What Is eToro?

eToro is a social trading platform that allows users to trade stocks and cryptocurrencies, as well as keep up with the investing strategies and patterns of other eToro users.

The company is based in Tel-Aviv, Israel, and its CEO is Yoni Assia. Originally, eToro was crypto-only but now offers multiple other assets to trade.

The eToro platform has over 33 million registered users in over 140 countries and 45 states.

eToro is officially organized as eToro USA LLC.

This eToro review will tell you about the features offered on eToro, as well as whether they’re safe and trustworthy.

How Does eToro Work?

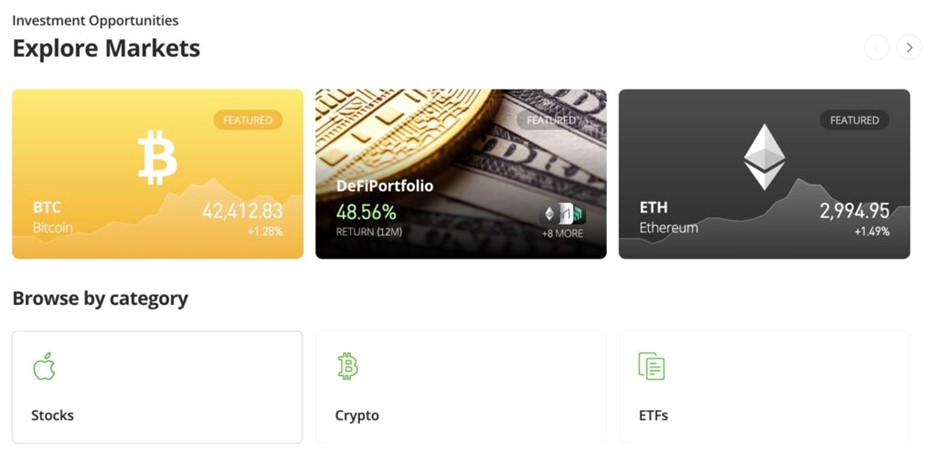

eToro has several different sides to its business.

This includes the ability to trade different asset classes, copy top traders’ portfolios, and trade virtual currency for practice. They were one of the early adapters of crypto trading, and now they’ve evolved to include many other features.

These features include the ability to trade other assets (like stocks and ETFs), the ability to mimic the strategies of successful investors, a place to have conversations with other users, a paper trading feature, and ESG ratings.

eToro’s goal is to make trading more accessible.

It is a good option for beginning investors. The eToro platform is very well laid out with easy access to its tools and features.

eToro operates through a web and mobile platform and both are very functional.

Both are available in 21 languages.

Let’s talk about the different features available on eToro.

Pro Tip

eToro is a revolutionary trading platform that lets you copy the trading strategies of ultra-successful investors. When you sign up for eToro using this link and deposit $100 into your eToro account, you’ll get a $10 cash bonus!

eToro Offerings

Stocks on eToro

eToro lets you trade stocks commission-free.

eToro offers around 2,000 stocks so you will be able to find your favorite companies and easily invest in them or learn how others are investing in them.

You can also invest in fractional shares on eToro.

Fractional Shares

Fractional shares allow you to buy a portion of a stock without having to pay the full stock price.

If a stock is trading for $100 but you only have $50 to invest, you can buy half a share of that stock.

You’ll still see the same percentages of price increases and decreases for that fractional share, but the amount of money you gain or lose will be smaller since you didn’t buy a full share.

Fractional shares also help with dollar-cost averaging, as you don’t have to save up enough to buy a full share of stock before investing.

Options on eToro

eToro users can trade options using the eToro Options app.

You won’t pay any commissions or contract fees when you trade options.

ETFs on eToro

Investors can also choose over 250 ETFs to trade.

ETFs, or exchange-traded funds, are collections of stocks that are similar to mutual funds, except they’re more easily accessible.

They are like mutual funds in that they package a whole set of stocks into one security for you to invest in, instead of having to buy each stock individually.

But mutual funds come with several barriers that can make them difficult to deal with, or even put them out of reach of the everyday investor.

For example, they often require hefty fees that may have to be paid upfront or upon selling, in addition to the normal management fees they charge.

In addition, mutual funds only trade once per day, after the market closes.

But ETFs tend to be cheaper due to the fact that many of them are passively managed, and you can trade them on a stock exchange as long as the market is open – hence the name “exchange-traded fund.”

You can invest in ETFs that track the market or a particular sector or industry, ETFs that compile different asset classes, or even ETFs that bet against certain indexes or industries.

Again, you can invest in over 250 ETFs on eToro.

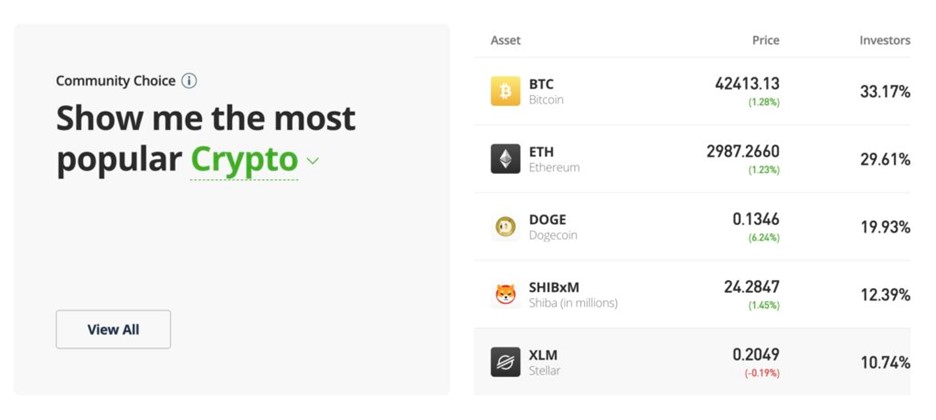

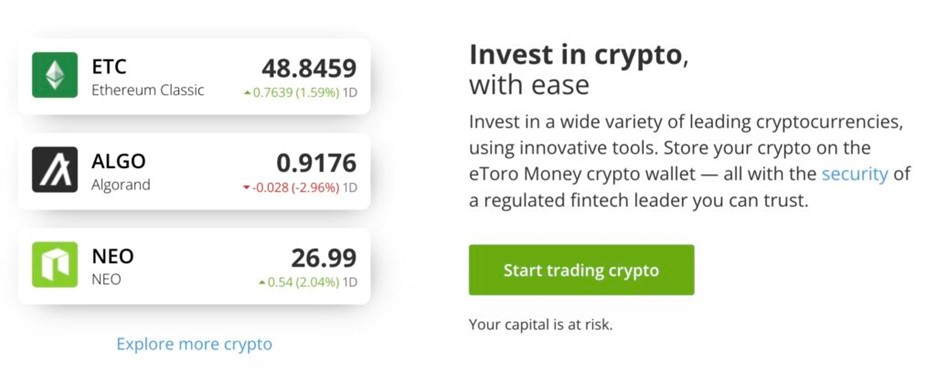

Cryptocurrency on eToro

Crypto is where eToro got its start.

eToro was one of the early adopters of crypto trading and it functions as a full crypto exchange.

You can trade over 20 cryptos on eToro, such as Bitcoin, Ethereum, and Dogecoin.

The cryptocurrency trading experience on eToro is quick and easy, with a solid user interface.

CopyTrader

One of eToro’s most outstanding features is the CopyTrader program.

CopyTrader is a feature for crypto trading that lets you see what strategies other crypto traders are using and copy them automatically.

You can see how other traders’ crypto portfolios are performing and how many other people are copying their strategies.

You can choose a “top-performing trader” to copy, and replicate their moves in your own crypto portfolio.

When you copy a trader, they get paid. This payment structure incentivizes traders in the Popular Investor Program to keep their strategies tight so that their followers stick around. (And it can even incentivize you to join the Popular Investor Program and share your crypto trading knowledge with the eToro community!)

More on the CopyTrader feature below.

If you’re looking for an introduction to cryptocurrency and crypto trading, check out our crypto article here.

Pro Tip

eToro is a revolutionary trading platform that lets you copy the trading strategies of ultra-successful investors. When you sign up for eToro using this link and deposit $100 into your eToro account, you’ll get a $10 cash bonus!

Features

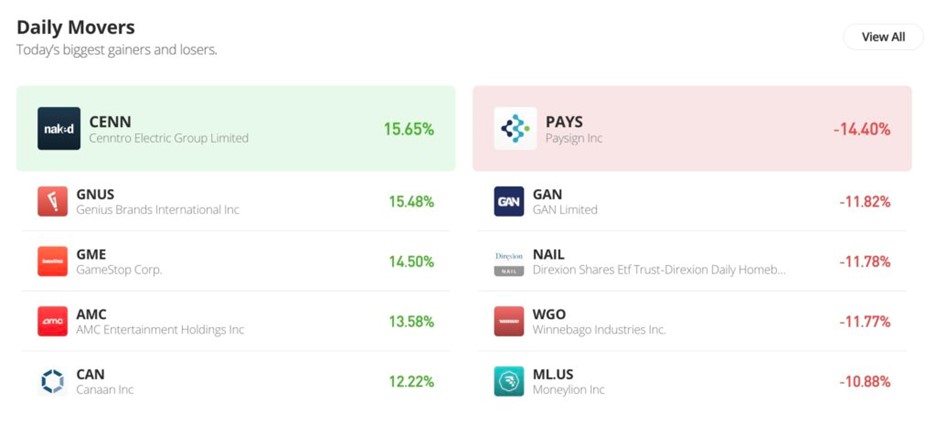

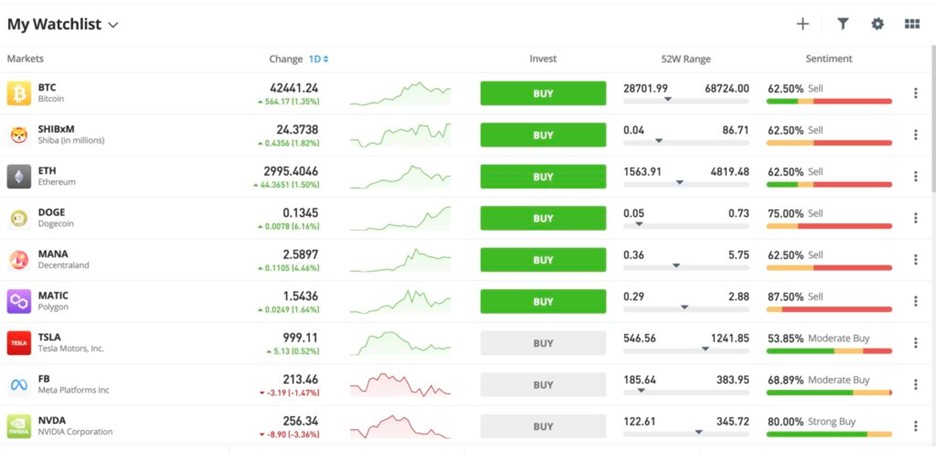

Watchlist

You can create a watchlist by adding stocks and cryptos that you’re interested in.

Any securities that you add will populate your Watchlist page, where you can see them all in one place.

The watchlist shows you the price, gain or loss percentage, and chart for each security.

You can also see the 52-week price range for each security as well as analyst sentiment.

The sentiment will tell you whether most analysts are rating security as buy, hold, or sell.

You can easily trade your favorite securities from the Watchlist view.

Crypto Wallet

eToro has a mobile wallet app where investors can safely secure multiple crypto assets.

Traders can use the wallet to buy, receive, and store their cryptocurrencies.

eToro allows investors to transfer their crypto from their trading accounts to their wallets. eToro charges a small fee for all transfers.

It also features a built-in exchange to convert cryptos into other currencies.

The wallet uses a private key feature to recover your wallet.

Social Investing

One of the features that makes eToro so unique is its social aspect.

The eToro trading platform is essentially bridging investing and social media!

Copy Trading

The “copy trading” feature lets you automatically replicate another investor’s crypto strategy or portfolio at the click of a button.

You can look at how top investors are trading, and what cryptos they’re fans of right now.

These top investors get paid when you copy their strategies through eToro’s Popular Investor Program.

Smart Portfolios

Smart Portfolios allow you to invest in an array of crypto assets and traders with a specific theme or strategy.

The Smart Portfolios are meant to give investors a way to implement specific crypto strategies without such a huge emphasis on timing the market.

Virtual Portfolio

eToro also has a Virtual Portfolio feature.

The Virtual Portfolio allows you to paper trade, or trade virtual money as practice for real investing!

You get $100,000 of virtual money which helps you learn from your successes and mistakes.

The Virtual Portfolio allows you to trade any security you can trade-in your real portfolio. A great way for beginners to get a feel for trading and the platform.

ESG Investing

eToro offers ESG scores for over 2000 assets.

ESG stands for environmental, social, and governance.

It’s a term that refers to companies’ efforts to care for the environment, support social causes, and ensure that their leadership boards are operating in a moral fashion.

eToro has partnered with ESG Book to give companies ESG ratings that you can use determine whether you want to invest in certain stocks or not.

Pro Tip

eToro is a revolutionary trading platform that lets you copy the trading strategies of ultra-successful investors. When you sign up for eToro using this link and deposit $100 into your eToro account, you’ll get a $10 cash bonus!

eToro Fees

So, now that we know what eToro is and how it works, how much does eToro cost?

eToro is a commission-free investing platform for stocks; you won’t have to pay any fees when you trade equities.

Investors based in the U.S. won’t have to pay too many fees to trade on eToro from their retail investor accounts.

For example, the company charges a 1% fee any time you buy or sell cryptocurrency on their trading platform.

If you’re using the eToro Money Wallet for your crypto, you’ll also pay a 0.1% conversion fee to convert one coin to another.

There’s also a 0.5% transfer fee (minimum of $1, maximum of $50) when you transfer funds from your eToro brokerage account to the Money wallet.

eToro also charges miscellaneous fees for certain optional services.

For example, if you decide to transfer your eToro account to another brokerage, you’ll pay a $75 ACATS fee.

You’ll also pay different fees for paper services, wire transfers, and other services.

eToro does not charge based on what payment method is used to fund your account.

eToro has a minimum deposit of $10. For wire transfers, the minimum is $500.

If you are an inactive eToro user for more than 12 months, they will charge you a $10 monthly fee. International users pay $5 to withdraw funds to their bank account.

These fees are typical among most brokerages and are easily avoidable depending on how you use the platform.

You will have to withdraw a minimum of $30 any time you want to withdraw money from your account.

Education

Compared to some other crypto brokerages, eToro’s educational tools lack quality. To practice trading, they do have demo accounts. They also offer a tutorial to understand their trading platform.

eToro Academy has videos, written guides, podcasts, and online training courses. They are sorted by category and experience level.

The latest crypto news is available to read on their blog.

Check out how eToro educational tools compare to Coinbase in our eToro vs Coinbase article.

Customer Service

eToro provides customer support through live chat and an online ticket system.

You must be login in to access the live chat, but anyone can use the support ticket system.

eToro users have reviewed that the representatives on the live chat are hard to reach. The support tickets are your most effective way to get help. You will receive a response in your email within 24 to 48 hours.

There is a help center that answers frequently asked questions; as well as articles that address how to open an eToro account, how to transfer assets, or how to use the trading interface. These articles provide users with a step-by-step guide and are fairly easy to understand.

For eToro loyal customers with more than $5,000 in equity, they hire account managers to look after active traders.

Is eToro Safe?

As you’re doing your due diligence while evaluating eToro, you’re probably asking: is eToro reliable?

Well, we think that eToro’s years of business in the investing world and millions of users speak for themselves.

But on top of that, eToro is a member of both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

eToro is also regulated by the United Kingdom’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investment Commission (ASIC).

This means that eToro is heavily regulated by the government, just like many other big investing platforms.

eToro is also a member of the Securities Investor Protection Corporation (SIPC).

This means that your stocks and deposited cash are protected in the event that eToro goes out of business and you’re unable to liquidate the assets in your account.

Funds are held in secure tier 1 banks and your personal information is kept private under the SSL encryption.

eToro offers users a Two Factor Authentication (2FA) to protect their account further.

eToro networks are monitored by cybersecurity professionals all day and every night. They make sure to prevent attacks on Etoro’s firewall and actually hire ethical hackers to find holes in the system.

Keep in mind that cryptocurrencies are not insured.

For further insights into the safety of eToro, read our article dedicated to answering the question: is eToro safe?

Final Thoughts

If you’re looking for a modern investing platform that can connect you with other investors, eToro might be the right choice for you.

You can learn new investing strategies, practice stock trading risk-free, and duplicate successful investors’ portfolios!

eToro is safe and legit. It is simple to use, and the mobile trading app is top-notch. It offers a quality selection of US stocks, ETFs, and cryptocurrencies.

In terms of analysis, charting tools include many technical indicators to help you invest wisely.

It is a great place to start trading, gain experience, and connect with other investors.

Thank you for reading our eToro review, and be sure to let us know what you think of the platform in the comments!

And if you want to compare eToro to another platform that lets you copy strategies, read our TipRanks review!

eToro Disclosure

Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Click here to see our advertising disclaimer.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.