan, plus extra capabilities on other features.

What You Get with Seeking Alpha Premium

Here are some of the highlights of the features you’ll get if you pay for Seeking Alpha Premium.

Top Rated Stock Screeners

The Top Rated Stocks screener is a special tool for Premium users that automatically finds you the most promising stocks by applying filters for the best quant ratings, Seeking Alpha author ratings, Wall Street analyst ratings, and several factor ratings.

When you use the Top Rated Stocks screener, you’re getting evaluations of a stock from three different perspectives, all with different motives and methods.

Seeking Alpha authors are independent investors who spend hours searching through news and financial statements in order to get a good read on the fundamentals of a stock.

Wall Street analysts are financial professionals who have access to expensive tools and research that help them build thorough financial models such as discounted cash flow (DCF) models that can provide a good estimate on the valuation of a company.

The quant, or quantitative analysis, system is an objective, unemotional stock evaluation system that is executed entirely through computer algorithms.

When you have a stock that is rated highly by all three of these sources, it will appear on the Top Rated Stocks screener, making it easy to know that you can be confident in the stocks on the list!

Market Analysis and Earnings Call Transcripts

With a Premium subscription to Seeking Alpha, you can read transcripts and listen to audio recordings of earnings and conference calls for stocks that aren’t covered anywhere else.

Earnings calls help us see if there were any surprises by comparing the last quarter’s earnings to what they were expected to be.

We can also use information given in earnings forecasts to make educated guesses on whether a stock’s price will rise or fall.

Dividend Grades & Metrics

Seeking Alpha has its own unique dividend grading system that helps you evaluate the strength, growth, and reliability of a stock’s dividend.

Dividend Grades give you a different score for a company’s dividend safety, growth, yield, and consistency.

If you’re looking to balance your portfolio out with a big-name, dividend producing company, or you want to pursue an income investing strategy, Seeking Alpha’s dividend grades can get you there.

Stock Comparison Tool

Seeking Alpha’s quant system has a stellar history of beating the market, making it a valuable tool for deciding which stocks to invest in.

The Seeking Alpha quant system gives stocks a rating based on value, growth, profitability, momentum, and EPS (earnings per share) revisions.

With a Premium subscription, you can see all quant ratings and underlying metrics that determine what quant rating stocks receive. They’re a useful tool when comparing stocks and work well with Seeking Alpha Premium’s comparison tool, which allows you to compare 7 different stocks at the same time.

This level of depth is extremely useful if you have a specific investing strategy in mind and you want to get to the bottom of a stock’s quant rating.

Let’s say you want to add an up-and-coming tech stock to your portfolio, but you’re stuck between a few different options.

Seeking Alpha will let you compare stocks side-by-side to help you decide which stock is the best by whatever standard is important to you.

You can compare a stock to its peers as well as a stock’s Wall Street ratings vs. its Seeking Alpha ratings.

Verified Performance History & Data Accuracy

Based on the fact that their “Strong Buy” rated stocks have drastically outperformed the market by 5x, the answer is absolutely YES, they are definitely worth it and providing the “alpha” they promise. My personal experience of buying their Alpha Picks stocks confirms it.

If you want to buy stocks that are mostly likely to outperform the market, and avoid those stocks that are likely to underperform, then YES, it is definitely worth it.

Pros and Cons of Seeking Alpha (Compared to Competitors)

Here are some Seeking Alpha pros and cons to assist you in your investment research comparison to find the best stock research tools.

Some of Seeking Alpha’s key competitors include Morningstar, Motley Fool, and Zacks. Here’s how they compare.

| Seeking Alpha | Morningstar | Motley Fool | Zacks | |

|---|---|---|---|---|

| Cost | $299/yr (Premium) | $249/yr | $199/yr | $495/yr |

| Features | Stock screeners, Quant ratings, expert analysis, verified results | Watchlists, stock screeners, independent analysis, ratings, active investor community | 2 stock picks/month, watchlists, screeners, monthly rankings, analysis, and news | Access to Zacks Rank, up-to-the-minute news & prices, weekly market analysis. |

| Picks | Quant “Strong Buy” picks consistently outperform the market | Based on undervalued stocks; results are mixed and not as good as other services. | Picks consistently outperform the S&P 500 | Picks based on earning surprises; historically have performed well |

| Research | Verified and in-depth | Independent and verified research | Access to up-to-the-minute news, financials and more | Current news and market prices; expert analysis |

| User Experience | Easy-to-use interface; strong customer support | Users have noted an array of technical issues and the interface may be confusing for beginners | User-friendly interface, strong customer support | Interface could be less cluttered and more beginner-friendly |

Here are some pros of Seeking Alpha to consider:

- Top-notch portfolio management tools make it easy to keep an eye on your investments

- Interface is easy to use and beginner-friendly

- Active community is a great resource for investment advice

- Quant ratings are reliable and useful when choosing investments

- The service is affordable compared to some other stock picking and research services

A few potential cons to keep in mind:

- The volume of information may be overwhelming to some

- User analysis is not always vetted

Who Should Subscribe to Seeking Alpha?

So, who should use Seeking Alpha? Is Seeking Alpha good for beginners?

Mostly, it’s long-term investors, active traders, and dividend investors. If you want to dig into the research, get access to investing tools for traders, and join an active community, then Seeking Alpha will be a good choice for you.

On the other hand, if you’re a casual investor, someone who doesn’t want to get into the weeds with research, or a passive ETF holder, then you probably won’t get enough value out of Seeking Alpha to make the cost of a subscription worthwhile.

Real User Reviews and Testimonials

We always like to look at online reviews before spending money, so let’s look at some Seeking Alpha user reviews, aka, real investor opinions on Seeking Alpha.

Seeking Alpha gets:

- Capterra: 4.3 out of 5 stars

- Apple Store: 4.8 out of 5 stars

- Trustpilot: 3.9 out of 5 stars

Some of the things that users praise include Seeking Alpha’s research tools, charting options, active community, and in-depth analysis.

Some reviewers took issue with slow customer service response times (although many had good experience), a less-than-ideal portfolio linking process, and the fact that it can be challenging to separate truly expert analysis from user analysis that isn’t vetted.

How Much Does Seeking Alpha Cost?

The cost of Seeking Alpha is something you’ll need to consider. Is the Seeking Alpha premium price worth it?

- Basic: Free, comes with limited features

- Premium: $299 per year

- Alpha Picks: $499 per year

- Bundle (Premium + Picks): $798 per year

- Pro: $2,400 per year

If you’re a new investor and looking for the best value investing tools for your buck, then we recommend Premium. It has plenty of features for most investors. Our second choice would be the bundle because there are usually discounts available that give you access to all Premium features plus the picks.

Most investors don’t need to (and shouldn’t) opt for the Pro plan, which is for extremely active investors with large portfolios.

All plans except Picks and the Basic plan come with a trial, but they’re not free. For example, the Premium trial is $4.95 for a month and the Pro plan trial costs $99.

There are almost always coupons and discounts available, so use one of our links to save some money!

Is Seeking Alpha Worth It?

Seeking Alpha is absolutely worth the money, if you use it the right way. Stocks rated “STRONG BUY” on their Quant Rating have outperformed the S&P 500 1,754% to 385%; and stocks rated “VERY BEARISH” have underperformed miserably. So only buy stocks rated “STRONG BUY” and avoid all “VERY BEARISH” stocks!

Remember: Stocks rated “STRONG BUY” by Seeking Alpha’s “Quant Rating” are up 1,754% compared to the S&P 500’s 385% over the last 10 years.

Bottom line: You should only buy stocks that are rated “STRONG BUY” and don’t own any stocks rated “VERY BEARISH!”

Act Today; Offer Ends Soon

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They are currently offering a big discount that only runs for a limited time.

Here's you chance to get free trial, save 10% AND get their Top Stocks for the 2nd Half of 2025 report.

- 7 Day Free Trail & Save $30 on Seeking Alpha Premium; usually

$299now only $269/year — Learn more.- Save $50 on Alpha Picks; usually

$499now only $449/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

Seeking Alpha Conclusion

Given the above graphs that show the Seeking Alpha STRONG BUY’s crush the market and their VERY BEARISH drastically underperform the market, given the 2024 study by professors at the University of Kentucky, and given my own personal results, it is safe to conclude that their Quant Rating works and Seeking Alpha is definitely worth it. Plus, those five features above also provide extra reasons to upgrade from their free service.

And my chart comparing the performance of their Alpha Picks service to various Motley Fool and Zacks services shows they truly are providing ALPHA and beating the competition since the launch of this service in July 2022. I even showed you screenshots of my ETrade account to prove it. So if you are looking for stock recommendations and have at least a few $100 to invest each month, then you should try Alpha Picks.

Remember: Even if you had bought just $100 of those 70+ picks, your return would give you a profit well above the SPY return and the subscription easily pays for itself–if you try to buy equal dollar amounts of all of their picks as the are released. Now keep in mind, with their growing subscriber base, their stock picks to rise immediately so you need to get their picks as soon as they are released.

And if you are the type of investor that likes to do their own research or wants feedback on your existing portfolio to know what Seeking Alpha’s quant rating is on each of you stock, then at the price of $299 per year ($269 through our link), I find Seeking Alpha Premium to be a no-brainer investment for anyone that wants to increase their odds of beating the S&P 500. However, if you are the type of investor that just wants their 2 top rated stocks each month and you don’t need all their research, then a subscription to their Alpha Picks newsletter might be better for you.

Additionally if you wan the full suite of alerts from Seeking Alpha, their Pro service is $2,400 a year. Check out our Seeking Alpha Premium vs Seeking Alpha Pro Review.

If you can’t decide, then they let you try both Seeking Alpha Premium AND Alpha Picks for $639, a savings of $159.

FAQs

Yes, it does! The research tools and analysis are excellent and Seeking Alpha’s “Strong Buy” stocks have consistently outperformed the market.

The answer to this question really depends on what you want. There are some stock picking services that have been around for longer or have performed better (Motley Fool Stock Advisor is an example), but if you’re looking for in-depth analysis and research tools plus access to their research-backed Quant ratings and an active community, we don’t think you can do better.

We think paying for Premium, Alpha Picks or the bundle is definitely worth it if you want to improve your chances of beating the market. Given the volatility we have had in the last 3 years it is quite impressive that it continues to beat the market. The price of Seeking Alpha’s products is relatively low if you consider that improving a $25,000 portfolio by just 1% means that any Seeking Alpha subscriptions should pay for itself many times over. If you have more than $25,000 then it seems to be a no brainer.

Most online investment platforms have had at least a little controversy. The two issues that have somewhat plagued Seeking Alpha are accusations of market manipulation, and of operating as an unregistered investment advisor. Lawsuits related to both issues have been dismissed by judges.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.