This article is now outdated and is no longer being updated. The Motley Fool Everlasting Stocks service is now called Hidden Gems which now part of the Motley Fool “Epic” service. Please read our Motley Fool Epic Review here.

Investing is hard. It seems so simple in theory—all you have to do is buy low and sell high, right? But there’s a reason those Wall Street bigwigs command the kind of salaries that would make King Midas himself blush. What’s the reason? We just told you like two sentences ago. Investing is hard.

There are a few different ways you can make money on the stock market.

- Get a degree in finance and work your way up to the trading floor at a bank or brokerage

- Get a degree in finance and work your way up to being a financial advisor/asset manager at a bank, brokerage, or financial advising firm

- Teach yourself how to invest, get some capital together, and make some very well-placed investments

You’ll notice that none of these paths seem particularly feasible for most people.

Option 3 seems the most reasonable…until you take a look at some of the sobering statistics about day traders and their (lack of) success. Most sources/surveys report that only around 1% to 15% of day traders turn a profit at all, and only a small sliver of those profitable traders made enough to live on. Again: investing is hard.

But hang on, don’t throw in the towel just yet. A good businessperson knows that sometimes you have to spend money to make money, right? And if you don’t have the expertise you need to make a profit, wouldn’t buying or borrowing some of that expertise be the next best option?

Before we get down to the actual subject of this piece, do us a favor: try to keep one question in mind while you’re reading about the Motley Fool’s Everlasting Stocks service. Ask yourself, would the potential profits you could make by following the service’s stock recommendations be more or less than the price of the service?

In other words: is the Motley Fool’s Everlasting Stocks service worth it?

How Motley Are They, Really?

Let’s kick things off with a little background.

The Motley Fool is a financial advice firm that’s named after a character from Shakespeare.

Their mission has remained the same since the firm was founded in 1993: to provide honest financial guidance to investors of all shapes and sizes. They pride themselves on their commitment to questioning conventional wisdom, acting in good faith, and doing right by their customers.

The highly qualified people of the Motley Fool work their butts off to bring you and their other customers the best advice possible in the form of stock recommendations, actively managed portfolios, and expert analyses that cover all corners of the market.

You want to know which biotech companies to invest in? How about fintech? Augmented reality? Software as a service? Look no further. The Motley Fool has it all.

If you’re looking to rent yourself some expertise, well, here you go. The people at the Motley Fool don’t always get it right, of course, but they haven’t stayed in business this long by being bad at what they do. What is it they do? Chill, we’re getting to it.

Pro Tip:

The Motley Fool Everlasting Stocks portfolio has seen some ups and downs throughout its life. Feel free to give it a try; but for an unparalleled, tried and true stock picking list, we recommend checking out our Motley Fool Stock Advisor review. The Stock Advisor list has beaten the S&P 500 by over 300% since 2002.

Everlasting Stocks

Price: $299/year

The Motley Fool’s Everlasting Stocks service is a service that recommends stocks you can hold indefinitely. The recommendations are a result of intensive research and analysis by a team of professionals with years of investing experience, and each stock is personally approved by Tom Gardner, one of the Motley Fool’s founders.

It’s never a good idea to pay random people for investing advice, but that isn’t the case with the Everlasting Stocks service.

Think of it this way: Tom Gardner put his name on the service knowing that he and the Motley Fool are directly incentivized to give good advice. That’s sort of the Motley Fool’s whole business. If they lose their reputation as a go-to for reliable investing advice, they’re out of luck.

That’s solid logic, right? Still, all the incentives in the world won’t make bad investors give good advice. So you know what’s better than incentives? Track records.

It’s true that prior performance isn’t necessarily a guarantee of future returns.

Good investors make bad decisions, bad investors can make good decisions, and the market can do crazy things that literally no one saw coming. That said, prior performance doesn’t have to be a guarantee of future returns to be a useful metric when looking for good investing advice—especially when you have a track record as impressive as the Motley Fool’s.

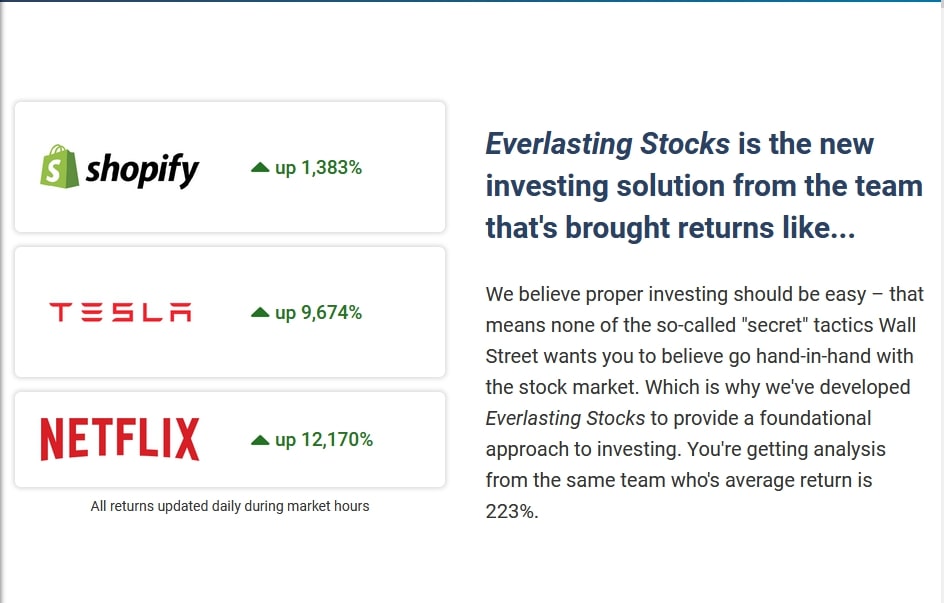

Buying Tesla early enough to see a gain of nearly 10,000% is impressive enough, let alone seeing the potential in Netflix long enough ago to realize a return of 12,170% on their investment. And while these three are probably the most impressive feathers in the Motley Fool’s cap, they’re far from the only evidence that the folks at the Fool know what they’re doing.

It’s worth repeating what’s on the above image for emphasis alone. The team in charge of Everlasting Stocks hasn’t just consistently beaten the market over the last two decades, they’ve delivered four times the returns that the S&P 500 has seen over the same period.

Think about that for a second. Most investors, financial advisors, traders, hedge funds, mutual funds, and all other participants in the market struggle to beat the market for a single year, let alone on a consistent basis over two decades.

That the Motley Fool’s team has managed to deliver market-beating returns with such regularity means they have the combination of luck and skill that separates successful investors from failed day traders.

People pay big bucks for the privilege of riding on the coattails of investors with such illustrious records, and the Motley Fool is renting out their expertise for only $299 a year.

Pro Tip:

The Motley Fool Everlasting Stocks portfolio has seen some ups and downs throughout its life. Feel free to give it a try; but for an unparalleled, tried and true stock picking list, we recommend checking out the Motley Fool Stock Advisor. The Stock Advisor list has beaten the S&P 500 by almost 300% since 2002, with an average return of 608% over the last five years!

What Do You Get?

When you sign up for the Everlasting Stocks service you immediately receive a few things:

- 15 timely stock recommendations

- Access to a library of stock recommendations

- Future recommendations

- Quarterly recommendations from Tom Gardner

- Friendly and knowledgeable customer service

- A 30-day refund guarantee (for credit on the Motley Fool, not cash)

- Access to the Motley Fool’s Portfolio Allocator tool

- Access to the Simulators tool

Everlasting Stocks: The Reality

The Motley Fool lists these as the principles for success with Everlasting Stocks.

- Buy 25 or more companies recommended by the Motley Fool over time

- Hold those recommended stocks for 5 years or more

- Invest new money regularly

- Hold through market volatility

- Let your portfolio’s winners keep winning

- Target long-term returns

The service made its first recommendations in October of 2018, so we recently hit the five-year mark for some of their recommended stocks. We have a list of all the stocks that have been recommended since the service’s inception.

It’d be a little messed up of us if we told you exactly which stocks the Motley Fool has recommended (plus it’d probably tick them off), so let’s keep this general.

First Recommendations

Of the initial 8 stocks that the Motley Fool recommended back in 2018:

- All 8 are up

- 7 are up compared to the S&P 500

- 7 have delivered over 100% returns since 2018

- 1 is up over 1,000% since its initial recommendation

Not too shabby, right? Now let’s look at the most recent picks.

Most Recent Recommendations

Everlasting Stocks has put a more regular recommendation schedule in place since it first started, so let’s take a look at the first page of results.

Of the 15 stocks on the first page of results:

- 11 are up since being recommended

- 8 are up compared to the S&P 500

- 8 have delivered double-digit returns

- 1 is down nearly 50%

Overall Performance

The Everlasting Stocks service has picked some very big winners, but it’s also picked enough underperforming stocks that the portfolio as a whole hasn’t actually beaten the S&P 500 over its lifetime.

Everlasting Stocks is up 31.75% as of February 2024, while the S&P 500 is up 32.46% over the same time period (since 2018), for a total underperformance of 0.71%.

Pro Tip:

The Motley Fool Everlasting Stocks portfolio has seen some ups and downs throughout its life. Feel free to give it a try; but for an unparalleled, tried and true stock picking list, we recommend checking out the Motley Fool Stock Advisor. The Stock Advisor list has beaten the S&P 500 by almost 300% since 2002, with an average return of 608% over the last five years!

Downs

- 1 stock is down over 90% since being recommended

- 30 of the picks have seen double-digit losses (compared to the price at which they were recommended)

Ups

- 1 stock is up by over 1,000%

- 11 picks have seen increases in the triple-digits

Conclusion: Is Everlasting Stocks Worth It?

Is the Motley Fool’s Everlasting Stocks service worth it? Maybe. Its picks have seen huge gains and huge losses, and the portfolio as a whole hasn’t gone up or down since its inception. It’s almost impressive; if you’d followed every recommendation your portfolio would be almost exactly the same value today as it was when you started investing in the service’s picks.

The Everlasting Stocks picks performed well toward the beginning of the portfolio, and all their original picks were up. However, they didn’t pick any new stocks for two years, and then started a bit of a slump. Their more recent picks haven’t been performing very well…and unfortunately, the Everlasting Stocks portfolio picked Silicon Valley Bank (SVB), which saw a full loss.

While Everlasting Stocks has been up and down, there’s one service that has absolutely blown the S&P 500 out of the water, and that’s the Motley Fool Stock Advisor. Their picks over the last five years have averaged a 608% return. Read our Motley Fool Review to learn more about Stock Advisor.

go

To see how the Everlasting Stocks service matches up to the famous Stock Advisor stock picking list, read Motley Fool Everlasting Stocks vs Stock Advisor.

If you want to learn more about other Motley Fool stock recommendation services, check out our Motley Fool Augmented Reality review and our Motley Fool Options review.

Did this Motley Fool Everlasting Stocks review help you make a decision on the service? Let us know in the comments below!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.