Money and responsibility don’t always work hand in hand. But today we’re here to ask the question: why not both? Today we’re looking into the concept of socially responsible investing This article will teach you how to invest in companies with a conscience.

Intro to Socially Responsible Investing

Quick quiz: What kind of investing makes up roughly 12% of the $25 trillion moving through the U.S. stock market?

Hint: It’s not the kind that places profit before people (and the planet). The answer is: Socially Responsible Investing (SRI).

In this Mission, by examining why investors would choose this strategy and how they would do it. We’ll get into the details of how to build an environmentally and socially friendly portfolio while staying competitive alongside other kinds of securities in a typical market environment. We’ll also look at some examples of successful socially responsible companies.

What is SRI

In 1987’s Wall Street, Gordon Gekko proclaims that “Greed is Good” – that profits above all else are what matter. But it’s not 1987 anymore. In today’s modern world, investors and the general public expect companies to maintain some social conscience, and they’re putting their money where their mouths are.

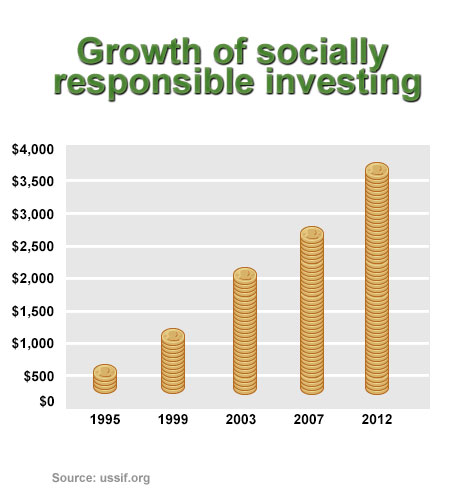

Here is what’s undeniable: trillions of dollars are pouring into SRI every day and that number is growing. The US SIF (Forum for Sustainable and Responsible Investment) estimates the volume to be at about $3.7 trillion. That’s a nice chunk of change!

Investors are proving some of the basic and underlying assumptions of people’s incentives wrong. You don’t have to be out for just yourself!

Look, nobody in their right mind invests to lose money, but SRI is one path to seeking returns that poses a significant collateral benefit for everyone. When you think about how it works, everyone stands to gain. If people invest in socially responsible companies, they show that they care about our ecosystem. In turn, companies see this and react to it by working to be more socially responsible. This results in an increase in value as investors are looking for SRI. It’s a win, win, win!

Definition: Socially responsible investing is the buying and selling of stock in companies that aim to do no harm. That is, they conduct business in such a way that there is little to no negative impact on the environment or human beings.

Case Study: Green Mountain Coffee

Fair Trade is a big deal when it comes to coffee beans, and Green Mountain Coffee Roasters got this part of roasting right early on. While there is a perennial debate about the ins and outs of growing, exporting, and importing coffee, the Fair Trade brand licenses its logo to companies that qualify under its rubric. To join the Fair Trade circle, a coffee company has to meet a number of political, payroll, and price-oriented standards.

In fact, Green Mountain Coffee is a two-time winner of the Best Corporate Citizen award, given to the publicly traded company which demonstrates the best SR practices.

Green Mountain Coffee was founded in 1981 as a single shop on the base of a mountain in Vermont, upholding free-trade practices. In 1993, GMC went public via IPO (initial public offering) and today sells over 20 million pounds of coffee per year. The company’s annual revenue is close to $4 billion.

Let’s practice by buying 100 shares of GMCR now.

What are Socially Responsible Companies?

Socially responsible investing sounds like the best of both worlds, doesn’t it?

It sure seems like a natural strategy for the ecology and fair-trade minded investor: hitch your funds only to companies that are practicing a sensible kind of world stewardship, and taking care of the environment. But how can investors find SR companies? Certainly not all of them are as transparent as Green Mountain Coffee.

The truth is, finding SR companies requires quite a bit of research. When it comes to socially responsible investing: it’s not all earthy-crunchy companies.

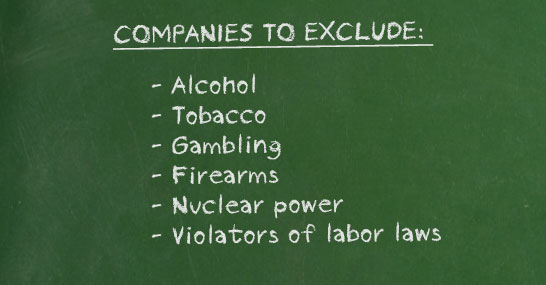

It may be easier to start by crossing certain industries off the list. Here are some things to avoid:

So that means companies like Budweiser (Alcohol), Altria and Philip Morris (Tobacco), Las Vegas Sands (Gambling), Smith and Wesson (Firearm), Energy Solutions (Nuclear Power) and Nike (Sweatshops) wouldn’t be part of a Socially Responsible Investor’s portfolio.

Examples of Socially Responsible Companies

So now that we’ve learned what type of companies not to invest in when building a socially responsible portfolio, let’s look at some examples of companies that should be investing in. Unfortunately, researching and quantifying SRI companies is pretty difficult. Unlike profitability, there aren’t readily available metrics like P/E or EPS to measure social impact. Fortunately enough, the web has some great resources like the USSIF, Maclean’s and ethispehere that do most of the heavy lifting.

SRI Indexes

An index helps investors get a glimpse at the overall performance of a market. Some of the most famous indexes are the Dow Jones and the S&P 500.

SRI Indexes

While the DOW and S&P 500 capture the entire broad market, there are also a number of indexes that represent subsets of the market. This is good news for Socially Responsible Investors – there are a number of indexes designed to provide a snapshot of the entire SR market. Let’s look at a few:

Domini 400 Social Index

This index is probably the most popular among Socially Responsible Investors. These 400 public companies meet the Domini Social Investments’ criteria for environmentally and human-friendly practices. You won’t find, for example, makers of guns, cigarettes, booze, or nuclear power plants on this index.

This index is probably the most popular among Socially Responsible Investors. These 400 public companies meet the Domini Social Investments’ criteria for environmentally and human-friendly practices. You won’t find, for example, makers of guns, cigarettes, booze, or nuclear power plants on this index.

FTSE4Good Index

These indices include companies throughout the world that have been vetted according to globally recognized corporate responsibility standards. If a company fails to make the grade along the lines of human rights, labor practices, environmental management, or climate-change criteria, it gets deleted from the index. Recent additions to FTSE4Good include: LG, Siemens, and Aetna.

These indices include companies throughout the world that have been vetted according to globally recognized corporate responsibility standards. If a company fails to make the grade along the lines of human rights, labor practices, environmental management, or climate-change criteria, it gets deleted from the index. Recent additions to FTSE4Good include: LG, Siemens, and Aetna.

Dow Jones Sustainability Index

Including big players such as General Electric and Verizon, the DJSI is a prime example of how socially responsible doesn’t have to mean small-entity investing. Companies from any and all sectors are included in the index, so long as they continue to fulfill certain sustainability criteria and benchmarks.

Including big players such as General Electric and Verizon, the DJSI is a prime example of how socially responsible doesn’t have to mean small-entity investing. Companies from any and all sectors are included in the index, so long as they continue to fulfill certain sustainability criteria and benchmarks.

The Future of SRI

In this mission, we’ve learned what Socially Responsible Investing is, how to find SR companies and how to track the market. Nice work!

Here are some closing thoughts:

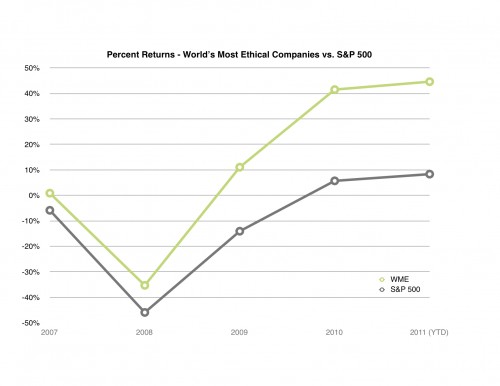

In today’s economy, it can be very profitable to be a socially responsible investor. In a study by Ethisphere, “ethical” companies have outperformed the S&P 500 since 2007. But that’s not all; the Domini 400 Social Index, the FTSE4Good Index and the Dow Jones Sustainability Index have also outperformed the general market.

On the other hand, some investors believe the pendulum may have shifted too far – that companies can justify or write-off losses as social costs. Some capitalists believe in profits and corporate efficiency above all else and have been extremely successful investors. Like many things in life, the truth probably lies somewhere in the middle.

This goal of this mission wasn’t to prove that being a socially responsible investor is better than the alternative but rather to prove investing in socially responsible companies doesn’t mean sacrificing profits.