Each of them has a different investing approach, but every stock picking service has the same goal: Outperform the market.

To that end, Motley Fool has been almost unbeatable for over 20 years (more on this below). But since its launch in 2020 Moby has outperformed the Motley Fool with its own track record of excellent stock picks.

And while they may seem similar on the surface, Motley Fool and Moby take totally unique approaches to investing and finding stocks and also provide two very different products.

In this article I break down the differences between Motley Fool Stock Advisor (its most popular service) and Moby Premium and will help you determine which service is better for you.

Quick Comparison: Motley Fool vs Moby

| Motley Fool | Moby | |

|---|---|---|

| Overall rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service type | Stock picking | Stock picking and investment research |

| Best for | All investors | Emerging markets research & stock strategy |

| Service delivery | Mobile & Desktop app | |

| Cost | $199/year | $199/year |

| Special offer | First year for $99 | Get 1 pick for free, or … First year for $99 |

While they both provide stock picks and accompanying research reports, the primary difference between the two services is that Moby also provides a holistic set of features which will help you become a better, more-informed investor.

- If you want to become a better investor and more skilled in your investment analysis, you may choose Moby over Motley Fool.

- On the flip side, if you only want stock picks and nothing more, you may prefer Motley Fool and find Moby to be overwhelming.

That said, the two provide completely different stock picks based on different investment criteria, so I would encourage you to try both and decide which gets you better results.

For more information about both companies and their investment approaches, track records, and more, keep reading.

About The Motley Fool

The Motley Fool was founded in 1993 by David and Tom Gardner. The brothers wanted to make investing and building wealth more accessible to everyone.

Three decades later, The Motley Fool has helped millions of people reach their financial goals through their premium investing services, financial education, blog articles, podcasts, and online investing communities.

Its flagship service is Stock Advisor, a stock-picking newsletter service which delivers 2 new stock picks and accompanying research each month. Stock Advisor has more than 500,000 subscribers worldwide, including me.

Motley Fool Stock Recommendations

Before jumping into the specifics about some of Stock Advisor’s previous stock picks and its performance to date, I want to quickly cover The Motley Fool’s investment philosophy it expects its members to follow.

There are 6 parts to investing The Motley Fool Way:

- Buy 25+ companies – A well-diversified portfolio is essential for balancing risk and reward.

- Hold those recommended stocks for 5+ years – A longer time horizon gives great companies time to produce great results.

- Regularly invest new money – You should be able to invest in new stocks without having to sell old picks.

- Hold through market volatility – Stock market declines happen frequently. You should expect them and be ready to take advantage of them.

- Let winners run – Winning companies tend to continue winning.

- Target long-term returns – Anything can happen in the short term. Investing in the stock market is a game best played over your entire lifetime.

The Motley Fool is currently offering 50% off for new subscribers.

Visit this page & get 1 year for only $99. Don’t miss out on their next pick.

Remember: They have 30 day money back guarantee.

Make sure you can stick to these rules if you’re considering a Motley Fool subscription. While some of them can be difficult to stick to at times, the combination of these rules and its stock picks is remarkable.

WSS readers will know I’ve been a paying subscriber to several of Motley Fool’s services for years and have personally benefited from (and can attest to the performance of) their stock picks.

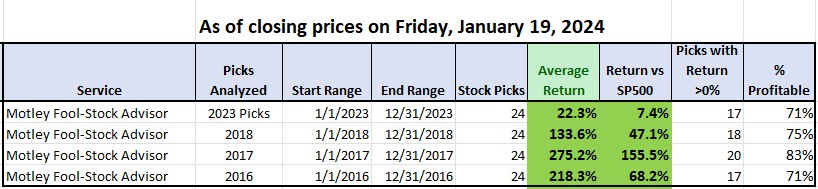

I’ve also been meticulously compiling Stock Advisor’s results since joining the service.

The long-term returns of the stocks recommended by The Motley Fool have been extraordinary. The investment team isn’t infallible, they do sometimes pick losers, but those losers have been completely overshadowed by the quantity and size of the winners.

Some of those winners include Amazon (up 19,000+%), Netflix (up 26,000+%), Disney (up 4,900+%) and Nvidia (up 30,000+%). All of these stocks were first recommended in 2005 or earlier.

The Stock Advisor team can recommend any stock with growth potential and sustainable competitive advantages.

About Moby

Moby is an investment research platform for stock and cryptocurrency investors. It was founded in 2021. To date, the company has helped more than 5 million investors stay informed about the markets and make better investment decisions.

Unlike Motley Fool (which is primarily email-based), Moby has created an app which houses all of its stock picks, portfolios, and market updates.

Moby is powered by its team of analysts. The team is comprised of former analysts from institutional investors like Goldman Sachs and journalists from financial media companies. This unique combination is able to produce sophisticated analysis in easily digestible articles and reports.

Moby Stock Recommendations

Like The Motley Fool, Moby provides done-for-you stock recommendations. Moby, however, provides 1 to 3 per week (as opposed to just 2 per month at Motley Fool).

To aid its team of experts, the company developed and deploys machine learning and quantitative algorithms to help identify potential stock picks.

A few of its former picks include Tesla (up 560+% since 2020), Nvidia (up 460+% since 2020), and Elf Beauty (up 400+% since 2022).

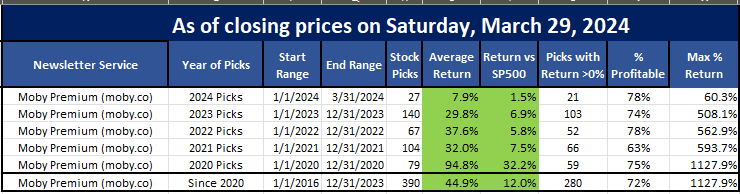

The question still stands, are Moby’s stock picks any good? After interviewing the CEO and the CFO, and then doing my own analysis on their picks since they started, I came up with the following summary of the last 4 years of their picks, as of March 29, 2024 prices:

That is quite impressive that:

- EVERY year their picks are beating the market,

- that the average beat is 12% over the last 4 years over 390 picks,

- and that 72% of their picks are profitable.

Moby is currently offering 50% off for new subscribers.

Click on the WallStreetSurvivor Exclusive offer on this page & get 1 year for only $99.

Remember: They have 30 day money back guarantee.

Moby 2024 Top 5 Picks Returns as of August 31, 2024:

- CAVA: 125%

- MMYT: 66%

- FTAI: 51%

- MSFT: 47%

- TSM: 45%

Beyond the latest 2023 picks (last year), this system has made a number of exceptional picks:

- Tesla, picked on 4/9/20, is up 566%

- Texas Pacific Land Corp, picked on 3/20/20, is up 359%

- Nvidia, picked on 5/18/20, is up 460%

- Elf Beauty, picked on 2/3/22, is up 409%

In all, Moby’s team has made 75 stock recommendations that have returned more than 100%, and its average Premium stock pick has returned 250%.

Each of Moby’s stock picks are posted in the app. You can either read the recommendation report or listen to the podcast-style recording of why the team is bullish on the stock.

Moby is currently offering 50% off for new subscribers.

Click on the WallStreetSurvivor Exclusive offer on this page & get 1 year for only $99.

Remember: They have 30 day money back guarantee.

While The Motley Fool has been outperforming for decades, that doesn’t mean its picks will outperform Moby’s in the future. Both services have similarly impressive track records.

Moby’s just come with a host of other features.

Similarities & Differences: Moby vs Motley Fool

1. Service Type

Motley Fool Stock Advisor is a relatively simple service. A new stock pick and a report on why it’s being recommended is delivered to your inbox twice per month. You’ll also find a list of “Best Buys Now” stocks and all previous recommendations on the website. Additionally, your membership comes with access to the online community and some additional educational materials.

Moby, on the other hand, is a fairly robust investment research and market news app. In addition to its stock recommendation reports, you’ll find daily market updates, educational guides, and a list of other features including a tool that tracks trades made by politicians, multiple “Model Portfolios”, an economic calendar, and more.

While they both provide stock picks as the core of their service, Moby provides much more in addition to its stock picks. Whether this is good or bad depends on what you’re looking for.

2. Performance

While both services boast exceptionally strong track records of returns, I have to give the slight edge to The Motley Fool in this category because it has been outperforming the S&P consistently for 30 years, whereas Moby was just founded 3 years ago.

That said, past performance doesn’t guarantee future results, and it’s impossible to say which of these two services will perform better in the years to come.

3. Assets Covered

In addition to stock picks, Moby also covers cryptocurrencies, giving its service the edge in this regard.

After spending some time reading a few of its reports, I’m blown away by how much the Moby team knows about Web 3.0, AI, blockchains, and other emerging technologies which are likely to disrupt many industries.

4. Pricing & Guarantees

Both services cost $199 per year, though new members can get Stock Advisor for $99 and Moby Premium for $99.

Both Stock Advisor and Moby Premium come with a 30-day membership fee-back guarantee.

5. Other

While The Motley Fool does provide some bonus educational and community resources, Moby definitely wins in the “Other” category.

6. Compare Your Portfolio’s Future Value Depending on Your Annual Returns

Adjust the calculator below to explore how your portfolio will increase over time depending on your current value, your expected return, your annual additions, etc. Notice that just a few percentage points in return makes a huge difference over time. THAT is why it is so important for you to have the right stocks in your portfolio.

Moby’s daily market commentary, additional reports, and other features including Political Trades, Asset Lookup, Economic Calendar, and Crypto Screener make it a far more holistic investment research tool. Plus, its mobile app makes it easy to access all of this additional research.

Which Stock Picking Service is Better for You?

There are 2 primary differences between Motley Fool and Moby:

- Their stock picks will be different

- The service type is different

The Motley Fool and Moby teams have different approaches to investing and different criteria in what makes for a good investment. As such, the two services will be recommending different stocks which is likely to result in different returns/performance.

Beyond their stock picks being different, the other main difference is the actual service provided is different.

Stock Advisor essentially only provides stock picks – I have never really used any of its other features. This isn’t necessarily a problem though, as I only have to spend about 15 minutes per month reading their stock reports and buying their recommendations.

You get a lot more on Moby Premium. In addition to 12+ stock picks per month, you get market updates, Model Portfolios, economic reports, and a variety of other features all in the Moby app. In all, it’s a much more complete offering, and you should expect to become a better investor with your subscription. While you may still be interested to learn more on what are the best stock picking services this year, there are multiple factors to consider (beyond even stock picks) when it comes to grading the full customer experience.

Obviously, how these services perform in the future will have a large impact on which one is “better”. That said, it’s impossible to predict how either service will perform in the future (though their past performance has been strong). As such, my recommendation is to read a few research reports by each company and decide which style of investing better suits you.

It’s easy to try each service for 30 days and then choose one or the other because of their membership fee-back guarantees.

Or, if you’re like me, you may just keep both.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.