Choosing between TipRanks vs Motley Fool pivots on your investment style: are you data-driven or in pursuit of curated stock picks for long-term gains?

This no-fluff comparison delves into the strengths of TipRanks’ analyst ratings and Motley Fool’s expert selections to guide your decision, scrutinizing their performance records and how they match your investing needs.

Key Takeaways

- TipRanks offers a data-driven approach with a proprietary ranking system and Smart Score for stock analysis, while Motley Fool focuses on strategic long-term investments with expert stock recommendations and educational resources.

- Motley Fool’s Stock Advisor service boasts a historical performance with significant market outperformance, while TipRanks’ predictive analyses provide a quantitative insight into stock market fundamentals and potential.

- Both platforms provide a variety of tools and resources designed to empower investors, with TipRanks catering to investors who conduct their own technical analysis and Motley Fool providing in-depth educational content and forums for collaborative learning.

TipRanks vs Motley Fool: Unveiling the Investment Platforms

Choosing an investment platform can often be as critical as making the investments themselves. TipRanks and Motley Fool stand out as beacons for investors, each with its unique set of features, specialties, and a proven track record.

TipRanks, known for its robust data-driven resources, offers an unrivaled lens into the performance of financial professionals. Motley Fool, on the other hand, takes a more strategic approach, with a focus on comprehensive market analysis and long-term performance. These platforms cater to investors who yearn for depth and reliability in research while seeking to navigate the complex financial markets with confidence.

What Is TipRanks?

TipRanks was founded in 2012 by Uri Gruenbaum and Gilad Gat, with the help of a finance professor at Cornell University named Roni Michaely.

The Tel Aviv-based financial technology company launched its first major service in 2013, something it called the Financial Accountability Engine.

The Engine is a pseudo-A.I. designed to utilize machine learning and natural language processing to scan and analyze analyst ratings, corporate filings submitted to the SEC, financial news websites, and whatever other information it can get its digital hands on.

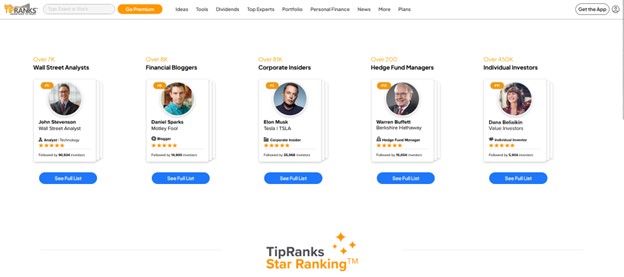

It crunches all the numbers and parses all the information it can to monitor and rank the performance of investors, financial bloggers, corporate insiders, financial advisors, hedge fund managers, and a whole range of other experts – making it easier for TipRanks users to find out which experts are worth listening to and which ones are full of it.

A Glimpse into TipRanks’ Offerings

With its proprietary ranking system, TipRanks upholds transparency in the financial universe. It rates financial analysts using a formula that considers a multitude of factors, including success rate and average return per transaction. The shining star of their offerings is the Smart Score—a quantitative system that evaluates stocks on a scale from one to ten, integrating eight distinct market factors to predict performance.

This objective, data-driven method compiles insights from financial bloggers, analyst ratings, and news sentiment, providing a comprehensive stock analysis and a view of a stock’s potential based on stock market fundamentals. By utilizing stock research, investors can make informed decisions in the stock market.

Pro Tip: TipRanks gives you access to the investment strategies of stock experts, top Wall Street analysts, and even corporate insiders. You can follow your favorite experts, see if they’re beating the S&P 500, and copy their trades for yourself. You can sign up for TipRanks Premium for less than $1 per day, PLUS a 30-day money-back guarantee.

What is The Motley Fool?

The Motley Fool was founded in 1993 by David and Tom Gardner. The brothers wanted to make investing and building wealth more accessible to everyone.

3 decades later, The Motley Fool has helped millions of people reach their financial goals through their premium investing services, financial education, blog articles, podcasts, and online investing communities.

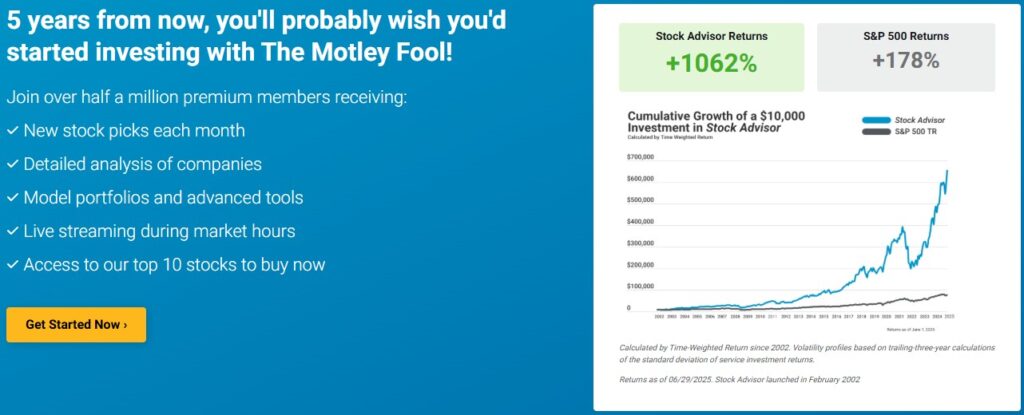

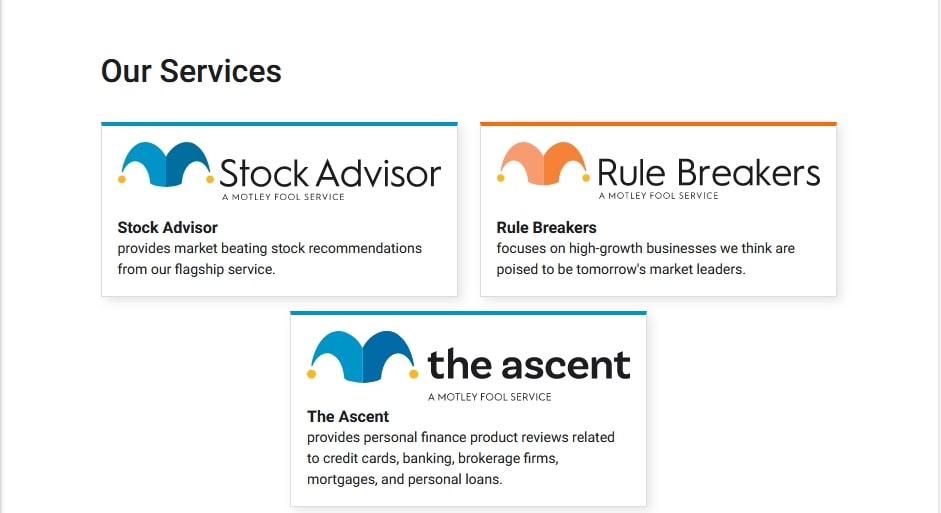

Its flagship service is Stock Advisor, a stock-picking newsletter service which delivers 2 new stock picks and accompanying research each month. Stock Advisor has more than 500,000 subscribers worldwide, including me.

Exploring Motley Fool’s Stock Advisor Service

The Motley Fool’s Stock Advisor service, also known as the Motley Fool Stock Advisor, offers:

- Expert stock recommendations aimed at substantial, sustained growth

- Two handpicked stock picks each month

- Access to a portfolio allocation tool

- Ongoing support including a live market hour stream

This service guides investors in making informed investment decisions, embarking on long-term investment journeys, and provides a treasure trove of investment education resources.

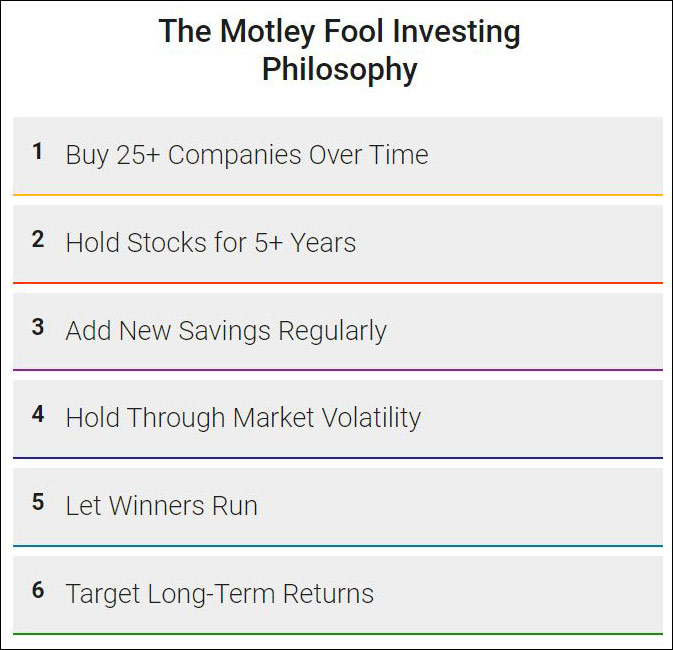

The Motley Fool says this is the key to using their services:

The Stock Advisor service demonstrates The Motley Fool’s commitment to providing its members with the tools for building profitable investment portfolios.

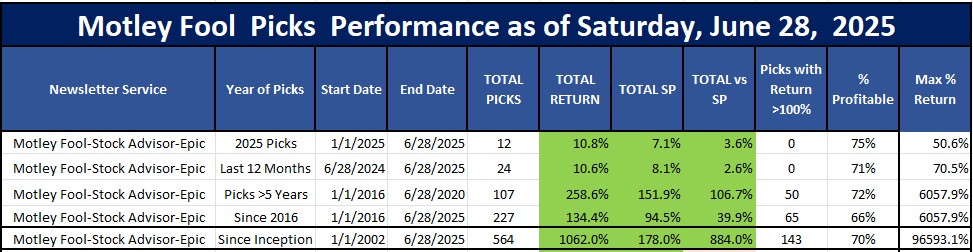

Here are the Motley Fool results we have been tracking since 2016…

My Experience with the Motley Fool Stock Advisor Picks Since I Subscribed in 2016.

Here's a summary of the performance of Stock Advisor since I subscribed in January 2016. I was so impressed with their performance that I started buying $1,000 to $2,000 in my Etrade account. I quickly learned to put a 30% stop loss on these picks in case they do pick a big loser. You can see how their picks have performed for the 2025, the last 12 months, and the last 8 years. Notice those picks that are older than 5 years since I subscribed are up 258% and are beating the market by an average of 107%.

See what you missed out on by not signing up a few years ago when I did? You would be up 134%, beating the market by 40% and you would have bought NVDA in 2017!.That means if you had just bought $100 of each of their 227 stocks your $22,700 would have a profit of $30,418. Seems to justify the $99-199 per year price, right? Seems like a no brainer based on this track record.

That’s quite impressive that their 2024 and 2023 picks are easily beating the market over such a short term. But more importantly their stocks picks that are over 5 years old are doing EXTREMELY WELL. So, like the Motley Fool recommends, buy equal dollar amounts of all their stock picks and plan on holding for at least 5 years and you should easily beat the market.

The Motley Fool is currently offering 50% off for new subscribers.

Save $100 on this page & get 1 year for only $99. Don’t miss out on their next pick.

Remember: They have 30 day money back guarantee.

Analyzing Stock Picking Services: Precision vs. Performance

Investors often grapple with the accuracy of stock picking methodologies and the historical performance of those picks. Both Motley Fool and TipRanks have carved out niches in this arena, but they differ significantly in their approach.

The Stock Advisor service from Motley Fool pledges allegiance to long-term growth and has a storied past of outstripping market performance. TipRanks, while not as forthcoming about its stock picking methodology, offers predictive insights through its Smart Score system.

Stock Advisor’s Track Record

The Stock Advisor service boasts impressive achievements, including a staggering 900+% return since its launch in February 2002, underscoring its prowess. This resounding success is not a flash in the pan; Motley Fool’s stock picks have consistently outperformed the market, averaging a 900+% return over the past 22 years.

This exceptional performance results from a long-term investment strategy exploiting the power of compounding and emotional resilience to short-term market fluctuations.

The Predictive Edge of TipRanks

TipRanks’ Smart Score system offers investors a comprehensive, data-driven analysis of stocks’ performance potential, serving as a predictive tool. This system garners its foresight from a confluence of eight key metrics, ensuring a well-rounded and unbiased predictive score.

The Smart Score system’s objective approach eliminates human bias, and stocks with a score of 8 to 10 signal a higher probability of market outperformance.

Research Tools and Educational Resources: Empowering Investors

In pursuit of investment mastery, the quality of a platform’s research tools and educational resources can make a significant difference. TipRanks and Motley Fool each offer a treasure trove of tools and knowledge designed to empower investors to make informed decisions. Whether it’s delving into the intricacies of the stock market or enhancing one’s financial literacy, these platforms serve as bastions of knowledge for individual investors.

Technical Analysis Tools on TipRanks

TipRanks provides a suite of stock trading tools, ideal for active traders who thrive on monitoring the market’s pulse. Within the Technical Analysis tab, a cornucopia of indicators like RSI and MACD await, ready to serve those seeking to decipher market trends. These tools do not just cater to the technically savvy; they offer summary signals that amalgamate various indicators, translating complex data into straightforward ‘Strong Sell’ to ‘Strong Buy’ signals.

Motley Fool’s Wealth of Knowledge

In addition to stock picks, The Motley Fool promotes financial literacy with a wealth of educational resources. Investors can explore a spectrum of topics from the fundamentals of long-term investment methodologies to the finer points of economic theories.

The platform’s guide on personal finance is a compass for navigating credit, debt, and brokerage accounts, offering a holistic approach to financial well-being.

Community and Expert Insight: Navigating the Market Together

The collective wisdom of a community, coupled with expert market insights, can light the path to successful investment. Both TipRanks and Motley Fool appreciate the value of engagement and discourse, fostering environments where investors can share experiences, learn from one another, and gain clarity in their decision-making processes.

TipRanks’ Financial Bloggers and Analysts

On TipRanks, the combined insights of financial bloggers and analysts reverberate in the realm of market sentiment analysis. This platform harnesses their insights, providing a multifaceted view that informs the analyses and rankings pivotal for short-term traders.

The Motley Fool’s Investor Education Forums

The Motley Fool’s investor education forums provide a platform for the exchange and discussion of investment strategies and insights. From personal finance to retirement planning, these forums offer a rich soil for financial knowledge to take root and flourish. Investors can join clubs and delve into specialized subcategories, fostering a collaborative environment for learning and stock analysis.

Subscription Costs and Value Propositions

It’s imperative to understand the structure of subscription costs and their associated value when choosing an investment advice platform.

TipRanks and Motley Fool each have their unique pricing strategies, designed to cater to a range of investor needs and preferences.

Decoding TipRanks’ Pricing Plans

TipRanks presents a range of pricing plans, starting from the free Basic plan and extending to the feature-packed Ultimate plan. The Premium plan, for instance, unlocks advanced capabilities at $29.95 per month, billed annually, offering a middle ground for those seeking more than the basics but less than the ultimate toolkit.

Weighing the Worth of Motley Fool Subscriptions

The Motley Fool presents its Stock Advisor service at an annual fee of $199, giving subscribers a clear price point for its premium stock recommendations. For those seeking more comprehensive services, The Motley Fool offers a range of additional subscriptions, each with its focus and price tag, such as the Motley Fool Epic service for $499 a year.

Investment Styles and Platform Suitability

The compatibility of an investment platform heavily depends on an investor’s individual style and preferences. Whether one is a long-term investor seeking stability or an active trader desiring real-time data, TipRanks and Motley Fool offer distinct advantages to different types of investors.

Short-Term Trading vs. Long-Term Investing

Motley Fool’s long-term investment strategy contrasts with TipRanks, which provides a versatile range of tools supporting various investment horizons, including rapid, data-driven decisions for short-term trading.

DIY Research vs. Guided Stock Picks

The dichotomy between conducting one’s own research versus relying on guided stock picks defines the core difference between TipRanks and Motley Fool. TipRanks caters to the former with its comprehensive tools, while Motley Fool simplifies the investment process for the latter with its vetted stock picks.

Alternatives to Consider: Expanding Your Research Horizons

Alternative platforms like Seeking Alpha and Zacks Investment Research, which are examples of stock research websites, also surface, each bringing unique offerings to the table. These platforms provide investors with additional perspectives and tools, enriching their investment analysis and expanding their research horizons.

Summary

As we draw the curtains on this exploration, it’s clear that both TipRanks and Motley Fool offer valuable insights and tools, each tailored to different investment styles and needs. Whether you’re captivated by the data-driven analytics of TipRanks or the comprehensive stock recommendations of Motley Fool, these platforms can serve as your financial compass, guiding you towards informed investment decisions that resonate with your personal investment philosophy.

Frequently Asked Questions

Is Tipranks worth it?

It’s worth considering TipRanks, especially if you’re an active investor or if you want to delve into individual stock selections. The Premium plan, at $30 per month, can provide valuable information for making well-informed decisions. Go here to get the Best Tipranks Discount and Promo Codes.

What is the best stock advice website?

The best stock advice websites include Motley Fool Stock Advisor, Seeking Alpha, and Moby. These platforms offer in-depth stock analysis and investing research to help you make informed decisions.

Moby is a newcomer in the space, and currently showing signs of the hottest picks on the market. Read more on how Moby’s stock picking app might the next best stock advice on the market!

What’s better than Motley Fool?

While Motley Fool is a reputable source, some alternatives worth considering are Moby, Zacks, or even Morningstar, each offering different focuses and services in the investment field. Consider exploring these options to find the best fit for your needs.

What does the Motley Fool’s Stock Advisor service include?

The Motley Fool’s Stock Advisor service includes monthly stock recommendations, portfolio allocation tools, and ongoing coverage of prior recommendations, emphasizing long-term investment strategies.