Your Investment strategy is like your game plan to building your portfolio. But it is very important that you find the one that’s right for your objectives and situation in life. A 25 year old should have a different strategy then a 65 year old.

We generally spend a decent amount of time planning for our workday, a vacation, and buying a car, but we often forget the most important plan of all: mapping out our investment strategy and plan for growing old and retiring.

Investing your money without an investment strategy is like a football team going into a game without a playbook. Although investment strategies are not required, they significantly improve your chances of winning. Creating an investment strategy should be your #2 step after you learn some of the basics of investing in the stock market like how to read stock quotes and how to buy stocks and other “getting started” info found here.

The Importance of Defining Your Investment Strategy

Most financial planners agree that the following are the beginning steps to a successful investment strategy:

- Stop paying high interest rates on credit cards and other debt.

- Try to save 10% of your income

- Have at least 3 months of expenses saved in cash

- Invest a fixed dollar amount each month in the stock market

- Plan on investing in stocks for at least 5 years

So, if you are at step 3 and ready to invest in the stock market, what stocks do you buy?

Having an investment strategy is like having an instruction booklet guiding you through the investment process. It will help you discard many potential investments that may perform poorly overtime or that are not right for the investment goals you are looking to achieve.

When creating an investment strategy, it is important to quantitatively figure out what you are seeking to accomplish. Stating that you simply want to make money or become wealthy is not helpful. A better objective would be to say “I want to achieve an 8% average annual return on my investment contributions over the next 10 years in order to have a $200,000 portfolio that will be used to purchase a 2nd home.” The more specific the objective, the better. And it doesn’t stop there. An investment strategy is useless without a proper understanding of it. There are many different stock investment strategies that apply to different investment objectives, the key is pairing the right strategy with the right objective.

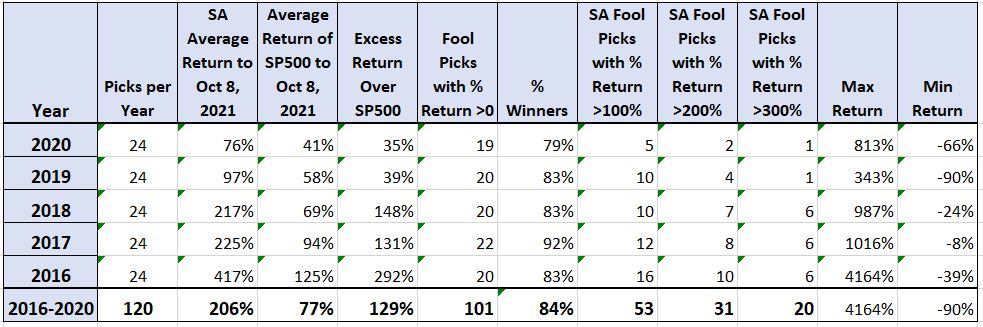

Once you have gained some familiarity with the stock market terminology and are ready to take the next step, we have found this one newsletter is the BEST for beginner investors to GET THE BEST STOCK PICKS that have beat the market consistently over the last 5 years. In fact, their last 24 stocks picks have an average return of 111%. That means you would have more than doubled your money in 12 months had you bought just a little of each of their picks. Read this review of the Motley Fool to learn more.

Types of Investment Strategies

Value Investing

There are many investment types, but the most popular strategy, especially for beginners, is value investing. An investment strategy made popular by Warren Buffet, the principle behind value investing is simple: buy stocks that are cheaper than they should be based on their long-term earnings potential. Finding stocks that are under-priced takes a lot of research on the fundamentals of the underlying companies. And once you’ve found them, it may take a few months or years for their price to rise. This buy and hold technique requires a patient investor who wants to keep their money invested for a few years, which is why it’s one of the best investment strategies for beginners. While the stock market has returned about 8% per year over the last 100 years, there are a few people like Warren Buffet whose stock picks have significantly outperformed the market as a long term investment strategy. If you are planning on keeping your money invested in the stock market for at least 5 years and you want the best source for excellent “value stock” recommendations then consider the Motley Fool Stock Advisor. Take a look at the performance of the Motley Fool stock picks over the last 5 years, as of the date in the table:

The summary of the Motley Fool performance is this: Over the 5 year period from 2016 to 2020, the average return of all 120 of their stock picks is 206% and 84% of those picks are profitable. That means their stock picks beat the market by 129% Without a doubt, if you have at least $500 to invest in the stock market each month and you plan on leaving that money in the stock market for at least 5 years, the Motley Fool is the best place to get stock picks. If you are a new subscriber, you can get the next 12 months of their stock picks at a discount. All investors should understand at least the basics of value investing.

Income Investing

A great way to build wealth over time, income investing involves buying securities that generally pay out returns on a steady schedule. Bonds are the best known type of fixed income security, but the income investing strategy also includes dividend paying stocks, exchange-traded funds (ETFs), mutual funds, real estate investment trusts (REITs), and other types of investment funds. Fixed income investments provide a reliable income stream with minimal risk and depending on the risk the investor is looking to take, should comprise at least a small portion of every investment strategy.

Growth Investing

An investment strategy that focuses on capital appreciation. Growth investors look for companies that exhibit signs of above-average growth, through revenues and profits, even if the share price appears expensive in terms of metrics such as price-to-earnings or price-to-book ratios. What Warren Buffet did for value investing, Peter Lynch did for growth investing. A relatively riskier strategy, growth investing involves investing in smaller companies that have high potential for growth, blue chips and emerging markets.

Small Cap Investing

An investment strategy fit for those looking to take on a little more risk in their portfolio. As the name suggests, small cap investing involves purchasing stock of small companies with smaller market capitalization (usually between $300 million and $2 billion). Small Cap stocks are appealing to investors due to their ability to go unnoticed. Large-cap stocks will often have inflated prices since everyone’s paying attention to them. Small cap stocks tend to have less attention on them because: a) investors stay away from their riskiness and b) institutional investors (like mutual funds) have restrictions when it comes to investing in small cap companies. Small cap investing should only be used by more experienced stock investors as they are more volatile and therefore difficult to trade.

Socially Responsible Investing

Investing in a stock portfolio built of environmentally and socially friendly companies while staying competitive alongside other kinds of securities in a typical market environment is called socially responsible investing. In today’s modern world, investors and the general public expect companies to maintain some social conscience, and they’re putting their money where their mouth is. SRI is one path to seeking returns that poses a significant collateral benefit for everyone.

How Choose An Investing Strategy That’s Right For You

Setting up your investment strategy is like buying a new car, before you look at the different models, you need to figure out what style suits you best. And just like cars, there are many investment types to choose from when creating an investment strategy. When choosing the right investing strategy, there are questions that need to be answered first. What is your investment horizon? What returns are you seeking to achieve? What amount of risk are you able to tolerate? What are the funds in this investment to be used for? Answering these questions will ultimately also help in building your stock portfolio.

Determining what will be your breakdown between cash, fixed-income securities and stocks is a good start towards creating your investment strategy. The breakdown of your asset allocation ultimately depends on your risk tolerance. A conservative investor may prefer to hold 80% of his portfolio in fixed-income and 20% in stocks. The reverse would be true for an aggressive investor, while a balanced investor will follow a 50-50 split.

In terms of specific stock market strategies within your asset allocation, if you are a high risk investor with a long investment horizon, you may want to include small cap and growth investing in your portfolio. If you have a moderate risk tolerance and shorter investment horizon, you may be more suitable for value and income investing. If you have a low risk tolerance and short investment horizon, you may want to focus solely on income investing. For those looking for companies that aim to do no harm, you can add socially responsible assets to your portfolio with relative ease. It is also important to adapt to the investment strategy you are most comfortable with. Someone with a knack for choosing growth stocks may make that strategy the priority in their portfolio.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.