*** UPDATED with stock prices and percentage returns thru May 17, 2025***

Motley Fool Stock Picks Revealed: Top Investment Choices 2025

IMPORTANT NOTE FROM THE AUTHOR: If you landed here expecting to see a list of the Motley Fool stock picks, then you are in the right place. I have been a subscriber since 2016 and I will show you many of their picks. But you need to know that you are going about investing the wrong way!

You should NOT be searching for the list of Motley Fool stocks that have ALREADY gone up.

Rather, you should be seeking the stocks that are ABOUT to go up. That is the Holy Grail of investing and that is what the Fool does so well.

The Motley Fool Stock Advisor has a terrific track record when it comes to picking stocks for its subscribers to buy.

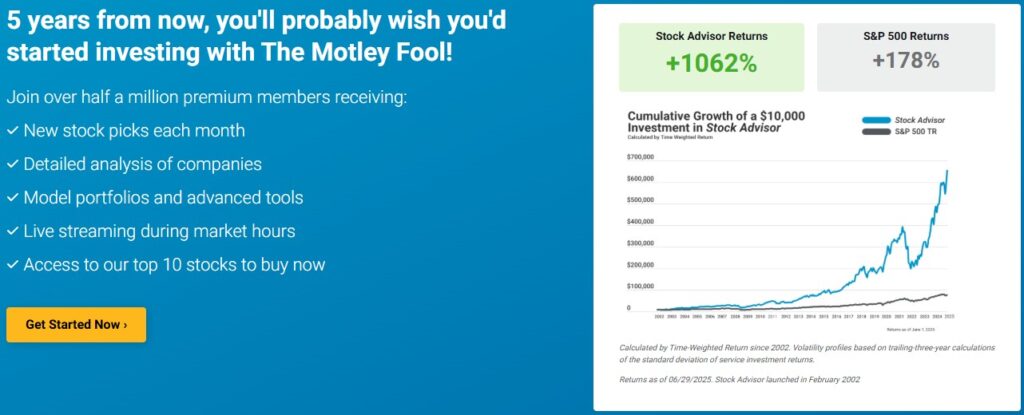

To give you an idea of what we’re talking about, here’s one of Motley Fool Stock Advisor’s most recent ads as of May, 2025.

You can see that someone who started buying every single stock recommended by Motley Fool Stock Advisor back in 2002 would have earned returns of over 900%. Compare that to the S&P 500’s performance. Motley Fool stock picks have outperformed the S&P 500 by more than 5 times!

Seems too good to be true, right?

Well it is a fact. They did it by picking a few stocks that absolutely have crushed the market.

In January 2016, I decided to find out. I purchased a subscription to the Motley Fool and opened a new E*TRADE account. For the last 8 years I have purchased about $2,000 of every one of their stock picks. In this review of Motley Fool, I summarize the results of my Motley Fool investments over 8 years and show you some recent stock picks to buy now.

I also did a deep dive into all of their picks and recalculated their returns from 2022. I found they did an excellent job of finding key stock earlier than most. Take a look at these picks:

And here are a few of their all-time best stock picks as of June 29, 2025. Just take a look at some of these returns. They picked Nvidia back in 2005 and that stock is now up over 90,000%. They also picked Netflix early and it is now up 70,000%:

Not only did they pick those stocks on the dates indicated. They have repeatedly picked them over the years when their prices dipped!

In fact, when we look at their most profitable stock picks we see how they got that average 900% return per stock…

This shows that the repeatedly picked some trend-setting stocks in the mid-2000’s and then again in the mid 2010’s.

What this means is they have been very good about picking these industry leaders and industry changer stocks EARLY and then riding them. That is why they say they pick stocks that they want you to hold for at least 5 years.

Take a look at the Motley Fool stock picks returns since I have been a subscriber from 2016.

My Experience with the Motley Fool Stock Advisor Picks Since I Subscribed in 2016.

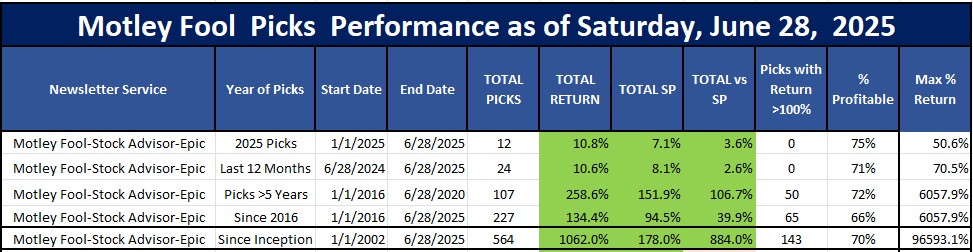

Here's a summary of the performance of Stock Advisor since I subscribed in January 2016. I was so impressed with their performance that I started buying $1,000 to $2,000 in my Etrade account. I quickly learned to put a 30% stop loss on these picks in case they do pick a big loser. You can see how their picks have performed for the 2025, the last 12 months, and the last 8 years. Notice those picks that are older than 5 years since I subscribed are up 258% and are beating the market by an average of 107%.

See what you missed out on by not signing up a few years ago when I did? You would be up 134%, beating the market by 40% and you would have bought NVDA in 2017!.That means if you had just bought $100 of each of their 227 stocks your $22,700 would have a profit of $30,418. Seems to justify the $99-199 per year price, right? Seems like a no brainer based on this track record.

As you can see, I have been very successful buying their stock picks as they come out each month. The last 12 months, their 2024 picks, their 2023 picks and especially their picks that are at least 5 years old are easily beating the market.

Why Future Stock Picks Matter More Than Past Picks

Let’s start by talking about future stock picks. It’s all well and good to tell you how Motley Fool’s past picks have performed (read: MOTLEY FOOL PERFORMANCE), but that’s not going to help you make the best picks now.

The most successful investors know the best stocks to watch. They have a knack for anticipating market trends and picking stocks that are about to go up. Or they have access to a subscription stock-picking service like Motley Fool Stock Advisor to help them!

Of course, there’s no guarantee that buying a stock now will result in future gains. That said, Motley Fool Stock Advisor picks have an impressive track record. If you buy and hold some of their new picks, there’s an excellent chance you’ll be watching your money grow.

All in all, it’s better for us to focus on Motley Fool new picks. That way, you can take advantage of them and start building your portfolio with an eye toward the future.

How to Leverage Motley Fool’s Stock Picks for Maximum Gains

Before we get into some actionable stock picks for you to buy, let’s talk about how to use Motley Fool stock picks to your advantage and maximize stock returns.

Motley Fool investing tips include the following:

- Buy every stock pick. Motley Fool Stock Advisor’s picks are chosen to help investors build a profitable portfolio. For that reason, it’s recommended to buy every pick in whatever amount you can afford. For example, if you had $1,000 to invest each month, you would purchase $500 of each recommended stock.

- Hold stock for at least 5 years. Motley Fool works on a “buy and hold” strategy. This strategy is designed to help investors ride out stock market fluctuations and volatility and maximize their returns. In other words, it’s the opposite of a reactive strategy.

- Diversify your portfolio. It’s important not to have too large a percentage of your holdings in any one investment class or industry.

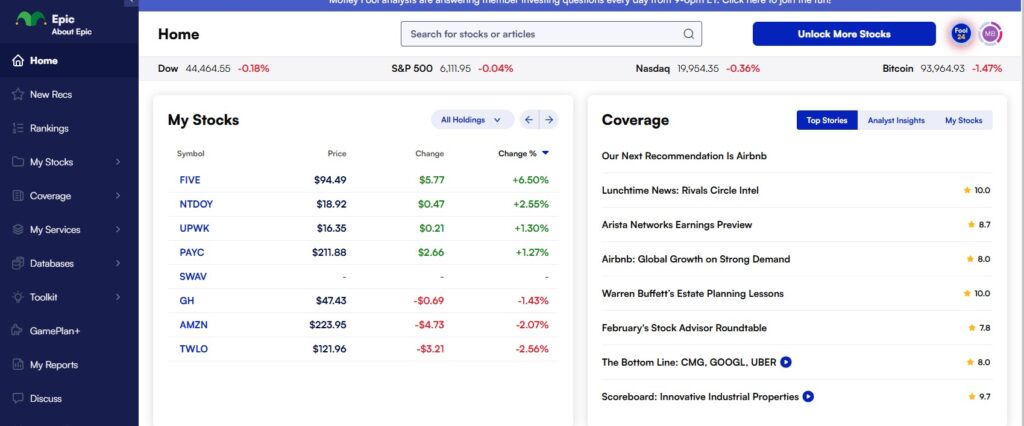

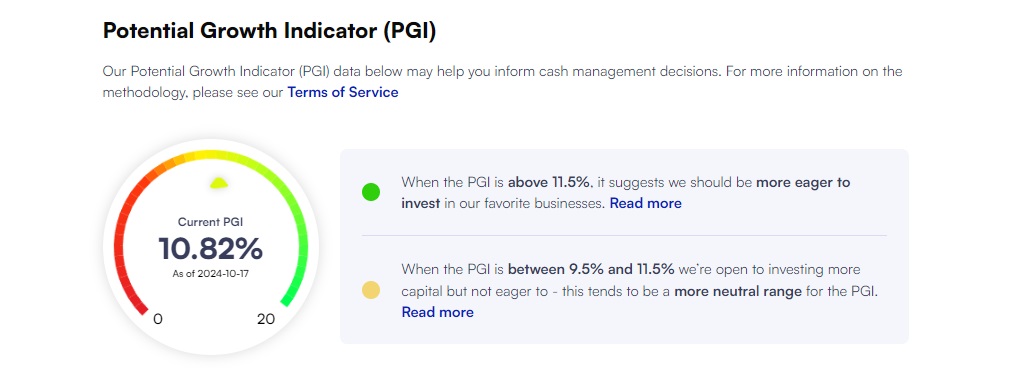

- Manage your portfolio using Motley Fool tools. Motley Fool subscribers get access to portfolio strategies, real-time price updates, and more. If you’re an Epic subscriber, you’ll get real-time Upgrades and Downgrades, as well.

If you follow these Motley Fool guidelines, you’ll increase the chances of seeing substantial gains as you buy their recommended stocks.

Here Are The Key Lessons From My Experience with The Motley Fool

- You MUST buy equal dollar amounts of EVERY one of their stock picks. So if you can invest $1,000 a month in the market, plan on buying about $500 of each of their two picks each month.

- The longer you hold their stocks the better they perform. As you can see from the table above, the average return of their stock picks from 2016 was 423%.

- The Motley Fool is consistent. I have been a subscriber since January 2016 and you can see how consistent their performance has been for me.

- Another reason they are so consistent is the founders, David and Tom Gardner, are still the ones picking the stocks. Other stock newsletters have so much turnover you never really know who’s picking their stocks.

- Finally, you would expect a service like this to cost thousands of dollars, but the price is $199 a year and new subscribers can try it for just $99—View this New Subscriber discount page to save $100.

Those are exceptional returns and no other stock newsletter I have discovered comes close to it.

But you need to know that with over 500,000 subscribers, these stocks usually pop 2-5% in the first few days of the release of their picks. So if you want to get these returns, you need to buy the stock as soon as it is released.

Recent Fool Picks and Their Performance

If you didn’t subscribe to the Stock Advisor in 2002 and earn 500+% on your investments, you should be asking yourself, how have the Fool’s recent stock picks performed?

- Their 2016 stock picks are beating the S&P 500 by 102%

- Their 2017 stock picks have beat the S&P 500 by 296%

- Their 2018 stock picks have beat the S&P 500 by 83%

Here are a few recent Motley Fool stock picks and their performance so far.

- On April 3, 2025 they recommended APP and it is already up 38%

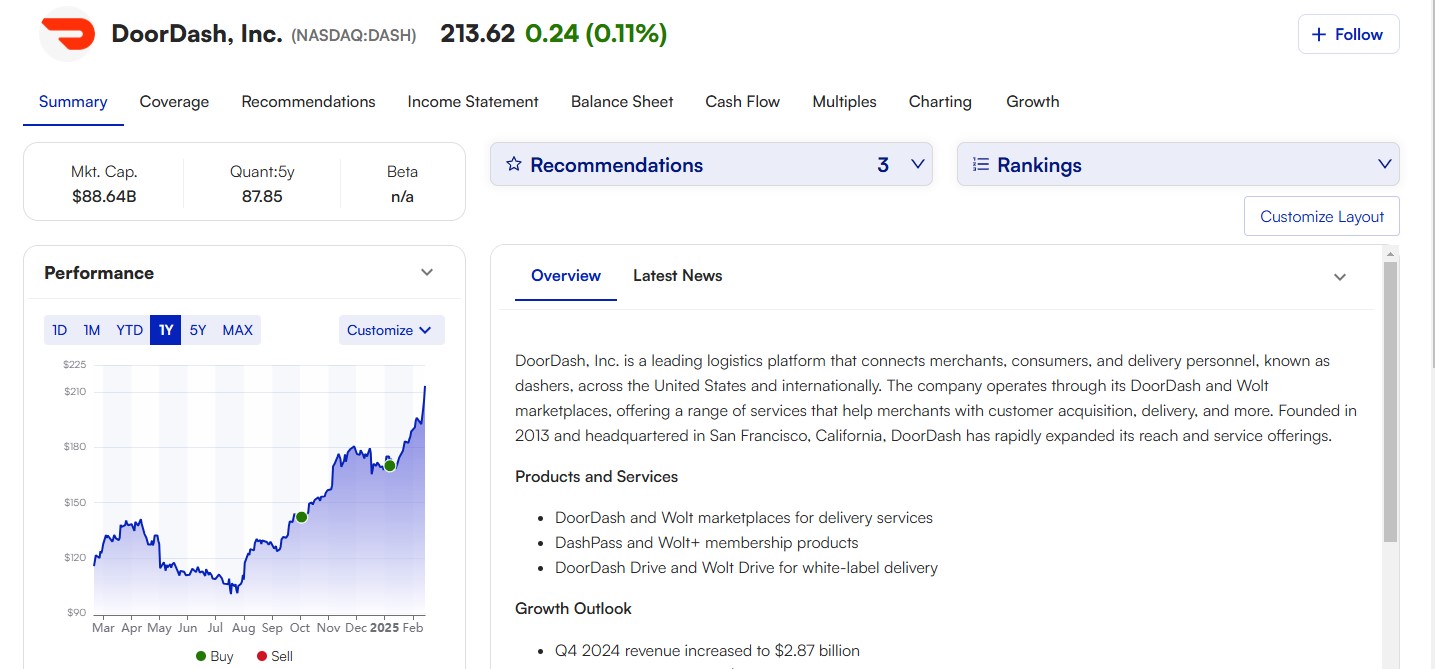

- On October 3, 2024, they recommended DoorDash. As of May 17, 2025, the stock is up 42%.

- On August 15, 2024, they recommended Lululemon Athletica, which is up 33%.

- On August 1, 2024, they recommended Progressive, which is up 35%.

Those are just a few examples, but there are many more Motley Fool success stories that have the potential to deliver excellent returns to investors.

The Motley Fool Stock Advisor Summary and Subscription Value

Here’s our summary of Motley Fool subscription benefits to help you decide whether to become a subscriber.

- Two brand new stock recommendations per month delivered in real-time to your email.

- Access to all of the Motley Fool Stock Advisor recommendations going back to 2020 and before.

- The Motley Fool’s Top 10 Best Stock to Buy Right Now report that features some of their recent picks that still offer the best potential return.

- The Motley Fool’s Top 5 Starter Stocks report that features the ideal stocks that should be the foundation of new investors’ portfolios.

- Normally the price is $199 a year, but they frequently run price promotions of 50% off.

Now, let’s talk about the value of a Stock Advisor subscription. The annual price is $199, which works out to $16.28 per month.

For that price, every month you’ll get two stock picks from the creators of Motley Fool Stock Advisor. Historically, these picks have outperformed the S&P 500 by more than 500%. You’ll get additional stock recommendations, plus access to a ton of research, analysis, and portfolio management tools.

They also have a 30 day money back guarantee.

Get the Motley Fool’s Next Stock Picks and Receive:

- Two brand new stock recommendations per month delivered in real-time to your email.

- Access to all of the Motley Fool’s stock recommendations going back to 2020 and further.

- The Motley Fool’s Top 10 Best Stock to Buy RIGHT Now report that features some of their recent picks that still offer the best potential return.

- The Motley Fool’s Top 5 Starter Stocks report that features the ideal stocks that should be the foundation of new investor’s portfolios.

- Unlimited access to their stock research pages and message boards.

- Access to The Motley Fool’s promotional page to get their absolute best price.

Here are two more recent (ish) stock picks to inspire you. Stock Advisor picked Arista Network on December 14, 2023 and the stock is up 170.51%. On August 10, 2023, they recommended Hubspot and that’s up 7.83%.

Not all recommendations are going to lead to triple-digit gains, but Motley Fool’s track record speaks for itself.

If you are a new subscriber, you can try it for just $99.

They also have a 30-day money-back guarantee.

Before You Subscribe, You Need to Know

There is definitely a “Fool Effect.” Within the first 2 hours of the Stock Advisor recommendations being released, the stocks tend to shoot up 2% or so. Then within the first 2 days, they creep up a little more as the word gets out. So if you do subscribe, it is always best to get your buy order placed immediately when you get their BUY ALERTS.

So, in conclusion, if you are looking for a source of solid stock recommendations and a few that might double or triple, you should definitely consider the Motley Fool Stock Advisor.

I find that it takes the stress out of researching, analyzing and picking stocks. And it has helped my overall portfolio increase dramatically since I started subscribing 8 years ago.

FAQs

Have Motley Fool Stock picks beaten the market?

They certainly have! Historically speaking, Motley Fool Stock Advisor picks have beaten the S&P 500 by over 500%.

What is Motley Fool’s track record?

Motley Fool’s track record is very good. Collectively, Stock Advisor picks have beaten the market by more than 500%. That doesn’t mean every stock has performed that well, but it is an indication that overall, their picks have been profitable for subscribers.

Is a Motley Fool subscription worth it?

We think it is, especially if you take advantage of our links to get access for just $99 for your first year.

Does the Motley Fool tell you when to sell?

Yes. While the Motley Fool’s recommendations are intended for a “buy and hold” strategy, they also recognize that conditions change. All subscribers receive a notification if Stock Advisor’s recommendation changes from a Buy to a Hold or Sell recommendation.

Summary

Here’s our Motley Fool Summary and Stock Advisor wrap-up.

- With Motley Fool Stock Advisor, you’ll get two stock picks every month directly from Tom and David Gardner.

- Historically, their picks have outperformed the S&P 500 by over 700%.

- It’s important to buy ALL picks for the best results.

- Buy new stock recommendations as quickly as possible to take advantage of the Fool Effect.

- Sign up for alerts and notifications to stay on top of new picks and other investment advice.

Remember, the track record of Stock Advisor is impressive. That’s not a guarantee of future performance, but our Motley Fool takeaways illustrate just how much value you can get if you subscribe.

Ready to invest with confidence? Start with Motley Fool’s Stock Advisor today – only $99 for new subscribers!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.