Stock Rover Review

What Is Stock Rover?

Stock Rover is a stock screening and stock analysis platform that is suddenly becoming very popular and winning many awards.

It was developed in 2008 by two software engineers, Howard Reisman and Andrew Martin, who wanted to create an all-in-one portfolio analysis and screening tool that would do away with the need for a multitude of spreadsheets and tabs that further complicate the financial analysis process.

According to their website, “Stock Rover addresses a gap in the stock research marketplace by offering sophisticated, streamlined tools that are accessible to individual investors while providing all the power needed by financial professionals.”

And is the Stock Rover platform a valuable resource for investors?

Our answer is a definite YES, we love the analysis tools and the price!

It appears that the Stock Rover reputation is getting a big boost from winning awards such as these from Barron’s and the American Association of Individual Investors:

In this Stock Rover review, we will take a deep dive into the Stock Rover tool and show you all you want to know.

Stock Rover is NOT just Another Old Stock Screener…

One of our favorite things about Stock Rover is that they’re constantly striving to make complex and sometimes boring information accessible to investors by using creativity and innovation.

For instance, I love the Stock Rover Research Reports. ‘

Financial research is time-consuming, scattered, and always seems like it’s being buried down in the depths of clunky, outdated websites.

But with Stock Rover, they do the heavy lifting for you, and give you everything you need to know in 8 short pages!

Research Reports

Research Reports give you a real time, comprehensive summary of any of the 8,500+ stocks Stock Rover tracks on the U.S. and Canadian exchanges.

Here’s an example of the first page from a Home Depot report.

In fact, they have 30 free full reports that you can check out here!

Stock Rover is currently offering a FREE 2 WEEK TRIAL of their Premium Plus plan! That is their best plan, with all the best features, and the trial does NOT require a credit card. So CLICK HERE to try it out today. It only requires an email address.

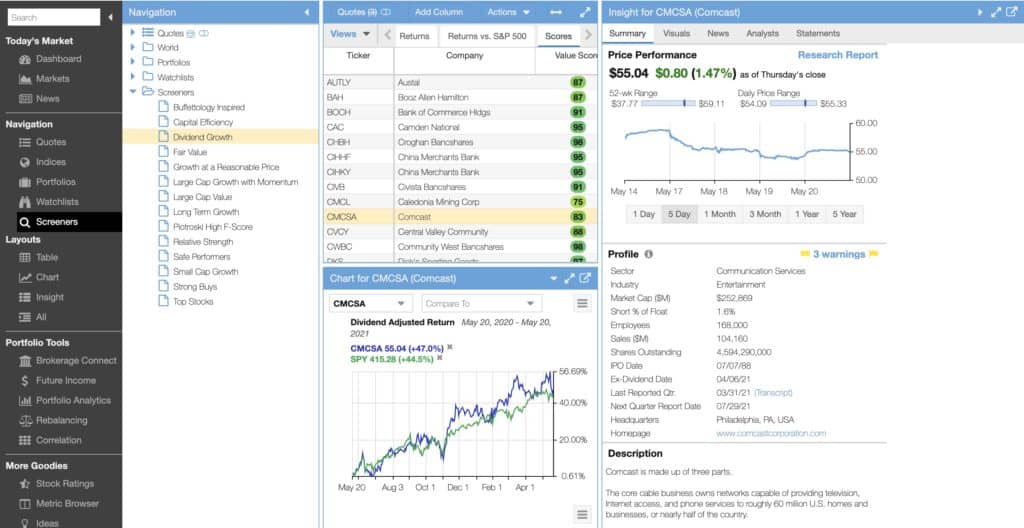

Once you have access to the Stock Rover Research Reports, you can access them at any time by right clicking on any stock ticker from the Table and selecting Research Report.

Or you can run the report from Stock Rover’s Insight Panel…

The best part is that you can get access to these 8,500+ real time reports for just $49.99 per year when bundled with any yearly or two-year Stock Rover plan.

When purchased separately, the reports are $99.99

Email at support@stockrover.com

STOCK ROVER SUMMARY

What You Get:

- Stock Screener with Over 275 Factors

- Research Reports on Over 8,500 Stocks, 4,000 ETFs, and 40,000 mutual funds

- Charting Tools for Short-Term Trading

The Stock Rover Appeal:

- Portfolio Analytics Features That Connect to Your Brokerage Account

- Table View Shows You Stock Rover Ratings for All Your Stocks at Once

Stock Rover Pricing:

- The basic plan is COMPLETELY FREE

- Paid plans cost between $7.99 and $27.99 per month; you can get a 2-week FREE trial of their highest-tier plan!

How Does Stock Rover Provide Value?

Does providing new members free access to their highest level subscription for FREE sound like providing value? We think it does! Try Stock Rover’s Premium Plus plan, for two weeks absolutely free!

Stock Screeners

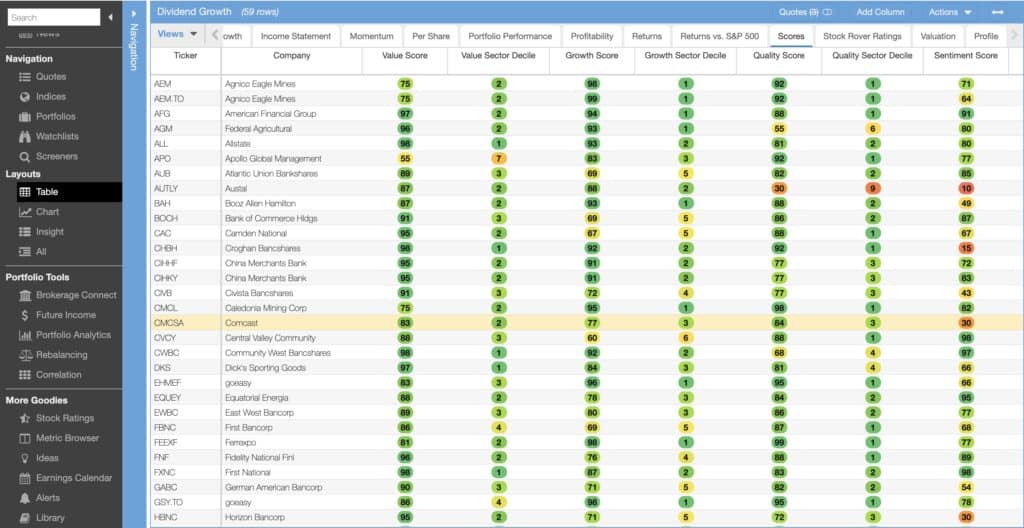

Stock Rover’s stock screening capabilities are some of the best in the business, especially when you upgrade to their premium plans.

If you’re looking to quickly filter out certain qualities and metrics of a stock in order to find out which investments are best for your goals and strategies, you can choose from the pre-made screeners offered by Stock Rover.

If you want to customize your own stock screener with your own set of specified metrics, you can build your own stock screener using over 700 different factors.

Stock Rover is constantly adding new screeners for its customers to use to optimize their investment portfolios.

Some of the most recent Stock Rover screeners include Top 25 S&P 500 Dividend and Revenue screeners, Top 25 Largest REITs by market cap, and Top 15 Largest MLPs by market cap!

Stock Comparison

Stock comparison on Stock Rover can be done using their Table tool, which functions much like an Excel spreadsheet.

One of the best features about the Table is that you can load ticker symbols into your screen or even download your own portfolio into the Table in order to receive instant financial metrics and equations.

You can also use the Stock Rover Table to perform basic spreadsheet functions like sorting, filtering, and coloring.

The Research Reports feature, which comes at an additional cost, gives you access to reports on over 7,000 stocks.

Stock Rover’s Research Reports come with basic financial statistics such as earnings per share and dividend yield, buy/sell ratings, scores for Value, Growth, Quality, and Sentiment, comparisons versus benchmark and versus industry, profitability summaries, earnings surprise analyses, and financial statement summaries.

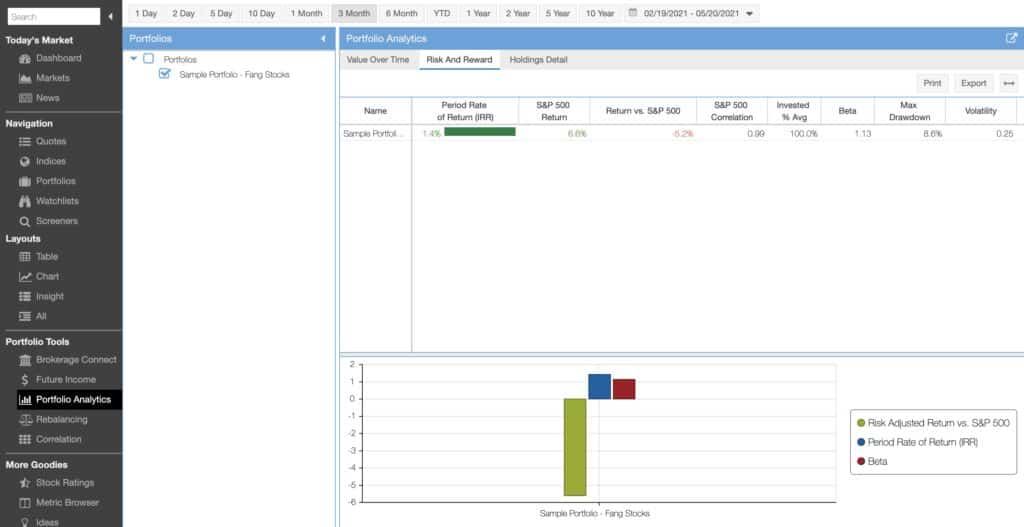

Portfolio Management

Stock Rover’s portfolio management feature utilizes an easy-to-use brokerage integration facility so you can instantly download your portfolio onto the website, directly from your brokerage.

This feature lets you eliminate the need to individually select the stocks and dollar amounts you have in your portfolio, letting you save time in getting down to the actual analysis.

The portfolio management section lets you analyze your risk-adjusted returns, valuable financial ratios such as the Sharpe Ratio, and correlation statistics in order to maximize your diversification.

You can also get rebalancing suggestions and periodic portfolio reports from Stock Rover sent to your email.

Stock Charting

Stock Rover provides some basic charting functionality that, while not ideal for day traders, can provide useful insight into your portfolio and its potential by analyzing historical data.

You can chart your portfolio against a benchmark to analyze peaks and troughs, analyze statistics like the P/E ratio, and even do some technical analysis using indicators such as simple moving average, relative strength index, and candlesticks to show what the historical data says about the strength of your portfolio.

To check out another platform that offers charting tools, read our VectorVest review.

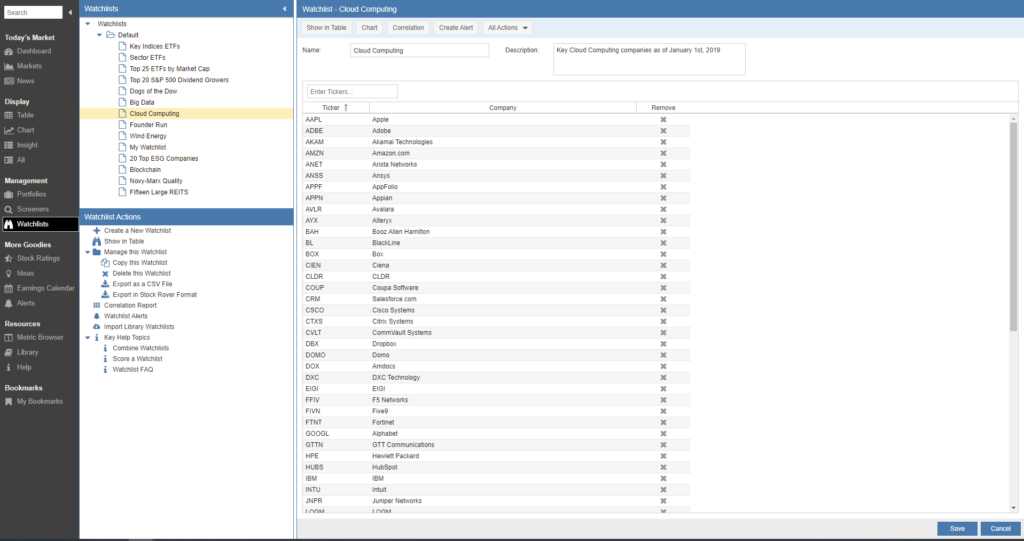

Watchlists

You can also utilize watchlists on the Stock Rover platform.

A watchlist lets you keep an eye on stocks that might be a good fit for your portfolio so you can see how they’re performing.

You can make your own watchlists using custom criteria, or you can pick custom watchlists created by Stock Rover!

Stock Rover added some new watchlists for their users in 2024.

You can use these watchlists to track stocks in categories such as Best and Worst S&P 500 performers for 2023, Dogs of the Dow, Top 25 S&P Growers by Dividend and Revenue, The Big 20 of MLPs, and Top 25 ETFs by volume and market cap!

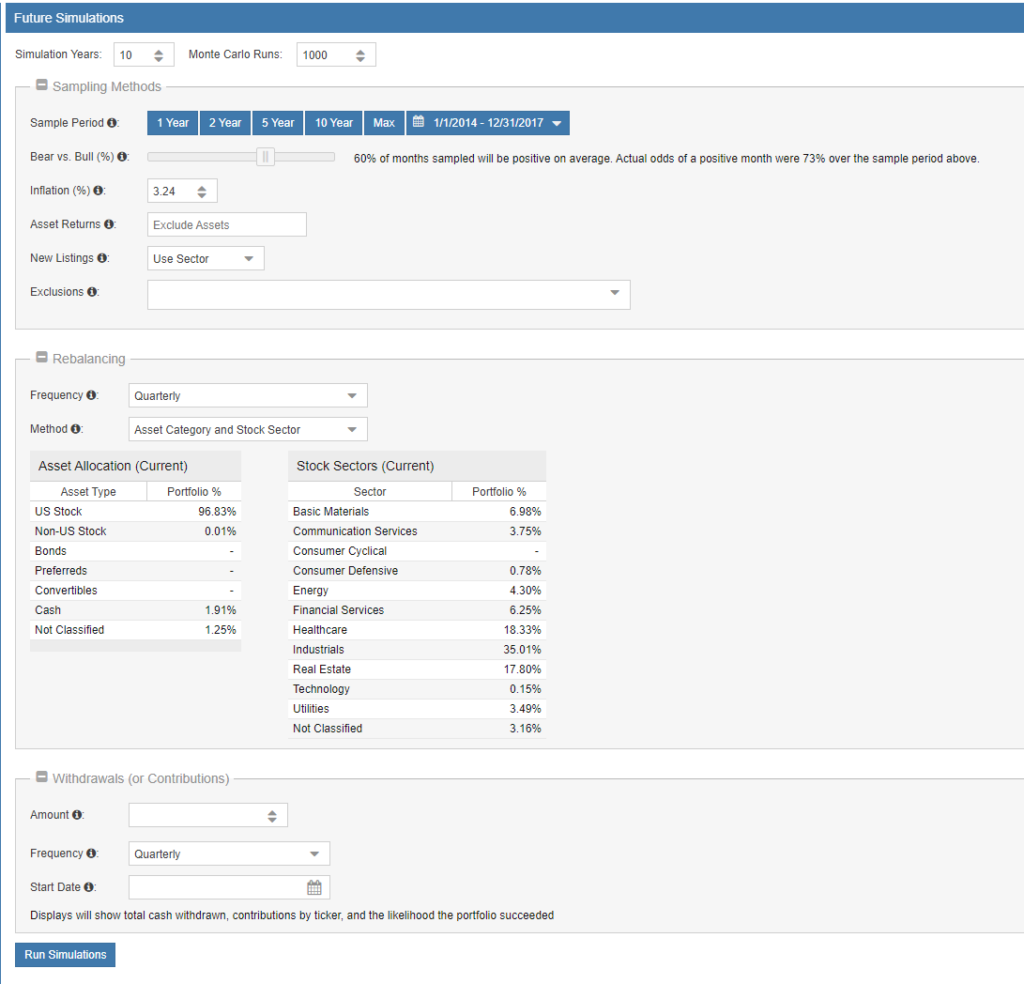

Future Simulations

Stock Rover recently rolled out a new feature on the platform called Future Simulations.

Future Simulations allow you to run a hypothetical test of how your portfolio might perform in a given period of time in the future.

The tests are done using Monte Carlo simulations, which are a type of simulation that tests possible outcomes when random variables are present.

Essentially, Stock Rover would run hundreds or thousands of different tests on your portfolio while randomizing the variables that might affect it.

Then, you’ll be able to see many different outcomes as well as the probability of each one.

You can use the average of these outcomes as a guideline (but not a foolproof plan!) for what could happen to your portfolio.

Stock Rover Membership Plans

Stock Rover provides four different membership plans, one free plan and three paid:

THE FREE PLAN

The Stock Rover free plan includes the following:

- Comprehensive information on over 8,500 North American stocks

- Coverage of 4000 ETFs and 40,000 mutual funds

- Portfolio management

- Portfolio Brokerage integration for automated syncing of portfolios

- Portfolio dashboard with detailed portfolio performance information

- Powerful and flexible charting capabilities

- What’s happening pages covering markets, stocks, ETFs, bonds and commodities

- Daily analyst ratings with analyst rankings

- In depth market news and news for individual stocks

- Informative market dashboard with detailed display of markets and key stocks

- Comprehensive and flexible earnings calendar

- Ideas panel with screeners of the week and additional investment ideas and articles

- Quick context aware links to other key data sources

THE ESSENTIALS PLAN

The Stock Rover Essentials plan includes the following:

- Over 8,500 North American stocks

- Plus 4,000 ETFs and 40,000 funds

- 275+ financial metrics

- 5 years of detailed financial history

- Powerful investment comparison

- Customizable views and columns

- Flexible stock screening

- Comprehensive charting capabilities

- Portfolio management

- Brokerage integration

- Watchlist tracking

- Daily analyst ratings and rankings

- Real time text and email alerting

- The Stock Rover Investment Library

- Highly responsive support

- Ad-free experience

COST: The Stock Rover Essentials Plan costs $7.99 a month. If you buy a one-year subscription, you will get two months free for a total price of $79.99. The best monthly cost comes with a two-year plan, which costs $139.99. But keep reading to get the best value.

The PREMIUM PLAN

The Stock Rover Premium plan includes everything in the Essentials plan plus the following:

- 100+ additional metrics, 375+ in all

- 10+ years of detailed financial history

- Data export

- Powerful Stock and ETF screening

- Ranked screening

- 100+ charitable financial metrics

- Multiple metrics charting

- Advanced alerting with alerts on indices, portfolio, and watchlist levels

- Detailed portfolio analytics

- Future dividend income projections

- Correlation analysis

- Portfolio branding & rebalancing tools

- Multi-monitor support

- Integrated comment/notes facilities

- Prioritized email support

- The Trade Evaluator Facility

- Monte Carlo portfolio simulation

COST: The Stock Rover Premium Plan goes for $17.99 a month, $179.99 per year, or $319.99 for a two-year plan. Keep reading to get the best deal.

THE PREMIUM PLUS PLAN

Stock Rover’s top-tier plan is called the Premium Plus plan. This plan includes everything in the Premium plan as well as the following:

- 300+ additional metrics, 700+ in all

- Custom Metrics

- Equation screening

- Historical data screening

- 180+ ETF screening metrics

- Stock ratings

- Stock fair value & margin of safety

- Current and historical stock scoring

- Investor warnings

- Ratio charts

- Much higher data limits for brokerage connections, portfolios, screeners, & watchlists

- Top priority email support

- Valuation charts

- Tiled comparative views

COST: The plan costs $27.99 per month, $279.99 per year, or $479.99 for a two-year plan. This is absolutely the best plan and the price is very reasonable, but we suggest you take advantage of the following 2 week free trial of this plan. Their website makes it very easy to subscribe or change your plan to a higher or lower plan….

Stock Rover is currently offering a FREE 2 WEEK TRIAL of their Premium Plus plan! That is their best plan, with all the best features, and the trial does NOT require a credit card. So CLICK HERE to try it out today. It only requires an email address.

Email at support@stockrover.com

STOCK ROVER SUMMARY

What You Get:

- Stock Screener with Over 275 Factors

- Research Reports on Over 8,500 Stocks, 4,000 ETFs, and 40,000 mutual funds

- Charting Tools for Short-Term Trading

The Stock Rover Appeal:

- Portfolio Analytics Features That Connect to Your Brokerage Account

- Table View Shows You Stock Rover Ratings for All Your Stocks at Once

Stock Rover Pricing:

- The basic plan is COMPLETELY FREE

- Paid plans cost between $7.99 and $27.99 per month; you can get a 2-week FREE trial of their highest-tier plan!

As you can see, the more you upgrade, the more functionality you receive, with the highest tier giving you access to over 700 screening metrics and over 180 ETF-specific metrics.

But one of the features that may still be unclear is the customer service.

All subscribers, even those with the free plan, can email Stock Rover support at any time.

However, free plan members are not guaranteed an email response.

Paid subscribers are guaranteed a response, with the top priority being given to emails from Premium Plus members.

While it is not discussed on the webpage linked above, Stock Rover also has a dedicated phone line for customers.

Access to this line is offered to Premium and Premium Plus members subscribing to a one-year or two-year plan and costs an additional $50 per year, if chosen.

The line is open during business hours on business days.

The other feature that comes at an additional cost is the Research Reports feature.

Access to Stock Rover’s Research Reports costs $49.99 per year for members subscribed to a one-year or two-year plan, and $99.99 per year if not.

One of the main drawbacks to Stock Rover is that there is no mobile app or desktop app available.

At the moment, the only way to access Stock Rover is through the website, which can be done on a computer or phone. They’re also working on a mobile app, which is currently in beta testing as of October 2023.

Final Thoughts

There’s no reason to wonder why Investopedia chose Stock Rover as its best stock screener for buy and hold investors for 2024!

Its extensive stock screening capabilities and ability to link your portfolio right from your brokerage make it the ideal tool for analyzing the fundamentals of your portfolio.

However, day traders looking for access to foreign stock exchanges or complicated charting and analysis tools for technicals may need to look elsewhere.

Overall, Stock Rover is a great choice for long-term investors who want access to a free or paid screening service with great portfolio analysis abilities.

Our advice: Sign up for your free 2 week trial here and comment down below which stocks your analyzing!

Then, if you think that Stock Rover is worth it for you, you can work your way up to Stock Rover Premium, or even Stock Rover Premium Plus!

For information on other stock research tools, you can read our Zacks Premium review and Morningstar Investor review.

If you are curious about how Stock Rover compares to Seeking Alpha, check out our new review comparing the two here!

Stock Rover Review 2024 has been updated to include new features in the Stock Rover library in 2024. Did we miss anything? Let us know in the comments below!

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. $3 monthly 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

Robinhood

Robinhood$0

✅ U.S. stocks, ETFs, options, and cryptos

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes

✅ Access to U.S. and Hong Kong markets

✅ Educational tools60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analyticsRefer a Friend and Get $200

Interactive Brokers Review

4.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

5.

M1 Finance

✅ Automated investing “Pies”

✅ Banking & low-interest loans

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

6.

Webull

$0

✅ Extended-hours trading

✅ Great charts and screeners

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

7.

Public

$0

✅ Fractional shares

✅ No payment for order flow model

✅ “Alpha” tool with earnings calls$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

8.

Composer

$32 a month

✅ Invest in automated strategies

✅ Build custom strategies easily

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

9.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools

✅ Curated theme portfolios$5 when you invest $5

Stash Review

10.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

11.

Etoro

$0

✅ CopyTrading™ to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.