If you’re looking for a stock picking service that’s streamlined, data-backed, and built for today’s market environment, Moby Invest is one of the top contenders worth considering. With a growing reputation for accuracy and a user-friendly experience, Moby Invest offers a premium product aimed at helping investors of all levels make smarter, faster decisions in the stock market.

In this comprehensive Moby Invest review, we’ll break down its core features, who it’s for, how it compares to other investment services, why 87% of trustpilot reviews rate Moby at 5 or 4 stars, and whether it’s worth your money in 2026.

Introduction to Moby Invest, Now Just ‘Moby’

Moby Invest is a stock picking service and investment research platform that provides real-time insights, curated stock recommendations, and financial education tools for retail investors. The platform’s strength lies in simplifying complex financial data and giving users clear, actionable insights.

The Moby team is made up of seasoned analysts, many with experience at major institutions like Goldman Sachs and Morgan Stanley. Their deep research and institutional-grade insights are distilled into plain-language reports designed for individual investors.

| Feature | Moby Free | Moby Premium |

|---|---|---|

| Description: | Use website or mobile app to get access to their current take on the market from their team of former hedge fund managers and CFAs. | Professional Hedge fund research written in plain English. They deliver their investing research in brief, easy to understand terms. |

| Strengths: | Their morning email is concise, topical, and entertaining. | Clear research; several stock picks per week; well diversified; proven track record of almost doubling S&P the last 4 years. |

| Retail Price: | Free | $199 a year and 30 day money-back guarantee |

| Current Promotion: | Get 1 Free Stock Pick | Save $100 |

| Link to get best promotion: | Get their next stock pick for free-no credit card required. | January SALE STILL ON: Get next stock pick FREE and save $100 when you subscribe. |

The Moby app delivers these insights directly to your phone or inbox through features like:

- 1-3 stock picks per week; they tell you which industry each pick is in so if you aren’t into “real estate” or “auto” then just skip it

- Daily email updates of what is driving the market; easy to unsubscribe or adjust settings.

- Model portfolios for various strategies

- Audio and video briefings

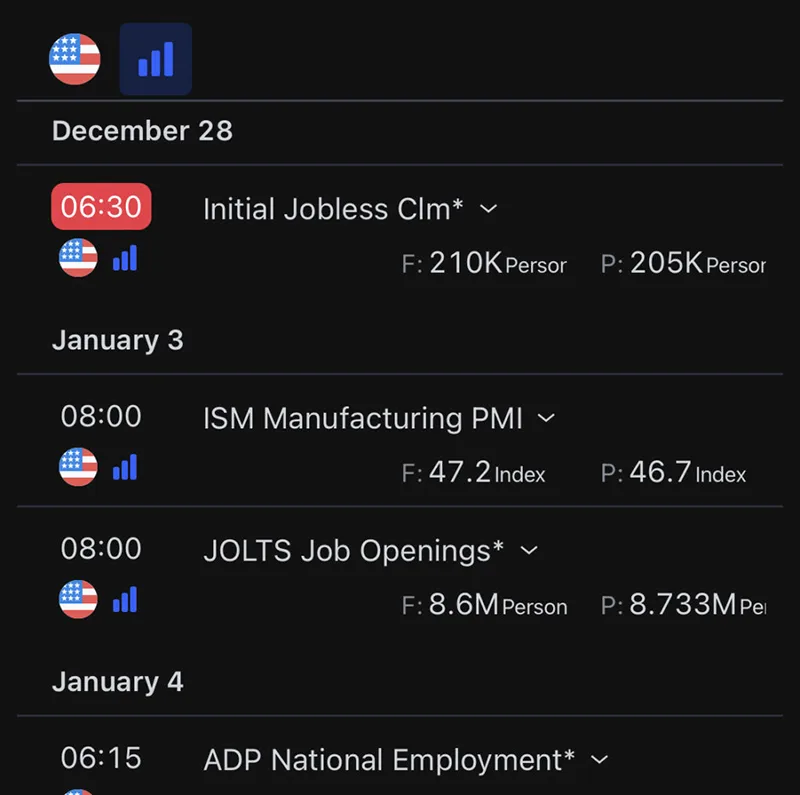

- Weekly economic calendar and inflation reports

With an emphasis on emerging markets and undervalued technology companies, Moby Invest offers a unique edge for those aiming to diversify beyond conventional blue-chip stocks.

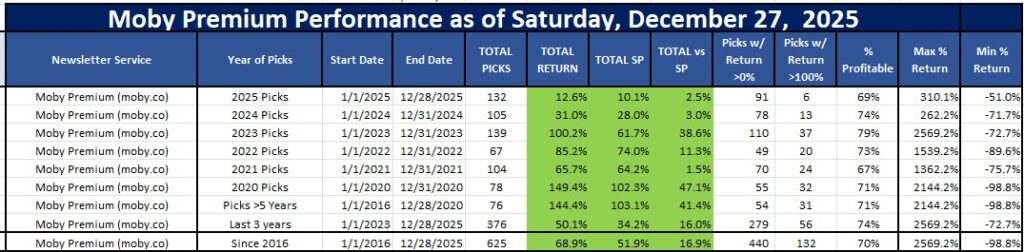

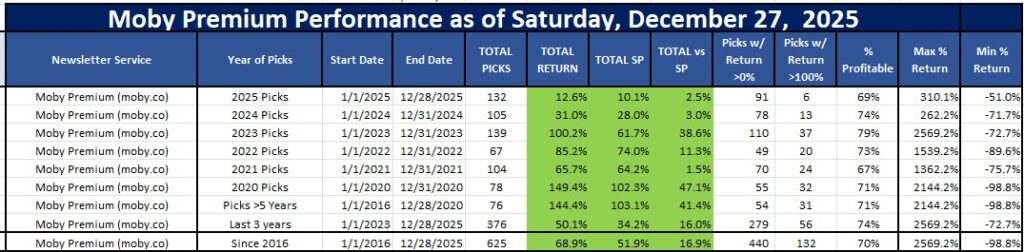

I have been tracking all of their picks since they started in 2020.

Here is my analysis of the performance of ALL OF THEIR STOCK PICKS by year. I have also added some other ways I look at them such as Last 12 Months, Picks Older Than 5 Years, and Just Last 3 Years of Picks to see their trends.

This has taken a lot of work on my part to put this together, so please enjoy that I have done your homework for you. You see they beat the market every year and 70% of their picks are profitable, but 132 have doubled or more. THAT is how these returns are so strong.

This performance over 6 years and 625 picks is quite remarkable given that their picks are beating the market every single year.

You can see in the 2 far right columns their Max and Min returns. Your picks would be higher if you would place a stop loss on their picks. I back tested a stop loss and found that 30% stop loss actually improves your returns so that is what I do now when I buy a Moby recommended stock.

Moby doesn’t issue sell recommendations, so a stop loss is very helpful to keep some cash in the account so I can continue to update my portfolio.

I talked to the CEO several times about their lack of sell recommendations, and his suggestion is to sell when the stock reaches their set price target. I have just started implementing that approach so I will let you know how it goes soon.

Features and Benefits

Moby Invest delivers a compelling set of tools for both beginner and intermediate investors. These include:

- Stock picks vetted by analysts and supported by detailed investment research

- Model portfolios tailored to different risk profiles and time horizons

- A mobile-first experience through the intuitive Moby app

- Access to in-depth financial news, market summaries, and investment analysis

- Technical analysis tools and educational content

Premium users get additional access to advanced features like:

- Political trade tracking

- Hedge fund data and signals

- Extended economic calendar tools and forecasts

- In-app commentary and updates from the Moby team

The blend of machine learning insights and traditional analyst review sets Moby apart from more basic stock advisor services.

Investment Research and Analysis

Moby’s core value is in its research engine. The platform uses both algorithmic tools and human analysis to generate reports that cover:

- Investment ideas and sector trends

- Price targets and expected timelines

- Portfolio strategy aligned with market volatility

- Fundamental and technical analysis on selected stocks

Unlike some platforms that rely on past performance alone, Moby’s research stays up to date with shifts in market conditions. Whether you’re tracking undervalued technology companies, emerging markets, or growth businesses, Moby provides clarity.

Moby is currently offering Get Moby's #1 Stock Pick for Free HERE! and offering 50% off for new subscribers.

With the WallStreetSurvivor Exclusive offer on this page, enter your email, and then you can save 50% on an annual membership (only $99).

Don’t miss out on their next pick and remember they have 30 day money back guarantee.

And unlike the jargon-heavy research reports from institutional brokers, Moby’s are presented in a way that’s easy to understand. This makes it an excellent fit for intermediate investors who are building confidence in their own analysis while benefiting from expert input.

Comparison to Other Services

Moby Invest is often compared to competitors like Motley Fool Stock Advisor and Seeking Alpha Premium. Here’s where it stands out:

- A heavier emphasis on model portfolios and up-to-date economic calendar events

- Exclusive access to political trade tracking and hedge fund activity

- A mobile-first, user-friendly interface on the Moby app

- Flexible subscription options and a 30-day money-back guarantee

While Motley Fool offers a strong track record, Moby’s strategy is more dynamic and data-driven. If you’re someone who appreciates a blend of quantitative signals and human insight, Moby Invest may suit your style better.

Moby took expert analysts from institutions like Morgan Stanley and Goldman Sachs and paired them with journalists who know how to distill complex financial jargon into easily-comprehensible and actionable advice.

In addition to its own research, the team also deploys machine learning and quantitative algorithms to find investment ideas.

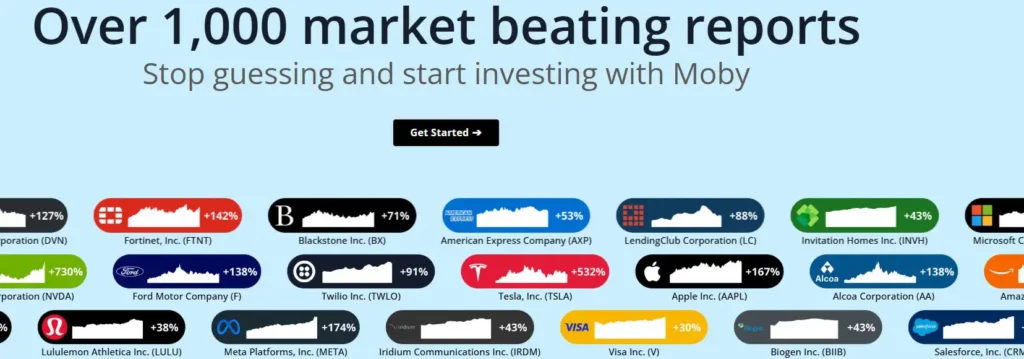

Top Moby Performing Stocks

Moby Top 2025 Stock Picks:

- BE up 310%

- WDC 176%

- AA 116%

- CVNA 115%

- MP 107%

- HOOD 99%

Moby 2024 Top 5 Picks As of September 27, 2025 and Their Returns:

- RDDT up 262%

- HOOD up 199%

- U up 183%

- AVGO 144%

- EMBJ 141%

Moby 2023 Top 5 Picks and Their Returns As of September 27, 2025:

- PLTR: 2,569%

- RKLB 1,505%

- NVDA: 1,182%, 564%, 343% (picked Jan 7, 2023 and April 17, 2023 and May 30, 2023)

- BE: 496%

- META: 285%, 273% (picked Feb and March of 2023

- SPOT 292%

- GOOG: 252%

- GE: 252%

- EDR 241%

Moby Stock Picks of 2022:

- RKLB: 1,539%

- SPOT: 455%

- SOFI 428%

- ELF: 357%

- SOFI: 344%

- LLY: 265%

- UBER:230%

Moby Invest Pricing and Plans

Moby Invest Premium offers flexibility in how you subscribe:

- Monthly Plan: Great for testing the waters and includes a 7-day trial

- Annual Plan: Discounted price with extended access to premium features

Moby often provides limited-time discounts and seasonal promotions. If you’re on the fence, the 30-day money-back guarantee provides peace of mind.

Premium features are priced competitively relative to other premium services in the same space, particularly considering the daily updates, research reports, and insights tailored to investment goals and risk tolerance.

Guarantee and Refund Policy

Moby stands behind its product with a 30-day money-back guarantee. This allows users to evaluate its tools, research, and stock recommendations risk-free.

If within the first month you’re not satisfied, the full refund policy gives flexibility. This is a standout feature compared to other platforms that offer only partial refunds or none at all.

Economic Calendar and Market Insights

Moby Premium provides access to a live economic calendar featuring:

- Interest rate decisions

- Inflation reports

- Sector earnings summaries

- Jobs data and GDP updates

These updates are designed to help investors make more informed decisions based on real-time macroeconomic trends.

Moby is currently offering a free stock pick here and offering 50% off for new subscribers.

With the WallStreetSurvivor Exclusive offer on this page, enter your email, and then you can save 50% on an annual membership (only $99).

Don’t miss out on their next pick and remember they have 30 day money back guarantee.

Combined with daily market summaries and alerts, users can fine-tune their strategies around big events and avoid surprises that can destabilize a portfolio.

Moby Review and Testimonials

Moby Invest holds high ratings across Google Play, Apple’s App Store, and other third-party review sites. Users consistently highlight:

- The clarity and precision of Moby’s stock picks

- The utility of daily briefings and mobile alerts

- Ease of use of the Moby app

Some testimonials note that Moby helped them feel more confident managing their own investment portfolio, particularly when they previously relied on financial advisors.

Moby Premium has also been featured on top review lists and has gained traction for its ability to generate alpha relative to the broader stock market.

Investment Goals and Objectives

Every Moby user is encouraged to align recommendations with their personal financial goals. The platform helps clarify:

- Time horizon and strategy

- Portfolio structure based on risk tolerance

- Preference for growth vs. stability

Moby’s investment strategy is designed for those who want to take charge of their finances, without needing to be an expert.

Its model portfolios offer blueprints for long-term investing, tailored to different asset classes and objectives. That makes it a great fit for both intermediate investors and those just getting started.

Pros and Cons of Moby Premium

| Pros | Cons |

|---|---|

| Excellent results and beating the market the last 6 years. Outsource your investment research to a team of experts | More suited for intermediate investors, Moby simplifies decisions, offering guidance that may not cater to advanced investors seeking purely objective data. |

| Beginner-friendly investment analysis and market summaries | Many investment ideas to choose from |

| High-quality investment ideas and model portfolios | |

| Mobile-first platform |

Stock Newsletter Return Calculator

Curious to see what your returns could be if you signed up for one of the above stock picking newsletters? Use the calculator below to find out.

For example, let's say you have $10,000 to start and you can invest another $1000 a month for the next 10 years.

You would input $10,000 in the first box, $1000 in the second box, and "Monthly" in the third box.

Then, you would plug your return in the fourth box. You could use 10% (the average annual return of the S&P 500) to see what your market return would be. Or, you could use the (annualized) returns for one of the above newsletters.

Put 10 years to grow in the last box, and that gives you...well, I'll let you see for yourself!

Conclusion: Is Moby Invest Worth It?

After reviewing all the features, pricing, research tools, and user feedback, here’s the bottom line: Moby Invest is a compelling stock picking service that strikes a strong balance between expert-led guidance and DIY-friendly tools.

With results like this it certainly seems like it is worth it:

For anyone looking to take investing more seriously in 2025 without being overwhelmed, Moby offers structure, insight, and flexibility. The 30-day money-back guarantee seals the deal, letting you explore the platform without commitment.

If you’re trying to decide between competing services, Moby stands out for:

- Clean, mobile-first experience

- Rich data, research, and analysis

- Exclusive tools like political trade tracking

- Transparent pricing and easy refund policy

It’s a platform built to empower investors to take ownership of their portfolios—and that’s why it continues to earn high marks from users.

If you are curious about whether or not Moby Premium is actually worth the cost, check out our full article: Is Moby Premium Worth It?

FAQs

Moby Invest is a stock picking and research service offering real-time stock picks, model portfolios, and expert market insights.

It’s best suited for intermediate investors and beginners who want clarity, structure, and expert-driven recommendations.

Yes. Moby Premium includes a 7-day free trial and a 30-day money-back guarantee.

Yes. You can cancel any time and receive a full refund within the first 30 days if it’s not a fit.

Moby emphasizes mobile usability, political and hedge fund data, and more tailored investment strategies.

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | January Promotion: Save $50 HERE |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | January Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | January Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | January Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | January Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | January Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | January Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | January Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||