With so many trading platforms available to investors, it’s natural to ask: Is moomoo safe? Whether you’re trading stocks, ETFs, or options, safety, regulation, and platform reliability are key factors in selecting the right broker. Moomoo, operated by Futu Holdings, has grown in popularity in the U.S. and international markets thanks to its user-friendly interface, strong regulatory backing, and competitive features.

This in-depth review explores moomoo’s security features, regulatory protections, account setup process, and the measures the company takes to safeguard users’ assets.

Introduction to Trading Platforms

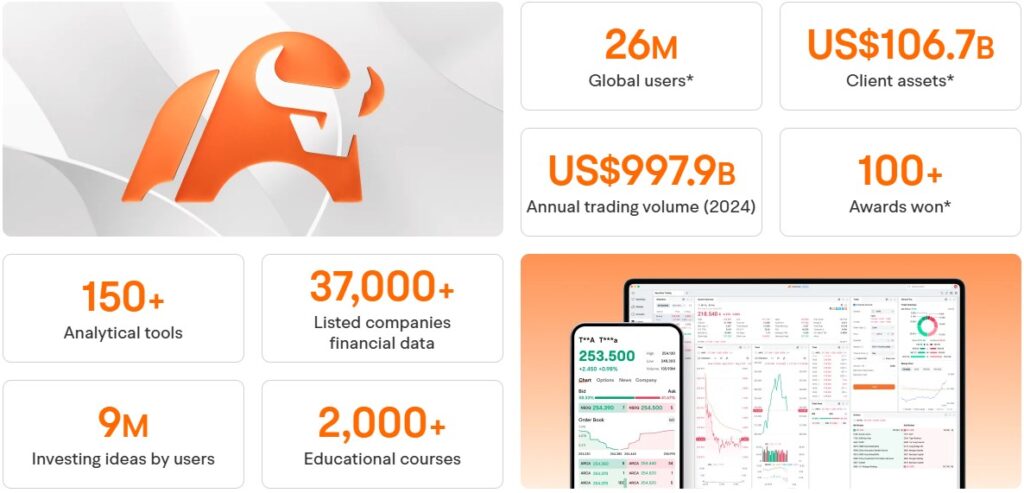

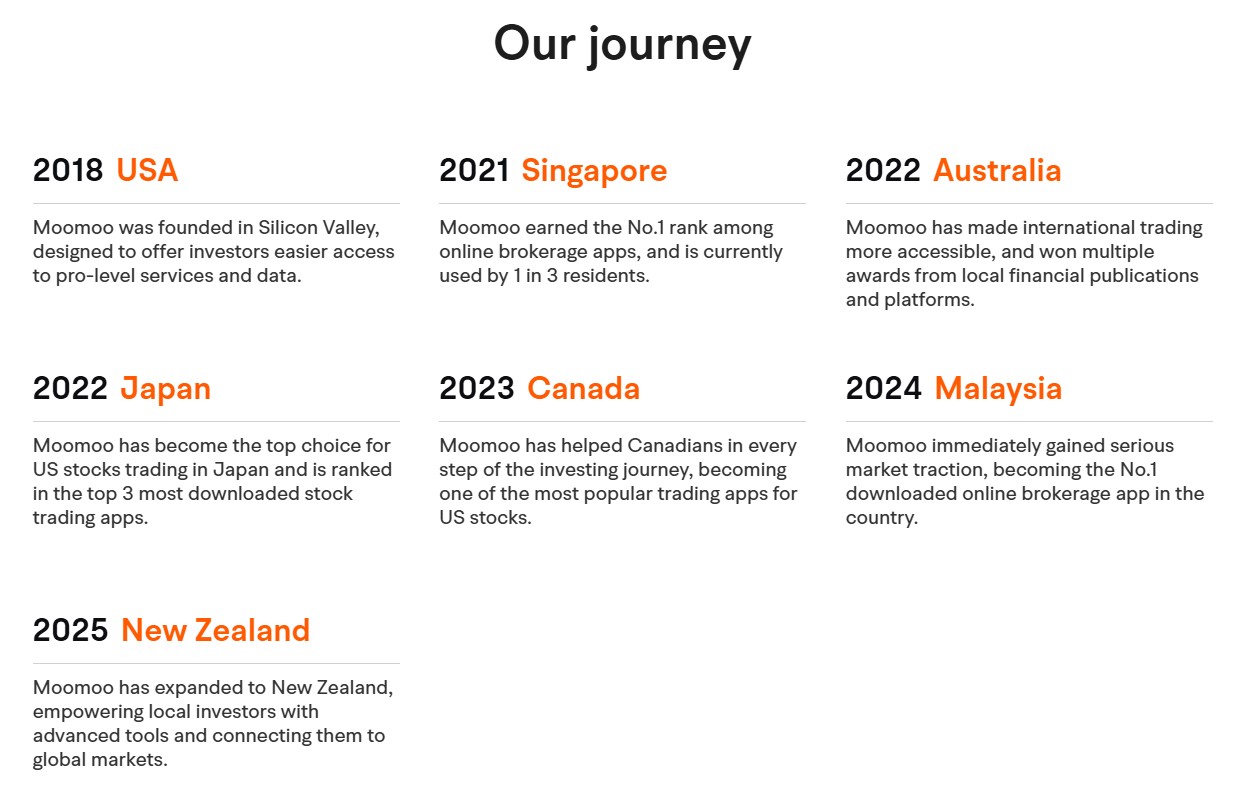

Moomoo is a powerful trading platform offering access to U.S. and global markets, including Australian markets, Hong Kong stocks, ETFs, options, crypto, and American Depositary Receipts (ADRs). Built for both new and experienced investors, moomoo combines commission-free stock trading with advanced tools and rich educational content.

The platform is backed by Futu Holdings, a publicly traded company listed on the NASDAQ under the ticker FUTU. The parent company operates across several countries and has positioned moomoo as its flagship retail investing platform.

Moomoo is regulated by major financial regulatory bodies, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Moomoo’s U.S. brokerage arm, moomoo Financial Inc., is also a member of the Securities Investor Protection Corporation (SIPC), which provides insurance coverage for customer assets.

Creating a Moomoo Account

Creating a moomoo account is a streamlined process. New users can either visit the moomoo website or download the moomoo app on both iOS and Android platforms.

To begin, users provide their full name, email address, and Social Security number. Identity verification follows standard financial procedures, ensuring compliance with U.S. financial regulations. Once verified, users can fund their moomoo account through ACH bank transfer or wire transfer.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA Stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Moomoo has a low minimum deposit requirement, allowing users to start trading with a modest balance. Promotional offers often include free stocks for new account sign-ups, further lowering the barrier to entry.

Note: If you’re a Canada resident, you can sign up on the moomoo Canada website and claim your welcome bonuses!

Moomoo Review and Ratings

Moomoo reviews highlight its strengths in both functionality and user satisfaction. The app has earned strong ratings in both the Apple App Store and Google Play Store, with average user ratings exceeding 4.5 stars.

Users consistently praise the intuitive layout, robust suite of research tools, and seamless trade execution. Many also appreciate the availability of real-time market data, especially Level 2 quotes, which are often gated behind premium tiers on competing platforms.

The platform has also been favorably reviewed by financial sites and comparison tools. Reviewers often point out moomoo’s low fees, powerful charting tools, and accessible customer service.

Security Features for Moomoo Users

Is moomoo safe for investors? The platform takes security very seriously. Key features include:

- Two-factor authentication (2FA): Adds an extra layer of protection during logins and account changes.

- Encryption protocols: All communications between the user and platform are encrypted to prevent data interception.

- Secure servers: Moomoo uses industry-standard infrastructure to store sensitive data securely.

In addition to these features, moomoo allows users to set custom account alerts, including login notifications and trade confirmations. These features help users monitor account activity and respond quickly to any suspicious activity.

Protecting Against Suspicious Activity

To ensure user safety, moomoo employs a combination of automated systems and human oversight to detect and respond to suspicious activity. This includes:

- Monitoring for logins from new devices or unusual IP locations

- Transaction analysis to identify unusual trading behavior

- Triggering account holds or alerts in the event of possible fraud

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA Stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Users are encouraged to report any suspicious account behavior through moomoo’s customer support team, which is available via live chat and email. In serious cases, the moomoo security team will work directly with users to secure accounts, initiate investigations, and assist with resolution.

Regulatory Oversight and Investor Protection

Moomoo is a regulated broker-dealer in the United States. It is subject to strict rules and compliance standards enforced by:

- The Securities and Exchange Commission (SEC)

- The Financial Industry Regulatory Authority (FINRA)

- Membership with the Securities Investor Protection Corporation (SIPC)

These affiliations ensure that moomoo adheres to operational standards and accountability required by U.S. law.

SIPC coverage protects moomoo users for up to $500,000 in securities, including up to $250,000 in cash. This does not protect against market loss but does offer peace of mind that funds are covered in the case of broker failure.

Commission-Free Stock Trading

Moomoo offers commission-free trading on U.S. stocks, ETFs, options, and crypto, making it an attractive choice for traders seeking a cost-efficient platform.

- Stock trading: No commissions for buying or selling U.S. listed stocks.

- Options trading: No commissions on options contracts, though a $0.50 contract fee and regulatory fees apply.

- Index options: Subject to a $0.50 per contract fee and standard exchange fees.

This pricing model puts moomoo in line with other low-cost brokers and enhances accessibility for first-time investors.

Understanding Margin Rates

Moomoo offers margin trading to eligible users, providing increased buying power for certain accounts. As of May 2025, moomoo’s margin rate is a flat 6.8% annually for debit balances under $25,000. This rate is competitive among discount brokers, many of which offer tiered pricing.

Users interested in trading on margin should consider both the risks and rewards. While margin can increase gains, it also increases losses. Moomoo provides tools to calculate interest costs and manage risk. Users must meet certain eligibility requirements and complete a suitability review before enabling margin functionality.

Is Moomoo Safe for Trading?

The short answer is yes. Moomoo is safe for trading and complies with all U.S. regulatory requirements.

- It is registered with the Securities and Exchange Commission and regulated by FINRA.

- Moomoo’s brokerage arm, moomoo Financial Inc., is a member of SIPC, which insures customer accounts.

- The platform uses strong encryption, two-factor authentication, and alert systems to protect against fraud.

Moomoo’s customer support team is available to assist users with both technical and security-related questions, making it a dependable option for new and experienced traders.

Moomoo’s New Crypto Trading Features

Moomoo recently expanded into cryptocurrency trading, giving users the ability to diversify their portfolios beyond traditional stocks and ETFs. Through its new crypto trading interface, investors can now buy and sell a curated list of digital assets, including Bitcoin, Ethereum, and a handful of other top-tier coins.

While the selection is currently limited compared to larger crypto exchanges, the rollout prioritizes compliance and ease of use—ideal for traders who want to explore crypto without leaving the Moomoo ecosystem. You’ll get real-time price updates, basic charting tools, and competitive spreads, all within the same app you already use for equities and options. This move puts Moomoo on the radar for crypto-curious investors looking for a secure, all-in-one platform.

Cash Management and Withdrawal

Moomoo allows users to withdraw funds via bank ACH or wire transfer. Domestic wire transfers cost $20, while international transfers are $25. There are no withdrawal fees imposed by moomoo for ACH transfers, though users should verify whether their banks charge additional fees.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn up to $1000 in NVDA Stock with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Moomoo also offers a cash sweep program that pays interest on uninvested cash. As of May 2025, users can earn up to 4.1% APY on idle balances, with a temporary 4.0% booster for new customers for up to $20,000 in cash.

This makes the platform’s cash management features competitive with both online brokers and high-yield savings products.

Best Practices for Trading Safely on Moomoo

While moomoo offers several built-in protections, users should also take steps to safeguard their accounts:

- Always enable two-factor authentication on your moomoo account.

- Use strong, unique passwords and avoid sharing login credentials.

- Monitor accounts regularly for unusual activity.

- Set up account alerts for transactions and logins.

- Contact customer support immediately if you detect suspicious activity.

Following these practices enhances your trading experience and helps ensure your funds remain safe.

Educational Resources and Support

Moomoo provides a wide range of educational resources to help users understand markets, platform features, and investment strategies.

- In-app tutorials and guides

- Livestream events and webinars

- Articles explaining key market terms and trading techniques

The moomoo website also includes an FAQ section that addresses common concerns, including account security, fees moomoo charges, and platform functionality.

If users still need help, moomoo offers live chat, email support, and phone assistance in certain regions.

Additional Resources

Moomoo continues to invest in its educational and support infrastructure. Users can access:

- Community forums where moomoo users share strategies

- Video tutorials for new users

- Insights from market analysts to support smarter trading decisions

- Regular updates on platform changes and regulatory alerts

These resources position moomoo as not only a trading platform but also a learning environment for both beginners and experienced investors.

Final Thoughts: Is Moomoo Safe?

Given its strong regulatory ties, security architecture, and positive user feedback, moomoo is safe for trading and investing.

The platform offers the protections expected from a U.S.-regulated broker, including SIPC insurance, encrypted transactions, and identity verification. With additional tools such as two-factor authentication, account alerts, and customer support, moomoo demonstrates a commitment to fraud prevention and user confidence.

While no trading platform can completely eliminate risk—especially market risk—moomoo provides a solid foundation for secure investing. With low fees, competitive tools, and access to both U.S. and international markets, it’s a strong choice for investors looking for both value and security.

If you want to know how moomoo’s safety compares to its US based competitor Robinhood, check out our full review Moomoo vs Robinhood!

FAQs

Yes, moomoo offers 2FA, which you will need to enable once you set up your account. We suggest installing a moomoo token on your primary device to make sure that nobody can log in from another device.

The best way to protect your account from hacks is to take full advantage of the available security features. Create a strong password that you don’t share with anybody else, enable 2FA, and install a moomoo token on your laptop and/or phone to make sure your account is secure. Educate yourself about phishing and don’t click on any suspicious links.

Yes. Moomoo has many security measures in place, including encryption, 2FA, and tokens. Just remember that moomoo can’t protect you if you share your password or device, so be careful and keep your personal information private.

Yes, moomoo’s website and mobile app are encrypted. Encryption can’t fully guarantee that your information will be safe, but if you take advantage of moomoo’s other security measures to safeguard your account, you’ll be as safe as you can be using a digital trading platform.

Yes, it is. The moomoo app is well regarded and encrypted. You can take additional steps to secure your account by turning on Device Lock and downloading a moomoo token to protect your mobile devices.

Moomoo ensures the safety of its trading platform with state-of-the-art encryption, passwords, tokenization, and by providing 2FA to its users. Moomoo users’ deposits and investments are protected by SIPC insurance up to $500,000.

Yes, you may use a third-party authentication app to secure your account.

Yes, moomoo offers up to 4.1% APY through its cash sweep program, plus a temporary 4.0% booster for new customers.

Top U.S. Brokers Promotions for 2026

★ ★ ★ ★ ★

✅ Now 23 million users

✅ Cash mgt account and credit card

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals; US residents only!

Get Free Stock

★ ★ ★ ★ ★

✅ Access to U.S. and Hong Kong markets

✅ Educational tools

Deposit $500 get $30 in NVDA stock; Deposit $2,000 get $100 in NVDA stock; Deposit $10,000 get $200 in NVDA stock; Deposit $50,000 get $400 in NVDA stock.

Get Free Shares

★ ★ ★ ★ ☆

✅ Trade U.S. stocks, ETFs, and crypto

✅ Trades with themed portfolios

★ ★ ★ ★ ☆

✅ Great charts and screeners

✅ Commission-free options trading

$10 and a 30-day complimentary subscription to Webull premium; $200-$30,0000 Tiered Sign up bonus

Learn more

★ ★ ★ ★ ☆

✅ IBKR Lite & Pro tiers for all

✅ SmartRouting™ and deep analytics

The Best Canadian Brokerages as of February 1, 2026

Ranking of Top Canadian Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of Canadian stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for Canada-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

✅ Dual-currency accounts without conversion fees

✅ Advanced trading with multi-leg options support

✅ Tiered interest on idle cash balances over $10,000 CAD

✅ Supports portfolio margin and direct market routing

✅ Access to Canadian Markets

✅ RRSP and TFSA Accounts

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Learn more✅ In-kind transfers & dividend reinvestment plans for CA stocks

✅ RESP and FHSA accounts with self-directed tools

✅ 24/5 U.S. market access with fractional share support

✅ No FX fees on U.S. trades if subscribed to USD feature

Fees, features, sign-up bonuses, and referral bonuses are accurate as of June 30, 2025. All information listed above is subject to change.