Is The Motley Fool Reputable and Reliable? 2025 Insights

There are many financial services on the internet that claim to offer investors the secret to making money. They come and go. Few have stood the test of time, and even fewer have actually outperformed the market.

Motley Fool was founded in 1993, so they’ve been around for a while. They have over 500,000 paid subscribers (myself included) and they’ve got a proven track record of outperforming the S&P 500.

I know first hand that the Motley Fool is definitely legit and has helped me make money in the stock market. I will even show you some screenshots of my ETrade account to prove it.

The Motley Fool’s most popular services, Stock Advisor and Motley Fool Epic review, have both outperformed the S&P 500 by a wide margin since they were launched. This is quite remarkable given that 95% of fund managers on Wall Street struggle just to match the market’s return.

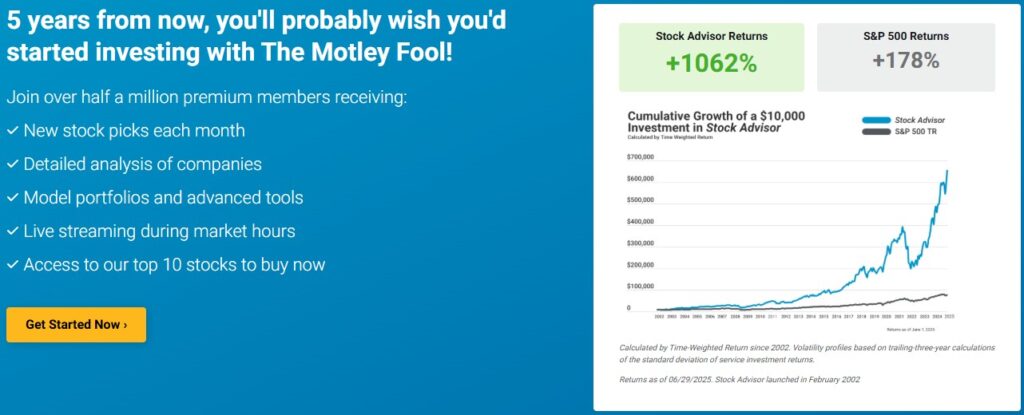

Take a look at this chart below. It is really all you need to know about their most popular, which also happens to be their most profitable, subscription service.

Going back to the launch of their Stock Advisor service in 2002, the average return of all 500+ stock picks (that’s 2 stock picks per month) has crushed the S&P 500. As you can see from the chart, their picks spiked in late 2021 but took a hit in 2022 (like most stocks). But over the last 3 years their picks are back on their strong uptrend and just slightly off their now at record highs.

Take a look at their current ad which shows an average return of 800+% vs the market’s 160+% return. No other stock subscription service comes close to that 22 year record.

So are they legit? The answer is an absolute YES. Over 23 years there picks absolutely have outperformed the market by a wide margin. How did they do it? By picking stocks likes the ones below that have absolutely crushed the market by an amazing 5,000+%:

And here are a few of their all-time best stock picks as of June 29, 2025. Just take a look at some of these returns. They picked Nvidia back in 2005 and that stock is now up over 90,000%. They also picked Netflix early and it is now up 70,000%:

Curious to explore Motley Fool? Check out their latest picks!

The Motley Fool Current Picks and Performance

But the real question you should be asking now is “how are their current picks doing?’

As you can see from above chart, the Motley Fool Stock Advisor picks are once again performing really well in 2023, easily outperforming the market. They are beating the other services listed above. FYI–the Hidden Gems Stocks service is also a Fool product and is now part of their Motley Fool Epic subscription.

In case you are wondering where I get all of this information, I am a subscriber to ALL of these services and another dozen or so. For example, I have been a paid subscriber to their stock newsletter services for over 8 years now. You can see my results in that table.

Let’s look at a couple of picks from 2023 and 2024 to see how they’re performing so far.

Arista Networks was a Hidden Gems pick on December 13, 2023. Since then, the stock price is up an impressive 85%. In that same time period, the S&P 500 gained 32% That means that Arista Networks has outperformed the S&P 500 by over 200%.

DoorDash was a Motley Fool Stock Advisor pick on October 3, 2024. As of February 2025, it’s already up by 50%.

Keep in mind that The Motley Fool Stock Advisor’s picks are meant to be used as part of a “buy and hold” strategy, so short-term performance is not really the game. The overall performance against the S&P 500 is even more impressive, showing gains of more than 700%.

2025 Updates and Market Relevance

Motley Fool Stock Advisor picks from two investing teams called Team Everlasting and Team Rule Breakers. As you might guess from their names, these teams look for different things when making stock picks.

Picks from Team Everlasting focus on founder-led companies with a strong corporate culture with the sustained potential to beat the market. They also look for companies with proprietary advantages and loyal customers, and with low debt and plenty of liquidity.

The Rule Breakers team takes a different approach. They look for companies in emerging industries with a competitive advantage and a track-record of sizable share prices. They also focus on competent leadership, strong consumer appeal, and stocks that may be overvalued according to mainstream sources.

By focusing on companies with the potential for sustainable growth and those in emerging industries, Motley Fool Stock Advisor has baked in the ability to keep up with the times. They’re always thinking ahead, but they use historical performance of each individual stock, plus sector and index performance, to make their recommendations.

A glance at their picks in the past few years shows a willingness to embrace new technology and trends. For example, AI stocks like Nvidia have been making more frequent appearances on their recommendation list, and someone who bought Nvidia when they first recommended it would have made a huge profit.

One thing that we like is that subscribers can see, next to each of the historical picks, an indication of whether an investment is best suited for a Cautious, Moderate, or Aggressive investing style.

Here’s one more pick from last year. On February 1, 2024, PayPal was a Stock Advisor pick with moderate risk. Since the pick was announced, the stock price has increased by 26%.

Why Does Motley Fool Get Negative Reviews?

Like any service, Motley Fool sometimes gets negative online reviews from users. Reading these reviews might make you wonder: Is Motley Fool a reliable source for stock picks?

If you look at their historic performance, the answer is yes. But let’s run through some of the most common criticisms.

- Short term losses. Some reviewers complain that they’ve been members for two or three years without seeing huge gains. These people may not fully understand the “buy and hold” strategy. That said, it’s certainly true that not every stock has performed well, let alone beat the market.

- Too many emails. Another common complaint is that Motley Fool sends too many emails and spends too much time promoting other products trying to get subscribers to upgrade. We agree that the email volume is high and, so far at least, we haven’t seen any effort to change that.

- Too much focus on financials. While it’s important to focus on financials when evaluating investments, some users wish that Motley Fool would look more at strategic market positioning and other factors when they make recommendations.

The bottom line is that Motley Fool Stock Advisor and other services are not for day traders or swing traders. They’re for long-term investors who plan on staying invested for at least 5 years.

I have been a subscriber and buying their picks since 2016 and yes I have lost money on some, but OVERALL my portfolio is well ahead of the S&P500.

Motley Fool is definitely a legit investment-advice service that helps you stay on top of trends and conquer the market and it has helped me beat the market since I subscribed.

But it’s very important to have an understanding of the Motley Fool before signing up.

Motley Fool Services Overview

Motley Fool offers several premium services, each with their own unique features and benefits. Before we get into that, here are two key features that apply to the Motley Fool as a whole.

- Long-term investments. Overall, The Motley Fool is ideal for investors who want to buy vetted stock and then hold it for at least five years. It’s not ideal for day traders. The brains beyond The Motley Fool focus on a buy and hold strategy, which means some of their picks may lose money initially but outperform the market in the long run.

- Money-back guarantee. The Motley Fool offers a full refund to subscribers within the first 30 days, no questions asked. What that tells us is that they value subscribers and want them to be happy.

Now, let’s get into the details of their subscriptions.

1. Motley Fool Stock Advisor

Every month, the team carefully vets and selects 2 stock picks that they officially recommend for you to consider picking up.

They provide 10 stocks that they think are great to buy at the moment you subscribe.

You’ll also get access to a bunch of educational resources, including articles, screeners, and portfolio management tools.

Stock Advisor is Motley Fool’s primary premium service and is ideally suited for beginner investors and those who want reliable picks instead of doing the research themselves.

Stock Advisor lists for $199 a year, but you can sometimes get it for $99 or less.

When you consider the +750% average return that the service has claimed over 22 years, this is well worth the investment if you can invest a few hundred dollars a month in the market.

2. Motley Fool Rule Breakers

Rule Breakers focuses on businesses with high growth potential that the Motley Fool thinks are well-poised to disrupt entire industries.

They provide a couple of stocks that they think are good picks each month, and they also offer 5 stocks out of 200 that they think are the hottest buys at the moment.

You’ll also get recommendations for starter stocks and access to plenty of educational resources.

Rule Breakers picks have performed exceptionally well. Since September of 2004, they’ve returned 301.79% compared to the S&P 500’s 142%, meaning they’ve more than doubled the benchmark.

Rule Breakers is ideal for those who already have a solid portfolio and are willing to take some chances with their money. In other words, more advanced investors and not beginners.

It lists for $299/year but you can get a significant discount of $99!

3. Motley Fool Hidden Gems

Motley Fool Hidden Gems used to be a stand-alone service, but is now included in the Epic bundle and all higher bundles.

Hidden Gems picks are built on Tom Gardner’s Everlasting philosophy, focusing on companies with founder-leaders, a strong company culture, or pricing power.

The intention of these picks is to find investments that the market might be undervaluing and recommend them because they have the potential to beat the market over long periods.

Since September of 2018, Hidden Gems picks have returned 35.25% compared to the S&P 500’s 42.96%. These results aren’t surprising since HG picks are meant to be held for the long-term.

Hidden Gems is a service you can get if you upgrade to one of Motley Fool’s bundles. We think it’s best for long-term investors who aren’t comfortable with a ton of risk.

4. Motley Fool Dividend Investor

Motley Fool Dividend Investor picks focus on helping investors build a portfolio of dividend-paying companies.

Ideally, these picks should deliver what Motley Fool describes as “outsized total returns” while also generating a steady stream of income for the investor.

Since February of 2023, Dividend Investor picks have underperformed the S&P 500, returning 18.95% vs the S&P’s 39.88%.

Dividend Investor is not available as a stand-alone service, but it comes with the premium bundles. Dividend Investor picks are ideal for people who want to hedge a bit by accepting slower growth in exchange for ongoing earnings.

About Motley Fool: Background and Track Record

The Motley Fool is not an investment broker, it’s an investment guidance and education service. They provide both stock picks and long-term education around the way that the stock market works.

It’s this balance of evergreen advice and hot off the press news that keeps the Motley Fool so fresh.

If you want to be a great investor, you’re going to need to understand how the stock market works.

We’re talking nuts and bolts.

You have to know how the pieces move and the best way to bring the information to bear on your portfolio.

But you also have to understand the latest news and culture of the world.

Without hot tips in the moments that they break, even the best investors can lose money and miss opportunities.

By delivering both kinds of information, the Fool tries to maximize return.

| Motley Fool Stock Advisor | Seeking Alpha Premium | Zacks Premium | |

| Primary Features | 2 monthly stock picks; portfolio management tools; up-to-the-minute market news; investor toolkit | Quant ratings; portfolio management tools; preset and custom watchlists and screeners; access to investor community and investment groups | Proprietary quantitative ratings; access to news and up-to-the-minute prices; screeners and portfolio management tools |

| Performance | Picks have beaten the S&P 500 by 750+% over the past 22 years | “Strong Buy” rated stocks have beaten the S&P 500 by 486% since 2010 | Stocks “#1 Strong Buy” ratings have beaten the S&P 500 by an average of 13% each year |

| Subscription Cost | $199 per year | $299 for first year; $499 on renewal | $249 per year |

Ready to see how Motley Fool stacks up? Start exploring with a free trial [affiliate link].

Motley Fool Services Overview

Motley Fool offers several premium services, each with their own unique features and benefits. Before we get into that, here are two key features that apply to the Motley Fool as a whole.

- Long-term investments. Overall, The Motley Fool is ideal for investors who want to buy vetted stock and then hold it for at least five years. It’s not ideal for day traders. The brains beyond The Motley Fool focus on a buy and hold strategy, which means some of their picks may lose money initially but outperform the market in the long run.

- Money-back guarantee. The Motley Fool offers a full refund to subscribers within the first 30 days, no questions asked. What that tells us is that they value subscribers and want them to be happy.

Now, let’s get into the details of their subscriptions.

1. Motley Fool Stock Advisor

Every month, the team carefully vets and selects 2 stock picks that they officially recommend for you to consider picking up.

They provide 10 stocks that they think are great to buy at the moment you subscribe.

You’ll also get access to a bunch of educational resources, including articles, screeners, and portfolio management tools.

Stock Advisor is Motley Fool’s primary premium service and is ideally suited for beginner investors and those who want reliable picks instead of doing the research themselves.

Stock Advisor lists for $199 a year, but you can sometimes get it for $99 or less!

When you consider the +750% average return that the service has claimed over 22 years, this is well worth the investment if you can invest a few hundred dollars a month in the market.

2. Motley Fool Rule Breakers

Rule Breakers focuses on businesses with high growth potential that the Motley Fool thinks are well-poised to disrupt entire industries.

They provide a couple of stocks that they think are good picks each month, and they also offer 5 stocks out of 200 that they think are the hottest buys at the moment.

You’ll also get recommendations for starter stocks and access to plenty of educational resources.

Rule Breakers picks have performed exceptionally well. Since September of 2004, they’ve returned 301.79% compared to the S&P 500’s 142%, meaning they’ve more than doubled the benchmark.

Rule Breakers is ideal for those who already have a solid portfolio and are willing to take some chances with their money. In other words, more advanced investors and not beginners.

It lists for $299/year but you can get a significant discount of $99!

3. Motley Fool Hidden Gems

Motley Fool Hidden Gems used to be a stand-alone service, but is now included in the Epic bundle and all higher bundles.

Hidden Gems picks are built on Tom Gardner’s Everlasting philosophy, focusing on companies with founder-leaders, a strong company culture, or pricing power.

The intention of these picks is to find investments that the market might be undervaluing and recommend them because they have the potential to beat the market over long periods.

Since September of 2018, Hidden Gems picks have returned 35.25% compared to the S&P 500’s 42.96%. These results aren’t surprising since HG picks are meant to be held for the long-term.

Hidden Gems is a service you can get if you upgrade to one of Motley Fool’s bundles. We think it’s best for long-term investors who aren’t comfortable with a ton of risk.

4. Motley Fool Dividend Investor

Motley Fool Dividend Investor picks focus on helping investors build a portfolio of dividend-paying companies.

Ideally, these picks should deliver what Motley Fool describes as “outsized total returns” while also generating a steady stream of income for the investor.

Since February of 2023, Dividend Investor picks have underperformed the S&P 500, returning 18.95% vs the S&P’s 39.88%.

Dividend Investor is not available as a stand-alone service, but it comes with the premium bundles. Dividend Investor picks are ideal for people who want to hedge a bit by accepting slower growth in exchange for ongoing earnings.

Competitor Comparison

Let’s take a look at how The Motley Fool compares to some of its competitors.

About Motley Fool: Background and Track Record

You may be wondering where the name “Motley Fool” comes from. It comes from a Shakespeare comedy known as “As You Like It.”

In this comedy, there is a single character that can speak truth to power.

The “Motley Fool” can say the truth to the king without getting his head chopped off.

The idea behind The Motley Fool is that someone should speak the truth in the investment space.

The truth helps ordinary people navigate the power of the stock market.

And the Motley Fool actually began with some interesting tactics.

They first gained some attention by publishing an April Fool’s joke with a string of messages about penny stock investing and a sewage-disposal company This led to an article in the Wall Street Journal, and they later got a content partnership with AOL. The company was then featured in the New Yorker that same year.

That was in 1994, before internet investing advice really took off.

In 1996, the founding Gardner brothers published an investing guide which hit the best seller list in the New York Times, and by 1997, they had cut ties with AOL and created their own domain.

By 2002, after the dot-com bubble burst, the company moved to subscription revenue and launched its investment advice service.

The company believes that every dollar you invest should be treated with care and responsibility.

They think that finding the great businesses of the world is the best way to make a great return.

By keeping score and remaining transparent in the way that they deliver information, they inspire trust and encourage great investments.

Motley Fool Results

We’ve already talked quite a bit about Motley Fool Stock Advisor results, but here’s a little more information to help you understand how well their picks have performed. Here’s an overview.

If you look in the third column of percentages, you can see that more recent picks have underperformed the S&P 500, while older picks have significantly outperformed the index.

We still have confidence that the picks from more recent ears will play out over time. We have to remember that 2020 and 2021 were anomalous years because of the COVID-19 pandemic.

We shared results for a few recent picks earlier in this article, and those are significantly outperforming the benchmark – so we think our optimism is justified.

Is The Motley Fool Legit? Final Verdict

Yes, the Motley Fool is completely legit.

The company seeks to “make the world smarter, happier, and richer.”

You don’t have to spend a ton of money on a subscription service to get started (around $199 for Stock Advisor, my favorite of their subscriptions).

Poke around the community, the blog, and their social media outlets and you’ll find genuine, authentic information and advice. The podcasts are delightfully honest takes on the current state of the market.

The Motley Fool successfully fulfills its mission to make sure that people learn about the market while laughing a little too.

And within the paid subscription services, you can get great investment information. Click on the image below to see exactly how they got these impressive results and to see what their hottest stock picks are.

There are a selection of Fool portfolios and advice columns that have decades of outperforming the market averages.

If all that sounds like what you’re looking for, you can save $100 and get a year of Motley Fool picks for only $99.

What’s the risk? After all, they have great money-back guarantees if you aren’t 100% happy with the service.

But you probably will be–the Fool has some great picks.

Let us know what you think in the comments.

And let us know if you’ve tried and loved the Motley Fool services!

*** Tuesday, July 15, 2025 ALERT—Motley Fool Picks Still CRUSHING the SP500!****

The Motley Fool Stock Advisor’s stocks picks, even with this recession, inflation, and COVID recovery have been performing very well as of late.

I have been a subscriber since 2016 and their average pick of the last 8 years is easily beating the SP500. Keep in mind these FIVE very important tips regarding the Motley Fool Stock Picks.

Tip #1 is that you need to buy them as soon as you get the alert because the stocks typically rise 2-5% in the first 24 hours of the pick being released.

Tip #2 is that I buy about $2,000 of each pick and I immediately place a 20% stop loss order to control risk.

Tip #3 is that their next stock pick should come out Thursday, so make sure you have subscribe now so you are ready.

Tip #4 is to always read your emails from the Fool because they also tell you when to sell stocks.

Tip #5 is to save $100 and get a Full Year of Stock Picks for only $99 (new members only)