One of the first (and most important) choices any investor will make after deciding that they are ready to start investing on their own is what is the best stock broker for beginners app to chose.

The reason this is so important is whichever one you decide to go with will be the that you probably end up keeping for a long time. Sure, you can change brokers, but it is a bit of a pain to do.

As investors, we must place an incredible amount of trust in the stock broker app we chose. We download their app, give them our social security number, send them money, and hope that they execute our trades fairly. Most importantly of all, we hope they store our stocks securely so we can sell them and get money out when we want to.

With so many stock brokerages available in this day and age, it can be difficult to determine which broker platform will be most beneficial to your financial success.

But never fear; that’s why Wall Street Survivor is here to help you narrow down your choices!

We’ve done all the grunt work for you. For over 20 years, our team here at Wall Street Survivor has reviewed many dozens of stock broker apps, websites, stock screeners, stock newsletters, etc. We specialize in helping beginner investors learn to invest. We provide a free virtual stock market simulator so you can practice investing a virtual $100,00, we provide reviews of the best stock newsletters, and we review the best stock broker for beginner investors!

Our team of analysts have poured through all of the online brokerage choices out there, and we’re proud to present you with a list of the best online brokers for investors of different types and experience levels. Enjoy!

Best Stock Broker for Beginners Ranking:

- Robinhood – Best Stock Brokerage for Beginners

- Moomoo – Best Stock Giveaway for New Accounts

- Interactive Brokers – Best Brokerage for International Trading

- TD Ameritrade – Best Brokerage for Option Traders

- E* Trade – Best Stock Brokerage for Frequent Traders

Honorable Mentions:

- thinkorswim – Best Stock Broker for Data and Analysis

- M1 Finance – Best User Interface

- Acorns – Best Stock Broker for Hands-Off Investors

1. Robinhood: Best Stock Brokerage App for Beginners

Robinhood Overview

Robinhood should have a special place in the heart of every investor.

This online broker led the investing revolution that succeeded in forcing most brokerage firms to offer commission-free trading for individual investors willing to place their own online stock trades. When Robinhood was launched in 2013, most “discount brokers” were charging $8 to $20 per trade. Robinhood launched their mobile app offering commission-free trading and quickly grew to a 1,000,000 users. That forced the whole industry to reduce or eliminate their commissions in order to compete.

Robinhood wanted to bring the world a commission-free investing platform that would allow investors with all levels of income to be able to create a portfolio without spending money on commissions.

When Robinhood quickly gained millions of users, the other brokerages realized that they had no choice but to follow suit. So now there are dozens of commission-free stock broker apps available, so see why Robinhood wins our award for the best stock broker for beginning investors.

Fast forward to 2025 and Robinhood now has 23,000,000 users.

Key Features of the Robinhood Stock Broker Platform

- Commission-free trading on U.S. stocks, ETFs, and options.

- Super-easy to open a brokerage account in just 2 minutes.

- Robinhood new account promotion: Get a free stock valued between $5 and $200 when you deposit as little as $1 in your account.

- Personal referral link to earn more free stock: share your referral link with your friends and both you and your friend will get another free stock!

- Up to $1,500 in free stock per year: just keep referring friends each year on your personal link and get more stock.

- Best crypto trading prices: The lowest crypto trading fees among the major crypto trading platforms; only drawback is they only trade about 25 coins.

- Earn good interest rate on uninvested cash. Join Robinhood Gold to get the best interest rates on your idle cash.

- Support desk: Robinhood has excellent support. You can easily reach someone by messaging or phone. Ideal for beginner investors.

- Assets insured by U.S. Government: Robinhood is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), offering security for up to $500,000 in securities. The app is also compliant with regulatory standards in its operating regions, including the U.S. Securities and Exchange Commission (SEC).

In addition to its valuable contribution to the stock broker industry, Robinhood also boasts an extremely simple, but modern, user interface that makes viewing your account, your profit and loss on each stock, and trading really easy.

The home page is easy to understand for young and more mature investors alike, making it easy to see what you’ve gained in a given time period.

When you press on a stock or fund to see its information, Robinhood will provide you with the basic fundamentals needed to make informed investing decisions, as well as news and analyst reports regarding the chosen security.

You can access Robinhood directly from your phone using their simple, sleek app.

Robinhood also offers incredible features for the beginner investor such as margin trading, fractional shares, premium research tools, options trading, and Cash Management accounts that allow you to use a Robinhood debit card to make transactions directly from your online brokerage account.

Robinhood does not currently support mutual funds, foreign stocks, bonds, and several other securities.

Visit the Robinhood FREE STOCK Promotion page

to Claim Your First Your First FREE stock.

Robinhood Cost

To download, open an account, and trade U.S. stocks and ETFs on Robinhood is absolutely free.

There is a premium subscription called Robinhood Gold that costs $5 per month and gives you special perks such as higher interest rates on your cash, bigger instant deposits from your bank account, professional market research and data, and a margin trading program that lets you borrow your first $1,000 interest-free. It is absolutely worth it if you plan on having more than $1,500 in cash in your account. Read Our Complete Robinhood Review.

What you Need to Open a Robinhood Account

To open a Robinhood account, you will need to meet all of the following individual requirements:

- Be 18 years or older

- Have a valid Social Security Number (not a Taxpayer Identification Number)

- Have a legal United States (US) residential address within the 50 states, Puerto Rico, or the US Virgin Islands (exceptions may apply for active US military personnel stationed abroad)

- Be a US citizen, US permanent resident, or have a valid US visa*

That’s all it takes.

2. Moomoo Stock Broker App

Moomoo is a mobile and online stock brokerage app that provides a comprehensive platform for beginner investors. Now a Nasdaq-listed company, Moomoo aims to make investing more accessible and intuitive for individual traders.

Moomoo Overview and Background

The Moomoo stock brokerage app is designed to cater to both beginner and experienced investors. The app offers a range of features including zero-commission trading, advanced charting tools, and access to real-time market data. It primarily targets users in the U.S., with additional services available in countries like Singapore and Hong Kong. One of the app’s most appealing aspects is its ability to offer commission-free trading across various asset classes, including stocks, options, and exchange-traded funds (ETFs).

Moomoo has grown rapidly, attracting millions of users due to its user-friendly interface, low costs, and wide array of tools for analyzing the market.

It is copying Robinhood’s free stock giveaway but it doing it with 15 stocks when you deposit $1,000 into your new account.

Key Features of Moomoo

- Zero-Commission Trading: Moomoo offers commission-free trading on U.S. stocks, options, and ETFs.

- Real-Time Market Data: Users of Moomoo get access to real-time stock quotes, charts, and market data, which are essential for making well-informed trading decisions.

- Advanced Charting Tools: The Moomoo app has very good charting tools to help beginner investor see historical stock prices.

- Stock Research: Moomoo provides lots of research tools, including stock screeners, news updates, and financial reports.

- Educational Center for Beginner Investors: The platform also offers an educational center for beginner investors looking to learn more about trading strategies, stock analysis, and financial markets.

- User-Friendly Interface: The Moomoo app has a very easy to follow design that simplifies the trading process. Whether you are buying stock or reviewing your portfolio, the app is designed for ease of use, making it accessible to both novice and experienced investors.

- Social Trading Features: Users can interact with one another, share trading ideas, and follow top investors within the Moomoo community. This adds a social element to the app and allows traders to learn from each other.

- Security and Regulation: Moomoo is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), offering security for up to $500,000 in securities.

Benefits of Using Moomoo

- Cost-Effective: Moomoo offers zero-commission trading, which allows investors to minimize costs. This is particularly beneficial for active traders or those who make frequent trades, as they won’t have to worry about high commission fees cutting into their profits.

- Educational Resources: The educational center on Moomoo offers a wealth of content that helps users enhance their trading knowledge. It is particularly beneficial for novice investors who are looking to gain a deeper understanding of how to trade and analyze the stock market.

- Comprehensive Tools for Analysis: Moomoo provides a range of technical tools that can help investors make better-informed decisions. The platform’s advanced charting tools, combined with real-time data and research features, make it suitable for both day traders and long-term investors.

- Accessibility: The app’s user-friendly interface and mobile accessibility allow traders to manage their investments and make trades on the go. The platform is available on both iOS and Android devices, offering flexibility and convenience for users.

- Community and Social Features: Moomoo’s social trading network encourages users to engage with other traders and share insights, which can be helpful for those who prefer collaborative learning.

Key Considerations

- Limited Asset Classes: Although Moomoo offers access to U.S. stocks, options, ETFs, and ADRs, it does not support the trading of other asset classes such as cryptocurrencies or forex. For investors looking for a broader range of trading options, other platforms may be more suitable.

- Margin Trading Risks: Margin trading allows users to amplify their gains, but it also exposes them to greater risks. Users who engage in margin trading must be aware of the risks associated with borrowing money and the possibility of losing more than their initial investment.

- Customer Support: While Moomoo provides customer support, some users may find that the app’s support services are not as extensive as those offered by larger, more established brokers. Users should consider this when using the platform.

- International Availability: While Moomoo is available in multiple countries, certain features and services may be restricted depending on the user’s location. It’s important to verify if the full set of features is available in your region.

Conclusion

Overall, Moomoo is a competitive and modern brokerage app that offers a range of tools and features suitable for both beginner and experienced traders. Its zero-commission trading model, advanced charting tools, and educational resources make it a valuable platform for those looking to take control of their investments. However, potential users should consider factors such as asset class limitations and margin trading risks before committing to the platform. Moomoo’s social trading and mobile accessibility set it apart from other apps, making it an attractive option for investors who want a seamless, cost-effective trading experience.

Open a MooMoo account and claim your 15 free stocks now!

3. Interactive Brokers: Best Brokerage for International Trading

Interactive Brokers made history in 2022 when Barron’s ranked them as the number one overall online brokerage for an unheard of fifth year in a row. Barron’s also gave Interactive Brokers the top ranking in the race for the best online brokerage for active traders in 2022, not to mention naming Interactive Brokers as the best brokerage for finding information on stocks and other securities.

So why did Barron’s give Interactive Brokers such high praise? What separates IB from the crowd?

International Trading

Part of Interactive Brokers’ appeal lies in the sheer number and variety of financial products that can be traded on its platform. In addition to the standard slate of US-based stocks, ETFs, and options, Interactive Brokers also gives investors practically unprecedented access to markets and securities around the world.

Seasoned investors don’t just flock to Interactive Brokers for its commissions or for its impressive interface. Interactive Brokers makes a point of giving advanced investors access to as many markets and asset classes as possible. Internationally minded investors can currently trade on over 150 exchanges in 33 different countries, giving traders the opportunity to trade in all the international equities and foreign bonds—corporate and government—as their hearts desire.

Innovation

As part of its quest to be a full-service trading platform, Interactive Brokers announced that its clients can trade cryptocurrencies on its platform as of September 13, 2021. Users can now trade Bitcoin, Ethereum, Litecoin, and Bitcoin Cash through Paxos Trust Company with industry low commissions of 0.12-0.18% of trade value with a minimum of $1.75 per order.

Interactive Brokers is also one of the few brokerages that support investors located outside of the United States, further solidifying its position as one of the most innovative and accessible brokerages out there.

Interactive Brokers connects its clients to so many different exchanges in so many countries that it’s hard to imagine international investors taking their business anywhere else. In fact, IB even offers IBKR Pro pricing to investors from 200 countries and territories regardless of trading frequency.

Fee Flexibility

Interactive Brokers’ fee structure is a bit more complicated than other brokerages, but that complication comes with more flexibility than you’ll see in other brokerages. Its IBKR Pro United States stock commissions can either be fixed at $0.005 per trade, for instance, or you can choose the tiered option that charges as much as $0.0035 per trade if you trade fewer than 300,000 shares per month or as cheap as $0.0005 per trade if you move over 100,000,000 shares per month.

The fee structure differs by membership type, asset class, and country of origin, so you’ll want to double check the rates before you make any trades. That said, none of the fees are significant, so you don’t have to worry too much about wasting money.

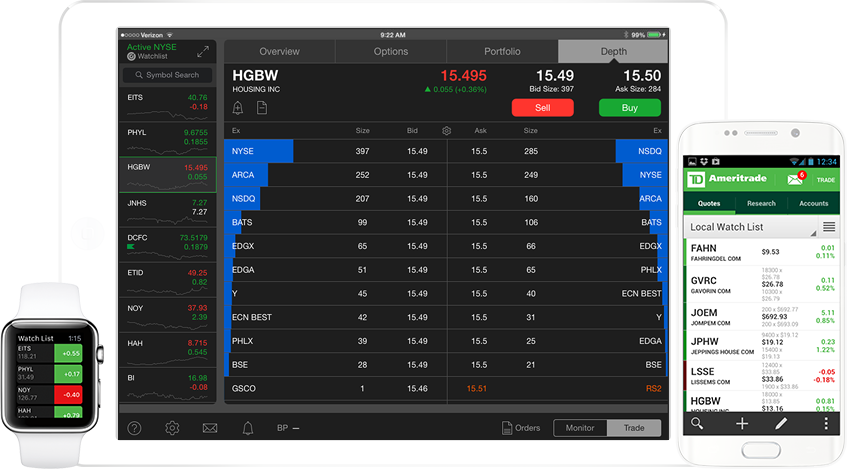

4. TD Ameritrade: Best All Around Brokerage for Beginners

Create a FREE account with TD Ameritrade, Our Best All Around Brokerage for Beginners!

TD Ameritrade Overview

TD Ameritrade and its trading platforms are highly regarded among investors, and it isn’t hard to see why. In addition to their free online stock, ETF, and options trades, their (relatively) simple platform puts a whole host of useful information and educational resources right at your fingertips.

The TD Ameritrade was designed for beginners in mind. Where many investing platforms cram as much information into the window as possible, the minimalist design of TD’s platform is careful not to overwhelm newbies with information. It has all the charts, statistics, and research you need to make informed investing decisions, but it makes sure to dole them out in easily digestible chunks. It’s a perfect starting point for new investors, though veterans may want to switch to a platform with more features and functions.

TD’s platform also comes complete with an Education Center that boasts a suite of educational resources like tutorials, learning tools, and even practice assessments. The platform is built around helping new investors learn about different types of securities, how their underlying value drives their prices, and how to make informed trades. It even promises to deliver educational content specifically tailored to a user’s skills and interests so newbies can get up to speed as quickly as possible.

Once users get up to speed, the TD Ameritrade platform has a limited but effective set of tools that help identify opportunities and build long-term investment plans. Free research from firms like Market Edge and CFRA provide the kind of objective data that investors need to evaluate stock prices and prospects, and their Stocks Overview feature provides news, earnings, volume, social sentiment, and other factors with just a few clicks.

The platform has a few other features that make it easier for newbie investors to keep up with the market. Their Portfolio Planner gives investors the tools they need to plan their investment strategy, for one, and their Retirement Planner helps users track their asset mix to make sure their investments meet their goals. TD also lets users set up alerts for certain stocks and track important events with a built-in calendar, perfect for traders who can’t sit in front of their computers all day.

TD Ameritrade: Versions and Price

TD’s platform is available as both a mobile app and a browser-based online service. Both versions are free to use and share most of the same features, though only the mobile app lets users deposit checks using their phone’s camera and use an Apple Watch to monitor their accounts.

New traders will also love that TD charges no commission for trading US exchange-listed stocks and ETFs, though veterans may bristle at their $0.65 per contract fee for options trades and $6.95 commission on all trades of over-the-counter stocks.

5. E*Trade: The Best Stock Brokerage for Frequent Traders

E*Trade Overview

E*Trade made the first ever online transaction sent to an exchange back in 1982, and its longevity is no fluke. Their two platforms, E*TRADE and Power E*TRADE, offer a whole range of asset classes, charting tools, and fast trades with incredibly reasonable fee structures give them an edge over the competition, and they continue to add functionality every year.

The basic E*TRADE platform is a streamlined, web-based system that makes trading stocks, options, ETFs, mutual funds, and bonds as easy as possible. The platform gives users access to a suite of investing tools and a bunch of free guidance and educational modules, plus the ability to write checks, pay bills, and transfer money to and from your account with just a few clicks. In other words, the whole thing is built around making trading and portfolio building as fast and easy as possible.

Power E*TRADE builds on the basic E*TRADE platform with additional charting tools, customizable data streams, a set of preset stock scans and technical studies for quickly finding and analyzing potential investment opportunities. On top of all that, Power E*TRADE lets you place stock, ETF, simple and complex options, and futures orders on a single trade ticket, which is perfect for investors who want to make big trades quickly.

E*Trade Cost

E*Trade’s fee structure is designed around making frequent trading as cheap as possible. Trading stocks, options, and ETFs is completely free—although over-the-counter stock trades are $6.95 each, then $4.95 after conducting 30 trades per quarter—and trading other asset classes isn’t a whole lot more expensive.

Trading options contracts comes with a $0.65 fee ($0.50 after making 30 trades in a quarter), futures contracts are only $1.50 per trade, and bonds come at just $1 per bond. In other words, E*Trade is perfect for investors who want to trade a ton of stocks, options, and ETFs without wasting money on fees.

6. Wealthfront: Best Robo-Advisor Stock Broker

Wealthfront Overview

If you’re looking to get all the perks of having a financial advisor at a fraction of the cost, Wealthfront is the way to go.

Wealthfront is a robo-advisor, or a platform that is designed to be a hands-off choice for investors.

Wealthfront is designed to do all the work for you; just create your portfolio using the tools in the app, set up a recurring deposit, and watch your money go to work for you.

Wealthfront will automatically rebalance your portfolio to make sure you have the right percentages of your money invested.

This online broker also does automatic tax loss harvesting, meaning it will sell stocks for you at the right time to help decrease your tax burden.

Wealthfront also offers some great financial tools to help you plan for things like homeownership, retirement, travel, and college.

Wealthfront Cost

The management fee for Wealthfront is 0.25%, but this fee is waived for the first $5000 in your portfolio.

There is an account minimum of $500 for Wealthfront.

Wealthfront is one of the biggest players in the robo-advisor game, and stands out among online brokers as one of the best!

Honorable Mentions

1. thinkorswim: Best Stock Broker for Data and Analysis

thinkorswim

thinkorswim Overview

If technical analysis is your thing, then thinkorswim is the perfect platform to help you accomplish your goals.

Here at Wall Street Survivor, our goal is to focus on investing rather than trading; however, we respect any method that our fellow investors choose to use in order to work towards their financial futures, and that’s why we want to tell you about thinkorswim.

thinkorswim is TD Ameritrade’s online trading platform, designed to help you analyze market movements like historical patterns in price and volume.

As far as short-term trading goes, thinkorswim is one of the best online stock brokers.

TOS is known for its plentiful amount of bells and whistles, which is why it’s our pick for more advanced investors.

There is certainly a lot to learn in the platform, but once you have a grasp on all the features it offers, you’ll be able to tailor your trading experience to your specific preferences with capabilities such as advanced charting, scanning, and watchlists.

thinkorswim Cost

thinkorswim is free for most “basic” trades, such as stocks and ETFs.

But if you want to day trade some more complicated securities like options, mutual funds, or forex, you’ll have to pay a commission.

One of the best parts about TOS is that it offers paper trading simulations – make sure to try your hand at this before you dive into day trading!

2. Acorns: Best Stock Broker for Hands-Off Investors

Acorns Overview

Acorns, whose motto is “Invest, Earn, Grow, Spend, Later”, is just about as hands-off as you can get when it comes to online brokers.

Acorns’ model revolves around investing your “spare change”; every time you make a purchase, Acorns will round up the transaction amount to the nearest dollar.

The extra change is then added to your Acorns account and automatically invested.

For example, if you buy a meal that costs $10.20, then $0.80 will be transferred to your Acorns account and invested in your portfolio.

These spare change transfers can really add up, especially if you make a lot of regular purchases.

Acorns is easy to start and easy to maintain; you can create an account in less than five minutes and choose one of Acorns’ preset funds, and the app will do the rest.

The platform offers more than just a regular investment account, though. They offer:

- Invest (brokerage account)

- Later (retirement account)

- Banking (checking account)

- Early (investment account for kids)

Acorns Cost

There are two Acorns membership plans currently available.

The Personal plan costs $3 per month and gives you access to Invest, Later, and Banking.

The Family plan costs $5 per month and gives you access to Invest, Later, Banking, and Early.

3. M1 Finance: Best User Interface

M1 Finance Overview

When it comes to ease-of-use, M1 Finance is the clear winner.

This online broker offers a modern design and convenient investing tools that will benefit beginner and advanced investors alike.

M1 Finance functions as a sort of middle-ground between robo-advisors and full service online brokers.

It offers typical online brokerage account features such as automatic investing, automatic rebalancing, and preset portfolios.

At the same time, if you are a more hands-on investor, M1 will give you the freedom to make your own portfolio and invest your money however and whenever you’d like.

M1 uses a “pie” system to define its portfolios and sections of portfolios; you can create a pie by combining different stocks, fixed assets, and funds, or choose ready-made M1 pies composed of ETFs, target-date funds, mutual fund replications (like Berkshire Hathaway), or social impact investing funds.

You can then divide up your money within this pie, or use the pie as a section of an even larger pie.

For example, if you want to create a portfolio made up of 25% Apple, 25% Microsoft, and 50% IBM, you can easily make this happen by creating a pie with these percentages in the M1 app or website.

You can then deposit money into this pie and your cash will be divided up accordingly, or you can make this pie a portion of a larger pie.

You can also put your money into several different pies at one time.

M1 does not currently offer mutual funds or options, but you can easily replicate mutual funds by using an expert pie or creating your own.

M1 also offers a stock research section for investors who would like to stay up-to-date on the latest news and statistics in the stock market.

M1 Finance Cost

M1 Finance is absolutely free; there are no management fees or commissions.

They do have a premium subscription called M1 Plus that gives you special perks, and you can get a whole year of M1 Plus free when you sign up now! Read our moomoo review.

Conclusion

As you can see, there are plenty of online stock brokers out there that are ready to help you along the way to your financial goals.

It’s really just a matter of deciding which platform best suits your particular investing style and preferences.

And don’t worry, if you feel like you need to take a step back and learn more about what a brokerage is and does, check out our Starter Guide: Introduction to Stockbrokers.

At the end of the day, you can always make multiple brokerage accounts if you’d like!

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. $3 monthly 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

Robinhood

Robinhood$0

✅ U.S. stocks, ETFs, options, and cryptos

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes

✅ Access to U.S. and Hong Kong markets

✅ Educational tools60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analyticsRefer a Friend and Get $200

Interactive Brokers Review

4.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

5.

M1 Finance

✅ Automated investing “Pies”

✅ Banking & low-interest loans

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

6.

Webull

$0

✅ Extended-hours trading

✅ Great charts and screeners

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

7.

Public

$0

✅ Fractional shares

✅ No payment for order flow model

✅ “Alpha” tool with earnings calls$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

8.

Composer

$32 a month

✅ Invest in automated strategies

✅ Build custom strategies easily

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

9.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools

✅ Curated theme portfolios$5 when you invest $5

Stash Review

10.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

11.

Etoro

$0

✅ CopyTrading™ to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.