There are a lot of stock picking services out there.

The list of investment platforms, portfolio management services, charting, scanning, screening, researching, and analyzing programs is long and grows longer by the day.

Offline. Online. Browser-based. Desktop-based. Mobile app-only – you can find an almost alarming number of programs that promise to help you make more money. Most probably don’t help, but there are a few that do seem to offers tools to help investors consistently beat the market.

As the founder of WallStreetSurvivor, my greatest contribution to investors is to help them find the best tools to help them invest successfully in the stock market. One thing I do is purchase all of the most popular stock investing services, use them, and then write fact-based reviews of these services. Right now I a subscribe to about 3 dozen stock newsletters and tools.

This TipRanks Review will show you what you need to know about the service and it will identify their most popular and successful tools to help you make more money in the stock market. Once you understand the unique value of Tipranks Smart Score it should help you buy better stocks, and help you sell stocks that are likely to underperform the market.

Here’s a quick summary of TipRanks services, prices, and best discounts:

| TipRanks Basic | TipRanks Premium | TipRanks Ultimate | |

| Overall Rating: | ⭐⭐⭐ | ⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type: | Free access to TipRanks stock quotes, charts and very limited news. | For the investor who wants to make “smarter, data-driven investment decision” and access “institutional level insights” on their stocks and/or specific trade recommendations. Includes their proprietary “Smart Score” rating on every stock. | Get everything from Premium plus Stock Risk Factor Analysis, Insiders’ Hot Stocks, Complete Expert Rankings & Research Firm Rankings. |

| Strengths: | An easy to use stock quotes, charts and limited research tool. | Smart Score stocks are up 340% vs 203% the last 8 years; beating the market by 137%! | The Insiders’ Hot Stocks and very important info to have when evaluating a stock. |

| Best for: | Beginner investors who just want stock quotes and charts. | Beginner & intermediate investors that want access to their Smart Score on their stocks and who want alerts of when to sell. | Intermediate to advanced investors who have the time to look at many more stock indicators. |

| Retail Cost: | Free | US$30 a month or $360 a year. | US$80 a month or $960 a year |

| Current Promotion: | None | July, 2025 PROMO: Save $40% & get access to their Smart Scores on all stocks and their Top Smart Score stocks and save $144; 30 day money back guarantee! | July, 2025 PROMO: Get Ultimate $960 |

| Link to Promo Page: | None | Save 40% on TipRanks Premium on THIS promo page and try it for just $215 your first year. | Try TipRanks Ultimate for $960 on THIS promo page. |

In such a saturated market, there’s really only one big question we should be asking of every single investing-related platform, software, and application:

Does TipRanks Make it Easy for Me to Make More Money in the Stock Market?

What about their value proposition is so compelling that we should jump out of our seats, payment cards in hand, and sign up for their undoubtedly pricey premium services?

More to the point, what exactly does TipRanks do better than its peers? What does it have that’s compelling enough to make us drop whatever service we’re already using and sign up as their newest members?

How Have the TipRanks Top Smart Score Stocks Performed Recently?

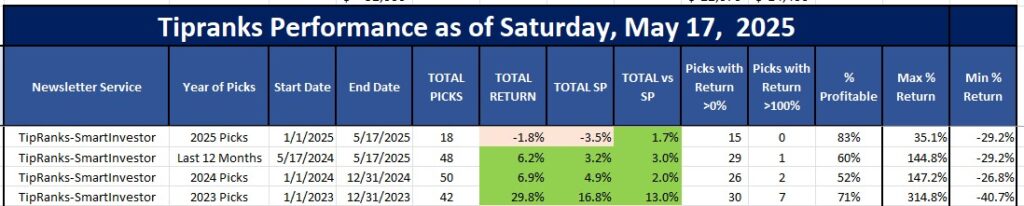

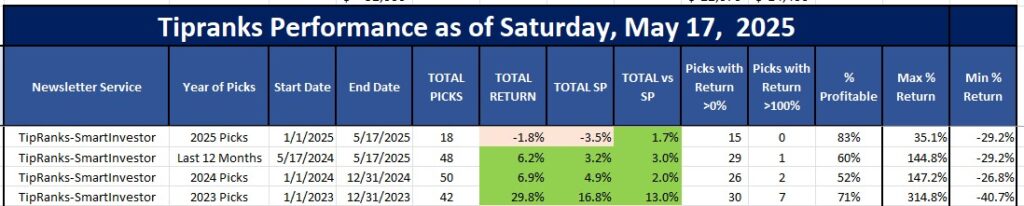

Here's the quick answer. Take a look at my tracking of their stock picks based on top Smart Score from their Smart Investor Newsletter that comes with TipRanks Premium. You will see they are easily beating the market each of the last 3 years. Also note that 83% of their 2025 picks are profitable and about 75% of their picks the last 3 years are profitable. One of their picks (GE) from 2023 is up over 300%.

Pro Tip:

TipRanks Premium gives you access to their proprietary Smart Score stock rating tool. This is based on their algorithm of identifying investment strategies of stock experts, top Wall Street analysts, and even corporate insiders. Their Smart Score rating has been back tested and in my own experience of investing in their top Smart Score stocks has helped me beat the market as you see above. Normally $360 per year, but sign up for TipRanks Premium and SAVE 40% on THIS PROMO page. (30-day money-back guarantee).

The first good sign is that TipRanks has the highest investing platform rating on TrustPilot that I have ever seen.

That’s a great sign, so let’s dig in.

What Is TipRanks?

TipRanks was founded in 2012 by Uri Gruenbaum and Gilad Gat, with the help of a finance professor at Cornell University named Roni Michaely.

TipRanks launched its first major service in 2013, something it called the Financial Accountability Engine.

The Engine is a pseudo-A.I. designed to utilize machine learning and natural language processing to scan and analyze analyst ratings, corporate filings submitted to the SEC, financial news websites, and whatever other information it can get its digital hands on.

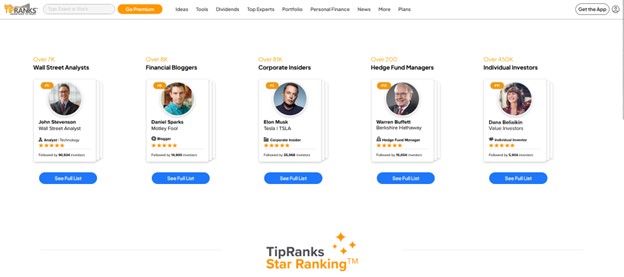

It crunches all the numbers and parses all the information it can to monitor and rank the performance of investors, financial bloggers, corporate insiders, financial advisors, hedge fund managers, and a whole range of other experts – making it easier for TipRanks users to find out which experts are worth listening to and which ones are full of it.

TipRanks Performance

OK, let’s first start with what matters most. Does this service help you beat the S&P500?

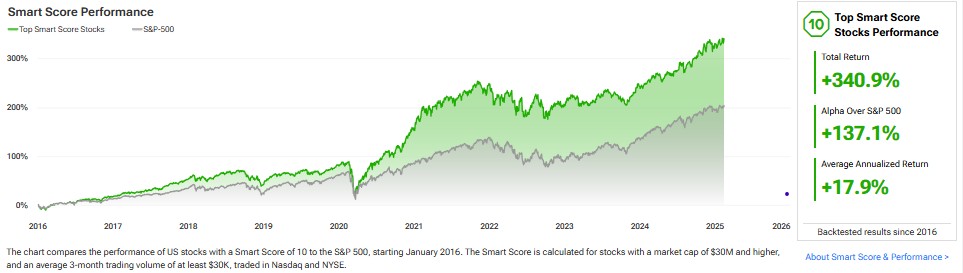

TipRanks has developed its own proprietary quantitative stock scoring system called Smart Score. It gives stocks a score from one to ten, based on a variety of market key factors such as Wall Street analyst rating, trades of corporate insiders, hedge fund manager activity, financial blogger opinions, investor sentiment, news trends, technical analysis and fundamental analysis.

The lowest score is a 1 and the highest is 10. The scoring system works such that stocks with a score of 8, 9, or 10 are considered Outperform and stock with a 1, 2, or 3 are considered UnderPerform. Here is their own analysis of the success of their Smart Score rating.

That is very impressive. Since 2016 their Top Smart Score stocks are up 340.9% versus the S&P500’s return of 203.8% over the same time period. That is pretty solid proof that their Smart Score metric works as it is beating the market by 137.1%.

So why not pay $299 a year to help you beat the market?

TipRanks Features

Now that the performance chart above has captured your attention, let’ dig deeper to see all the services that TipRanks offers and figure out which pieces will help you the most.

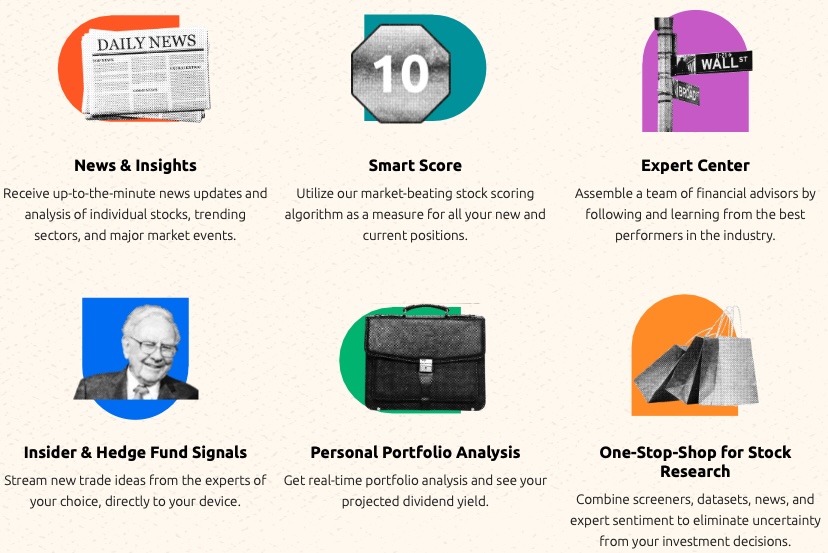

In addition to their Smart Score rating, TipRanks has a bunch of other services and features like up-to-the minute news, the Expert Center, Insider and Hedge Fund trades, etc as you can see below.

Those are all very nice features to help you research, build and manage your portfolio, but the investor ratings seem to be the main differentiating factor that they bring to the table.

Their ability to monitor, analyze, and rank the performance of tens of thousands of financial professionals seems unmatched for finding hot stocks, and they seem very confident about the value of having that financial information at your fingertips.

So let’s start with that, shall we?

TipRanks Expert Rankings

When you click on the Top Experts link you’ll be brought to the page pictured above.

This is where TipRanks shows off the number of experts it tracks, what their positions are, and the star rating they’ve been assigned by the system.

Expert Ranking Factors

The fact that Elon Musk is listed alongside Warren Buffett is…curious, but it makes more sense when you consider the factors that TipRanks uses to rank its experts:

- Success Rate: TipRanks monitors all the experts on its list (all 96,000 of them) and marks down each recommendation and/or transaction they make. Each transaction is monitored over a one-year period or until the expert changes their recommendation, at which point it is marked down as a win or a loss. And yes, you guessed it: wins are better for your rating than losses. Fascinating stuff.

- Average Return: This is exactly what it sounds like. TipRanks monitors each rating or transaction an expert makes, then measures their return over a default period of one year (or if they change their recommendation). This data is then averaged across all their transactions and used to calculate a good portion of their star rating.

- Statistical Significance: This one’s a little less obvious. The TipRanks website says: “The more recommendations or transactions an expert makes, the more statistically significant their performance results. For this reason, experts with a higher number of recommendations are more likely to be ranked higher if their success rate and average return rate are high. Or they may be ranked lower if their success rate and average return are low/negative.”

Let’s take Musk as an example to see how this all plays out in practice.

His rating seems to be primarily based on his occasional sales and buybacks of Tesla stock, which has netted him quite a lot of upside – not surprising, considering the fact that he got in on the company before the share price started doing its gravity defying act.

Those profits, the fact that he’s mostly traded the stock at advantageous times, plus his high-profile status among certain types all add up to five stars; though it isn’t clear why Musk is labeled #2 but doesn’t appear anywhere on the top 50 list.

If you click on any individual investor, analyst, etc you’ll be taken to their personal page.

There you’ll find things like their success rate, their average returns, what your portfolio would earn if you’d followed every trade of theirs (for one year per transaction, which confuses things a little), the number of buy/hold/sell stock ratings they’ve made, their stock coverage, and so on.

As you can see from the screenshot below, every one of these pages has a ton of data that you can use to assess whether or not the expert in question is worth listening to.

So it’s pretty clear that TipRanks’ expert ranking system is robust and practically unmatched in the market.

That feature alone may be worth the price of admission, but what else do they have going for them?

Pro Tip:

TipRanks gives you access to the investment strategies of stock experts, top Wall Street analysts, and even corporate insiders. You can follow your favorite experts, see if they’re beating the S&P 500, and copy their trades for yourself. Remember to save 40% on TipRanks Premium, PLUS a 30-day money-back guarantee.

TR Ideas

The TR Ideas section of TipRanks’ site is essentially an aggregated, high-level view of what the best-performing experts that TipRanks monitors have been recommending, buying, or selling. It’s broken up into several sections:

- Stocks

- ETFs

- Crypto

- Options

- Currency

- Pro Newsletters

Each section contains a bunch of subsections, each with their own little gimmicks and/or TipRanks special sauce.

For example, the Stocks section includes these subsections:

- Top Analyst Stocks

- Top Smart Score Stocks

- Top Insiders Stocks

- Top Stock Websites

- Top Gainers/Losers/Active Stocks

- Dividend Stocks

- ChatGPT Stocks

Each of the subsections has its own specific high-level area of focus.

For example, the Top Analyst Stocks subsection measures the sentiment of the best-performing analysts and shows you how they feel about certain industries and specific stocks, giving you both a high-level and a more granular perspective on their current sentiment.

Research Tools

TipRanks doesn’t just show you what the most influential and highest-performing analysts and investors are trading and/or recommending; it also comes with a fairly impressive set of tools for finding your own trades.

There’s a stock screener with a pretty wide set of filters (pictured below), an ETF screener that does pretty much the same thing, just with ETFs, a penny stock screener that – you guessed it – does the same thing with penny stocks, and even a technical analysis screener that lets you look for hot stocks based on technical factors.

There are tools that let you compare up to 10 stocks or ETFs at the same time with criteria like technical indicators, analyst consensus and stock price targets, dividend information, earnings data, performance, and other factors.

There’s a tool to research stocks that have been trending (rated by 3 or more analysts in the last few days), and you can even find stock portfolio tracker tools for tracking daily insider transactions and daily analyst ratings.

Most of TipRanks’ research tools are functional and fairly robust, but not all that special in the grand scheme of things.

You can find better screeners, more impressive research, better charting tools, and a whole host of other interesting features on other sites – but that’s not necessarily what TipRanks is going for.

A lot of the value that TipRanks brings to the table comes from their expert ranking system, and that’s as true of their research tools as it is of their actual ranking system.

Their platform isn’t going to give you as much of a technical analysis and/or quant-centric toolset; their platform is going to help you get a sense of how the market and its most talented participants are feeling, acting, and trading on a day-to-day basis.

It’s a different focus than you may be used to, but it’s one that may pay off greatly for some investors.

How Much Does TipRanks Cost?

Now, let’s dive into the price of TipRanks.

TipRanks has two paid tiers: Premium and Ultimate.

As you can see, both tiers have a lot going for them.

There’s tons of additional content, additional functionality for the research and analysis tools, more investment ideas, the ability to maintain more smart portfolios (which, let’s be honest, you can do on every other stock research service as well), and, of course, more access to the expert data that TipRanks collects.

The Premium package will likely be worth it to investors who are very interested in following along with and learning from some of the highest-performing traders and analysts.

A lot of people learn best by example, so it’s not hard to see why a lot of folks would be interested in the TipRanks model of investing advice.

The Ultimate tier has some compelling bonuses, but it’s always a good idea to do a free trial or even a month or two of the Premium tier before signing up for Ultimate.

The Ultimate tier is $600 a year, after all, so it’s a good idea to make sure you’re actually going to get enough use out of it before you pull the trigger.

The ultimate litmus test, of course, is whether or not you can make more money off of the information TipRanks gives you than your TipRanks subscription costs.

This is kind of hard to determine without spending at least some time on the platform, but it’s also the only way to truly know if the service is worth it to you.

Pro Tip:

TipRanks gives you access to the investment strategies of stock experts, top Wall Street analysts, and even corporate insiders. You can follow your favorite experts, see if they’re beating the S&P 500, and copy their trades for yourself. You can try TipRanks Premium for 40% off your first year, PLUS a 30-day money-back guarantee.

Mobile Experience

The TipRanks app is free, relatively lightweight, and not nearly as good of an experience as the browser version.

Sure, it looks fairly sleek, and yes, the interface is relatively responsive and straightforward; but a smartphone’s screen just doesn’t have the real estate that TipRanks needs to display all of its important information.

The app is a lot like most other mobile versions of popular sites and services: TipRanks has clearly spent a long time trying to pack as much information onto the screen as it can while selectively cutting or hiding information to better fit a smartphone.

It’s a perfectly functional experience, but you don’t want functional when you’re trying to pore over financial data and compare statistics – you want to be able to actually pore over the data without wondering what’s been omitted for the sake of visual brevity.

To put it another way: the TipRanks app is fine. Just, you know, use the app to browse around and read stuff, then hop on your PC to make sure you get the information you need to make educated decisions.

Conclusion

TipRanks takes an interesting approach to investing.

It doesn’t have the most advanced screeners, research tools, stock charts, or technical stock analysis features. It doesn’t have the widest selection of assets on offer, nor does it have the volumes of professional research reports you’d find on some other sites.

What it does have is possibly the most expansive and in-depth expert performance-tracking functionality on the market.

So when we ask: What exactly does TipRanks do better than its peers? That’s the answer. Same goes for “so what?” and “what about TipRanks is so compelling it’s worth signing up for?”

TipRanks’ value proposition is very compelling. So much so I have been a subscriber for the last 3 years and I make the trades based on the recommendation of their Smart Investor PRO Newsletter which gives me a stock recommendation every week or so. Here is what it has done for me.

How Have the TipRanks Top Smart Score Stocks Performed Recently?

Here's the quick answer. Take a look at my tracking of their stock picks based on top Smart Score from their Smart Investor Newsletter that comes with TipRanks Premium. You will see they are easily beating the market each of the last 3 years. Also note that 83% of their 2025 picks are profitable and about 75% of their picks the last 3 years are profitable. One of their picks (GE) from 2023 is up over 300%.

Want to trade on sentiment, track the performance of important investors, mimic and/or learn from talented traders, and get a decent set of research and portfolio management tools at the same time?

Chances are you’ll find TipRanks pretty darn compelling. Just make sure you get your money’s worth.

Save 40% on TipRanks here! 30 day money back guarantee!

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. $3 monthly 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

Robinhood

Robinhood$0

✅ U.S. stocks, ETFs, options, and cryptos

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes

✅ Access to U.S. and Hong Kong markets

✅ Educational tools60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analyticsRefer a Friend and Get $200

Interactive Brokers Review

4.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

5.

M1 Finance

✅ Automated investing “Pies”

✅ Banking & low-interest loans

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

6.

Webull

$0

✅ Extended-hours trading

✅ Great charts and screeners

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

7.

Public

$0

✅ Fractional shares

✅ No payment for order flow model

✅ “Alpha” tool with earnings calls$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

8.

Composer

$32 a month

✅ Invest in automated strategies

✅ Build custom strategies easily

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

9.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools

✅ Curated theme portfolios$5 when you invest $5

Stash Review

10.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

11.

Etoro

$0

✅ CopyTrading™ to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.