We all want to believe that we’re stock gurus whose every pick will result in triple-digit returns. The fact is that the overwhelming majority of investors, as well as mutual funds, fail to beat the market. While we can study financial reports across SEC filings, follow economic trends, and analyze charts, most of us don’t beat the market or don’t even have the time to try.

So instead, we look for help. Seeking Alpha and TipRanks are two very popular services that claim to offer above average guidance, so let’s see how these two services compare and find out which is better.

Here is the first clue:

Academic Research Now Validates Seeking Alpha’s Quant Rating: On April 19, 2024 an independent study was released by professors at a major university regarding Seeking Alpha. It found, much like my returns below, that Seeking Alpha Quant Ratings “strongly predict” future returns and offer “pronounced benefits” to investors. (more on this later…)

Dr. Jame and Ph.D. Candidate Yuling Guo from the Gatton College of Business and Economics at the University of Kentucky

There seem to be as many websites and services that provide stock research and analysis as there are stocks in the market.

Each investing tool has their own unique features, specialties, and track record of historical success. Finding the right tool or service that works for you and gives good returns for your portfolio can be challenging.

We can’t talk about all the services available, so let’s concentrate on two popular portfolio management tools in today’s market.

Act Today; Offer Ends Soon

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They are currently offering a big discount that only runs for a limited time.

Here's you chance to get free trial, save 10% AND get their Top Stocks for the 2nd Half of 2025 report.

- 7 Day Free Trail & Save $30 on Seeking Alpha Premium; usually

$299now only $269/year — Learn more.- Save $50 on Alpha Picks; usually

$499now only $449/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

Seeking Alpha and TipRanks Comparison

Seeking Alpha and TipRanks are both top stock research and analysis platforms that investors can use today.

Seeking Alpha offers two premium services and TipRanks just one. Here is a quick summary of their services:

| Seeking Alpha Premium | Alpha Picks | TipRanks Premium | |

| Overall Rating: | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

| Service Type & Strengths: | Full access to all their research; link your brokerage account to get Quant Ratings on all your stocks and alerts of when to sell. Quant Rating now endorsed by academic study. | 2 stock picks a month that have their highest Quant Rating; so far extremely accurate and profitable; results verified. | Includes full access to research and SmartScore picks |

| Best for: | Self-directed investors who want to take the guesswork out of investing. | Investors looking for specific stock recommendations each month | Both |

| Performance Claim: | “Strong Buy” rated stocks have average return of 26% over the last 14 years easily beating the market’s 11%; Strong Sell stocks drastically underperform market. | Since launch in 2022, their picks are beating the market by 47%; 11 picks have already doubled. | Top “Smart Score” stocks have an average return of 17%, which is beating the market since 2016. |

| Retail Cost: | $299 a year | $499 a year | $359 a year |

| Current Promotion & Link: | July, 2025 July, 2025 Sale: Save $30, get 7-day free trial & get next Alpha Pick for free. Subscribe today to take advantage of this sale. | July, 2025 Save $50 on Alpha Picks on THIS promo page. | July, 2025 Sale: Save 40% your first year: only $214; 30 day money-back guarantee |

They both offer some information and analysis for free, and they both have some premium (paid) content and subscriptions.

Seeking Alpha offers 2 services:

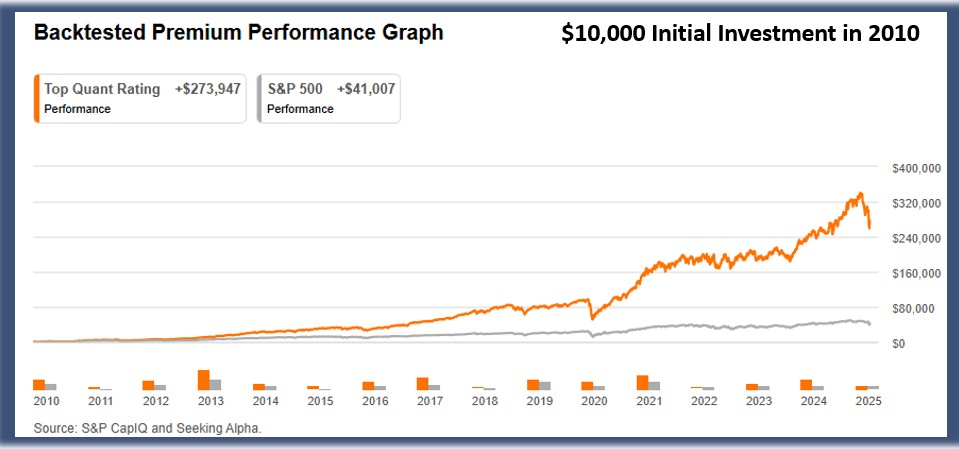

- Seeking Alpha Premium, which allows you access to their Quant Rating and allows you to synch your stock portfolio so you can monitor the Quant Ratings and alerts on your portfolio. Seeking Alpha’s marketing literature claims that their Quant Ranting, when back tested to 2010, has an average annual return of 26%. That return, when compounded over 14 years results in a portfolio that is 400% over the S&P 500.

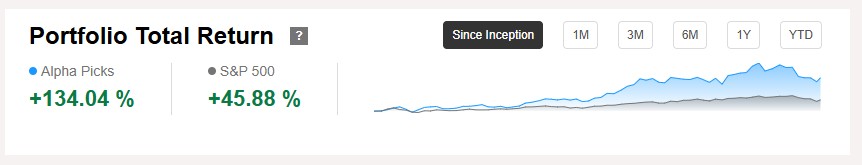

- Alpha Picks, which is their stock recommendation service giving you 2 stock picks a month of their highest Quant Rated stocks. This service is, as you will see, truly beating the S&P 500 by about 3x and has truly provided alpha after the first 2 years.

To compare the two, read our Seeking Alpha Picks vs Premium article.

TipRanks Premium includes lots of features, but its most popular are:

- TipRanks Premium, which allows you access to their Top Top Smart Score Stocks and Top Analysts Stock Picks and Top Insider Stocks. TipRanks marketing literature claims that their Top Smart Score stocks, when back tested to 2016, has an average annual return of 17.2%. That’s 60% over the S&P 500.

- Smart Investor, which is their stock recommendation service with a model portfolio of 25-35 stocks giving you about 2 buy and sell recommendations per month. I have been tracking these stocks going back to 2022 and they are not beating the market.

But which one of them is worth purchasing for investment decisions, and trying to maintain an advantage over Wall Street analysts? Let’s find out.

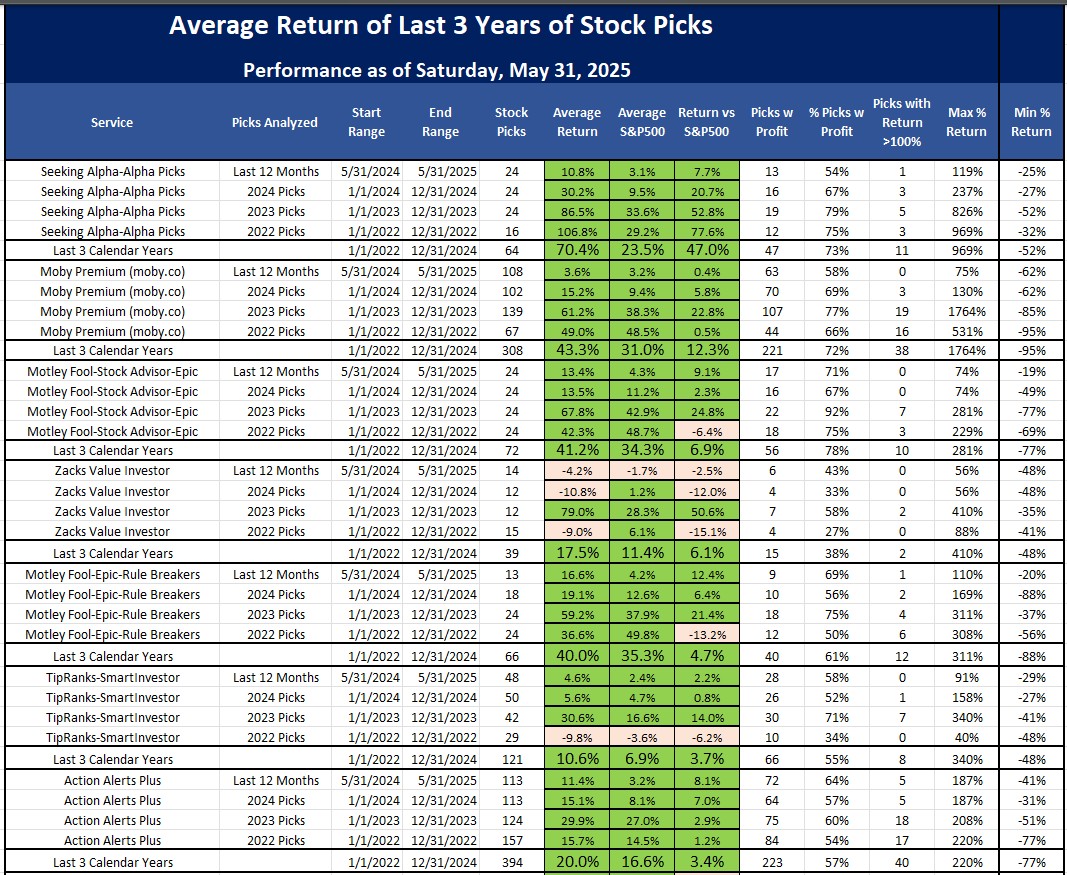

If you are just interested in the stock picks from the 2 stock recommendation services, here’s a little teaser showing the performance of over a dozen stock newsletters and their last 3 years of performance.

You can clearly see that Seeking Alpha’s Alpha Picks is crushing all the others in terms of Average Return, Percent Profitable, Max Return and Min Return.

TipRanks’ SmartInvestor had a good 2023 where those picks beat the S&P by 11%, but 2022 and 2024 picks have struggled.

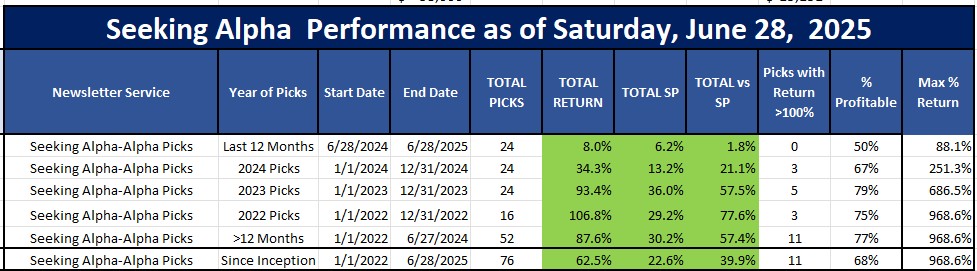

As you can see, over the last 3 years, Seeking Alpha’s Alpha Picks service is just crushing the market by an average of 40+% over 59 stock picks. Their pick of SMCI was up over 800% since Alpha Picks recommended it and they sold it near the peak.

Alpha Picks is also leading in the Percentage Picks with Profit as 76% of their picks have been profitable.

Tipranks’ SmartInvestor service is doing well to beat the market by 3% and they have picked some big winners (232% and 178%) but only 43% of their picks have been profitable.

IMPORTANT PRICING NOTE: Take advantage of Seeking Alpha’s July, 2025 Sale: Save $30 & get a 7-day free trial on a Premium subscription or Save $50 on an Alpha Picks subscription.

What is Seeking Alpha?

Seeking Alpha bills itself as the world’s largest investing community. It has the same information, news, market updates, and stock statistics as Yahoo! Finance and other services, but it also has developed its own proprietary Quant Rating. This Quant Rating appears to be very effective at identifying stocks that are most likely to outperform the market.

Seeking Alpha constantly updates their detailed stock research, portfolio analysis, and Quant Ratings across each and every sector of the market. They use industry knowledge and their algorithms to give users actionable insights that are useful for making decisions.

Like most companies these days, Seeking Alpha has multiple memberships.

- Their free service allows you to get up-to-date stock prices, create a portfolio, get access to some community features, and read one Premium article per month.

- The best thing about their Seeking Alpha Premium service is that it allows you access to their Quant Rating for each stock, it allows you to create a portfolio (although you can’t link to an outside portfolio) so that you can get immediate Quant Ratings on all of your stocks, AND it alerts your when the Ratings or prices on your stocks change.

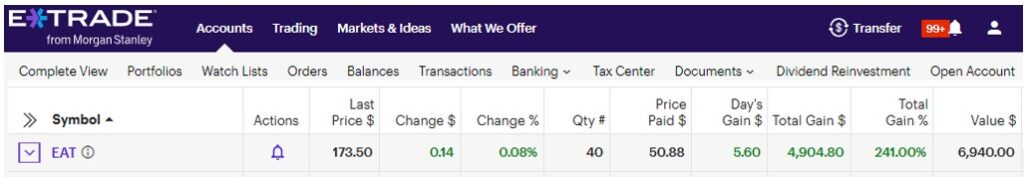

- Their Quant Rating was doing so well, Seeking Alpha launched a new product in 2022 called Alpha Picks that just gives you the top 2 Quant Rated Stocks each month. I am a subscriber to both, and their Alpha Picks are doing so well I started buying about $1,500 of each of their picks.

- I was so convinced after a year of monitoring Alpha Picks that I started buying $1,500-$2,000 of each of their picks. Here is a screenshot of my ETrade account showing my purchase of 40 shares of their April 2024 pick of EAT that as of May 31, 2025 already is up 241% with a $4,904 profit in just 13 months. So is it worth it? Absolutely.

While I am at it, here is their October 2023 pick of CLS-Celestica on my account, as of May 31, 2025 showing my 357% profit of $7,028 in just 19 months:

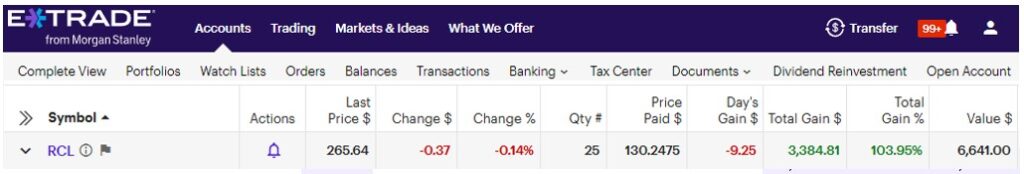

And here is one more so you know I am not making this up. Here is their March, 2024 pick and my 103% profit of $3,384 on RCL-Royal Carib Cruises as of May 31, 2025:

How Does Seeking Alpha Gather Financial Information?

By having over 7,000 experts share investing ideas, research, analyze, and report covering the entire market.

Seeking Alpha has developed a notable community for investing and has grown from a small to global enterprise with over 20 million visitors each month. It continues to grow without slowing down, as each community touches on individual stocks, and best investment opportunities.

Features:

How Does Seeking Alpha Have 7,000 Investment Analysts?

Seeking Alpha’s community of 7,000+ analysts provides a wealth of insights and analysis for almost every type of retail investor. In 2022, despite market volatility, these contributors published over 55,000 articles covering a wide array of investment opportunities, including stocks, bonds, ETFs, commodities, and cryptocurrencies.

Their work is characterized by high-quality, in-depth research and commentary, offering both bullish and bearish perspectives, which helps investors make informed decisions. The platform covered nearly 10,000 unique tickers, surpassing even Wall Street coverage.

What is Seeking Alpha’s Quantitative Algorithm?

Seeking Alpha’s Quantitative Algorithm is a sophisticated tool designed to assist individual investors in making informed decisions through quantitative analysis. This method is akin to a fundamental investment analysis amplified by technology.

It leverages computers to analyze a company’s fundamentals, such as value, growth, and profitability, alongside other inputs like news, stock pricing information, and analyst coverage. You can look at the examples below in terms of how you can use this offering for increased returns on your investments.

They offer this chart to prove that validity of their STRONG BUY recommendations actually beat the market to provide alpha. Look at this chart and these returns vs the S&P500:

That’s pretty impressive with that return and average annualized return they certainly are providing alpha.

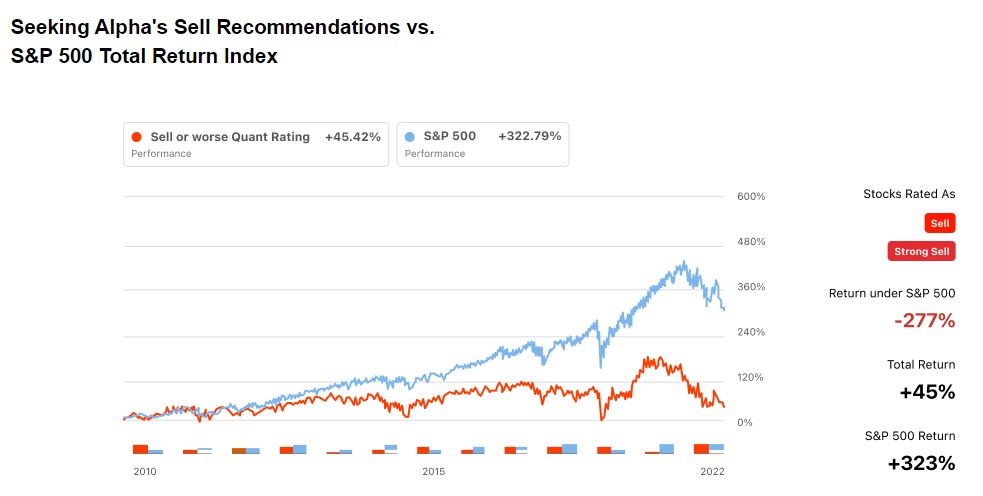

And they offer this chart to prove that their STRONG SELL RATINGS underperform the market.

IMPORTANT PRICING NOTE: You can now Save $50 on Alpha Picks. SO ORDER TODAY and save for a year of picks.

Other Features

Seeking Alpha offers several other features that you should know about before subscribing.

Portfolio Health Rating

One of the newest features Seeking Alpha offers is the Portfolio Health Rating, which shows investors how their holdings compare to portfolios of other members. You’ll get a quick snapshot of how your portfolio looks, plus an overview of any alerts you’ve set up.

Stock and ETF Screeners

Another Premium feature we love is the availability of preset screeners and the ability to create custom screeners.

Preset screeners include things like Top Stocks, Top ETFs, Top Dividend Stocks, and more. You can set up screeners based on market cap, industry, Quant ratings, or anything else you think will be useful to help you monitor current and prospective investments.

Real-Time Alerts

Once you’ve created a portfolio in Seeking Alpha, you have the option to set up alerts. There are two basic types of alerts, News & Analysis, and Price & Ratings.

News and Analysis alerts will ensure you’re informed of new content about each asset as it becomes available. That way, you’ll know what pros and community members are saying about your investments.

Price & Rating alerts require you to specify some parameters. For example, you might decide you want a notification if the price of one of your holdings drops more than 5% or if the Quant Rating slips from Buy to Hold.

Full Access to Research and Analysis

You’ll get access to some of the analyst ideas and research as a free subscriber, but if you choose Seeking Alpha Premium, you’ll get access to every piece of analysis on the platform.

You’ll also get access to 10 years of financials, Earnings Call Transcripts, and much more — all things that can help you make wise and informed investment decisions.

Community and Investment Groups

Seeking Alpha’s crowdsourced content model is a key feature that makes it a unique and valuable resource for investors. The platform leverages the collective wisdom and diversity of a large community of contributors and users to provide a wide range of investment insights and analysis.

At the same time, you’ll get access to investment groups. These are groups where community members team up, share information and opinions about investments, and track the performance of the investments they decide to pursue.

What Does Seeking Alpha Offer?

Seeking Alpha offers two paid subscription services, while providing access to their exclusive Quant Ratings.

As an investor, there are two types of things to consider when deciding on the best paid service on Seeking Alpha. These considerations will help you make informed decisions.

- Alpha Picks is a service for investors who want monthly stock recommendations without doing research.

- Seeking Alpha Premium if you prefer to do your own research, and would like to see how they rate your stocks.

Why Consider Alpha Picks from Seeking Alpha?

A great offering for those investors who simply want someone to inform them about Seeking Alpha’s 2 highest rated stocks each month.

Seeking Alpha launched this Alpha Picks service on July 1, 2022 and so far they are absolutely delivering alpha and beating the market quite easily.

Their Alpha Picks service suggests 2 top-rated stocks monthly with the highest potential for excellent returns. When you look at my analysis of the most its lifetime performance, you see Seeking Alpha’s Alpha Picks really are beating the market and generating alpha!.

The Alpha Picks service retails for $499/year, but you Save $50 if you use the button below.

Alpha Picks Save $50What Does Seeking Alpha Premium include?

For $299/year, you can have unlimited access to stock research and quant ratings for any asset class you want, every day.

For more in-depth information on Seeking Alpha Premium read our review below, or $90 now by using the button below.

- Read our full Seeking Alpha review for a complete breakdown of their most popular service.

What is TipRanks?

TipRanks is a platform that, in their words, “makes it easy for millions of retail investors to reach better, data-driven investing decisions with our suite of research tools and datasets.”

According to TipRanks, you can find over “96,000 financial experts” and their ratings, rankings, performance, and analysis on the site. The performance records include fund managers, financial bloggers, analysts, corporate insiders, and other financial professionals.

In other words, TipRanks tracks and measures the performance of financial professionals. It gives users information instead of professionals giving advice and analyzing stock based strategies or indicators.

TipRanks offers a comprehensive tool for investors, offering a range of data-driven resources to aid in investment decisions. As they have similarities to other platforms out there, they are able to differentiate themselves by a set of specific features.

What they do best, is organize all of this data so you can get just the info you want on the stocks you want; or you can see what the platform’s most highly rated stocks are.

How Does TipRanks Gather Financial Information?

Having information on blogs, financial advisors, and analysts is useful for comparing your portfolio’s performance. However, the real value lies in the ratings assigned by TipRanks to each expert they monitor.

TipRanks tracks expert recommendations and transactions. It evaluates their performance and assigns star ratings. Highly rated professionals are usually more accurate, so finding the right advice is simple by browsing a few lists.

TipRanks ratings for each financial expert rely on:

- Success rate (how often do they have winning trades)

- Average return (what is the standard % returned for each $ invested)

- Statistical significance (what the overall % they have generated from their investment ideas)

Features:

What is TipRanks Smart Portfolio?

Their other biggest and probably most impressive feature is their Smart Portfolios (which varies depending on membership plan selected). Besides features like watchlists and basic performance data, Smart Portfolios include expert performance and recommendation data.

You can compare your portfolio’s performance with other members of TipRanks and professional traders. You can also see what similar investors have done and get trade ideas from top TipRank investors. Have access to 8,000 investment advisors, coaching you for free, without paying them any commissions.

How Does TipRanks Insider Trading Feature Work?

One of TipRanks more undervalued features comes from its ability to stream new trade ideas coming from the likes of corporate executives, giving you valuable insight into how the markets are moving behind the scenes.

You can filter trading behavior of specific public companies, and create actionable investment decisions based around how members of the C-suite are even viewing their own respective company.

What Does TipRanks Offer?

TipRanks offers free services and tools for investors, and offers more for premium investors looking for additional insight.

- Free ($0 per month)

- Premium ($29.95/month for one year) or ($19.95/month for three years )

- Ultimate ($50.00/month) or ($33.30/month for three years)

What is Included in TipRanks Premium Membership?

When it comes to the Premium Membership on TipRanks, this service was built with a retail investor point of view. Beyond being provided with market news and insights, you’ll have access to their exclusive smart portfolio tool, personal portfolio analysis, and a smart score to help with measuring the success of your investment decisions.

For starters, here is their IDEAS PAGE:

Notice the Top Analysts, Top Smart Score Stocks, and their Smart Investor Newsletters which gives you specific ideas that Tipranks is placing in their model portfolios.

To summarize even more:

- News and Insights

- Smart Score

- Expert Center

- Insider & Hedge Fund Signals

- Personal Portfolio Analysis

- Smart Portfolio

- Stock Analysis

Once you subscribe, you can then sync your own portfolio so you can really get excellent feedback about your stocks and alerts when the ratings change.

A great offering that starts at $29.95 a month, and is built for the everyday retail investor with leveling up their research on the market.

Get 40% off Tipranks-(30 Day Money Back Guarantee)What is Offered in TipRanks Ultimate Membership?

Everything that is included in the Premium Membership, but with more of an emphasis on private data (not widely available to every investor).

This includes tools that involve understanding underlying portfolio and company risk, insider trading, and credible investment research firm reports.

To summarize even more:

- Personalized Expert Ranking

- Alpha Generating Tools

- Manage Multiple Portfolios

At $50.00 a month, this offering is for the sophisticated investor, potentially with an institutional investment background, and includes the necessary information to grow your portfolio as a top performing investor.

What Do Seeking Alpha and TipRanks Have in Common?

Seeking Alpha and TipRanks share similar features and functionality across a variety of their products.

For instance, they both offer the following tools for investors:

- Newsfeeds

- Live market data

- Portfolio analyzing tools

- Stock screeners

- Price indicators

- Price movement tools

- Free and paid versions

- Stock ratings

- Community features

The Differences Between Seeking Alpha and TipRanks?

Seeking Alpha and TipRanks have different approaches, even with shared features.

Most stock research and advice sites have news feeds, but most of those sites aggregate their feeds from a bunch of third party publications.

Both Seeking Alpha and TipRanks don’t aggregate their financial news feeds. Both sites have writers who create content for their news feeds, resulting in diverse perspectives, opinions, focuses, and levels of analysis. Seeking Alpha has over 8,000 contributors and they have their proprietary Quant Rating that seems to be working very well. Most of their stock ideas come from the well-vetted contributors and their own Quant Ratings. TipRanks tracks and monitors the performance of over 96,000 financial experts and rates them; and they have come up with their own Smart Score. Most of their stock ideas come from the top analysts they track, and their SmartInvestor Portfolio is an actively managed portfolio of 25-35 stocks using their Smart Score.

| Feature | Seeking Alpha | TipRanks |

| News Feed | Not aggregated; content from 8,000+ contributors, including both vetted Authors and community members | Not aggregated; Tracks and monitors 96,000+ financial experts and rates them |

| Ratings | Quant Ratings based on a proprietary algorithm | Smart Score |

| Stock Ideas | Mostly drawn from contributors and Quant Ratings | Mostly from Top Analysts |

| Managed Portfolio | N/A | SmartInvestor Portfolio, 25-35 stocks based on Smart Scores |

Seeking Alpha Analysts vs. TipRanks Analysts

The way these two sites approach investment research and analyze stocks is the largest difference when comparing their products.

Let’s dive into some of the major and minor components for each platform’s team of analysts covering the stock market.

Seeking Alpha Analysts

Seeking Alpha gathers investment analysis from various investors and analysts who want to write about a specific stock and its potential.

This often means you’ll find posts by trusted contributors who take deep looks into the stock’s fundamentals.

The length and depth of each written stock analysis will differ based on the writer’s perspective and how much they want to say.

Often, well-thought-out arguments about the writer’s stance on the stock and the reasons behind it arise.

TipRanks Analysts

TipRanks goes for more of a “quantity over quality” approach. They focus more on measuring how people feel about a company, rather than giving a platform to analysts with opinions. They consider the sentiment of the market, professional investors, and TipRanks users.

TipRanks focuses on the fundamentals and the opinions of successful investors and analysts when evaluating stocks. One of TipRanks most sought after feature is their stock forecast.

As you can see, a “Moderate Buy” rating has been assigned from the opinions of two different analysts. Both of whom have more or less agreed that its price should climb in the next 12 months.

It’s not very scientific, but that might not be important for something as unpredictable as the stock market.

Stock Ratings Summaries

Seeking Alpha and TipRanks provide summaries of their findings through Quant Ratings and Analyst Ratings. These summaries are available for those who do not wish to analyze the data or read the reports themselves.

To an untrained eye, the two different types of ratings may look quite similar.

Both websites provide their overall opinion on a stock and predictions on its performance. However, they use different methods to reach their conclusions.

Seeking Alpha’s Quant Rating system uses data, trends, and market forces to evaluate stocks and is available to Premium members.

The scientific approach may not be a better predictor for a stock’s future compared to TipRank’s fundamental approach. TipRank’s fundamental approach emphasizes quality stock picks.

In other words: Seeking Alpha goes all intellectual with it while TipRanks is more of a popularity contest.

Conclusion

Seeking Alpha and TipRanks have both earned their reputations as sources for actionable insights, solid investing ideas, and the kind of research and analysis that helps you make big plays with confidence.

It’s hard to say which service is better. They both have their strengths, neither have many weaknesses, and you can make good arguments for and against either one.

If you really want to know which would be better for you, ask yourself this: Do you care more about fundamentals or sentiment?

If you care more about the fundamentals, Seeking Alpha is for you. They have all the in-depth fundamental analysis you could ever want, plus all the quantitative reasoning you need to make your inner value investor feel good about the trades you make.

I really like Seeking Alpha’s Alpha Picks service. Even at the $499 price per year with our $50 savings link, I am getting my money back easily.

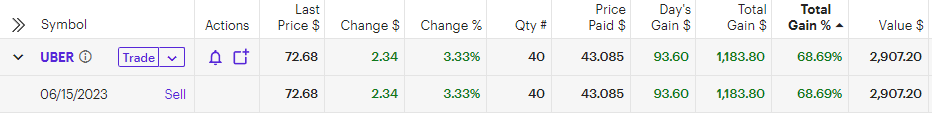

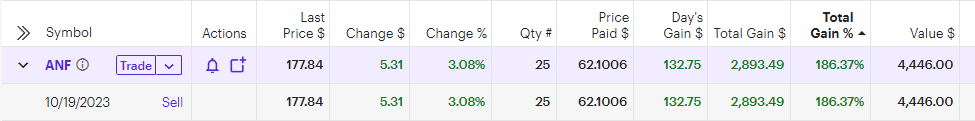

I have actually started buying about $1500 of each of Alpha Picks’ monthly picks. Take a look at my profit on these their June 2023 pick of UBER and their October 2023 pick of ANF as of June 29, 2024:

Seeking Alpha’s “Quant Rating” and TipRank’s “SmartScore” are both are beating the S&P 500 over the last 3 years,

But Seeking Alpha’s Alpha Picks are beating the market by a much larger margin.

If you care more about sentiment and market trends than underlying data, chances are you’ll have a better time with TipRanks. Their analysis isn’t nearly as thorough as Seeking Alpha’s, but that doesn’t really matter to investors who prefer to trade on prevailing opinions over underlying facts.

For even more information on Seeking Alpha, check out our other Seeking Alpha Premium review!

Alpha Picks Save $50 Save 40% on Tipranks-(30 Day Money Back Guarantee)FAQs

Is Seeking Alpha worth subscribing to?

We believe it is. The Basic Plan is free but offers only limited features. Anybody who wants to get serious about investing can benefit from Seeking Alpha Premium, which includes access to Quant Ratings and a ton of other useful features. Seeking Alpha Picks takes the guesswork out of investing and provides subscribers with two “Strong Buy” picks every month.

How reliable is Seeking Alpha for investment research?

Seeking Alpha subscribers have access to thousands of investment ideas and analysis every month. In addition to articles written by community members and vetted Authors, investors can also get review 10 years of financials and use screeners and watchlists to invest before they buy. We can’t say that researching stocks and ETFs will guarantee a good return, but in terms of giving subscribers what they need for research, Seeking Alpha is excellent.

Is Seeking Alpha Premium worth the cost?

That depends on what you want, but we think many investors can benefit from subscribing to Seeking Alpha Premium. People who want to dig deep into research before investing will benefit from the extensive financials, screeners, and analysis. Those who want a quick way to evaluate stocks and ETFs can use Seeking Alpha’s Quant Ratings, which have an excellent record of outperforming the S&P 500.

Is Seeking Alpha suitable for beginner investors?

The amount of research and analysis available on Seeking Alpha may be overwhelming to some beginner investors, particularly those who aren’t already knowledgeable about stock market metrics or how to read financial statements. That said, beginners who don’t mind a learning curve may choose to use a subscription as a learning opportunity and can benefit from reviewing Quant Ratings to make investment decisions.

To compare Seeking Alpha to other platforms, read our other reviews:

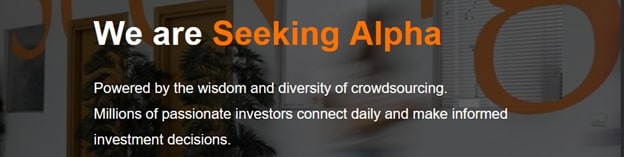

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.