The Motley Fool’s Epic is one of the Motley Fool’s latest stock recommendations services.

Actually, it’s not really a new service but rather a great combination of a few of their existing top performing services. Think of it as a sampler platter to help you build a balanced and diversified portfolio.

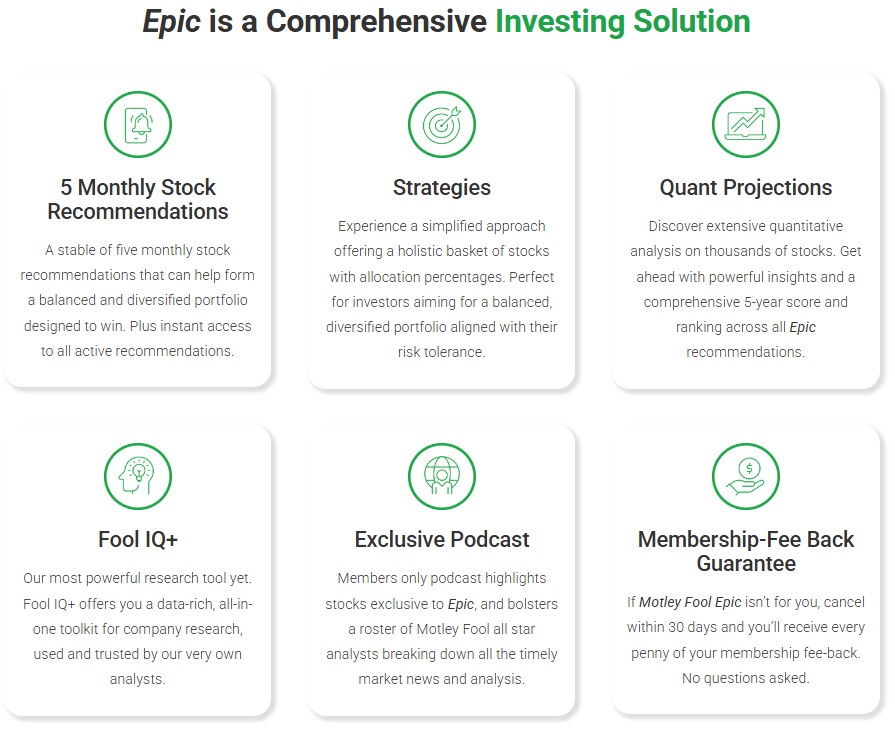

When you subscribe to Epic, you get 5 stock picks per month with a variety of objectives as follows:

- 2 diversified stock picks from the top performing Stock Advisor service

- 1 pick with high growth potential from their other top performing Rule Breakers service

- 1 pick from their new Hidden Gems service to give you a long-term foundation for your portfolio (this is my favorite)

- 1 pick from their high dividend service called Dividend Investor to help diversify your portfolio

If you bought these 4 services individually, they would cost over $1,000. So their July, 2025 promotion of save $200 and try it for just $299 makes it a great value.

Summary

- 5 stock picks per month

- Combines Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor.

- Graphs show consistent outperformance of Stock Advisor and Rule Breakers.

- Hidden Gems picks provide a long-term foundation for your portfolio.

- Dividend Investors picks provide excellent high quality dividend stocks to help balance risk.

- Recommended for investors looking for long-term, diversified strategies.

- Annual cost of $499 on the Fool.com page ( our readers can try it now for just $299 with coupon for a limited time only!) is justified by potential savings and historical returns compared to individual subscriptions.

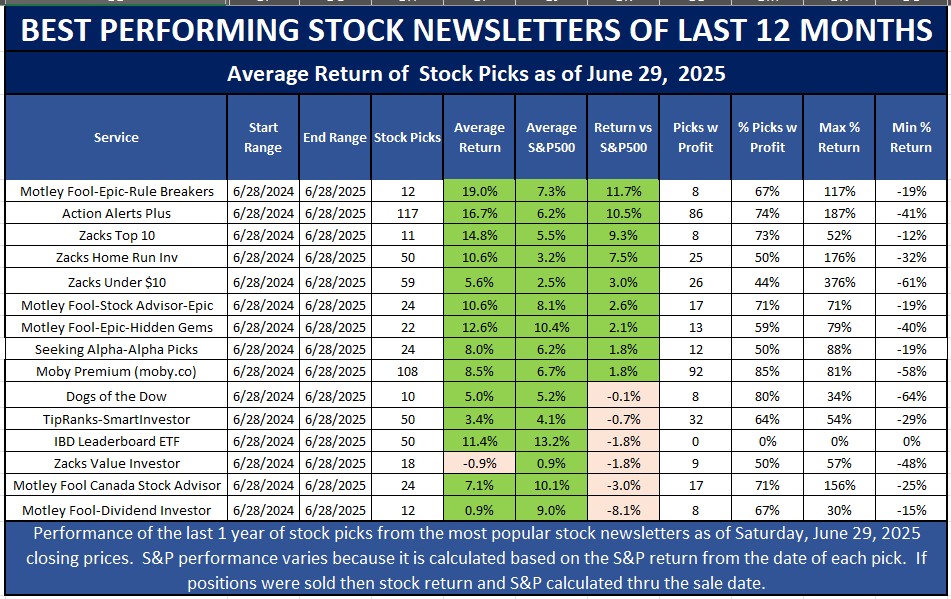

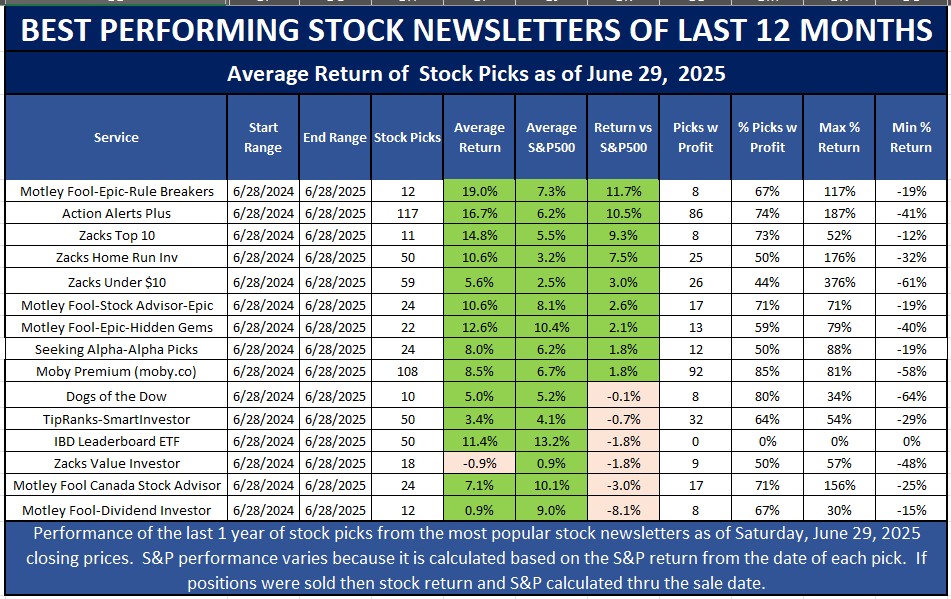

- And the Epic picks are the best performing stock newsletter of the dozens we track that are all less than $500. Note the performance of their Rule Breakers, Stock Advisor and Hidden Gems…

The Motley Fool offers a 30 Day Money Back Guarantee:

“Best of all, when you join through the Epic today, you’ll receive IMMEDIATE access to our latest stock picks inside all these services!

And if you give the Epic a try and decide it’s not for you, that’s fine too. Simply cancel within 30 days and you’ll receive every penny of your membership fee back.”

Fool.com

I have been a subscriber to both Stock Advisor and Rule Breakers since 2016, so I am very familiar with those 2 services. They both have made a lot of money for me over the years with stocks like TSLA, NVDA, NFLX, SHOP, TTD, OKTA, ETSY, and many others.

In 2024, the Motley Fool changed some of their subscriptions and rolled Rule Breakers, Epic, and their dividend service into this Epic package; so you can no longer buy just Rule Breakers or Epic or their dividend newsletter. At first I didn’t like this, but now I realize the advantage of broader diversification and lower risk.

Stock Advisor retails for $199 a year and Rule Breakers retailed for $299 per year; which totaled $498 a year. So when they came out with this Epic bundle it was a no-brainer for me to switch and save money at $299 the first year. Occasionally you can find some best Motley Fool discounts here so take a look.

Now I am writing this Motley Fool Epic Review to share my personal experience of all 4 services.

Table of Contents

[Editor’s Note: All percentage returns calculated as of the close of business on May 31, 2025.]

What is the Epic Service?

Here is a quick review of what you get with the Epic service:

SAVE $200 BY USING A TIP IN THIS REVIEW

And here is my description of the 4 services you get immediate access to when you subscribe to the Epic service:

1. Motley Fool Stock Advisor:

The Motley Fool Stock Advisor is their original newsletter going back to April, 2002. It is the combined efforts of the Motley Fool founders, brothers Tom and David Gardner. Every month each brother (or his team) picks one new stock and gives a list of his top 5 favorite stocks. So that is 2 new stock picks a month and recommendations of 10 of their current favorite stocks from previous picks. This is their most popular service as it has over 500,000 subscribers.

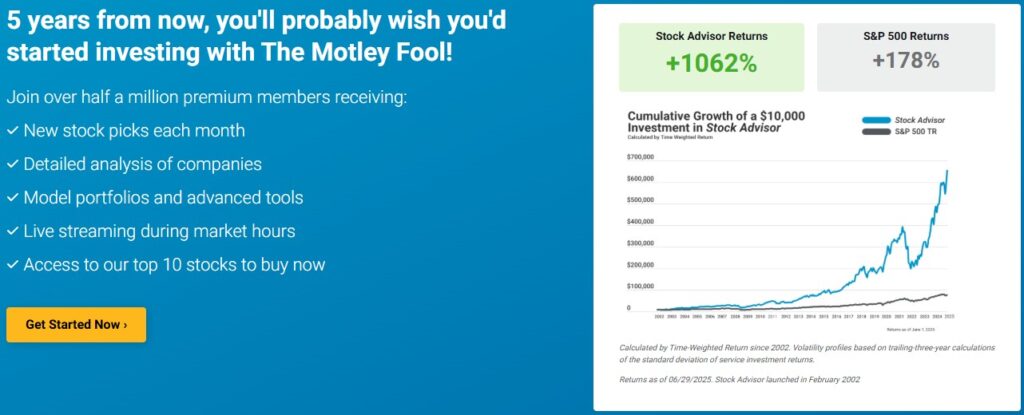

Mostly importantly, the average return of all of the Motley Fool Stock Advisor’s stock picks from this service is 900+% compared to the SP500’s 170+% (23 years). That means they are still performing 5x the market!

Read more about this service in our Motley Fool Stock Advisor review.

2. Motley Fool Rule Breakers

Rule Breakers was launched in December, 2004. This is specifically just David Gardner and his team’s picks. They target high growth companies in high growth industries. What this means is that it might take a year or so for these stocks to take off. And when they do take off, they really take off. But what it also means is they pick a few losers each year. David Gardner’s teams

Mostly importantly, the average return of all of Rule Breakers stock picks from this service is 336% compared to the SP500’s 144% (20+ years).

As I said earlier, this service can no longer be purchased separately. It is now part of Motley Fool Epic.

3. Motley Fool Hidden Gems

The Motley Fool Hidden Gems (formerly known as Everlasting Stocks) service was launched in October 2018. This service is managed by Tom Gardner, one of the 2 brothers that founded the Motley Fool. Second on the team is the Motley Fool’s Chief Investment Officer Andy Cross.

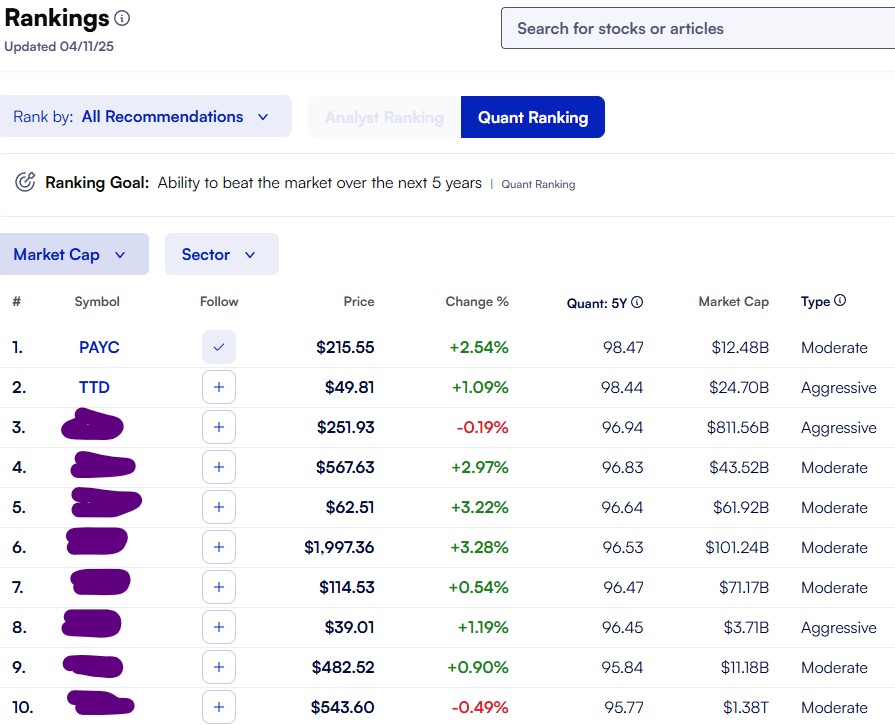

One unique feature of Hidden Gems is the ranking they provide monthly of their picks. As they say:

Everlasting Stocks is designed to beat the market over 5 years with companies that represent Tom Gardner’s Everlasting principles. Our Top 10 Rankings each month highlight those that we believe are the most timely to beat the market and attractive for new money or additional capital. Just because a company isn’t on the list doesn’t necessarily mean we’ve lost confidence in it. We just prefer these to consider first.

Read more about Motley Fool’s Everlasting Stocks review here.

4. Motley Fool Dividend Investor

The Motley Fool Dividend Investor (formerly known as Real Estate Winners) is focused on allowing you to reap the benefits of investing in dividends, primarily through real estate related stocks; not in actual real estate projects, but investing in publicly traded securities that focus on real estate. Their commentary will also help make you a better real estate investor as they reveal the trends that they are noticing in the current conditions of the market.

How has Epic Performed over time?

The chart above showed you how Stock Advisor has outperformed the S&P500 over the last 22 years.

That doesn’t really matter though since you have missed out on all of those returns. What matters to you is how are doing lately. Since I have been a subscriber since January 2016 and buying about $1,500 of each of their stock picks, I can confirm that their stock picks continue to outperform the market over these 9 years that I have been a subscriber. They have taken a little hit the last few months, but still they are overwhelmingly beating the market.

The best thing is it takes the stress out of picking stocks. They tell you what to buy; and they tell you when to sell.

To be successful with the Motley Fool picks, they say you should plan on buying at least 25 stocks and staying invested for at least 5 years.

Here’s a little peak of their April 2025 Top Rankings. I am just showing the top 2 as I don’t want to get in trouble from the Fool…

So how is it performed over time? Take a look at this stat and these 3 top performers of the Epic service. Over 50 stocks with a 1,000+% return…

How Much Does Motley Fool’s Epic Cost?

The current retail price is $499 per year. That is a savings of $547 per year over the prices of the individual services since Stock Advisor is $199 a year, Rule Breakers was $299, Epic Stocks was $299, and Dividend Investors was $249.

Save $200 in July, 2025 with the Motley Fool’s Epic Offer HereIs the Motley Fool Epic Worth It?

At first I was skeptical, and then the more I researched it, I became convinced it was worth it. With Epic you are getting $1,046 worth of their newsletters for $299. That saves you $700+ each and every year on the renewal. Stock Advisor is normally $199/yr, Rule Breakers $299/yr, Hidden Gems is $299/yr, and Divided Investor is $249/yr so to buy all 4 individually it will cost $1,046 a year.

Why Should You Subscribe to the Motley Fool’s Epic ?

You might be able to find a promotion link to get the Motley Fool Stock Advisor or Rule Breakers at a discount for the first year for new subscribers, but if you let them renew for the second year, it will be “at the then current rate.” So Epic definitely saves you money because it is much cheaper in year 2 and thereafter.

If you can invest at least $1,000 in the market each month, then the $499 is a small price to pay to get stock picks that historically have outperformed the SP500. Remember, to be successful investing in the stock market you must be thinking long term (at least 5 years), you should invest monthly so that you are always buying (dollar cost average principle), and your goal is to outperform the SP500.

The recent addition of the Real Estate Winners to the Epic is a tremendous advantage for one huge reason: DIVERSIFICATION! Now with these 4 services you will get recommendations across information technology, consumer discretionary, communications, industrials, health care, and now real estate services.

And when you subscribe to Epic , each month you will get 6 new stock picks and 15 timely re-recommendations of previous stock picks. You also get immediate access to each of the 4 services’ historical picks.

Is the Motley Fool Epic Legit?

The Motley Fool Epic is absolutely legit. The Motley Fool is a very reliable company. I know many of their team members and they are very active presenting at financial education conferences around the country. Their customer service is also perfect, offering both a phone number and email support during market hours.

Bottom line, if you are looking to make you life a little easier and can invest at least a few hundred dollars in the market each month, and plan on keeping the money invested for at least 5 years, you should try it.

Do You Really Need all Four Subscriptions?

With 5 new Motley Fool stock picks every month, you might be thinking that after a year you will end up with 60 stocks per year. But that is not what happens. There is a little overlap occasionally in stock picks each year across the 4 services. There are also some re-recommendations of previous picks so I end up buying more stocks like TSLA over time.

The Motley Fool also tells you when to sell some of the stocks, and some of them end up merging or getting bought out over time. So, you won’t end up with as many stocks in your portfolio as it seems.

I also like to use stop-loss orders so that I never lose 20% on any new position, and for the profitable picks, I use a tighter 10% stop-loss so I take my profits off the winners that start to fall.

Conclusion

With 5 new Motley Fool stock picks every month, you might be thinking that after a year you will end up with 60 stocks. But that is not what happens with this Epic service. There is a little overlap occasionally in stock picks each year across the 4 services. There is also some re-recommendations of previous picks so I end up buying more stocks like TSLA over time.

Remember their top performance the last 12 months. Don’t you wish you would have subscribed 12 months ago?

The Motley Fool also tells you when to sell some of the stocks, and some of them end up merging or getting bought out over time. So, you won’t end up with as many stocks in your portfolio as it seems.

I also like to use stop-loss orders so that I never lose 20% on any new position, and for the profitable picks, I use a tighter 10% stop-loss so I take my profits off the winners as they start to fall.

Sign up for the Epic service below, and receive their lowest price (exclusive to WallStreetSurvivor).