Are you looking to grow your wealth in the stock market but not sure where to start? That’s okay! Most of us aren’t experts and we need some guidance.

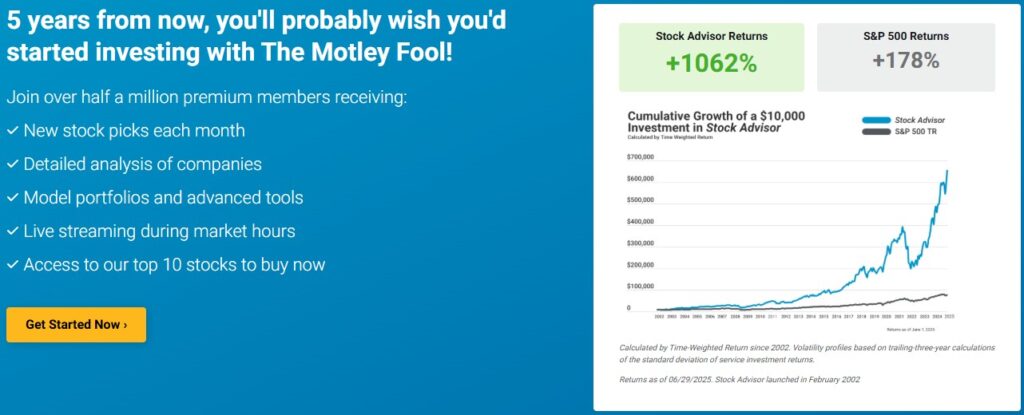

Did you know that Motley Fool Stock Advisor picks have consistently outperformed the market? Some picks have doubled or tripled in value over the past few years. In fact, a subscriber who started with a $10,000 investment back in 2002 would have have seen an AVERAGE stock return of 979% vs the S&P average return of 171% as of June 1, 2025.

June 1, 2025 Motley Fool Performance Update: The Motley Fool picks continue their winning ways as overall their picks are now up 979% vs the market’s 171%–so they are 5x the market since their launch 23 years ago. Not every pick is a winner of course, but they do pick some big winners year after year that more than make up for their losers. Their April pick of APP is already up 50%; January pick of HWM is up 38%. Their December, 2024 pick of TMDX from their Epic service is already up 110%; and their May 2024 Epic pick of CHWY is already up 169%.

Also, 7 out of 24 of their 2023 picks have doubled, including CRWD which is up 255%.

From our experience of being subscribers since 2016, the key to using the Motley Fool picks is to buy their picks as soon as they are released; buy equal dollars of each pick, and use a 20% stop-loss from your entry point. It is 24 picks a year, but they have recommended selling about 1/3 of their picks over time.

Stop being penny wise and pound foolish! Pun intended! Get their next pick in real-time on THIS PROMO page, and take advantage of their 30 day money back guarantee.

WallStreetSurvivor Stock Newsletter Performance Team

The Motley Fool’s Best Stock Picks of All Time

The Motley Fool is an investor education platform with a stock picking service that provides subscribers with monthly stock recommendations. Stock Advisor is its most popular service, providing two new picks each month led by the same team that has been their since 2002 when they launched this service. This team has achieved some phenomenal results over the years.

And here are a few of their all-time best stock picks as of June 29, 2025. Just take a look at some of these returns. They picked Nvidia back in 2005 and that stock is now up over 90,000%. They also picked Netflix early and it is now up 70,000%:

The primary benefit of having expert-backed stock picks, such as Motley Fool’s Stock Advisor, is that they take the guesswork out of investing and can even help you minimize losses and maximize gains when the market is uncertain.

And here are more of the Motley Fool Stock Advisor’s top 10 stock picks of ALL TIME!

This is the list of the Fool’s top 10 picks in the history of Stock Advisor as of the date below the table. You’ll notice that the list is made up of 5 stocks total: Nvidia, Netflix, Amazon, Booking Holdings, and Tesla. Some stocks appear more than once; this is because Stock Advisor may recommend one stock, and then recommend that you buy more of that same stock at a later date (with a different cost basis).

Can you believe those returns? All of Stock Advisor’s top 10 picks have returns over 10,000 percent! You can see they picked many stock multiples times (NVDA, NFLX, AAPL) over the years and this is how they got these incremental returns. Don’t you wish you had picked NVDA in 2005 when it was at a split adjusted price of only 16 cents, or NFLX at $1.85?

If you’re looking for stock picks with a proven track record, we’ve got the Motley Fool best stocks to buy now list for you. We’ll reveal them in this article and help you understand why their expert picks are sought after by investors in the US and around the globe.

Summary of Motley Fool's July, 2025 Best Discounts & Promotions

| Motley Fool Stock Advisor | Motley Fool Epic | |

|---|---|---|

| Overall Rating: | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type: | 2 stock picks and 2 "Five Best Stocks to Buy Lists" per month. That's 1 email per week on Thursday. Next pick comes out July 17th. | 5 stock picks per month from Stock Advisor (2 picks), plus 1 pick from Rule Breakers, 1 from Hidden Gems and 1 from Dividend Investor. Next pick comes out July 17th. |

| Strengths: | Original and best performing stock newsletter since its launch 23 years ago. Average pick is up 1,062% vs market's 178%; 70% profitable. | Well diversified, lower risk, high percentage of accuracy with 75% of picks being profitable. |

| Best for: | Beginning & intermediate investors that want to invest each month and plan on staying invested for at least 5 years. | Intermediate to experienced investor looking for better diversification, less risk, & some dividend yield. |

| Retail Cost: | $199 a year | $499 a year |

| Links to Best Promotion and Discount Pages: | Best Stock Advisor July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: Best money saving deal--Get 2 years for only $179 and save $229 on THIS promo page with code 'WSS179' if prompted. --Get 1 year for only $99, save $100 AND get their just released AI Supercycle: An Investor’s Guide to the Artificial Intelligence Boom ($49 Value) on THIS promo page with code 'WSS99' if prompted. --Save $100 and get 1 year for only $99 AND get Fool's top 3 "Double Down" Picks on THIS promo page with code 'WSS99dd' if prompted. |

Best EPIC July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: --Save $200 if you use EPICSALE on THIS promo page; includes 30 day money back guarantee. --Use this link to compare Stock Advisor ($100 off) and Epic ($200 off). |

Motley Fool History: Why You Can Trust Their Picks

Motley Fool got its start in 1993 by two brothers, Tom and David Gardner, along with Todd Elter and Erik Rydholm. It’s a private company and it’s not a brokerage, which means it isn’t regulated by the SEC or FINRA.

The investment philosophy of Motley Fool is a buy-and-hold strategy. It involves buying equal amounts of each stock they recommend and holding those stocks for a minimum of five years.

As we mentioned earlier, Motley Fool’s overall track record has been stellar (Read: Motley Fool Performance). The company uses financial metrics such as profitability and liquidity to determine which stocks to recommend. With each recommendation, they publish an article explaining the rationale behind Motley Fool’s stock picks.

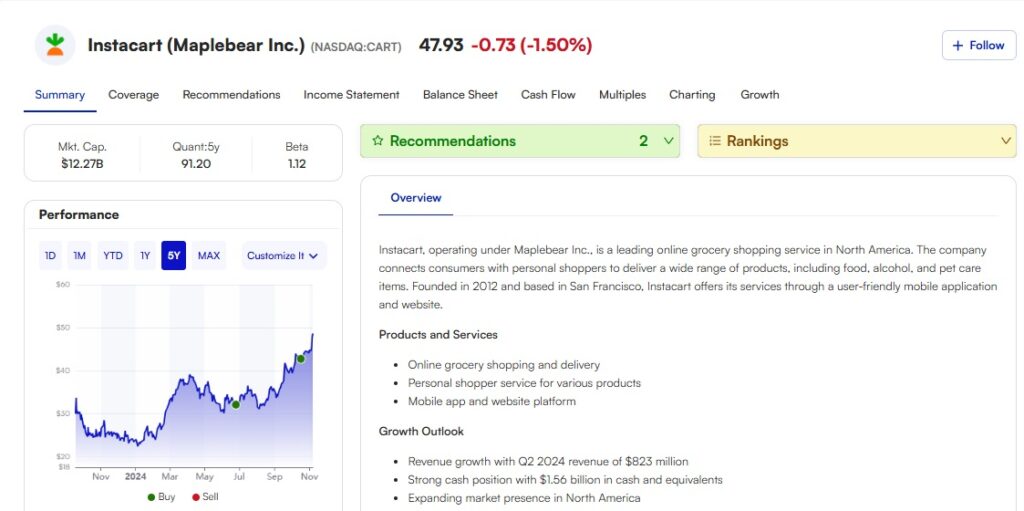

For example, the company recommended Instacart in October, 2024 – more on that below – and here are some of the reasons they provided for the pick.

- Instacart has maintained consistent profit margins.

- The company’s model is endlessly scalable. It started off as a grocery delivery app and now partners with an array of retailers, including Target, CVS, Dollar Tree, and many others.

- Instacart has increased its profits with advertising revenue from partners.

These articles help investors understand the thinking behind each recommendation and provide context for their consideration. These things all underscore Motley Fool’s commitment to financial education and its reputation for helping investors make informed investment decisions that will serve their financial goals.

Pro Tip:

With over 500,000 subscribers, their picks often jump 2-5% on the day the pick is released. So to maximize your returns and get their pick in real-time you need to subscribe to The Motley Fool.

Take advantage of their July, 2025 promotion and save $100 & get a 30-day money back guarantee!

What Are the Motley Fool’s Top 10 Stocks Right Now?

If you are looking for the Motley Fool’s Top 10 stocks, we will show you some of their recent picks.

But you need to know that because the Motley Fool has over 500,000 subscribers, their picks usually go up a few percentage points within minutes of them releasing their picks. So if want to really maximize your returns you need to subscribe so you get their next pick, which comes out July 17th, as soon as it is released and buy it immediately. If you are interested in The Motley Fool’s best AI stocks to buy now, check out our new article: Motley Fool’s Top AI Stock Picks!

But remember, plan on buying equal dollars amounts of a few of their picks to diversify properly. (read: Is a Motley Fool Subscription Worth It?)

Now, let’s look at the Motley Fool Stock Advisor’s top 10 stock picks right now. For each stock, we’ll explain why it was picked and share some performance and growth metrics to help you understand why these are investments you may want to consider, no matter their stock price.

The Motley Fool has lots of rankings and lists.

Before we reveal their top 10 stocks, please keep in mind that these become outdated very quickly. Please note they only allow me to reveal their picks that are at least 90 days old. These are just to give you an idea of their recent picks and performance. Don’t be a fool. Become a Fool and get their updated lists for only $99.

Here are the Fool’s top 5 stock picks based on their 5 Years Quantitative rating as of mid February, 2025. This Quant Rating is of stocks that have already recommended (frequency of recommendation and across all of their analyst teams) and how strong they feel they will outperform the market over the next 5 years.

- The Trade Desk (TTD)

- Tesla (TSLA)

- MercadoLibre (MELI)

- Paycom (PAYC)

- Meta Platforms (META)

In terms of their more recent picks, here are the Fool’s top 5 current stocks from February, 2025 …

- Howmet Aerospace (HWM) pick from January, 2025 is up 32% and it is beating the market by 31%

- Kyndryl Holdings (KD) also from January and it is up 14% and beating the market by 12%

- Pure Storage (PSTG) from December, 2024 and it is down 9%

- MELI from November and it is up 32% and beating the market by 31%. Notice this is one of their TOP 5Y Conviction stocks!

- DoorDash (DASH) from October and it is up 31% and beating the market by 30%

Other picks from 2024 were:

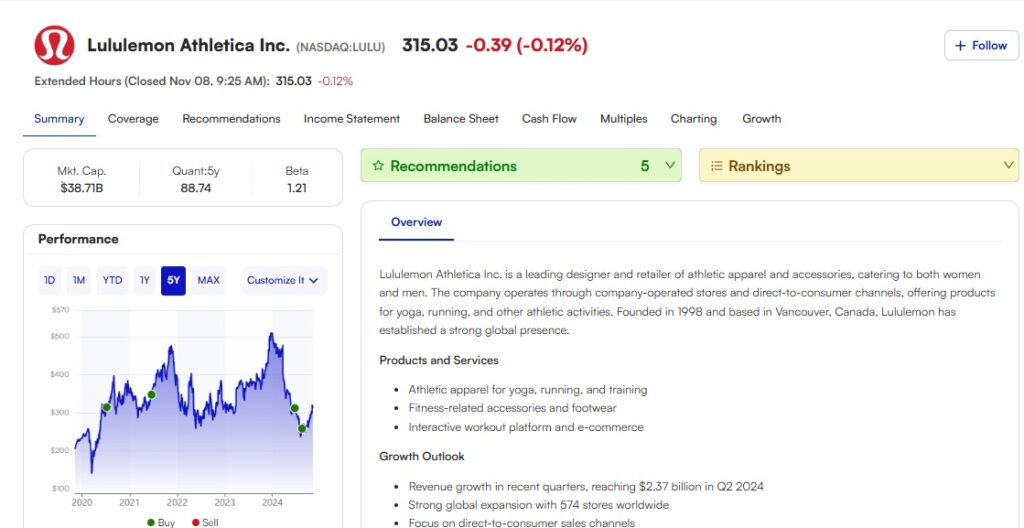

- Lululemon Athletica is a sportswear brand with a history of success. The share price was down due to a new product miss when Stock Advisor recommended it on August 15, 2024 and has risen 35% since the recommendation. Fool experts believe the stock will continue to rebound based on Lululemon’s goals to double revenue for both menswear and digital sales by 2026, and to triple sales in non-US markets, with a focus on mainland China.

- Instacart is a third-party delivery app that started out with grocery deliveries and has since expanded to other retailers, including pharmacies and big box stores. It was a Stock Advisor recommendation on October 17, 2024, and since the recommendation less than a month ago, the price has already risen 4%. The company’s scalability and impressive ad revenue are two reasons cited for its selection.

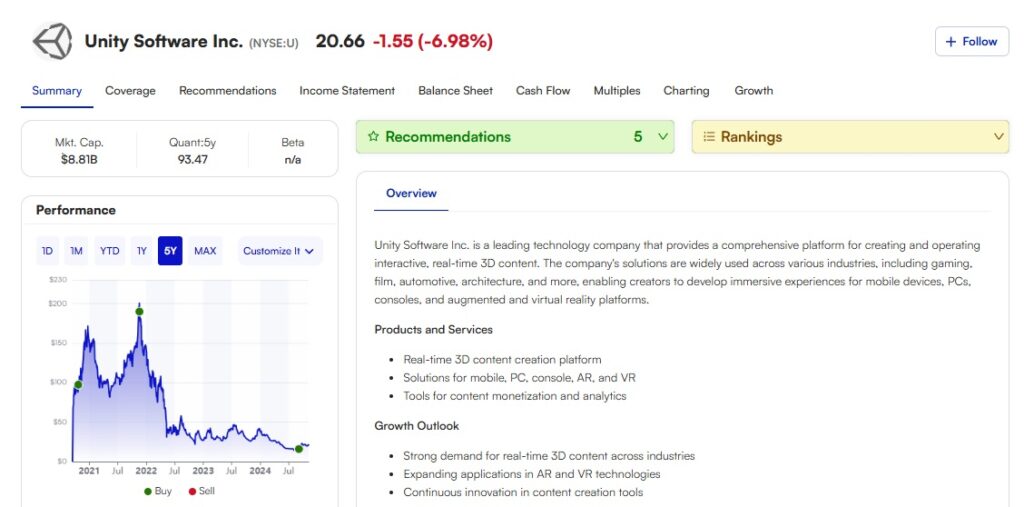

- Unity Software is the developer of a cross-platform game engine. The stock has been down due to a fumble in the company increasing its fees and its accelerated spending. That said, the share price is up 32% since the recommendation on September 5. Fool experts believe the stock is undervalued and that the company’s new CEO will right the ship and deliver profits for investors.

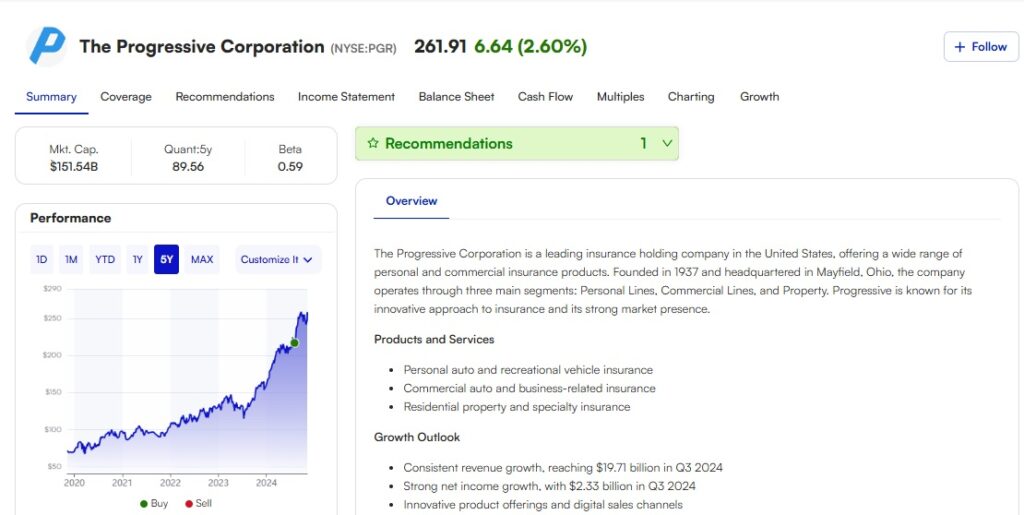

- Progressive is one of the largest insurance companies in the US and was a Stock Advisor pick on August 1. The share price has risen 35% since it was recommended. It was chosen because of its strong record of profits, including profits for the last four years – even during the COVID-19 pandemic. Its adoption of new technology in an industry that’s usually a laggard is another reason that the Fool’s experts believe it will perform well.

- Globus Medical was a Stock Advisor pick on July 18 and its share price has fallen by 14% since then. It was chosen after it acquired NuVasive, a move that will help to increase the company’s market share and its profits. Globus has consistently maintained a profit margin above 20%. The Fool’s experts see the company’s investment in enabling technologies as something that will drive continued growth.

So, there you have it. Those are the Motley Fool Stock Advisor 10 best stocks to purchase now. If you’re wondering which are the best stocks to buy, Motley Fool picks like these can help you.

Pro Tip:

With over 500,000 subscribers, their picks often jump 2-5% on the day the pick is released. So to maximize your returns and get their pick in real-time you need to subscribe to The Motley Fool.

Take advantage of their July, 2025 promotion and save $100 & get a 30-day money back guarantee!

How to Start with Motley Fool’s Stock Picks Today

Signing up for Motley Fool Stock Advisor is simple. All you need to do is visit the Motley Fool website and you’ll be walked through the process. Here are the steps.

That’s it! You won’t be able to sync with your brokerage portfolio, but you can create a duplicate of your portfolio by entering transaction dates and amounts.

Once you’re a member, you can access Motley Fool’s current and historical picks, including the 10 top Motley Fool picks we’ve included here. For each pick, you can view financials, price history, and the Fool’s expert analysis of each company and its growth potential.

Pro Tip:

With over 500,000 subscribers, their picks often jump 2-5% on the day the pick is released. So to maximize your returns and get their pick in real-time you need to subscribe to The Motley Fool.

Take advantage of their July, 2025 promotion and save $100 & get a 30-day money back guarantee!

Conclusion

While anybody can try to do their own research before choosing stocks to buy, there’s no question that it becomes a lot easier to build a profitable and diversified portfolio when you have expert advice to follow.

We have been Stock Advisor subscribers for a while and we’re very happy with our experience. If you’re someone who prefers a long-term approach to investing and is willing to stick to a buy-and-hold strategy, this Motely Fool service might be right for you.

So I just gave you a lot of their recent stock picks. But if you want to maximize your return, you need to subscribe and buy the stocks as soon as they are released each Thursday. This is because their stocks tend to pop up 2-5% the day the pick is released. Don’t be a fool. Become a Fool and get their updated lists for only $99.

FAQ

The Motley Fool doesn’t specify a timeframe for updating its list of the top stocks, but new subscribers get the most recent list when they sign up. It’s a safe assumption that they update regularly because they update their Buy, Hold, and Sell recommendations regularly.

The Motley Fool Stock Advisor looks for companies with sustained growth and profitability, and gives preference to founder-led companies with a strong corporate culture and competitive advantages. Reading their recommendations reveals a forward-looking approach that takes past performance into consideration while also evaluating how the company is likely to perform in the future.

The Motley Fool recommends a buy-and-hold strategy where investors buy equal amounts of all stock recommendations and hold them for a minimum of five years. It’s not the ideal service for traders or people who want to play the market.

Yes, non-subscribers usually don’t get to see any of the Motley Fool’s picks, although they did agree to let us share five in this post.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.