If you’ve read our M1 Finance review, you know that M1 is a great investing platform that allows long-term investors a way to take control of their portfolios with a state-of-the-art user interface.

But is the platform safe?

That’s the question we’re here to answer today!

We’re going to take a look at how M1 Finance makes money and who they have keeping them accountable.

What Is M1 Finance?

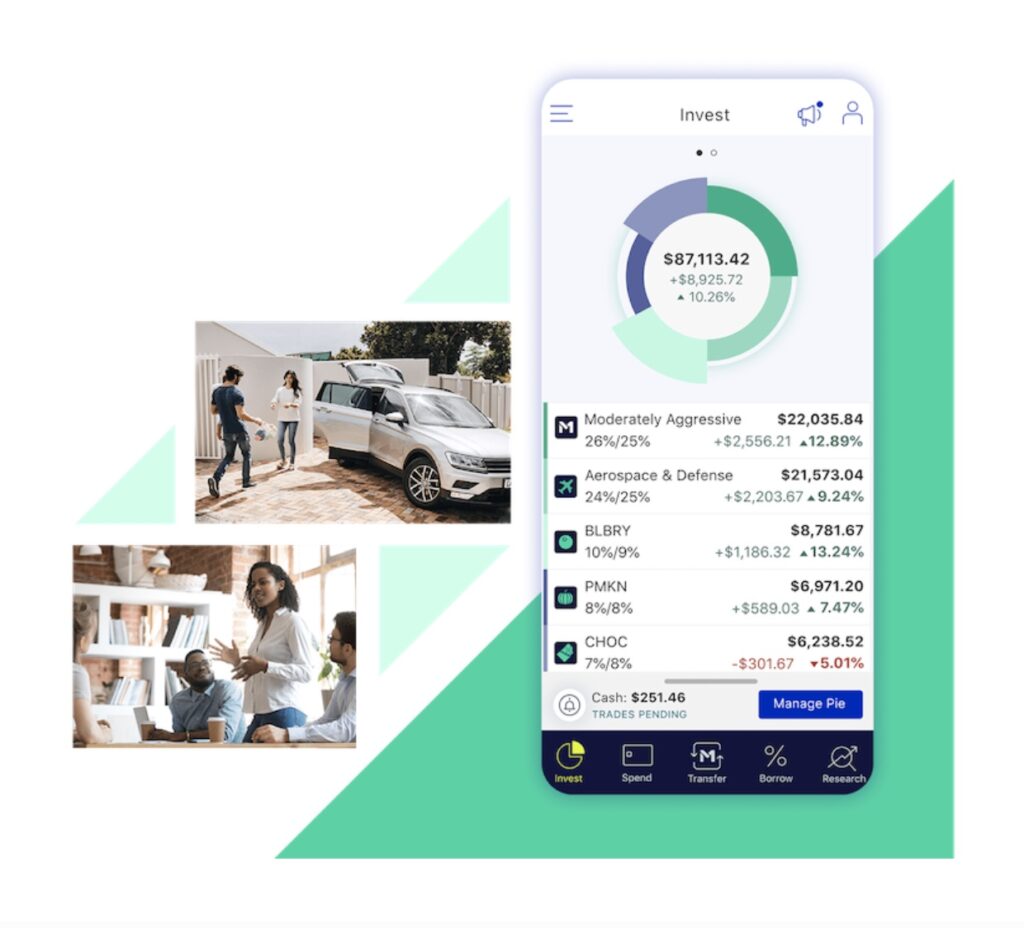

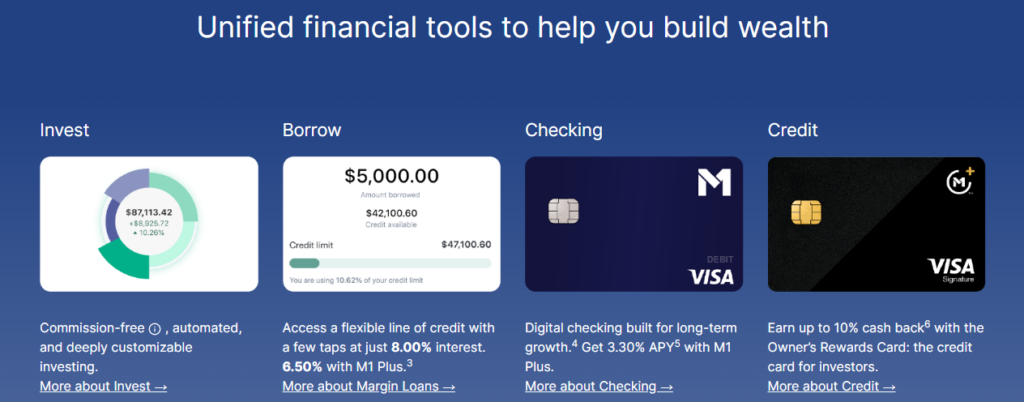

M1 Finance is a financial services company that acts as a hybrid between traditional robo advisors and typical brokerages.

M1 offers several types of investment accounts, such as taxable brokerage accounts, tax-advantaged retirement accounts, crypto accounts, and margin trading.

They also offer personal finance tools such as a cash management program, a checking account, and a credit card, with a high-yield savings account coming in early 2023.

M1 does not offer mutual funds or options.

The platform uses a unique portfolio construction system centered around “pies” that gives you total control of how your portfolio looks.

The pies let you control how your portfolio looks and specify your asset allocation.

Due to the amount of freedom M1 provides, they do not offer special tools like tax loss harvesting or retirement planning.

If you want a more hands-on platform that can help you with things like tax loss harvesting or expert investment advice, you might want to look at full-service robo advisors or a wealth management firm.

M1 Finance Backstory

M1 finance was founded in 2015 by Brian Barnes.

Brian was taught the value of investing at a young age by his parents, who made sure he knew that investing is a serious matter with real stakes.

He would invest in the market through a brokerage account that his parents set up for him.

They would let him decide which stocks would be bought in the account as long as he did his own research and made a compelling case for each investment.

When Brian grew older, he took his investing into his own hands. He had accounts with some of the older, major brokerages that many people still use today.

But Brian had an issue with these brokerages…

…none of them were what he was looking for!

Many of the brokerages that Brian tried had confusing, buggy user interfaces that made the user experience unpleasant.

Other brokerages charged ridiculously high commissions, such as $10 per trade.

But the most important factor that was missing was the lack of automation.

Brian wanted an investing platform through which he could have his own investments automatically set up.

He wanted to be able to set up a portfolio with certain allocation percentages going to different stocks, and then put money into his account on a regular basis to be automatically invested into that portfolio.

In his own words, Brain wanted to “rethink personal financial management to design an entirely new set of tools and services, built with the latest technologies.”

There was no platform on the market that could do what Brian wanted it to…

…So he decided to build his own!

He founded M1 Finance in 2015, with its headquarters in Chicago, Illinois.

Today, the platform has over half a million users with about $6 billion in assets under management.

Customer Service:

Phone at (312)600-2883 M-F 9:00:4:00 ET

Email at support@m1finance.com

M1 FINANCE SUMMARY

What You Get:

- Taxable, Retirement, Trust, and Custodial Accounts

- Free Checking Account for Your Uninvested Cash

- Credit Card with Cash Back Rewards

The M1 Finance Difference:

- Copy Expert Pies or Create Your Own

- M1 Plus Gives You Access to Special Perks and Rewards

M1 Finance Pricing:

- Basic account is completely FREE

- M1 Plus costs $125 per year, but you can GET YOUR FIRST THREE MONTHS FREE!

How Does M1 Finance Make Money?

M1 Finance makes money in several different ways, and it’s transparent about all of them.

The first way that M1 makes money is through payment for order flow.

If you’re not familiar with this term, it’s essentially when a brokerage receives payment for directing its users’ trades to certain market makers.

This practice has been criticized because it isn’t always best for investors; many “commission-free” brokerages end up passing on slightly different prices to their customers, which can cost them more money.

But payment for order flow is pretty commonplace among commission-free brokerages today, so it’s just part of the game at this point.

M1 Finance also makes money through charging interest for lending cash and stocks, and collecting an annual fee for their premium subscription, M1 Plus.

Is M1 Finance Insured?

Yes!

M1 Finance is insured by the Securities Investor Protection Corporation, or SIPC.

The SIPC insures the securities that you hold in your portfolio, as well as the cash sitting in your investment account.

Now, this does NOT mean that the SIPC insures you against your stocks going down in price. That risk is on you!

The Securities Investor Protection Corporation protects the assets in your investment account in the event that your brokerage goes bankrupt or otherwise cannot pay you money you want to withdraw from your account.

The bank that provides the M1 Spend checking accounts is Lincoln Savings Bank, which is FDIC insured.

The Federal Deposit Insurance Corporation insures money you have stored in your bank account.

So if something were to happen to Lincoln Savings Bank and your M1 Spend account was compromised, the FDIC insurance would have you covered.

Note that an FDIC insured checking account is insured up to $250,000.

Other Notes

It’s worth noting that M1 Finance has received overwhelmingly positive reviews from some big players in the investing world, which helps the platform’s credibility even more.

The platform has been praised by the likes of Investopedia, Yahoo!, and even the Motley Fool.

M1’s customer reviews also speak for themselves – they have a 4.7-star rating with over 51,000 ratings on the Apple Store.

Final Thoughts

So, now that we’ve laid out all the important factors about the inner workings of M1 Finance, it’s time to answer the question…

…Is the platform actually safe?

Drumroll, please…

…Yes! M1 Finance is absolutely safe.

With the amount of transparency and insurance that M1 has, it’s almost impossible to imagine M1 being a scam or an unsafe company to do business with.

Of course, we suggest that you do your own research and only invest your money on platforms that you trust completely.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.