Ever wondered how to invest with little money?

Most of us don’t have millions sitting around in a bank account somewhere, and we have to invest what we can!

Many people think that it takes thousands to tens of thousands of dollars to start investing in the stock market.

This was true for many people in earlier decades, but since the turn of the century (and especially since 2009), investing has become democratized to an extent that allows anyone with a little extra savings money to start their investing journey.

In this article, we will explore how even the smallest of initial investments can help you get started in the stock market, and even better, how far it can take you towards building your financial future.

We will outline five simple yet essential steps you can take today to invest with as little or as much money as is available to you.

Before we begin

The five steps listed in this article are completely for your own benefit.

At Wall Street Survivor, a free financial education website for over a decade, our mission is to show anyone and everyone that investing is one of the most empowering tools you can use to build your ideal financial future.

You’ll see a lot of specific services and tools suggested in this article, some of which we have partnerships with and some we do not, but the reason they’re in this article is because we truly believe they are the best resources out there and that they will genuinely help you in your path to financial success!

Step 1: Self-Assessment

- Goals: Why are you investing? Are you saving for retirement? Are you trying to pay your way through college or earn some extra income to supplement your job? Are you just trying to learn how the stock market works?

- Interest Level: How much time do you plan on investing (no pun intended) into your portfolio? Do you want to pour hours into researching and reevaluating your positions, or do you want to set up a portfolio and let it go to work?

- Investment Horizon: How long do you have until you need to start withdrawing your earnings? Are you leaving your money in your brokerage account until retirement, or making withdrawals on a monthly or yearly basis?

- Risk Tolerance: How much volatility in the market can you stomach? This factor is extremely important when making investment decisions, as investing in securities that are riskier than you can comfortably handle often leads to emotional decisions which can bleed out even the most savvy investor’s account. Click below to watch Wall Street Survivor’s video on determining your personal risk tolerance.

Step 2: Habits

- Monthly Investing: If you have a regular income, it’s extremely important to set aside a certain portion of your earnings to be invested every month or every other week. This will lower the amount that your overall portfolio swings in times of market volatility; a lump sum of money saved up and invested at one time will swing greatly with the market, but regular contributions will expose you to less risk and help you keep your cool when the market gets rough.

- Automatic Transfers: This is one easy habit that you don’t even have to pay attention to! Simply set up an automatic transfer with your brokerage so that a certain amount of money is withdrawn from your bank account regularly and invested in your portfolio. This way, you don’t have to worry about logging in often to make transfers.

- Smart Apps: There is an app for just about every financial need you could possibly have. Mint is a great budgeting app that automatically tracks how much money you’re earning and spending every week and sorts it into categories to help you take control of your spending. Round-up apps like Acorns will round up every purchase you make to the nearest dollar and invest the extra money. Automatically investing a few cents every day can lead to a sizable portfolio over the long term!

Step 3: Open a Free Brokerage Account

There are plenty of options available when it comes to choosing your first brokerage account.

The good news is that plenty of the most reputable brokerages are free to start and charge very little fees on your portfolio.

Many even offer options for retirement accounts like IRAs and Roth IRAs, as well as joint brokerage accounts!

- Account Minimums and Fees: Many brokerages, such as Robinhood, TD Ameritrade, and E-Trade, offer investment accounts with a $0 minimum investment requirement and zero commission trades!

Other Types of Investment Accounts

Opening a plain old brokerage account is a great way to get started and begin investing for your future, but brokerage accounts do not offer any tax advantages.

In other words, you’ll have to pay your regular income taxes on the money you’re investing, AND you’ll have to pay capital gains tax when you sell a stock to realize gains, as well as taxes on dividends for the stocks you hold and interest for the fixed income investments you hold.

If you want to make the most out of your investing, you should check out some of the account types mentioned above, like traditional and Roth IRAs.

Let’s look at a brief overview of a few different account types to see if one or several might be right for you.

401(k)s

If you have a job that offers you a 401(k) with employer matching, you’ve essentially struck gold.

This is because you’re receiving FREE MONEY when you choose to contribute to your 401(k).

A 401(k) is a type of employer-sponsored, tax-advantaged retirement account.

Many employers offer contribution matching, which means that they will contribute an equal amount of money to your 401(k) whenever you contribute, or contribute a certain percentage of what you contribute.

For example, your employer might match your contributions dollar-for-dollar up to the first 3% of your salary that you contribute, then 50 cents on the dollar for the next 4% of your salary that you contribute.

This means that if you contribute 7% of your salary, your employer will contribute 5% of your salary. That’s free investing money!

Many 401(k)s are handled by large investment firms.

All you have to do is choose a risk tolerance and investing strategy, and your 401(k) will automatically be invested in an appropriate portfolio of stocks, fixed income investments, mutual funds, index funds, and target date funds.

You can often choose between a traditional 401(k) and a Roth 401(k).

The differences between traditional and Roth will be explained below.

If you want to learn more about 401(k)s, you can read our article here.

Traditional IRAs

Individual Retirement Accounts, or IRAs, are another type of tax-advantaged retirement account.

As the name suggests, these accounts are individual, rather than sponsored by your employer.

Anyone can open an IRA, as long as you have taxable income to contribute.

Contributions to traditional IRAs (and traditional 401(k)s) are tax-deductible, meaning you’ll be able to reduce the amount of your taxable income for the year by the amount you contributed to your traditional IRA, which will reduce your tax burden.

When you withdraw your contributions and earnings in retirement, you’ll have to pay taxes on them.

Roth IRAs

Contributions to Roth IRAs are made with after-tax dollars.

This means that you don’t get a tax deduction for contributing to your Roth IRA (or Roth 401(k)).

But making contributions to a Roth account means that, since you’ve already paid taxes on the money you contribute, that money can grow tax-free.

When you withdraw your contributions and earnings from a Roth account in retirement, you will have no taxes to pay.

You can read our article on Roth IRAs here.

Both 401(k)s and IRAs have restrictions that limit how much money you can contribute every year, so make sure to plan accordingly!

Step 4: Try a Strategy

- Robo-Advisors: Robo-advisors are a sort of mix between financial advisors and hands-off brokerages. You get to set up your own portfolio, and the robo-advisor will automatically invest your money and rebalance your investments as needed. These apps often come with an abundance of free goal-setting tools as well as investment advice. Wealthfront and Betterment are two of the most popular robo-advisors, each charging a 0.25% management fee.

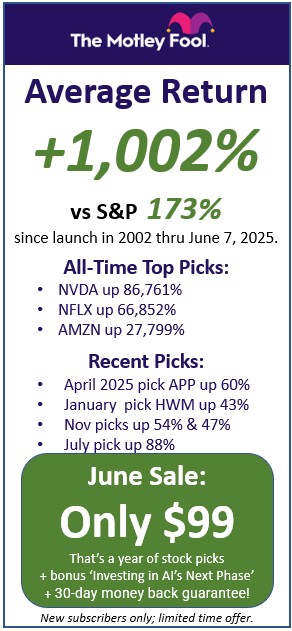

- Stock Pickers: There are many ways to obtain lists of stocks to buy from some of the most successful researchers around. The Motley Fool Stock Advisor has one of the most successful stock pick lists available, with a 527% return over the last 18 years.

- Dividend Stocks: Many investors choose to invest for income rather than for growth; that is, they invest heavily in companies that regularly and reliably issue dividends to their investors.

- Fractional Shares: Many brokerages allow you to invest in just a portion of a stock. This makes even the most expensive stocks affordable to the everyday investor!

- ETFs: Exchange-traded funds, or ETFs, are collections of stocks that are traded as one security. They are often created to track the market as a whole, or certain sectors of the market (index funds). For example, VOO is a popular Vanguard index fund that tracks the S&P 500. ARKK is an ETF that focuses specifically on leading technology. ETFs are usually available to investors at a fraction of the cost of buying all of the included securities.

Step 5: Use a Stock Simulator

Many investors try their hand at investing virtual money before diving in using cold, hard cash.

Stock simulators can be a great way to test out a portfolio you’ve created before you fully commit to it.

Fortunately, you came to the right place! Wall Street Survivor helps thousands of investors learn how to invest with our real-time stock simulation platform.

Hopefully, the above steps can help you jumpstart your investing journey without breaking the bank.

Let us know what you think, and feel free to reach out and let us know what you’d like us to write about next!

FIRST STEPS TO FINANCIAL SUCCESS:

At WallStreetSurvivor, we love with the stock market and we are obsessed with finding the best deals to help us all make more money. Here is our list of the BEST STOCK SERVICES to help you get start investing correctly:

1 - Get Up To $1,000 in FREE Stock with Robinhood! The fastest growing brokerage, Robinhood, just hit 10,000,000 accounts. Why? Because they DON'T charge commission AND they are giving away up to $1,000 in free stock when you open an account. CLICK HERE to learn more about Robinhood.

2 - Not Sure What Stocks to Buy? Get the BEST Stocks Picks! We subscribe to dozens of stock newsletters, and there is one that has outperformed all the rest for the last 5 years. This one service has an amazing average return of 74.63% on ALL of their stock picks the last 3 years. Their recent winners have been stocks like Shopify (SHOP) up 866%, Match Group (MTCH) up 549%, Paycom (PAYC) up 235%, and many others that have doubled in the last 3 years.

CLICK the image below go see their latest offer...

3 - Don't Pay Commission! Open a Real Brokerage Account and Trade Commission-Free. Here's the GREAT NEWS--the brokerage industry is very competitive right now and some brokers are offering FREE COMMISSIONS and other incentives to acquire new accounts. CLICK HERE to get commission-free trades. Or CLICK HERE to get a review of the Best Online Stock Brokers.

4 - Get the Best Stock Picking Newsletter of 2020 We subscribe to dozens of stock newsletters. Some of these newsletters are longer term investing, some are short term, and some are penny stocks. Find the best newsletter for your interests. So which stock newsletters are the best? Visit our review of the best stock newsletters.

5 - Is the Motley Fool a Good Source of Stock Picks? The Motley Fool is probably the best know stock newsletter service. Is it worth it? Read our full Motley Fool Review