Both Motley Fool Stock Advisor and Rule Breakers have their fans. They also have a lot in common.

Stock Advisor offers two done-for-you stock picks every month and is sold as a stand-alone subscription. Motley Fool Rule Breakers used to be sold separately but is now part of Motley Fool’s Epic bundle.

Here’s our Motley Fool Stock Advisor vs Rule Breakers comparison.

|

Motley Fool Stock Advisor |

Motley Fool Rule Breakers |

|

|

Picks |

2 picks per month focusing on reliable stocks that they believe will outperform the S&P 500 in the long term. |

1 pick per month focusing on stocks with the potential for accelerated growth. (5 total picks as part of Epic bundle.) |

|

Best suited for |

Beginner investors and those who don’t want to do their own research. |

Investors who are comfortable with risk and want more aggressive picks to maximize returns. |

|

Other features |

Access to historical picks; access to Game Plan financial hub; guidance for Cautious, Moderate, and Aggressive investing styles. |

Everything in Stock Advisor plus monthly recommendations and ratings; Fool IQ; access to the members-only podcast; and more. |

|

Price |

$199 per year |

$499 per year |

Stock Advisor is the better pick for new investors, while Rule Breakers (as part of the Epic bundle) is best suited for more experienced investors with an established portfolio.

What is the Motley Fool?

Are you asking: What is the Motley Fool? Here’s a snapshot.

Motley Fool is a company that was founded by brothers David and Tom Gardner, along with Erik Rydholm and Tod Etter. It got its start as an investment newsletter, but today it has expanded to include additional services and has more than 300 employees worldwide.

The company has had its share of attention and some controversies. It first came to national attention just one year after it started, when the Gardner brothers posted a series of online articles about a non-existent sewage company to prove a point about penny stocks.

Some have criticized the company’s investment philosophy, which we’ll talk about in the next section.

The Motley Fool has reported that they have approximately 500,000 subscribers across all of their services.

The primary value of being a subscriber is that you’ll get access to The Fool’s monthly stock picks. A Stock Advisor subscription gets you two monthly picks, while upgrading to the Epic bundle, which includes Rule Breakers, will get you five picks every month.

Neither Stock Advisor nor Rule Breakers is regulated by the SEC, but Fool Portfolios, which gives subscribers access to Tom Gardner’s managed portfolio, is.

The Motley Fool’s Investing Philosophy

The whole idea behind The Motley Fool investing philosophy is a simple one. It encourages investors to embrace a buy-and-hold strategy.

Buy-and-hold refers to a strategy where investors buy stocks and hold them for a minimum of five years. The Fool recommends this strategy because it is designed to help investors ride out market volatility and fluctuations.

Why does this matter? Well, for starters, it’s surprisingly easy to panic when there’s negative stock market news. A significant fall in a major benchmark such as the Dow Jones Industrial Average, S&P 500, or Nasdaq, can create panic. When investors panic and rush to sell their holdings, prices drop even more. It can turn into a vicious cycle that continues to drive the market down.

You might think that it’s better to sell before prices drop more after a downturn, but actually, in most cases the opposite is true. The overall trend of the stock market is up. People who sell without considering the possible ramifications run the risk of missing out on the market’s resurgence.

The recommended process for Stock Advisor subscribers is to buy equal amounts of every stock they recommend – and the same is true of Rule Breakers. The idea is that buying every stock will diversify your holdings and mitigate risk.

We should note that no stock picking service gets it right 100% of the time. Both Stock Advisor and Rule Breakers have picked some stinkers, but they get it right more than they get it wrong.

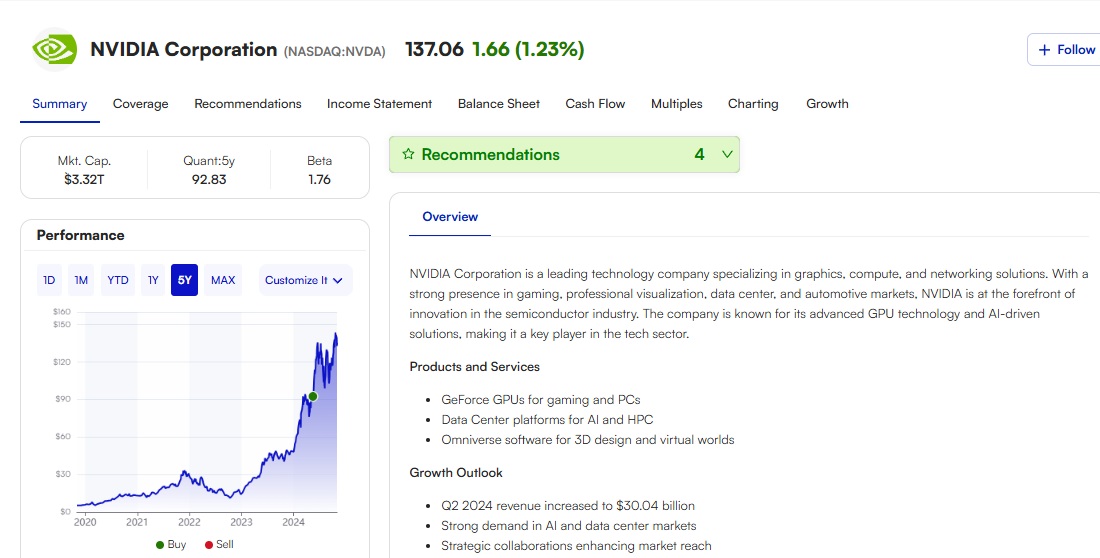

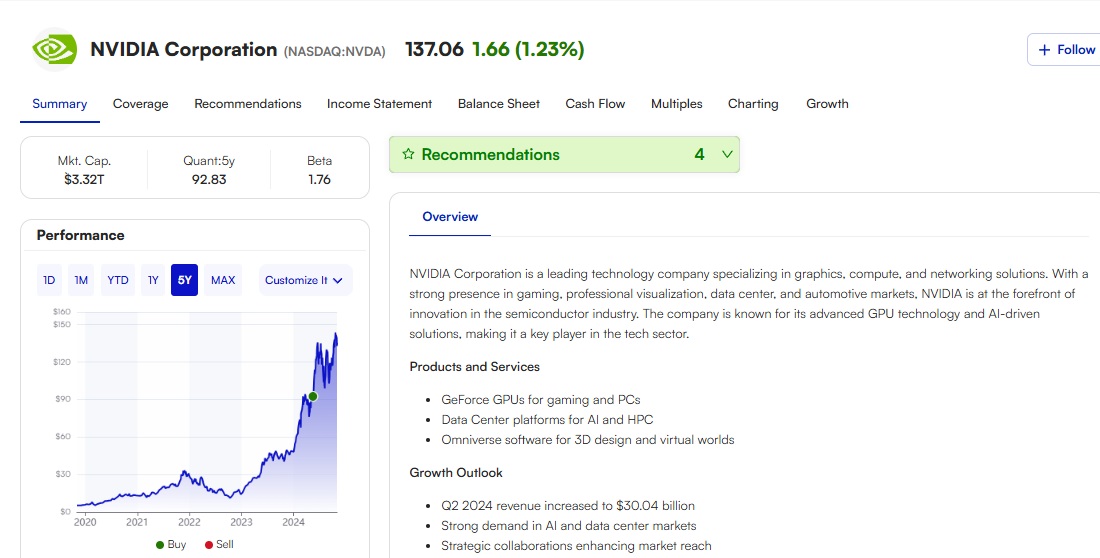

Motley Fool Stock Advisor picks have outperformed the S&P 500 by almost 400%, while Rule Breakers picks have outperformed by about 150%. Stock Advisor picks are more suited for a “slow and steady” investment style, while Rule Breakers is best suited for people who are comfortable taking more risk.

How Motley Fool Rule Breakers vs Stock Advisor Work

Now, let’s talk about how each of these services work.

How does Stock Advisor work? As we stated above, Stock Advisor issues two new stock picks every month. They’re released on the first and third Thursdays of each month. So, for example, the last two picks issued by Stock Advisor were as follows:

- October 3, 2024: DoorDash

- October 17, 2024: Instacart

It’s common for Stock Advisor picks to get a price bump thanks to subscribers rushing to buy new picks as soon as they’re announced. For example, Instacart’s price was $42.70 at closing the day before the pick was announced. As of November 4, the price is at $44.99, an increase of 5.36%.

As we noted above, the Stock Advisor philosophy is to buy equal dollar amounts of each stock recommendation and hold them for at least five years. The idea is for investors to ride out volatility and take advantage of the overall increase of the market.

Now, that doesn’t mean it’s always the right thing to sell after five years. If The Fool is still recommending a stock as a “buy” or “hold” at that time, then you’ll probably want to continue to hold until they change their rating.

Now, let’s ask another question: How does Rule Breakers work?

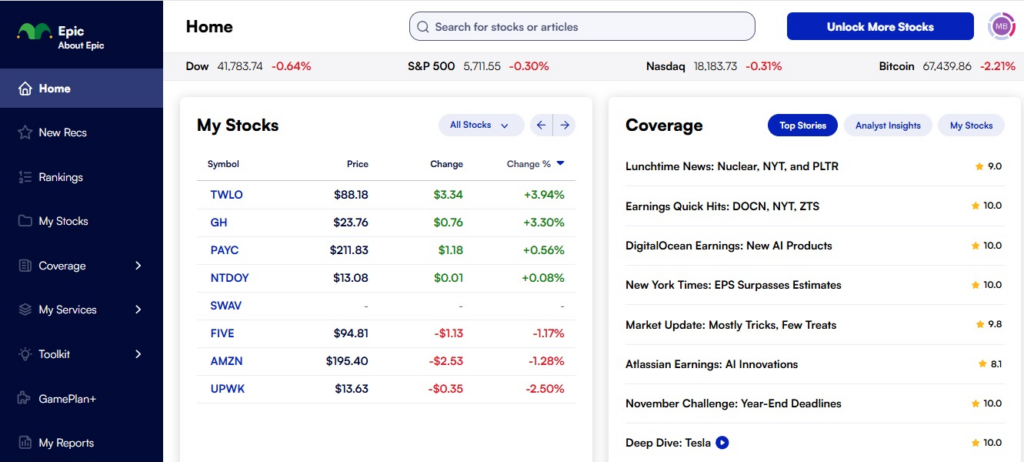

Let’s start with the release of new picks. As a reminder, Rule Breakers is only available as part of Motley Fool’s Epic bundle. There is one new Rule Breakers pick per month and it’s released on the same day as the second Stock Advisor pick, on the third Thursday of the month.

Keep in mind with all picks that Motley Fool may issue recommendation changes at any time. For example, they issued three “Sell” recommendations in September. One was for Wayfair, which was a recommended stock back in January of 2021, so that’s less than four years.

The investment philosophy is the same as it is for Stock Advisor: buy equal amounts of all recommendations and plan to hold them for five years.

Remember that Rule Breakers stock picks are for more aggressive investors who are comfortable taking some risk. They have the potential to deliver huge returns, but there’s a risk of lower returns or even a loss.

Join Motley Fool today for detailed stock recommendations.

Performance: Rule Breakers vs Stock Advisor

As we’ve noted previously, stock picks for both Rule Breakers and Stock Advisor have performed well against the S&P 500. Here are some details for you to consider as you compare Motley Fool Rule Breakers vs Stock Advisor.

|

Stock Advisor |

Rule Breakers |

|

|

Performance vs S&P 500 since inception |

583.9% |

148.9% |

|

2019 picks vs S&P 500 |

-24% (Note that SA picks still delivered a 45% return for investors) |

-51% (39.7% return for investors) |

|

2022 picks vs S&P 500 |

-25.5% (14.7% return for investors) |

-9.8% (29.1% return for investors) |

|

2023 picks vs S&P 500 |

-8.6% (26.5% return for investors) |

+11.4% (46.7% return for investors) |

One of Stock Advisor’s biggest winners has been Nvidia, which they recommended in May of 2024, when the price was $94.36. As of November 4, 2024, the price is up to $137.68, an increase of 46% in less than six months.

On the other side, Open Text was a Rule Breakers pick in July of 2021 when the price was $49.55. On September 12, 2024, RB changed the status to Sell. The price on that day was just $6.32, representing a loss of 87.25%.

Keep in mind that the buy-and-hold strategy is designed to help investors ride out market volatility. It’s possible that some of these recent performance numbers may improve. Likewise, it’s important to remember that investors have made money on these picks even when they didn’t outperform the S&P 500.

Stock Advisor vs Rule Breakers

There are some important differences between Stock Advisor and Rule Breakers.

Stock Advisor Rule Breakers Similarities

The similarities between Stock Advisor and Rule Breakers are significant. Here’s a rundown.

- Both are stock-picking services designed to help investors build their portfolios without having to do extensive research on their own.

- Both are offered through The Motley Fool, a financial advice and investment picking company.

- Both embrace a buy-and-hold strategy, which asks investors to buy equal amounts of each stock recommendation and hold them for at least five years or until Motley Fool changes to a “Sell” recommendation.

- Both have excellent track records of beating the S&P 500 benchmark.

- Both release monthly stock picks via their newsletters.

- Both allow investors to view historical picks on the subscriber portal.

You can see that these services have quite a lot in common. That’s not surprising, since both are Motley Fool subscriptions and both embrace the same investing philosophy.

Stock Advisor Rule Breakers Differences

Here are the key differences between Stock Advisor and Rule Breakers.

- Stock Advisor provides two stock picks per month, while Rule Breakers provides one. (However, keep in mind that since Rule Breakers is only available as part of the Epic bundle, subscribers get a total of 5 picks per month, including one each from Hidden Gems and Dividend Investor.)

- Stock Advisor is available as a stand-alone service and Rule Breakers is not.

- Stock Advisor is aimed at long-term investors who value slow-and-steady growth, while Rule Breakers is best suited for growth-focused investors with an aggressive investment style and high risk tolerance.

- Stock Advisor is less expensive at $199 per year, while the Epic bundle costs $499 per year.

- Epic subscribers get access to more features, including Fool IQ, GamePlan+, and the members-only podcast.

These similarities and differences should help you figure out which subscription is best suited to your needs.

Pricing and Plans: Stock Advisor vs Rule Breakers

Now let’s take a look at the Stock Advisor pricing and Rule Breakers pricing, plus a few important features to help you compare.

|

Feature |

Stock Advisor |

Rule Breakers |

|

Annual Subscription Price |

$199 |

$499 |

|

Free Trial? |

No |

No |

|

Money-Back Guarantee? |

Yes, 30 days |

Yes, 30 days |

|

Number of Stock Picks/Month |

2 |

5 (as part of Epic bundle) |

|

Investment Style |

Long-term |

Growth-focused |

|

Research Reports Access |

Yes |

Yes |

|

Customer Support |

Email, Chat |

Email, Phone |

As you can see, the biggest differences are the number of picks you’ll get (two vs five) and the price. The Epic bundle is much more expensive, but you’ll get access to additional features and more stock picks.

Sign up now to lock in the best price!

Which Motley Fool Newsletter is Right for You?

What’s the best way to decide which Motley Fool newsletter and stock subscription is right for you? Here are some pointers.

First, consider your investment experience. Beginner investors may be more comfortable with Stock Advisor, while those with more experience may prefer Rule Breakers because of its additional stock picks and more growth-oriented investment philosophy.

Next, think about your tolerance for risk. All investments come with some risk, that’s to be expected. However, an investor who’s just starting out or someone who’s close to retirement age may embrace a cautious or moderate investing style. Someone who’s younger or who already has an established portfolio may be willing to take more risk.

Related to the issue of risk, next you should think about your personal investment philosophy. Remember, Stock Advisor is for long-term investors, while Rule Breakers, as part of the Epic bundle, is better suited for growth-focused investors.

Do you want to be more involved in stock research, or do you prefer done-for-you picks? If it’s the former, go with Rule Breakers, and if it’s the latter, Stock Advisor may be more your speed.

Finally, think about your wallet and how much you want to spend on a Motley Fool newsletter. Stock Advisor costs $199 per year while the Epic Bundle (including Rule Breakers) costs two and a half times as much at $499 per year.

Taking these things into consideration will help you choose the Motley Fool subscription that’s right for you.

Take a quiz to find your ideal Motley Fool service.

Should You Invest 100% of Your Portfolio in Motley Fool Stocks?

One question we hear a lot is whether it’s a good idea to invest 100% of your portfolio in Motley Fool stocks. We’d say that there are benefits and risks to doing so.

Let’s start with the benefits. Motley Fool has a very good track record overall of its picks outperforming the S&P 500. That’s an argument in favor of sticking to their picks. Rule Breakers also has a good record, although not as good as Stock Advisor.

Arguments against investing 100% of your portfolio in Motley Fool picks include a caution against putting all your investment decisions in someone else’s hands. We’d also be remiss if we didn’t point out that recent picks (from 2019 to the present) haven’t performed as well as older picks. While some of that is likely due to market volatility caused by the COVID-19 pandemic, it is important to be aware that for some investors, the bloom may be off the rose.

If you’re building a portfolio, we’d suggest starting with Motley Fool recommendations and educating yourself about investing at the same time. If you’re more established as an investor, you might consider dividing your funds and investing half in Fool picks and the other half in picks you research yourself.

Either way, keep in mind that historical success is never a guarantee of future earnings. You should always bring your own common sense into the mix.

Final Verdict: Stock Advisor vs Rule Breakers Which One is Best for Investors?

The most important things to know about Stock Advisor vs Rule Breakers is that each of these Motley Fool newsletters has its advantages. The key differences are in the investment style promoted by each: long-term investing for Stock Advisor and growth-focused investments for Rule Breakers.

If you’ve got the money to spend, the Epic Bundle gives you access to 2 Stock Advisor picks per month, plus one pick each from Rule Breakers, Hidden Gems, and Dividend Investor. You’ll get access to other tools, including Fool IQ and GamePlan+ for extra financial and investment education.

Ultimately, we think Stock Advisor is the best choice for beginners who are just starting to build a portfolio, while Rule Breakers and the Epic bundle are best suited for intermediate and experienced investors who aren’t afraid to take some chances.

Subscribe to the service that fits you best.

FAQs

What are the main differences between Stock Advisor and Rule Breakers?

There are three major differences between Stock Advisor and Rule Breakers. First, you’ll get two stock picks per month with Stock Advisor, and five with Rule Breakers as part of the Epic bundle. Second, Stock Advisor is geared toward long-term investors while Rule Breakers is best for growth-focused investors. Third, Stock Advisor is a stand-alone service that costs $199 per year, while Rule Breakers is only available as part of the Epic bundle and costs $499 per year.

Can I switch between Motley Fool services if my investment strategy changes?

Yes, you can switch. Upgrading is easily done on the website. Simply click on your account and click the “Access More Stocks” button, and you’ll be walked through the process. Downgrading (from Epic to Stock Advisor, for example) requires a call to customer service.

How often does each service update their stock picks?

Both services issue alerts when the status of a stock changes. For example, if a previous Buy recommendation changes to Hold or Sell, you’ll get an email notification. You can also check the status of any stock by using the search bar or by clicking on Recs on the side menu.

Are there any discounts available for new subscribers to either service?

There are sometimes discounts available. For example, we sometimes share an offer where new subscribers can get Stock Advisor for about half price, $99 per year.

What type of investor typically uses Stock Advisor? What about Rule Breakers?

Stock Advisor is best suited for beginners and people who have a cautious investing style. Stock Advisor picks aren’t without risk, but they are designed for long-term investors to purchase as part of a buy-and-hold strategy. Rule Breakers is designed for growth-focused investors who are comfortable with some risk and want to maximize their returns by focusing on stocks with significant growth potential.

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. ✅ U.S. stocks, ETFs, options, and cryptos $3 monthly sub 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

$0

✅ Now 23,000,000 users

✅ Cash management account and credit cardFree stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes for advanced traders

✅ Access to U.S. and Hong Kong markets

✅ Learning tools built in60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for different experience levels

✅ SmartRouting™ and deep analytics for executionRefer a Friend and Get $200

Interactive Brokers Review

4.

M1 Finance

✅ Automated investing “Pies” with fractional shares

✅ Integrated banking & low-interest borrowing

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

5.

Webull

$0

✅ Extended-hours trading premarket and after-hours

✅ Built-in technical charts, screeners, and indicators

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

6.

Public

$0

✅ Fractional shares of U.S. stocks and ETFs

✅ No payment for order flow (PFOF) model

✅ “Alpha” tool with earnings calls and sentiment data$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

7.

Composer

$32 a month

✅ Invest in fully automated stock strategies

✅ Build custom strategies with our no-code builder

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

8.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools for beginners

✅ Curated theme portfolios for retail investors$5 when you invest $5

Stash Review

9.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Retirement Accounts

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

10.

Etoro

$0

✅ CopyTrading™ feature to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto in one app

✅ Commission-free trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

11.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data; Morningstar

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.