*** UPDATED as November 1, 2024 ***

Summary

- Over the 8 year time period from January 2016 through 2023, the Rule Breakers stocks picks have outperformed Stock Advisor’s picks with an average return of 122% vs 91%.

- Based on my experience, Rule Breaker’s delivers exactly what they say. Over these 8 years, over a quarter of the picks (44 out of 168) have more than doubled (compared to 43 for Stock Advisor)

- On the downside, Rule Breakers has picked some big losers each year (including Silicon Bank). So, what you see, is the greater returns and greater volatility with Rule Breakers.

- Launched in 2004; over100,000 subscribers

- Rule Breakers service is only available as part of the Motley Fool Epic subscription

- The retail price is $499 a year

- Introductory Offer for New Members Only: Get the next 12 months of Rule Breakers, Stock Advisor, Dividend Investor and Hidden Gems, & full access to all recent stock picks. Read our Epic Review to find their lowest price promo page.

Are you on the hunt for high-growth stock opportunities but unsure which Motley Fool service is the right one to help you reach your goals?

Motley Fool Rule Breakers and Motley Fool Stock Advisor are both popular, but they cater to different types of investors. While picks from both services have performed well against the S&P 500, they offer different benefits.

You might be an investor who likes a balanced approach… or you might prefer to take some chances by investing in disruptive, high-potential stocks.

In this Motley Fool Rule Breakers review, we’ll explain how Rule Breakers works, how it differs from Stock Advisor, and how much it costs, so you can make your own decision about whether it’s the right stock picking service for you.

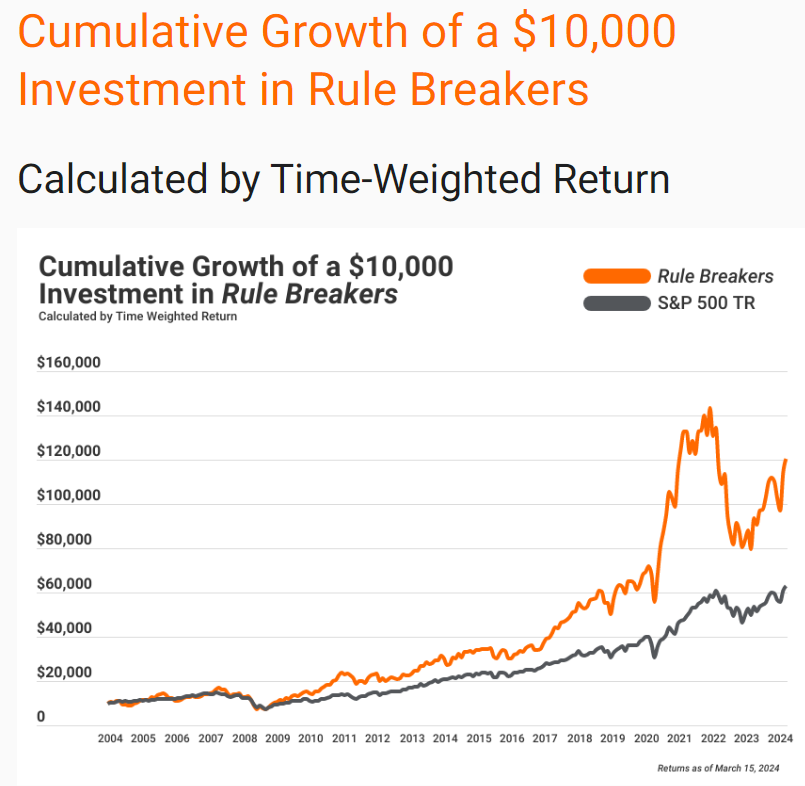

This chart shows that Rule Breaker stocks were just following the S&P 500 in the first few years from 2004 to 2008, but their picks’ performance started separating from the S&P 500 in 2009 and has consistently outperformed the market since then.

What is Motley Fool Rule Breakers?

Motley Fool Rule Breakers is a stock-picking service that’s tailored to users looking for high-growth stocks in high-growth industries. This differentiates it from Stock Advisor, which was Motley Fool’s first newsletter and focuses on steady growth.

Rule Breakers used to be available as a stand-alone service. Now it’s included with the Epic and Epic Plus bundles.

Rule Breakers was launched in 2004 and subscribers get two stock picks per month. To qualify, a stock must:

- Be a top dog and first mover in an emerging industry

- Have a sustainable advantage gained through business momentum, patent protection, visionary leadership, or inept competitors.

- Show strong past price appreciation

- Have a strong management team and strong financial backing

- Offer substantial consumer appeal

This is a service that’s focused on high-growth stocks, not slow-growth stocks or dividend stocks. They’re also not looking for day trades or swing trades.

Here’s what you’ll get if you subscribe to Epic and get Motley Fool Rule Breakers picks:

- First Thursday of the month: RoundTable discussing overall market and recap of recent picks

- Second Thursday: They release one specific New Stock Recommendation

- Third Thursday of the month: They release their 10 Best Buys Alerts

- Fourth Thursday of the month: New Stock Recommendation

You can go buy each new recommendation right away, or if you prefer, you can use the Motley Fool’s platform to do additional research. Keep in mind that the price usually gets a “bounce” in price when the recommendation is released, so buying right away will save you some money.

CTA: Try Rule Breakers for yourself and see how it identifies tomorrow’s leaders!

Motley Fool Rule Breakers vs Stock Advisor: Comparison

Motley Fool Stock Advisor focuses on identifying and recommending value stocks for people to buy and hold for at least five years. It’s best suited for people who want to minimize risk and who don’t want or need to do extensive research on their own.

Rule Breakers has a different approach, focusing on stocks in emerging industries, and in particular, companies with a distinct advantage over their competitors. They’re still looking at a company’s performance history, but there’s a risk/reward calculation happening. There’s additional risk involved with Rule Breakers, but also a chance that any given stock could significantly outperform the market.

Both Rule Breakers and Stock Advisor offer two monthly stock picks. People who subscribe to the Epic or Epic Plus bundle get access to both sets of picks, plus a few extras.

The overall percentage returns of Rule Breakers picks since inception is lower than Stock Advisor. But for both 2023 and 2022, Rule Breaker picks are outperforming Stock Advisor’s picks as you can see in the big chart above.

While Rule Breakers did pick a few stocks that are up over 2,000%, they also picked a few big losers. This caused the variance of the Rule Breakers stock picks to be higher, which most investors don’t want. The risk with Rule Breakers is that if you aren’t disciplined, don’t have the cash, and don’t buy every stock when they recommend it, you might miss out on a few of their best picks. Missing out on just 4 stocks over the 4 years could have brought the performance back in line with Stock Advisors’ return.

The Stock Advisor service is more focused on well-known stocks and is more oriented for investors who prefer lower volatility. On the other hand, the Rule Breakers service has much more volatility and is focused on companies with high growth potential. It’s also important to note that both services are made up of a team of expert analysts at The Motley Fool.

| Feature | Stock Advisor | Rule Breakers |

|---|---|---|

| Number of picks per month | 2 | 2 |

| Risk level | Low | Medium/High |

| Portfolio focus | Buy and hold | Buy and hold |

| Best suited for | Beginners and value investors | Intermediate or advanced investors; those comfortable with some risk |

Rule Breakers New Subscriber Offer: Try Rule Breakers and Stock Advisor now as part of the Epic service and save over $100* and get the next 12 months of their stock recommendations PLUS immediate access to all their recent stock picks.

Risk Assessment in Rule Breakers: What You Need to Know

This Motley Fool Rule Breakers review would not be complete if I didn’t discuss the the potential downsides.

The Motley Fool Rule Breakers service has much more volatility than the Stock Advisors service due to its focus on growth companies.

When they get it right, their stocks skyrocket. When they get it wrong, they pick some real losers. They say that they try to find companies that “are poised to become tomorrow’s market leaders”. They are usually right, but each year about 5 of their 24 stocks have been losers – and that’s why we always say that investors should buy every stock they suggest. The big winners have historically made up for the stocks that lost value.

Rule Breakers has sometimes pointed out stocks before they got popular. That’s something that’s allowed subscribers to get a jump on other investors and ride the wave from the beginning.

The Rule Breakers team evaluates risk by asking 25 questions of each stock they consider. The number of “no” responses is the company’s risk rating. In other words, six “no” responses is a 6 rating, 10 is a 10 rating, and so on.

The questions they ask relate to things like profitability, positive cash flow, brand recognition, and customer base, to name a few. The risk is expressed as a percentage. For example, recent pick Warby Parker has a safety rating of 46%, putting it in the middle but a bit toward the riskier side.

In terms of diversity, Rule Breakers doesn’t usually make diversification recommendations. However, they do think about diversity when making recommendations. You should use Motley Fool’s portfolio management tools to make sure your portfolio is balanced.

Is Motley Fool Rule Breakers Right for You?

How can you decide if Motley Fool Rule Breakers is right for you? It starts with your financial goals and risk tolerance. Here are some questions to ask yourself.

- How comfortable am I with volatility? If you’re someone who’s going to get upset if stocks in your portfolio lose value in the short term, then Rule Breakers might not be right for you.

- How long is my investment horizon? People who are close to retirement may not want to take unnecessary risks, which may make Stock Advisor a better choice.

- Are you eager to maximize your gains? Rule Breakers’ pick are chosen for their growth potential, so you may consider it worthwhile to take a chance to get recommendations that could skyrocket in value.

On the whole, we’d say that someone with a growth mindset who’s comfortable with some risk and volatility in their portfolio would benefit from Rule Breakers. People with a more conservative mindset or those close to retirement may want to stock with Stock Advisor.

How much does Motley Fool Rule Breakers cost?

As of this writing, Motley Fool Rule Breakers is not available as a stand-alone service. It is available if you subscribe to Motley Fool’s Epic or Epic Plus bundles.

The cost of Stock Advisor is $199 per year. The price for Rule Breakers is $499 per year, but that gives you access to Stock Advisor picks, plus:

- Motley Fool Rule Breakers

- Motley Fool Hidden Gems

- Motley Fool Dividend Stocks

You’ll also get access to five-year quantitative ratings, historical picks, the members-only podcast, and investment strategies with specific stock recommendations for Cautious, Moderate, and Aggressive investors.

Final Verdict: Rule Breakers vs Stock Advisor – Which One Reigns Supreme?

Our verdict on whether Rule Breakers or Stock Advisors is better is really based on the type of investor you are.

If you’re someone who prefers not to take too much risk and you just want two reliable stock picks each month, then Stock Advisor is probably the best choice for you.

But, if you’re a long-term investor with cash to invest every month, and you don’t mind riding out some volatility, then you’ll probably be best served by upgrading to Epic so you can get your hands on the Rule Breakers picks, too.

To get high returns on their winning picks, you should buy every single stock they recommend because every year, there are always one or two stocks that are up 400-1000% after 2 years. If you missed just one stock, you might not have had the same results.

As I mentioned in my review for Stock Advisor, an Investor must always do their own due-diligence. You should always do your own research to understand what the assumptions were behind a statement. You will learn not only how to analyze stocks, but also develop your own trading strategies. With that being said, I would suggest signing up and see for yourself how they perform. During the process, you will understand what to look for in an investment and ultimately, invest better.

Of course, you should always remember that past performance is not a predictor of future results.

Get Rule Breakers’ and Stock Advisor’s next 12 months of stock picks and save $199*.

FAQs

Is Rule Breakers Suitable for Beginners?

We don’t think it’s the best choice for beginner investors, particularly those who are just building a portfolio. The higher risk and volatility may be too much for beginners to handle. That said, you should make your own assessment. If you want access to additional picks and you have the money to invest in them, you may want to choose the Epic Bundle to get access.

Is Rule Breakers Worth the Money?

That depends on your perspective. Historically, Rule Breakers picks have outperformed the S&P 500, and that may be enough for you to spend the money to buy the Epic Bundle and get access to Rule Breakers picks. That said, it’s probably not worthwhile for beginners who are trying to build a portfolio from the ground up.

How Often Does Rule Breakers Release New Stock Picks?

Rule Breakers releases new stock picks twice every month. You’ll get an email with each pick, and you can also view current and historical picks by clicking on the New Recs option on the side menu.

Can I Use Rule Breakers Alongside Stock Advisor?

Yes, you can use both services at the same time. The most important thing to keep in mind is diversification, so keep an eye on your portfolio and make sure you’re not over-invested in any one industry or investment class.

Does Rule Breakers Offer a Money-Back Guarantee?

Yes, there’s a 30-day money-back guarantee for subscriptions to the Epic Bundle, which includes Rule Breakers. Please make sure to read the terms and conditions when you subscribe, just in case Motley Fool changes their policy.

Don’t pay full price. Save $200 on THIS promo page! Next picks comes out July 3rd.

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. ✅ U.S. stocks, ETFs, options, and cryptos $3 monthly sub 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

$0

✅ Now 23,000,000 users

✅ Cash management account and credit cardFree stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes for advanced traders

✅ Access to U.S. and Hong Kong markets

✅ Learning tools built in60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for different experience levels

✅ SmartRouting™ and deep analytics for executionRefer a Friend and Get $200

Interactive Brokers Review

4.

M1 Finance

✅ Automated investing “Pies” with fractional shares

✅ Integrated banking & low-interest borrowing

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

5.

Webull

$0

✅ Extended-hours trading premarket and after-hours

✅ Built-in technical charts, screeners, and indicators

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

6.

Public

$0

✅ Fractional shares of U.S. stocks and ETFs

✅ No payment for order flow (PFOF) model

✅ “Alpha” tool with earnings calls and sentiment data$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

7.

Composer

$32 a month

✅ Invest in fully automated stock strategies

✅ Build custom strategies with our no-code builder

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

8.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools for beginners

✅ Curated theme portfolios for retail investors$5 when you invest $5

Stash Review

9.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Retirement Accounts

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

10.

Etoro

$0

✅ CopyTrading™ feature to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto in one app

✅ Commission-free trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

11.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data; Morningstar

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.