As investors, we demand cheap, convenient, and intuitive online brokerages.

There are plenty of online brokerages to choose from, and one of the most popular these days is Webull, a commission-free trading platform.

You may have heard of Webull and wonder, is it a good choice for you? We’re here to help.

In this Webull review, we’ll tell you what Webull is, how it works, and answer the most important question of all:

Is Webull a good trading platform?

By the time you’ve finished reading our Webull review, you’ll have all the information you need to make a decision about whether you should be using Webull. Here are some questions to get you started:

- Are you looking for commission-free stock trades?

- Are you looking for a stock brokerage with no account minimum?

- Are you a fundamental or technical investor? Both?

- Are you looking to trade on margin?

If you answered yes to 3 out of 4 of these question…

…Webull may be the investment app to suit your needs!

The broker-dealer Webull offers:

- 100% commission-free trading

- No account minimum

- Tools for fundamental and technical investors

- Easy access to margin trading

If this sounds good to you, stay tuned for the rundown on this investment app.

Is Webull Safe and Legit?

Webull Financial LLC is a registered broker-dealer with the Securities and Exchange Commission (SEC), and a member of FINRA and SIPC. In other words, they’re fully regulated and users’ deposits are insured by the SIPC. (It’s important to note that insurance won’t cover you if you lose money because you compromised your own security or if you lose money due to market volatility or poor investment decisions.)

The company was founded in 2018 and offers users the option of logging in through their website or using their well-reviewed mobile app.

You might be asking yourself Is Webull safe? Is Webull legit?

Webull takes users’ security seriously. They offer these security features:

- Two-factor authentication

- Device protection

- Password protection, including the option to set a unique trading password

- Pattern lock

By enabling 2FA, setting a strong password, and making sure to keep you login and password safe, you’ll have all the protection you need to keep your Webull account secure.

Webull Platform and Tools

The Webull trading platform is offered in a mobile web-based app and desktop app. Both options provide an intuitive and easy-to-use user interface.

The platform is excellent for both fundamental and technical stock analysis.

Our favorite thing is this:

You can access features that most brokerages charge for, but the same features are 100% free with Webull.

The free features include news, real-time market data, analysis tools, and trading commissions.

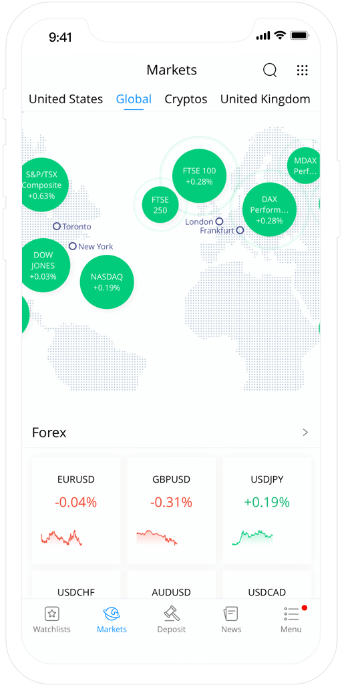

The real-time market data is available for all U.S. markets.

Having access to timely and accurate data ensures that you are seeing real prices in real-time.

If you are an active trader, the real-time market data will be an invaluable resource.

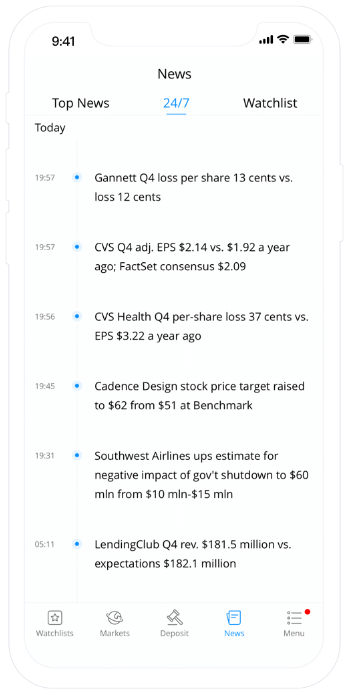

The news stream offers real-time financial news with articles from trusted sources such as Reuters and Bloomberg.

This feature gives you a single location to view financial news and provides a mixed collection of content to provide you with diverse views on specific topics.

The agency rating feature gives you the ability to track and see expert analyst ratings on specific stocks.

Smart alerts give you the ability to set numerous alerts that will notify you if a stock hits a fixed price, moves a set percentage, or has reached a specific volume level.

In terms of fundamental analysis, the platform enables you to access revenue data, and historical earnings per share.

There are also key statistics, insider trades, stock information, including earnings, dividends, and stocks splits.

And, as promised, there are tools for fundamental and technical analysis.

Pro Tip:

You can earn 20 FREE FRACTIONAL SHARES when you make a qualifying deposit on Webull!

Smart Tools of Webull Include:

- News

- Press releases

- Analyst recommendations

- Historical EPS

- Revenue data

- Insider holdings and transactions

- Financial calendars

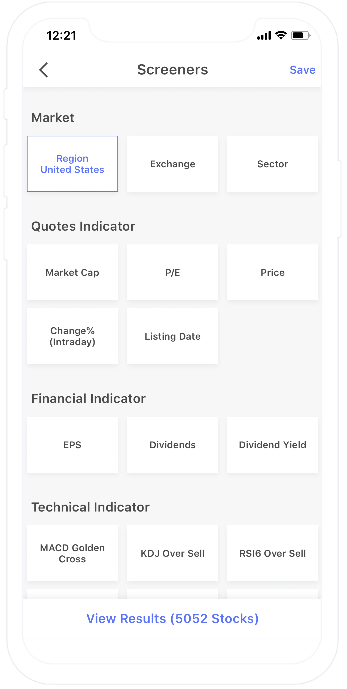

- Stock screeners

- Watchlist and alerts

Technical Analysis Indicators Include:

Webull technical indicators include:

- Bar, candlestick, and line charts

- Exponential moving averages

- Bollinger Bands

- Money Flow Index

- MACD

- RSI

One of the primary reasons Webull is one of the top research tools is that the company provides research and tracking for stocks, ETFs, indices, futures, cryptocurrencies, options, and commodities.

The app also comes with real-time quotes.

Other Useful Features Include:

- Margin trading

- Extended-hours trading

- Customer service (email, chat phone)

- Short-selling

The best part is that these features are at your fingertips with the use of your mobile device.

Is Webull Beginner Friendly?

You may be wondering, is Webull good for beginners?

Let’s start with the basics. Webull offers top-notch education and research tools that make it easy to find, use, navigate, and access information.

Even people who are just starting out can find news and use screeners that include markets, news, individual stocks, and a screeners page.

The screeners’ page allows users to choose:

- Which stocks to track; and

- Which technical parameters to watch

You can use these tools to uncover new investment ideas. For instance, you can use the stock screeners to find things like “Biggest movers in the last 5 minutes.”

Additionally, you can use this feature to view an economic calendar with upcoming Initial Public Offering (IPO) dates, earnings, and other news relevant to your stocks of interest.

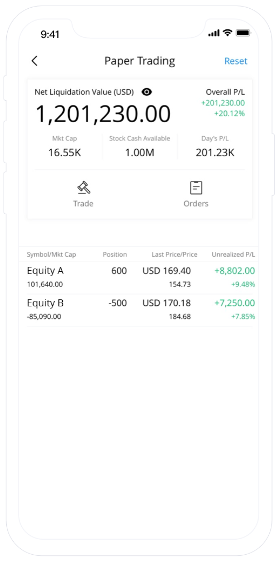

And finally, one of my favorite for beginners features is the stock trading simulator.

The trading simulator enables you to trade with “paper money” (i.e., fake money) so you can test the waters without any risk. It’s a great way to learn how to trade stocks.

This feature is valuable for new investors to learn the ropes, as well as for seasoned investors testing new trading strategies.

You can use this in-app tool to gain valuable experience without the risk of losing money.

The tool also comes with real-time data and advanced charting for U.S.-listed securities.

In other words, if you’re just starting out, we think Webull’s intuitive interface, accessible research, and especially the option to engage in paper trading to learn the ropes, make it an excellent choice for beginners.

Pro Tip:

You can earn 20 FREE FRACTIONAL SHARES when you make a qualifying deposit on Webull!

Webull Commissions, Fees, and Asset Availability

Webull offers commission-free U.S. stock trades and it is free to open and maintain an account.

Additionally, you can open a regular trading account without a deposit minimum.

However, there are some Webull fees that you should know about.

For starters, the SEC and FINRA charge minor fees on all trades (this is standard industry practice).

The SEC fees are $0.0000278 * Total $ Trade Amount (Min $0.01) and apply only to Sells.

The FINRA fees are a trading activity fee of $0.000166 * Total Trade Volume Min $0.01 per – Max $8.30 per trade and apply only to Sells.

CAT regulatory fees are $0.000040 * Total Trade Volume and apply to both Buys and Sells.

There are additional fees for margin trading, options, futures, and some other trades. You can find the complete fee tables here.

Lastly, wire transfers are $8 for domestic deposits and $25 for domestic withdrawals.

We found that Webull fees are significantly lower than other brokerages. That said, remember that Webull has the right to change its fees at any time and fees from regulatory agencies are also subject to change.

Webull Asset Classes and Account Types

Webull provides trading on over 5,000 U.S. stocks and electronically-traded funds (ETFs) in the United States.

You can trade with Webull during extended trading hours which includes pre-market and after-hours trading.

You can use these extended trading hours at the following times:

- Pre-market trading hours: 4:00 a.m. to 9:30 a.m. EST

- After-hours trading hours: 4:00 p.m. to 8:00 p.m. EST

In addition to these features, you can also leverage the sale up to four times the amount.

If you have over $25,000 in equity in a margin account, you gain access to unlimited day trades.

With Webull, you may invest in several asset classes, including stocks, ETFs, OTC, options, index options, and futures.

However, the company does not support the trading of mutual funds, bonds, or cryptocurrencies.

For account types, you can open an individual taxable account and a margin account.

Webull does not offer retirement accounts.

Ideally, we would like to see more asset class and account types offered, but the app is great for stock trading.

Webull vs. Competitors (Robinhood, TD Ameritrade, etc.)

Let’s take a quick look at how Webull compares with some of its competitors. Keep in mind that regulatory fees are the same for every platform, so we won’t be including those here.

|

Webull |

Robinhood |

TD Ameritrade |

E*trade | |

|

Asset Classes |

Stocks, ETFs, OTC, futures, options |

Stocks, ETFs, ADRs, select cryptocurrencies |

Stocks, ETFs, mutual funds, Forex, bonds |

Stocks, ETFs, bonds, mutual funds, options, futures, CDs |

|

Commission Free? |

Yes |

Yes |

Yes, commission free for stocks and ETFs |

Yes, commission free for US stocks, ETFs, and mutual funds |

|

Security |

Passwords, encryption, 2FA, device protection, private insurance |

Passwords, encryption, 2FA, private crime insurance |

2FA, encryption, identity verification, voice ID |

2FA, encryption, network defense, privacy protection, private crime insurance |

|

Customer Support |

Email, phone, chat |

In-app, online knowledge base |

Live chat, phone, email |

Phone, email |

|

Interface |

Intuitive and beginner friendly |

Intuitive and beginner friendly |

Beginner friendly; tons of learning |

Intermediate to advanced |

|

Other considerations |

No cryptocurrency |

Limited crypto |

Must have a Charles Schwab account |

Must have a Morgan Stanley account |

|

Retirement accounts |

No |

Yes |

Yes |

Yes |

Comparing Webull vs Robinhood, you can see that Webull has more asset classes, but doesn’t offer cryptocurrency trading or retirement accounts, while Robinhood does. If we look at Webull vs TD Ameritrade, we can see that TD Ameritrade offers some asset classes that Webull doesn’t, but their support options are similar. Also, TD Ameritrade is available only to those who have a brokerage account with Charles Schwab, and anybody can use Webull.

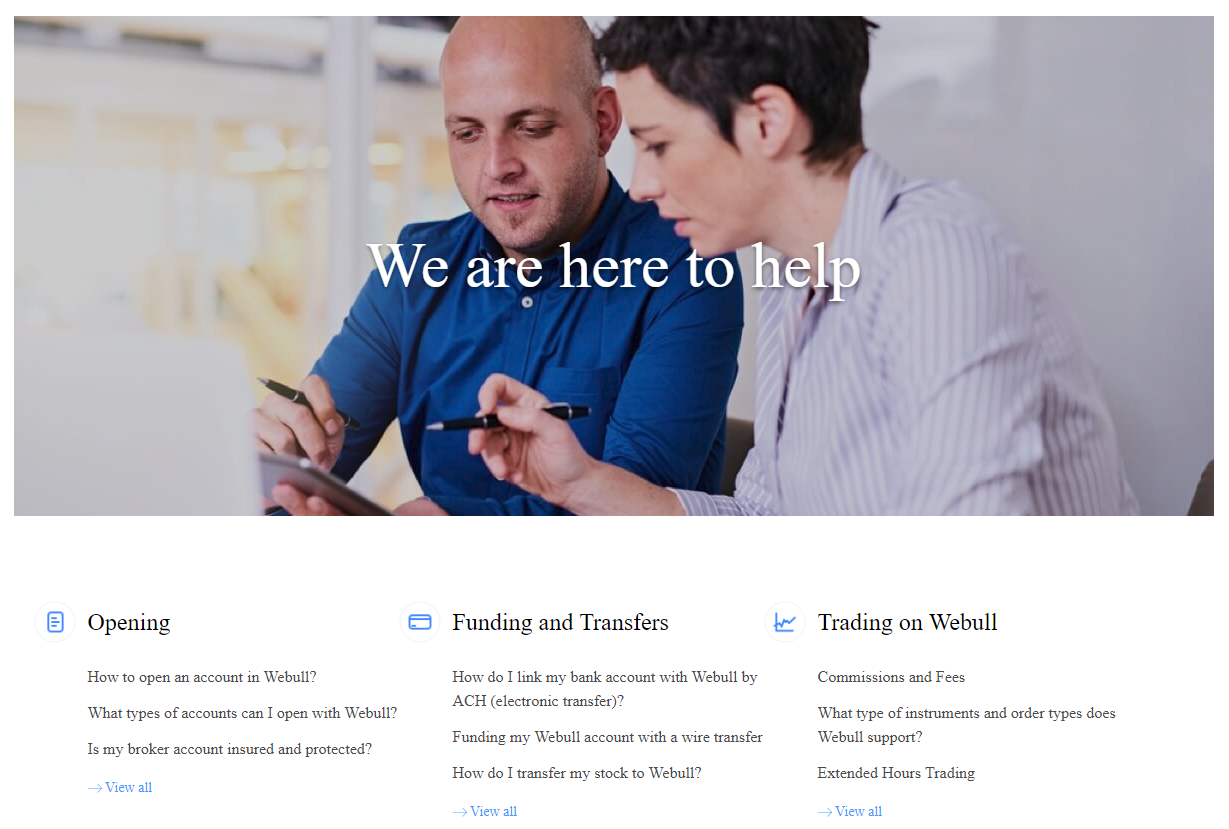

Webull Customer Service

Now, let’s get into our Webull customer service review.

Webull customer service can be reached through chat, email, and phone.

The customer service response time is prompt, and users typically get a response in a matter of minutes.

Other trading platforms can take up to 24 hours, if not multiple days before answering your query.

Additionally, Webull’s Help page offers an extensive FAQ section that covers many of the basic questions.

The company’s FAQ page offers information on topics like opening an account, funding an account, and transfers of cash and stocks.

You can find answers to questions like these:

- I am at the step where I verify my email, but I can’t find the verification code in my inbox. What should I do?

- I have a U.S. bank account. How do I make a deposit into my Webull brokerage account?

- How do I transfer stocks to my Webull account?

So, the FAQ section covers many of the questions you may encounter while using the service.

You can also view the “Trading on Webull” section, which contains information about commissions, fees, tradeable assets, and order types.

Can’t find an answer? Make sure to email Webull for more details or to speak to an agent directly.

Overall, the customer service offered at Webull is on point for any query you may have.

Who Should Use Webull?

By now, you’re probably wondering who should use Webull… and we’ve got the answers!

Here are a few investor types that we think can benefit the most from using Webull.

- Beginning traders. Webull has an intuitive interface, useful online resources and research, and strong customer support. Even if you’re just starting on your investment journey, you can get a lot out of using Webull as your investment app.

- Active traders. Webull’s real-time market prices and updates make it an ideal app for anybody who’s an active trader. Even if you’re not day trading, you’ll appreciate how easy Webull makes it to stay on top of your investments.

- Options traders. Webull offers option trading and makes it accessible for investors. If you’re interested in trading options in addition to stocks and ETFs, you can do it with Webull.

- Investors who don’t want to pay commissions. It used to be that you couldn’t trade without paying commissions, but that’s no longer the case. Webull is committed to commission-free trading, which means anyone can afford to use this platform.

It’s free to set up a Webull account, and because they offer paper trading, you can play around with a variety of investments to get a feeling of how it works before you start.

Pro Tip:

You can earn 20 FREE FRACTIONAL SHARES when you make a qualifying deposit on Webull!

What We Love about Webull

Here are some of the biggest Webull benefits as we see them.

Commission-free trades.

You can execute unlimited trades without paying a cent in commissions. (Remember, there will be regulatory fees and some trades, including options, do have fees associated with them.)

No account minimum.

You can put as much, or as little, as you would like to start investing.

There’s no minimum deposit and you can purchase fractional shares.

Intuitive trading platform.

The platform is very well-designed, includes tons of features, and is surprisingly easy to navigate.

Even beginners can dive right in and start trading.

Leverage of 4 to 1 on margin trades.

Leverage up to 4 times the amount in the account for trades occurring on the same day.

(We suggest if you’re a beginner, you start with straightforward trades and work your way up to margin trading.)

Free trading simulator.

Use the free trading simulator to simulate new trading strategies or make your first few trades.

What We Don’t Love about Webull

Here are a few Webull drawbacks to consider. These may not apply to you, but it’s important to us to give you a complete picture of Webull.

Supports limited asset types.

Webull does not support trading cryptocurrencies, mutual funds, bonds, and other assets.

However, you can access many different markets, including options and futures.

No retirement accounts

Unlike some other electronic brokerages, Webull doesn’t offer users the option to open a retirement account, such as an IRA.

That may be a drawback for some users who prefer to have all their investments in one place.

Webull Review Summary

Our Webull final review is that we like this platform for many reasons.

- It offers commission-free trading

- The interface is user-friendly and intuitive

- There’s a ton of research and learning available

- Webull’s security is top-notch and includes 2FA, encryption, and private insurance.

We like Webull for ALL traders because of the wide-range of features and tools the app has to offer.

The primary benefits for beginner traders are commission-free trades, no minimum account balance, and free stock trading simulator.

These factors being present means:

- You can keep more money in your pocket;

- You do not need much money to get started; and

- You can practice with the app before using real money.

For intermediate to advanced investors, the primary benefits are commission-free trades and fundamental and technical analysis tools.

These factors being present means:

- You can keep more money in your pocket; and

- You can perform your analysis entirely on Webull.

However, if you are looking to save for long-term goals (i.e., retirement), Webull may not be the ideal option.

Whether beginner or advanced, Webull caters primarily to active stock traders.

The lack of asset classes and account types are limiting for the long-term “buy-and-hold” type investor.

However, your long-term investment strategy does not need to interfere with your short-term and active stock trading goals.

All-in-all we highly recommend giving Webull a shot because it’s free to use and you won’t pay commissions.

So, what do you say? Is Webull the next big investment app? Are you going to try it?

Let us know with a comment below!

Join Webull today and start trading with no commissions!

FAQs

Yes, it’s free to set up an account! Webull doesn’t charge commissions on many trades, but keep in mind there are some regulatory fees that you’ll need to pay.

Yes, we think Webull is a good trading app for beginners. We particularly like that they offer paper trading, which allows beginners to practice trading before they start trading with their own money. We also like that Webull provides an excellent knowledge base that beginners can use to learn about investing.

No, there’s no minimum deposit requirement.

Not at this time, but you can trade crypto on the Webull Pay app, which is a separate app dedicated to cryptocurrency.

The answer to this question really depends on what you want. For example, Robinhood offers limited crypto trading and Webull only offers crypto trading through a separate app, Webull Pay. Likewise, Robinhood offers users the option to open an IRA and get matching funds. On the flip side, Webull offers paper trading and far more research options and a bigger knowledge base than Robinhood.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.