As an investor, you have a nearly unlimited number of tools to assist in your investment research.

There are hundreds of websites that provide:

- Stock and mutual fund recommendations

- Market forecasts

- Charting tools

- Investment research

- Many other esoteric financial services

Each of these sources is unique in their own way, but which one is best for you?

Two of the most popular and affordable stock recommendation services are the Motley Fool and Seeking Alpha. In this article we will do a deep dive into these 2 services, comparing their products, subscriptions services, pricing and historical performance. Our Motley Fool vs Seeking Alpha comparison which will help you figure out which feature or service is best for you based on your investing skills and needs.

An Introduction to The Motley Fool and Seeking Alpha

These two platforms speak to investors in different ways.

The Motley Fool was founded in 1993 by brothers David and Tom Gardner with the aim to “make the world smarter, happier and richer.” They started out as their own newspaper, then became popular as an nationally syndicated investing column in many newspapers, and then launched Fool.com as their website for their news, analysis, and public chat blogs.

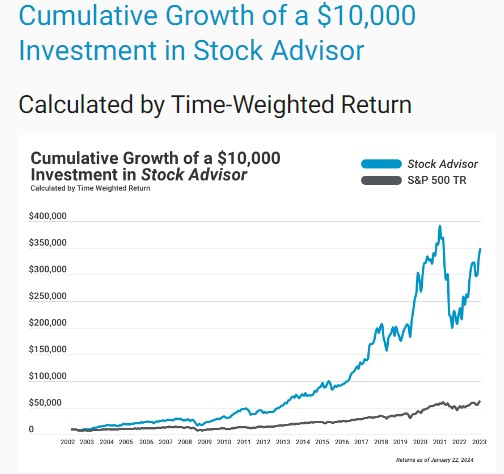

In 2002 they launched their first paid product, The Motley Fool Stock Advisor newsletter where they recommended 2 stock picks a months. This is their flagship product, and their stock picks have an average return of 500+% compared to the S&P500’s 130+% over these 20 years. On The Motley Fool website, users can still get free research and read their group blogs. They now offer over a dozen paid subscription stock picking services where investors receive their “expert” stock recommendations. Users still get free access to some analysis as well as additional educational resources, access to a community of like-minded investors, and a number of other tools to enhance your investing.

Seeking Alpha was launched in 2004 as a crowd-sourced service and they describe themselves as “the world’s largest investing community.” On Seeking Alpha, investors can read investment analysis provided by thousands of contributors plus gain access to Seeking Alpha’s proprietary grading system and Quant Ratings. Seeking Alpha also offers 2 premium services for a fee. They have Seeking Alpha Premium which gives you their Quant Rating on any stock, lets you synch your brokerage account so you can view YOUR stock portfolio’s Quant Ratings.

In July of 2022 they launched their second paid service called Alpha Picks (probably to compete with the Motley Fool’s Stock Advisor) that also recommends 2 stock picks a month. This service is also easily beating the market in its first 2 years as you will see.

While they both now offer investment research and stock pick services, the two services were built for very different types of investors. In this article, you’ll find out which one, Seeking Alpha or Motley Fool, is better for you.

At-A-Glance Comparison: Motley Fool vs. Seeking Alpha

| Motley Fool | Seeking Alpha | |

| Target Audience | Individual investors | Individual investors |

| Best For | New and intermediate investors | Advanced, analytical investors |

| Primary Services | Free stock research site; Stock Advisor | Free stock research site; Premium & Alpha Picks |

| Biggest Strengths | Outstanding performance of their stock picking newsletters | In-depth research and analysis (Quant Rating); stock picks newsletter off to a great start. |

| Discount | ||

| < Try Stock Advisor > | < Try Premium > |

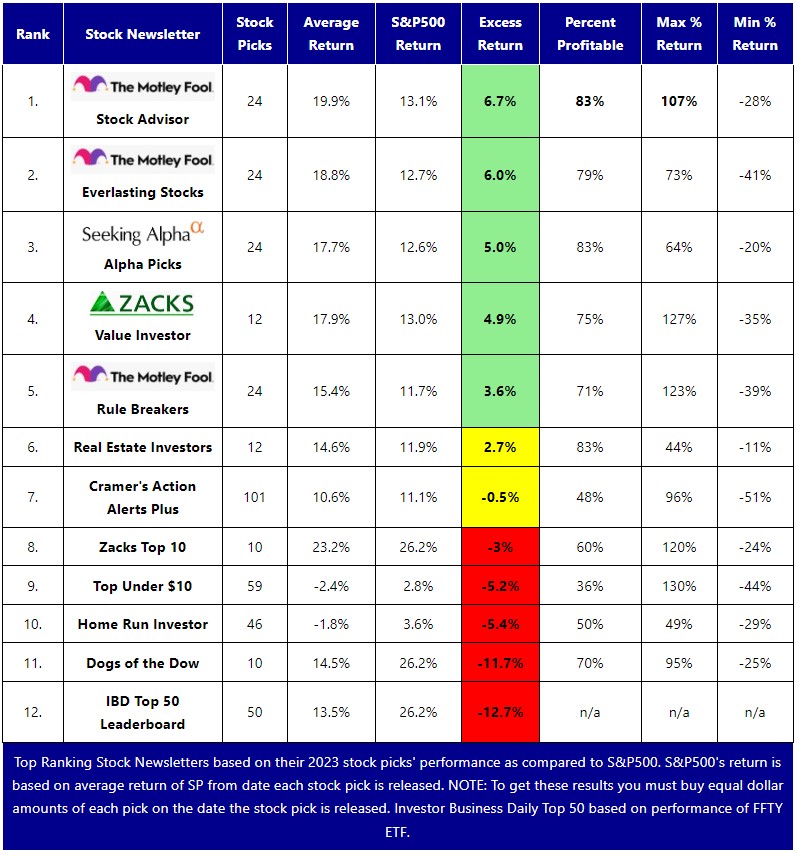

In terms of their performances for the calendar year 2023, you can see below in my analysis of the a dozen of the top stock pick services they both did very well.

Keep reading for an in-depth breakdown of each service and learn why I subscribe to both Motley Fool and Seeking Alpha’s Alpha Picks.

The Motley Fool

Brothers Tom and David Gardner founded The Motley Fool back in 1993.

Since then, the company has helped millions of investors invest better via their done-for-you stock recommendations services, website, educational content, and more.

The Motley Fool is for investors of any skill level.

Here’s a closer look at its most popular services.

Motley Fool Newsletter Services:

1. The Stock Advisor (SA)

The Motley Fool Stock Advisor is The Motley Fool’s flagship service. This stock-picking newsletter sends out emails the first 4 Thursdays each month. Over the course of a month, subscribers receive 2 stock picks and 2 lists of the Top 10 Stocks to Buy (these are often a re-analysis and a re-recommendation of previously picked stocks). And, occasionally the Motley Fool sends out emails advising you to sell one of their previous picks.

This service has over 500,000 subscribers, making it the most popular service of its kind. The retail price is $199 per year, but they frequently run discounts and promotions.

Why is it so popular? Outperformance.

Since its inception in 2002, the stock picks in the Motley Fool Stock Advisor have outperformed the S&P by nearly 4x:

Stock Advisor’s team of expert analysts sift through thousands of stocks each year to bring you only their highest-conviction investments each month. These picks, along with the accompanying analysis, are delivered straight to your inbox.

In addition to the stock picks, members receive:

- Top 10 Rankings – A list of the team’s 10 best stocks to buy now.

- Investment Articles – Curated content to increase your investing acumen and to help build your net worth.

- Online Community – Talk to and share ideas with fellow Stock Advisor members.

- Money-Back Guarantee – If Stock Advisor isn’t for you, cancel within 30 days and get your full membership fee back.

Stock Advisor typically costs $199/year, but new subscribers can get it for just $79 for the first year through this link:

Try Stock Advisor2. Rule Breakers (RB)

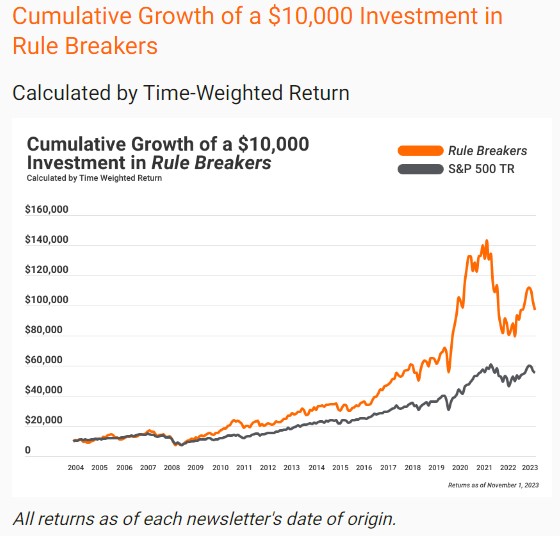

Rule Breakers is The Motley Fool’s 2nd most popular service.

Like Stock Advisor, Motley Fool’s Rule Breakers is a stock-picking newsletter which has a team of analysts that deliver 2 stocks per month and 2 Top 10 Stocks List straight to your inbox. This team, however, focuses exclusively on stocks with the potential to disrupt entire industries and become market leaders.

The performance of this newsletter is similarly impressive as Stock Advisor’s:

Former picks include MercadoLibre, Shopify, and Tesla.

Like Stock Advisor, members of Rule Breakers also receive expert analysis, a number of bonus reports, community access, and more. Plus, the service is backed by The Motley Fool’s membership-fee-back guarantee.

This service is slightly more expensive than Stock Advisor at $299/year; but it is currently on sale for $99 for new subscribers.

Try Rule Breakers3. Other

- Rule Your Retirement (RYR) – Rule Your Retirement was made for those investors nearing, or already, retired. The membership costs $149/year and includes model retirement portfolios and tips on Social Security.

- Motley Fool Options (OPT) – Are you looking for some alternatives? Motley Fool Options gives you access to Options University, weekly commentary, and investment recommendations. This service costs $999/year and is tailored to intermediate and advanced traders.

In addition to all of its service offerings, the Motley Fool also has advanced services tailored for very specific investors. These services range in price from $249/year to $4,999/year.

You can unlock all Motley Fool services with a subscription to ‘One’ for $13,999/year. A more popular bundle is the ‘Epic Bundle’ which includes access to Stock Advisor, Rule Breakers, Everlasting Stocks, and Real Estate Winners for just $499/year.

That said, Stock Advisor is by far the most popular service The Motley Fool has to offer.

Why Moby May Be the Next Motley Fool…

Motley Fool has had the best run historically…

Moby is looking like the new age Motley Fool (beating the S&P 500 by 8.3% over the last 3 years)

Read our Moby review & see why we think this might be the next Motley Fool.

Seeking Alpha

Seeking Alpha was founded in 2004.

Its founders liked reading Wall Street analysts’ perspectives on individual investments but realized there was a massive gap in coverage – there weren’t nearly enough analysts to cover every angle on every stock. Plus, most of these Wall Street reports weren’t available to retail investors.

So they launched Seeking Alpha.

Today, more than 18,000 analysts produce over 10,000 investment research articles each month on 7,000+ securities for the Seeking Alpha website. The breadth of analysis on Seeking Alpha is unparalleled making it a favorite for advanced investors.

Coupled with its contributors’ investment analysis, Seeking Alpha provides aggregated Ratings of its contributors, Wall Street, and its proprietary Quant Rankings for every stock:

Seeking Alpha’s Quant Rating

Seeking Alpha’s Quant Rating is based on an algorithm which considers each stock’s profitability, growth, value, EPS revisions, and momentum vs its peers. These attributes earn a stock a grade from ‘Strong Sell’ to ‘Strong Buy.’

Here’s how that system has performed:

That’s pretty impressive! This is saying a $10,000 investment in Seeking Alpha’s Strong Buy rated stocks over a 13 year period would have outperformed the S&P500 $198k to 42k. Plus, Seeking Alpha provides fundamental data, charting, newsfeeds, and other market data. That’s why more than 20 million people use Seeking Alpha every month.

All of these features can be overwhelming for new investors but are loved by Seeking Alpha’s target market: intermediate and advanced investors.

While you can access a handful of articles for free each month, most users quickly bump into a paywall to upgrade after viewing a certain number of articles or attempting to access its Ratings or Quant Rankings data.

Seeking Alpha Services

1. Seeking Alpha Premium

For unlimited access to premium content which includes:

- All new and archived investment articles and news

- Analyst Ratings, Wall Street Ratings, and Quant Ratings

- Analyst Performance

- Stock Grades

- And a number of other features

Investors need to upgrade to Seeking Alpha Premium if they want to do their own research on stocks.

The service typically costs $239/year, but you can take $50 off and get a free week trial with our link:

Try Seeking Alpha Premium2. Seeking Alpha Pro

Seeking Alpha Pro gives you everything in Premium plus expert-selected analysis, peer networking, small cap research, short opportunities, VIP customer service, and a higher tier of professional investing. It is really aimed at professional investors.

Additionally, Pro members unlock Seeking Alpha’s Top Ideas, 4-6 actionable ideas per day to help you pinpoint under-the-radar investing opportunities.

This service costs $2,400/year, or $200/month:

I’ve never tried Pro, but I’m very content with my Seeking Alpha Premium subscription and believe it’s an excellent money-for-value service.

3. Alpha Picks

In July 2022 Seeking Alpha launched Alpha Picks as their stock picking service to compete with Motley Fool’s Stock Advisor.

Alpha Picks is a stock-picking newsletter which is primarily focused on quantitative analysis and momentum. The investment team which runs the service uses the Quant Rating system plus a number of other filters to find stocks with the potential to outperform.

With Alpha Picks, you receive 2 stock picks a month, representing their highest Quant Rating stocks.

Since its launch, Alpha Picks has proven to be an excellent source of stock picks. Take a look at my analysis since I have been a subscriber from the very beginning of this service.

As you can see, their 2022 picks really did well.

I have so much confidence in this service I started buying about $1,500 of all of their picks. Take a look at the $1,000 profit I have on these picks. These are screenshots of my ETrade account.

Seeking Alpha’s Alpha Picks is normally $199 a year. But you can get a special introductory offer ($99 for your first year) through our link:

Try Alpha Picks for $99 a yearSummary: Seeking Alpha vs Motley Fool

The Similarities

Both Motley Fool and Seeking Alpha are investment research services to help you make better investing decisions. They both primarily target long-term investors who want to invest in individual stocks.

Neither of them are for day traders or swing traders.

Additionally, both Motley Fool and Seeking Alpha’s Quant Ratings have delivered exceptional historical results. Alpha Picks has also generated impressive returns, though the service is relatively new.

The Differences

While on the surface Motley Fool and Seeking Alpha may seem similar, they’re two very different services.

Motley Fool is focused on stock-picking newsletters, a great service for new investors or those looking for a done-for-you investing service. And they have done very well over the last 20 years.

Seeking Alpha, on the other hand, has taken a rigorous quantitative approach to stock research and is jam-packed with in-depth investment analysis written for intermediate investors who want to take a hands-on approach to their investing.

Seeking Alpha Premium is for those that want to get expert analysis on the stocks in their portfolio and be alerted when the ratings change. Seeking Alpha’s Alpha Picks is for those investors that want to take the stress out of investing and just get 2 excellent stock picks each month.

Alpha Picks and Stock Advisor are very similar services, but Alpha Picks is primarily focused on quantitative analysis and momentum whereas Stock Advisor’s team relies more heavily on fundamental analysis. Personally, given the length of Stock Advisor’s track record and the impressive results of Alpha Picks, I subscribe to both!

The Bottom Line: Is Motley Fool or Seeking Alpha Better For You?

If you want a team of experts, which has delivered exceptional returns for the last 20+ years, to send you 2 stock picks per month to add to your portfolio and no additional work required on your end, The Motley Fool has the 20 year track record (more specifically, its Stock Advisor newsletter). If you want the more quantitative stock picking service which seems to get better, faster returns, then Alpha Picks is off to a great start.

If you want to make all of your own investment decisions but want a nearly unlimited amount of research analysis to help guide those decisions at your fingertips, Seeking Alpha is the service for you (more specifically, Seeking Alpha Premium).

And if you can’t decide, you can just do what I do and subscribe to both.