Acorns is a robo-advisor platform that lets you round up your everyday purchases and invest your spare change.

Today, we will be talking specifically about the Acorns app and how it can help enhance your Acorns experience even further. If you want to compare Acorns to a popular competitor Stash in 2025, check out: ACORNS VS STASH: WHICH INVESTMENT PLATFORM IS BETTER?

What Is Acorns?

Acorns is a popular robo-advisor that has made a name for itself in the investing world through its application of a simple but powerful investing tool: round-ups.

Acorns tracks the purchases you make in your everyday life and automatically rounds up the charge to the nearest dollar.

They take the extra change from the roundup and invests it for you in a portfolio that’s suited to your financial profile and investing needs.

Did you just buy your morning cup of coffee for $5.25? Congratulations, you’ve just invested 75 cents!

Acorns uses its platform to help its customers capitalize on the magical effects of compound growth.

If you can make tiny contributions to your investment accounts every day, your invested money will start earning more money.

Then, the money you originally invested plus your gains will continue to grow, creating an exponential growth effect.

Current Promotion: Create Your Account Today & Get a $20 Bonus!

You can set up your account and recurring investments here (in under 3 minutes), and then your $20 BONUS will be deposited into your account!

Acorns makes taking advantage of the compounding effect simple and hands-off!

It must be doing pretty well for itself, because it’s looking to go public in the near future.

Read our full review on investing with Acorns for an up-to-date, Acorns review 2023.

But for now, let’s get into the specifics of the Acorns mobile app.

Customer Service:

Phone at (855)739-2859 M-F 5:00:7:00 PST

Email at support@acorns.com

ACORNS SUMMARY

What You Get:

- Brokerage, Retirement, and Custodial Accounts

- Checking Account with Metal Debit Card

- Earn Rewards for Shopping Online

The Acorns Appeal:

- Round-Ups Let You Build Your Portfolio Through Everyday Transactions

- Acorns Earn Can Help You Find a New Job

Acorns Pricing:

- Acorns Personal Costs $3 per Month

- Acorns Family Costs $5 per Month

What Can I Find on the Acorns App?

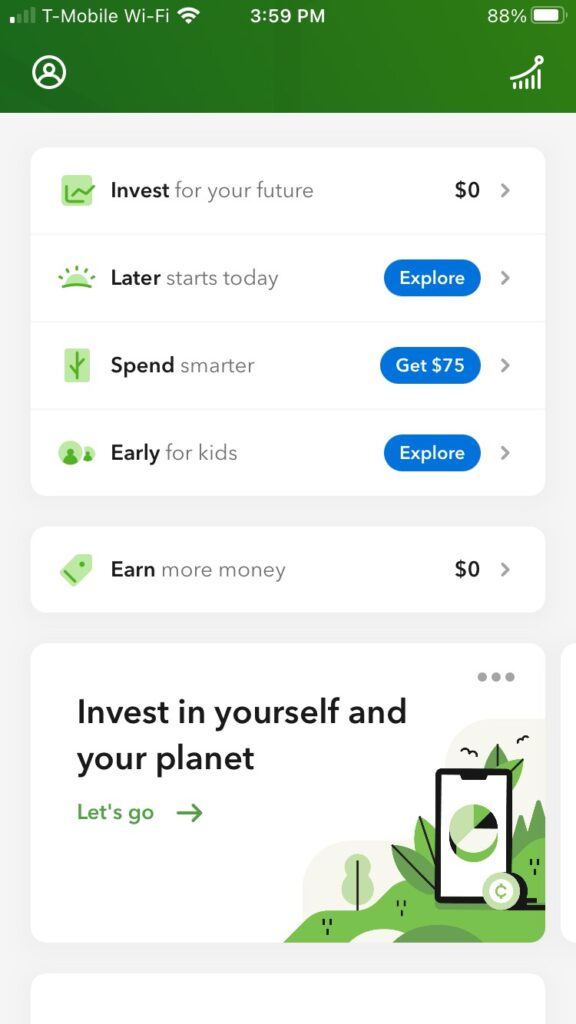

The homepage of the Acorns app gives you easy access to the following sections of the platform:

Invest, where you can make one-time deposits to your investment account, manage your round-ups, make withdrawals, change your portfolio type, see graphs of your performance, and more. The Acorns Invest account is a traditional brokerage account with some added features.

Later, where you can create and manage an IRA and start preparing your finances for retirement. Your retirement account can be one of several types.

Banking, where you can sign up to get a metal debit card for your checking account that automatically manages your round-ups as well as set a certain amount of your paycheck to be invested every payday. This serves as a sort of cash management account.

Early, where you can open UTMA / UGMA accounts for your children and other family members in order to prepare them for their own financial futures. An investment account for kids is a huge plus, and pretty rare among modern investing platforms.

Current Promotion: Create Your Account Today & Get a $20 Bonus!

You can set up your account and recurring investments here (in under 3 minutes), and then your $20 BONUS will be deposited into your account!

Earn, where you can earn bonus investments for shopping with Acorns’ partner companies as well as look for job openings in your area. Earn is available to anyone with an Acorns account.

At the moment, Acorns does not offer tax loss harvesting services.

Under the main dashboard of the Acorns app, you will find a section titled “Grow Your Knowledge.”

This educational section serves to set Acorns investors up for success in their financial journeys as well as answer basic questions you might have about the investing account, such as how the round-ups feature works and why Acorns put you in your specific portfolio.

If you’re looking for financial education, the Grow Your Knowledge section has tons of articles in categories such as retirement, borrowing, investing during the pandemic, and much more.

If you have questions about Acorns specifically, you will be brought to the Frequently Asked Questions section where you can find all the answers you need.

The Acorns app also gives you quick access to the new Sustainable Portfolios feature.

Sustainable Portfolios is Acorns’ collection of ESG portfolios.

If you’re not familiar with ESG investing, it stands for environmental, social, and governance.

ESG investing is a way for investors to make a conscious effort to invest only in companies and funds that are dedicated to making a positive impact on the world.

This could include investing in companies that work to reduce their carbon footprint, companies that are dedicated to diversity in the workplace, and companies that adhere to the highest accounting and shareholder standards.

Current Promotion: Create Your Account Today & Get a $20 Bonus!

You can set up your account and recurring investments here (in under 3 minutes), and then your $20 BONUS will be deposited into your account!

You can use the Acorns app to easily change your investment portfolio from Core to Sustainable Portfolios.

The portfolios in the Sustainable Portfolios feature are designed to perform just as well as the Core portfolios.

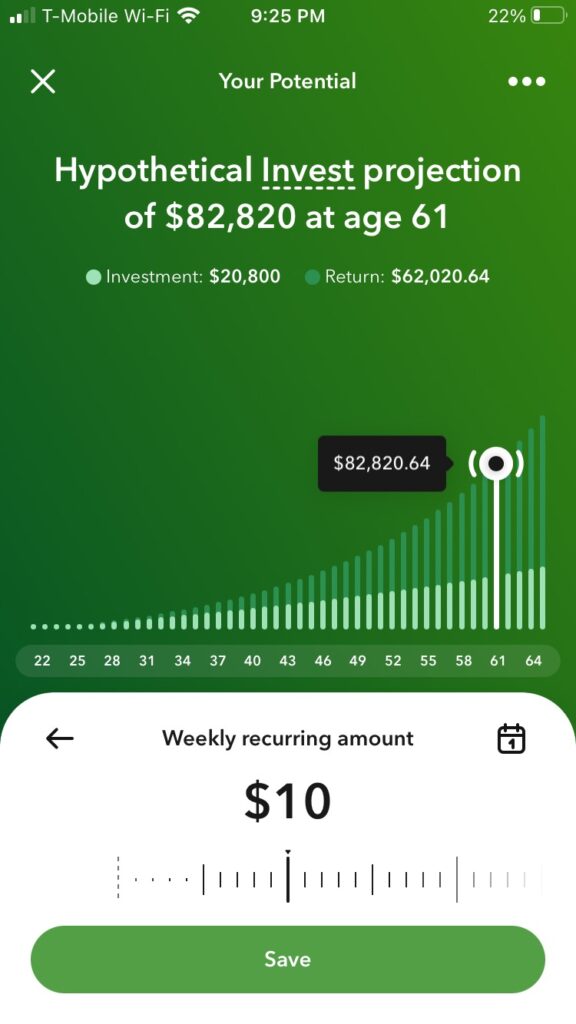

In the top-right corner of the app’s home screen, you will see an icon that will bring you to the app’s useful Hypothetical Invest Projection tool.

This tool is essentially a calculator that can give you an estimate for how your investments will perform.

You can choose a hypothetical recurring investment amount that you would deposit daily, weekly, or monthly, and the tool will tell you how much you will have at retirement based on a 6% annualized return.

Likewise, you can also see how your investments from the round-up feature might perform in the long term.

If you have linked a card to your account, the Acorns app will analyze your spending habits with this card and tell you how much money you are likely to make if you keep using that particular card the way you’ve been using it.

This is a nifty tool that can help you keep your morale high and your eyes on the prize as you look forward to withdrawing your money in retirement!

If you only have a little money to invest, a robo-advisor like Acorns can be a great way to watch your money grow over time.

Check out our article on How to Invest with Little Money!

Is the Acorns App Easy to Use?

Using the Acorns app isn’t just easy, it’s fun.

Acorns truly has done a great job with their brand design and user interface; the app looks sleek, simple, and inviting.

With only a few different sections on each page, the app is never overwhelming or complicated, and it’s easy to figure out exactly where you need to go.

As far as we’re concerned, there haven’t been any issues with bugs or glitches in the app, either.

How Much Does It Cost to Use the Acorns App?

The good news is that it doesn’t cost you any extra to use the Acorns app.

As long as you already have an investment account, you’re good to go!

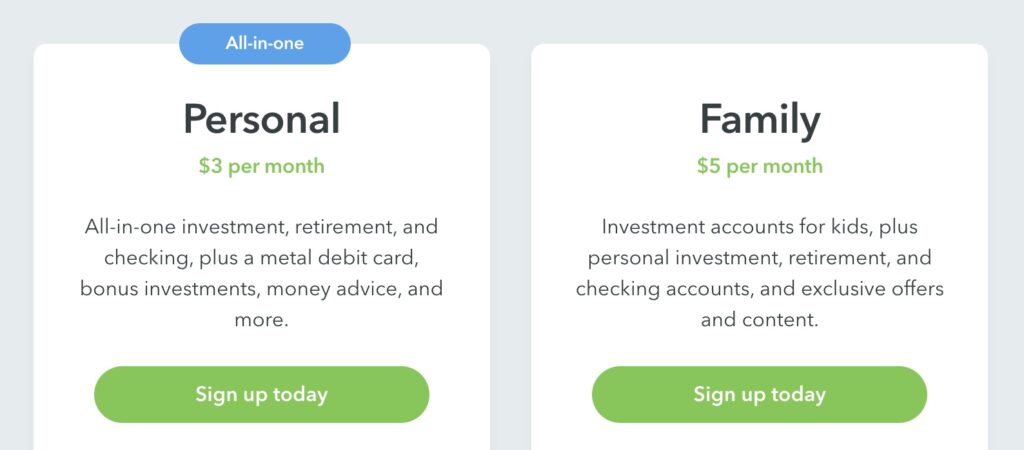

Here are the prices for each of Acorns’ two different plans:

Personal

costs $3 per month and gives you access to Invest, Later, and Banking.

Family

costs $5 per month and gives you access to Invest, Later, Banking, and Early.

Final Thoughts

While Acorns is already a phenomenal platform by itself, its mobile app only serves to improve the Acorns experience. It’s a great way to see your investment accounts, checking account, and more in the same place.

With quick, on-the-go access to your investment accounts, round-up information, retirement accounts, UTMA / UGMA accounts, and checking account, the Acorns app provides a valuable mobile experience for its customers who prefer to bank and invest from their phones.

So do your bank account a favor and put those everyday purchases to good use!

If you want to learn about another app that has plenty of financial tools for families, read our Greenlight review.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.