Composer is an exciting new investment platform that lets average investors trade like Wall Street titans.

With hedge funds and high-frequency traders dominating the market, it feels like everyday investors just can’t compete. Composer is changing the game by giving users access to the strategies used by the best of the best!

Now, the most important question is if these strategies will help make you money.

Not every strategy is flawless, but Composer offers automated portfolios that have a record of very high returns with low variance. Best of all, the platform lets you test strategies with historical data, so you know how your portfolio would have performed in the past.

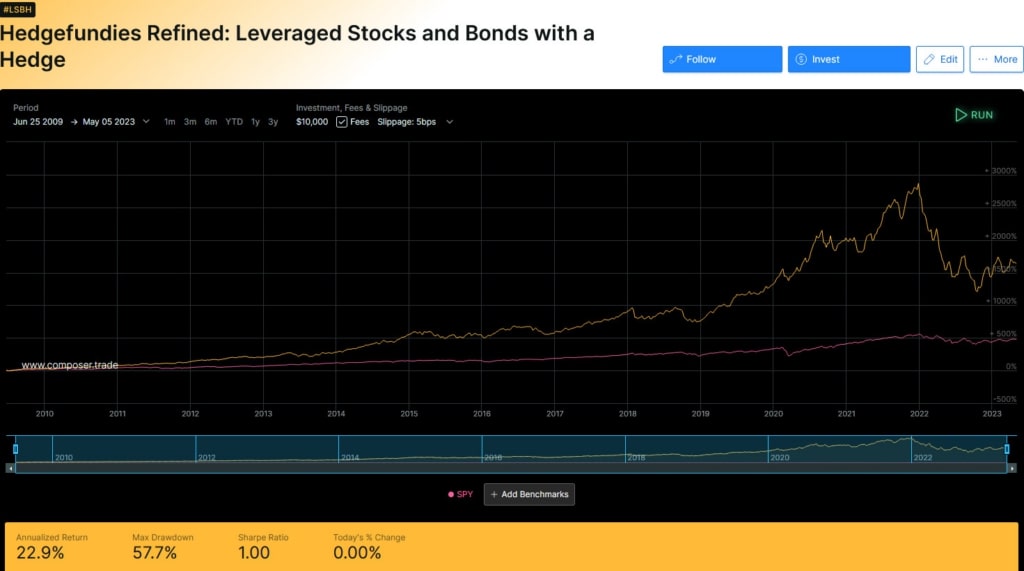

On Composer, specific portfolio strategies are called ‘symphonies’. Check out this symphony that lets you invest like a hedge fund with levered stocks and bonds.

The Hedgefundies Refined Symphony beat the S&P500 over the past decade, with a cumulative return of 1,647.9% versus the S&P’s 482.2%. That’s more then 3X the return, using a standard symphony created by Composer!

If a basic strategy focused on levered stocks and bonds can beat the S&P 500, imagine what you could do with a custom-built strategy tested with historical data.

Not every portfolio will beat the market, but Composer offers some awesome tools to help find the strategies that will. Let’s take a look at the platform as a whole so you can decide if it’s right for you.

Pro Tip:

Composer lets you build your own automated investing strategies or use tried-and-true strategies created by other investors. Make sure to try the 14-day free trial to see if Composer is right for you!

Composer Overview

Composer is built to help investors achieve higher returns through smart algorithms and automated trading. With logic-driven trading strategies tested with historical market data, investors can leverage Composer to try and beat passive indexing.

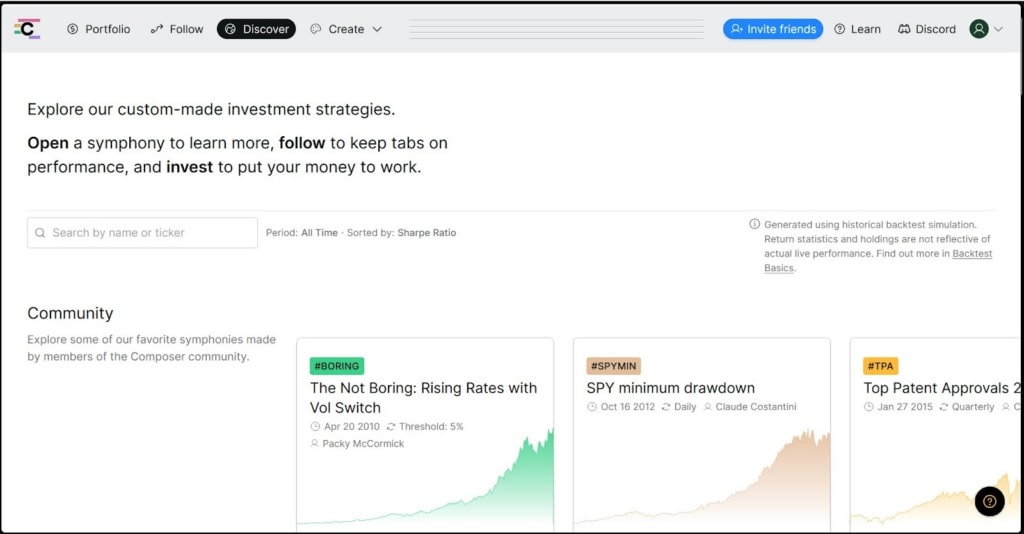

Discover

The Discover tab is one of the most important areas in Composer. From this page, you can find different symphonies that fit your personal investing style.

There are strategies for long-term oriented investors, strategies that focus on specific sectors (like healthcare or tech), and even strategies that let you mimic the trading style of legendary investors like Ray Dalio or Warren Buffett!

If we click through to a specific symphony, we can get more detail from Composer to decide if it’s the right play for us. Also, if you want to keep track of a symphony you like, you can “Follow” it to see its performance over time.

I’ve always been interested in diversification strategies and international investing, so I’ll follow a couple symphonies I like and then we’ll head over to the “Follow” tab to see how it looks!

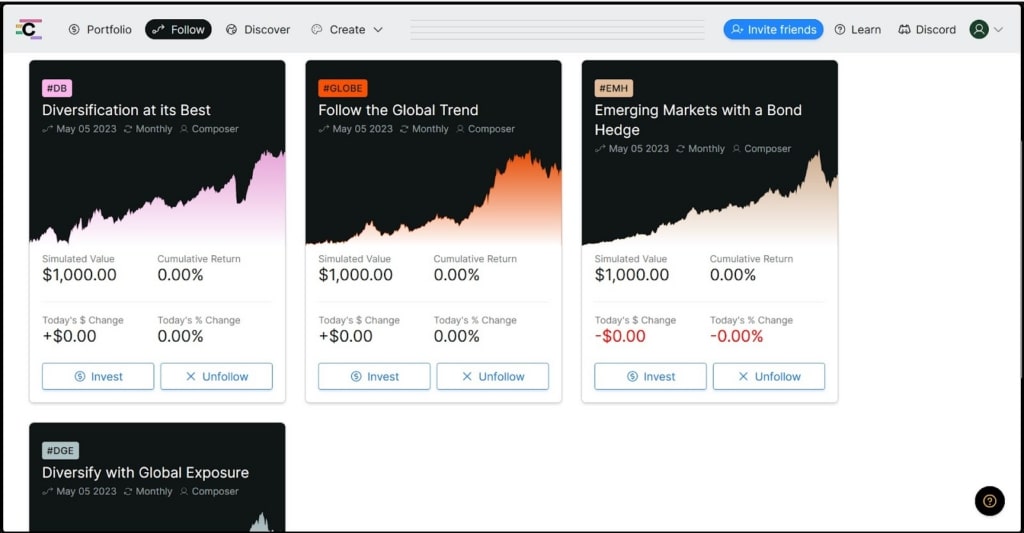

Follow

Now that I’ve followed some symphonies, they’ll show up on the “Follow” tab.

Every symphony I follow shows up side by side, which lets me quickly compare performance. Since I just added them, the return figures and changes appear as zero, but over time I will be able to see the performance of each strategy since following it.

You’ll be able to access the Portfolio tab once you decide on the symphonies you want to invest in. Before you do that, though, you might want to learn a bit more about how Composer works, and especially how to create custom symphonies.

Let’s click over to the Learn tab to find out more.

Learn

One of the best parts of Composer is the amount of knowledge you can access through the Learn tab. Composer includes articles not just on how to use the platform, but also information on the ways professional investors make decisions.

If you ever wanted to learn how backtests work or how to calculate a Sharpe ratio, both of which are tools used by the top hedge funds in the world, Composer has in-depth articles on these topics.

Outside of the Learn tab, Composer also has an ETF database, a blog, and tutorials accessible through the home page.

Now that we’ve learned a bit more about Composer, let’s dive into creating our own custom symphony to express our unique investment style.

Pro Tip:

Composer lets you build your own automated investing strategies or use tried-and-true strategies created by other investors. Make sure to try the 14-day free trial to see if Composer is right for you!

Custom Symphony Walkthrough

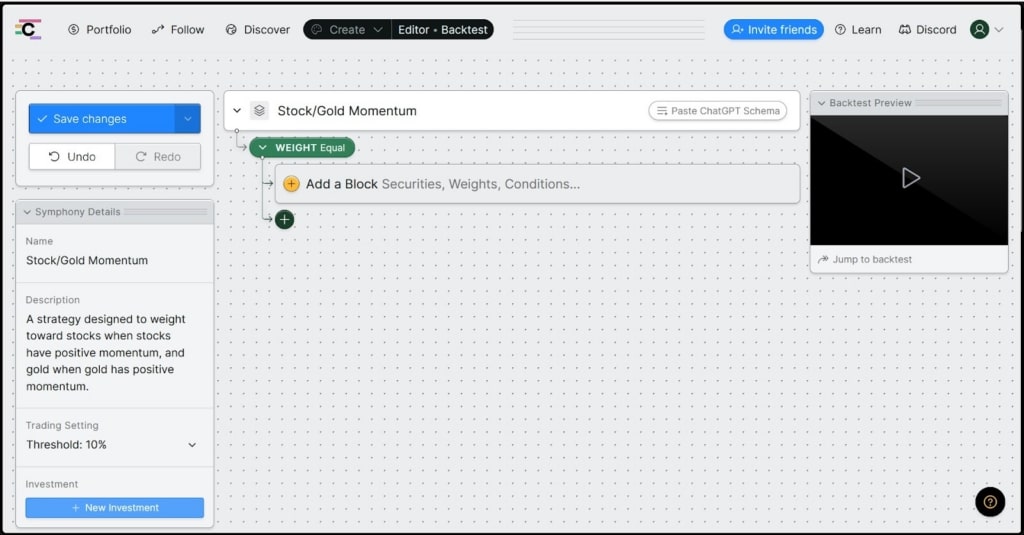

Head on over to the Create tab, and select New Symphony. We’ll walk through how to build a custom strategy that automatically trades based on market data, which is one of the most powerful tools Composer offers.

Step One: Name and Describe Your Symphony

I’ll name my custom symphony ‘Stock/Gold Momentum’ to describe the strategy I want to create. I’ll also add a description to describe the strategy in more detail.

Step Two: Create Your Custom Symphony Logic

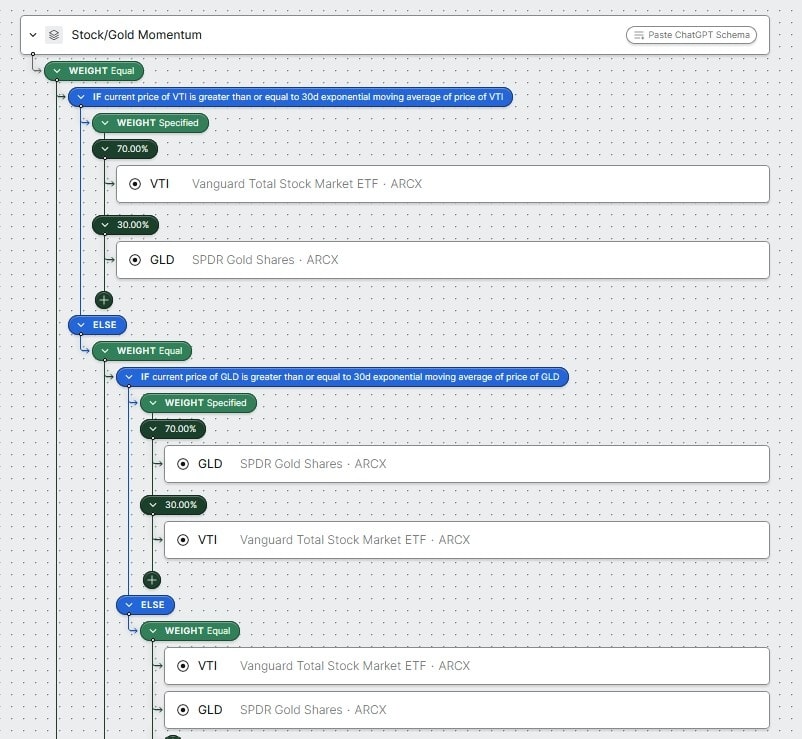

To see the power that Composer offers, I’ll create a trading strategy with three distinct asset weights depending on two price signals.

If the current price of our stock basket is greater than the 30-day exponential moving average of the basket, then stocks appear to have some positive momentum, so we’ll weight our portfolio 70% toward stocks and 30% toward gold.

If this is not the case, then we can check if gold has any positive momentum. We set up our symphony to check if the price of gold is greater than the 30-day exponential moving average of gold. If this is the case, then we’ll weight our portfolio 70% toward gold and 30% toward stocks.

One of the great elements of Composer is the wide array of ETFs and stocks the platform supports – in this case, we can get exposure to the price of gold through an ETF, rather than needing to own the metal outright.

If no momentum is present, then we will weight equally between the two positions. Our resulting logic looks like this.

Wow! With just a couple clicks and no code necessary, we can create a complex trading strategy. Now let’s see how our symphony would have performed historically.

Step Three: Run the Backtest

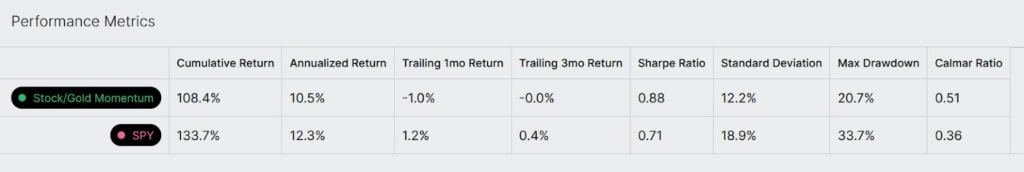

We don’t have to rely on our intuition to check if this is a good trading strategy. On the right-hand side of the screen, click Run under the backtest preview, then scroll down to see the full results.

While our strategy did not outperform the return of the S&P 500 index, it had a lower standard deviation, which means its Sharpe ratio was actually higher than the market! This means our strategy might be a starting point for conservative investors to explore high-return, low-volatility strategies.

Pricing

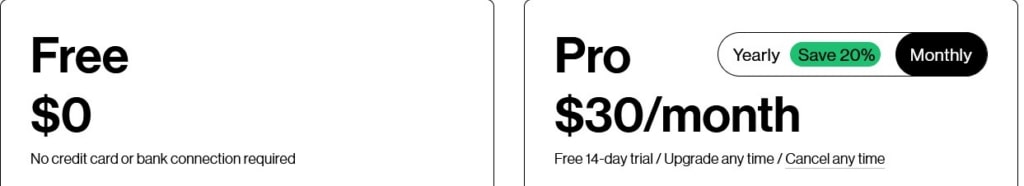

Like other great investment tools, Composer charges for premium features. Its free tier is useful, but does not allow for live trading, meaning you won’t be able to put your symphonies into practice.

At $30/month with a monthly subscription, though, Composer Pro is fairly priced versus competitors. This is especially true because Composer Pro gives you access to Opus, a symphony managed by Composer’s investment committee.

Most other actively managed strategies charge investors a percentage of assets under management, which eats away at investment returns. By paying a fixed fee, investors save more money in the long run!

Luckily, Composer offers a free 14-day trial so you can decide if the platform is right for you.

Here are the features included in the Free version:

- Unlimited backtesting

- Symphony editor

- Follow list

- Symphony data and insights

Upgrading to the Pro version adds the following features:

- Invest in an unlimited number of strategies

- Fully automated strategy trading

- Real-time portfolio metrics

- Access to the member-only Opus strategies

- Weekly market analysis and performance updates

- Premium customer support

Pro Tip:

Composer lets you build your own automated investing strategies or use tried-and-true strategies created by other investors. Make sure to try the 14-day free trial to see if Composer is right for you!

Pros and Cons

Composer is a great tool, but it’s not without some limitations. Let’s take a quick look at the pros and cons of using the platform.

Pros:

- Ability to create no-code custom trading strategies with built-in backtesting solutions.

- Strong regulations: Composer is a registered investment advisor regulated by FINRA. Composer’s brokerage partner is Alpaca, regulated by FINRA and member SIPC, meaning funds are secured against brokerage failure up to a $500K limit. Investments are custodied with BMO Harris, a bank.

- Unlimited backtesting, even at a free level, allowing you to see the historical performance of strategies.

- Easy-to-use interface and intuitive platform.

- Dedicated Discord channel.

Cons:

- Not available to non-US users. If you are an international investor looking for a stock trading platform, check out our eToro review!

- No mutual funds or cryptocurrencies. Some investors who want exposure to specific mutual funds or cryptocurrencies in their portfolio will be disappointed to find out that Composer only supports stocks and ETFs. However, ETFs can replace almost any mutual fund out there, and there are some ETFs with crypto exposure.

Composer Final Verdict: Is It Worth It?

Overall, Composer is definitely worth it if you are looking for an investment platform that allows you to simply implement cutting-edge strategies.

If you are the type of investor who likes to make money without needing to check their portfolio or manually trade, you will love Composer’s automated trading features.

Having access to professionally managed strategies for just $30/month is a great deal by itself. Combining this with industry-leading backtesting tools and custom strategies means you get great value for the price you pay.

With a 14-day free trial for the Pro version, you have nothing to lose by checking out the platform for yourself!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.