Most of our courses are all about building up your portfolio while the stock market is going great – more about picking the best stocks when there are lots of great options. But what about when nothing looks good? Time to pull out your money and sit on the sidelines, right?

Wrong!

By leveraging “Short Selling”, even beginning investors can grow their portfolio, even when the markets are down. This is a more advanced trading strategy with different types of risk than just buying stocks – but here is the run-down of what you need to know.

What is Short Selling?

Here’s how it works:

- An investor goes to their broker and borrows a share of stock

- The investor immediately sells that borrowed share on the market, and pockets the cash

- Some time later, that investor needs to return those borrowed shares to their broker. That means they need to buy them back at the market price, and give the shares back. This is called “Covering” the short.

And here’s where the profit comes from:

- When the investor borrowed that share of stock, it was trading at $100. That means when they sold the share, they got $100 cash immediately.

- When they went to return the share, the stock’s price crashed to $33. That means they only had to pay back $33 to return the stock to their broker.

- Total profit: $100 – $33 = $67

What do you need to Short Sell?

In the example above, short selling involved borrowing a stock. This means you are engaging on margin trading when you short sell – usually you will need to this authorized in your brokerage account first.

Margin trading means borrowing – and that means collateral. It differs from broker to broker, but you will need to keep your portfolio topped up with a certain minimum value in order to be able to borrow against that for margin trading.

When you go to short sell, it will create a margin requirement for your portfolio – your portfolio needs to have assets worth at least this much in order to keep borrowing. Your margin requirement can be met either with cash in your portfolio, or stocks you own that you could sell if you need to.

This means your stock broker is paying close attention to that stock that you borrowed. They do not let you just sell the stock, withdraw the cash from your account, and skip off into the sunset. That cash gets “locked” into your account as a margin requirement – you need to keep enough assets in your brokerage account to actually pay back the stock you borrowed until you “cover” your short.

Risks With Short-Selling

When you buy a stock, the most you could possibly lose is the price of that stock – if it goes bankrupt, your stock becomes zero, and you lose your entire investment. This means the entire “Risk” is the amount you invested, but the potential rewards are infinite – the stock can grow forever (if you’re lucky).

The risk (and profit) is the opposite with a short sale. When you sell short, the cash you get when you first short the stock is the maximum profit: the best-case scenario for you is that the company goes bankrupt, the stock’s price goes to $0, and you keep the full $100. But if the stock’s price starts to go up, you need to buy it back for more – resulting in a loss. Since the stock’s price can keep going up, that means your potential losses are infinite!

For example, if I bought Amazon (AMZN) stock in 1998, it would have cost me about $5 a share. The most I could lose was that $5 if Amazon went bankrupt. However, the price is now over $3000 – over 600% return on my investment. The price can continue to go up – there is no “cap”.

But it is the opposite with short selling. In 1998, imagine if I thought Amazon had a dumb business model and would go bankrupt any second. If I short-sold 1 share of Amazon stock, I get $5 cash – this is my maximum profit. However, my losses are unlimited – if I never “covered” my short, today I would have LOST over $3000 on that single share.

Margin Call

In the real world, your broker will not let you just have losses pile up forever – they need to know that stock you borrowed is eventually going to get paid back. This means that they are also constantly watching the price of that stock – as its price goes up, so does your margin requirement. If the margin requirement rises to the point where you would have a hard time covering it with the cash or other stocks in your portfolio, your broker could force a “Margin Call”.

With a margin call, your broker forces you to buy back the stock immediately, before you can no longer afford it. This closes your position, and locks in your losses. This is fine if you were holding the cash in reserve, but more likely you had it invested in other stocks – and a margin call can force you to sell off other stocks. Investors hate margin calls, so it is always a good idea to cut your losses before it gets that bad.

Never Lose More Than 10%!

Mark Brookshire, CEO of StockTrak.com

The Short Squeeze

“Short Squeezing” has been a hot topic in trading recently – individual investors made a ton of money on Gamestop stock in 2021 using this technique. With a “Short Squeeze”, you are actually doing the opposite of short selling – you are trying to make short sellers suffer.

A “Short Squeeze” is possible because it isn’t just small investors who short sell – the big boys on Wall Street do it too. If Wall Street thinks a company is in decline and eventually go bankrupt, some big players will start heavily short-selling the stock. Remember – short selling means you borrow the shares and sell them off on the market. When there are a lot of short sellers, it means the market is getting flooded with people trying to sell their shares, which pushes the stock down even farther.

With a short squeeze, other investors see this happening, and decide that the short sell has gone too far – just the downward price pressure of short-selling is making the stock’s price drop faster than it normally would. So the “Squeezers” start buying up the cheap shares of stock. And keep buying – and keep buying.

…and keep buying until the price pressure is completely reversed – now there are so many buyers betting against the short sellers that it creates upward pressure on the stock’s price, just because so many buyers entered the market. As the stock’s price starts to go up, the short sellers start to take losses – which means they need to buy back the shares they shorted. Now all the short sellers become buyers, pushing up the stock’s price even faster.

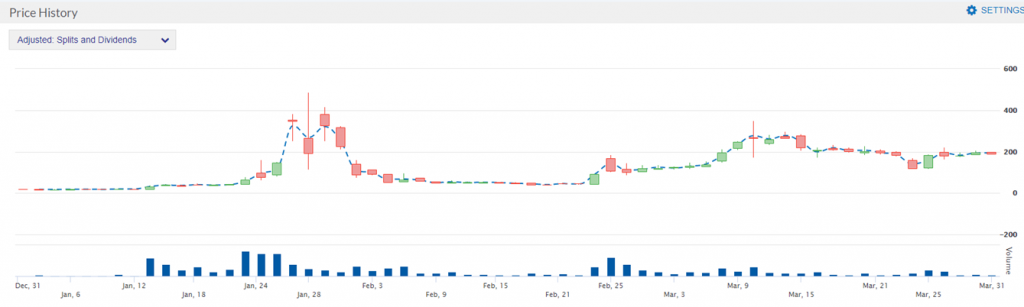

Once the short squeezers think that most of the short sellers have “covered” their shorts, they will start selling off the shares they were buying. In a perfect world, both the shorters and squeezers will both close their positions on this stock, and the final price will settle somewhere above where it was when the squeeze started, but below the peak it reached when all the short sellers were forced to cover their shorts. In reality, the cycle usually goes back and forth several times (with short sellers thinking the squeezers went away and they were justified shorting to begin with, and squeezers coming back to try to profit from another “squeeze”). In the case of Gamestop, you can see in the price chart below that the “squeeze” caused the price to spike, then it fell back down again as squeezers left the market and short sellers came back. This went back and forth for months (and even continues to this day) as shorters and squeezers battled for the upper hand.

How To Practice Short Selling

Short selling can have risk – which means it is always a good idea to get some practice first. Luckily, we at WallStreetSurvivor have your back!

Register for your free practice portfolio today, which will give you $100,000 of fantasy funds to use to buy, sell, short, and cover real stocks and options to practice your trading strategies with real-time data, and no risk. You can even create your own trading contest and invite your friends to see has the best trading strategy (and exchange tips and tricks for improvement), or join our regular contests!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.