Editors Note: We know stock picking in a volatile market is nerve-wracking. That’s why Zacks just released a FREE report detailing Zacks’ 7 Best Strong Buys for this month.

They also are allowing new subscribers 30 days of full access to their top 6 subscriptions services (Zacks Investor Collection) for only $1. This includes their top performers of Zacks Value Investor and Zacks Top 10. Click here to get immediate access to all their stock picks.

Zacks Investment Research Review

In this Zacks Review, I am going to tell you exactly what you want to know about the various Zacks services:

- What is Zacks?

- Is Zacks worth it?

- How can I get their popular list of “5 Stocks Set to Double” for free?

- How much does Zacks Premium cost?

- How have Zacks stock picks performed over the years?

My Experience with Zacks

I have been using Zacks stock research tools since my dad started taking me to the library in the 1980s to show me how to research stocks.

Zacks was the first company to aggregate stock earnings forecasts from all the major Wall Street firms and then share the collective data.

So instead of just looking to see what one analyst at Merrill Lynch was forecasting for a particular stock, Zacks can show you ALL of the analysts’ recommendations and how many were rating a stock as a Strong Buy, a Buy, Hold, Sell, or Strong Sell.

And most importantly, you could see what the changes or trends were over the recent quarters. My dad told me only to buy stocks that were rated Strong Buys by Zacks.

A Brief History of Zacks Research

What neither my dad nor I realized back then was that the Zacks CEO and founder, a researcher with a Ph.D. from MIT, had spent years analyzing Wall Street analysts’ earnings forecasts and discovered what he called ‘the most powerful force impacting stock prices.’

This ‘powerful force’ was NOT earnings forecasts but rather earnings forecasts revisions.

So if a lot of stock research analysts start increasing their earnings estimates and revising them upward, then those stocks were the ones that tended to outperform other stocks.

And conversely, if analysts were downgrading stocks from Buy to Sell or Strong Sell based on earnings estimates, then those stocks tended to underperform the market.

Zacks Investment Research was founded in 1978. They have expanded their stock research tools and continue to refine their initial tool.

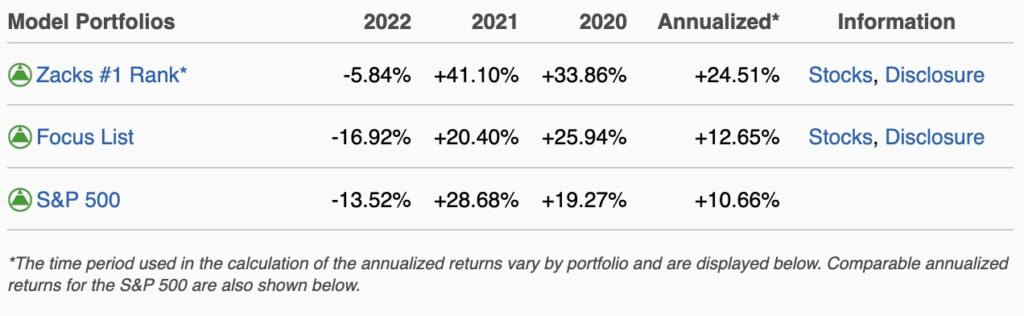

Zacks Performance vs. the S&P500

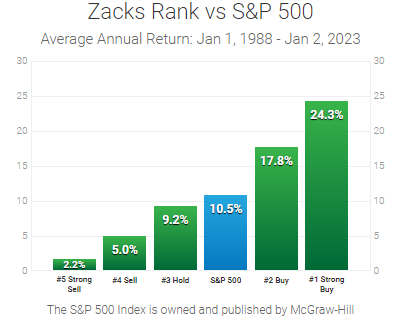

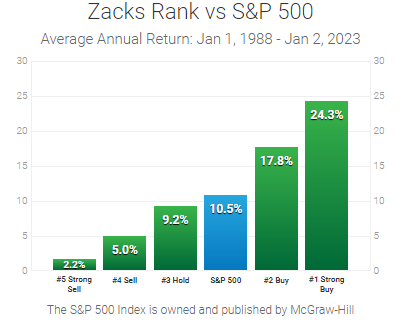

Take a look at this graph below that covers stock data since 1988. (Their usual footnote on this chart indicates it is based on rebalancing monthly and paying $0 commissions.)

That chart is quite impressive.

But make sure you understand what that chart is saying!

See that blue bar? That is the S&P 500 performance. So over the last 35 years, the S&P has averaged 10.5%, and the stocks that Zacks ranks as #1 Strong Buy are up 24.3%. So they BEAT THE S&P 500 BY 13.8% on average each year.

On top of that, stocks that are ranked as #5 Strong Sell are only up 2.2%, so they’re underperforming the market.

WOW! Think about that. Zacks is not quite a crystal ball, but that chart is exactly what you want to see. Find the stocks that are rated #1, and avoid the stocks rated #5.

Just like my dad said when he was showing me how to pick stocks back in the late 1980s, ‘only buy stocks that Zacks rates as a Strong Buy!’

Is Zacks Worth It?

Is Zacks Premium worth it? Yes, absolutely. Zacks is worth it.

Given that the stocks they rate as a #1 Strong Buy have beat the SP500 by 13.9% on average for the last 34 years, their system works.

And the fact that the stocks they rate as a #5 Strong Sell have underperformed the market by 8.4% all but proves their system.

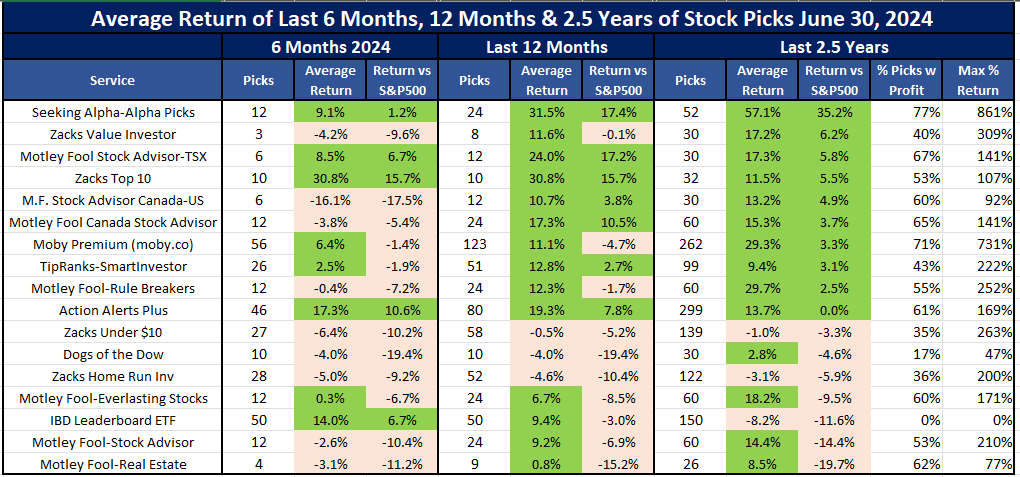

And take a look at their performance versus other popular stock newsletters under $500. Zack’s Value Investor and Zacks Top 10 are always in the top performers of my rankings and especially over the last 2.5 years.

Both these services are part of the Zack Investor Collection. Click here to get immediate access to all their stock picks for only $1.

Zacks Premium is worth it to start for beginner investors, and Zacks Investor Collection and Zacks Ultimate are worth it for more advanced investors.

How To Get Started With Zacks?

Right now, a great way to get started with Zacks is to get a copy of their most recent report of “5 Stocks Set to Double.”

These are their analysts’ picks of the best of the best #1 rated stocks.

ZACKS INVESTMENT RESEARCH SUMMARY

What You Get:

- Professional Stock Research Tools

- Access to the Zacks #1 Strong Buy List

- FREE Report on 5 Stocks Set to Double

VERIFIED Historical Performance:

- #1 Strong Buys Have Beat the Market by Over 14%

- #5 Strong Sells Have Underperformed the Market by 8%

How To Subscribe at the Lowest Price:

- Zacks Premium is $249 per Year

- Full Access for only $1: Click here to get immediate access to all their stock picks.

You don’t have to give them a credit card. If you follow this link, you can get their report for free.

What is Zacks Investment Research?

Zacks Investment Research was founded in 1978.

Zacks believes that the most powerful factor driving equities prices is earnings estimate revisions.

In other words, when financial analysts make changes to the amount that they predict companies will earn in a given quarter, that change affects prices more than anything else.

The company’s goal is to provide objective financial research to be used by analysts to inform their clients and be used by retail investors as well.

Given that Zacks founding principle is that earnings estimate revisions are the biggest mover of stock prices, it is no surprise that the company is well known for its large earnings per share (EPS) estimates.

However, it has branched out into other areas as well.

The Zacks home page contains the headings: Stocks, Funds, Earnings, Screening, Finance, Portfolio, Education, Video, Podcasts, and Services.

You can find everything from stock rankings and articles on personal finance to a portfolio creation tool and educational podcasts within these headings.

The Zacks System – Is Zacks Reliable?

Zacks uses a rather simple rating system.

In the areas of value, growth, and momentum, Zacks ranks stocks with a ranking of A through F.

Securities are also given a rank of 1 (strong buy) to 5 (strong sell).

The Portfolio Tracker allows you to tell Zacks what stocks and funds you are holding and receive the Zacks stock ratings on them 24/7.

The system Zacks uses to rate and rank stocks runs on quantitative analysis.

If you’re not familiar, quantitative analysis is a form of analysis in which complex mathematical equations and statistical analysis are combined with computer algorithms and high-tech models to help make predictions about the value of a stock.

Essentially, Zacks is saying that since they rely on a quantitative analysis algorithm rather than humans to rate financial securities, they are completely objective, unlike human analysts at other firms.

So is Zacks reliable?

Well, this claim by Zacks must have some truth to it because many larger financial companies use the firm’s research to inform their decisions and advise clients.

Zacks is regulated by the U.S. Securities and Exchange Commission (SEC), and all of its filings can be found here.

How Zacks Investment Research Provides Value to Customers

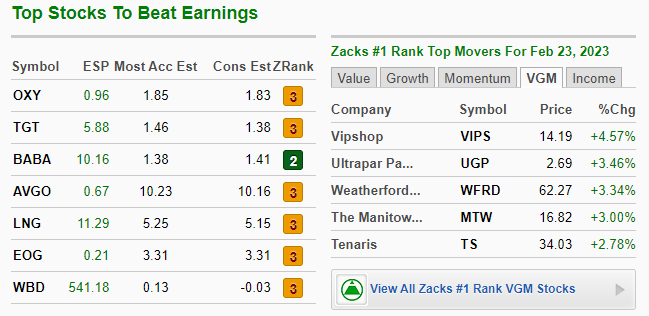

If you choose to sign up for Zacks Premium, you will get access to the Zacks Earnings Expected Surprise Prediction (ESP) Filter, which tells you which stocks are most likely to post higher or lower earnings than expected.

You also gain access to Zacks premium screens, which fall into categories such as value, growth, momentum, and many more for stocks, mutual funds, and ETFs.

Zacks claims that their screeners have a list for every type of investor!

You can also create your own custom screener to filter the criteria you do or do not want in your portfolio.

With Zacks Premium, you can use Premium screens to find a stock, mutual fund, or ETF that fits your portfolio.

The Zacks #1 Rank List shows you the top 5% of stocks with the most potential each day.

The list is broken up into the categories of value, growth, momentum, VGM, and income, so you can look at the stocks that are most relevant to your investing style.

The Focus List shows you the best long-term investments based on earnings momentum.

As you can see, the Focus List has also performed the S&P 500 along with the #1 Rank List.

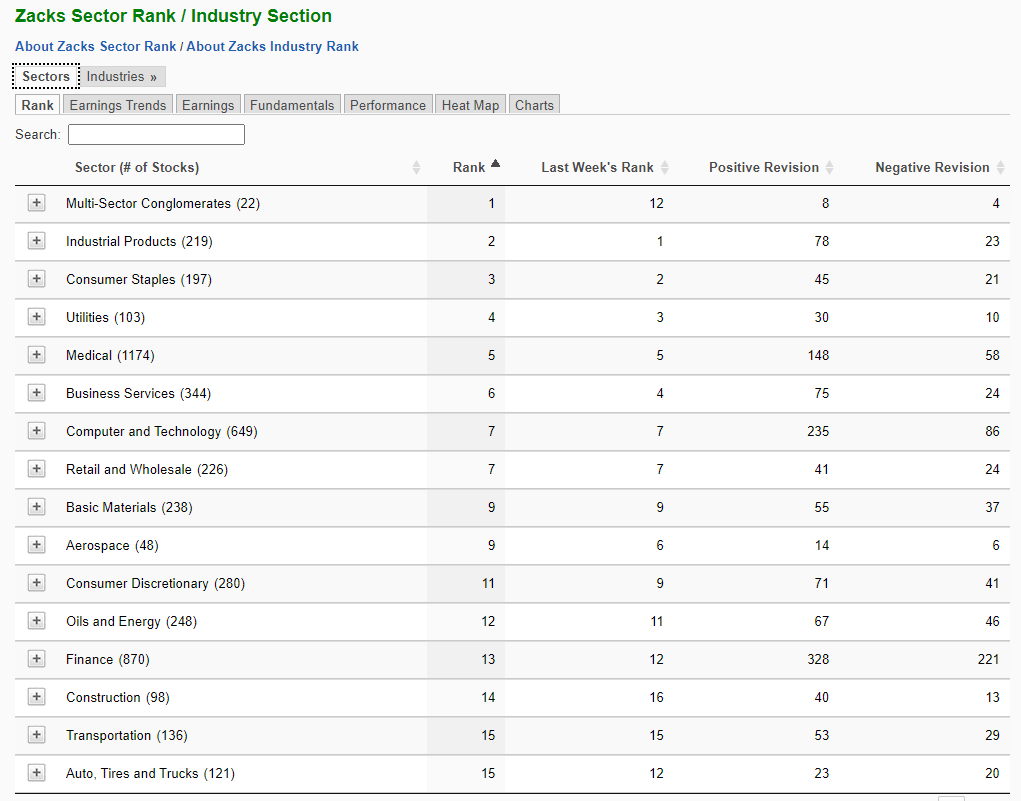

The Zacks Industry Group separates securities into over 250 industry groups.

The Zacks Premium Insight feature gives you daily market research, upgrades, and downgrades.

Zacks Membership Plans

How much does a Zacks subscription cost? The following membership plan information comes straight from the Zacks website.

Zacks Premium is the least expensive Zacks service. Zacks Premium costs $249 per year and gives you access to:

- Equity Research Reports

- Focus List Portfolio

- Premium Screens

- Zacks #1 Rank List

- Zacks Rank

Zacks Investor Collection is meant for long-term investors and comes with its own set of tools and strategies. For $59 per month or $495 per year, you’ll get:

- Zacks Premium

- ETF Investor

- Home Run Investor (read our Zacks Home Run Investor Review)

- Income Investor

- Stocks Under $10

- Value Investor

- Zacks Confidential

- Zacks Top 10 Stocks

Zacks Ultimate, the highest membership tier, costs $299 per month or $2995 per year. It is meant to give subscribers access to all of Zacks’ portfolio recommendations and investment strategies so that you can choose which one is best for you. Zacks Ultimate members have access to:

- Zacks Premium

- Black Box Trader

- Blockchain Innovators

- Commodity Innovators

- Counterstrike

- ETF Investor

- Headline Trader

- Healthcare Innovators

- Home Run Investor (read our Zacks Home Run Investor Review)

- Income Investor

- Insider Trader

- Large-Cap Trader

- Marijuana Innovators

- Options Trader

- Short Sell List

- Stocks Under $10

- Surprise Trader

- Value Investor

- TAZR

- Technology Innovators

- Zacks Confidential

- Zacks Top 10 Stocks

For more information on Zacks Ultimate, read our Zacks Ultimate review.

The best part of all of these options? They can be accessed for FREE for 30 days with just $1 down for Zacks Ultimate and Investor Collection packages.

Final Thoughts

With all of the research, analytical, and educational tools it offers, Zacks has made a name for itself in the investment research space.

Make sure to check out what Zacks has to say next time you’re looking into a stock!

If you are curious how Zacks compares to other stock research and advisement sites, check out our new review comparing Zacks to Morningstar, the Motley Fool, and Seeking Alpha!

While the prices of Zacks Investment Research might seem high, the investment services really can pay for itself if you use it correctly.

For example, you could use Zacks Premium to get access to Zacks Rank, earnings estimate revisions, equity research, and premium screens.

Then, you could use that research to optimize your portfolio, gain a trading advantage, and secure some extra gains.

If you find a lot of value from Zacks Premium, you can then upgrade to Zacks Investor Collection or even Zacks Ultimate.

If you’re worried about whether Zacks is worth it for you, you can always try out Zacks Premium with a free trial and see what you think. If you don’t like it, you can try out another stock research platform like Stock Rover (read our Stock Rover review) or Trade Ideas (read our Trade Ideas review).

As an introduction to Zacks, they invite you to download their most recent report of “5 Stocks Set to Double.”

Five experts start with the Zacks quantitative system but add their personal research to seek stocks with potential to gain +100% and more in the coming months.

Previous editions have nailed gains like Chewy +213.0% . . . NVIDIA +243.4% . . . Sea Limited +542.2%

Normally you have to register and give them a credit card, but if you follow this link, you can get their report for free.

Want to use your research from Zacks to construct a paper trading portfolio and invest with virtual money? Check out Wall Street Survivor’s Stock Market Game!

Or, are you ready to use your Zacks recommendations to invest with real money using automated trading strategies? Read our Composer review!

Furthermore, if you are looking to compare Zacks as a whole against competitors such as the Motley Fool and Seeking Alpha, check out our new review comparing the three here!

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.