I am personally very excited to bring you Wall Street Survivor’s M1 Finance review.

I have my own Roth IRA on M1 and would highly recommend it for many investors.

In this review, you will learn about:

- What M1 Finance is

- What features are offered on M1 Finance

- If M1 Finance is safe

- How much M1 Finance costs

- How to sign up for M1 Plus and get your FIRST THREE MONTHS FREE

What Is M1 Finance?

M1 Finance is a financial services company that offers brokerage accounts, a cash management program, and margin trading.

The platform uses a unique portfolio construction system centered around “pies” that gives you total control of how your portfolio looks while also emphasizing automated investing.

Let’s take a look at M1 and see if it’s the right investment platform for you.

What Account Types Are Offered on M1 Finance?

M1 offers several different account types that all serve different purposes.

Taxable Investment Accounts

M1 Finance offers both individual and joint investment accounts.

These are your typical, taxable brokerage accounts. You’ll pay capital gains tax and you’ll be making your contributions with after-tax dollars.

Retirement Accounts

M1 Finance offers several types of individual retirement accounts (IRAs): Traditional, Roth, and SEP IRAs.

Traditional IRAs allow you to receive a deduction to your taxable income when you contribute.

Roth IRA contributions are made with after-tax dollars, but you don’t have to pay any taxes when you withdraw your contributions and earnings in retirement.

Simplified Employee Pension (SEP) plans allow employers to contribute to their employees’ traditional IRAs (even if you’re self-employed).

You can also rollover your 401(k) from a previous employer to M1.

Trust Accounts

If you want to set up a trust or you’re the beneficiary of a trust, M1 Finance supports trust accounts on its platform.

Crypto Accounts

You can open an M1 Crypto account to trade cryptocurrency on M1 Finance.

As a free M1 user, you can build crypto pies or choose from Expert crypto pies (coming soon).

But as an M1 Plus user, you can trade crypto on-demand, since cryptocurrency trades 24/7.

M1 Plus users can make up to 10 on-demand crypto trades per month.

Custodial Accounts

You can use M1 Finance to set up a custodial account for your child or another minor, which you will transfer to them when they become an adult.

Custodial accounts are only available to M1 Plus members.

At the moment, M1 Finance does not offer mutual funds or options.

So, What Are M1 Finance “Pies?”

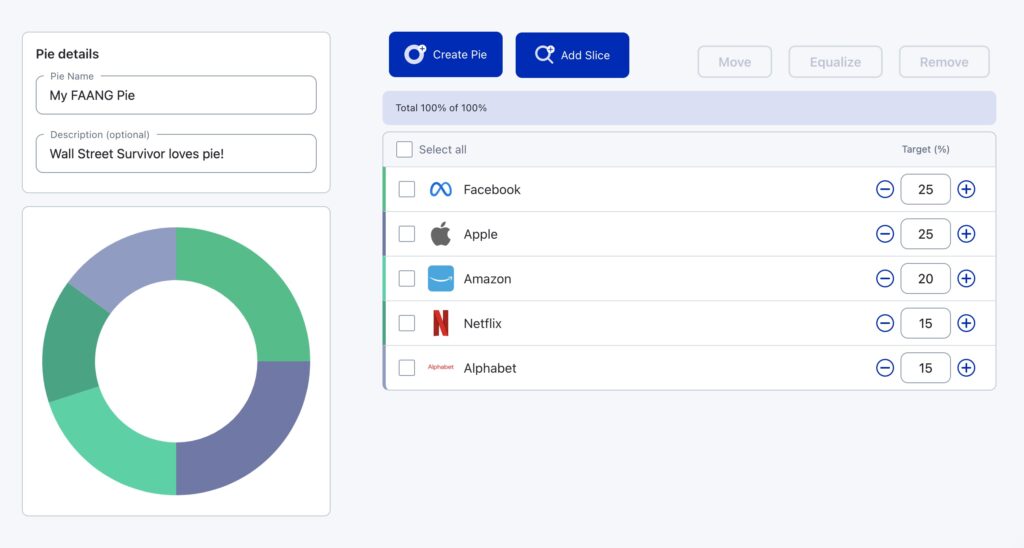

A “pie” is M1 Finance’s name for mini-portfolios you can create and add to your main portfolio.

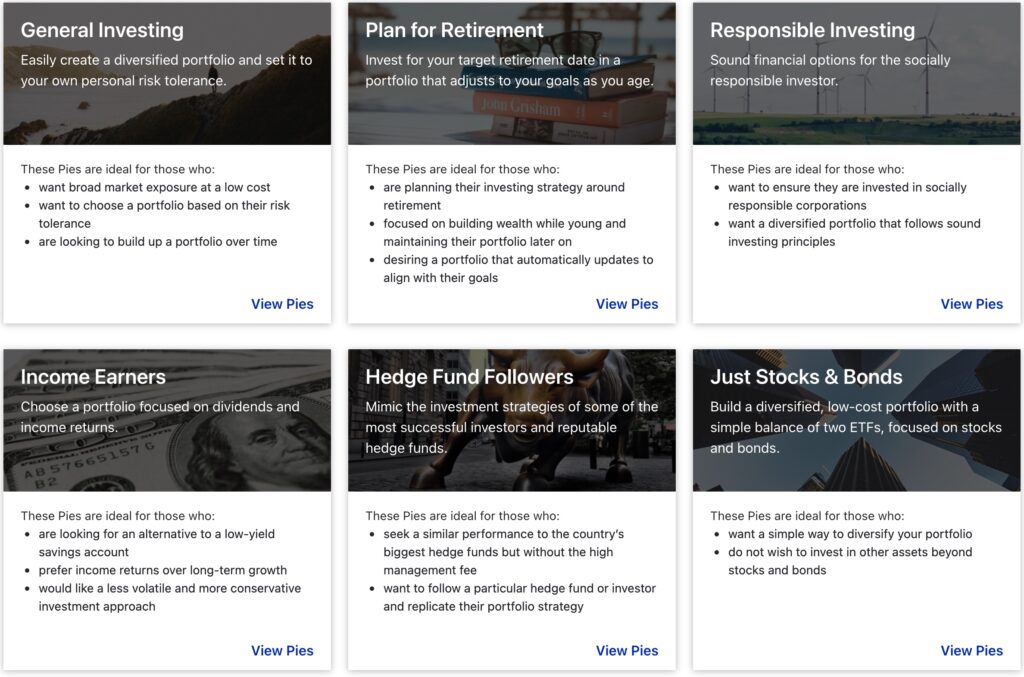

You can create and name your own pies, or choose from M1 Finance’s selection of Expert Pies.

The Expert Pies include everything from saving for retirement, to socially responsible investing (SRI), to mimicking a hedge fund’s investments at a fraction of the cost.

For example, let’s say I wanted to create a portfolio on M1 Finance that’s made up of 50% tech stocks and 50% Berkshire Hathaway.

I would first create my own pie comprised of my favorite tech stocks, weighting them any way I like.

Then, I would select the Berkshire Hathaway pie from the Hedge Fund Followers section of the Expert Pies.

Then, I would add these two pies to my main portfolio and give them each a 50% weight, and boom! I have my desired asset allocation.

Trading Windows

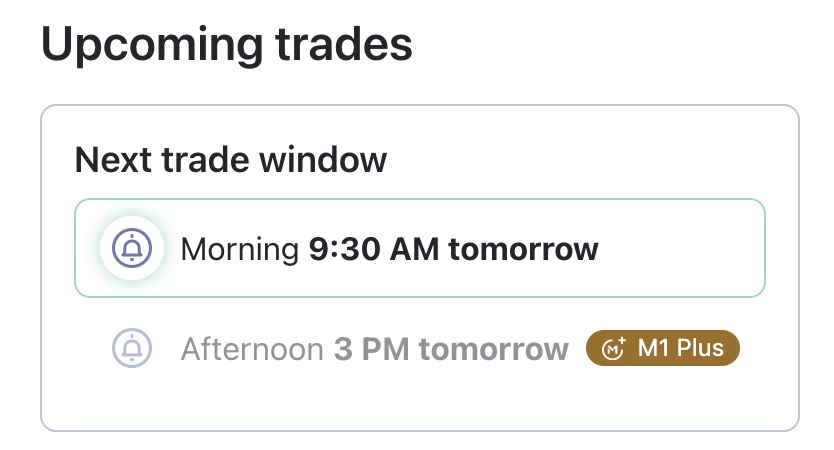

M1 Finance only lets you place trades during certain windows of time.

As a standard M1 user, you can place trades during the 9:30am window.

If you sign up for M1 Plus, you also get access to the 3:00pm window.

This feature is not ideal for day traders or investors who want to place short-term trades at specific times of the day.

But for buy-and-hold investors, it shouldn’t be an issue, since you can just submit your trade ahead of time and know that it will go through during the next trading window.

M1 Finance Borrow

M1 Borrow is M1 Finance’s margin program.

To be eligible to borrow money, your portfolio must be worth at least $2000.

You can borrow up to 40% of the value of your portfolio at a 6.50% to 8% interest rate.

If you’re a member of M1 Plus, your interest rate is 6.5%. Otherwise, you’ll have to pay the 8% margin rate.

Keep in mind that while trading on margin can help you increase your overall return, it can also exacerbate your losses.

If you need a refresher on how margin works, check out our article on How to Use Debt to Your Advantage.

M1 Finance Spend

M1 Checking

The M1 Spend Checking account is a cash management account that allows you to open a free checking account and link it to your M1 Spend and M1 Borrow accounts.

There is no minimum balance for the checking account, no monthly fee, and no foreign transaction fees.

You can set up direct deposit and automatic transfers, and you even get instant transfers between your M1 accounts so you can have quicker access to your money.

When you sign up for Spend Checking, you get a debit card you can use for everyday purchases.

While this M1 cash management account does not have a dedicated ATM network, you can use your debit card at any ATM to withdraw money.

M1 will reimburse you for one ATM fee per month.

The ATM fee reimbursement limit is raised to four per month for M1 Plus members.

M1 Plus members will also receive interest at a 3.30% APY for the money deposited in their Spend Checking account and 1% cash back on purchases.

Unfortunately, free users do not receive interest on their balance or cash back on purchases.

M1 Plus members who sign up for M1 Checking can also send checks and have international card fees reimbursed.

The M1 Spend Checking account deposits your money with Lincoln Savings Bank, M1 Finance’s partner bank.

High-Yield Savings

M1 is planning to roll out a high-yield savings account in early 2023.

The savings account will offer a 4.5% APY and will be available only to M1 Plus members.

There will be no minimum deposit or minimum balance.

You can sign up for updates on the high-yield savings account on the M1 website.

The Owner’s Rewards Card

The Owner’s Rewards Card is a credit card from M1 that uses a unique cash back program: you earn cash back when you spend money at companies you own investments in!

The card is named the Owner’s Rewards Card because holding stock in a company makes you a partial owner of the company.

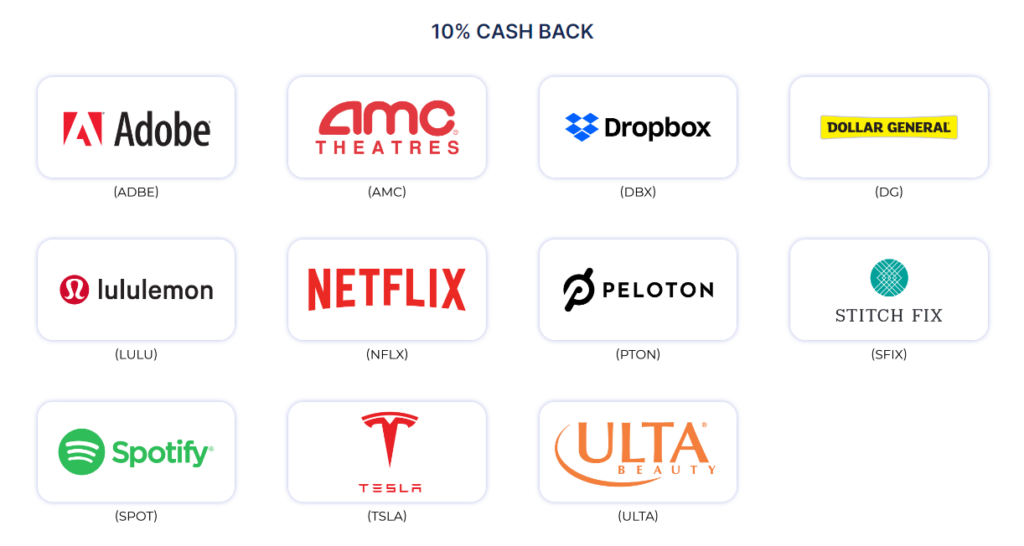

The cash back program for the credit card has a tiered system that lets you earn more cash back depending on which company you’re buying products or services from.

You can then take that cash and put it right back into your own investments.

There is a 2.5% cash back tier, a 5% cash back tier, and a 10% cash back tier. To unlock these tiers, you must be an M1 Plus member.

Click here to see a full list of the companies in each tier.

For purchases at companies not in those tiers, cardholders will earn 1.5% cash back everywhere else.

Free users will only receive the 1.5% cash back, and not the higher tiers.

You can earn a maximum of $200 cash back per month.

There is no annual fee for the Owner’s Rewards Card.

Customer Service:

Phone at (312)600-2883 M-F 9:00:4:00 ET

Email at support@m1finance.com

M1 FINANCE SUMMARY

What You Get:

- Taxable, Retirement, Trust, and Custodial Accounts

- Free Checking Account for Your Uninvested Cash

- Credit Card with Cash Back Rewards

The M1 Finance Difference:

- Copy Expert Pies or Create Your Own

- M1 Plus Gives You Access to Special Perks and Rewards

M1 Finance Pricing:

- Basic account is completely FREE

- M1 Plus costs $125 per year, but you can GET YOUR FIRST THREE MONTHS FREE!

M1 Plus

M1 Plus is M1 Finance’s premium subscription for users who want to get more out of the M1 experience. Here are the features you get with M1 Plus:

- Smart Transfers

- 6.5% interest for M1 Borrow (vs. 8% with standard membership)

- 3.30% APY for your M1 Spend Checking account balance

- Custodial accounts

- 1% cash back on M1 Spend debit card purchases

- Four ATM fee reimbursements per month on M1 Spend Checking (vs. one with standard membership)

- International fees reimbursed for purchases made with your M1 Checking debit card

- Send paper checks with M1 Checking

- Afternoon trading window (vs. only morning with standard membership)

- Checks for M1 Spend Checking

- Gain access to the 2.5%, 5%, and 10% cash back tiers of the Owner’s Rewards Card

- Access to the high-yield savings account (coming in early 2023)

- On-demand crypto trading (up to 10 trades per month)

A subscription to M1 Plus costs $125 per year (billed annually), but you can get your first three months for free when you sign up now!

Is M1 Finance Safe?

Yes.

M1 Finance has been in business since 2015 and has over half a million users who have invested more than $4.5 billion on their platform.

They are a member of both the SIPC and FINRA, meaning that they are regulated just as much as any other broker-dealer and your invested cash is insured (against M1 losing your money, not against the stocks in your investment portfolio going down in price).

M1’s partner banks are FDIC insured, so you won’t have to worry about the money in your M1 Spend Checking account being lost, either.

If you’re still not convinced, don’t worry! We have an entire article dedicated to answering the question: is M1 Finance safe?

Is M1 Finance Free?

M1 Finance is absolutely free, if you want it to be.

There are no commissions on trades and no monthly fees on M1 Spend Checking.

As long as you keep at least $20 in your bank account and avoid terminating your accounts or doing wire transfers, your experience will be free.

But if you want to subscribe to M1 Plus, you’ll pay the annual fee for that, which is $125 per year billed annually.

But you can get your first three months of M1 Plus for free if you sign up for M1 Plus now!

Who is M1 Finance For?

M1 Finance is for:

Experienced investors.

M1 assumes that you know what you’re doing and gives you the freedom and control to build and manage your portfolio the way you want.

For example, M1 does not offer automatic tax loss harvesting.

Tax loss harvesting is a strategy where an investor intentionally sells a security for a loss in order to offset some of their gains and reduce their capital gains tax burden.

Automatic tax loss harvesting is a feature that you’ll find with many robo-advisors, but not with M1.

M1 assumes that you know how you want to carry out your tax strategy and lets you decide whether you want to do tax loss harvesting or not.

Investors with a long-term focus.

M1 is built for investors who want to keep their money invested for a long time.

As long as you don’t need to be able to make trades at a moment’s notice, you’ll be good to go with M1.

Of course, M1 Plus users can trade crypto on-demand up to 10 times per month.

But besides that, free users have to stick to the morning trading window, and M1 Plus users can trade during the morning and afternoon windows.

M1 Finance is NOT for:

Beginners.

If you’re looking for a beginner platform that will guide you through your trades and give you investment advice on your portfolio, you may want to look elsewhere.

While M1 does offer Expert Pies that are already created for you, you won’t get any tips on how to balance your portfolio’s asset allocation or tools to help you plan for retirement.

There are research tools and simple screeners to help you narrow down your stock search, but M1 doesn’t have financial advisors on staff to give you investment advice.

If you want a service that will allow you to talk on the phone with financial advisors or tailor a portfolio to your specific needs, you’ll want to use a different platform.

Day Traders.

The way M1 orchestrates your trading during designated trading windows means you can’t always buy or sell a stock at the exact second you want to do it.

The platform is best for those investors who are planning on holding their investments for many years and don’t care about the time of day during which they’re making trades.

Final Thoughts

As you can see, M1 Finance is a spectacular investing platform, but that doesn’t mean that it’s right for everyone.

Experienced investors will find a great home for their investments at M1 due to the amount of control they have over their portfolios.

But beginner investors might want to get started with a beginner broker before stepping up to a hands-on platform like M1.

We highly recommend signing up for the free, three-month trial of M1 Plus to see if it’s the right platform for you.

If you don’t like it, you can cancel at no cost.

Just make sure you cancel your subscription before the three months are up!

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. $3 monthly 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

Robinhood

Robinhood$0

✅ U.S. stocks, ETFs, options, and cryptos

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes

✅ Access to U.S. and Hong Kong markets

✅ Educational tools60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analyticsRefer a Friend and Get $200

Interactive Brokers Review

4.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

5.

M1 Finance

✅ Automated investing “Pies”

✅ Banking & low-interest loans

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

6.

Webull

$0

✅ Extended-hours trading

✅ Great charts and screeners

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

7.

Public

$0

✅ Fractional shares

✅ No payment for order flow model

✅ “Alpha” tool with earnings calls$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

8.

Composer

$32 a month

✅ Invest in automated strategies

✅ Build custom strategies easily

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

9.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools

✅ Curated theme portfolios$5 when you invest $5

Stash Review

10.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

11.

Etoro

$0

✅ CopyTrading™ to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.