In the fast-paced world of online investing, choosing the right trading platform can be the difference between a smooth trading experience and constant frustration.

Two of the most popular options available today are moomoo and Robinhood. Each platform offers distinct features tailored to different levels of investor experience. Whether you’re just getting started or consider yourself among the more advanced traders, understanding what sets each apart is essential.

Both Robinhood and moomoo are safe to use. Robinhood and moomoo users’ accounts are protected by the SIPC and Robinhood by the FDIC (moomoo by FINRA), and their website and mobile app have 2FA, end-to-end encryption, and the company has private crime insurance to protect users if their security is breached.

This moomoo vs Robinhood comparison will help you assess which app is best for your goals, trading style, and level of experience.

Introduction to Trading Platforms

When selecting a trading platform, your choice should align with how you trade, your financial goals, and the types of assets you want access to.

Moomoo and Robinhood are two well-known trading apps, but they cater to slightly different audiences. While both offer commission-free trading and accessible interfaces, the depth of tools, analytics, and available markets varies considerably.

Investing involves risk, so evaluating each app’s tools, features, and fee structures can help ensure you make informed financial decisions.

Features and Fees

Robinhood made waves by eliminating commission fees, helping to spark a trend toward commission-free trading. It remains a favorite for beginner investors looking for a sleek interface and fast onboarding process. The app is intuitive and built for those who want simplicity without a steep learning curve.

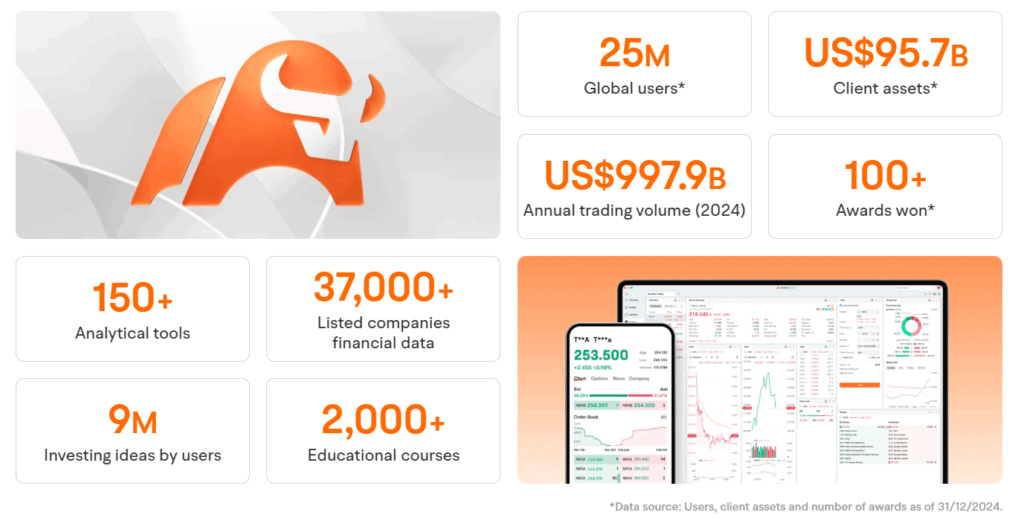

Moomoo, by contrast, leans into a more robust experience. It offers tools like an advanced stock screener, technical indicators, and extended charting capabilities that appeal to intermediate traders and experienced investors.

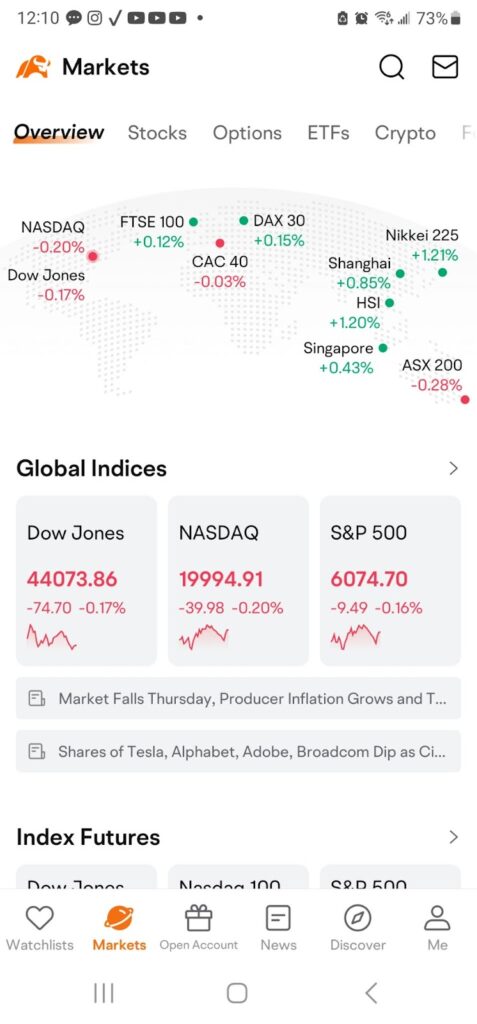

While both platforms offer stocks, ETFs, and options trading without commissions, moomoo supports trading in international markets, including the Hong Kong stock market, and offers extended trading hours for select U.S. securities. Robinhood currently limits trades to U.S. markets but does offer crypto trading.

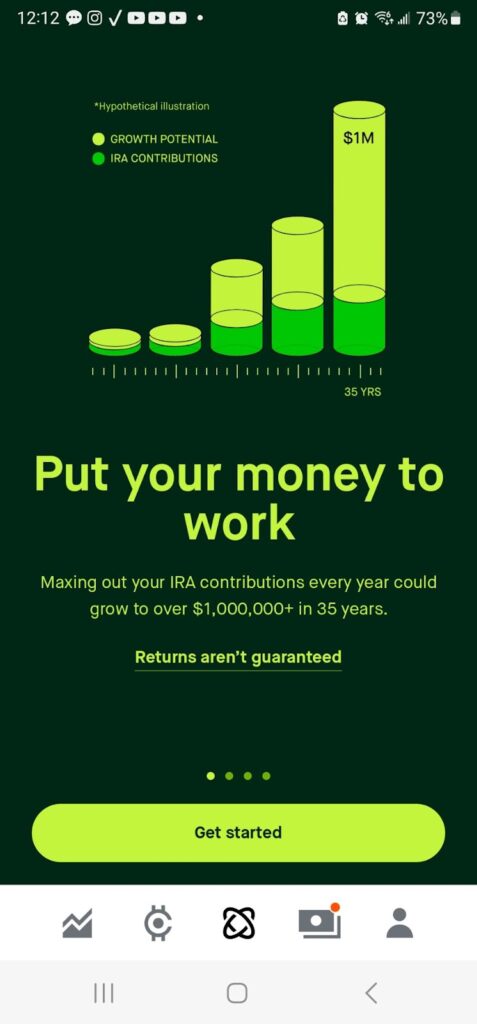

Fee-wise, both are competitive. Robinhood’s optional Robinhood Gold subscription includes access to margin trading, Level 2 market data, and Morningstar research for $5 per month. As of May 2025, Robinhood Gold also includes 4% APY on uninvested cash, a 3% IRA contribution match, and a 1% transfer match. Moomoo offers margin trading with a flat rate of 6.8% and provides access to real-time Level 2 data and research tools without requiring a paid tier.

Investment Options

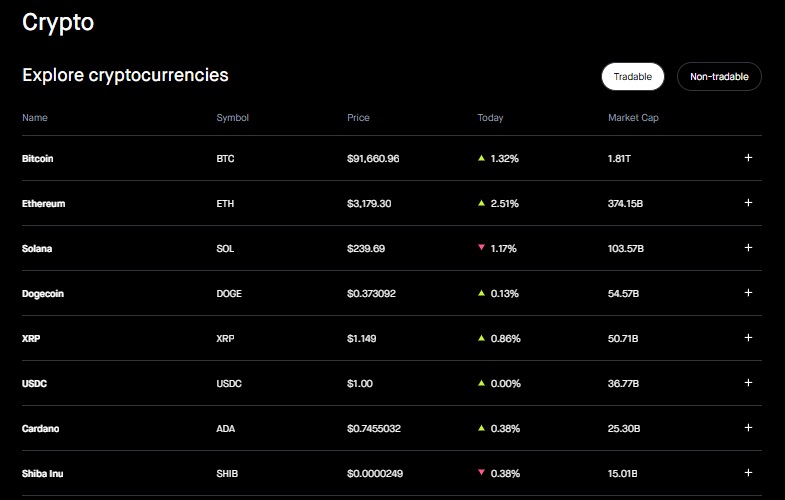

Robinhood supports stocks, ETFs, options, and cryptocurrency trading, including Bitcoin, Ethereum, and Dogecoin. It does not currently support trading in mutual funds or bonds. Investors can also use Robinhood to open retirement accounts, such as IRAs, or use the Robinhood Cash Card to earn rewards.

Moomoo, in comparison, focuses on traditional and international equities. It offers stocks, ETFs, options, and access to the Hong Kong stock exchange for global investors. Hong Kong trades come with a standard commission of 0.03% of the trade value (minimum 3 HKD), plus a 15 HKD platform fee per order. While moomoo does not offer crypto trading or retirement accounts, its access to foreign markets gives it a unique edge.

Traders looking to diversify their investment options globally may find moomoo’s offering more compelling, whereas those wanting crypto exposure may lean toward Robinhood.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn 60 free stocks with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Trading Tools and Analytics

Moomoo offers a suite of tools that appeals to those who prefer a hands-on approach to research. Key features include an advanced stock screener, real-time Level 2 market data, customizable alerts, and technical indicators that support in-depth investment platform analysis.

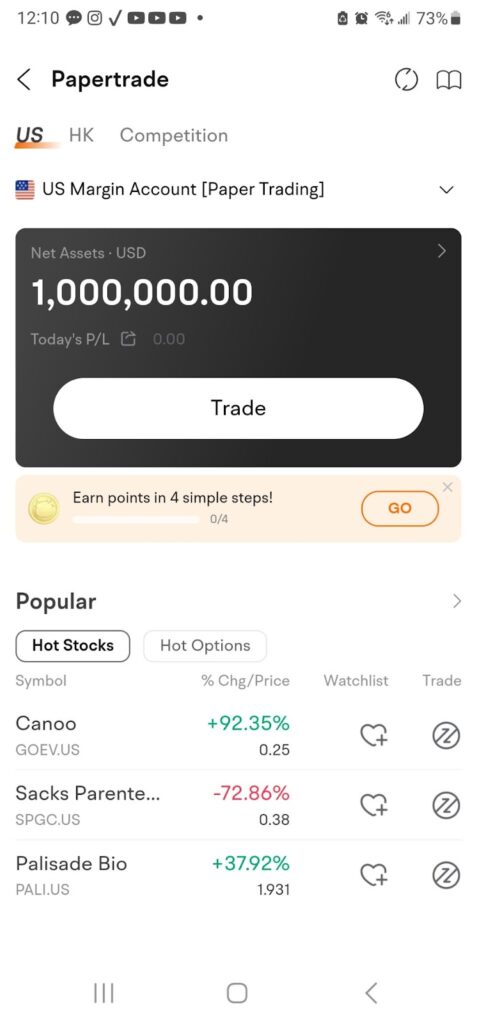

Its paper trading feature allows users to test strategies without putting real money on the line. The desktop and mobile app are synchronized, offering a seamless experience across devices. This is ideal for advanced traders who need quick access to charts and trade data.

Robinhood’s tools are easier to navigate but more limited. Traders get access to real-time price data, basic charting tools, and a streamlined order system. Robinhood’s simple layout is perfect for beginner traders, but may feel restrictive for those who want multi-variable screeners or multi-monitor capabilities.

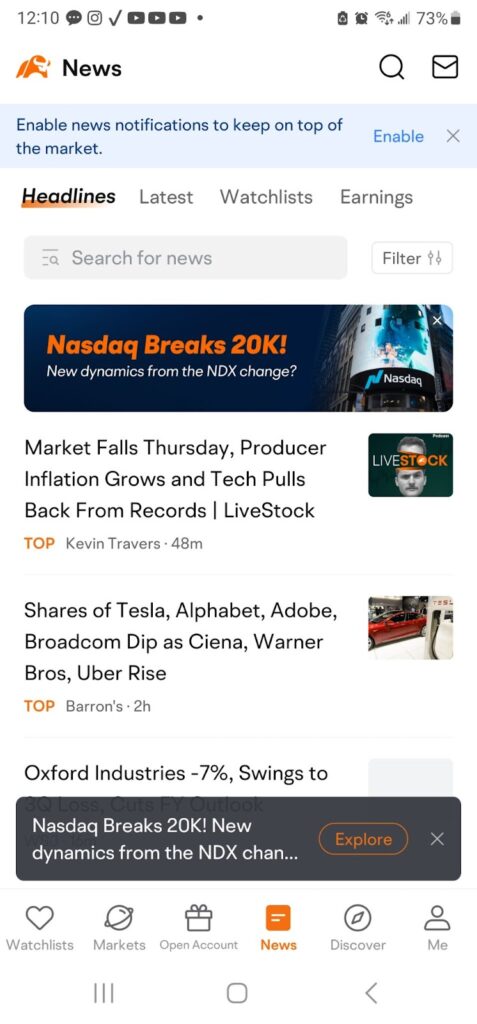

Both platforms provide real-time data and news updates, though the depth and customization options are noticeably greater on moomoo.

Educational Resources

Moomoo places a strong emphasis on investor education. Its platform features interactive tutorials, investing articles, and webinars led by professionals. Moomoo also hosts a supportive online community and offers live chat support, allowing users to ask questions and learn in real time.

Robinhood includes a section called Robinhood Learn, which includes a wide range of tutorials, articles, and market explainers. While these resources are beginner-friendly, they are not as interactive or advanced as what moomoo provides.

For beginner investors, both platforms deliver enough to get started, but moomoo’s educational library and user community go further in preparing users for advanced trading.

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn 60 free stocks with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

Fees and Pricing Structure

The fee structures for moomoo and Robinhood are similar but not identical. This table illustrates the similarities and differences.

| Feature | Moomoo | Robinhood |

|---|---|---|

| Margin Rate | 6.8% flat for U.S. margin accounts. | 5.75% standard rate; first $1,000 of margin is interest-free for Gold members. |

| Hong Kong Trading Fees | Commission: 0.03% (min HK$3); Platform Fee: HK$15; Stamp Duty: 0.1% of transaction amount. | Not available. |

| Crypto Trading | Not available. | Supports 19 cryptocurrencies, including BTC, ETH, DOGE, SOL, ADA, XRP, and PEPE. |

| Robinhood Gold Features | Not applicable. | $5/month; includes 4% APY on uninvested cash, 3% IRA match, 1% transfer match, access to Morningstar research, and Level II market data. |

Note: if you’re a Canada resident, you can visit the moomoo Canada website to see their fees, sign up for an account, and claim your commission rebate and stock cash coupon!

Premium Services

Robinhood Gold is a monthly subscription costing $5 and includes access to margin trading, Level 2 market data from Nasdaq, stock research from Morningstar, 4% APY on uninvested cash, a 3% IRA match, and a 1% transfer match. It also increases the instant deposit limit and provides access to advanced tools not available in the free tier.

Moomoo offers a range of premium services without charging for platform access. Traders can access real-time quotes, advanced analytics, and priority customer service without a monthly fee. It also features a cash sweep program offering a 4.1% base APY and a temporary 4.0% booster for new users on up to $20,000 in uninvested cash.

While Robinhood Gold adds extra incentives through its membership, moomoo provides competitive tools at no added cost.

Unique Features

Here’s where the two platforms diverge:

- Moomoo gives users access to the Hong Kong stock exchange, making it a strong choice for international investors. It also provides extended trading hours, multi-screen desktop tools, and in-depth analysis features.

- Robinhood supports cryptocurrency trading and retirement accounts, and integrates with the Robinhood Cash Card for users interested in blending investing with everyday spending.

- Moomoo also offers fractional shares, though this feature is still rolling out across all assets. Robinhood was among the first to launch fractional shares, and the feature is widely available across most stocks and ETFs.

Each platform offers advanced tools, but the way they’re delivered and supported makes all the difference. Moomoo focuses on giving intermediate traders and professionals the tools they need to take control, while Robinhood continues to streamline investing for casual users.

Investment Platform Comparison

Moomoo vs Robinhood comparisons often come down to the investor’s experience level and goals.

- Moomoo provides robust tools, access to international markets, and deeper research options. It suits users looking to explore advanced strategies and diversified holdings.

- Robinhood focuses on simplicity and ease of use. It is perfect for people just learning to trade stocks or invest in cryptocurrencies.

Both are solid platforms, but they serve different needs. If you’re moving from a beginner to intermediate investor and want more tools at your disposal, moomoo is likely the better fit.

Choosing the Right Platform

Start by evaluating your trading style, experience, and investment goals. Are you primarily investing in U.S. stocks and crypto? Do you want access to advanced tools and international equities?

Moomoo is currently offering 8.1% APY!

With the WallStreetSurvivor Exclusive offer on this page, earn 60 free stocks with a qualified deposit.

Canada Residents: You can get up to $200 Cash when you visit this Canada Promo Page!

If simplicity and ease of use are your top priorities, Robinhood delivers an intuitive interface with all the basic functions you need. If you want deeper analytics, real-time data, and access to global markets, moomoo presents a more powerful alternative.

Consider whether you need features like margin trading, advanced screeners, or extended trading hours, and weigh them against your comfort level and preferred trading app.

Hong Kong Trading

One of moomoo’s standout features is its access to the Hong Kong stock market. Investors can trade stocks, ETFs, and options on the Hong Kong stock exchange, gaining exposure to fast-growing sectors and emerging industries.

This global reach allows users to diversify beyond U.S. markets, but it also requires awareness of currency exchange, local regulations, and market hours. Moomoo supports users with translated data feeds, educational content, and compliance resources to help manage international trades effectively.

For those interested in investing in Asia or expanding their international exposure, moomoo is a rare tool that brings this level of access to retail traders.

Commission-Free Trades

Both moomoo and Robinhood offer commission-free trading on stocks, ETFs, and options. This makes both platforms highly competitive and appealing for cost-conscious investors.

Where they differ is in scope. Moomoo offers commission-free trading on Hong Kong stocks as well, making it a global contender. Robinhood, on the other hand, restricts commission-free trading to U.S. securities and does not offer access to foreign markets.

Additionally, neither platform charges for basic account usage or imposes account minimums, further lowering the barrier to entry.

Beginner Trading

For those new to trading, Robinhood is often the first stop. Its clean interface, intuitive layout, and quick sign-up process are ideal for those unfamiliar with investing. The Robinhood app simplifies concepts and limits options to reduce confusion.

Moomoo, while more robust, can initially feel overwhelming for new users. However, its educational resources, paper trading, and customer support make it a viable choice for beginner traders willing to invest time in learning.

Beginners should consider their risk tolerance and desired level of involvement. Robinhood is great for learning the basics and building comfort, while moomoo better supports those looking to grow into more active and advanced traders.

Advanced Trading

Advanced traders will appreciate moomoo’s platform versatility, including its detailed charting tools, global reach, and access to institutional-grade analytics. The desktop platform supports multi-monitor setups, technical overlays, and real-time scanners.

Robinhood’s advanced offerings come through Robinhood Gold, but these tools are more limited. While useful for casual options trading and research, they do not match the depth provided by moomoo’s native tools.

Users with defined strategies, time to research, and international interests will likely gravitate toward moomoo for its precision and scale.

Conclusion

Moomoo and Robinhood are both strong platforms, each serving a specific segment of the investor population. If you’re looking for ease, commission-free trading, and exposure to crypto trading, Robinhood fits the bill. If your goals include exploring international markets, practicing strategies, and accessing advanced tools, moomoo offers more depth.

Both platforms make investing accessible and continue to evolve with their user base in mind. Your decision should come down to what kind of investor you are today—and who you want to become tomorrow.

Still curious to learn more about moomoo, read our full Moomoo Review!

FAQs

Moomoo offers more advanced trading tools and access to international markets. Robinhood offers crypto, retirement accounts, and a simpler user experience.

No, Robinhood is not currently offering paper investing. If you’re willing to spend a little money, you can start building a portfolio with fractional shares. As you get accustomed to how the trading process works, you can buy additional shares.

Yes, both Robinhood and moomoo are safe to use. Robinhood users’ accounts are protected by the SIPC and FDIC, and their website and mobile app have 2FA, end-to-end encryption, and the company has private crime insurance to protect users if their security is breached.

Moomoo is protected by the SIPC up to $500,000 per investment account. They also offer 2FA and encryption.

Both platforms offer commission-free trading on U.S. stocks, ETFs, and options. Robinhood Gold is a paid subscription for extra features. Moomoo provides advanced tools at no additional cost.

No. Only Robinhood currently offers cryptocurrency trading.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.