Have you been looking for Seeking Alpha reviews?

We’re here to help!

We’ve been members of the Seeking Alpha free service since 2010. Then, in 2020, we signed up for Seeking Alpha Premium so we could review it and share our experiences with you.

In this Seeking Alpha Review, we’ll show you what you get for free, what the benefits are of becoming a Premium user, how their stock picking service is doing, and our experiences with both of these services.

Most importantly, we will reveal the most important fact about Seeking Alpha: Does it help you make money in the stock market? (Our short answer is YES, if you use it the way we do!)

| Seeking Alpha Premium | Alpha Picks | Seeking Alpha Bundle | |

|---|---|---|---|

| Overall Rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type & Strengths | Full access to all their research; link your brokerage account to get Quant Ratings on your stocks and alerts of when to sell. | 2 stock picks a month that have their highest Quant Rating and most likely to outperform the market. | Includes both services |

| Strengths: | Strong Buy Quant Rating stocks have 5x the market since 2010. Quant Rating now verified by academic study. 250,000+ Premium members. | Beating the market by 46% in just 2+ years; 11 picks have already doubled; over 80% of picks are profitable. | Get both to monitor your portfolio & get the best picks to buy. |

| Best for | Self-directed investors who want to easily optimize their portfolio’s return. | Investors looking for specific stock recommendations each month | Both |

| Retail Cost | $299 a year | $499 a year | $798 a year |

| Current Promotion | July, 2025 Sale: Save $30, get 7-day free trial, & get access to their TOP STOCKS of 2025. Subscribe today to take advantage of this sale. | July, 2025 Sale: Save $50. | July, 2025 Sale: Save $159 when you get both. |

| Link to Promo Page: | Save $30, get 7-day free trial & get their TOP STOCKS OF 2025 on THIS promo page! | Save $50 on Alpha Picks on THIS promo page | Try Both for $639 and save $159 now. |

What Is Seeking Alpha?

Seeking Alpha is an investment research platform started in 2004 by financial analyst David Jackson. In the stock market, the word “alpha” refers to the excess return you get versus a benchmark. So, since everyone wants to beat the S&P 500, everyone is “seeking alpha” even though they don’t realize it.

The original concept was simple: let investors who are passionate about the stock market share their own stock analysis and debate the merits of each stock so they can become more informed investors.

From that simple idea, Seeking Alpha has now become “the world’s largest investing community” with over 20 million active monthly users.

If you register as a free member, you can access a limited number of articles. Seeking Alpha has over 7,000 active authors who publish 10,000 stock analysis and ideas monthly.

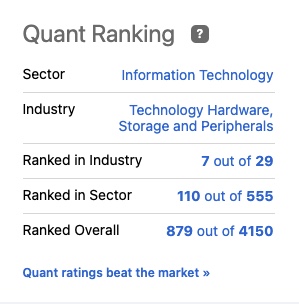

While its contributors’ research reports remain the core offering of Seeking Alpha Premium, they’ve added many other features. Chief among them is a proprietary, quantitative algorithm that ranks stocks based on key factors. These Quant ratings are one of our favorite features of Seeking Alpha. But are they worth paying for?

How Does Seeking Alpha Work?

Seeking Alpha is easy to use. Let’s walk through the process of registering, and then we’ll explain its key features.

To register, all you need to do is click the Sign Up button at the upper right-hand corner of the screen. You have two options to create a free account. You can log in with Google or you can enter your email address and choose a password.

The free account is totally free. There’s no need to give Seeking Alpha a credit card number and you won’t be automatically billed for anything. With the free account, you can set up a portfolio, use basic screeners, read some analysis, and check out one free Premium article per month.

Seeking Alpha Content

There’s a ton of content on Seeking Alpha, including:

- News articles

- Expert analysis

- Community “ideas” and analysis

- Pre-set screeners

With a Premium or Pro subscription, you’ll also get access to Quant ratings, which we mentioned above, and Author ratings. The former can help you decide which stocks to buy, and the latter are designed to track analysts’ stock recommendations to help community members evaluate content and decide which analysts to follow.

A few other special features we like include the Portfolio Health Score, which rates your portfolio based on Quant ratings and against other investors, and the option to join investing groups. Keep in mind that most of these features are only available if you upgrade to Seeking Alpha Premium.

If you still feel unsure about how Seeking Alpha actually works, check out our new guided overview of the platform: HOW TO USE SEEKING ALPHA FOR INVESTING!

How Seeking Alpha Empowers Members with Community-Driven Research

Crowdsourcing is a method of getting information or labor from a large, open pool of people, usually on the internet.

Seeking Alpha obtains much of its research from individual users just like you. That makes it a place where anyone can be a part of the investing conversation.

SEEKING ALPHA SUMMARY

What You Get:

- Over 10,000 Stock Research Articles per Month

- Professional Stock Ratings

- Listen to Earnings Calls and Read Transcripts

- Support Phone at 1-347-509-6837

VERIFIED Performance History:

- STRONG BUY ranked stocks have beaten the S&P 500 by over 400%

- Strong Sell ranked stocks have underperformed the S&P 500 by over 300%

Take advantage of their current Sale and save $30!

Seeking Alpha Editorial Review Process

Any community member can post content on Seeking Alpha.

If you want to be a Seeking Alpha Author, there’s a vetting process. Each article must pass a rigorous editorial review process before being published.

Here are the main tenets of the editorial review process:

- Articles must interest Seeking Alpha’s readership.

- Articles must conform to Seeking Alpha’s standards of rigor and clarity.

- Articles about a stock trading at less than $1 or with a market cap below $100 million will see extra scrutiny but are still eligible for publication.

- The author must agree in writing to Seeking Alpha’s disclosure standards.

- Their recent stats indicate 10,000 articles, written by 7,000 contributors, are approved monthly.

Seeking Alpha also only accepts articles from credible authors and requires the authors to disclose if they have a position in the particular stock they’re writing about, so you can be assured that there aren’t any conflicts of interest!

You can see an author’s track record of predictions and analysis and use that to decide whether to follow them or not. Be careful with community content, since it may not have been vetted.

You can also just look up the Top Authors and go from there!

Seeking Alpha Features

Apart from discovering new investing ideas and keeping up with your favorite Seeking Alpha authors, here are some of the other features offered by the platform.

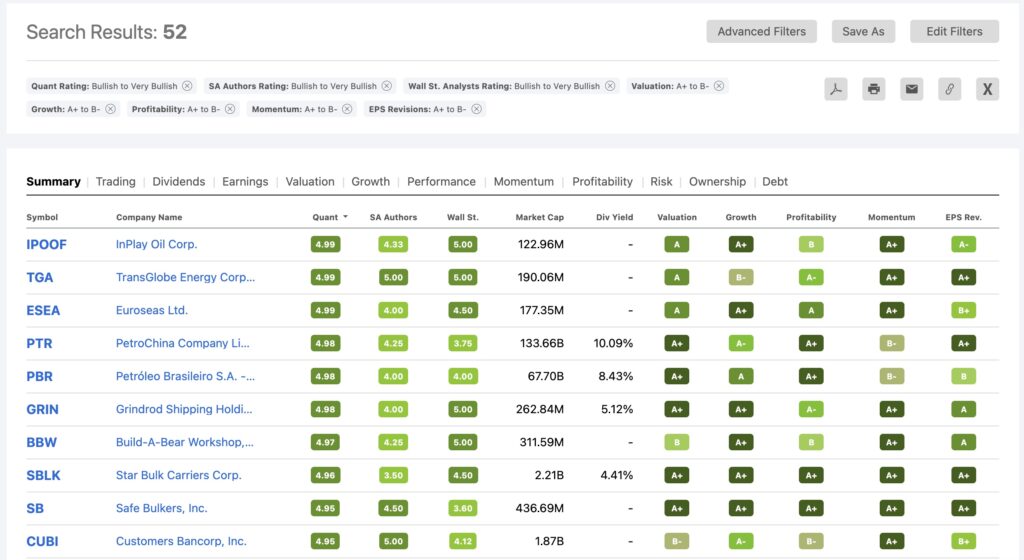

1. Top Rated Stocks Screener

Quant ratings range from 1 to 5, with a 1 being a “Strong Sell” and anything rated 4.5 or higher a “STRONG BUY.”

Those “Strong Buy” rated stocks are the ones that have beaten the market by 4x over the years.

The Top Rated Stocks screener is a feature available to Premium subscribers that lets you screen for the stocks with the best Seeking Alpha author ratings, Wall Street ratings, and Quant ratings all in one place.

You can also create your own screens using 100 filters to help you pinpoint stocks that fit your specific investing style!

Seeking Alpha Tip: Build a custom watchlist of stocks in your portfolio, and monitor their Quant ratings daily. Consider selling anything rated 1.5 or lower.

2. Earnings Calls

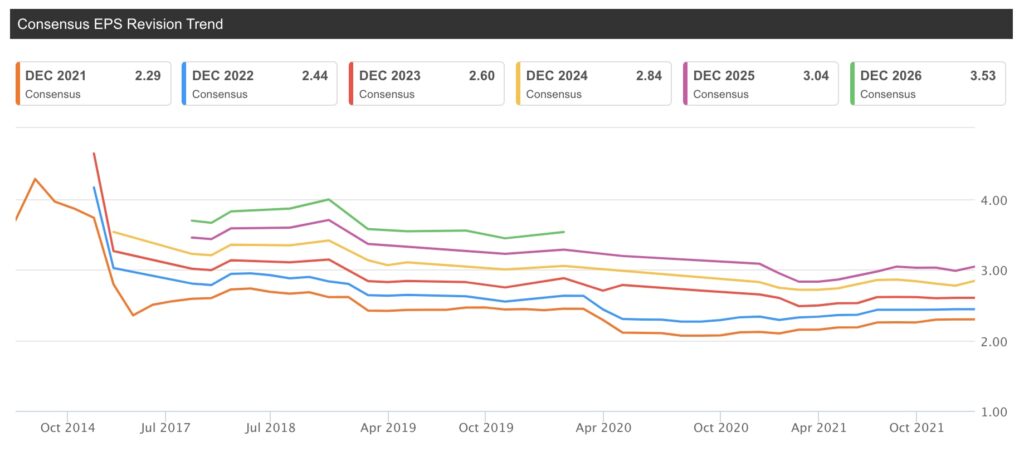

When you want to analyze a stock’s earnings history or EPS revisions, it can be helpful to read the transcript of the company’s earnings call (or even listen to the audio!) as a supplement to your research.

With a Premium subscription to Seeking Alpha, you get access to over 1 million investing ideas and earnings call transcripts and audio on stocks that aren’t covered anywhere else.

Keep in mind that earnings calls may have a spin on them, so doing additional research before acting on the earnings call is wise.

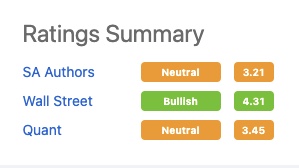

3. Stock Ratings

When you want to evaluate whether a stock will be a good addition to your portfolio, you have access to three main types of ratings on Seeking Alpha: the Quant Rating, the Seeking Alpha Author Ratings, and Wall Street Analysts Rating.

Ratings offer investors a way to quickly assess a stock’s strength or weakness. We wouldn’t suggest making buy and sell decisions based solely on ratings, but you can use them as part of your analysis and research.

Quant Ratings

This proprietary rating is obtained through quantitative analysis, which is a non-human analysis powered by algorithms and coding to find the best stocks to trade.

The quant ratings are based on a stock’s value, growth, momentum, profitability, and EPS (earnings per share) revisions.

All of the above ratings range from “Strong Buy” to “Strong Sell” and are an excellent way to start your search for a new stock.

This is the most valuable rating to consider. According to Seeking Alpha, stocks rated 4.5 or higher beat the S&P 500 by about 4x (1,754% vs 385%). On the bearish side, stocks rated 1.5 or lower return only 1/3 (156% vs 279%) of the S&P 500.

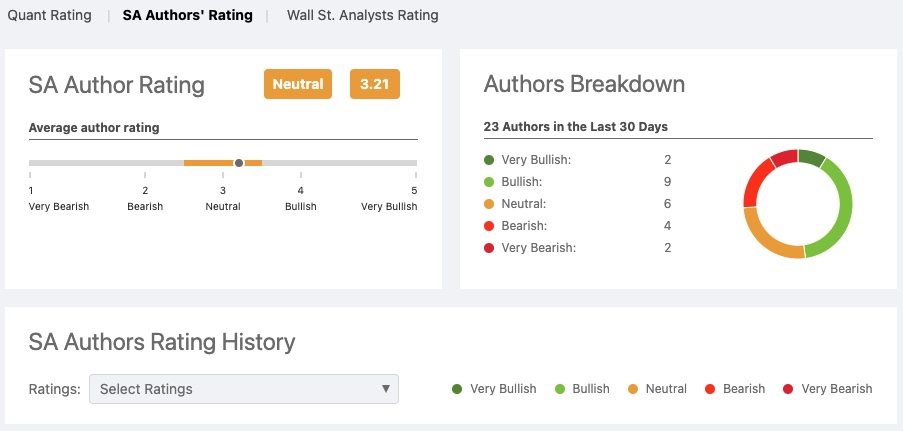

Seeking Alpha Author Ratings

These ratings are an average stock rating from Seeking Alpha authors. Remember, authors must go through a vetting process, but some of the content on Seeking Alpha is created by community members who aren’t vetted.

This is invaluable, as you can find out what the community thinks about your current stock picks.

To get full access to Seeking Alpha author ratings, you’ll need a premium subscription.

Get a FREE one-week trial of Seeking Alpha Premium!

Wall Street Ratings

This is a collection of ratings from Wall Street financial analysts.

It is updated weekly from over 100 Wall Street banks and brokerages.

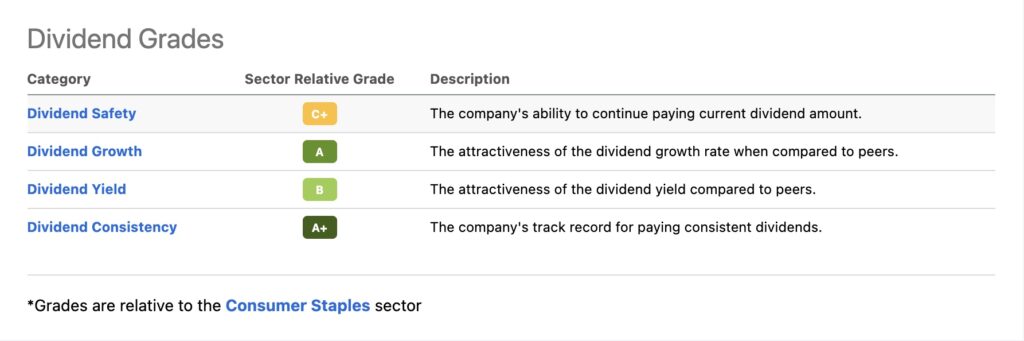

4. Dividend Grades

If you’re looking to implement an income investing strategy or you’re just looking for a company that has increased its dividends steadily over the last few years, you can use Seeking Alpha’s proprietary Dividend Grades feature.

Dividend Grades give you a different score for a company’s dividend safety, growth, yield, and consistency.

5. Data Visualizations

Seeking Alpha has plenty of data visualizations to help you view earnings forecasts, revisions, and surprises, as well as dividend forecasts and other important metrics.

Data visualizations can help you look at investments in a different way. For example, you can look at a stock’s or ETF’s performance over time, analyst consensus ratings, and much more.

6. Peer Comparisons

If you’re trying to compare two different stocks to see which one is better or you just want to see how a certain stock compares to related securities, you can make these comparisons in a side-by-side view.

When you pay for a premium subscription, you can add up to 20 stocks and compare them on the same chart.

7. Downloadable Financial Statements

Are you the type of investor who really likes to dive deep into the fundamentals before making a decision?

Well, Seeking Alpha will help you by granting you access to 10 years of financial statements that you can download and analyze.

8. Email Alerts

Seeking Alpha also lets you subscribe to a multitude of email lists that can help you with your portfolio.

For example, you can sign up for email alerts for individual stocks in your portfolio, which will tell you when there’s a big swing in price or a change in rating.

You can also sign up for email alerts from certain authors which will notify you when your favorite authors post.

You can sign up for newsletters of your choosing, such as Must Reads, Wall Street Breakfast, Tech Daily, and Global Investing. You’ll get an email notification whenever a new issue of one of your newsletters is released!

9. Portfolio Health Check

One of the newest features on Seeking Alpha is the Portfolio Health Check.

Like the Quant ratings, it’s a score of 1 to 5 that rates your portfolio’s health in terms of risk and as it compares to other portfolios on Seeking Alpha.

The rating can be useful if you want to make sure you don’t have too many “Strong Sell” or “Sell” stocks in your portfolio.

Seeking Alpha Pricing

Here’s an overview of the features in the different membership plans offered by Seeking Alpha.

| Feature | Seeking Alpha Basic (Free) | Seeking Alpha Premium ($299/yr for new subscribers) | Seeking Alpha Pro ($2,400 per year) |

|---|---|---|---|

| Create a portfolio | Y | Y | Y |

| Read articles and analysis | Y (limited) | Y | Y |

| Rating and price alerts | Y | Y | Y |

| Real-time stock prices | Y | Y | Y |

| Seeking Alpha community | N | Y | Y |

| Quant Ratings | N | Y | Y |

| Investing groups | N | Y | Y |

| Pre-set and custom screeners | N | Y | Y |

| Top stock & ETF rankings | N | Y | Y |

| Portfolio Health Score | N | Y | Y |

| Portfolio warnings | N | Y | Y |

| Stock comparisons | compare 2 | compare 20 | unlimited |

| Top analyst insights | N | N | Y |

| Exclusive Buy/Strong Buy coverage | N | N | Y |

| Upgrades & downgrades | N | N | Y |

| Short Ideas | N | N | Y |

| VIP Status | N | N | Y |

You can get a one-month trial subscription of Seeking Alpha Premium for $4.95, and a one-month trial of Seeking Alpha Pro for $99.

Is Seeking Alpha Reliable?

When judging whether or not an investment research platform is reliable, it’s always best to judge each platform on its performance.

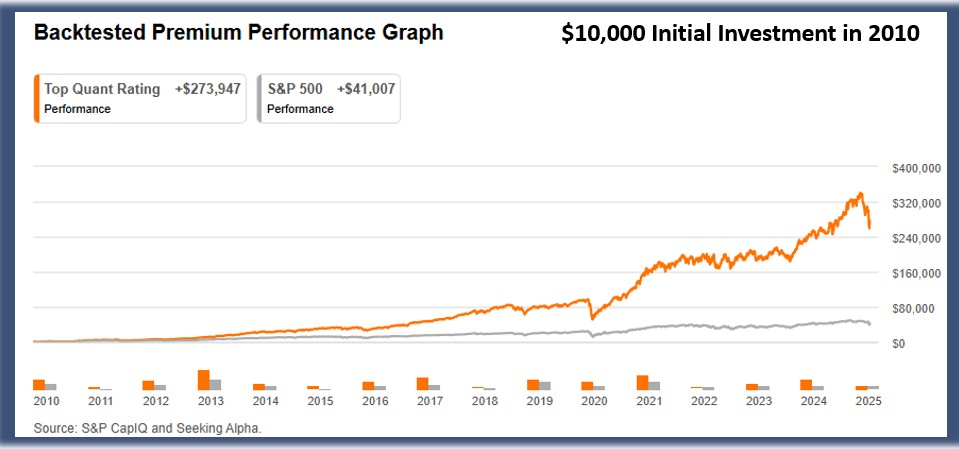

And as you can see, Seeking Alpha’s “Strong Buy” rated stocks have a phenomenal history of beating the market.

This graph illustrates the performance of Seeking Alpha’s “Strong Buy” stocks compared to the performance of the S&P 500 over the last 14 years.

If you had invested $10,000 into a portfolio made up of Seeking Alpha’s “Strong Buy” stocks in equal parts, then you would have made an average annual return of 274%, earning $230,000 more than you would have if you had simply invested in the S&P500.

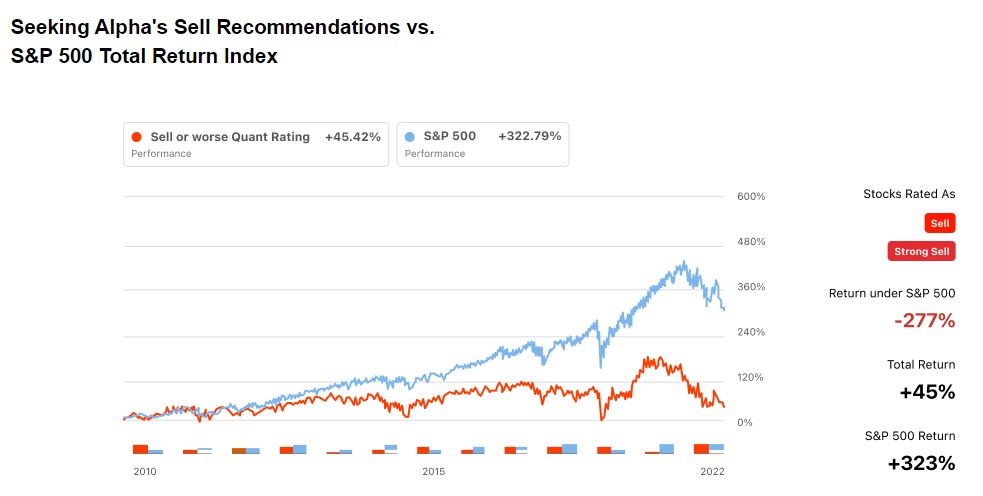

On the flip side, Seeking Alpha’s “Very Bearish” rated stocks have performed very poorly, which shows the system also works well for telling you which stocks to avoid. You can see that comparison in the graph below which shows that Seeking Alpha’s “Strong Sell” stocks underperformed the market by 277%.

Simply put: Seeking Alpha’s “Strong Buy” rated stocks CRUSH the market by nearly 5x and their “Strong Sell” rated stocks lag the market by 306%.

As you can see, Seeking Alpha has a stellar history of accuracy when it comes to evaluating stocks through quantitative analysis.

So we can say with complete confidence that…

…Seeking Alpha is reliable!

Is Seeking Alpha Right for You?

We truly believe that Seeking Alpha is a stock research platform that has something for everyone.

The Basic plan is right for you if…

You’re just starting out in the investing world, or you want to get a feel for how Seeking Alpha works.

You’re trying to learn about the basics of fundamental investing while seeing what a professional research platform has to offer, you can start out with the Basic plan.

You’ll have the “lite” version of the most important basic tools, but you won’t have full access to the features that will help you manage a full portfolio.

The Premium plan is right for you if…

You’re an intermediate-level or experienced investor committed to saving up for retirement or other long-term goals.

The Premium plan is the ideal plan for real fundamental investors that want to check on the Quant Ratings of the stocks they hold in their portfolio and be alerted when they should be selling their stocks.

The best part about the Premium plan is that you can do as much or as little research as you want.

If you just want to know which stocks have the best ratings from Seeking Alpha, Wall Street analysts, and quantitative analysis, then you can see that in a matter of seconds.

But if you want to drill down deep into the different evaluation factors that Seeking Alpha uses, then you’re able to do that type of in-depth research as well.

The PRO plan is right for you if…

You’re a professional investor who wants the VIP treatment.

The level of special treatment that Seeking Alpha PRO subscribers enjoy is suitable for professional or institutional investors who make regular trades (including shorts) and/or want to contribute to the Seeking Alpha community by sharing their investing opinions regularly.

Final Thoughts

One of our favorite things about Seeking Alpha is that they have a variety of service levels depending on which type of investor you are. After reading our Seeking Alpha review, you may want to read Seeking Alpha reviews from individual users.

If you want to research your own stocks to make sure you are picking those with STRONG BUY ratings, then their Premium service is for you.

Either way, their website is easy to use. There is a lot of information but they make it super easy to find the Quant Rating on each stock.

If you are curious about how Seeking Alpha stacks up against competitors such as Benzinga Pro, check out our latest review: SEEKING ALPHA VS BENZINGA PRO!

They truly believe that investing knowledge should be democratized into an affordable platform that anyone can use, and that’s exactly what they’ve done.

FAQ

Is Seeking Alpha worth subscribing to?

We think it is! The free plan offers the opportunity to check out Seeking Alpha’s basic features and user interface, and if you’re at all serious about investing, it’s worth paying to get access to Quant ratings and other premium features.

How reliable is Seeking Alpha for investment research?

Seeking Alpha has some of the most extensive analysis available to investors, and its Quant ratings have consistently outperformed the market. We wouldn’t recommend taking any one analyst’s word about which stocks to buy, but Seeking Alpha’s has taken a lot of the guess work out of the investment selection process with Quant ratings.

Is Seeking Alpha Premium worth the cost?

The answer depends on how much money you have in the stock market. If you have more than $10,000 in your portfolio than you should link your brokerage account to your Premium account so you can quickly see the Quant Rating of your stocks and get alerted when to sell. Just improving your performance by 3% a year will return you $300 in returns. Hence if you have more than $10k in the market than you should seriously sign up for this service. Your get 7 days for free so try it. As you can tell, we think Seeking Alpha is worth the investment. The Premium plan gives subscribers access to everything they need to make investment decisions and monitor their portfolios and at a price that’s pretty reasonable.

Can Seeking Alpha be trusted for stock recommendations?

There’s no way to predict whether Seeking Alpha’s Quant ratings will continue to be accurate, but we can certainly say that the historical performance of their “Strong Buy” stocks has been impressive, beating the S&P 500 by more than 4x.

Is Seeking Alpha suitable for beginner investors?

We think it is. For beginners who just want to get their feet wet, the Basic plan offers an opportunity to do just that. Even the Premium plan may be suitable for beginners who don’t mind taking on a bit of a learning curve and who want the option to conduct deep-dive research before investing.

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. ✅ U.S. stocks, ETFs, options, and cryptos $3 monthly sub 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

$0

✅ Now 23,000,000 users

✅ Cash management account and credit cardFree stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes for advanced traders

✅ Access to U.S. and Hong Kong markets

✅ Learning tools built in60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for different experience levels

✅ SmartRouting™ and deep analytics for executionRefer a Friend and Get $200

Interactive Brokers Review

4.

M1 Finance

✅ Automated investing “Pies” with fractional shares

✅ Integrated banking & low-interest borrowing

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

5.

Webull

$0

✅ Extended-hours trading premarket and after-hours

✅ Built-in technical charts, screeners, and indicators

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

6.

Public

$0

✅ Fractional shares of U.S. stocks and ETFs

✅ No payment for order flow (PFOF) model

✅ “Alpha” tool with earnings calls and sentiment data$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

7.

Composer

$32 a month

✅ Invest in fully automated stock strategies

✅ Build custom strategies with our no-code builder

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

8.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools for beginners

✅ Curated theme portfolios for retail investors$5 when you invest $5

Stash Review

9.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Retirement Accounts

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

10.

Etoro

$0

✅ CopyTrading™ feature to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto in one app

✅ Commission-free trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

11.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data; Morningstar

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.