If you’re looking for a stock picking service that’s streamlined, data-backed, and built for today’s market environment, Moby Invest is one of the top contenders worth considering. With a growing reputation for accuracy and a user-friendly experience, Moby Invest offers a premium product aimed at helping investors of all levels make smarter, faster decisions in the stock market.

In this comprehensive Moby Invest review, we’ll break down its core features, who it’s for, how it compares to other investment services, why 89% of trustpilot reviews rate Moby at 5 stars, and whether it’s worth your money in 2025.

Introduction to Moby Invest

Moby Invest is a stock picking service and investment research platform that provides real-time insights, curated stock recommendations, and financial education tools for retail investors. The platform’s strength lies in simplifying complex financial data and giving users clear, actionable insights.

The Moby team is made up of seasoned analysts, many with experience at major institutions like Goldman Sachs and Morgan Stanley. Their deep research and institutional-grade insights are distilled into plain-language reports designed for individual investors.

| Feature | Moby Free | Moby Premium |

|---|---|---|

| Description: | Use website or mobile app to get access to their current take on the market from their team of former hedge fund managers and CFAs. | Professional Hedge fund research written in plain English. They deliver their investing research in brief, easy to understand terms. |

| Strengths: | Their morning email is concise, topical, and entertaining. | Clear research; several stock picks per week; well diversified; proven track record of almost doubling S&P the last 4 years. |

| Retail Price: | Free | $199 a year and 30 day money-back guarantee |

| Current Promotion: | Get 1 Free Stock Pick | Save $100 |

| Link to get best promotion: | Get their next stock pick. | Get next stock pick FREE and save $100 when you subscribe. |

The Moby app delivers these insights directly to your phone or inbox through features like:

- Daily stock picks

- Model portfolios for various strategies

- Audio and video briefings

- Weekly economic calendar and inflation reports

With an emphasis on emerging markets and undervalued technology companies, Moby Invest offers a unique edge for those aiming to diversify beyond conventional blue-chip stocks.

Features and Benefits

Moby Invest delivers a compelling set of tools for both beginner and intermediate investors. These include:

- Stock picks vetted by analysts and supported by detailed investment research

- Model portfolios tailored to different risk profiles and time horizons

- A mobile-first experience through the intuitive Moby app

- Access to in-depth financial news, market summaries, and investment analysis

- Technical analysis tools and educational content

Premium users get additional access to advanced features like:

- Political trade tracking

- Hedge fund data and signals

- Extended economic calendar tools and forecasts

- In-app commentary and updates from the Moby team

The blend of machine learning insights and traditional analyst review sets Moby apart from more basic stock advisor services.

Investment Research and Analysis

Moby’s core value is in its research engine. The platform uses both algorithmic tools and human analysis to generate reports that cover:

- Investment ideas and sector trends

- Price targets and expected timelines

- Portfolio strategy aligned with market volatility

- Fundamental and technical analysis on selected stocks

Unlike some platforms that rely on past performance alone, Moby’s research stays up to date with shifts in market conditions. Whether you’re tracking undervalued technology companies, emerging markets, or growth businesses, Moby provides clarity.

Moby is currently offering a free stock pick here and offering 50% off for new subscribers.

With the WallStreetSurvivor Exclusive offer on this page, enter your email, and then you can save 50% on an annual membership (only $99).

Don’t miss out on their next pick and remember they have 30 day money back guarantee.

And unlike the jargon-heavy research reports from institutional brokers, Moby’s are presented in a way that’s easy to understand. This makes it an excellent fit for intermediate investors who are building confidence in their own analysis while benefiting from expert input.

Comparison to Other Services

Moby Invest is often compared to competitors like Motley Fool Stock Advisor and Seeking Alpha Premium. Here’s where it stands out:

- A heavier emphasis on model portfolios and up-to-date economic calendar events

- Exclusive access to political trade tracking and hedge fund activity

- A mobile-first, user-friendly interface on the Moby app

- Flexible subscription options and a 30-day money-back guarantee

While Motley Fool offers a strong track record, Moby’s strategy is more dynamic and data-driven. If you’re someone who appreciates a blend of quantitative signals and human insight, Moby Invest may suit your style better.

Moby took expert analysts from institutions like Morgan Stanley and Goldman Sachs and paired them with journalists who know how to distill complex financial jargon into easily-comprehensible and actionable advice.

In addition to its own research, the team also deploys machine learning and quantitative algorithms to find investment ideas.

Top Moby Performing Stocks

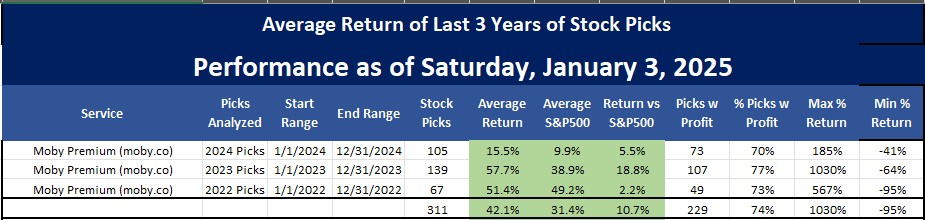

Moby 2024 Top 5 Picks As of January 3, 2025 and Their Returns:

- CAVA up 125%

- MMYT up 66%

- FTAI up 51%

- MSFT up 47%

- TSM up 45%

Moby 2023 Top 5 Picks and Their Returns As of January 3, 2025:

- PLTR: 1,030%

- NVDA: 872%, 440%, 260% (picked Jan 7, 2023 and April 17, 2023 and May 30, 2023)

- RKLB: 553%

- META: 251%, 198% (picked Feb and March of 2023

- CAVA: 246%

Moby Stock Picks of 2022:

- RKLB: 566%

- SPOT: 343%

- ELF: 324%

- SOFI: 190%

- ELI: 165%

Moby Invest Pricing and Plans

Moby Invest Premium offers flexibility in how you subscribe:

- Monthly Plan: Great for testing the waters and includes a 7-day trial

- Annual Plan: Discounted price with extended access to premium features

Moby often provides limited-time discounts and seasonal promotions. If you’re on the fence, the 30-day money-back guarantee provides peace of mind.

Premium features are priced competitively relative to other premium services in the same space, particularly considering the daily updates, research reports, and insights tailored to investment goals and risk tolerance.

Guarantee and Refund Policy

Moby stands behind its product with a 30-day money-back guarantee. This allows users to evaluate its tools, research, and stock recommendations risk-free.

If within the first month you’re not satisfied, the full refund policy gives flexibility. This is a standout feature compared to other platforms that offer only partial refunds or none at all.

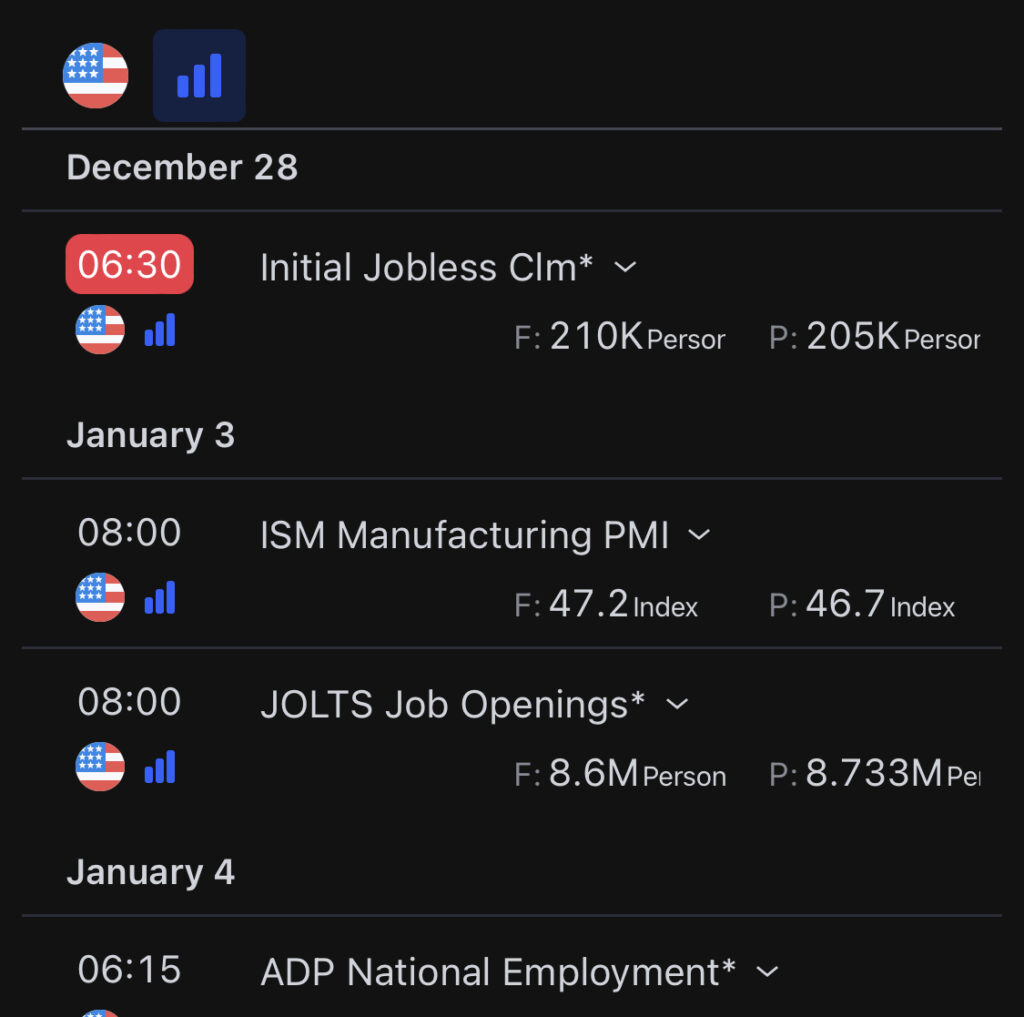

Economic Calendar and Market Insights

Moby Premium provides access to a live economic calendar featuring:

- Interest rate decisions

- Inflation reports

- Sector earnings summaries

- Jobs data and GDP updates

These updates are designed to help investors make more informed decisions based on real-time macroeconomic trends.

Moby is currently offering a free stock pick here and offering 50% off for new subscribers.

With the WallStreetSurvivor Exclusive offer on this page, enter your email, and then you can save 50% on an annual membership (only $99).

Don’t miss out on their next pick and remember they have 30 day money back guarantee.

Combined with daily market summaries and alerts, users can fine-tune their strategies around big events and avoid surprises that can destabilize a portfolio.

Moby Review and Testimonials

Moby Invest holds high ratings across Google Play, Apple’s App Store, and other third-party review sites. Users consistently highlight:

- The clarity and precision of Moby’s stock picks

- The utility of daily briefings and mobile alerts

- Ease of use of the Moby app

Some testimonials note that Moby helped them feel more confident managing their own investment portfolio, particularly when they previously relied on financial advisors.

Moby Premium has also been featured on top review lists and has gained traction for its ability to generate alpha relative to the broader stock market.

Investment Goals and Objectives

Every Moby user is encouraged to align recommendations with their personal financial goals. The platform helps clarify:

- Time horizon and strategy

- Portfolio structure based on risk tolerance

- Preference for growth vs. stability

Moby’s investment strategy is designed for those who want to take charge of their finances, without needing to be an expert.

Its model portfolios offer blueprints for long-term investing, tailored to different asset classes and objectives. That makes it a great fit for both intermediate investors and those just getting started.

Pros and Cons of Moby Premium

| Pros | Cons |

|---|---|

| Outsource your investment research to a team of experts | More suited for intermediate investors, Moby simplifies decisions, offering guidance that may not cater to advanced investors seeking purely objective data. |

| Beginner-friendly investment analysis and market summaries | Many investment ideas to choose from |

| High-quality investment ideas and model portfolios | |

| Mobile-first platform |

Conclusion: Is Moby Invest Worth It?

After reviewing all the features, pricing, research tools, and user feedback, here’s the bottom line: Moby Invest is a compelling stock picking service that strikes a strong balance between expert-led guidance and DIY-friendly tools.

For anyone looking to take investing more seriously in 2025 without being overwhelmed, Moby offers structure, insight, and flexibility. The 30-day money-back guarantee seals the deal, letting you explore the platform without commitment.

If you’re trying to decide between competing services, Moby stands out for:

- Clean, mobile-first experience

- Rich data, research, and analysis

- Exclusive tools like political trade tracking

- Transparent pricing and easy refund policy

It’s a platform built to empower investors to take ownership of their portfolios—and that’s why it continues to earn high marks from users.

If you are curious about whether or not Moby Premium is actually worth the cost, check out our full article: Is Moby Premium Worth It?

FAQs

Moby Invest is a stock picking and research service offering real-time stock picks, model portfolios, and expert market insights.

It’s best suited for intermediate investors and beginners who want clarity, structure, and expert-driven recommendations.

Yes. Moby Premium includes a 7-day free trial and a 30-day money-back guarantee.

Yes. You can cancel any time and receive a full refund within the first 30 days if it’s not a fit.

Moby emphasizes mobile usability, political and hedge fund data, and more tailored investment strategies.

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. $3 monthly 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

Robinhood

Robinhood$0

✅ U.S. stocks, ETFs, options, and cryptos

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes

✅ Access to U.S. and Hong Kong markets

✅ Educational tools60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analyticsRefer a Friend and Get $200

Interactive Brokers Review

4.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

5.

M1 Finance

✅ Automated investing “Pies”

✅ Banking & low-interest loans

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

6.

Webull

$0

✅ Extended-hours trading

✅ Great charts and screeners

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

7.

Public

$0

✅ Fractional shares

✅ No payment for order flow model

✅ “Alpha” tool with earnings calls$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

8.

Composer

$32 a month

✅ Invest in automated strategies

✅ Build custom strategies easily

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

9.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools

✅ Curated theme portfolios$5 when you invest $5

Stash Review

10.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

11.

Etoro

$0

✅ CopyTrading™ to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.