June 29, 2025 UPDATE: We have just completed our performance analysis and rankings through June 29, 2025 of dozens of popular stock newsletters priced less than $500 per year. See which stock newsletter would have helped you beat the market by 11.7% over the last 12 months. And see which would have helped you beat the market by 40% over the last 3 years.

Investment newsletters and stock picking newsletters make getting stock market analysis and stock picks easy. Perhaps too easy.

There are so many stock and investment newsletters available, however, that choosing one to trust can be an overwhelming task. Some stock newsletters are free, some are relatively cheap at less than a few hundred dollars per year, and some are priced over a thousand dollars per year. So not only do you have to decide which stock newsletter to buy, but then you also have to decide which of their stock picks you are actually going to buy.

With so many choices, how do you know which ones are worth your money and, more importantly, which is the best stock newsletter whose stock picks will CONSISTENTLY beat the market?

The answer is easy! You have to subscribe to them all and track all their trades–and that is exactly what I do!

My job here at WallStreetSurvivor is to purchase these investment newsletters, track the performance of all their stock picks, and then share my reviews of the performance of all these services. In this ranking of the top performing stock newsletters, I stick to the facts and share my data. Over the last 30 years I have subscribed to 100+ stock newsletters, various software screeners, and tested a variety of charting tools. I am currently subscribed to about 25 stock and investment newsletters priced under $500 per year.

In this June 29, 2025 analysis of the best stock and investment newsletters I am revealing:

- the performance (percentage return) of their last 12 months of picks

- the performance of their last 3 years of picks

- and the details of their performance of their 2024, 2023, and 2022 stock picks through June 29, 2025

I then calculate the return of the S&P500 from the date of each pick through June 29, 2025 (or the date they were sold) and compare each stock pick’s performance versus the S&P500 over the same time to get the “excess return” over the market of each stock pick.

It is important to focus on the “excess return” over the S&P 500 because that is the what every investor wants–to beat the market consistently. If you just want to match the S&P, then just buy an index mutual fund or ETF.

But if you want to beat the market, then keep reading and you will see how you could have beat the market by 47% over the last 3 years!

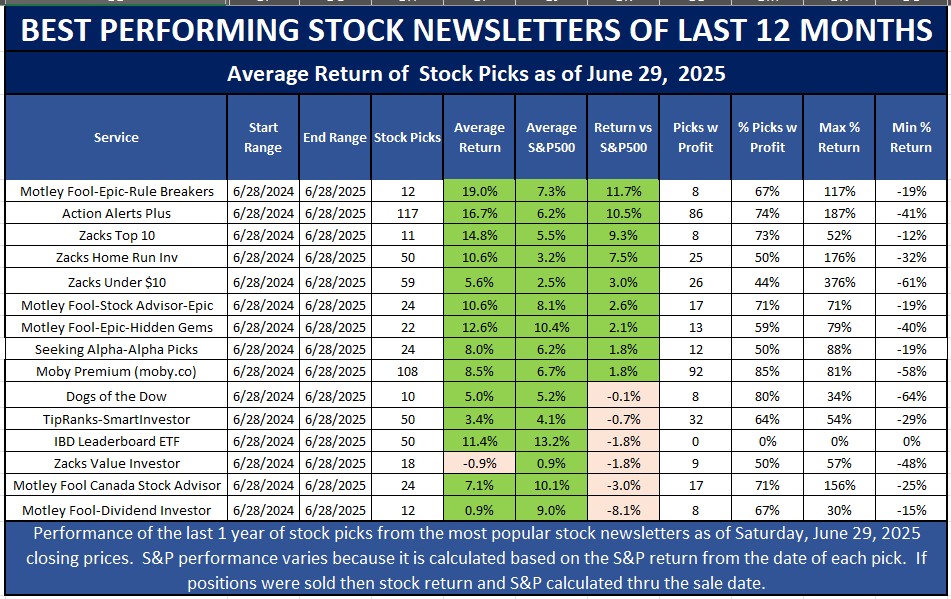

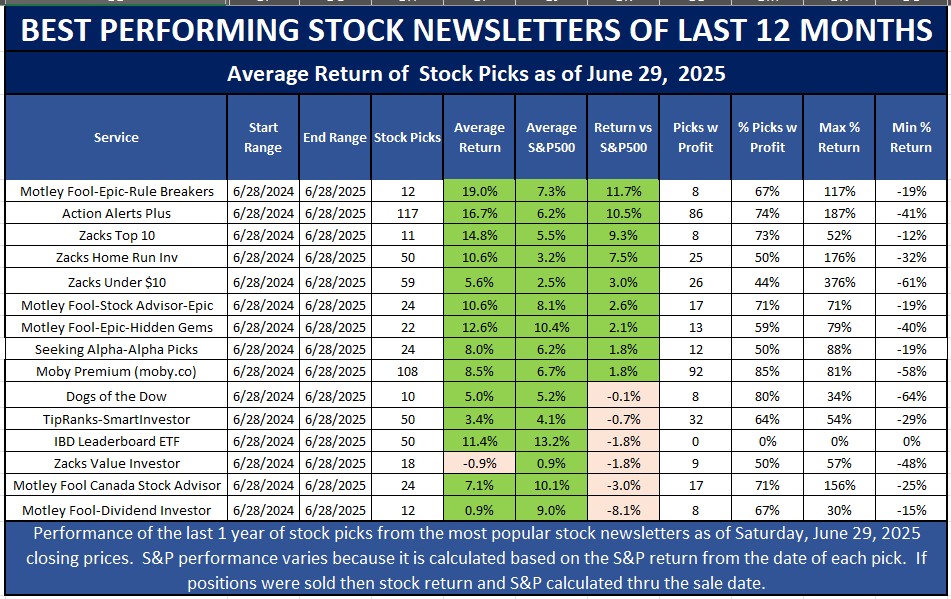

Stock Newsletter Rankings Based on Last 12 Months of Stock Picks

First, I calculate the last 12 months’ return of each stock pick from each of the newsletters that I follow and then average each newsletters’ picks.

This is a fun list to look at. Everyone wants to know who has the hottest stock picks over the last 12 months and and how much money you could have made had you subscribed.

Well, here is the answer in the stock newsletters less than $500 per year category.

As you can see Motley Fool’s Epic Service that includes (Rule Breakers, Stock Advisor and Hidden Gems) is winning this race. Their 12 stock picks are up an average of 19.0% while the market is up only an average of 7.3% so they beat the market by 11.7%. They did have one pick that was up 117% that really propelled them to the top of this ranking.

Had you bought just $1,000 of each of those 12 stock picks your $12,000 would be worth $14,280 and you would have an excess profit of $1,404 above the S&P. This service retails for $499 a year so it easily would have paid for itself. But you can use promo code “EPICSALE” on this Motley Fool Epic Sales page and save $200 and get the next months for only $299.

But if you have ever been around any stock broker and stock newsletter, you know that “past performance does not guarantee future results.”

While impressive, those calculations were based on just one year of stock picks. So now let’s see what happens when we expand our horizon to 36 months.

As I showed you, just having one really good pick can sway the average returns.

Over the years, I have found that the best indicator of future performance is to focus on the performance of THREE years of stock picks.

So let’s now look at some more meaningful data of 3 years of stock picks and their performance to maybe get rid of a lucky pick or two.

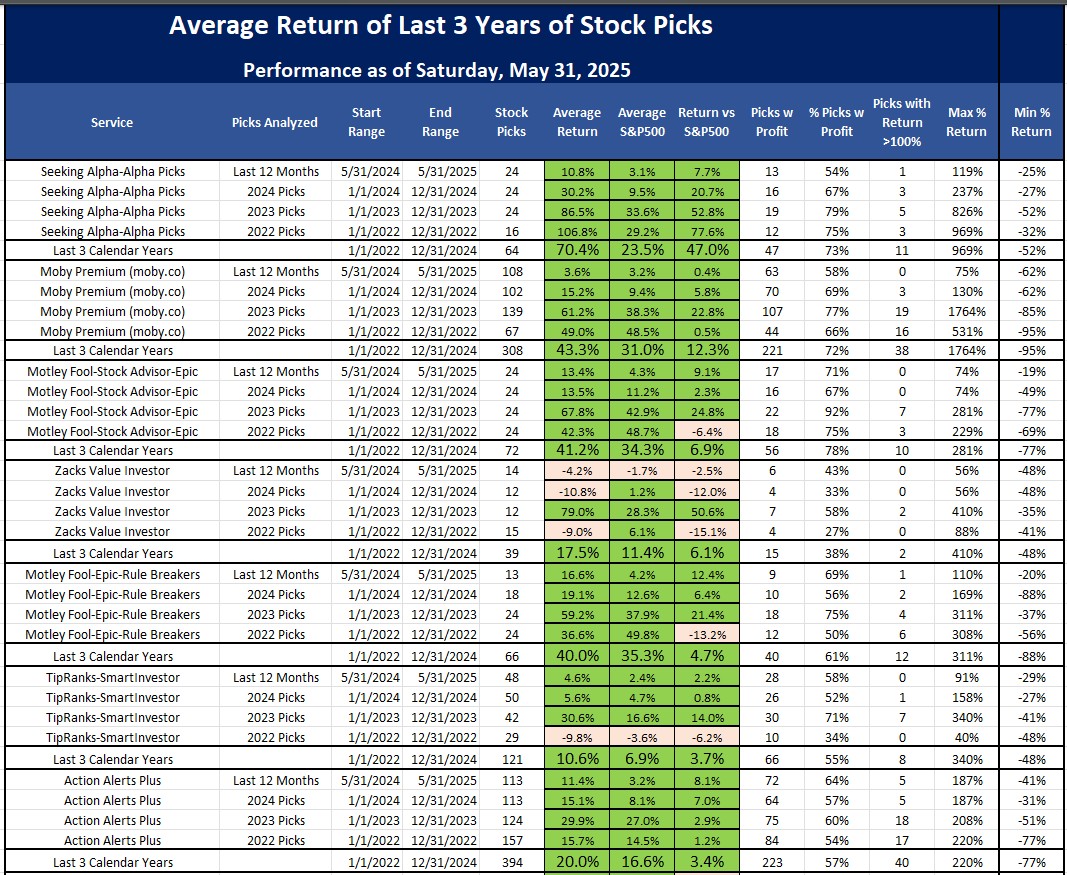

Stock Newsletter Rank Based on Last 3 Years of Stock Picks

Now when we look at 3 years performance this is where it gets interesting and the cream starts to rise to the top.

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of June 29, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is “Return vs SP500” which is their return above that of the S&P500. So, based on June 29, 2025 prices:

Best Stock Newsletters

| Rank | Stock Newsletter | Picks Return | Return vs SP500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 62.5% | 39.9% | 68% | 969% | July, 2025 Promotion: Save $50 |

| Summary: 2 picks/month based on Seeking Alpha’s Quant Rating; Retail Price is $499/yr. See complete details and analysis in our Alpha Picks Review. | ||||||

| 2. |  Moby.co | 44.4% | 13.3% | 71% | 1,749% | July, 2025 Promotion:Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. | ||||||

| 3. |  Zacks Top 10 | 31.4% | 12.8% | 73% | 170% | July, 2025 Promotion:$1, then $495/yr |

| Summary: 10-25 stock picks per year based on Zacks’ Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

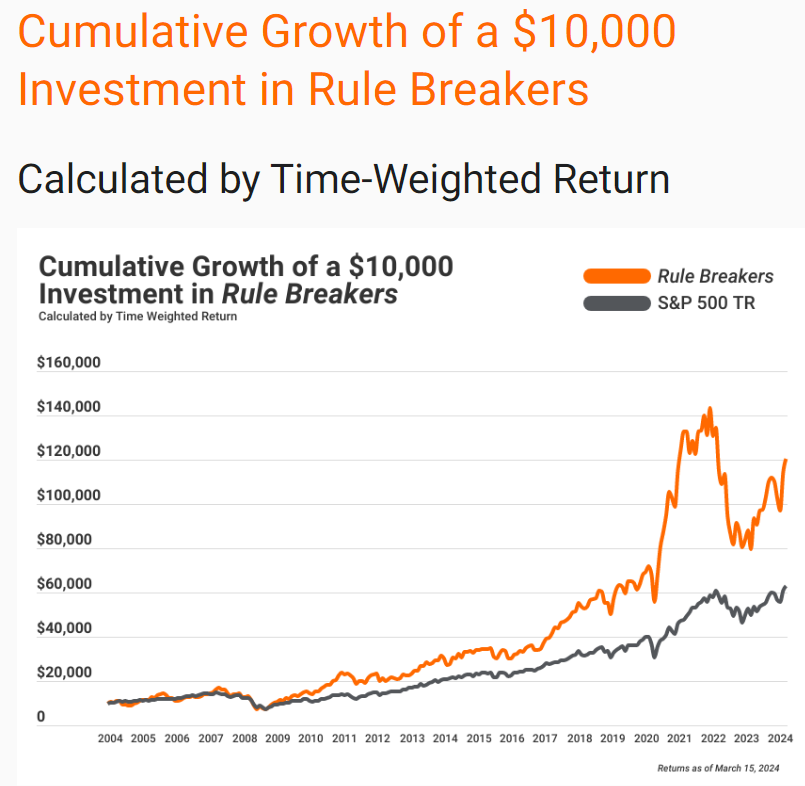

| 4. |  Rule Breakers | 43.0% | 7.9% | 68% | 343% | Current Promotion: Save $200 |

| Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500’s 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| 5. |  Stock Advisor | 40.7% | 7.2% | 79% | 304% | July, 2025 Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 6. |  TipRanks SmartInvestor | 16.6% | 6.8% | 65% | 355% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500’s 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 7. |  Action Alerts Plus | 25.7% | 6.1% | 67% | 220% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 8. |  Zacks Under $10 | 3.6% | -0.1% | 73% | 170% | July, 2025 Promotion:$1, then $495/yr |

| Summary: 10-25 stock picks per year based on Zacks’ Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | July, 2025 Promotion:Save $129/yr |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily. | ||||||

| 10. |  Stock Advisor Canada | 23.5% | -4.6% | 69% | 378% | July, 2025 Promotion: Save $100 |

| Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. | ||||||

| Top Ranking Stock Newsletters based on their 2024, 2023, 2022 stock picks’ performance as compared to S&P500. S&P500’s return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of June 29, 2025. | ||||||

Based on my analysis, the best performing stock newsletters over the last 3 years are:

- Seeking Alpha’s Alpha Picks: This relatively new service has an average return of 62.5% which is beating the market by 40%, 68% of their 76 picks are profitable and 11 have already doubled.

- Moby Premium: This fast growing service has an average return of 44.4% which is beating the market by 13.3%, 71% of their 345 picks are profitable and 38 have already doubled.

- Zacks Top 10 picks are doing well with 67% profitable and are beating the market by 12.8%. This service just releases picks are January 1st of each year, sells them on December 31st. Nothing to do here in middle of year.

- Motley Fool’s Epic-Rule Breakers 60 picks are beating the market by 7.9% and 68% are profitable.

- Motley Fool’s Stock Advisor: This popular service continues to do well with a 40.7% return which is beating the market by 7.2%, 79% of their 72 picks are profitable and 11 have already doubled.

- TipRanks are consistently in the top of the list are these 123 picks are beating the market by 6.8%. This service has a lot of turnover in their picks as the average holding period is only about 5 months.

- Cramer’s Action Alerts Plus are beating the market by 6.1%. You gotta hand it to Jim! But 340 trades in 3 years?

- Another Zack’s service of just stock under $10 with 169 picks are very churny.

- Hey here is the Dog’s of the Dow being profitable so far but under performing the market by -0.1%.

- Investor’s Business Daily has a great model and great track record, but is struggling the last 3 years.

- Motley Fool Canada stock are usually strong but not in this ranking as this mix of US and Canada stocks is currently in a slump and down 4.6%.

- All the others, including many not listed here are underperforming the market.

Here’s My Detail Calculations for This Ranking

Here’s a whole a whole table of numbers that I keep track of in Excel. Take your time and absorb what each row and each column is telling you. There is a lot of data here.

You can see how each is performing over the last 12 months, the last 3 years, and the average of the last 3 years. You can also see number of picks that are profitable and number of picks that have at least doubled. You can also see the maximum percentage gainer and the worst performing stock.

In this table above you see the Seeking Alpha’s Alpha Picks is the leader when looking at the last 3 years of stock picks. They are consistently beating the market each and every year and that is why it has risen to the top over the last 3 years.

Seeking Alpha’s Alpha Picks cost $499 a year. You can read this in-depth Seeking Alpha-Is it Worth It? article or you can find their best Seeking Alpha discount on this site.

The Moby Premium stock picks are from a group of ex-Wall Street Hedge Fund managers and CFAs. This service was launched in 2019 and their picks are doing very well, especially in 2023 when they picked Palantir and now it is up 1,700%. Their service cost $199 a year but you can get their next pick free and get full access to their site/app to see if you want to subscribe for only $99 for your first year.

The ever popular Motley Fool Stock Advisor comes in third place. They have an amazing track record, struggled a bit with their picks during Covid, but have resumed their winning ways. This Stock Advisor service costs only $99 for new subscribers and has a 30 day money back guarantee so this is still a favorite of many. In fact, they claim they have over 500,000 subscribers to this service.

Congratulations to all the top stock newsletters of Seeking Alpha, Moby Premium Picks, Motley Fool Stock Advisor, Zacks Value Investor, Motley Fool Epic-Rule Breakers, TipRanks and Cramer’s Action Alerts for solidly and consistently beating the market over 3 years. Keep reading to learn more details about each service.

Summary of the Best Stock Newsletters Based on Last 3 Years of Stock Picks

When I look at 3 years of performance, I get more confidence in the service as I believe the cream starts to rise to the top.

Seeking Alpha’s Alpha Picks is the overall winner by far on my 3-year performance ranking with an average return of over 60% across 76 stock recommendations and those picks are beating the market by 40%.

For those of you who want to see my full detail analysis, below you can find the performance of each of these stock newsletters by year, and you can see the weighted average of the last three years of their stock picks.

For those of you that have been following this blog post for a while, this is the first time several newsletters (Seeking Alpha’s Alpha Picks, Moby, and Action Alerts Plus) all had GREEN sections indicating that they are consistently picking winners AND beating the market.

Zacks’s has services that rank #4 and #10 in this analysis, but you can clearly see the volatility that their picks have had; and these services only pick10 stocks throughout the year so you can subscribe and go months without a new stock pick.

If you simply do not have any money to spend on a newsletter and are looking for FREE stock picks from top stock newsletters, here are 2 of our favorites:

- Moby Stocks will give you 1 free stock pick when you subscribe to Moby’s FREE newsletter HERE

- Zacks will give you their list of 5 stocks set to double for free on this Zacks’s promo page.

But before I review this 3 year ranking in detail, let’s discuss some questions that many of you may have.

The Most Popular Stock Newsletter: Is it the Best Stock Newsletter?

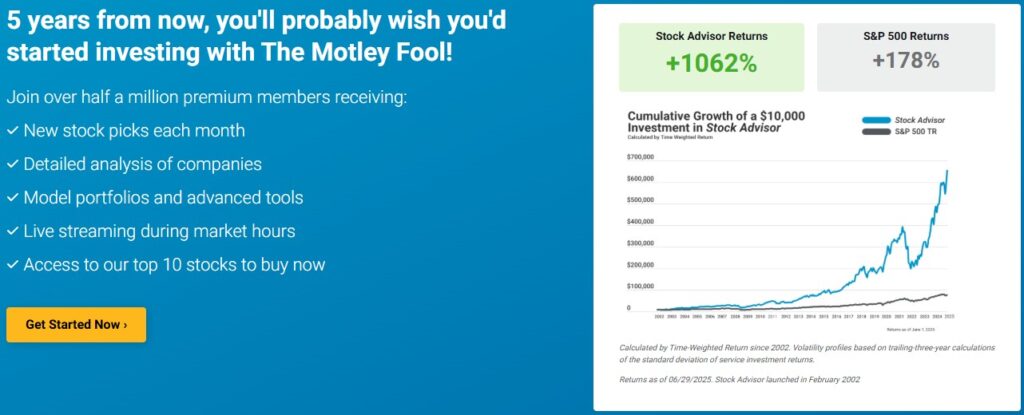

First of all, I do want to comment on the most popular stock newsletter. The Motley Fool Stock Advisor is the most popular stock newsletter out there. They advertise that they have over 500,000 subscribers and since it’s inception in 2002, it has crushed the S&P500 returns by over 5x as you can see from the graphic below.

That is truly impressive as no other service comes anywhere close to this track record for a 20 year period. To be clear, only about 67% of their stock picks are profitable. They have some bad picks and every year is not a winner. But they tell you to plan on holding their picks for at least 5 years and you can expect to beat the market as they have done. They do sell a lot of their stock picks too (they have sold about 40% of their picks over the years).

If you read some blogs and discussions on the Motley Fool, you will find many negative comments. But if you read them carefully, it is simply that these people are not long-term investors and instead are looking at short-term returns. When I look at Motley Fool stocks held at least 5 years, they are definitely beating the market consistently–which is what they really advertise.

If you have at least a few hundred collars to invest each month, and plan on staying invested for at least 5 years, it is still one of my all-time favorites AND it is the most affordable at $199 a year. It is frequently on sale for $50 off, occasionally more, on THIS Motley Fool promotion page.

The Best Stock Newsletters for the Last 3 Years are…

Ok, now back to my deep analysis of these investment newsletters for those of you that like to dig deeper.

To test all of these newsletters, I set up virtual trading accounts here at WallStreetSurvivor for each of these stock newsletters and I have diligently bought and sold all the recommended stocks in these virtual trading accounts.

A lot of services advertise how they have done over the last 10, 20 or 30 years. And some advertise how they have done over the last year. So which is more important? Keep in mind you already missed out on all of the returns from all of these stock picks.

And who knows if it is the same analyst team now as it was back then. And if you focus on how the picks have done for the last year, you might be misled as the sample size is smaller and the time period is shorter. So it is important to review both: how the most recent stock picks AND their historical picks from these stock newsletters are performing.

Some important notes to understand my analysis:

- I am calculating Average Returns, returns of the S&P500 for the same time periods, and EXCESS RETURNS to see who is really beating the S&P500. When we look at the Excess Return versus the SP500, we start seeing some negative performers and we see the cream rise to the top.

- The S&P500 returns varies because it is based on when the picks came out and how long the positions were held. Some services just make their picks on January 1st (like Zacks) and expect you to hold them for the full year so that S&P return is the annual S&P return. Others release picks each month so you would expect the S&P for those services to be about 1/2 of what the S&P did for the year (if the S&P rose evenly month after month). And other services will sell positions in a matter of weeks so those S&P returns are minimal.

- To get these overall returns for YOUR portfolio, you need to buy equal dollar amounts of EVERY stock pick. You also need to buy the stocks as soon as the recommendations come out; and you need to sell if they say sell.

These newsletters give us lots of advice and many stock picks each month. But which ones consistently outperformed the market and are worth the money?

Notice I keep saying “consistently outperform” the market? That’s because one newsletter might be a high flyer one year and then crash and burn the next. That won’t help me. So I am looking for newsletters that consistently beat the market year after year–and that is exactly what you should be looking for too!

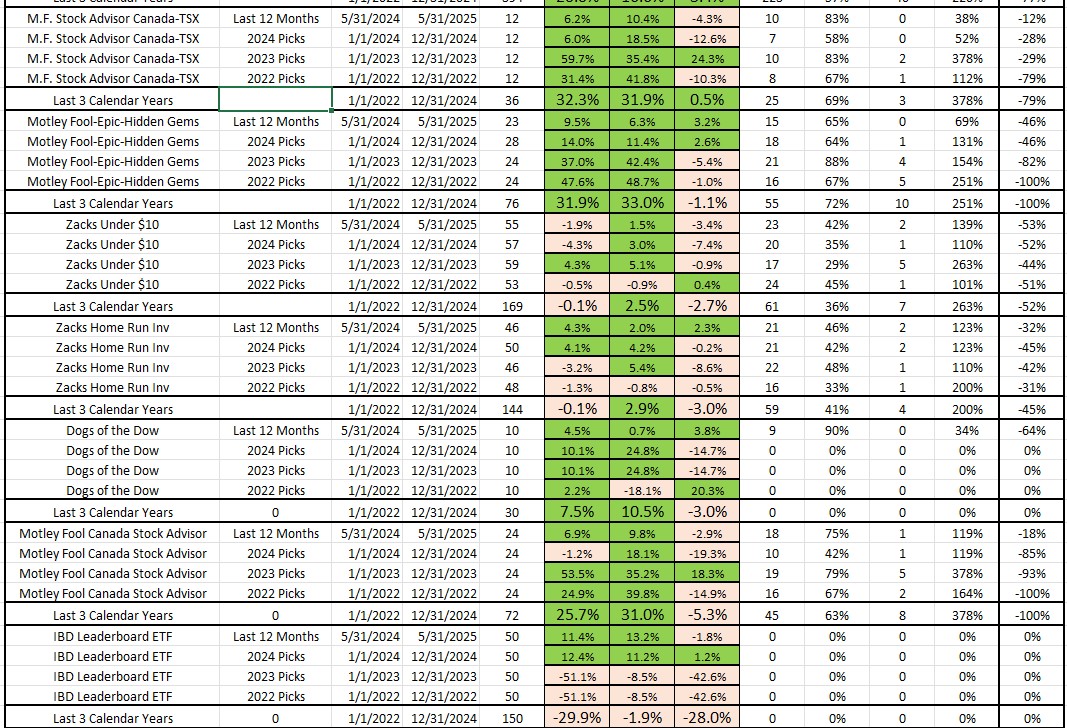

Below I present again the ranking of the Best Stock and Investment Newsletters based on their performance the last 3 years:

This table list 15 stock newsletters priced at $500 or less per year; it includes the Dogs of the Dow strategy too.

The first three columns lists the name of the service and the date ranges, the second section shows the number of picks, the average return of the picks, the average return of the S&P500 over the same time period, and performance vs the S&P500. The last few columns shows their profitable picks and top and worst performers for the last 3 years.

Based on their 3 year performance, the top services are…

#1. Seeking Alpha’s Alpha Picks

For the first time ever as of June 29, 2025, one stock newsletter is now all green in my table AND winning on many counts!

Alpha Picks’ 2024 stock picks are up 34% and beating the market by 21%, their 2023 picks are up 93% and beating the market by 57%, and their 2022 picks are up 107% and beating the market by 78%.

They also have a great accuracy rating as 68% of their 76 stock picks have been profitable.

They also have the one of the biggest winners up over 900%

And–their biggest losing pick is only down 52%.

WOW! How did they do that?

Seeking Alpha is known for it proprietary quantitative analysis and rating system they call their “quant rating.” Their data shows that stocks with a strong quant rating significantly outperform the market, and stocks that have a weak rating significantly underperform the market.

Seeking Alpha launched their Alpha Picks stock newsletter in 2022. It gives you their 2 top rated stock picks each month.

Their “proof” of their Strong Buy based on their quant rating is this:

This chart shows that their Strong Buy rated stocks portfolio have outperformed the market by $277k vs the market’s $57k since 2010.

Likewise, their Strong SELL rated stock significantly underperform the market.

They also had a recent study by the University of Kentucky confirm that the Seeking Alpha Quant Rating actually does provide alpha and help you beat the market. They concluded that you should buy the stocks that Seeking Alpha rates as a Strong Buy and avoid the stocks they rate as a Strong Sell. Read our full Alpha Picks review to get more information.

This Alpha Picks stock newsletter is relatively new, but it has already picked a few BIG winners since it’s launch. One of their picks (SMCI) was up 969% and they sold it, 11 of their picks have already doubled, and they have sold 37 of their picks.

It has been a very profitable service for me, easily paying for itself, so it is definitely worth the $499 price if you are looking for solid stock picks and have at least a couple of hundred of dollars to invest per month.

Alpha Picks Current Promotional Offer:

Save $50 Now and Get 12 Months of Alpha Picks.

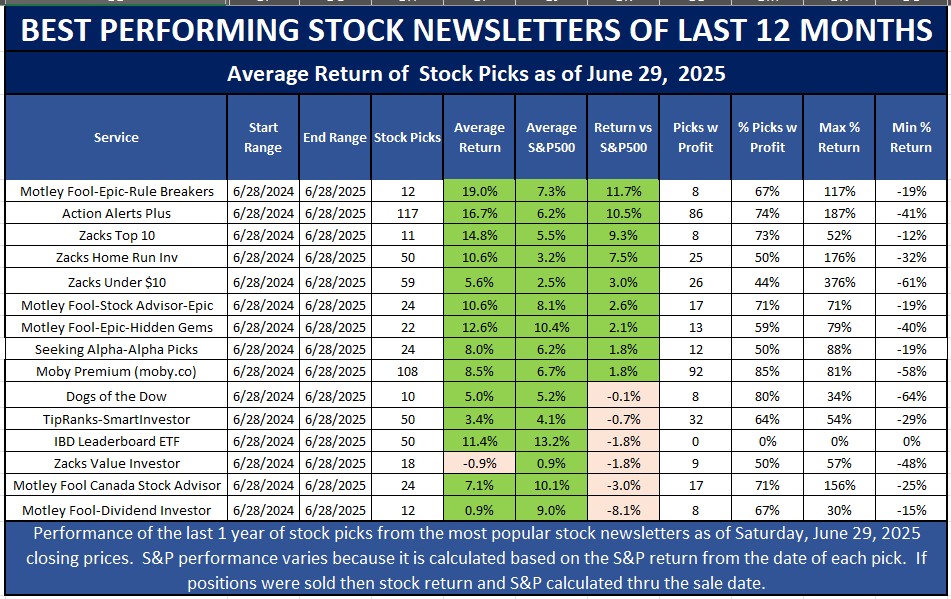

#2. Moby Premium

Moby is a relatively new service launched by some Wall Street portfolio managers in 2021. They make 1 or 2 stock recommendations a week, and provide a ton of market updates and analysis through their very popular Moby.co mobile app.

As you can see the picks from Moby are very accurate with 74% being profitable.

Their site is great for getting real Wall Street research on most well-know compananies.

The one thing I don’t like about Moby’s service is they do NOT offer sell recommendations. So I just stick to a 25% stop loss order on all of their picks and my results are even better than what is in the table doing that. I do, however, end up selling some stocks that later recover.

Moby Current Promotional Offer:

get their next stock pick for free

#3. Zacks Top 10 Stock Newsletter

Zacks Investment Research has a few research tools that have also withstood the test of time. But Zacks has historically been for a different type of investor. Zacks historically has been more for the investor that has their own stock ideas but wants to get another opinion of a stock before they buy it.

Zacks has launched a few stock newsletter subscriptions in recent years that are starting to get our attention. Their Value Investor service has only released 12 picks in 2024 but their 39 picks over the last 3 years are beating the market by an average of 6%

According to the Zacks’s website, their Zacks Value Investor service “Combines proven value criteria with Zacks Rank timing. It tracks undervalued companies until the market starts to see their real worth. Then pounces for gains that can build for several years.”

They also state the target holding period is 12 months to 12 years, they aim for 20-25 stocks in this portfolio and make 1 or 2 trades per month.

Here is a quick peek at a partial list so you can see their price targets and Zacks Rank. Note that they provide a stop loss price and a target price.

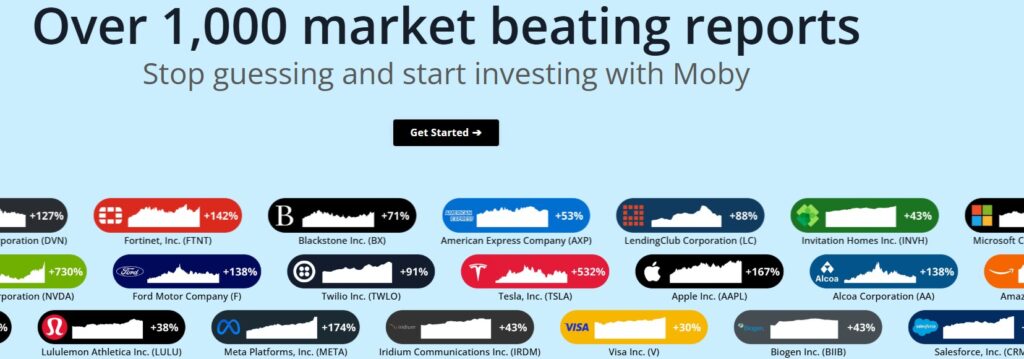

How does this Zacks Rank work?

They do a fantastic job at analyzing about 10,000 U.S. stocks and ranking them on a “Zacks Rank” score of 1 to 5. Stocks that are ranked “1-Strong Buy” have consistently outperformed the S&P. The average stock ranked “1-Strong Buy” has an average ANNUAL return of 24.2% compared to the S&P 10.7%. The nice smooth chart is exactly what you would expect if their ranking works. On the other end, stocks that are ranked “5-Strong Sell” have consistently done the worst as you would expect.

If you want a few solid stock recommendations each year, Zacks Top 10 is a great resource.

Zacks Current Promotional Offer:

Follow this link to get 30 day access for just $1

#4 The Motley Fool Rule Breakers (Best for Growth Investors)

The Motley Fool’s “other” newsletter was a close #4 on our list as it’s still one of the best financial newsletters out there. But the Fool changed how they sell access to Rule Breakers. It is no longer sold by itself, it is now part of their Epic service.

The Motley Fool Ruler Breakers is a high-growth investing service and it has certainly lived up to those expectations. Rule Breakers is similar to Stock Advisor, with a few twists…

With Epic, you still get one new Rule Breakers stock recommendations each month. These recommendations are based on stocks that will become tomorrow’s market leaders.

Here are the six rules that differentiate “Rule Breaker” stocks:

- Emerging Industry. Innovative companies in emerging industries that are poised to change the world.

- Sustainable Advantage. Companies must show potential for long-term advantage over competitors.

- Past Price Appreciation. Rule Breakers have performed well in the past.

- Good Management. You want to invest in companies with vision and competent management.

- Consumer Appeal. Customers have to love the product or service.

- Grossly Undervalued. Wall Street may be underestimating the companies’ transformative value.

Each rule is considered when stocks are being chosen and recommended to users.

As I did for the Motley Fool’s Stock Advisor, in January 2016 I also subscribed to Rule Breakers and started buying about $2k of each of these stock picks.

Notice from the chart above some stellar results especially for the stock picks from 2018-2016. Those stocks that I bought that are at least 5 years old have beat the S&P500 by over 150% on average. One stock (ticker: TTD) from 2017 is up over 3,000% and one stock (ticker: SHOP) is up 11,000%. They actually picked SHOP in Rule Breakers BEFORE the picked it in Stock Advisor so that is why the return is higher here.

Over the period 2016-2018, the stock picks from the Motley Fool Rule Breakers service have actually outperformed their Stock Advisor service, but their returns are more volatile so for that reason we marked it down a bit. This means that if you had missed just a few stocks over those years, your returns would not have been a strong. Also their Rule Breaker picks are a lot more volatile and they seem to take longer to go up in value. So I find this service to be more hit or miss since they are really trying to pick high growth stocks in newer industries. If you do subscribe to this service, you definitely need to buy EVERY pick that comes out so that you don’t miss on the few that skyrocket.

Here are some of their recent top performing stocks. For example, their October 2023 pick of CAVA is up 24%; their June 2023 pick of IOT is up 32%; their April pick of DUOL is up 70%. In February 2023 they picked CRWD and it is up 123%; in December 2022 they picked BRZE which is up 103%.

Save $200 on The Motley Fool Epic Service

#5 The Motley Fool Stock Advisor

The Stock Advisor ranked as our #1 Best Stock Newsletter for the 6 of the last 8 years.

Their 2023 stock recommendations were the top performer of 2023 and easily beat all of the other newsletters we monitor, They had a high profitability percentage, they lead in all-time performance, and they are priced very reasonably at $199 a year, with current coupons available for $100 off to net to $99 for new subscribers. They had a tough 2022 but seem to have recovered their winning ways.

Their 24 stock picks from 2023 are up an average of 77% versus the S&P500’s average return of 50% as of the date of this analysis. So they beat the market an average of 27% for 2023. Impressively, 92% of their picks were up, the biggest winner was up 304%.

So, even though this stock picking service won our Best of Award for their 2023 stock picks also look at its historical performance.

You may have seen the Motley Fool’s advertisements like the one below that since inception their stock ideas from the last 23 years are up 5 times the S&P500:

And then they have this chart which shows how their portfolio has grown over time:

Notice their curve has consistently been above the S&P500 and really spiked in 2019 and then corrected like most stocks did in 2020 due to Covid. But now the last 2 years the curve is moving sharply higher again. This is mostly likely to do the overselling of some of their picks like NVDA, SHOP, TSLA and more. Also, the surge in demand for AI stocks is benefitting the Fool’s picks.

Is The Motley Fool’s Stock Advisor really as good as they claim? Yes if you pay attention to one very important detail about their recommendations. They pick stocks that they plan on holding for at least 5 years. If you are reading any negative news from subscribers to the Motley Fool, you are reading from people that tried it for a short period of time and have not stayed with it for 5 years or more like I have.

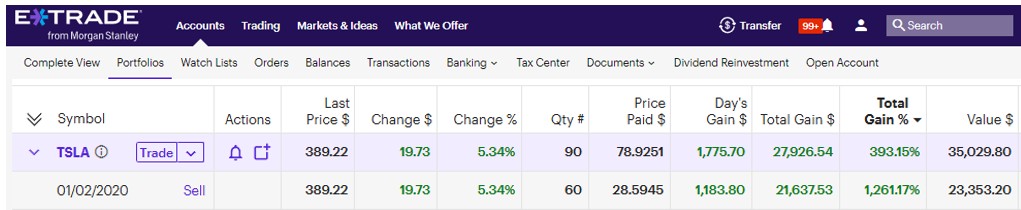

Over the years we have become so confident in the Motley Fool Stock Advisor stock picks that in December 2015 we opened up a dedicated ETrade account and actually started buying all of their stock picks. Starting in January 2016 we have purchased $1,000- $2,000 of every single one of their stock recommendations for over 8 years now.

How do they do it? They are really good at picking a few stocks that double or triple each year.

- One of their biggest winners lately was their January 2020 pick that I bought as a result of the Stock Advisor recommendation. See my Tesla trade below from my ETrade Account showing it up 884%:

-

What You Get When You Subscribe

When you subscribe, you will get two new stock recommendations each month and several BEST OF lists of stocks each year. Each recommendation comes with an in-depth (but easily understood) analysis that tells you why they recommend each stock. Note that our analysis only considers the 2 unique stock picks per month as the BEST OF lists are usually re-emphasizing previous stock picks that they still recommend strongly.

You will also get unlimited access to…

- All of their historical stock recommendations

- The Motley Fool’s list of “Best Stocks to Buy Now.” Best ideas chosen from all of the picks since the service started.

- The Motley Fool’s list of “Starter Stocks that should be in Everyone’s Portfolio.” Stocks that give you an excellent foundation for your portfolio.

- Their Knowledge Base and Community. Educational materials that will help you become an expert investor, and message boards to chat with other investors.

And in case you are wondering, yes, they do tell you when to sell a stock. They issue sell orders sometimes to lock in profits and sometimes to cut losses.

Motley Fool Stock Advisor Recap

- The Motley Fool Stock Advisor, according to the Fool themselves, is intended only for people that plan on holding stocks for at least 5 years.

- Its performance over the last 8 full years has crushed the competition.

- Lots of their stock picks double, triple, quadruple, and more.

- Older stock picks from 2016 and 2017 and 2018 continue to outperform.

- The Motley Fool has an EXCELLENT success rate of profitable picks.

- The Motley Fool stock picks are still coming from the 2 brothers (David and Tom Gardner) that started the company in the early 1990s. So when you order the Fool service, you know that you can expect similar results because the stock picks are coming from the same 2 guys.

- The price is extremely reasonable AND they offer a MONEY BACK GUARANTEE and they have a toll-free number for support. They are so confident in their service that they encourage you to try it and get their next 2 stock picks–then you can cancel if you aren’t happy and get your money back. Normally it is $199 a year, but if you are a new customer you can get the next 12 months of their picks for just $99.

There is one thing you need to know about their service, however…. Because they have so many subscribers (500,000+), their picks tend to go up a few dollars they day their recommendations come out. So to get the best returns, you need to buy their stock picks as soon as you receive their alerts.

Stock Advisor Current Promotional Offer:

PRICE DROP! MOTLEY FOOL STOCK ADVISOR NEW SUBSCRIBERS ONLY:

Get a $100 coupon and try it for just $99 for the next 12 months

#6. TipRanks

TipRanks is much like Seeking Alpha with their own proprietary ranking system of stocks. From their own website, they say they help investors “make smarter, data-driven investment decisions” and that they “level the playing field by making institutional research tools and data available to everyone.”

For this ranking, I am using their SmartInvestor portfolio which is supposed to be their highest rated stocks. These picks overall are up and beating the market by 4%.

Tipranks generally turns their stocks over a lot. I would guess that their average holding period is about 6 months.

Their algorithm includes data from Wall Street Analysts. They say “TipRanks drive transparency by tracking and measuring the performance of over 96,000 financial experts, including Wall Street analysts, financial bloggers, hedge funds, and corporate insiders, and making this information publicly available.”

They monitor the performance of all of these “experts” and rate them based on their performance, and make all of this analysis available to you. Read our full TipRanks review to get more info.

If you trade on ETrade, Interactive Brokers, TD Ameritrade, EToro or a few others, you have probably seen the Tipranks newsfeeds on those platforms.

Tipranks Current Promotional Offer:

Normally $29.95 a month, but save 50% on TipRanks here!

#7. Jim Cramer Action Alerts Plus

Whether you love him or hate him, Jim Cramer’s stock newsletter service and picks do speak for themselves. His picks the last 3 years are generally beating the market (thanks to recurring NVDA and MSFT picks).

His accuracy is decent with about 74% of his stock picks being profitable; and moderate turnover.

Jim Cramer offers his alerts as a subscription service available through TheStreet.com.

The service will send you an e-mail when Cramer has recommended a buy or sell for any stock.

You will also receive additional analysis such as…

- Detailed information on the stock

- The action being taken

- Why that action is being taken

At the end of each week, Cramer will do a weekly roundup of all the shares that he currently owns.

We like this service because it allows everyday traders to get inside the head of an industry expert.

With this, you will have the tools necessary to make well-informed decisions for your own investment portfolio.

Action Alerts Plus Current Promotional Offer:

14-day free trial of Action Alerts

#8 Motley Fool Canada Stock Advisor

The Canadian version of the Motley Fool’s Stock Advisor service newsletter picks one U.S. and one Canadian stock each month. Since the Toronto Stock Exchange seems to be less volatile than the U.S. markets, the addition of a TSX stock reduces the volatility of these stock picks overall. Read our full review of the Motley Fool Canada Stock Advisor to get more details on this service and to see its current price promotion.

Their 2024 stock picks are up slightly and they had a great 2024 and 2023. Here’s a clue: Their TSX picks are much more profitable than their US picks so if you live in Canada just buy their TSX picks.

Motley Fool Canada Stock Advisor Current Promotional Offer:

On sale this month only for $99!

Hidden Gems

This is relatively new service of the Motley Fool featuring Tom Gardner’s analyst team that has done so well over the last 20 years. What is unique about this service is not only do they show you what stocks to buy, but with this stock newsletter they also tell you how they are weighting each stock in their recommended portfolio.

Of their 24 picks for 2023, 19 of them were up and the average return was 18.8% vs the S&P500’s 12.7% for their picks; so they are beating the market by 6.0%. Their biggest winner is up 73% and their biggest loser is down 41%.

The Motley Fool sells this only as part of what they call “The Epic.” Their Epic package gives you 4 services in 1: Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investors ALL for $319. So this is truly the BEST VALUE.

Here is our full review of Motley Fool Epic.

The Others

Rounding out our ranking are Dogs of the Dow, Zacks Home Run Investor and IBD Leaderboard. None of these have done well over the last 3 years so focus on our top 5 newsletters in our ranking of the best stock and investment newsletters.

Interesting to note is the Dogs of the Dow strategy, though up, underperformed the market by a huge amount%.

And the IBD Leaderboard, which is really hard to track, saw its IBD Top 50 ETF underperform the market by 14%

Best Stock Investment Newsletter Conclusion

There are hundreds of services out there claiming they can help you find good stocks and beat the market. We subscribe to a few dozen and update this list quarterly so you can see which ones are performing the best.

Over the last 3 years, Seeking Alpha’s Alpha Picks has stormed onto the scene and is truly impressive so far, easily beating all of the other services we follow. It is priced at $499 a year with some 5 and 10% discounts at times, but it is worth it. Here’s our review of Seeking Alpha’s Alpha Picks.

Over the last 8 years and the last 23 years since inception, the stock picks from the Motley Fool Stock Advisor have consistently outperformed the overall market. For more info read our full Motley Fool Stock Advisor review. While every stock pick of theirs does not go up, they always pick a few stocks that double and triple each year–that is how they get their amazing returns. We don’t guarantee future results, we are only sharing our historical results. If you want to get a year of their next stock picks, for just $99, CLICK HERE.

The best VALUE right now is the Motley Fool’s Epic Stock service where you get 5 picks a month from Stock Advisor, Hidden Gems, and Rule Breakers for only $299 your first year.

If you simply do not have any money to spend on a newsletter and are looking for FREE stock picks from top stock newsletters, here are 2 of our favorites:

- Moby Stocks will give you 1 free stock pick when you subscribe to Moby’s FREE newsletter HERE

- Zacks will give you their list of 5 stocks set to double for free on this Zacks’s promo page.

If you are a serious investor with a more money to invest, then Seeking Alpha’s Alpha Picks has become the new rock star of stock newsletters with the best performance over the last 3 years. And a University of Kentucky business school research just validated their claim that their Quant Ratings do work to help you provide alpha. But it is priced now at $499 a year.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.