Seeking Alpha vs Zacks: what do these two titans of stock research and analysis have in common, what makes them different, and most importantly, which one is right for you?

Seeking Alpha and Zacks are known for their research and analysis tools for investors who like to do their own analysis and pick their own stocks.

Act Today; Offer Ends Soon

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They are currently offering a big discount that only runs for a limited time.

Here's you chance to get free trial, save 10% AND get their Top Stocks for the 2nd Half of 2025 report.

- 7 Day Free Trail & Save $30 on Seeking Alpha Premium; usually

$299now only $269/year — Learn more.- Save $50 on Alpha Picks; usually

$499now only $449/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

Both are famous for their stock ratings – thousands of people across the world pay to have access to each of their “Strong Buy” stocks and which “Strong Sell” stocks to avoid.

Both use expert analysts’ research and analysis to derive information about investments. Their goal is to provide investors with tools to learn and build their own portfolios.

But they also have stock newsletters where they release their top rated stocks that they believe are most likely to outperform the market.

They are similar in many ways, but the main difference is their approach to researching and presenting stock data. This article should help you decide which service fits your investing style better – Seeking Alpha or Zacks?

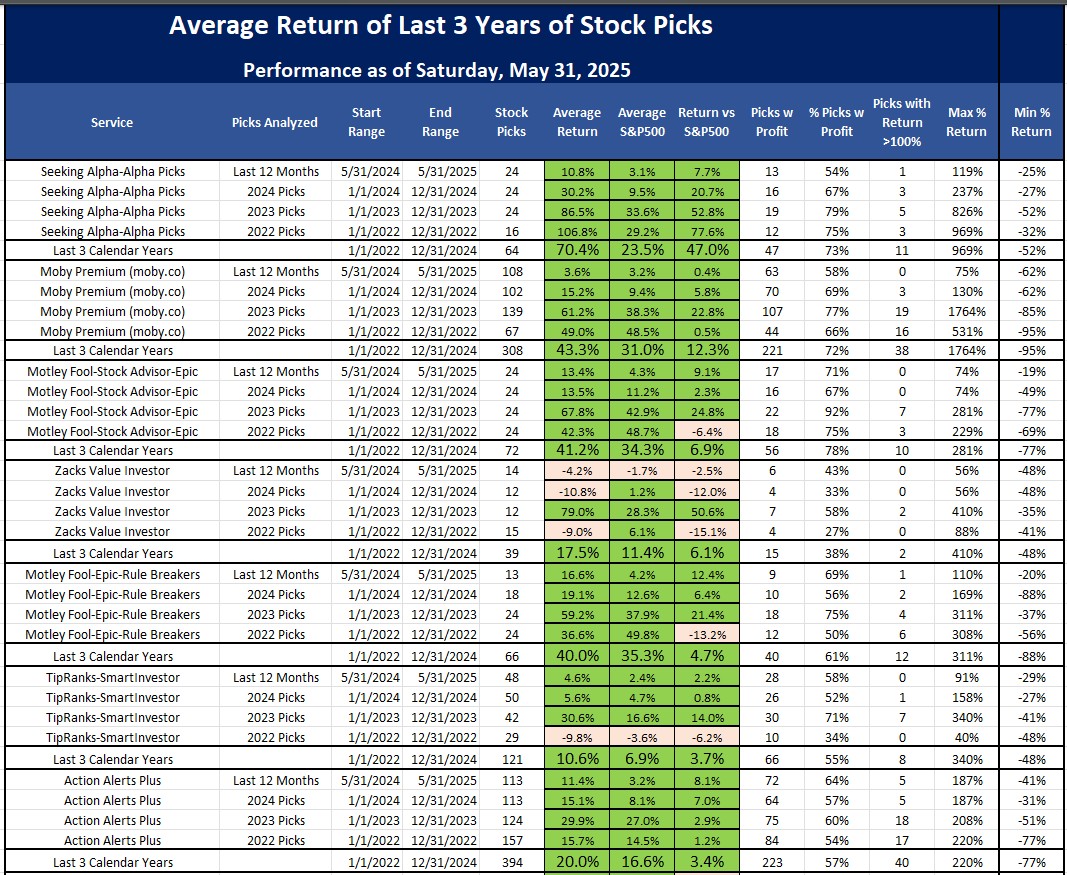

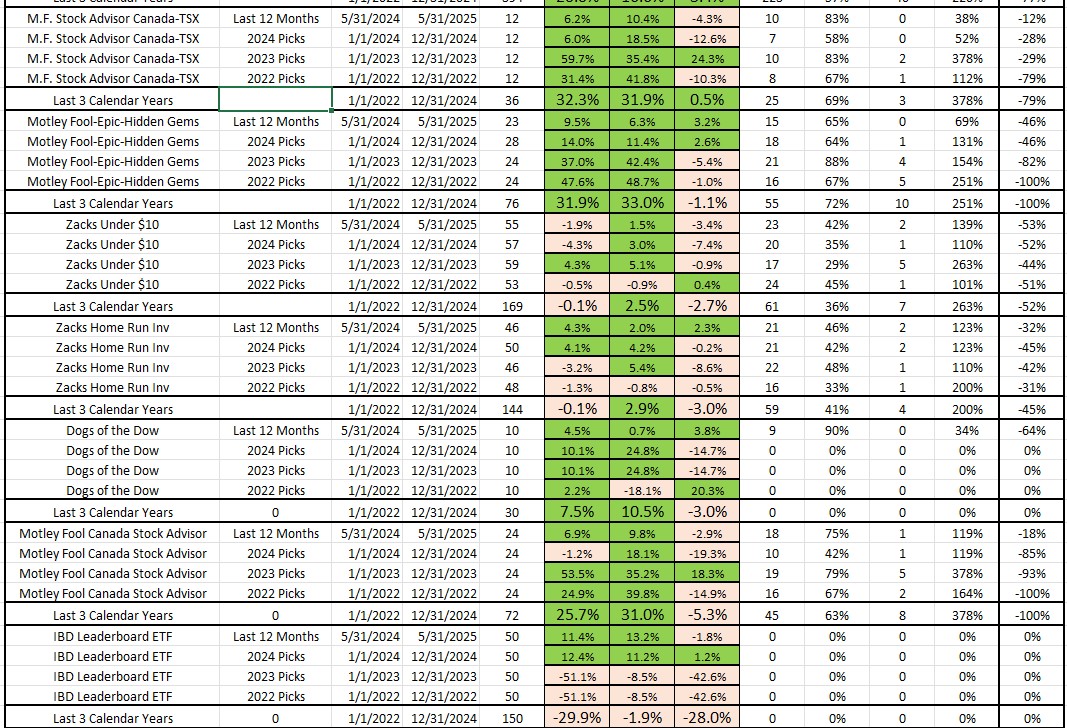

Performance of Recent Stock Picks

For those of you who just want to know which of their stock picks are better, I will get right to the point. How do the Seeking Alpha stock picks compare to the Zacks stock picks?

I subscribe to over a dozen stock picking services, and here is my most recent analysis of how their picks have performed over the last 3 years. For Seeking Alpha, I subscribe to their Alpha Picks service; and for Zacks I subscribe to their 4 most popular subscriptions that are less than $500 a year.

These are ranked based on their performance versus the S&P500 for the last 3 years. Seeking Alpha’s Alpha Picks is by far the top performer.

As you can see, Alpha Picks is crushing all of the others based on their average gain versus the S&P500 over the last 3 years–beating the S&P by 47% across 64 stock picks.

A relatively new service called Moby Premium is coming in 2nd– see my Moby Stock Picks Review.

As to be expected, Motley Fool’s Stock Advisor is doing well and is in 3rd place with an average return of 43% and 78% accuracy rate.

Zacks Value Investor is doing well too, but they have not been making very many picks over the last few years. The Motley Fool’s Rule Breakers stock picks-now known as Epic are doing quite well, as are Zacks Value Investor has only released 3 new picks in 2025, but they released 9 new picks in 2024, and their 2023 picks did so well they are carrying the average. Motley Fool’s Canada Stock Advisor is doing well and Zacks Top 10 is always doing OK.

Investors Note: See my full Alpha Picks Review or save Save $50 on Alpha Picks of this promo page now; or get this off coupon on Seeking Alpha Premium. Don’t miss out on their next picks

To compare the two, read our Seeking Alpha Picks vs Premium article.

How They Each Started

About Zacks

Zacks was started by Len Zacks in 1978, a Ph.D. from MIT.

Len was obsessed with analyzing Wall Street Analysts and wanted to build his own team of in-house analysts.

His vision was to create a team who could rate stocks, then provide productized ranks and lists for investors to analyze and build their portfolios.

Zacks believes that earnings estimate revisions are the most powerful factor to drive stock prices.

Basically, when financial analysts change how much a company will earn in a quarter, that can change stock prices more than anything else.

About Seeking Alpha

Seeking Alpha was started in 2004 by financial analyst David Jackson. The original plan was to create a research platform where passionate investors can share their own stock analysis with a community. The word “alpha” in stock market lingo is the percentage that your portfolio beats the market.

A big component of Seeking Alpha is this unique idea of crowdsourcing investing. Sharing knowledge with a community and all supplying, refining research, insights, and opinions.

Instead of having its own analysts, Seeking Alpha uses Wall Street analysts, individual investors, fund managers, and other reputable market watchers.

They do have in-house editors who cover current market news and review articles submitted to their forum.

Their Stock Ratings

The main reason to use either of these services is to research your own stock ideas and analyze your own portfolio. But they both have recently started stock newsletter services–more on this at the end.

Each of these platforms provides a list of stocks that are rated to get an idea of what to research. All these lists and ratings are done by respected analysts or quantitative factors.

Zacks Stock Rank

Zacks has a very straightforward rating system. In the areas of value, growth, and momentum, stocks are given a ranking of A through F. Based on the grade received in each category, stocks are then assigned a rank from 1 (Strong Buy) to 5 (Strong Sell).

The Zacks #1 list shows you the top 5% of stocks with the most potential. There are stock screens that allow you to pick stocks based on your investing strategy.

Zacks uses quantitative analysis to rate and rank stocks. This algorithm gives Zacks objective information to find the best stocks.

Zacks’ rankings have done very well against the S&P 500 as you can see in this chart:

Over the past 34 years, stocks that Zacks rank as a “#1 Strong Buy” have outperformed the S&P 500 by an average of 13.8% each year. Zacks has proven that its system works and why so many investors use its analysis.

See the Zacks #1 Rank Strong Buys

Zacks also provides rankings for ETFs, mutual funds, and other equities.

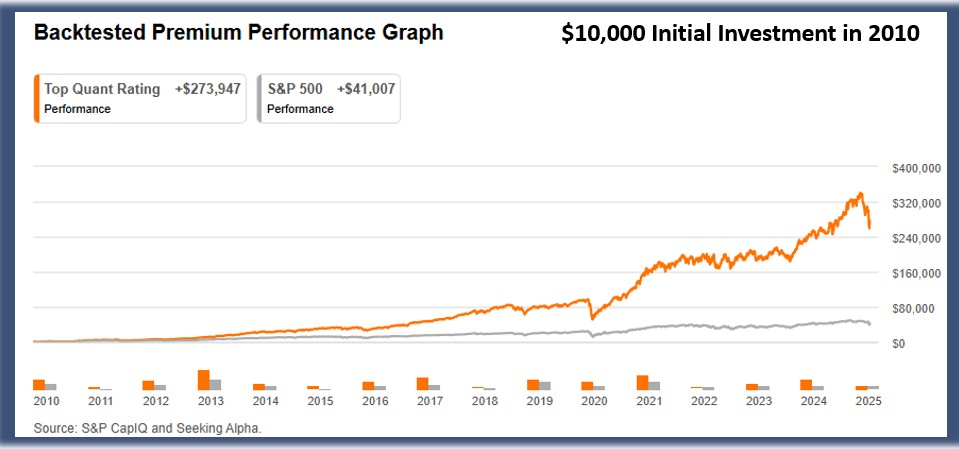

Seeking Alpha Quant Rating

Seeking Alpha has a top-rated stocks list as well, compiling of 50-75 stocks that earn Strong Buy scores. Scores are broken up and determined by Seeking Alpha contributors, Wall Street analysts, and Seeking Alpha’s quantitative algorithm. Any stock with a rating above a 4.5 is rated a Very Bullish buy. (If you want to do a deep, deep, deep dive into this read our Seeking Alpha Quant Rating Review).

Beside the analyst’s score, each stock is also given a letter grade for valuation, growth, profitability, and momentum. These ratings provide investors with a very easy way to get stock ideas.

Seeking Alpha has also done extremely well compared to the S&P 500 since 2010. Seeking Alpha’s “Strong Buy” rated stocks based on Quant Performance, are crushing the market as you can see bellow.

That’s 7x the average return of the S&P 500!!

Their quantitative analysis is slightly more successful compared to the market than Zacks.

Also of huge importance is an academic study that was released in April, 2024 by professors at the University of Kentucky that confirmed Seeking Alpha’s Quant Rating did provide relatively accurate predictions of future price movements. This is huge as it is the first time we have seen an academic study support the value of a certain stock service.

Their Stock Research

Seeking Alpha and Zacks provide stock research that is detailed and reputable.

Zacks is the better option if you want a traditional stock research report – a single report that’s relatively easy to read and presents a professional analyst’s view of a company they’ve been following for many years.

Each report contains a deep dive into the company and a look at its fundamentals and growth potential. They offer an in-depth report for every stock they cover.

Zacks also focuses a lot of Wall Street earnings forecasts, how the company actually do versus their forecasts, and then they place a lot of weight on forecasts CHANGES. If suddenly several analysts are improving their forecasts and raising a stock from BUY to STRONG BUY, or raising their estimated income from $1.25 a share to $1.35 a share, Zacks reports on this.

Another major feature of Zacks is their stock screener. It allows investors to filter and search for companies based on the return of investment, price changes, earnings per share, or your own investment style.

Zacks also offers interactive charts that show a stock’s reaction to earning reports and other fundamental data.

Seeking Alpha is the better platform if you want a complete quantitative analysis of diversity of viewpoints, analysis methods, and opinions.

Reading through several analysis articles takes more time than reading a single research report, but advanced investors can dive deeper into both the bull and bear cases for a stock.

This gives investors more tools to decide their strategy and grow their portfolio.

Seeking Alpha provides a stock screener that enables you to sort and search by financial ratios, analyst ratings, profitability, and many other fundamental and technical configurations.

This is my preferred method for researching stocks, which is why I’m a member of Seeking Alpha Premium.

Other Features

Both have education centers

- Zacks offers videos and courses on investment strategies. Zacks also has a complete guide on understanding the power of earnings estimates.

- Seeking Alpha offers numerous articles about the world of investing, portfolio management, and their quant ratings. If you are not much of a reader, they have investing podcasts and videos as well.

Seeking Alpha has news, and editors report on live coverage. It is a nice feature to have updated news on the stock market world and research your next stock pick all in one place.

Zacks provides an earnings calendar. It tells you which companies are releasing their earnings that specific day and what time of day they come out – before the market opens or after it closes.

Once the earnings report is released, it compares Zacks’ estimate to the actual results and the price change.

Each platform has a portfolio tracker. At Zacks, you will see their rankings of all the equities currently held and receive daily email notifications on the performance of your portfolio.

Same thing for Seeking Alpha, up-to-date notifications of your portfolio’s health.

Seeking Alpha vs Zacks: How Much Do They Cost?

Both keep their most sought-after features behind the paywall.

You can see Wall Street analyst ratings with Seeking Alpha, but to access their quant ratings and top-rated quant list, you have to subscribe to a Seeking Alpha premium account.

Zacks has free ranked lists which you can get in exchange for your email address. You can see what Zacks ranks stocks for free, but to get the Zacks #1 Stock List you have to be a premium member.

Zacks Premium $249, $20.75/month, 30-day free trial.

Seeking Alpha Premium $299/yr Save Save $30 and get a 7-day free trial on when you use this promo link.

Seeking Alpha Alpha Picks stock recommendations: $499 per year. If you are looking for 2 stock picks a month that have Seeking Alpha’s highest Quant Rating that have been vetted by their team of CFAs, Alpha Picks is the best choice.

Notably, Seeking Alpha’s 2022 Alpha Picks are by far the best performers, easily beating the Motley Fool’s and Zacks various services.

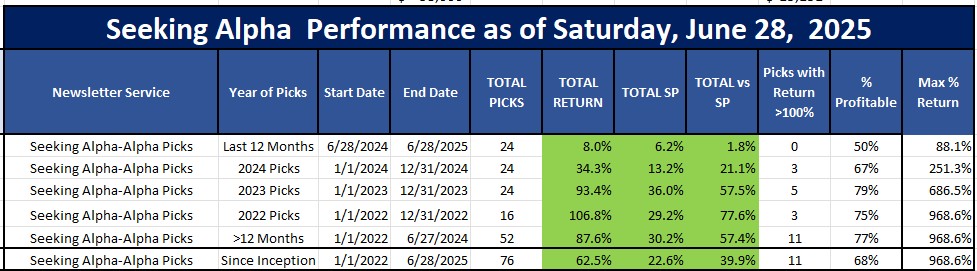

Here’s all the data on their picks:

- They had 16 picks (6 in July and then 2 each month thereafter) in 2022

- They made 24 picks in 2023

- They released 21 picks in 2024.

- They have released 11 picks so far in 2025.

- Of these 60+ stock picks, THEY ARE DEFINITELY GENERATING ALPHA as they, on average, are beating the S&P 500 by an average of over 47%

- More importantly, of their picks that are at least 12 months old, they are beating the S&P 500 by 55%, with 76% stocks being profitable

- Alpha Picks Update as of June 29, 2025: Since its launch in July, 2022, the 76 Alpha picks from 2022 thru 2024 are up an average of 63% and are easily beating the S&P500's return of 23% by 40%. But most impressively, their picks that are at least 12 months old are up 88% vs 30% for 58% ALPHA and 77% of those picks are profitable. Yes, these picks are tripling the SPY. Their November picks are already up 88% and 85%, June 2024 pick of SFM is already up 105%, their April, 2024 pick EAT is up 251%, their March pick RCL is up 140%. Oh yea, their November 2023 pick of APP is up 686%! See our full Seeking Alpha Picks Review for further analysis.

- They have sold 31 positions; so they are pretty quick to dump non-performers. TravelCenters (TA) was acquired in February 2023 for a 56.8% gain after they picked it in August 2022; they sold CVX with a 1% profit, COP with a 30% profit, NUE with a 60% profit, and both LTHM and HLIT with 32% losses. The others that were sold were all +/- 8%.

- Since inception, 73% of the stock picks have been profitable.

MOST IMPORTANTLY, their stock picks are easily beating all of The Motley Fool’s and Zacks’ services over the same time period:

THAT is exactly what you want from Alpha Picks. The longer you hold a stock the better it performs.

Remember, to get these results, you should try to buy equal dollar amounts of all the Seeking Alpha Alpha Picks stocks as they are released. Based on what I have seen so far, I will be buying about $1,000 of each of their picks as they come out.

As I mentioned, I am also a subscriber to the Motley Fool’s Stock Advisor and Rule Breakers. Alpha Picks’ return is the clear winner over the same time period.

If that is all you wanted to know about Seeking Alpha’s Alpha Picks subscription service and you want to give it a try, make sure you don’t pay full price. To save Save $50 and try Alpha Picks for a year, click the button below:

Save Save $50 Now and Get 12 Months of Alpha PicksEach has subscriptions greater than the Premium that comes with more features but costs a significant amount more. In my opinion, these two offerings are the best value for the money.

My Experience with Seeking Alpha and Zacks

Zacks

I like the lists they send via email, but don’t think I would ever browse the site.

The earnings calendar is helpful to keep up to date.

Try ZacksSeeking Alpha

I like the site and the platform, the customization of how I can look at the analysis. I’ve also found myself casually logging in to read interesting articles, news stories, and keep tabs in real-time on my portfolio.

It really feels like a “one-stop shop” for all my investing analysis needs, which is why I’ve been a user for the last 3 years.

Try Seeking AlphaComparison Bottom Line

Here’s the bottom line:

They use different methodologies.

Seeking Alpha

- Newer

- More tech, data, and AI-focused

- Crowdsourced analysts’ opinions

Zacks

- Older

- Focuses on more curation (ranked lists)

- In house analysts

- Fundamental analysis

- Monitor Wall Street earnings forecasts and focus on potential surprises

Seeking Alpha and Zacks offer a service to help investors find successful stocks. Their research and analysis are conducted by professionals. Their selections are proven and have outperformed the market. Both are great platforms, it just depends on your preferences.

More quant-focused investors may prefer Zacks, while quant- and fundamental-focused investors usually choose Seeking Alpha.

So which type of investor are you? How do you prefer to learn about your portfolio and analyze future investments?

It’s worth trying one or both, ESPECIALLY since they both have amazing, all-access free trials.

Get Seeking Alpha Premium Save $30 off for a Limited Time!

Get Zacks Premium FREE for 30 Days

To learn more about each one, see our Zacks Review and Seeking Alpha Review.

And to see how Seeking Alpha fares against other stock research companies, read Seeking Alpha vs TipRanks and Seeking Alpha vs Motley Fool.

For even more information on Seeking Alpha, check out our other Seeking Alpha Premium review!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.