With over 10,000 stocks listed in the U.S., it is impossible to research them all and find timely, accurate and valuable information.

Thankfully, there are many investment and stock research sites that are available to the average investor.

In fact, with the internet there are now too many stock market websites to follow.

So that explains the predicament that many individual investors face: too many stocks to follow and too many sources of often contradictory information.

In this article we present the best stock research websites and give you the pros and cons of each.

Keep in mind that there are really 2 types of sites that we will cover. The first list is the sites that do the research for you and tell you what to buy. The second list is the sites that give you the tools to do your own research.

The first type we will call stock analysis websites where the site does the analysis for you and, and second we will call stock research sites where the site gives you the tools to do your own research.

If you have spent any time researching stocks, then you are probably bombarded with tons of advertisements for stock picking services and market research newsletters.

So, how do you know if their research is helpful or even accurate?

Today we are going to dive into the best stock analysis website that has historically provided stock recommendations that have outperformed the market year after year. And we are going to dive into the sites with the best stock research tools.

Before we get started, it is important to understand what type of research you are conducting.

We are going to break these best stock research sites into three big categories (there is always some overlap, but this will help you with a quick reference).

- Investing Strategy

These answer questions like “What stocks should I buy?” - Stock Research

These answer questions like “Is Apple a good stock to buy vs. Google?” - Market Research

These answer questions like “What is the stock market doing?”

Let’s get right into it!

Investing Strategy (How To Find Winning Stocks)

1. Seeking Alpha

Seeking Alpha is a crowdsourced financial market news and research site that offers free and paid resources for investors and traders. Because of the level of expertise on this site, we consider it to be the best equity research firms or website available.

The goal of Seeking Alpha is to unite individual investors in a centralized space where they can share their research and analysis with the rest of the investment community.

When you visit the Seeking Alpha homepage, you will see a dashboard with market tickers, trending stocks, and the top articles of the day.

Articles touch on topics like Forex, US Economy news, natural gas futures, top stocks, and much more.

Although many of the articles are sourced from community members, authors who post consistently and have a good reputation develop a strong following and provide unique insight.

If you make a free account, you can follow your favorite authors and stocks.

The Premium service from Seeking Alpha is $19.99 per month and provides members with access to quantitative tools like earnings downloads, premium investing recommendations, and a ratings screener for top stocks.

BUT, right now Seeking Alpha is offering a FREE 14 day trial of their Premium Membership.

Since Seeking Alpha is community-driven, it is especially beneficial to investors who are looking for different market perspectives from a more local point of view.

Seeking Alpha also has a Pro service for high net worth individuals and professional traders. The service is $199 per month, and it offers access to a short ideas page that summarizes the top bearish positions on the site.

Pro members receive a host of other benefits such as no ads, access to an editorial concierge, and an investment screening service to analyze your portfolio and provide recommendations.

2. Motley Fool Stock Advisor

The Motley Fool is one of the most well-regarded stock picking and investment news sources around.

The Motley Fool was founded in 1994 by brothers Tom and David Gardner.

The company is headquartered in Alexandria, VA, and they have expanded to many other states and countries.

Investors who are looking for…

- The best stock recommendations; and

- Assistance evaluating stocks already in their portfolio

…can choose from free and paid resources from the Motley Fool to get ahead.

The Motley Fool provides many great resources for investors using the free service, including:

- Stock analysis articles;

- Market trend research; and

- Personal finance articles in The Ascent (the personal finance arm of the Motley Fool).

If you are looking for specific stock recommendations from a reliable sources that consistently outperforms the market, we strongly recommend the Motley Fool Stock Advisor service. As of November, 2021, the Stock Advisor stocks have an average return of 680% compared to the SP500’s 142% since inception of this service.

When you subscribe to Stock Advisor, you will immediately have access to all of their most recent picks as well as a list of starter stocks for those that are just starting to build their portfolio, access to member forums, and more.

You will also receive, twice a month, the brand new stock picks that come from one of the founding brothers.

Both Tom and David have their own independent research teams that analyze different market sectors and eventually settle on their top pick for the month.

Stock Advisor membership also includes monthly recommendations for other stocks that are poised to do well that have been researched by other Motley Fool Analysts.

One of the best benefits of Stock Advisor membership is the starter stock list for new members.

The starter stock list is a carefully curated list of stocks that have a proven track record and offer exposure to a multitude of different industries.

This list is especially helpful for newer investors because creating a diverse portfolio from scratch can be challenging for beginners.

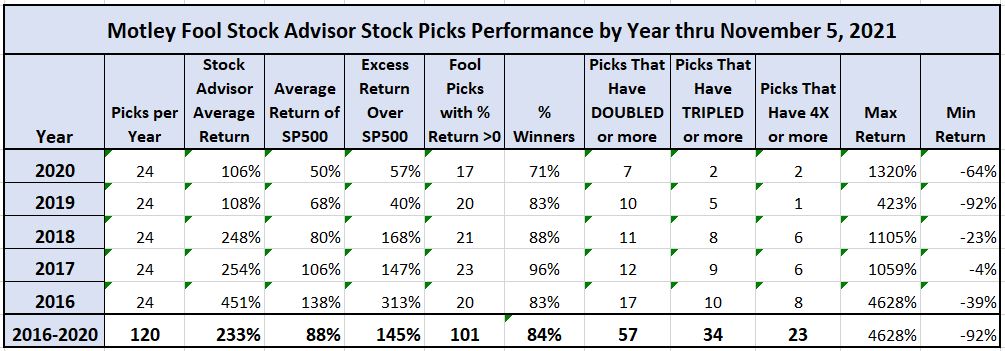

In terms of the 2 new stock picks each month, here is how they have performed over the last 5 years:

As you can see, over the last 5 years the Motley Fool Stock Advisor has an average return of 233% for each of their 120 picks, and 84% have been profitable. That is why it is ranked as our #1 best investment research research firms.

The price is usually $199 a year, but they frequently run sales promotions. Click Here to see their current offer of 60% off or only $79 for 12 months.

3. Motley Fool Rule Breakers

If Stock Advisor is for investors looking for balanced portfolios with a robust investment strategy…

…then Rule Breakers is for growth-oriented investors who want access to the fastest-growing companies on the market.

Rule Breakers is led by founder David Gardner, and their aim is to find companies that are poised for a potential explosion in growth that can swing widely.

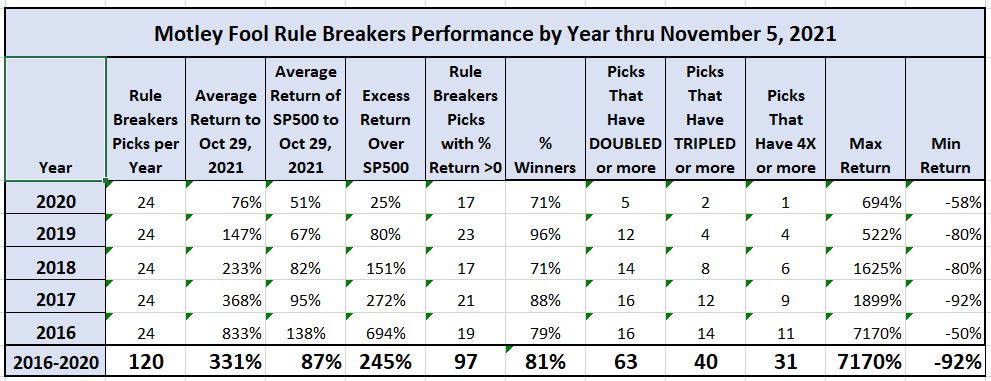

Here is our analysis of the Rule Breaker stocks for the last 5 years:

As you can see, it is also crushing the SP500 by a rate of 331% vs 87%. But only 81% of these picks are profitable and every year they do have some big losers.

So, if you can buy equal dollar amounts of every one of the Rule Breaker picks, then this is actually better than Stock Advisor.

The Rule Breaker service is normally $299 a year, but it is currently available for just $99 (again, with potential for MAJOR discounts) and comes with some similar perks to Stock Advisor, including access to members-only forums, stock recommendations, and more.

If you are an investor with some experience who is comfortable with some more risk and is looking for a resource to recommend growth stocks…

…Rule Breakers may be the perfect addition to your research.

Try Rule Breaker now for only $99 for the next 12 months or $39/month

4. The Street

The Street is a premium stock recommendation service that is spearheaded by Jim Cramer from CNBC’s Mad Money.

Ever heard of that guy?

The Street has some free resources such as stock charts, market news, and updates from Cramer’s team.

The premium service is called Action Alerts Plus, which costs $299 per year.

It is a stock picking service that is derived from Cramer’s charitable trust portfolio.

Members receive complete access to the portfolio’s holdings, and they receive alerts whenever trades are executed within the portfolio.

The goal of the Action Alerts Plus service is to learn how to build a portfolio from some of the leading minds on Wall Street that employ a fundamental analysis approach.

Other benefits include live chat features, a library of articles and past research, and the capability to download the portfolio’s financials offline.

Action Alerts Plus can be a great option for investors that like to learn by following examples and real-world experience.

5. Zacks

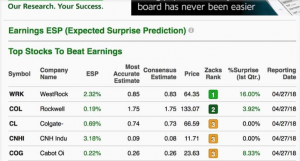

Zacks is renowned for its investment research and stock-rating system.

For every stock Zacks analyzes, it assigns an ESP (Expected Surprise Prediction) rating that seeks to predict if a stock will beat earnings expectations, and if so, by how much.

Like other portfolio services, Zacks offers both a free and paid premium stock service.

Free members have access to the backlog of articles on the site, custom stock watchlists, and a free #1 stock pick from the premium list every day.

For an annual fee of $249, members can upgrade to the Zacks Premium membership.

Zacks premium is best suited for investors who like building their own portfolios, but enjoy research that offers actionable tips and recommendations.

The most important benefits of the premium membership is the simplified curation of top stocks in different sectors and industries.

Investors can choose from pre-filled screens that have compiled the companies that have the best performance as well as the research and charts behind the recommendation.

Market Research

6. Wall Street Journal

The Wall Street Journal (WSJ) is one of the most popular and authoritative sources of information on the stock market, the economy, and the world of business.

The WSJ offers free and premium resources for investors and individuals looking for detailed news and articles that are written by veteran reporters with many years of experience.

If you are looking for a daily dose of articulate and comprehensive market news, a Wall Street Journal subscription may be well worth your time.

For $19.95/month, you can have an all-access subscription, which includes a free membership to WSJ+ and access to the entire backlog of articles on the site.

WSJ+ is a premium add-on for paying members. Some benefits of WSJ+ include giveaway opportunities, member-exclusive content, podcasts, and more.

The Wall Street Journal provides an impressive package of information for casual investors and seasoned day traders alike.

7. Barron’s

Barron’s research is a premium investment magazine and digital subscription service.

They focus almost exclusively on the financial markets, and most of their analysis and reports rely on fundamental analysis instead of technical analysis.

Barrons is one of the most comprehensive publications for investors who are familiar with financial terminology and who want to take a deep dive into their markets.

Market sectors include stocks, commodities, and derivatives, and there are dedicated resources for each subset of these categories.

For example, if you are familiar with growth stock investing, and you want to learn about more growth companies, Barrons can be a wonderful resource. Their articles dissect the business plans, financial statements, and the industry surrounding each company they research.

Barrons is one of the pricier publications coming in at $180 per year.

Subscribers can opt for either digital and print delivery or just digital. The weekly Saturday Print Edition provides insight and commentary on all markets for the week ahead.

8. Morningstar

The Morningstar subscription is an all-in-one resource for value investors that are looking for excellent research and portfolio optimization tools in one convenient bundle.

Morningstar is one of the most well-respected equity research publications, and they have the accolades to prove it.

The Morningstar subscription is $199 per year, and they offer very specialized services along with their newsletter and research tools.

A subscription will give you access to their entire backlog of articles and analyst reports on thousands of publicly traded companies.

Although you should always conduct your own research before you invest in a company, the stock highlights and picks are always supplemented with in-depth reports and track records over time.

The Morningstar service is especially valuable once you plug in your own portfolio’s information.

You can use the Morningstar Portfolio X-ray to analyze your portfolio and provide valuable insight.

It will tell you if you are too heavily allocated in a sector, country, or industry. The X-ray will also provide some recommendations to balance out your asset allocation in real-time, which is quite impressive.

If you are trying to compare multiple stocks to try and select your next investment, they also have a screener tool that compares them side by side to provide clarification for your decision.

Finally, for your retirement and long-term investments, the Morningstar service provides a cost-comparison tool on the top mutual funds and ETFs so that you pay the least in management fees over the course of your investment.

How neat is that?

9. CNBC

CNBC is one of the most accessible and wide-ranging market research services available.

One of CNBC’s most significant advantages is their extensive menu of free resources as well as their paid PRO service.

The CNBC app is very popular because it is a free download and provides market and general news updates in real-time.

Users can track a mock portfolio and set alerts for certain news updates.

They cover everything from personal finance to the futures trading markets and everything in between.

CNBC Pro is $299 per year, and it includes unbridled access to the CNBC business news stream as well as a host of other features. Subscribers will enjoy the live updates from the news stream, an exclusive curated daily email, and PRO market research not available to free members.

Whether you choose the free or paid option, CNBC is a great resource for anyone because they take complicated concepts and package them in an easily digestible format.

Traders who download the app will love the market updates, which include pre-market prices, opening bell activity, midday progress, and what the markets closed at.

Stock Research

10. Yahoo Finance

Yahoo Finance offers everything entry-level stock research capabilities all the way to a robust investment research platform.

Many users will be familiar with the layout of Yahoo Finance because it is built off of the original Yahoo homepage.

The differences begin in the newsfeed, where there is a daily curation of business articles that are written in house or pulled from other investment publications.

When you visit the Yahoo Finance site, you can build a stock watchlist and link your portfolio to track its performance.

As far as quick reference resources go, Yahoo Finance delivers outstanding value in their free service.

Their premium service is called Yahoo Finance Premium, and it is $349 per year.

Premium subscribers receive access to many additional services, including:

- Daily trade recommendations based off of your interests

- Enhanced charting tools for technical traders

- CSV support for historical financial data

- Monthly webinars with interactive Q&A

- Live chat support

Based on the features they offer in the Premium service, it is clear that Yahoo Finance caters to investors and traders who enjoy working with large amounts of data, and the CSV download capability is a godsend for people who enjoy making their own models.

Best Stock and Investment Research Sites Conclusion

There are so many stock recommendation tools and subscriptions, investment research companies and investment research services available to investors that the average investor is both overwhelmed and confused by the often contradictory messages.

At WallStreetSurvivor, we constantly monitor these stock research tools and rank the ones that perform best, are easy to use, and are affordable.

For the the last 5 years, the Motley Fool Stock Advisor service ($79 for next 12 months promo page) and the Motley Fool Rule Breakers service ($99 for the next 12 months promo page) have ranked #1 and #2 respectively for consistently outperforming the market and price.

Since there are so many options, make sure you decide what type of service you are looking for, and then go from there, so you are not overwhelmed when making your decision.

*** UPDATE -- Monday, June 30, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 1,002% VS THE S&P500'S 173% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- AppLovin picked April 3, 2025 and already up 50%

- Howmet Aerospace picked January 16, 2025 is up 38%

- Transmedics (Epic) picked December 19, 2024 is up 110%

- DoorDash picked October 3, 2024 and in 2023: now up 47% & 137%

- Shopify picked June 6 is up 75%

- Chewy (Epic) picked May 14 is up 169% &

- Cava (Epic) picked in October, 2023 is up 40%

- Crowdstrike October, 2023 pick up 185%

Also, the Motley Fool just launched a June, 2025 promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- July 3, 2025 - New Stock Recommendation

- July 10, 2025 - List of 5 Best Stocks to Buy Now List

- July 17, 2025 - New Stock Recommendation

- July 24, 2025 - List of 5 Best Stocks to Buy Now

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed the price for its top stock picking service.

Use WSS100 to get $100 off HERE