Seeking Alpha and Yahoo Finance are two of the many online investment research platforms available. As you might expect, they have some things in common and offer some similar features.

The real question is: which platform is best for investors who want to make data-driven decisions about which stocks to buy and get a handle on whether they should sell or hold existing investments.

Here’s a quick overview comparing the key features of each platform to give you an idea of what to expect in this Seeking Alpha vs Yahoo Finance review.

| Seeking Alpha | Yahoo Finance |

| Quant Ratings | Broad market overview |

| Detailed stock analysis | Simple user interface |

| 10 years of financials for most stocks | Daily stock recommendations |

| High-growth stock recommendations | Cryptocurrency analysis |

| Advanced stock and ETF screeners |

Comparing these two platforms to one another is essential for any investor who wants to make data-driven decisions about investing. Keep reading our Seeking Alpha vs Yahoo Finance review to get a detailed comparison of features and costs, plus our analysis of which platform is better for investors.

As you evaluate investment research platforms, keep in mind that neither Seeking Alpha nor Yahoo Finance is regulated by FINRA.

Features Breakdown: Seeking Alpha vs Yahoo Finance

The only way to get a handle on which stock research platform is best for you and your investing strategy is to do a direct comparison of features.

Here’s our take on Yahoo Finance vs Seeking Alpha features – and make sure to check out our Seeking Alpha review. Keep in mind that neither service is a brokerage, so they aren’t regulated by FINRA.

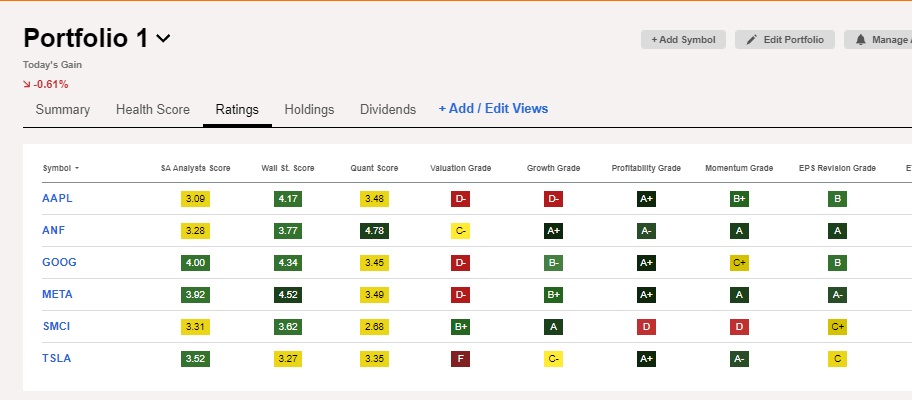

Quant Ratings

Seeking Alpha’s Quant Ratings are widely respected among investment professionals. Using more than 100 metrics, Seeking Alpha evaluates stocks and assigns a rating between 1 and 5. A rating of 1 indicates a Strong Sell, while a 5 indicates a Strong Buy recommendation.

Yahoo Finance doesn’t have anything that’s equivalent to the Quant Rating. The closest thing they provide is access to Morningstar Ratings, which are included in the Silver and Gold plans. There’s information there, but you’ll need to make your own evaluations of what it all means.

There’s a competitive advantage to using Quant ratings, since Seeking Alpha’s “Strong Buy” selections have outperformed the S&P 500 consistently.

Pro Tip:

Try out Seeking Alpha today and receive $30 off your premium membership, as well as an exclusive free trial!

Stock Analysis Depth

Both Seeking Alpha Premium and the Yahoo Finance Silver and Gold plans offer stock analysis to users. Seeking Alpha’s analysis includes Quant Ratings, news, and user-created content. The community aspect of Seeking Alpha is something that’s notable and unique. Our only caveat here would be that it’s important to verify information from user content since Seeking Alpha doesn’t vet it.

Yahoo Finance offers access to research reports and personalized investment ideas, but they’re only available with the Silver and Gold plans.

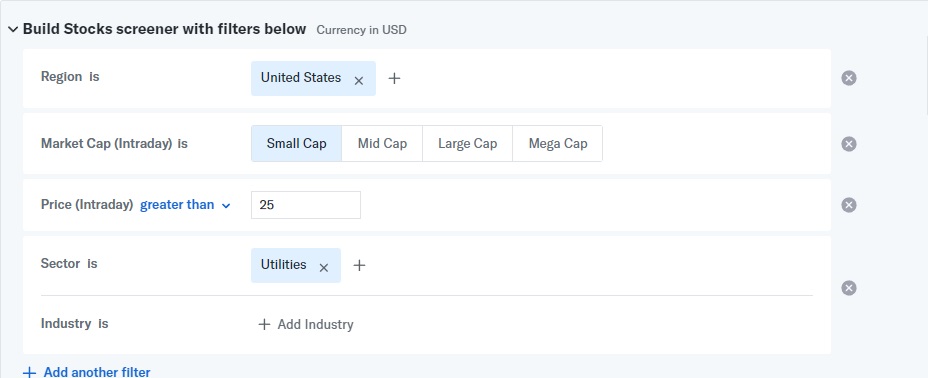

Advanced Tools and Screeners

Both Seeking Alpha and Yahoo Finance offer users the option to create stock screeners to help them make investment decisions. Seeking Alpha has advanced screeners with hundreds of options to get the exact data you need.

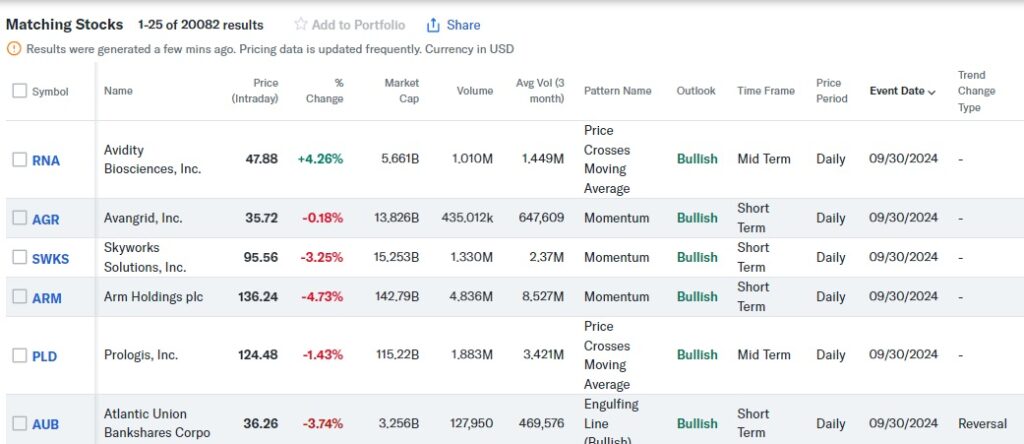

By contrast, Yahoo Finance’s screeners are much simpler and offer fewer filtering options.

There are also some pre-set screeners on Yahoo Finance, like this one that filters out stocks that Yahoo Finance has labeled as Bullish.

Seeking Alpha’s advanced filters are ideal for more experienced investors or those who are willing to explore the filters and learn how they can help them choose investments.

Pro Tip:

Try out Seeking Alpha today and receive $30 off your premium membership, as well as an exclusive free trial!

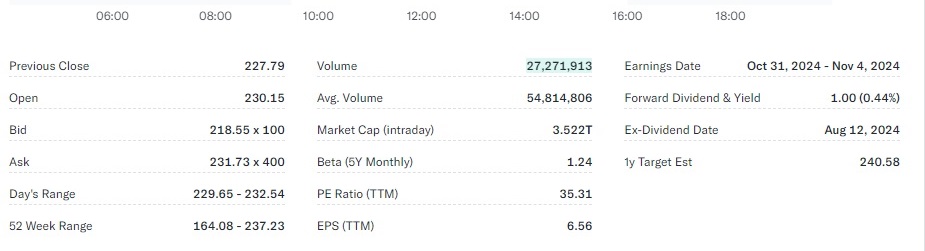

Financial Data Availability

Financial data is undeniably valuable when selecting investments. Seeking Alpha offers 10 years of financials for every stock, something that makes it easy to see any company’s history and performance, including financial statements, earnings call summaries, and much more.

Yahoo Finance has more limited data sets in some circumstances. Subscribers to the Gold Plan get access to historical data that includes income statements and balance sheets.

Portfolio Management Tools

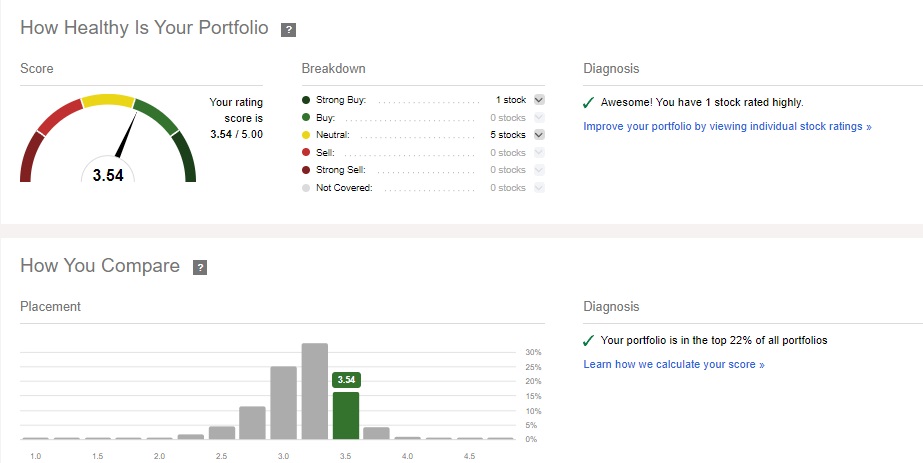

Both Seeking Alpha and Yahoo Finance offer subscribers access to portfolio management tools. Where Seeking Alpha stands apart is its Portfolio Health Score. The health score offers a snapshot of any portfolio’s stability and potential performance.

As you can see, this portfolio has mostly neutral investments and has received a health score of 3.54, which puts it in the top 22% of all portfolios on Seeking Alpha. Yahoo Finance does not have an equivalent to the portfolio health score, although they do offer limited portfolio analysis.

On a related note, Seeking Alpha offers users dozens of customization options for viewing a portfolio. If you’re someone who wants to get a handle on historical stock performance, dividends, or any other factor, you can revise your view to make it exactly what you need it to be.

Pro Tip:

Try out Seeking Alpha today and receive $30 off your premium membership, as well as an exclusive free trial!

Alerts and Notifications

One of the areas where Seeking Alpha and Yahoo Finance are similar is that both offer stock alerts and notifications to all users. They’re easy to set up and can help you stay on top of news, price changes, and more.

Cost Comparison: Seeking Alpha vs Yahoo Finance

One of the most important questions to ask before subscribing to any investment research service is how much the service costs. You’ll also want to know whether there’s a free trial and how the annual subscription is billed.

Let’s start with Seeking Alpha. There’s a free version that provides the option to link to a portfolio, set up alerts, and read one Premium article per month. Seeking Alpha Premium comes with a one-month trial for just $4.99. After that, the annual cost is $299 for new subscribers and $499 at renewal.

The Premium version comes with unlimited access to expert analysis, Quant ratings, in-depth analytics and financials, and membership in the Seeking Alpha community.

The Bronze membership costs $95 per year and is best for monitoring your portfolio and is, according to Yahoo, ideal for tracking 401(k) or IRA portfolios. The Silver membership costs $239.40 per year and is designed for investors who want to learn investment basics but aren’t interested in active trading. Finally, the Gold membership costs $479.40 per year and is best suited for experienced investors who want to actively manage their portfolios.

Here’s a comparison chart that lays it all out for you.

| Account | Price | Free Trial | Best For |

| Seeking Alpha Free | Free | N/A | Beginners who want to get their feet wet |

| Seeking Alpha Premium | $299/year for first-time subscribers; $499 for renewal | No, but there is a one-month trial for just $4.99 | Intermediate to advanced investors who want a ton of data to help them choose investments. |

| Yahoo Finance Free | Free | N/A | Beginners who want an easy way to access investment news |

| Yahoo Finance Bronze | $95 per year | No | Novices who want an easy way to track 401(k) or IRA portfolios |

| Yahoo Finance Silver | $239.40/year | No | Beginners who want to learn the basics but aren’t interested in active trading |

| Yahoo Finance Gold | $479.40 | No | Advanced investors who want a hands-on approach and are interested in active trading. |

Seeking Alpha Paid Services Summary

Here’s a quick comparison of the major characteristics of the two services and their bundle:

| Seeking Alpha Premium | Alpha Picks | Seeking Alpha Bundle | |

| Overall Rating: | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type & Strengths: | Full access to all their research; link your brokerage account to get Quant Ratings on your stocks and alerts of when to sell. | 2 stock picks a month that have their highest Quant Rating and most likely to outperform the market. | Includes both services |

| Strengths: | Strong Buy Quant Rating stocks have 5x the market since 2010. Quant Rating now verified by academic study. 250,000+ Premium members. | Beating the market by 40% in just 2 years; 9 picks have already doubled; over 76% of picks are profitable. | Get both to monitor your portfolio & get the best picks to buy. |

| Best for: | Self-directed investors who want to easily optimize their portfolio’s return. | Investors looking for specific stock recommendations each month | Both |

| Retail Cost: | $299 a year | $499 a year | $798 a year |

| Current Promotion: | July, 2025 Sale: Save $30 and get 7-day free trial. | July, 2025 Sale: Save $50 & get access to all their recent stock picks | July, 2025 Sale: Save $159 when you get both. |

| Link to Promo Page: | Save $30 & get 7-day free trial to Alpha Premium on THIS promo page! | Save $50 on Alpha Picks on THIS promo page | Try Both for $639 and save $159 now. |

I subscribe to both of these Seeking Alpha services, and many more from other stock services. I don’t plan on canceling either of my Seeking Alpha’s subscriptions any time soon. For me, both Seeking Alpha Premium and Alpha Picks are absolutely worth the membership fee. To compare the two services, check out our Seeking Alpha Picks vs Premium article.

Importance of Using Seeking Alpha over Yahoo Finance

We think that Seeking Alpha is superior to Yahoo Finance and is a better option for many investors.

Here are some takeaways to help you decide which platform might be best for you.

- Seeking Alpha offers more data and more features with its premium plan. If you’re an intermediate or advanced investor, then Seeking Alpha is likely the best choice for you.

- Yahoo Finance has fewer advanced features and may be more accessible for beginner investors. That said, we should note that beginners who learn and want to grow may find themselves wishing for the more advanced features of Seeking Alpha.

- Long-term traders may find more value from Seeking Alpha, while short-term and active traders may prefer Yahoo Finance’s news-based approach.

- Both services offer a free plan with limited features.

On the whole, we think intermediate and advanced investors will benefit more from Seeking Alpha.

Pro Tip:

Try out Seeking Alpha today and receive $30 off your premium membership, as well as an exclusive free trial!

Real User Experiences

We’re comparing Yahoo Finance vs Seeking Alpha, but we think it’s important to seek outside perspectives. Here’s a quick overview of how real users have experienced each service.

On Capterra, Seeking Alpha users have awarded the service 4.3 out of 5 stars and praise the platform’s detailed analysis and metrics, useful articles, and unique perspectives. The most common complaints were laggy customer service response times, automatic renewals, and unvetted user content.

Trustpilot reviewers are close, giving Seeking Alpha 4.0 out of 5 stars. They praise “Strong Buy” stocks’ performance against benchmarks, plus detailed analysis, customer service, and dividend tracking. The most common complaints had to do with unvetted content and Seeking Alpha’s tendency to switch up what’s included with the Premium plan.

There are fewer reviews for Yahoo Finance. Apple users have given the Yahoo Finance app 4.7 out of 5 stars. Users praise many of the features, but also complain about technical issues and discrepancies, with one of the most worrisome complaints being a lack of synchronization between the app and users’ portfolios.

Conclusion: Which Platform Is Best for You?

Both Seeking Alpha and Yahoo Finance offer features to help investors research stock and make investment decisions.

The biggest strengths of Seeking Alpha are its Quant Ratings and detailed analysis, while Yahoo Finance offers a slightly more user-friendly interface.

Based on our experience and analysis, Seeking Alpha is the better of the two platforms. It’s ideally suited for intermediate and advanced investors, and for anybody who wants to dive into the numbers and read detailed analysis before making choices about what to buy or sell.

Yahoo Finance offers an interface that may be less confusing for beginners, and people who aren’t experienced may find the limited filters a good introduction to investing basics.

Those who are investing in crypto are likely to prefer Yahoo Finance because it offers cryptocurrency analysis, while Seeking Alpha doesn’t.

Our final recommendation is that Seeking Alpha offers the best and most detailed features.

If you are curious about how Seeking Alpha compares to MarketWatch, check out our new review: SEEKING ALPHA VS MARKETWATCH!

FAQs

The answer depends on the type of investor you are. People who want to do a deep dive on the numbers and who are willing to learn as they go may prefer Seeking Alpha. Yahoo Finance has a slightly more attractive interface and its limited features may be preferable for beginners who want to get their feet wet.

The most important feature that Seeking Alpha offers that Yahoo Finance doesn’t is the Quant Rating. Stocks with a “Strong Buy” recommendation have outperformed the S&P 500 significantly.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.