If you’ve been in the investing game for awhile, chances are you’ve come across the term “stock screener” and are aware of how helpful stock screeners can be for your portfolio.

But in case you haven’t…

Let’s start with a definition.

What Is a Stock Screener?

A stock screener is an investing tool that helps you identify stocks you may want to buy based on certain criteria that you choose.

The criteria can be…

- Fundamental factors, such as the quality of the stock’s balance sheet and its earnings per share.

- Technical indicators, such as previous stock price and trading volume.

- Social measurements, such as a numerical or categorical rating of the company’s carbon footprint.

… And much more.

A stock screener contains a database that has all of the necessary information available on all of the stocks contained in the database. You select which criteria you want to screen for, and then the stock screener uses its search engine to filter out stocks that don’t meet your criteria and presents you with a list of stocks that do meet the criteria.

This can be a very quick and efficient way to narrow down your search for your next stock to buy!

Figuring out which stock screener is right for you can be a daunting task. But that’s why Wall Street Survivor is here! This list of the Best Stock Screeners in 2025 will help you decide which stock screeners may be a good fit for you depending on what type of investor you are and how much money you’re willing to spend.

So, without further ado, let’s get down to our list of the Best Stock Screeners!

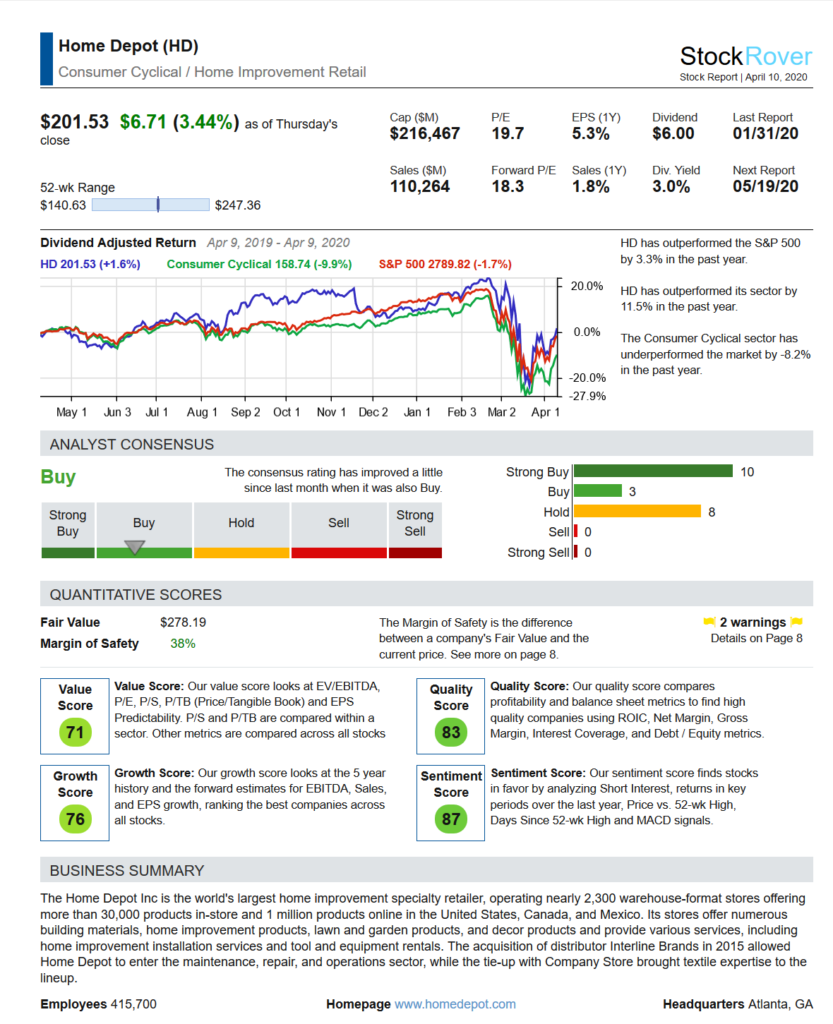

Best Stock Screener for Fundamental Investors: Stock Rover

Stock Rover offers robust screening and research features to help investors make informed decisions and find undervalued stocks. You can choose from more than 140 stock screeners or create your own customer screen with more than 700 factors.

As a premium member, you’ll have the option to screen stocks and other investments, including ETFs. Using their research and tools, it’s easy to build and diversify your portfolio to get the best results

Stock Rover tracks more than 8,500 stocks, 4,000 ETFs, and 40,000 mutual funds. You can create comparisons using their Table tool. After downloading your portfolio, you can use spreadsheet features to sort, color, and analyze your investments.

One of the things we really like about Stock Rover is that users can sign up to receive email recommendations about rebalancing portfolios or portfolio analysis. There’s a nice combination of DIY research and useful reports that sets Stock Rover apart from other stock screeners on the market.

Stock Rover also creates watchlists based on market data. They add new watchlists every year; for example, Best and Worst S&P Performers for 2023. You also have the option of creating a custom watchlist based on your portfolio and investment interests.

While Stock Rover does offer charting tools that can be used for short-term trades, we think that the platform’s fundamental analysis is what really makes it shine.

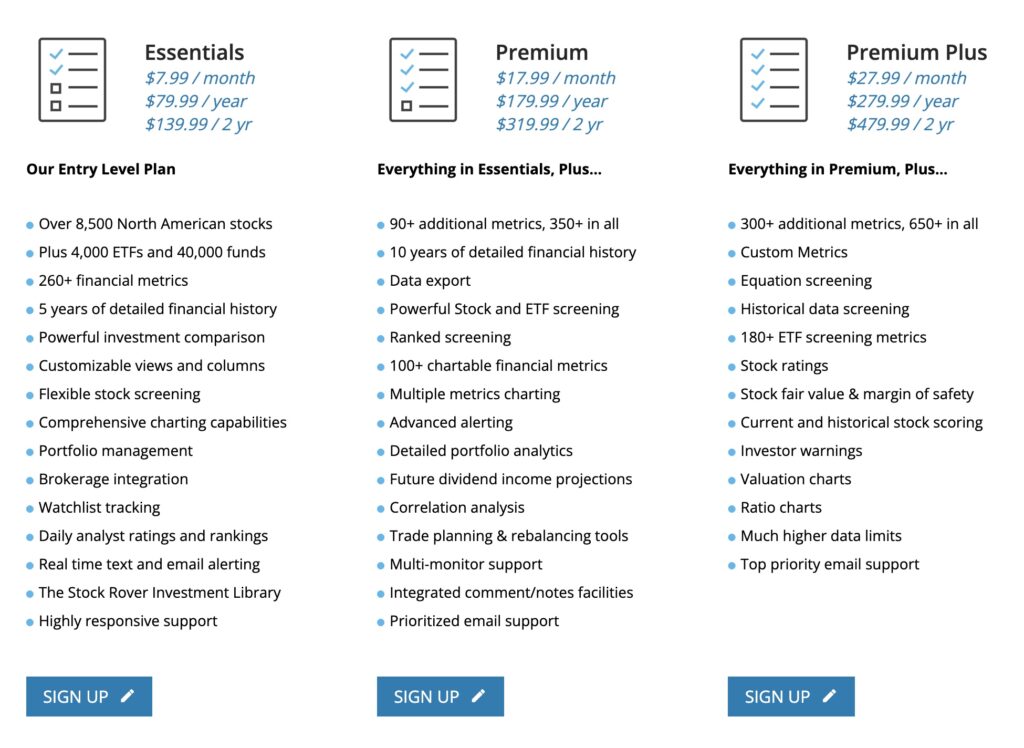

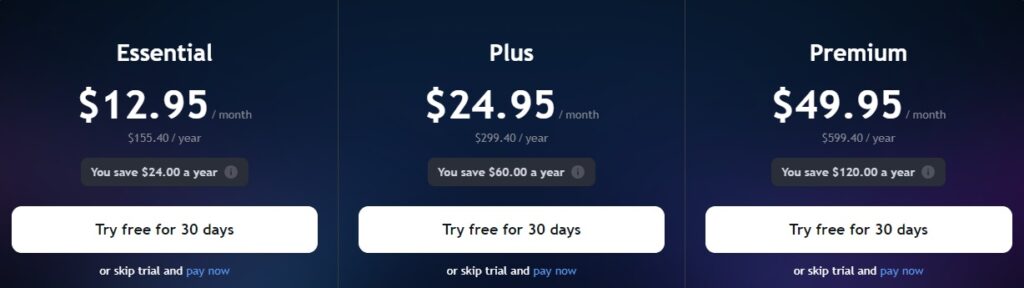

Stock Rover offers a free plan that will help you get your foot in the door with some limited screening capabilities. But if you want to take your screeners to the next level, you’ll need to sign up for one of the premium plans.

If you’re just looking to try out Stock Rover to get a feel for their impressive set of stock-screening technology, you can sign up for a FREE two-week trial of the Premium Plus plan!

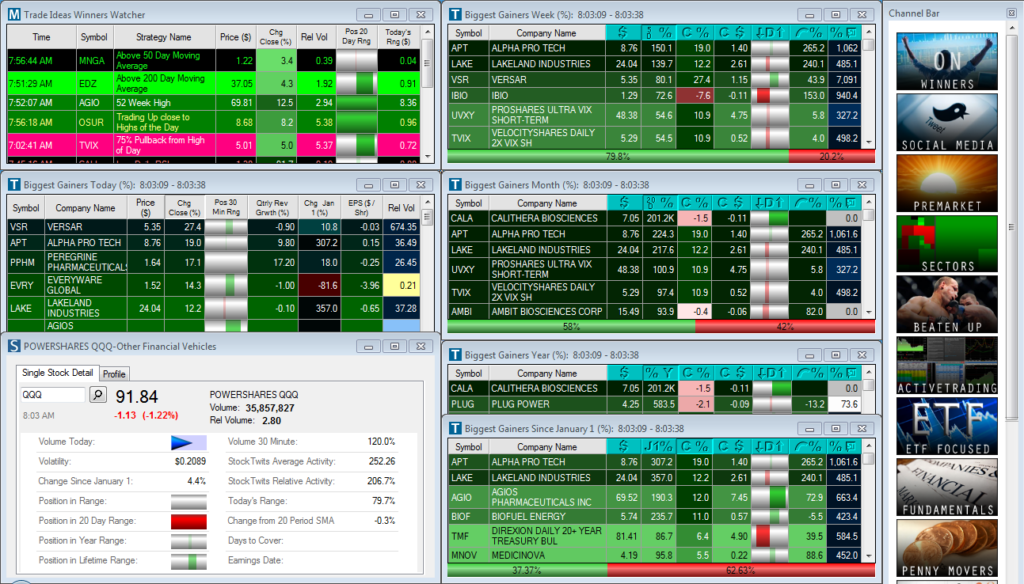

Best Stock Screener for Technical Traders: Trade Ideas

Trade Ideas has made waves in the stock screening space due to its superior machine learning capabilities.

The company harnessed the power of artificial intelligence to bring the world Holly, an AI-powered stock screener. Holly was named after the Holy Grail, which is fitting because she is the holy grail of A.I.-powered stock screening!

Trade Ideas provides users with a complete manual to use Holly. It includes recommendations to start with a simulation.

Every night, Holly reviews her strategies and tweaks her algorithm, enabling only those strategies that perform the best in testing.

Trade Ideas offers automated investing with Interactive Brokers, meaning you can use your specified screening preferences to execute trades automatically in your brokerage account from Interactive Brokers!

Trade Ideas offers a free plan, the TI Dashboard Plan. They’ve lowered their prices for the premium plans.

A monthly subscription to the Standard Plan is $84/month, or you can pay $999 annually and save $9.

A monthly subscription to the Premium Plan is $167/month, or you can pay $1,999 annually and save $5. (We should note that the savings on the Trade Ideas website are not accurate as of this writing. They appear to be holdovers from the higher prices.)

You can read our full Trade Ideas review or check out Trade Ideas here.

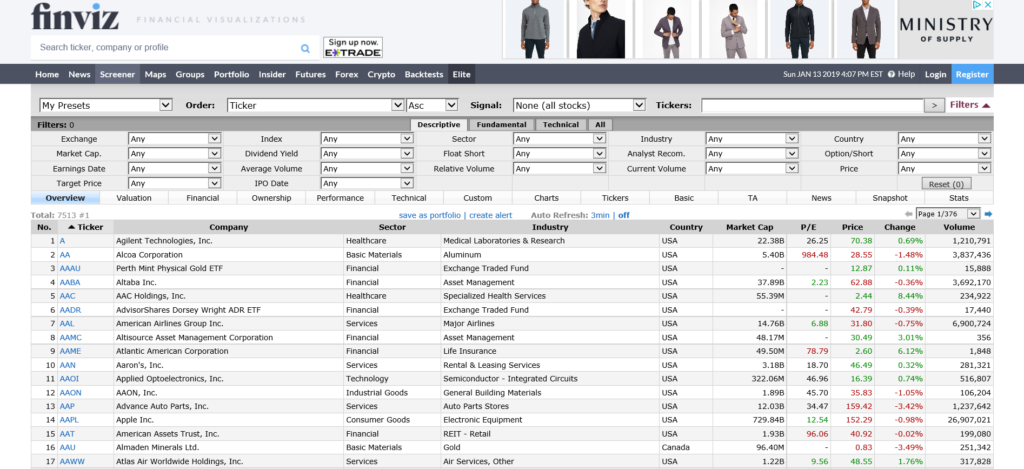

Best Stock Screener for Beginners: Finviz

You might know Finviz from their stellar S&P 500 map, which shows you a graphic of the performance of all the companies in the S&P 500 organized by market capitalization.

But did you know that Finviz also has some awesome screening capabilities that are super easy to pick up as a beginner?

Finviz, which is short for Financial Visualizations, is known for displaying data to its users in a way that’s aesthetically pleasing and easy to understand.

For example, you can simply hover over a stock’s ticker symbol on FinViz to see a candlestick chart of its performance over the last three months.

These visualizations combined with the easy-to-understand screening factors make Finviz a great screener for beginners.

You don’t have to be a professional trader or an investing genius to understand the different filters on Finviz. You can make your screen as simple as specifying the size of the company you want to invest in, its target price, and what sector it’s in. You can even export your screens for future use!

Finviz’s free stock screener version makes it a great option for buy-and-hold investors and some swing trading fans. While you won’t get stock price information updated in real time, you can use the free screens to make investment decisions in advance.

You don’t even have to register for an account to use the free version of Finviz – you can access it directly on the home page! (Keep in mind that you won’t be able to link a portfolio or export screeners if you don’t register.)

Finviz Elite costs $39.50 per month for a monthly subscription, or $24.96 per month for a yearly subscription.

Best Free Stock Screener: TradingView

TradingView is a robust screening and investment research platform. It has the most advanced screening and charting technology we’ve seen.

What sets it apart from other screeners is that it bills itself as an investment social media platform. Users can post information and read recommendations and analysis from users.

While a bit of caution is necessary, we think the overall quality of the community’s contributions is high.

There’s a long list of fundamental and technical factors you can use to screen investments and find the perfect stocks for your investment style and preferences.

Unlike a lot of screeners, TradingView offers subscribers the option to screen foreign stocks and crypto. In fact, you can set up stock screening in over 50 exchanges around the world.

While TradingView offers premium plans, we’ve chosen it as our Best Free Stock Screeners because you can get access to some amazing screening tools and research data with the free, Basic Plan.

In addition to screeners, you can chart stocks, view live streams and read articles from reputable sources like The Wall Street Journal and Kiplinger.

We also appreciate the Economic Calendar feature. Even as a free user, you can view TradingView’s list of world events that might impact your portfolio. Examples include expected interest rate increases or note auctions. Clicking an event will add it to your personal calendar.

Even if you think you might want to pay for a premium plan, we suggest starting with the Basic Plan to familiarize yourself with the available tools and metrics. You’ll need a premium plan to access some of the more advanced features, but you can still put together a portfolio without paying a dime!

If you sign up for a premium plan, you’ll get two months free if you pay annually in advance.

You can read our TradingView review or try TradingView here.

Best Stock Screener for Hands-Off Investors: Zacks

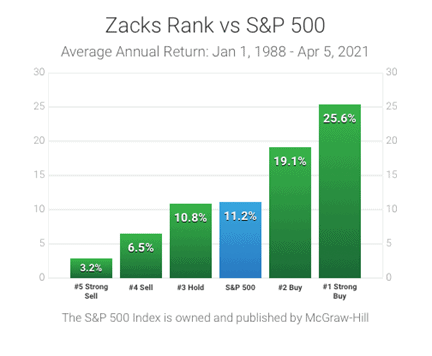

Zacks Investment Research has long been one of our favorite stock research platforms due to its high-performing #1 Strong Buy list.

Zacks uses the Zacks Rank system to evaluate stocks on plenty of different factors and assigns them a rank between 1 (Strong Buy) and 5 (Strong Sell). The stocks ranked as #1 Strong Buy have outperformed the market for 26 of the 31 years the list has been used!

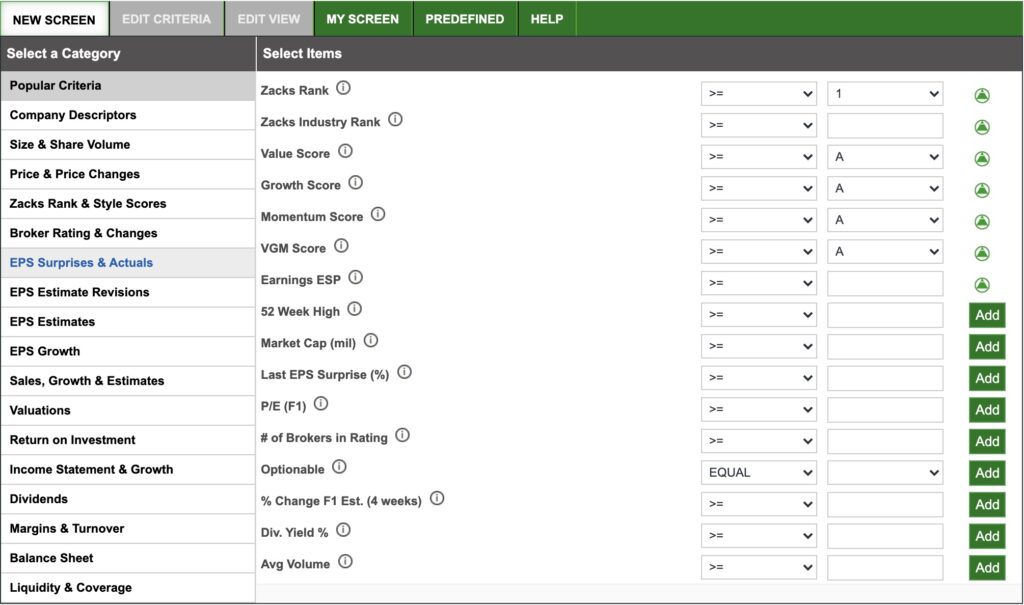

But Zacks also has its own screening tools that you can use to evaluate stocks on your own and put together your own portfolio.

Zacks is ranked as our Best for Hands-Off Investors because its screening system can do most of the work for you using the Zacks Rank system.

Instead of combing through hundreds of stocks using your own criteria, you can simply set up your screen to include stocks that are ranked #1 Strong Buy in Zacks Rank, highly ranked in Zacks Industry Rank, or have high Value, Growth, Momentum, or VGM scores.

If you don’t have the time or the interest in setting up elaborate screens using many different factors, then Zacks’ screening tools are a great fit for you!

You can get access to many of Zacks’ screening capabilities with the Free plan, but if you want to include Zacks Rank factors in your screens, you’ll need a Premium subscription. The Premium plan costs $249 per year.

Zacks Investor Collection provides a host of additional research tools. The cost is $59 per month or $495 per year. There’s also an Ultimate Plan that costs a whopping $299 per month and is more than most investors need.

Honorable Mention

If you’re looking for a platform that lets you trade commission-free AND gives you access to higher-level market data, check out moomoo. Moomoo is a free trading platform that provides access to level II market data, which is a pretty rare combination. Read our moomoo review.

Final Thoughts

If you haven’t signed up for a stock screening platform yet, we recommend that you at least take a look into a free trial. Stock screeners can be a great way to make your investing decisions quicker and more informed, and the screeners mentioned in this list are a great place to start! Furthermore, if you are looking to screen different stocks straight from Morningstar, check out of review of BetterInvesting here!

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. $3 monthly 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

Robinhood

Robinhood$0

✅ U.S. stocks, ETFs, options, and cryptos

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes

✅ Access to U.S. and Hong Kong markets

✅ Educational tools60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analyticsRefer a Friend and Get $200

Interactive Brokers Review

4.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

5.

M1 Finance

✅ Automated investing “Pies”

✅ Banking & low-interest loans

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

6.

Webull

$0

✅ Extended-hours trading

✅ Great charts and screeners

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

7.

Public

$0

✅ Fractional shares

✅ No payment for order flow model

✅ “Alpha” tool with earnings calls$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

8.

Composer

$32 a month

✅ Invest in automated strategies

✅ Build custom strategies easily

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

9.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools

✅ Curated theme portfolios$5 when you invest $5

Stash Review

10.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

11.

Etoro

$0

✅ CopyTrading™ to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.