The artificial intelligence (AI) revolution is no longer on the horizon; it’s happening now. From AI-powered search engines to cloud infrastructure, artificial intelligence is driving transformation across virtually every major industry. Investors looking to tap into this explosive growth are turning to trusted resources like the Motley Fool’s Stock Advisor service.

Keep in mind that Motley Fool is not a brokerage and is not regulated by the SEC. However, Motley Fool stock picks do tend to produce monster returns. Known for its long-term investment philosophy and market-beating recommendations, Stock Advisor has consistently identified emerging trends and standout companies.

As the AI boom accelerates, the Motley Fool has spotlighted several top AI stocks that they believe are poised to deliver substantial returns. These companies are not only leading in AI innovation but also show the kind of earnings growth, market influence, and product strength that long-term investors seek.

Here are five of the Motley Fool’s top AI stock picks for 2025 and beyond.

Why AI Investing Matters

AI is transforming how companies operate, offering smarter decision-making, automation, and cost-saving efficiencies. For investors, this shift presents opportunities to back companies that are shaping the future of industries like cybersecurity, e-commerce, advertising, cloud computing, and more.

The Motley Fool’s analyst team has tracked this evolution closely. They believe AI represents a generational opportunity, similar to what the internet or mobile computing offered decades ago.

With AI spending projected to grow significantly over the next several years, understanding the best stocks to buy in this space could be key to long-term portfolio growth.

What Are AI Stocks?

AI stocks are companies deeply involved in the development or application of artificial intelligence technology. This includes businesses that design AI chips, build AI tools, or provide AI infrastructure that powers applications across sectors. These companies are helping businesses scale and adapt to a fast-moving, increasingly automated world.

From advanced GPUs to machine learning algorithms, AI is at the core of products and services used by millions daily. The Motley Fool’s Stock Advisor focuses on businesses that not only participate in the AI market but are positioned to lead and expand as the industry matures.

Motley Fool’s Top AI Stock Picks

Here are five AI-focused stocks the Motley Fool is watching in early 2025. Please note that the following are their AI stock picks from early 2025 and are subject to change. Get their new picks in real-time to maximize your returns.

The Motley Fool is currently offering $100 off for new subscribers.

Visit THIS WallStreetSurvivor Exclusive offer page to get your discount!

Remember, they have a 30 day money-back guarantee.

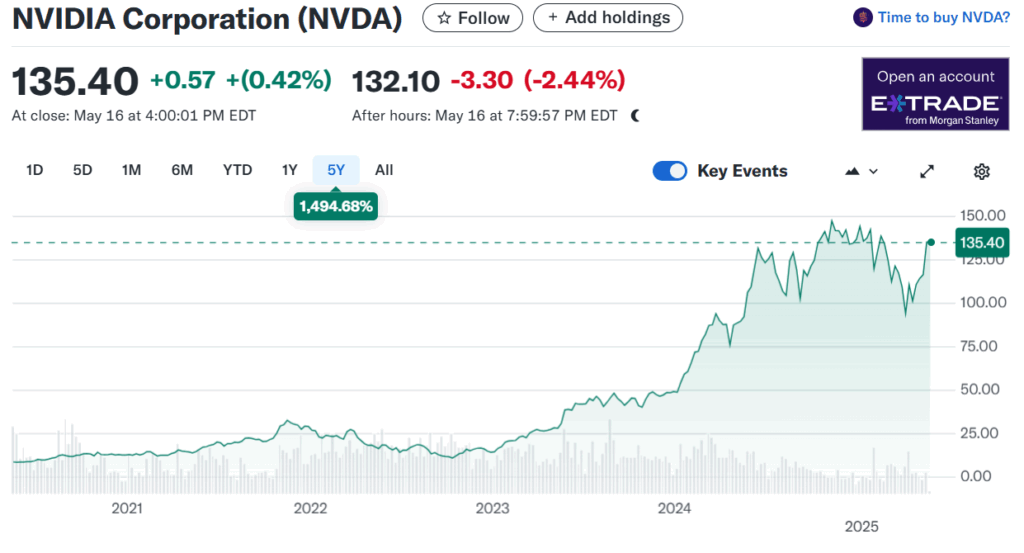

1. Nvidia (NVDA)

Nvidia continues to lead the AI revolution with its cutting-edge hardware and strategic partnerships. In 2025, the company announced plans to manufacture AI supercomputers and Blackwell chips in the United States for the first time, aiming to strengthen supply chains and meet rising demand.

Additionally, Nvidia is expanding its customer base beyond Big Tech firms by targeting sovereign AI projects and emerging cloud providers, including a multibillion-dollar chip deal with Saudi Arabia’s Humain and collaboration with the UAE on a major data center. This level of innovation and global reach keeps Nvidia at the top of the AI hierarchy.

2. Microsoft (MSFT)

Microsoft is deepening its commitment to AI through substantial investments and innovative projects. In 2025, the company plans to spend $80 billion on AI data centers, underscoring the intense capital requirements of artificial intelligence. An internal memo revealed plans for a new AI tool named “Tenant Copilot,” along with a broader initiative called the “Agent Factory,” aiming to integrate AI agents into all facets of development and operations.

With its AI capabilities embedded in Azure, Microsoft Office, and GitHub Copilot, Microsoft is becoming indispensable to enterprise and developer productivity.

3. Alphabet (GOOG)

Alphabet, the parent company of Google, is advancing its AI initiatives with the rebranding of Bard to Gemini, integrating it across Google Workspace and Android devices. The company is also planning to introduce ads for Gemini amid slowing growth, highlighting its strategy to monetize AI technologies.

Alongside Gemini, Alphabet continues to enhance its AI infrastructure through Google Cloud and its DeepMind division. With Gemini now central to Google’s AI strategy and continuous machine learning innovations underway, Alphabet is solidifying its role as a long-term AI leader.

4. CoreWeave (CRWV)

CoreWeave, a cloud computing services company specializing in AI infrastructure, has completed its $1.7 billion acquisition of Weights & Biases, signaling its strategic expansion into the software and AI developer platform space.

The company reported strong financial results for the first quarter of 2025, driven by accelerating demand for its purpose-built AI platform. CoreWeave also signed a $4 billion expansion deal with OpenAI, underlining its significant role in the AI ecosystem. Its ability to provide scalable access to Nvidia GPUs positions CoreWeave as an essential infrastructure partner for AI innovation.

5. Arm Holdings (ARM)

Arm Holdings is making significant strides in the AI semiconductor space. The company plans to develop artificial-intelligence chips, aiming to launch the first products in 2025. Arm’s processor designs are increasingly being adopted for AI-driven applications in smartphones, wearables, and edge devices, positioning it as a leader in edge AI.

Additionally, Arm and SoftBank Group have contributed $15.5 million to advance AI through a partnership with Carnegie Mellon University and Keio University, supporting research in transformative technologies powered by artificial intelligence.

Why I Subscribe to the Motley Fool

How do you consistently find winning stock picks?

For me, that’s why I subscribe to the Motley Fool’s Stock Advisor service. Their analysts have been recommending stocks since 2002, and the results speak for themselves. While the S&P 500 is up about 178% in that time, Motley Fool Stock Advisor picks have soared 937% overall. That’s not luck—it’s a track record more than four times better than the market.

The best part? These aren’t the household names you see on CNBC every day...at least not yet. The Motley Fool has a history of recommending companies before Wall Street catches on—think Amazon, Tesla, and Netflix, long before they became giants. Those are stocks I would've found way too late if it weren't for the Fool.

And right now, you can save $100 on a Motley Fool Stock Advisor subscription and see their next stock pick.

Cloud Computing and AI Expansion

Cloud computing and artificial intelligence are closely linked. Companies like Microsoft and Alphabet are not only AI leaders but also major players in the cloud space.

Their ability to deliver AI services through scalable cloud platforms creates synergistic growth. As the AI boom continues, cloud infrastructure spending is expected to rise, creating opportunities for investors aligned with this trend.

The Motley Fool’s Stock Advisor team has consistently emphasized the importance of cloud computing in driving AI development. Their top picks reflect companies that combine strength in both arenas, giving them an edge in long-term profitability.

The Evolving AI Landscape

The AI chip market continues to expand rapidly, with companies like Nvidia and Arm Holdings competing for dominance in next-generation hardware. These chips are essential to supporting the explosive growth in AI applications, from large language models to autonomous systems.

Many of the most successful stocks in recent years have had ties to the AI boom, driven by demand for smarter, faster, and more adaptive technologies. Big tech companies like Microsoft and Alphabet are leveraging their cloud infrastructure and AI platforms to maintain their leadership positions among tech giants.

The Motley Fool’s Stock Advisor service has built its reputation by identifying potentially lucrative opportunities early. Its analyst team, including some of the fool’s board of directors, carefully curates recommendations based on long-term growth potential, solid fundamentals, and a unique business model.

Long-term investors looking to build a strong foundation for their portfolios are increasingly interested in the AI landscape. These incredible companies offer innovative solutions and strong positioning for future growth.

Three incredible companies that consistently surface on buy stock lists from analysts include Nvidia, Microsoft, and CoreWeave. These businesses are reshaping how computer systems process and deploy artificial intelligence and offer the potential for market crushing outperformance compared to traditional tech names.

If you’re seeking access to some of the most successful stocks in the AI sector, Motley Fool’s Stock Advisor remains a trusted resource.

What Sets Motley Fool’s Stock Advisor Apart

Stock Advisor is known for recommending companies before they become household names.

Its stock picks are based on in-depth analysis of market trends, company fundamentals, and the potential for sustained earnings growth. Historically, Stock Advisor returns have delivered market-crushing outperformance, particularly in emerging tech sectors.

Investors who join Stock Advisor gain access to new monthly picks, timely updates, and a library of stock research focused on long-term gains.

For those interested in the AI market, this means getting ahead of the curve with insight into where the Motley Fool’s analyst team sees the most promise.

Stock Newsletter Return Calculator

Curious to see what your returns could be if you signed up for one of the above stock picking newsletters? Use the calculator below to find out.

For example, let's say you have $10,000 to start and you can invest another $1000 a month for the next 10 years.

You would input $10,000 in the first box, $1000 in the second box, and "Monthly" in the third box.

Then, you would plug your return in the fourth box. You could use 10% (the average annual return of the S&P 500) to see what your market return would be. Or, you could use the (annualized) returns for one of the above newsletters.

Put 10 years to grow in the last box, and that gives you...well, I'll let you see for yourself!

Final Thoughts

Artificial intelligence is reshaping the global economy, and the companies at the forefront of this shift offer powerful investment opportunities. The Motley Fool’s top AI stock picks—Nvidia, Microsoft, Alphabet, CoreWeave, and Arm Holdings—each represent a different strength within the AI ecosystem.

By understanding the AI market and aligning with companies that are leading this transformation, investors can position themselves for potential monster returns. With guidance from trusted resources like Stock Advisor, navigating the complex world of AI stocks becomes a smarter and more strategic process.

If you’re looking to build a future-focused portfolio, these five AI stocks are a strong place to start.

Want to know if a Motley Fool subscription is really worth it? Check out our full review: Is a Motley Fool Subscription Worth It?

The Motley Fool is currently offering $100 off for new subscribers.

Visit the WallStreetSurvivor Exclusive offer on THIS page to receive your discount!

Remember, they have 30 day money-back guarantee.

FAQs

No. The Motley Fool is not a brokerage and is not regulated by the SEC. However, it offers stock recommendations and investment research that have a strong track record of success.

AI stocks are shares of companies that are developing or using artificial intelligence technologies to power products, services, or infrastructure. These can include companies in AI chips, cloud computing, and data security.

The Motley Fool’s Stock Advisor team looks for companies with long-term growth potential, solid fundamentals, and a strategic position in the AI market. Their analysts evaluate company performance, innovation, and relevance to current market trends.

Not necessarily. While some stocks have already seen significant growth, the AI industry is still evolving. Many experts, including the Motley Fool analyst team, believe the AI boom will continue, creating ongoing opportunities for long-term investors.

You can join the Motley Fool’s Stock Advisor program to receive new monthly stock picks, updates on existing recommendations, and analysis of high-growth sectors like artificial intelligence.

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | February SALE: SAVE $50 NOW |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||