Have you ever wished that you had a robot to do things like clean your house or walk your dog?

After all, it is 2024 and life could be so much easier if we had more robots.

If you agree…

…you will likely see the benefit of a robo-advisor, which is basically a robot that invests money for you.

Robo-advisors provide automated, algorithm-driven financial planning software to build and manage your investment portfolio.

The technology collects information like your financial situation and future goals, through an online survey, and offers advice and makes investment decisions based on that information.

Robo-advisors can save you time by automating complex, time-consuming activities like rebalancing and tax optimization.

This type of investing can also save you money because you money because robots are cheaper than humans!

Robo-advisors weigh your personal preferences against unpredictable events to tailor a portfolio to your specific needs. Personal preferences and unpredictable events include the following:

Personal Preferences

- Time Horizon

- Financial Goals

- Risk Tolerance

Unpredictable Events

- Asset class performance

- Market Volatility

- Market Conditions

Robo-advisors are great because they require minimal human interaction and can do the same thing that humans do.

And, since there are low costs and low (or no minimum investment), robo-advisors can get you started quickly.

But sometimes investors need a human’s touch to guide them through such a complicated topic.

You have many robo-advisor options at your disposal – so which one should you choose?

Preferably one that is cheap, helpful, and easy to use.

This article aims to look at Wealthsimple, one of our top picks for best robo-advisors in 2024.

Wealthsimple Overview

Wealthsimple offers the benefit of investing with robo-advisors and humans.

Founded in 2014, Wealthsimple is Canada’s largest robo-advisor with over 100,000 clients.

Wealthsimple has world-class financial experts and top-talent from Silicon Valley working for you.

Additionally, the company’s team of software engineers, designers, and data scientists are from companies like Amazon, Google, and Apple.

Wealthsimple provides you with world-class, long-term investment management…

…without the high fees and account minimums!

Even better, the company helps you earn the best possible return and can lower your tax bill.

But you may be wondering…

What is the goal of Wealthsimple?

The primary goal of Wealthsimple is to make “investing easier for millennials.”

Because, as we know, most millennials are clueless about money.

So, how does Wealthsimple give you a hassle-free investment experience?

The company puts your investments on autopilot by creating a diversified portfolio made up of ETF indexes.

To put it simply, Wealthsimple’s low-cost, automated investment portfolios can help you reach your long-term investment goals.

So, apart from millennials, who is Wealthsimple best for?

Beginner & Advanced Investors

There is no minimum deposit required, and you can have your funds managed regardless of the amount.

Investors with over $100,000 to invest also receive numerous extra benefits. These benefits include lower fees and tax benefits.

Socially Responsible and Islamic Investors

This robo-advisor gives you the ability to make money while staying in line with your values.

That’s right – Wealthsimple is great for just about everybody – although that largely depends on your individual goals. For example, learn more about Socially Responsible Investing.

How Wealthsimple Works

Wealthsimple is surprisingly easy to use. The company uses the Nobel Prize-winning Modern Portfolio Theory. The company aims to diversify your portfolio by investing in a broad range of assets.

Here is how a robo-advisor works in FIVE steps…

- Complete a brief questionnaire to assess your investment needs.

- The robo-advisor creates a portfolio of Exchange-Traded Funds (ETFs).

- Experts’ monitor market activity and underlying investments to rebalance your portfolio.

- Speak with Certified Financial Planning professionals to update and improve your plan.

- Log in to your accounts to track progress, make adjustments, and move closer to your goals.

Wealthsimple works just as any other robo-advisor. You can begin your online application by selecting the “Start Investing” button on the website.

Signing up for the service is a breeze, to complete your sign-up, you must…

- Get Started Here

- Answer a few questions.

- E-sign the investment management agreement.

- Upload a bank statement, a screenshot of a bank account, or a void check.

If you experience any trouble signing up, you can contact Wealthsimple at +1 (855) 782-3559 or email help@wealthsimple.com

Wealthsimple offers several account types, including individual and taxable accounts…

- Registered Retirement Savings Plan

- Tax-Free Savings Account

- Locked-In Retirement Account

- Registered Education Savings Plan

- First Home Savings Account

- Non-Registered Account

- Corporate

- Spousal Registered Retirement Savings Plan

- Registered Retirement Income Fund

They also provide three themes for managed investment accounts:

- Wealthsimple Classic

- Wealthsimple Socially Responsible Investing

- Wealthsimple Halal Investing

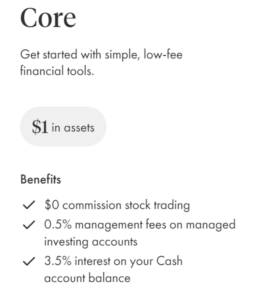

Furthermore, Wealthsimple offers three managed investment tiers for users: Core, Premium, and Generation

Wealthsimple Core

The Wealthsimple Core portfolio is the most common option.

This account is for account balances between $0 – $100,000. The management fee is 0.50% annually.

This portfolio offers the following services…

- Automatic deposits and account rebalancing

- Dividend reinvesting

- Personalized portfolios

- Expert financial advice

From there, you have three choices for your portfolio:

- Classic

- Socially Responsible Investing

- Halal Investing

Additionally, your ‘risk setting’ determines whether you should go with a conservative, balanced, or growth portfolio. The answers that you provide in your questionnaire will determine your risk setting (but you can override this).

Each portfolio is made up of ten different ETFs (six stock funds and four bond funds).

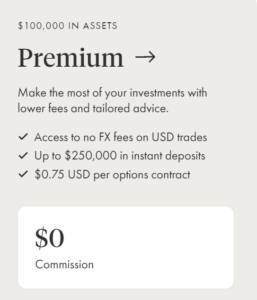

Wealthsimple Premium

This account is for account balances over $100,000+ and offers every feature included in the Basic account, plus:

- Lower fees: Management fee of 0.4%

- Goal-based planning: Get financial planning sessions with an expert financial adviser.

- Discounted will planning: Get 15% off your will planning

- Priority Support: Get access to priority email and call support

- Reduced Fees: Get reduced fees for options and forex trading

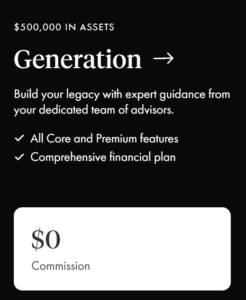

Wealthsimple Generation

This account is for account balances over $500,000 and offers every feature included in the Premium account, plus:

- Lower fees: Management fee of 0.2-0.4%

- Goal-based planning: Get financial planning sessions with a team of financial adviser.

- Custom Asset Allocation: Get custom portfolios and have assets assigned to specific accounts

- Airport Lounges: Get 10 free passes a year to airport lounges

Wealthsimple Generation accounts combine the best of roboadvising with a team of dedicated financial planners.

Wealthsimple Socially Responsible Investing (SRI)

Wealthsimple also gives you the opportunity to invest in good causes.

The SRI accounts focus on companies that support:

- Low carbon emissions

- Gender diversity

- Affordable housing

You can see for yourself which ETFs you are investing in and what causes they support.

Here are the six funds offered with the SRI portfolio:

- iShares MSCI ACWI Low Carbon Target (CRBN)

- PowerShares Cleantech Portfolio (PZD)

- iShares MSCI KLD 400 Social Index Fund (DSI)

- SPDR Gender Diversity (SHE)

- PowerShares Build America Bond Portfolio (BAB)

- iShares GNMA BD ETF (GNMA)

SRI portfolios do carry slightly higher costs associated with keeping your investments “socially responsible.” Otherwise, the SRI portfolio offers the same fee structure and asset allocation as the Basic and Black accounts. The primary difference involves the ETFs that you will be invested in.

Wealthsimple U.S. Halal Investing

Wealthsimple has also created a portfolio option that makes investing easy for Islamic people. The Halal portfolio does not include bonds, which goes against Islamic law that prevents profiting from debt.

These portfolios are not tailored to individual investors since the shares in this portfolio must comply with Sharia law.

Complying with Islamic law means no investment in companies that profit from tobacco, gambling, or other restricted industries.

The top ten holdings in the Halal portfolio include:

- Johnson & Johnson (JNJ)

- Novartis AG-Sponsored ADR (NVS)

- Exxon Mobil Corp (XOM)

- SAP SE-Sponsored ADR (SAP)

- Procter & Gamble (PG)

- Canon Inc.-Sponsored ADR (CAJ)

- Total SA-Sponsored ADR (TOT)

- Pfizer Inc. (PZE)

- Alibaba Group Holding-Sponsored ADR (BABA)

- Unilever N V-NY Shares (UN)

Wealthsimple Tools

Wealthsimple offers a simple, easy-to-use website without many extras.

You can also download Wealthsimple’s app (available on Android and iOS), which is very similar to the functionality on the site.

You can use the app for:

- Viewing your portfolio

- Tracking account activity

- Making deposits

- Updating your profile

This makes accessing your investments very easy, which was an important feature for us.

Wealthsimple also offers educational materials and tools to give you a better understanding of how your investments are doing.

Our favorite tool that you can use it called Wealthsimple Roundup. This feature rounds up the “change” on your purchases.

For example, if you purchase a $3.75 coffee that purchase will be rounded up to $4.00. Once per week your money will be combined and invested. Talk about a fully-automated way to invest.

And, believe us – that money can really add up!

Another tool we like is the compound interest calculator that you shows you your investments potential over time.

Seeing your investment potential can motivate you to get started – today!

You can also learn more about your investments in general in with company’s educational materials.

Here is an example of that with the company’s explanation of an ETF:

This information is simple and straight to the point.

If you need additional information, there is a wealth of it that can be found anywhere on the internet.

Wealthsimple Customer Service

This service allows robots to do your investing, but…

…Wealthsimple offers customer service that can assist you in opening your portfolio, specific investments, creating a financial plan, and more.

You can reach customer support…

- Over the phone, Monday through Friday, 8 to 8 EST.

- By e-mail, 24/7, at support@wealthsimple.com

You can also access certified financial planners and chartered investment managers. This access is an impressive opportunity that MOST robo-advisors do not offer.

Despite its low-cost offerings, Wealthsimple does not skimp on customer service and professional investment advice.

This benefit ensures that your investments will get, and stay, on the right track.

Bonus offer: Open an account today and get $50 free! Click Here

* this offer won’t last forever

Wealthsimple Fees

I know what you are thinking…

…this is great, but how much is it going to cost me?

There are no maintenance, trading, rebalancing or transfer fees.

The fee structure of this company is straightforward. Wealthsimple charges a flat percentage for all account balances. There are three annual fee tiers…

- Wealthsimple Core: 0.5% annual fee on account balances $0 – $100,000.

- Wealthsimple Premium: 0.4% annual fee on accounts balances over $100,000.

- Wealthsimple Generation: 0.2-0.4% annual fee on accounts balances over $500,000.

In addition to these fees, you will need to pay the expense ratios related to the ETFs in your portfolio.

These fees are slightly higher compared to other robo-advisors, but represent a fraction of what you would pay a human financial advisor or large institution!

These fees are standard within the industry, and there are no hidden fees.

What we love from this Wealthsimple Review

Account options

Your options include: individual and joint taxable accounts; trusts; traditional, Roth, and SEP IRA accounts.

Access to financial planners

Automation is the main benefit of robo-advisors, but sometimes you need human interaction.

Wealthsimple gives all customers the ability to get personalized help from one of the company’s certified financial planners or chartered investment managers.

Wealthsimple clients get more features with their plan. These features cover concerns like…

- Will I have enough money to retire?

- Which accounts should I withdraw money from?

- How can I improve my plan?

Having access to investment professionals is extremely important and this is where Wealthsimple stands out compared to other robo-advisors.

Free tax-loss harvesting

Tax-loss harvesting lowers an investor’s taxes by offsetting income with any investment losses. This service is usually a paid add-on service or only available for very wealthy investment clients.

However, any Wealthsimple customer can have a portfolio analyst review their accounts for tax-loss opportunities.

This free benefit can be significant and will pay-off the first time you file your taxes.

Minimum initial investment

There is a $0 account minimum for the Wealthsimple Core portfolio. This service includes free automated deposits, automatic rebalancing, and dividend reinvestment.

This makes investing with a robo-advisor easier than ever!

Account fees

Wealthsimple charges no fees for transfers, trading, or tax-loss harvesting. You just pay an annual fee on your account balance.

Socially responsible investment options

You don’t need to fund large corporations to invest.

You can invest in companies that specialize in things like clean technology innovation, efforts to lower carbon exposure, and supporting diversity in leadership roles.

You can put your money to work and do some good!

Shariah-compliant portfolio options

You can invest in a halal portfolio, which is a portfolio that complies with Islamic law.

Wealthsimple offers a portfolio containing around 50 individual stocks that are reviewed by a third-party committee of Shariah scholars.

What we don’t love about Wealthsimple

Account management fees

Wealthsimple charges a 0.5% fee on account balances less than $100,000. And 0.4% on balances over $100,000.

In contrast, numerous other robo-advisors charge between 0.25 – 0.35%.

SRI fund fees

It is not always cheap to invest responsibly.

Socially responsible investments typically come at a higher cost compared to other investment options. SRI portfolios can charge around 0.25% whereas non-SRI portfolios are approximately 0.1%.

Is Wealthsimple for you?

Most robo-advisors are relatively similar in investment format and fee structure.

So, how do you know which robo-advisor is right for you? Let’s look at the final details…

You can open an account with just $1, so these portfolios are available to any investor. Also, you will receive $50 for free in your cash account if you deposit at least $500.

Wealthsimple does charge higher fees than most robo-advisors – and you could end up paying 0.10 – 0.25% more, per year. But again, these fees are meager compared to paying a human investment professional.

Also, one key benefit that can be difficult to measure is the access to investment professionals.

Depending on your familiarity with investments, this benefit could prove to be invaluable and well worth the higher fee.

Wealthsimple’s Robo advisor approach is often compared to other popular Canadian brokerages like Qtrade (read: QTRADE REVIEW).

Also, Wealthsimple offers ways for you to invest that are consistent with your values. Robo-advisors are typically limited in specialty portfolios, but Wealthsimple is not.

If you are looking to try a robo-advisor, Wealthsimple is a logical place to start because trying their product is essentially risk-free.

Overall, we highly recommend Wealthsimple and recommend that you give them a shot.

Have you ever used a robo-advisor to invest? What was your experience?

Let us know your thoughts with a comment below!

P.s. If you sign up today with over $500, you will get $50 free! Sign up here

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.