eToro is one of the leading social investing platforms out there today.

The company started off as a cryptocurrency platform and has evolved into a community where you can trade equities as well as copy other investors’ strategies.

Today, we’re going to be talking about whether or not eToro is a secure platform to use.

What Is eToro?

eToro is a social trading platform that allows users to trade stocks and cryptocurrencies as well as keep up with the investing strategies and patterns of other users.

The company is based in Tel-Aviv, Israel, and its CEO is Yoni Assia.

eToro was founded in 2007, but the groundwork for the social investing platform that it is today was really laid in the early 2010s.

Stats

The eToro platform has over 33 million registered users in over 140 countries and 45 States.

Over $9.4 billion in total assets is managed by eToro.

eToro Features

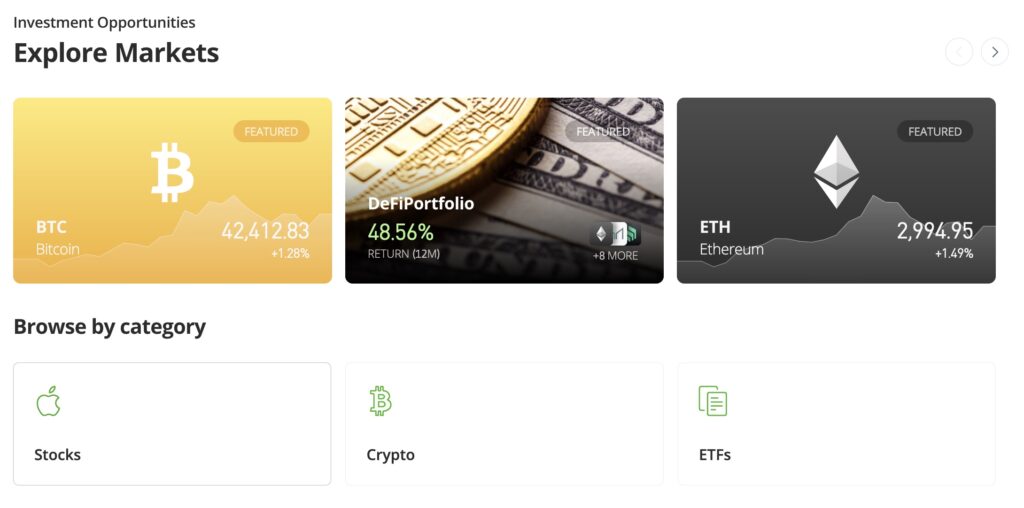

eToro offers a slew of different financial features that let you invest just about any way you want to.

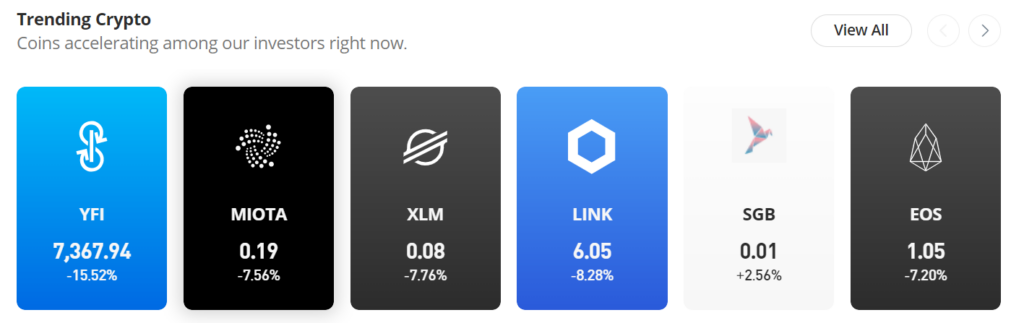

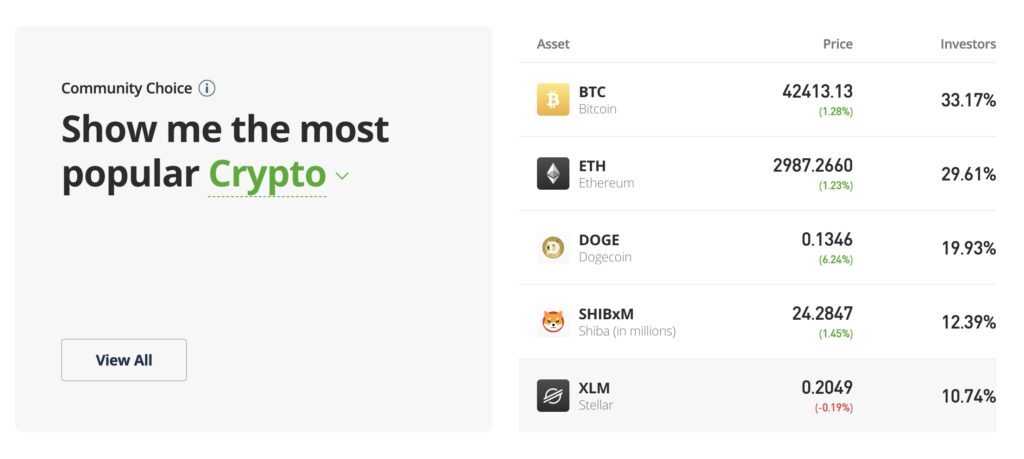

Cryptocurrency

eToro actually functions as a full-fledged crypto exchange.

You can trade cryptocurrencies as well as use their very own eToro crypto wallet.

You can trade more than 20 cryptos, like Bitcoin, Ethereum, and Dogecoin.

eToro is officially organized in the U.S. and retail investor accounts can trade crypto directly.

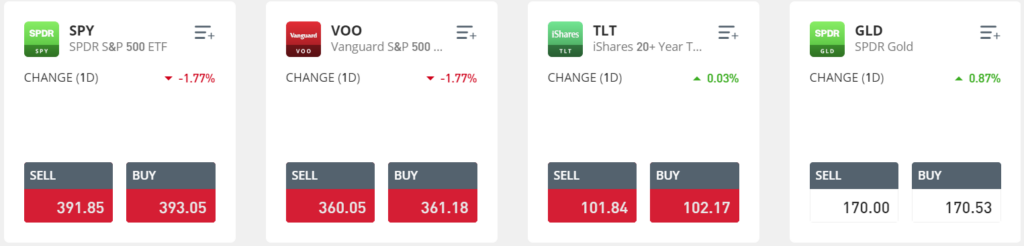

Stocks and ETFs

Stocks and ETFs are also available to customers in certain locations, and eToro expects to expand the reach of their equities offerings.

Stocks

In the U.S., eToro users can trade over 2400 stocks.

Stock trades are completely commission-free.

ETFs

United States-based eToto users can trade over 250 ETFs.

ETFs, or exchange-traded funds, are collections of stocks (and/or other securities) that you can buy and sell just like normal securities.

When you invest in an ETF, you get exposure to all of the stocks within that fund.

ETFs are like mutual funds, but they tend to be cheaper and more accessible.

Mutual funds come with hefty fees (because they’re usually actively managed), and can only be traded once per day – after the stock market closes at 4:00pm Eastern.

But ETFs are usually passively managed and therefore less expensive, plus they trade whenever the market is open.

You won’t pay any commissions for trading ETFs on eToro, but many ETFs do charge (usually small) management fees that are automatically taken out of the fund’s price, not out of your bank account.

Fractional Shares

You can also buy fractional shares when you invest on eToro.

Fractional shares allow you to buy a portion of a share of stock.

This lets you earn equity in a company with whatever amount of money you want to invest, instead of having to wait until you’ve saved up enough to buy a whole share.

Pro Tip

eToro is a revolutionary trading platform that lets you copy the trading strategies of ultra-successful investors. When you sign up for eToro using this link and deposit $100 into your account, you’ll get a $10 cash bonus!

Other Features

eToro also offers other special features such as a virtual portfolio and stock news and analysis.

The Virtual Portfolio is a paper trading feature that lets you practice trading without risking any of your real, hard-earned money.

When you use the Virtual Portfolio, you get $100,000 in virtual cash to invest with as you please.

You can then measure your success and get an idea of how effective your decisions would have been if you had used real money.

With the Virtual Portfolio, you can trade any security you can trade in a real eToro portfolio.

Watchlist

The eToro Watchlist allows you to add stocks, ETFs, and cryptocurrencies that you’re interested in and see how they’re all performing at a glance.

You can see the stocks’ prices, gain or loss percentages, and charts. You can also see the one-year price range and analyst sentiment for every investment in your watchlist.

Analyst sentiment information will take professional analysts’ opinions on a stock, average them together, and spit out a “Buy,” “Hold,” or “Sell” rating.

You can easily trade your favorite securities directly from the Watchlist.

CopyTrader

One of the main features that makes eToro unique is the CopyTrader feature.

CopyTrader lets you duplicate the crypto portfolio of another investor at the push of a button.

You can look up top traders that fit your style and then easily mimic their strategies.

These top traders get paid as part of eToro’s Popular Investor program in return for allowing other eToro users to copy their portfolios. Everybody wins!

Smart Portfolios

eToro’s Smart Portfolios are specifically for crypto.

They implement several different crypto investing strategies that are meant to take focus away from trying to time the market.

ESG Investing

ESG stands for environmental, social, and governance.

It refers to three of the big ethical standards that some investors want companies to excel in.

Environmental refers to companies’ efforts to reduce their carbon footprint and fight the effects of climate change.

Social refers to companies’ contributions to charitable organizations, their views on social issues, and the way they treat workers.

Governance refers to the morality of their leadership and whether they run the company according to ethical standards.

eToro gives ESG scores for over 2000 financial assets. They partner with ESG books to calculate the scores, and you can use them to decide whether certain stocks align with your values enough for you to invest in.

Education

eToro offers some educational tools to help users learn about investing as well as how to use the platform.

Their educational tools come in the form of writing, videos, podcasts, and courses, as well as the Virtual Portfolio.

There is also a news feed to help you keep up on certain topics in the finance world such as crypto.

The educational features aren’t exceptional, but we think they get the job done.

How Does eToro Make Money?

eToro is a commission-free trading platform for stocks; you won’t pay any fees when you make an equity trade.

So if stock trading is free, how does eToro make money?

Firstly, the company makes money on the spread.

When we refer to the “spread” when discussing stocks, we’re talking specifically about the bid-ask spread.

The bid-ask spread is the difference between the highest amount a buyer is willing to pay for a stock (the bid price) and the lowest amount a seller is willing to sell the stock for (the ask price).

When the bid price and ask price are different, the brokerage makes money by processing orders.

This is because they can simultaneously sell a stock for a higher price and buy it at a lower price.

The spread for stocks that trade at at least a decent volume is usually no more than a few cents, but this really adds up for brokerages when they’re processing millions of trades.

Lets say the market price for stock ABC costs $100, eToro charges $100.10 and they collect the 10 cents.

eToro also makes money by collecting fees, especially on cryptocurrency services.

For example, the company charges a 1% fee any time you buy or sell cryptocurrency on their eToro trading platform.

eToro offers leverage trading, which means you trade with borrowed money and eToro charges you an interest fee.

If you’re using the eToro Money Wallet for your crypto trading, you’ll also pay a 0.1% conversion fee to convert one coin to another.

There’s also a 0.5% transfer fee (minimum of $1, maximum of $50) when you transfer funds from your eToro account to the Money wallet.

If you are inactive on eToro for more than 12 months, they will charge you a $10 monthly fee. International users pay $5 to withdraw funds.

eToro also charges miscellaneous fees for certain optional services like conversion fees.

For example, if you decide to transfer your eToro account to another brokerage, you’ll pay a $75 ACATS fee.

You’ll also pay different fees for paper services, wire transfers, and other services.

These fees are typical among most brokerages and are easily avoidable depending on how you use the platform.

Pro Tip

eToro is a revolutionary trading platform that lets you copy the trading strategies of ultra-successful investors. When you sign up for eToro using this link and deposit $100 into your account, you’ll get a $10 cash bonus!

Is eToro Legit?

eToro has tens of millions of users and over a decade of experience under its belt.

But is eToro legit? Does the platform really do what it promises to do?

We’re happy to say that yes, eToro is legit.

The platform certainly provides the services it claims to provide.

You can trade stocks, ETFs, and cryptocurrency (with restrictions in certain states).

Equities trades are truly commission-free, and there aren’t any hidden trading fees.

eToro is transparent about the fees it does charge for crypto services and miscellaneous services, as they provide you with a full fee schedule.

The company is licensed to provide brokerage services and manage client funds in many countries.

In 2021, eToro went public with a $10.4 billion merger. It was a part of a SPAC and was listed on the NASDAQ in Q3 of 2021.

In addition to their business track record, eToro also has a thorough customer service program.

eToro provides customer support through live chat and an online ticket system.

While some customers have found the live chat agents hard to reach, the support tickets seem to have a good track record of solving users’ problems. (And you don’t even have to be logged into your eToro account to submit a ticket!) Representatives usually respond to support ticket submissions via email in 24 to 48 hours.

There is also a help center that users can take advantage of to get answers to their questions. The help center has an FAQ section and articles that show you how to open an account, transfer funds, use the eToro platform, and more.

eToro users that have more than $5000 in equity are assigned dedicated account managers that they can contact with questions.

So, Is eToro Safe?

Regulation

Well, we think that eToro’s years of business in the investing world and millions of users speak for themselves.

But if that wasn’t enough, eToro is a member of both the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

The company is also regulated by the United Kingdom’s Financial Conduct Authority (FCA), the Cyprus Securities Exchange Commission (CySEC), and the Australian Securities and Investment Commission (ASIC).

This means that eToro is heavily regulated by the government, just like many other big investing platforms.

FINRA is a nonprofit organization that oversees broker-dealers and individual stockbrokers.

It is not a part of the federal government, but it is overseen by the SEC.

FINRA licenses and makes rules for any entity that sells stocks.

The SEC is a government agency that serves to protect investors.

It has the power to enforce securities laws and bring suit against people who commit financial crimes.

They are the executive agency that fights against insider trading, pump-and-dump schemes, securities fraud, and the like.

eToro is also a member of the Securities Investor Protection Corporation (SIPC).

The SIPC is the nonprofit organization that takes care of retail investor accounts who lose money due to their brokerage going out of business.

This means that your stocks and deposited cash are protected in the event that eToro goes out of business and you’re unable to liquidate the assets in your account.

Of course, the SIPC does not cover you if you simply lose money on a stock; it’s only if your brokerage can’t give you the money already in your account.

Keep in mind that cryptocurrencies are not insured.

Account Protection

eToro has put a lot of time and money into making sure your assets are secure.

All data you share to eToro is encrypted by the Transport Layer Security (TLS) protocol.

eToro keeps their data in cold storage and has a firewalls to protect everything. They participate in bug bounty programs by hiring ethical hackers to find flaws in the fire walls.

Users can activate a multi-factor authentication to further protect their account. When the multi-factor authentication is enable, you must have your phone with you to login.

eToro’s network is monitored 24/7 but cybersecurity professionals to protect from hacks and data leaks.

…so yes, eToro is safe!

Pro Tip

eToro is a revolutionary trading platform that lets you copy the trading strategies of ultra-successful investors. When you sign up for eToro using this link and deposit $100 into your account, you’ll get a $10 cash bonus!

Final Thoughts

As you can see, eToro is a legit, trustworthy platform.

They provide legitimate services and charge honest fees.

eToro is regulated by high-end financial authorities in numerous countries. Funds are kept in tier 1 banks.

They have taken dynamic security measures to make certain client funds and assets are protected.

eToro is a modern investing platform that allows you to connect with other investors. It is a great service to learn how to trade on, grow your portfolio, and learn different strategies from experts.

If you’d like more information on the features that the platform offers, you can read our eToro review.

If you want to see a head-to-head comparison of eToro against another one of the biggest players in the crypto trading space, read eToro vs Coinbase.

And if you want to see how eToro stands up against other platforms that let you copy successful trading strategies, check out our TipRanks review!

eToro Disclosure

Stocktrak is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc. Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success.

Click here to see our advertising disclaimer.

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. $3 monthly 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

Robinhood

Robinhood$0

✅ U.S. stocks, ETFs, options, and cryptos

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes

✅ Access to U.S. and Hong Kong markets

✅ Educational tools60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analyticsRefer a Friend and Get $200

Interactive Brokers Review

4.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

5.

M1 Finance

✅ Automated investing “Pies”

✅ Banking & low-interest loans

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

6.

Webull

$0

✅ Extended-hours trading

✅ Great charts and screeners

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

7.

Public

$0

✅ Fractional shares

✅ No payment for order flow model

✅ “Alpha” tool with earnings calls$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

8.

Composer

$32 a month

✅ Invest in automated strategies

✅ Build custom strategies easily

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

9.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools

✅ Curated theme portfolios$5 when you invest $5

Stash Review

10.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

11.

Etoro

$0

✅ CopyTrading™ to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.