If you’re in the market for a stock picking service, you might be asking yourself: Is a Motley Fool subscription worth it?

Great question, and we’re here to help you answer it.

The Motley Fool is a stock research site that sells stock picking subscriptions. It was founded in 1993 by brothers David and Tom Gardner, and these 2 brothers continue to run the company. It’s not a brokerage, although it does have two affiliates, Motley Fool Asset Management and Motley Fool Wealth Management, that manage assets and are regulated by FINRA.

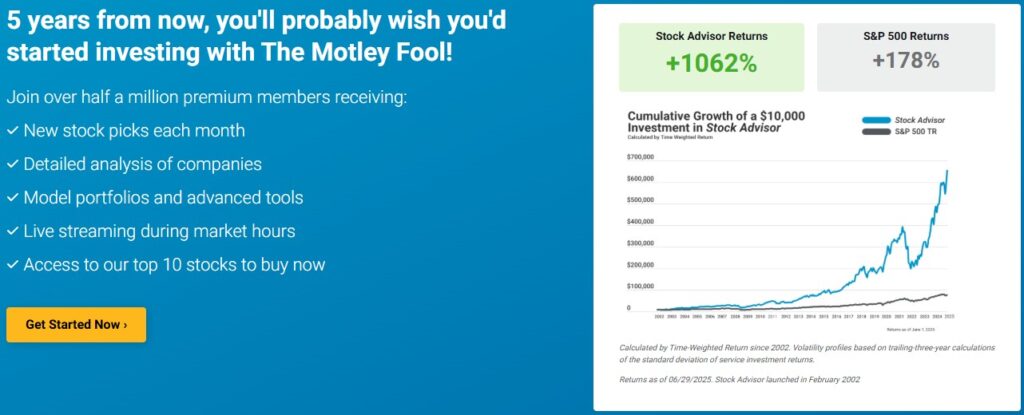

If you want access to affordable stock picks from a service with a proven track record, then a Motley Fool subscription to its Stock Advisor subscription service is the best value around. Take a look at this chart of returns since inception of Stock Advisor in 2002.

In addition to their popular Stock Advisor, the Motley Fool offers other types of subscriptions ranging from $199 to $13,999 a year. They are all designed to help investors make smart decisions by providing monthly stock picks. This article focuses on there Stock Advisor service which retails for $199 per year.

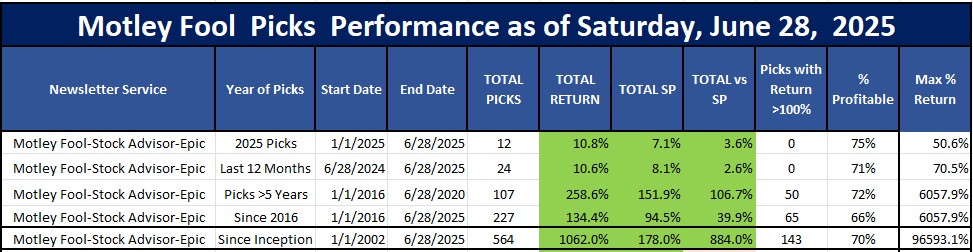

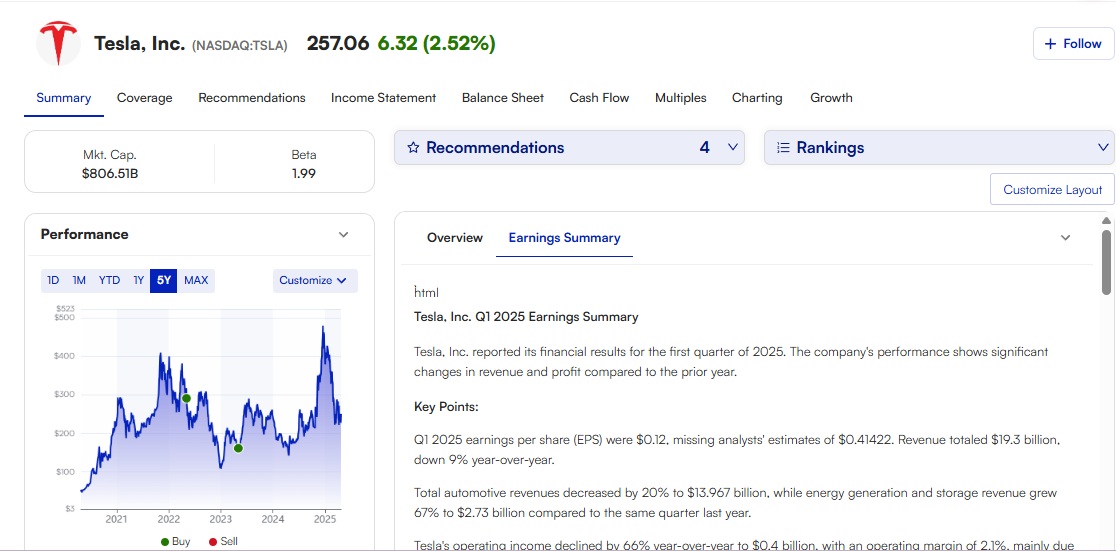

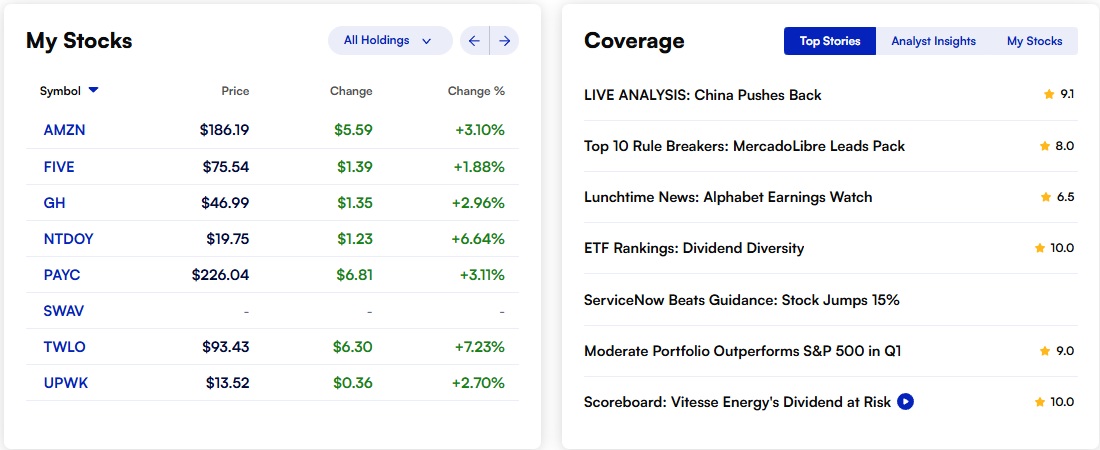

I’ve been a Motley Fool Stock Advisor subscriber since 2016 and their picks have done very well for me. Take a look at this chart of my Motley Fool stock picks since I subscribed in 2016.

My Experience with the Motley Fool Stock Advisor Picks Since I Subscribed in 2016.

Here's a summary of the performance of Stock Advisor since I subscribed in January 2016. I was so impressed with their performance that I started buying $1,000 to $2,000 in my Etrade account. I quickly learned to put a 30% stop loss on these picks in case they do pick a big loser. You can see how their picks have performed for the 2025, the last 12 months, and the last 8 years. Notice those picks that are older than 5 years since I subscribed are up 258% and are beating the market by an average of 107%.

See what you missed out on by not signing up a few years ago when I did? You would be up 134%, beating the market by 40% and you would have bought NVDA in 2017!.That means if you had just bought $100 of each of their 227 stocks your $22,700 would have a profit of $30,418. Seems to justify the $99-199 per year price, right? Seems like a no brainer based on this track record.

My purchases of Motley Fool recommendations from 2016, 2017 and 2018 have outperformed the S&P 500 by 102%, 296%, and 84% and since Stock Advisor’s inception, their picks have outperformed the S&P 500 by over 800%!

In this review, we’ll provide insights and updates about Motley Fool to help you decide if it’s the right service to transform your investment journey. Is the Motley Fool legit and is a Motley Fool subscription worth it for you? Keep reading to find out!

Pro Tip:

July, 2025 Promotion: Save $100 & try Motley Fool Stock Advisor for a year for just $99!

Summary of Motley Fool's July, 2025 Best Discounts & Promotions

| Motley Fool Stock Advisor | Motley Fool Epic | |

|---|---|---|

| Overall Rating: | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service Type: | 2 stock picks and 2 "Five Best Stocks to Buy Lists" per month. That's 1 email per week on Thursday. Next pick comes out July 17th. | 5 stock picks per month from Stock Advisor (2 picks), plus 1 pick from Rule Breakers, 1 from Hidden Gems and 1 from Dividend Investor. Next pick comes out July 17th. |

| Strengths: | Original and best performing stock newsletter since its launch 23 years ago. Average pick is up 1,062% vs market's 178%; 70% profitable. | Well diversified, lower risk, high percentage of accuracy with 75% of picks being profitable. |

| Best for: | Beginning & intermediate investors that want to invest each month and plan on staying invested for at least 5 years. | Intermediate to experienced investor looking for better diversification, less risk, & some dividend yield. |

| Retail Cost: | $199 a year | $499 a year |

| Links to Best Promotion and Discount Pages: | Best Stock Advisor July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: Best money saving deal--Get 2 years for only $179 and save $229 on THIS promo page with code 'WSS179' if prompted. --Get 1 year for only $99, save $100 AND get their just released AI Supercycle: An Investor’s Guide to the Artificial Intelligence Boom ($49 Value) on THIS promo page with code 'WSS99' if prompted. --Save $100 and get 1 year for only $99 AND get Fool's top 3 "Double Down" Picks on THIS promo page with code 'WSS99dd' if prompted. |

Best EPIC July, 2025 Promotions/Discounts: All promotions have a 30 day money back guarantee: --Save $200 if you use EPICSALE on THIS promo page; includes 30 day money back guarantee. --Use this link to compare Stock Advisor ($100 off) and Epic ($200 off). |

Motley Fool Subscription Type Overview

Motley Fool offers several subscription options and before you subscribe, you’ll need to get a handle on what they are and how they differ from one another.

| Subscription | Focus | Features | Price |

| Stock Advisor | Buy-and hold strategy for investors looking for good stock picks that can invest at least $200 a month in the market; suitable for beginners and experienced investors | 2 stock picks/month Monthly rankings Entry strategies Game Plan financial hub | $199 per year |

| Epic | Balanced mix of picks for people with $50,000+ in their portfolios | 5 stock picks/month Additional picks from Rule Breakers, etc. Fool IQ Access to 5Y Quant ratings | $499 per year |

| Epic Plus | Additional research, recommendations and trends for people with $100,000 or more in their portfolios | 8+ stock picks/month Tom Gardner’s real money portfolios Options trades Monthly recs & rankings | $1,999 per year |

| One | Access to the One Portfolio, plus all picks and additional features for people with $500,000 or more in their portfolios | 11+ stock picks/month One Portfolio with quarterly rebalancing Member Event access Investor Solutions Team access | $13,999 per year |

| Rule Breakers | Available as part of Epic memberships and above | 2 high growth stock recommendations per month Monthly Round Table 10 Best Buy alerts per month | Part of Epic, Epic Plus, and One bundles |

As you can see, each plan is geared toward investors based on their portfolio size and what type of information they want. Beginners who just want a couple of vetted stock picks each month will do best with Stock Advisor.

People who don’t mind spending a little more to get some extra picks may benefit from the Epic bundle, which gives access to the Stock Advisor Picks, plus Rule Breakers and a few other things.

Motley Fool Subscription Features Overview

| Motley Fool Subscription Type | Key Features |

| Motley Fool Stock Advisor | Monthly Stock Picks: 2 Recommendations of companies you can buy and hold for the long term Monthly rankings in Stock Advisor Three entry strategies across Cautious, Moderate, and Aggressive styles |

| Motley Fool Epic | Monthly Stock Picks: 5 Rule Breakers recommendations of high-growth stocks Access to Fool IQ Monthly recommendations and rankings from Rule Breakers, Hidden Gems, and Dividend Investor Portfolio Strategies Quant 5Y ratings Access to members-only podcast |

| Motley Fool Epic Plus | Everything in Stock Advisor and Epic Monthly Stock Picks: 8+ Access to Options Strategies Intro to Tom Gardner’s proprietary investing portfolio Monthly recommendations and rankings across Trends, Value Hunters, and Global Partners |

| Motley Fool One | Everything in Epic Plus Monthly Stock Picks: 11+ Access to One Portfolio Quarterly rebalancing Full access to all reports Member Event access Team Solutions access Full Industry Research, Company, & Market Coverage |

Key Benefits of Using Motley Fool Subscription

Here are some of the key benefits of using a Motley Fool Subscription.

- Access to expert analysis about stocks and other investments. Motley Fool subscribers can use the company’s huge library of analysis to learn about investments and decide whether to add them to their portfolios.

- Access to educational content. New investors can learn all about how the stock market works, how to understand investment metrics, and much more, to get them off on the right foot in their investment journey.

- Access to portfolio strategies ideal for cautious, moderate, and aggressive investors.

- High-performing stock picks. The Motley Fool’s stock picks have historically performed very well when compared to the S&P 500.

Motley Fool Rule Breakers Picks (included in the Epic, Epic Plus, and One bundles) have more than doubled the S&P 500 since its inception.

Pro Tip:

If you sign up with The Motley Fool today, you will receive $100 off and unlimited access to Motley Fool Stock Advisor!

Who Can Benefit Most from Motley Fool’s Services?

Let’s run through who can benefit the most from Motley Fool’s Services.

Beginner Investors

Motley Fool Stock Advisor is the best option for beginner investors who want to get their feet wet and start building a portfolio. By embracing the “buy and hold” strategy and buying each one of Stock Advisor’s monthly recommendations, you can increase your odds of beating the S&P 500.

Long-Term Stockholders

Long-term stockholders are the optimal subscribers for both Stock Advisor and Epic. Taking the long view in the stock market is wise because while prices may change from day to day, the overall trend of the market is up.

Growth-Seeking Investors

Growth-seeking investors can benefit the most from the bundles that include Rule Breakers picks, since they’re specifically focused on companies with significant growth potential. Having access to the regular Stock Advisor picks is useful because it can keep your portfolio balanced.

Pro Tip:

If you sign up with The Motley Fool today, you will receive $100 off and unlimited access to Motley Fool Stock Advisor!

Motley Fool Success Stories & Case Studies

Let’s look at two of the stocks that Motley Fool has recommended and see how they’ve performed.

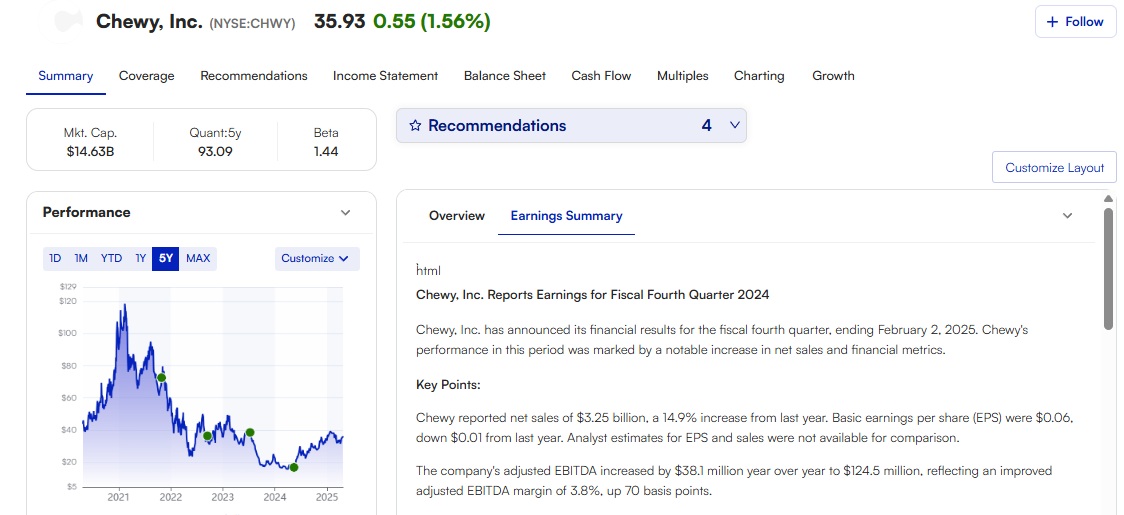

Chewy is a pet supply company and received a Buy recommendation for aggressive investors from Motley Fool in April of 2024, when the stock price was $16.10. As of April of 2025, the price is at $35.93, representing a gain of 123.2% in about a year.

Analysts at The Motley Fool have recommended buying Tesla stock multiple times. We reviewed the performance starting on January 2, 2020 through mid-April of 2025. Here’s what it looks like.

The price at the beginning of 2020 was $28.68 per share, and as of late April of 2025, the price is $256.89 per share, representing a gain of 796%. Tesla’s had its share of ups and downs, but overall its still delivering great returns.

What these examples show is that the Motley Fool team does an excellent job of choosing stocks that will appreciate over time. Of course, they don’t always get it right, but if you buy every pick and use the recommended buy and hold strategy, there’s a chance that you’ll do very well.

How to Get the Most Out of Your Motley Fool Subscription

Now that you’ve got our take on the various subscriptions offered by Motley Fool, here are our tips to help you make the most of your subscription.

- After you subscribe, the first step should be creating a portfolio. You can’t link directly to a brokerage portfolio, but you can mirror your investments. Having your portfolio handy will help you use Motley Fool’s features and keep track of what’s happening with your investments.

- Go to your Settings and set up your alert preferences. We suggest setting up email or text alerts to be advised when Motley Fool issues new guidance or when new recommendations are made. You can also opt in for some newsletters.

- Regularly check your portfolio updates. That way, you’ll be able to see what’s happening with your investments and make informed buy/sell decisions.

Of course, the only way to take advantage of Motley Fool’s features is to subscribe – and start using these tips today.

Furthermore, if you are looking to compare the Motley Fool as a whole against competitors such as the Seeking Alpha and Zacks, check out our new review comparing the three: SEEKING ALPHA VS MOTLEY FOOL VS ZACKS!

FAQs

Motley Fool annual subscriptions range from $199 for Stock Advisor to $13,999 for the One bundle. Most investors don’t need to spend the money for the One bundle. The Epic Bundle offers everything in Stock Advisor plus access to extra features and picks, making it a good choice for most investors.

Motley Fool doesn’t publish the success rate of every subscription service, but Motley Fool Stock Advisors picks have delivered gains of 900+% for members and more than quadrupled the S&P 500 since the service’s inception, and Motley Fool Rule Breakers picks have beaten the S&P 500 by 156.25%.

The primary difference is that Motley Fool Stock Advisor focuses on long-term growth and urges subscribers to stick to a ‘buy and hold” strategy to maximize their earnings. Rule Breakers is for aggressive investors who want stock picks with high growth potential and may want to take a more active role in managing their portfolios.

The Motley Fool One bundle offers over 11 picks each month, so that’s the service where you’ll get the most frequent picks. If you choose the Epic bundle, you’ll get 5 picks and with Epic Plus, you’ll get 8+.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.