While we maintain our objectivity in our reviews of financial products, it is no surprise to our readers that we here at WallStreetSurvivor are big fans of Seeking Alpha.

Personally, I was one of the early subscribers to their Premium service, and I was one of the very first to subscribe to their Alpha Picks stock recommendation service that they launched in July of 2022.

In many of our blog posts here on WallStreetSurvivor we talk about Seeking Alpha’s Quant Rating system. In this Seeking Alpha Quant Rating Review we will do a deep dive sharing all of the publicly known information we can find on this topic. Also, we have talked to several members of the Seeking Alpha performance teams and we will share what we have learned.

This review will share the hard facts about their Quant Rating system. We will also be discussing its accuracy as a tool to ultimately help investors make more money in the stock markets. And finally, we will show you how this system performs against other popular stock rating systems in the same price range.

Whether you’re looking for stock recommendations to buy based on Seeking Alpha’s Quant Ratings or looking to get their Quant Ratings on your stocks to make sure your have a solid stock portfolio, this guide will help you understand whether the Seeking Alpha Quant Rating is a valid tool and whether it is right for you.

Act Today; Offer Ends July 4th

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They just launched their biggest discount of the year on June 11th that runs for a limited time.

Here's you chance to save 20% AND get their Top Stocks for the 2nd Half of 2025 report.

- Save $60 on Seeking Alpha Premium; usually

$299now only $239/year — Learn more.- Save $100 on Alpha Picks; usually

$499now only $399/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

Overview of Seeking Alpha Quant Ratings

Of all the tools available on Seeking Alpha (or on any stock analysis service), I rely on their Quant Rating this most. Let me tell you why. If you are looking for a high level Seeking Alpha Review you can click there.

The Quant Rating is essentially their version of a buy/sell rating system. I will go into great detail later, but for now just know that they backtested this model and claim that back to 2010 this would have helped you BEAT the market by double digit percentage returns.

in addition to their backtesting results, here are other reasons I like it so much.

First, I have linked my Etrade account to my Seeking Alpha Premium account and so I am careful to only buy stocks that their Quant Rating lists as a ‘Strong Buy’ or ‘Buy’ and I sell my stocks when their Quant Rating drops to a ‘Strong Sell.’ So far this has really helped me outperform the market in a big way. If you want to learn more about Seeking Alpha Premium, then you should read our article about how to use Seeking Alpha Premium.

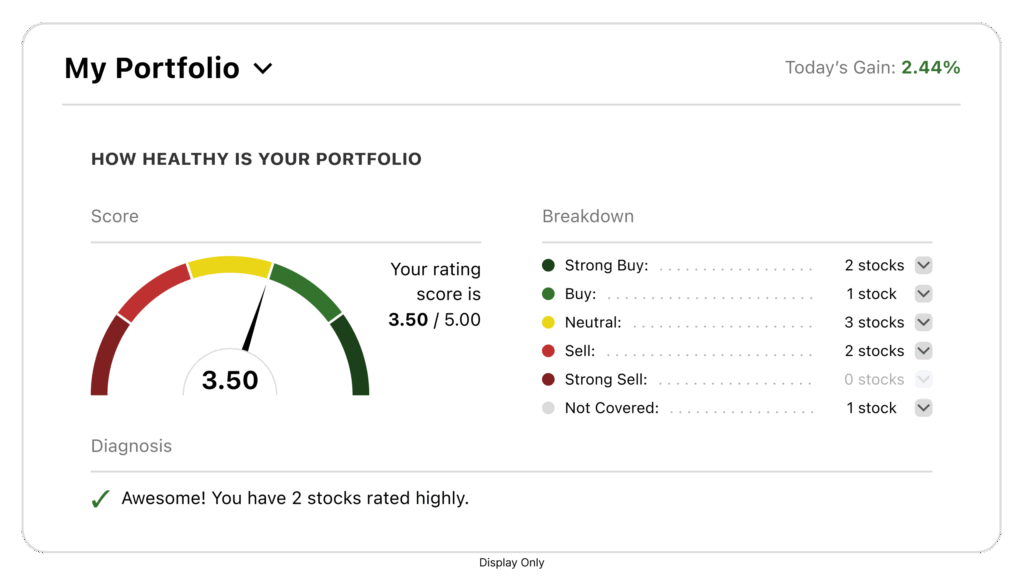

Here is an example of how it looks if you are a Seeking Alpha Premium user. Once you log in to Alpha Premium and link your accounts, you can go to ‘My Portfolio’ and it will show you the Quant Rating Breakdown as you see here. You generally want to avoid the Strong Sells and Sells.

The second reason I trust it so much is that professors at the University of Kentucky published an academic research paper in 2024 where they concluded that Seeking Alpha’s Quant Ratings actually “strongly predict” future stock returns and offer “pronounced benefits” to investors.

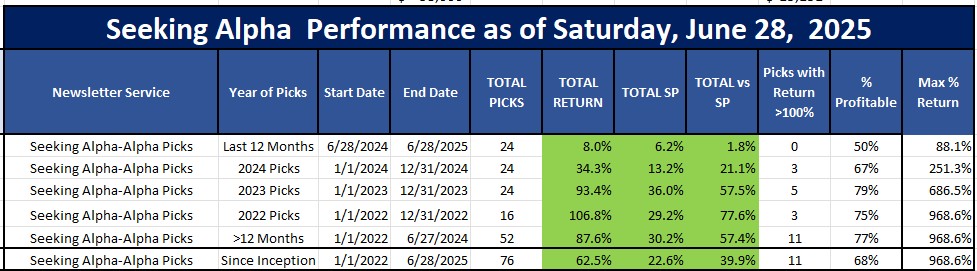

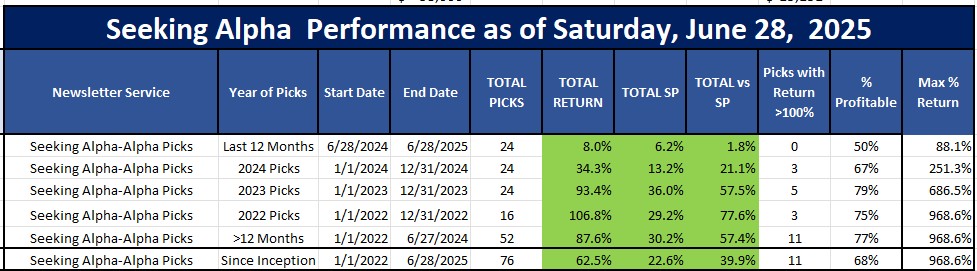

And third, look at the results of Seeking Alpha’s Alpha picks since it was launched in 2022:

Since inception, they are easily beating the market by over 40%, many stocks have doubled or more, and their accuracy rate is extremely high at 79% in some years.

Now that I have your attention, in this overview of Seeking Alpha Quant Ratings I will a answer these important questions first:

- What it is?

- How does it work?

- How investors can use?

- What makes it different from traditional rating systems?

From Seeking Alpha’s own web page (as of June, 2025), they describe their “Quant Rating” as:

Seeking Alpha’s Quant Ratings are an objective, unemotional evaluation of each stock based on data, such as the company’s financial statements, the stock’s price performance, and analysts’ estimates of the company’s future revenue and earnings. Over 100 metrics for each stock are compared to the same metrics for the other stocks in its sector. The stock is then assigned a rating (Strong Buy, Buy, Hold, Sell, or Strong Sell), and a score (from 1.0 to 5.0, where 1.0 is Strong Sell and 5.0 is Strong Buy).

Seeking Alpha grades each stock by five “factors” — Value, Growth, Profitability, Momentum and EPS Revisions. To do this, we compare the relevant metrics for the factor in question for the stock to the same metrics for the other stocks in its sector. The factor is then assigned a grade, from A+ to F.

Seeking Alpha’s Quant Ratings and Factor Grades are designed and managed by Steve Cress. Steve has 30 years of experience in equity research, quant strategies and risk management, and founded quant hedge fund Cress Capital Management. Steve is now Seeking Alpha’s Head of Quant Strategy.

www.SeekingAlpha.com

They calculate this Quant Rating on about 6,000 stocks each day and then they updated it each morning on their website.

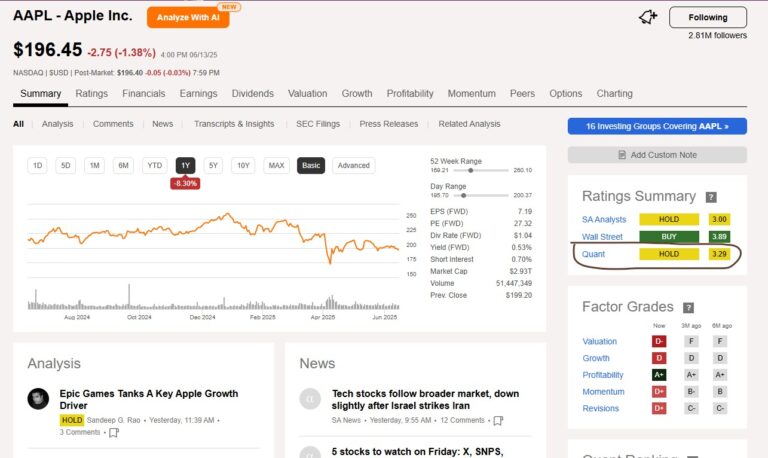

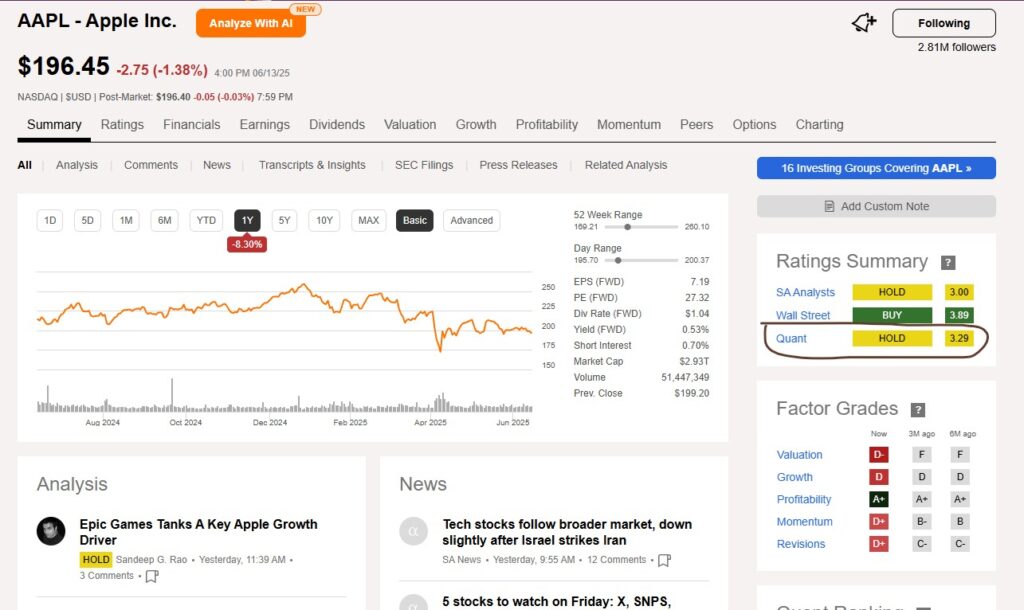

Their site is extremely simple to use. When I login to Seeking Alpha with my Premium subscription and pull up a quote on Apple, I see the following as of June 14, 2025:

In this image above I circled an important item. First in the middle right you see Apple as of June 14, 2025 had a Quant Rating of HOLD. If you are just a free member you don’t see this.

Also, in the very upper right, you see that 2.8 million people are following Apple on the Seeking Alpha platform. That gives you an idea of how many people are Seeking Alpha users.

Using the Quant Rating is quite simple. They have backtested their Quant Rating and shown that stocks with a Strong Buy rating outperform the market and stocks with a Strong Sell underperform the market. What that means is that I only want to buy stocks that are rated Strong Buy and when my stocks start to slip into their SELL Rating, then know when to sell.

This makes it different from most other stock rating systems as they are very prompt to change ratings to a sell and thereby avoid losses.

You can also link your brokerage account to Seeking Alpha which makes it really easy to monitor their ratings on your stocks, and you can get alerts when your ratings change. These factors make it very easy to use, very unique, and very helpful in managing my portfolio and confirming what stocks I am considering buying and letting me know when to sell.

Performance of Quant Rating

Ok, so let’s now look at what is really the most important thing you need to know—does it help you make more money in the stock market?

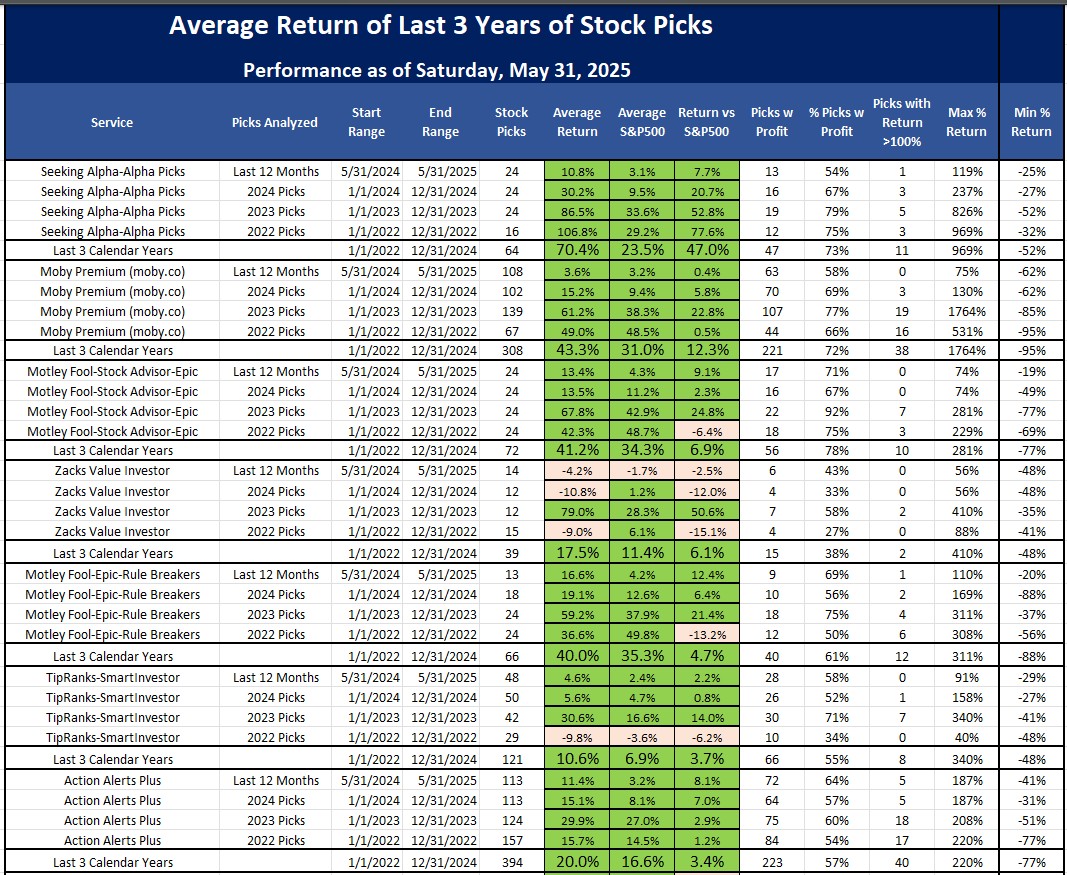

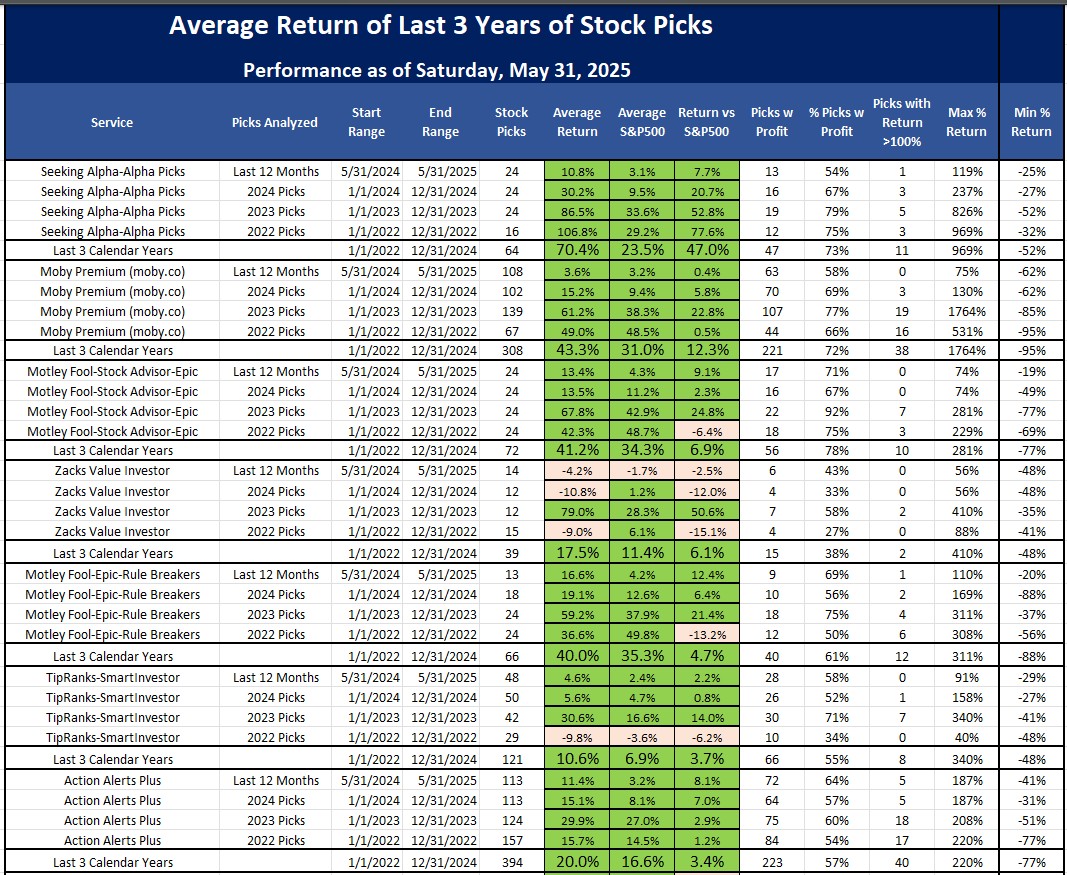

The most obvious testament to the performance of the Quant Rating is to look at the performance of the Seeking Alpha’s Alpha Picks stock recommendation service versus the competition over the last 3 years.

As you can see, the highest rated stocks as evidenced by Alpha Picks stock picks are absolutely the best stock newsletter amount the dozens that I follow.

The second way stock recommendations like to support their validity is to evaluate their performance through “backtesting” their performance of Quant Rating.

Backtesting Performance and Historical Accuracy

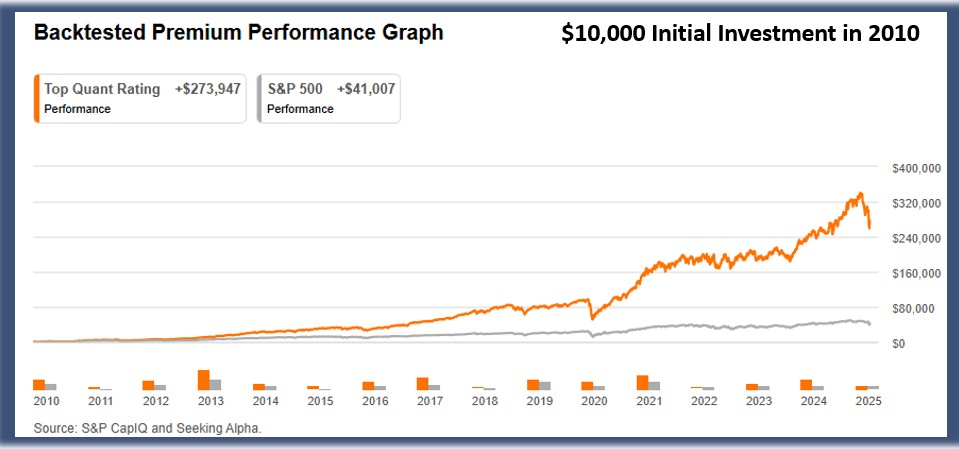

The following charts showing the Quant Ratings backtesting performance speak volumes. The performance of stocks with a STRONG BUY Quant Rating can be summed up by this chart:

As you can see above, when backtested to 2010 the Strong Buy stocks are absolutely beating the S&P500 by almost 7x.

And the performance of Quant Rating works just as well with stocks that have a STRONG SELL rating. Their performance is summed up in this chart:

As you can see, it is imperative to avoid the Strong Sell stocks as they have performed horribly. Specifically, here is what they say about how their STRONG SELL Quant Rating works…

It doesn’t matter if the stock is a large-cap, mid-cap or small-cap, if it is one of the 6,000 stocks they calculate their Quant Rating it works.

Strong Buy stocks tend to increase faster than the S&P500 and Strong Sell stocks tend to greatly underperform the market.

Key Metrics of Quant Rating Performance

As I said at the beginning of this review of Seeking Alpha’s Quant Ratings, I am a subscriber to both Premium and Alpha Picks, and I am a big fan of their Quant Ratings and use them weekly.

I trust them because of accuracy of their buy and sell ratings that I have experienced in my own portfolio, and the accuracy rates that I am seeing in their Alpha Picks service. As a reminder…

The Key Metrics of Quant Rating Performance are their performance versus the S&P500, the accuracy of their picks, and their volatility.

As you can see in the chart immediately above, they are consistently picking winning stocks over 75% each year. And in terms of their volatility you can also see their biggest loser stock is down less than 50%.

If you are convinced, try Seeking Alpha Premium and Save $60 on this link.

Reasons for Quant Rating Success

I think the main reasons for Quant Rating success of Seeking Alpha’s quantitative system lies in their analysis of over 100 data points per stock and those are analyzed against other stocks in that sector. Over 100 metrics for each stock are scored against the other stocks in its sector. Those relative metrics are then consolidated into five key ‘Factor Grades’. The Value, Growth and Profitability factors are used to identify mispriced securities, while the Momentum and EPS Revisions factors identify timeliness.

For a little more background, Seeking Alpha acquired CressCap Investment Research in 2018. That was a well respected, cutting edge quant analytics firm founded by Steven Cress. Upon the acquisition, Steven joined Seeking Alpha as Head of Quant Strategies and now manages the quant products for Seeking Alpha. He has over 30 years of stock analysis experience. Before starting CressCap, he ran the quant desk at Morgan Stanley.

Quant Rating vs. Analyst Ratings

The old traditional way of valuing a stock was to analyze fundamentals of the company like management experience, sales growth, EBITDA, industry outlook, discounted cash flow models, dividend policy, etc.

The newer way is to be extremely quantitative in your analysis and let the numbers to the talking and look objectively and less subjectively at dozens or even a 100 factors about a company.

In the battle of Quant Rating vs. Analyst Ratings it appears that the Quantitative analysis approach is winning.

How Will Seeking Alpha Quant Rating Improve Your Investment Strategy?

As you have seen, Seeking Alpha’s Quant Rating has been really successful in beating the market since it was launched. From my personal experience, connecting my Etrade account to my Seeking Alpha Premium account allows me to easily monitor my stocks’ Quant Ratings which has really helped my overall performance; and it takes the stress out of investing.

And adding the recommended stocks from Alpha Picks reminds me to be constantly investing a little each month, which is the key to building my personal wealth.

Is the Seeking Alpha Quant Rating Worth It?

So if you are still asking me ‘Is Quant Rating Premium Worth It?‘ then you haven’t been paying attention to all the evidence and charts that I presented above. If you are a free member, then you are only seeing the “tip of the iceberg” in terms of what Seeking Alpha has to offer. It is now pretty proven that stocks with a Strong Buy Quant Rating outperform the market and stocks with a Strong Sell Quant Rating underperform the market. So as long as you have at least $10k invested in the stock market it appears that the guidance provided by the Quant Rating will help your return and therefore it is worth it and pays for itself many times over.

Act Today; Offer Ends July 4th

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They just launched their biggest discount of the year on June 11th that runs for a limited time.

Here's you chance to save 20% AND get their Top Stocks for the 2nd Half of 2025 report.

- Save $60 on Seeking Alpha Premium; usually

$299now only $239/year — Learn more.- Save $100 on Alpha Picks; usually

$499now only $399/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

FAQs

Simply put, Seeking Alpha’s Quant Ratings tell you which stocks you should be holding and which stocks you should NOT be holding. This takes the stress of deciding what to buy and when to buy it, and it also lets you know when it is time to sell. So whether you want help with you existing portfolio that is underperforming, or whether you want 2 stock picks each month, Seeking Alpha has a service for you.

Quant Ratings and Factor Grades are similar and are both derived from Seeking Alpha’s trading algorithm.

Over 100 metrics for each stock are scored against the other stocks in its sector. “Seeking Alpha aggregates these metrics into five key ‘Factor Grades’. The Value, Growth and Profitability factors are used to identify mispriced securities, while the Momentum and EPS Revisions factors identify timeliness.”

“You can use Factor Grades to get an instant measure of whether a stock is strong or weak on any of these key investing metrics vs. the sector – and use the Quant Ratings to see which stocks perform best overall.”

Seeking Alpha’s “Quant Ratings are an objective evaluation of each stock based on a weighted analysis of the five Factor Grades. Each stock is then assigned a Quant Rating (from ‘Strong Sell’, ‘Sell’, ‘Hold’ and ‘Buy’ to ‘Strong Buy’). Factors with the greatest predictability carry higher weights.”

Quant Ratings are suitable for BOTH short-term and long-term investors. As you have seen in the performance of Alpha Picks over the last 3 years, their picks are very profitable and should help you beat the market. According to Seeking Alpha, “the overall Quant Rating attempts to identify mispricing and timeliness in a single rating, and that’s actionable for both long-term and short-term investors.”

They are updated each morning before the market’s open.

Competitor Summary

This article has been a deep dive on the Seeking Alpha’s Quant Rating. If it is too deep and just want to know more about their 2 main services, then read our Is Seeking Alpha Worth It? article and our Seeking Alpha Premium vs Alpha Picks article.

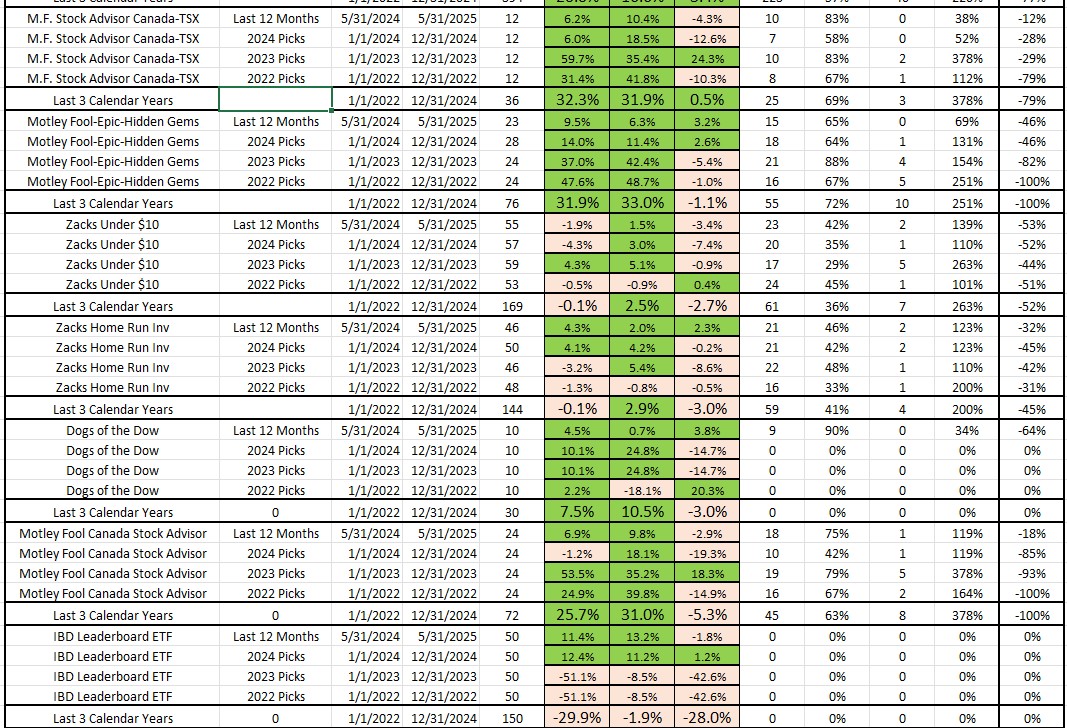

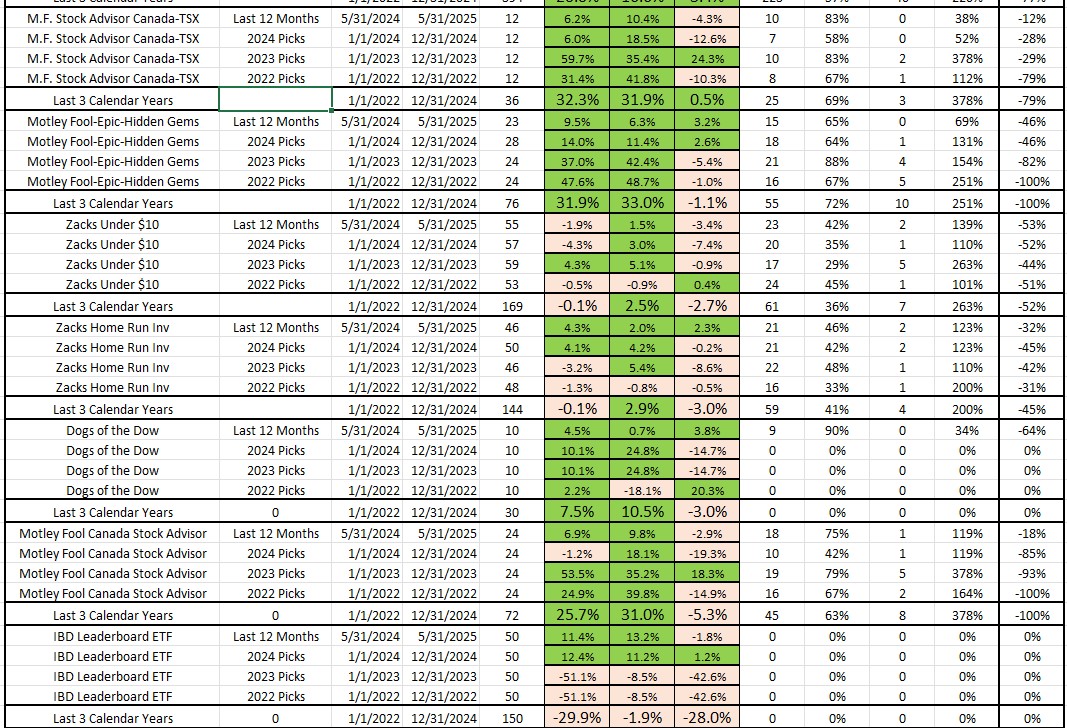

In terms of other stock analysis and recommendation tools that are available, consider this analysis that we do of services that are less than $500 per year.

As you can see, none of these services come close to Seeking Alpha in terms of performance, accuracy of their recommendations, and all with minimal volatility.

If you already have a stock portfolio and want to see the Quant Ratings on your stocks and get alerts as they change, then try Seeking Alpha Premium for free for 7 days and Save $60 on their service.

If you want excellent stock recommendations based on the highest Quant Ratings, then try Alpha picks and Save $100 here.