As an investor, you want to earn the highest return possible, right?

More specifically, you want to beat the S&P500 and you want to beat it by as much as possible.

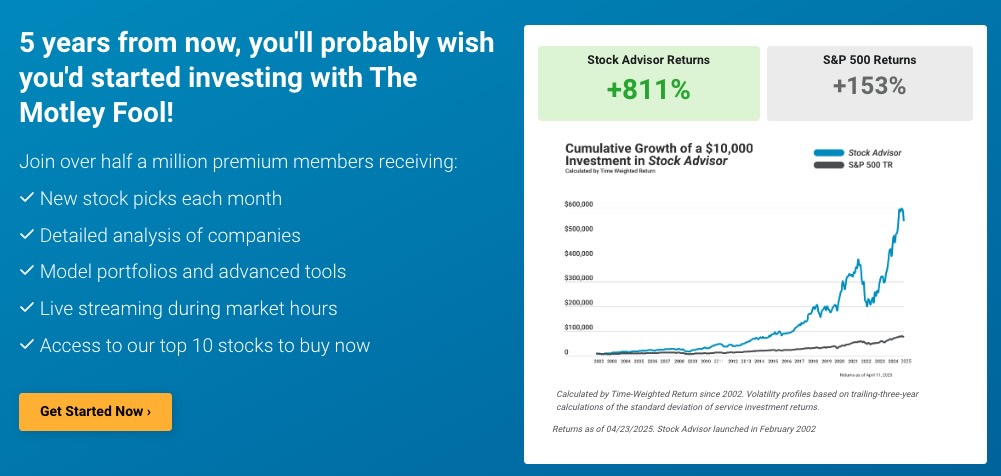

The Motley Fool performance advertises some fantastic returns that claim to really crush the S&P, but are they true?

As a matter of fact, yes they are!

This Motley Fool Review updated December 3, 2024: In the last few weeks the Dow topped 40,000 and S&P500 and the NASDAQ all set records. The Motley Fool Stock Advisor stock picks also set a record with an average return since inception of 911% vs. the S&P500’s 177%. That means that over the last 22 years their picks are beating the market by 734% so they are quadrupling the S&P500’s return. The Motley Fool is on a hot streak as 12 of their last 13 stock picks are up! The stocks that the Motley Fool has picked repeatedly over the last few years like CRWD, NOW, NVDA, AMZN, ASML TTD, NET, and ABNB are all doing extremely well and contributing to their impressive performance.

To find out if the Motley Fool performance is real, in January 2016 I subscribed to both their Stock Advisor and their Rule Breakers services. I wanted to analyze their performances and determine for myself it they were as good as they claim.

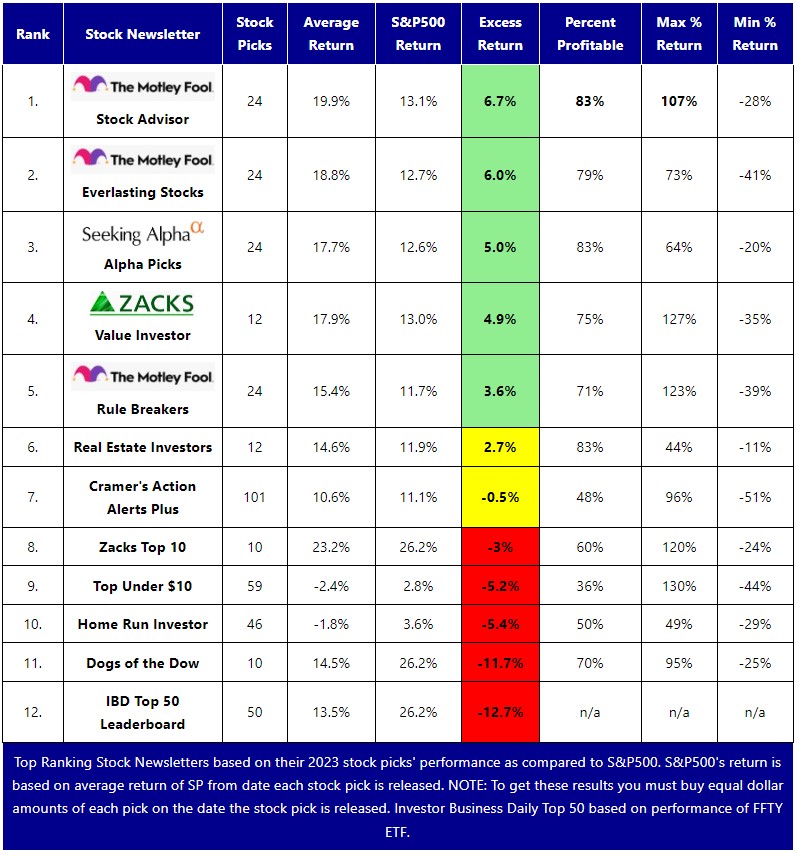

Here’s a quick peek at my performance of several Motley Fool newsletters and other popular ones as of December 31, 2023 for just each services’ 2023 stock picks. As you can see, The Motley Fool Stock Advisor service, with 24 picks for the year, and an average return of 19.9% beating the S&P by 6.7% for the year..

I will comment on those returns in that chart later.

In terms of 2024, take a look at this performance of the stock picks of their various services:

Stock Advisor has been around since 2002 and Rule Breakers since 2004. Each month they have 2 new stock picks so that is 24 picks a year for the last 20+ years so that is over 500 picks for Stock Advisor and over 450 for Rule Breakers

First I gained access to all of these stock picks and recalculated their returns and compared those against the S&P500. I can confirm that the results are advertise are accurate. Their calculations assume you invest equal dollar amounts in every stock pick on the day they release their recommendation and sell everything as they recommend closing positions. (FYI-about 35% of positions have been closed.)

Their stellar performances are great, if you had invested equal dollar amounts in each stock picks for the last 20+ years. The Motley Fool achieved this spectacular results with picks like these over the years:

What you need to know, however, if you are considering subscribing what you really need to be concerned with is how the picks have performed recently. Keep reading to see how their picks are performing for me since 2016 and in especially NOW in 2023.

Motley Fool Stock Recommendations Performance Summary

Historically, if you had invested an equal dollar amount in every single one of their 24 stock picks per year, and sold all of the stocks when they recommended selling them, then you would have really outperformed the market.

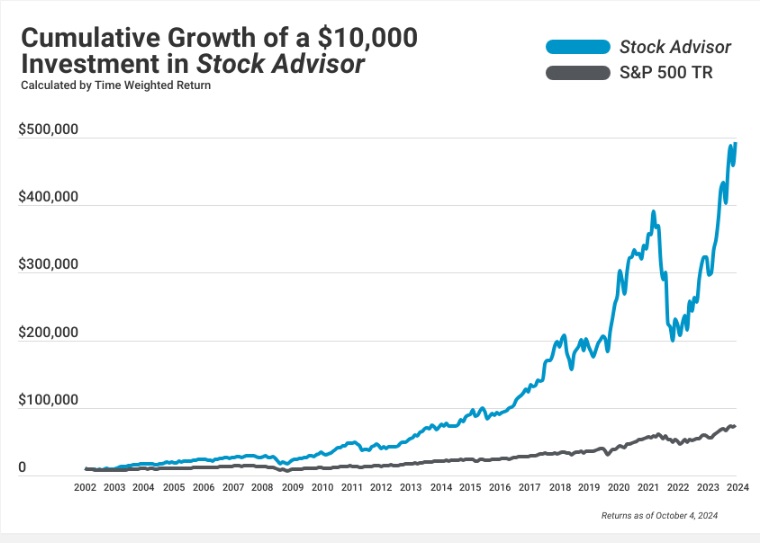

Stock Advisor began in 2002, and its average picks have more than quadrupled (4X) the returns achieved by the S&P 500.

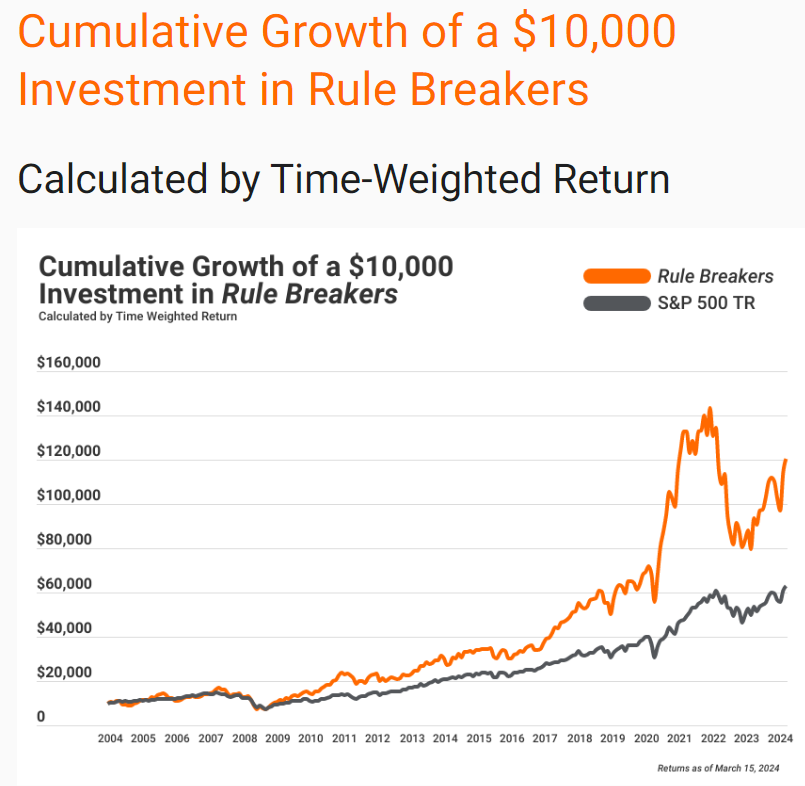

Rule Breakers began in 2004, and its average picks have more than doubled the markets.

So, if you have been seeking to outperform the market…

…you have come to the right place!

The Motley Fool has been helping hundreds of thousand of investors accomplish this goal.

But don’t take my word for it, we are here to review how Stock Advisor and Rule Breakers have done lately.

Are you ready?

We are about to dive into the Motley Fool Performance review.

Let’s GO!

Motley Fool Stock Advisor Advantage

Motley Fool co-founders Tom Gardner and David Gardner lead their respective teams of talented analysts who pick stocks for Stock Advisor.

Each month, you receive two stock recommendations, one from Team Tom and one from Team David.

You also gain access to each team’s list of five explosive stocks (ten stocks total), which are known as “Best Buys Now.”

Finally, you will also receive a list of “Starter Stocks,” which are foundational stock recommendations for new and experience investors.

So, what’s the difference between Team Tom and Team David?

Team Tom seeks out strong companies that operate in beaten-down industries that are poised to make a comeback.

Tom also searches for companies with strong financials, proven business models, and shareholder-friendly management.

Team David searches for companies ready to benefit from “undeniable, long-term trends” with a level of “unquantifiable greatness.”

David seeks to get in early and continue to add to his positions in the future.

The results speak for themselves…

…Stock Advisor is more than tripling the S&P 500’s returns.

Let’s check out what is driving these results.

Motley Fool Stock Advisor Performance

The graph above is dated October 4, 2024 and shows that the Stock Advisor picks have steadily outperformed the S&P500 since the beginning. Then from 2017 to early 2021 their performance really accelerated, corrected a bit back to the trend line in 2022 (think election, COVID, inflation), but have resumed their sharp upward climb in the last 2 years.

Here are some of the most recent Stock Advisor stock picks and their performance as of October 26, 2024:

- Last 5 picks are up 1%, down 2%, up 33%, up 6% and up 1%

- March 2023 picks of RBLX and CRWD are down 11% and up 22%

- Feb 2023 picks of KNSL and ACN are up 19 and 11%

- Jan 2023 picks of NOW and MASI are up 50% and 1%

- Dec 2022 picks of TTD and DGX are up 43% and down 8%

- Nov 2022 picks of NET and AMZN are up 40 and 31%

Normally, Stock Advisor costs $199 per year.

However, you can sign-up on THIS PROMO PAGE for just $99 per year, which provides unlimited access to Motley Fool Stock Advisor.

If you order today, you will get these upcoming email reports:

- Tom’s New Recommendation

- Tom’s New Best Buys Now

- David’s New Recommendation

- David’s New Best Buys Now

Sign up today to get Tom and David Gardner’s top stock recommendations.

Motley Fool Rule Breakers Advantage

David Gardner also handles Motley Fool Rule Breakers, but Rule Breakers was changed in mid 2024 to be part of the Epic Service and can no longer be purchased individually-This section is no longer being updated.

Rule Breakers operates similarly to Stock Advisor, but with a few twists.

Similar to Stock Advisor, you get two new stock recommendations each month.

You also get its own monthly “growth-centric” five stock picks, which are also known as the Best Buys Now.

Motley Fool Rule Breakers looks for companies with these six attributes:

- Innovative leaders in emerging industries;

- Sustainable competitive advantages, which include business momentum, intellectual property, visionary leaders, or a lack of viable competition;

- Strong history of price appreciation, which are poised to continue;

- Excellent management teams and strong investor backing;

- Solid branding and a wide-range of consumer appeal; and

- Stocks considered to be “grossly overvalued.”

Rule Breakers is more than doubling the performance of the S&P 500!

Once again, let’s take a dive into what is driving these results.

Motley Fool Rule Breakers Performance

The Rule Breakers chart above dated March 15, 2024 shows that their picks are also performing well in light of the current market conditions.

Here are some of the most recent Rule Breakers stock picks:

- April 2020 pick of Docusign, Inc. (DOCU) is up over 50%

- March 2020 pick of Quidel Corporation (QDEL) is up over 100%

- December 2019 pick of Freshpet, Inc. (FRPT) is up over 25%

- November 2019 pick of Etsy, Inc. (ETSY) is up over 100%

- September 2019 pick of Teladoc Health, Inc. (TDOC) is up over 200%

- July 2019 pick of Roku, Inc. (ROKU) is up over 25%

- June 2019 pick Novocure Ltd (NVCR) is up nearly 10%

- May 2019 pick Salesforce.com, Inc. (CRM) is up nearly 20%

Rule Breaker’s average stock picks rate-of-return is a whopping 140%.

Rule Breakers used to cost $299 per year.

However, Rule Breakers is now only available with the Motley Fool’s Epic service, which gives you Stock Advisor, Rule Breakers, Dividend Investors and Hidden Gems. Read this Motley Fool Epic Review which provides unlimited access to Motley Fool Rule Breakers.

If you order today, you will get these upcoming email reports:

- Tom’s New Recommendation

- Tom’s New Best Buys Now

- David’s New Recommendation

- David’s New Best Buys Now

Sign up today to get high-growth stock recommendations chosen by Tom and David Gardner.

Motley Fool Stock Advisor vs. Motley Fool Rule Breakers

So, how can YOU outperform the market?

To outperform the market, you need to act different than the other investors.

Different is what you get with Stock Advisor and Rule Breakers because these services recommend stocks overlooked by Wall Street.

Rule Breakers is best for the risk takers that seek in-depth scouting on stocks that could be homeruns.

Stock Advisor allows people to dig into a great selection of stocks across the board.

Fortunately, both services are PROVEN successes, so you can’t go wrong with either.

Both Rule Breakers and Stock Advisor are outperforming the S&P 500 since each services’ respective start date.

These results make both service offerings a compelling opportunity for any investor to beat the market.

In addition to everything mentioned above, you also gain access to the Motley Fool’s robust online community of investors.

Normally, Stock Advisor ($199 per year) and Rule Breakers ($299 per year) are a steal.

However, you can sign-up for either at a special introductory rate of $99 per year right now!

The subscriptions are always backed by a 30-day money-back guarantee, so there is no risk to you.

The Motley Fool is an established brand with proven results.

So, what do you have to lose by giving them a shot?

NOTHING!

Keep your day job, and let these “Fools” do the heavy lifting.

Perhaps you have experience with Motley Fool Stock Advisor or Motley Fool Rule Breakers.

Perhaps you prefer another investing service.

Now is the time to join the discussion with a comment below!

*** UPDATE -- Friday, April 25, 2025 -- MOTLEY FOOL STOCK ADVISOR AVERAGE RETURN OF ALL 500+ STOCK PICKS IS 958% VS THE S&P500'S 178% ****

The Fool investing philosophy is hold stocks for at least 5 years, invest regularly, and ride out the dips. Here is just a sample of some recent picks:

- DoorDash picked October 3, 2024 and is already up 50%

- LulLulemon picked Aug 15 is up 43%

- Shopify picked June 6 is up 109%

- Chewy picked May 14 is up 124%

- Cava picked in October, 2023 is up 287%

- Crowdstrike October, 2023 pick up 173%

Also, the Motley Fool just launched a APRIL promotion: $100 off (see the link below).

Here is their release schedule of their upcoming stock picks:

- May 1, 2025 - New Stock Recommendation

- May 8, 2025 - List of 5 Best Stocks to Buy Now List

- May 15, 2025 - New Stock Recommendation

So, if you have a few hundred dollars to invest each month and plan on staying invested for at least 5 years, we haven't found any better source of stock picks.

New Pricing: Motley Fool has slashed it price $100 for its top stock picking service.

Get $100 off HERE