Intro to Alpha Picks Review (updated June 29, 2025)

Seeking Alpha’s newest product, “Alpha Picks”, provides 2 stock picks every month that they believe have the greatest chance for price appreciation. They pick these 2 stocks based on their “proprietary, data-driven computer scoring system.” While that sounds interesting, it doesn’t tell us a whole lot. So in this review I will dive deeper and show you how this service works and, most importantly, tell you if it is making profitable stock picks.

I subscribed to Alpha Picks as soon as this service came out in 2022 and started buying every single one of their picks in my Etrade account. I will show you screen shots of my account so you can see how they are performing for me.

Alpha Picks Review Key Points:

Update June 29, 2025: The Alpha Picks April, 2025 stock recommendation is already up 19%; their February, 2025 pick is already up 36%.

Their November, 2024 pick CLS is up 88%; their October, 2024 pick is up 85%; their June pick is up 105%; their March pick RCL is up 140%; April 1, 2024 pick of EAT is now up 251%.

Alpha Picks Alert, April 19, 2024: University of Kentucky study finds Seeking Alpha Quant Ratings help investors beat the market. Their analysis found that the Seeking Alpha Quant-Rated Strong Buys significantly outperformed the market, substantiating the accuracy and predictive capabilities of the Seeking Alpha Quant model.

Seeking Alpha launched Alpha Picks on July 1st, 2022, and I subscribed right away. It is currently priced at $499 a year, but they do run pricing discounts from time to time. In this Alpha Picks Review I will tell you if Alpha Picks is worth it and where to find the best Seeking Alpha discounts.

WallStreetSurvivor Stock Newsletter Review Team

So here’s my review of Alpha Picks in which I pay special attention to what really matters: How are the stock picks performing, are they really generating alpha, and how they stack up against the competition.

My Experience As a Subscriber to Alpha Picks

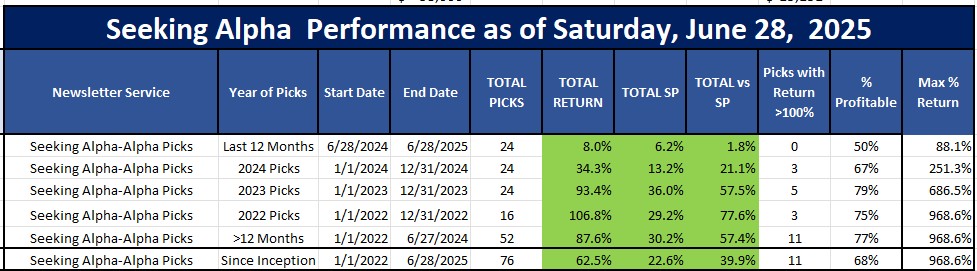

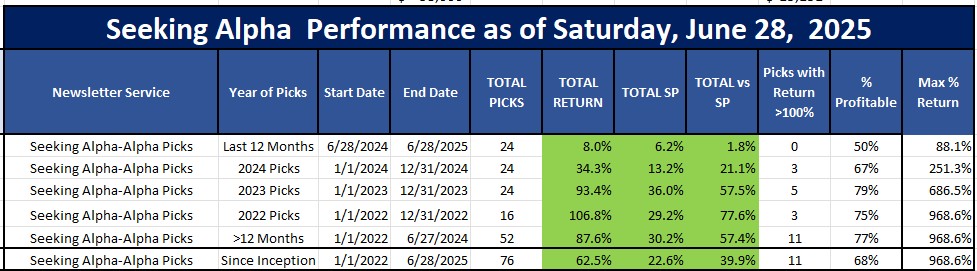

Here’s a little teaser of their performance as of June 29, 2025 to give you an idea if it is worth it…

Do you see that? The average return of all of their picks since launch is 62% compared to 22% for the SPY so Seeking Alpha’s Alpha Picks are beating the S&P500 by an average of 40% over the last 3 years.

So if you had saved $1,000 a month and bought just $500 of each of those 76 picks your $38,000 would be worth $61,734 If you bought the SPY ETF you would have only $46,583.

This means Alpha Picks gave you a profit of $23,734 and an EXCESS profit over the SPY of $15,151 in just 35 months on your $1,000 a month investment. No other newsletter comes close to providing this much ALPHA. So is it worth $499 a year? I think so.

Their 52 stock picks that are at least 12 months old are now up 88% and beating the market by 57%. About 77% of those picks are profitable.

Now keep reading to get the details of how Alpha Picks works.

Academic Research Validates Seeking Alpha’s Quant Rating: An independent study was just released by professors at a major university regarding Seeking Alpha. It found, much like my returns below, that Seeking Alpha Quant Ratings “strongly predict” future returns and offer “pronounced benefits” to investors (in other words–yes, it does help you beat the market)

Dr. Jame and Ph.D. Candidate Yuling Guo from the Gatton College of Business and Economics at the University of Kentucky

Here is another little teaser.

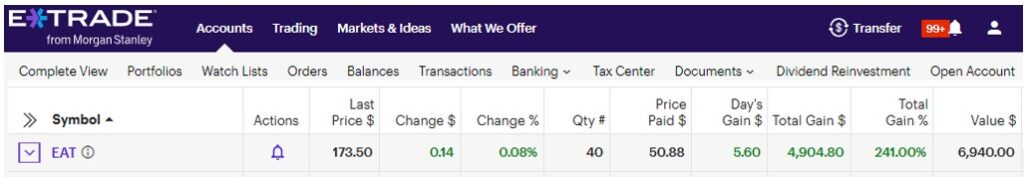

I was so convinced after a year of monitoring Alpha Picks that I started buying $1,500-$2,000 of each of their picks. Here is a screenshot of my ETrade account showing my purchase of 40 shares of their April 2024 pick of EAT that as of May 31, 2025 already is up 241% with a $4,904 profit in just 13 months. So is it worth it? Absolutely.

While I am at it, here is their October 2023 pick of CLS-Celestica on my account, as of May 31, 2025 showing my 357% profit of $7,028 in just 19 months:

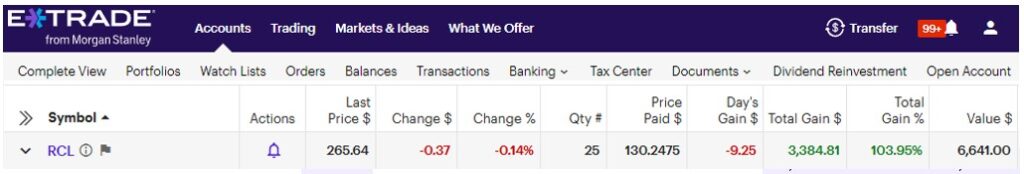

And here is one more so you know I am not making this up. Here is their March, 2024 pick and my 103% profit of $3,384 on RCL-Royal Carib Cruises as of May 31, 2025:

But, before I go deeper into this review, let’s make sure we are all on the same page. What does “ALPHA” mean in the investing world? Simply put, “alpha” is the excess return over a benchmark’s return. For example, if stock ABC is up 15% for the year and the S&P500 is up 12%, then you have 3% excess return and this is your ALPHA. So investors love ALPHA! Everyone wants to beat the market.

Ok, now that we are all clear on what we are talking about, let’s get back to my review.

Act Today; Offer Ends Soon

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They are currently offering a big discount that only runs for a limited time.

Here's you chance to get free trial, save 10% AND get their Top Stocks for the 2nd Half of 2025 report.

- 7 Day Free Trail & Save $30 on Seeking Alpha Premium; usually

$299now only $269/year — Learn more.- Save $50 on Alpha Picks; usually

$499now only $449/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

Seeking Alpha’s Alpha Picks Performance vs the Competition

I have been investing in the stock market for over 40 years and have subscribed to dozens of stock picking services over these years. In fact, right now, I am a subscriber to Seeking Alpha Premium, Alpha Picks, Motley Fool Stock Advisor, Rule Breakers, Real Estate Advisor, Hidden Gems, Zacks Premium, Zacks Home Run Investor, Zacks Top 10 Stocks, Jim Cramer, Investor Business Daily, 3 of Bernie Schaeffer’s options services and a couple of other options newsletters.

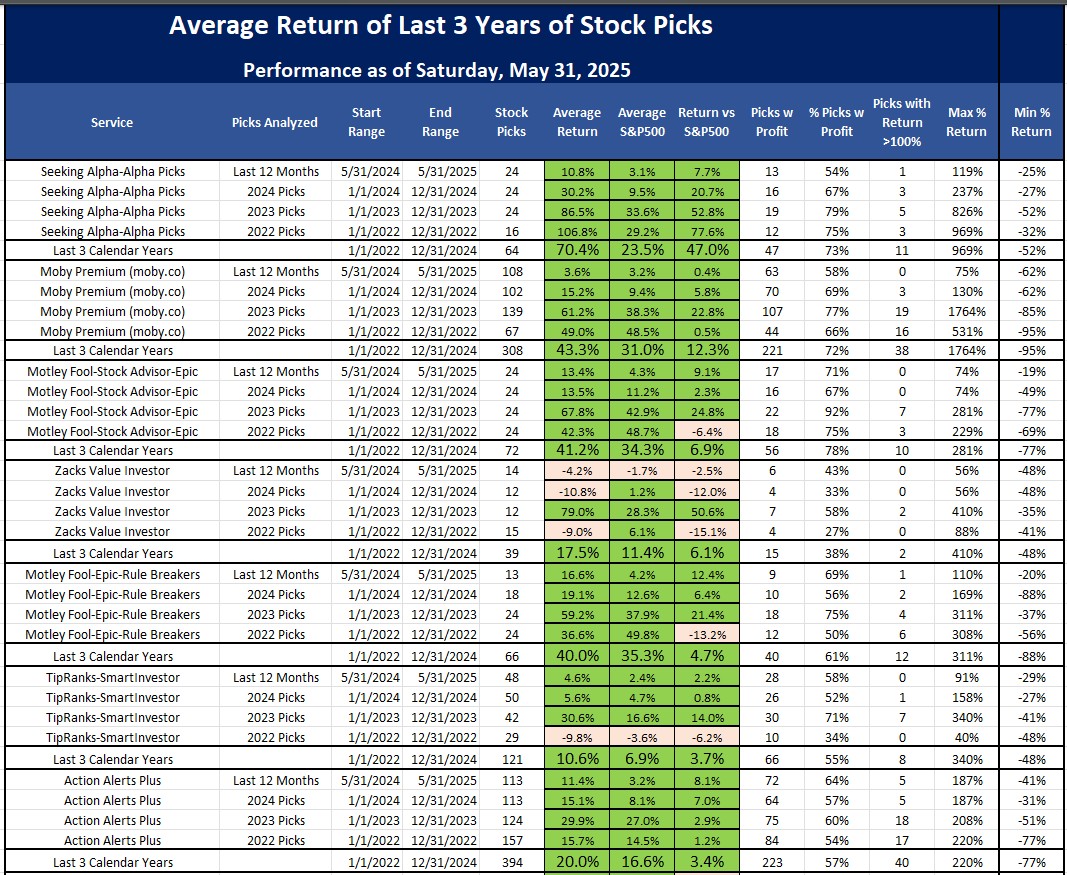

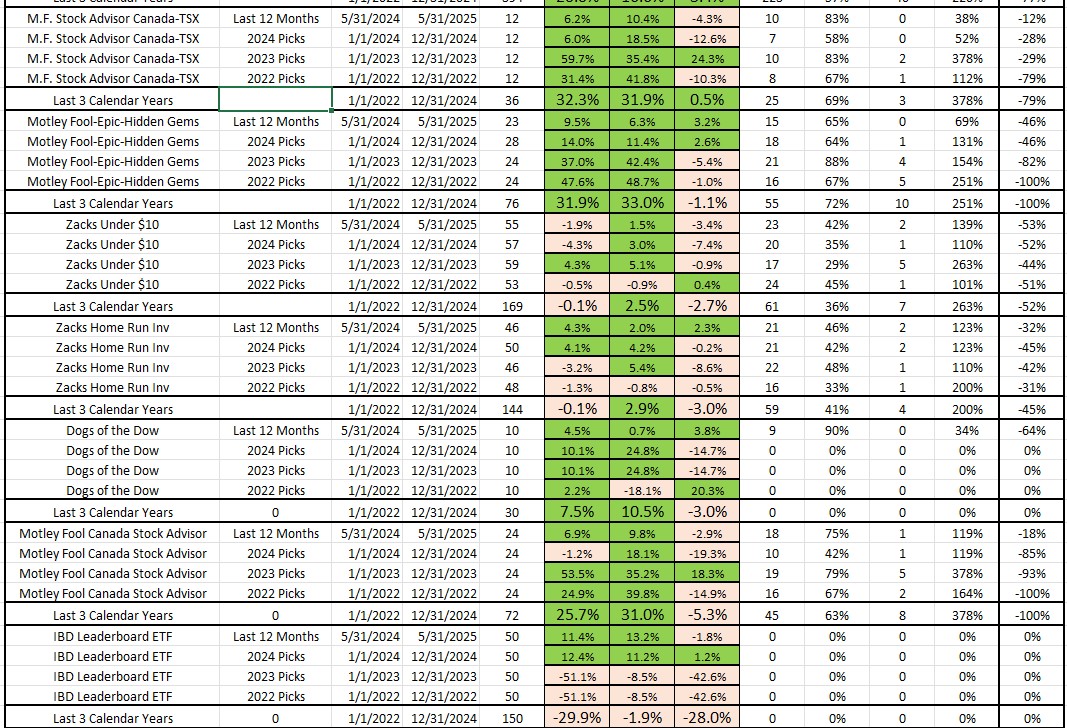

Here was my analysis as of June 29, 2025 summarizing the best stock newsletters over the last 3 years.

Of all of these, Alpha Picks has had the best performance over the last 3 years by a wide margin.

Moby Premium picks comes in second, Moby is relatively a new comer on the seen and is doing well. Read our Moby Premium Stock PIcks Review to learn more.

And of course Motley Fool Stock Stock Advisor continues to do well. One of the Zacks services is doing well also on average but not so well each year; plus they tend to only release picks on January 1st of each year so they are not much help in the middle of the year.

Alpha Picks is still outperforming the market and all of the other services.

💡 If you buy Alpha Picks directly from their website, it will cost you $499 a year; but you can Save $50 on this WallStreetSurvivor/Seeking Alpha July, 2025 promotion page.

Or, if you want to try Seeking Alpha Premium, take advantage of their July, 2025 promotion and on Premium with WSS30 here.

Why I Subscribed to Alpha Picks

I had been a free member of Seeking Alpha for over 12 years and finally signed up for Seeking Alpha Premium in 2020. Since then, I have grown to like them more and more as I find their quant rating analysis to be a good indicator for future stock performance.

So when they launched their “Alpha Picks” service on July 1, 2022 I couldn’t resist and I subscribed so that I could share my results with my Wall Street Survivor audience.

Predicting where the stock market is going is… hard. You can stare at charts all day. You can draw trendlines, calculate moving averages, perform technical analysis, consult shamans, sacrifice goats, watch to see if Warren Buffett sees his shadow, etc.

Many investors prefer to put the money in their 401(k) in mutual funds or hand it over to money managers who may or may not know what they’re doing. There’s nothing wrong with that. Not everyone has the time, expertise, or confidence to take their portfolio into their own hands and make the decisions of what to buy, when to buy it, and then there’s the 3rd decision that everyone forgets about. Now that I own it, when do I sell it?

I, however, don’t hand my money over to mutual funds or pay someone to manage my money. I prefer to BEAT the market by selecting top stocks that will likely outperform the market.

And so far, Seeking Alpha’s Alpha PIcks are doing just that!

Alpha Picks Performance as of June 7, 2025 (from their site)

Seeking Alpha promotes the performance of their Alpha Picks as follows:

My calculations differ so I called Seeking Alpha and had several conversations with their CFA that tracks their performance. They calculate their returns on a “portfolio” approach whereas I am calculating the average return of each of their picks. Their portfolio approach assumes you started with $100,000 and purchased equal dollar amounts of their first 6 stocks in July of 2022. Then when they released their 7th pick, they assume you sell a bit of each of the first 6 stocks and to have an equal weight (dollar amount) in all 7 stocks. Then with each new pick you sell off a bit of the holdings to buy the new stock picks, etc. So they are rebalancing their portfolio with each new pick, and I am assuming you add new cash each month and keep buying equal dollar amounts of all new stocks.

OK, let’s move on. As I have said, I’ve been tracking the performance of Seeking Alpha’s Alpha Picks since their launch in July 2022.

As you can see from the chart below, Alpha Picks had phenomenal returns in 2022 and a very high accuracy rate on their stock picks. Their 2023 and 2024 picks are doing just fine to, easily beating the S&P500 so far.

Notably, Seeking Alpha’s 2022 Alpha Picks are by far the best performers, easily beating the Motley Fool’s and Zacks various services.

Here’s all the data on their picks:

- They had 16 picks (6 in July and then 2 each month thereafter) in 2022

- They made 24 stock picks in 2023

- They made 24 picks in 2024

- They have made 12 picks so far in 2025

- Of these stock picks, THEY ARE DEFINITELY GENERATING ALPHA as they, on average, are beating the S&P 500 by over 40%

- More importantly, of their picks that are at least 12 months old, they are beating the S&P500 by 57%, with 77% stocks being profitable

- Alpha Picks Update as of June 29, 2025: Since its launch in July, 2022, the 76 Alpha picks from 2022 thru 2024 are up an average of 63% and are easily beating the S&P500's return of 23% by 40%. But most impressively, their picks that are at least 12 months old are up 88% vs 30% for 58% ALPHA and 77% of those picks are profitable. Yes, these picks are tripling the SPY. Their November picks are already up 88% and 85%, June 2024 pick of SFM is already up 105%, their April, 2024 pick EAT is up 251%, their March pick RCL is up 140%. Oh yea, their November 2023 pick of APP is up 686%! See our full Seeking Alpha Picks Review for further analysis.

- They have sold 37 positions. TravelCenters (TA) was acquired in February 2023 for a 56.8% gain after they picked it in August 2022; they sold CVX with a 1% profit, COP with a 30% profit, NUE with a 60% profit, and both LTHM and HLIT with 32% losses. The others that were sold were all +/- 8%

- Since inception, 73% of the stock picks have been profitable

MOST IMPORTANTLY, their stock Alpha Picks stocks are easily beating all of The Motley Fool’s, Zacks’ services, IBD, Cramer and others over the same time period:

THAT is exactly what you want from Alpha Picks. The longer you hold a stock the better it performs.

Remember, to get these results, you should try to buy equal dollar amounts of all the Seeking Alpha Alpha Picks stocks as they are released. Based on what I have seen so far, starting in 2024, I will be buying about $1,000 of each of their picks as they come out.

As I mentioned, I am also a subscriber to the Motley Fool’s Stock Advisor and Rule Breakers. Alpha Picks’ return is the clear winner over the same time period.

If that is all you wanted to know about Seeking Alpha’s Alpha Picks subscription service and you want to give it a try, make sure you don’t pay full price. To Save $50 and try Alpha Picks for a year, click the button below:

Save $50 Now thru end of July, 2025 and Get 12 Months of Alpha PicksIf you want more details, then please keep reading.

What You Get with Alpha Picks

Hopefully those results got your attention. Now let me dive into the details about my newest best friend Alpha Picks.

Quantitative Investing Made Easy

Alpha Picks is designed to make investing easy! It is specifically for investors that don’t have the time to research stocks but rather just want to be told which stocks have the highest rating each month.

This service is for buy-and-hold investors. It is not for day traders. It is not for swing traders.

If you’re familiar with Seeking Alpha, you already know just how much cognitive firepower they bring to the table. If you aren’t familiar with Seeking Alpha, you should be ashamed of yourself here’s a quick overview.

How Seeking Alpha Seeks Alpha

Seeking Alpha is a website, community, and crowdsourced research platform made by and for investors. The site hosts the world’s largest investing community—boasting a staggering 20 million visitors every month—and offers an unprecedented array of analyses, market-specific news, and investing tools that rival those found on Wall Street trading terminals.

In addition to all of the above, Seeking Alpha is also home to possibly the largest collection of crowdsourced investment analysis. This analysis is written, reviewed, and debated over by professional investors. Some 7,000 well-vetted contributors post over 10,000 investing ideas every month, each of which is reviewed by Seeking Alpha editors to make sure every post meets their quality standards.

As if that weren’t enough, Seeking Alpha also hosts news, discussions, and data-driven analyses on small-cap stocks, commodities, ETFs, cryptocurrencies, and just about any other security on the market. And if you want to go even deeper, Seeking Alpha Premium gives you access to a frankly insane amount of investing ideas, data visualizations, and author, quant, and dividend ratings—plus the ability to track the performance of individual authors.

In other words: It’s quant heaven.

Now that you have a sense of where their information is coming from, let’s get back to the reason we’re all here: Alpha Picks.

What Makes Alpha Picks Different

Finding great stocks to buy on Seeking Alpha can be a bit like panning for gold. It can take a while to sift through all the good stuff to get to the truly great, and there’s so much valuable information that the market might have moved on by the time you’re done reading through the research, scanning the charts, and checking out all the discussions.

If you’re thinking that it’d be great if Seeking Alpha had a service that did all the gold panning for you and just handed you the biggest, shiniest nuggets, guess what: they’re two steps ahead of you.

Alpha Picks is a subscription service that Seeking Alpha designed for that exact purpose. It takes all the information from the Seeking Alpha Quant model and filters it all down to the two stocks with the biggest potential for positive share price growth every month.

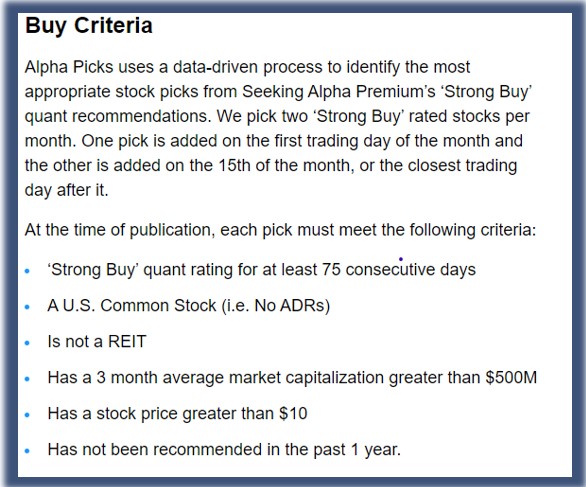

Here’s what you need to know about their Quant model:

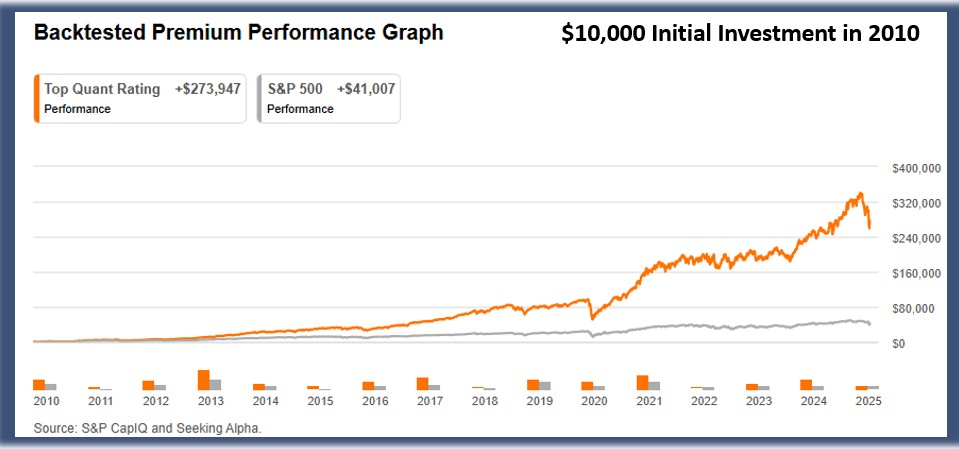

- It is Backtested:

- Backtested from 12/31/2010 to 12/31/2023

- Portfolio compounded monthly with a start of $10,000 and $1,000 added monthly

- Holding purchased in equal weights and rebalanced

- Stock Criteria:

- Each stock hold a Strong Buy Quant rating for at least 75 days

- Market cap greater than $500 Million

- Stock price greater than $10

- Portfolio Process

- One new pick the first trading day of the month; second pick on or after the 15th

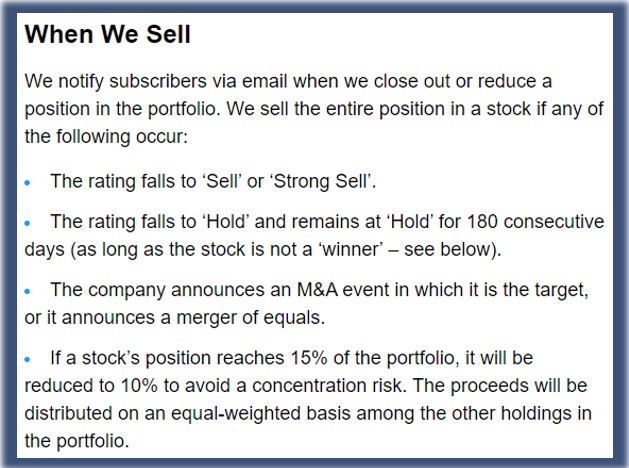

- Stocks will be sold when they become rated a Sell or Strong Sell, or remain Neutral for 180 days

A lot of stock picking services hide their methodology for any number of reasons—to build mystique, because they’re afraid someone will steal their proprietary recipe, because they identify with the Wizard of Oz from The Wizard of Oz, etc—but not Alpha picks. Their methodology and stock criteria are fully transparent, and their results speak for themselves.

So if you take a look back at how their Top Rated Quant Stocks have performed since 2010, you get this mind-blowing chart (note their Strong Buy Recommendations’ Total Return vs S&P500 Return over the same period):

Although they are packaging Alpha Picks as a new product for 2022, Seeking Alpha’s Quant Rating has been picking top stocks for years. With Alpha Picks, you are getting the cream of the crop of their highest rated Quant Stocks.

You don’t have to be a mathematician to appreciate numbers like that.

In terms of their buy criteria, here is there summary:

And in case you are wondering, here is there SELL criteria:

Stocks rated as a STRONG BUY by Seeking Alpha’s quant model, when back tested to 2010, had a total return of $250+k compared to $52k from the S&P500. This means Alpha Picks would have outperformed the S&P 500 by almost 5x over the past 14 years.

So, if you are seeking ALPHA, then there it is!

And now, Seeking Alpha is making it easy for you to find the best of the best STRONG BUY stocks!

How to Get Started with Seeking Alpha

While it is true that if you are not a subscriber you have missed out on those returns, Seeking Alpha has a some ideas of how you should get started.

Alpha Picks Review: Competitor Comparison

Here’s a quick overview of how Alpha Picks stack up against two of the more prominent stock picking services out there: The Motley Fool and Zacks.

Stock Criteria

To qualify for Alpha Picks, a stock must:

- Hold a Strong Buy Quant rating for a minimum of 75 days

- Have a market cap of $500 million or more

- Be traded as a common stock on standard exchanges

- Have and maintain a stock price of over $10 per share

- Have not been previously recommended within at least one year of the time of selection

To qualify for a recommendation by The Motley Fool, a stock must:

- Be selected by the investment team

- They don’t specify any further selection criteria

Zacks is very similar to the Motley Fool when it comes to concealing their methodology. To qualify for a recommendation by Zacks, a stock must:

- Pass some quantitative test (based on Zacks Rank)

- Get good marks on their proprietary equity research reports

- Make it through their earnings estimate revisions formulas with a good rating

Portfolio Process

Alpha Picks is tailored for investors who like to buy and hold stocks for longer periods of time, and their process reflects that ethos.

- One stock is picked on the first trading day and the closest trading day after the 15th of every month

- Stocks that have dropped into Sell or Strong Sell territory will be sold at the beginning of each month

- Stocks that are rated Neutral for over 180 days will also be sold

- (Simulated) cash generated from dividends and asset sales will be reinvested immediately

- Stocks that have doubled in price since purchasing gets a Sell or Strong Sell recommendation, though only the initial investment will be sold

- A stock will be sold if another Sell or Strong Sell is triggered while the stock has less than twice the value of the initial investment

Pretty straightforward, right?

The Motley Fool doesn’t have a specific portfolio process other than the six-step investing philosophy on their website:

- Buy 25+ companies over time

- Hold stocks for over five years

- Add new savings regularly

- Hold through market volatility

- Let your winners run

- Target long-term returns

It’s not entirely clear whether Zacks follows the same portfolio-based model as Alpha Picks and the Motley Fool, though again there may be more clarity hidden behind their paywall. That said, it’s probably safe to assume that their portfolio process, if any, is based on their Zacks #1 Rank list.

Performance Comparison

The Motley Fool

The Motley Fool measures their returns since their inception in 2002 as opposed to 2010 for Seeking Alpha’s Quant Ratings, but the timeframes don’t need to be exactly the same to get a sense for their overall performance.

According to their site, the stocks picked by the Motley Fool have outperformed the market by nearly 4-to-1 over the last 20 years. For this reason, Stock Advisor is one of my most recommended services. However, over the last 5 years, the Motley Fool picks have not beat the markets–and Alpha Picks are crushing the markets over the last 2 years.

Zacks

Zacks’ website says that stocks that Zacks ranks as a #1 Strong Buy have outperformed the S&P 500 by an average of 13.9% each year since they started picking stocks 34 years ago.

It’s tough to provide an apples-to-apples comparison here, but suffice it to say all three services do a good job of beating the market.

Pricing

Alpha Picks

A subscription to Alpha Picks will give you two top-quality stock recommendations a month and they will tell you when to sell them too. Its actual (not discounted) price is $499 per year, so you should make sure to take advantage of the discounted rate while you can. See our Seeking Alpha discount and promo codes to make sure you are getting the best price.

The Motley Fool

The Motley Fool’s Stock Advisor service is $199 per year ($99 through Motley Fool Review link), but that’s far from the only service they offer.

I subscribe to their Epic service (see my Epic Review), which gives you access to Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investors for $499 per year. Their other services range from $100 for a single stock recommendation to an option called One, which provides full access to all of their services for $13,999 per year.

Zacks

Zacks’ services range from $249 per year for Zacks Premium, to $495 per year for Zacks Investor Collection and $2,995 per year for Zacks Ultimate, which gives you access to pretty much everything Zacks has to offer.

FAQS

Is Seeking Alpha Legit?

Seeking Alpha has over 20,000,000 people using the site each month and over 7,000 contributors posting their research. Their Quant Rating is an excellent predictor of stock appreciation. Their 2 paid services, Premium and Alpha Picks, are very affordable.

Is Seeking Alpha Picks Worth It?

Seeking Alpha’s newest service, Alpha Picks, is definitely worth it. Their stock picks that are at least 12 months old so far are up 84% and beating the S&P 500by 55%. And 76% of those stock picks are profitable. The service is also very affordable, currently priced at just $499 a year but is occasionally on sale for new subscribers.

Are Alpha Picks Any Good?

Alpha Picks are very good given that 76% of all Alpha Picks have been profitable, and that the average return is 63% versus the market’s 23%, they are definitely providing ALPHA for their subscribers.

Alpha Picks Conclusion

There are a lot of quality stock picking services out there, and Alpha Picks is beating them all with their first 3 years of performance. That covers over 70+ stock picks since their launch in 2022.

Not only have I had really good results with buying each of their picks, professors at the University of Kentucky have now confirmed that Alpha Picks really are providing alpha (excess returns above the SP500).

Alpha Picks takes everything that makes Seeking Alpha great and delivers in a format that makes investing easy. They give you 2 of their best rated picks each month, and all the research and quantitative excellence to support those picks. They even tell you when to sell them; and they have sold about 1/3 of their picks so make sure you sell when they say sell.

You saw those screenshots above of my ETrade account that proves it is worth it! You can see my profit of $1,000+ on these 2 trades.

At their current price promotion of Save $50 for a year, you really have nothing to lose. Just remember, do what I am doing now—I buy about $1,500 of EACH of their picks. But you can buy however much you are comfortable investing, just make sure to buy equal dollar amounts of ALL of their picks.

Their picks come out around the 1st and 15th of each month.

Alpha Picks is normally $499 a year, but right now they are running a sale. Hit the link below to take advantage of a limited time offer on Alpha Picks: