Sometimes investing seems more like a crapshoot than an art, let alone a science. You can pore over data and manipulate charts for hours, read through every submission to the SEC, stare at the fundamentals and calculate ratios until your head starts throbbing and your eyes start bleeding and still make the wrong play.

The market is just so unpredictable, so irrational, so infuriatingly volatile that you might as well just buy some index funds and call it a day…right?

It’d be one thing if there was some secret code to all of it. Some time-tested tactic that almost guaranteed results, a formula for moolah that worked better than all the technical analysis and tea leaf-reading in the world. Unfortunately, no such formula exists…or does it?

Zacks Investment Research may be the closest thing we have to an equity oracle. Their system—the Zacks Performance Rank—is a proven method for getting the kind of consistent above-market returns that most investors could only dream of.

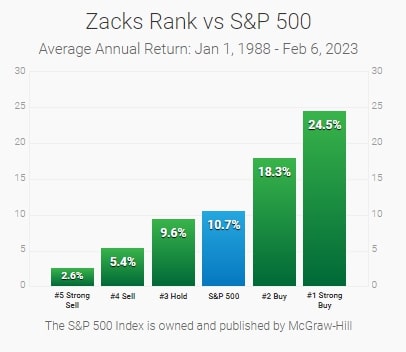

According to their studies (and math), Zacks has managed to deliver an average return of 24.5% in the decades between 1988 and 2023—well over twice the S&P 500’s average returns.

So how do you get in on this magic? Money, that’s how. Zacks will give you a little taste of what it has to offer for free, but you have to open your wallet if you want to get to the good stuff.

There are a couple different membership tiers—plus some ancillary membership things—that you can sign up for. We won’t waste time talking about all of them today, though. We’re here for the good membership. The Glengarry membership. We’re here to talk about Zacks Ultimate.

Pro Tip:

Zacks #1 Strong Buy ranked stocks have more than doubled the market’s performance since 1988. When you sign up for Zacks Ultimate, you get access to all the features included in Zacks Premium, PLUS more than 15 actively managed portfolios that target returns in different sectors and asset classes. Click here to get a 30-day trial of Zacks Ultimate for just $1!

A Bit of Background

In case you don’t already know, Zacks Investment Research is a stock research firm that’s been in business since 1978. Its founder started the firm with nothing but a PhD in mathematics from MIT, ten years of experience as a quantitative researcher, and an idea.

The founder started Zacks because he saw something others hadn’t. Through his work and his research he found that one factor was more influential than any other when it came to predicting major stock price moves. Rather than trend lines or moving averages or prayer, the founder discovered that earnings revisions had the biggest effect on stock prices.

What Does That Mean?

The term “earnings,” at a basic level, refers to the amount of profit a company makes in a given time period, usually a quarter (three months).

A company’s quarterly earnings are then divided by the number of outstanding shares of stock to obtain a number called earnings per share, or ESP, which is an important measure often used by investors to evaluate a company’s profitability.

Companies report their earnings every quarter, and their stocks’ prices usually fluctuate in anticipation of a good or bad earnings report, and sometimes after the report as well.

Zacks’ analysts thoroughly research companies’ history and performance to make predictions on their earnings. But more importantly, Zacks tells you whether or not they expect a company’s earnings to surprise the market.

They classify these predictions as earnings surprise predictions, or ESP. Basically, Zacks figured out that getting ahead of a surprising earnings report can be a profitable investing trick when done consistently and accurately.

That one realization has served Zacks well. It formed the backbone of an enterprise that’s grown to be one of the preeminent players in the game some 45 years later.

Zacks Ultimate

Like we said, you need to sign up for a membership if you want to get at all the primo stuff that Zacks has to offer.

You can always go for the lower tier, Zacks Premium, which gives you a ton of great recommendations, analytical tools, equity research reports, and prebuilt stock screeners, but that’s baby stuff. Plus, we’ve already covered what comes with Zacks Premium in another piece – read our Zacks Premium review.

If you’re tired of the baby stuff and if you think it’s time to start playing with the big boys/girls, Zacks Ultimate may be just what you’re looking for. It is pretty expensive though, so you should really do your due diligence before signing up.

How expensive is it?

Zacks Ultimate Pricing

This expensive:

- $299/month

- $2,995/year

That’s a lot, especially when you compare it to Zacks Premium:

- $249/year

And Zacks Investor Collection (which includes all of the features of Premium):

- $59/month

- $495/year

You don’t often see two membership tiers separated by such a massive price difference, but apparently that’s just how Zacks does things.

So what about Zacks Ultimate makes it so pricey? Let’s find out. And since Zacks Ultimate includes everything else that comes with other Zacks memberships, lets start with those.

Pro Tip:

Zacks #1 Strong Buy ranked stocks have more than doubled the market’s performance since 1988. When you sign up for Zacks Ultimate, you get access to all the features included in Zacks Premium, PLUS more than 15 actively managed portfolios that target returns in different sectors and asset classes. Click here to get a 30-day trial of Zacks Ultimate for just $1!

Premium Features

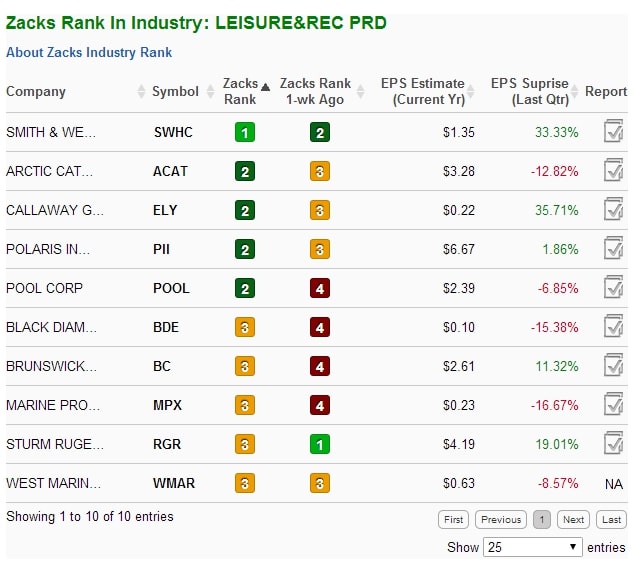

If you subscribe to Zacks Ultimate, you also get everything that comes with Zacks Premium. That means you get the Zacks #1 list, their long-term plays, all the research, all the stock screeners, the exclusive commentary, the industry filters and intra-industry ratings, and all that good stuff.

The Zacks #1 list is one of the biggest selling points of any level of Zacks membership.

This is the list that has put up some of the big numbers for Zacks, like that 24.5% average return from 1988 to 2023. Beating the S&P 500 by an average of over 13% is no small feat.

That’s a big benefit on its own, but even Zacks’ own math puts an annual value of $249 on Zacks Premium, which leaves about $2,746 of value on the table.

Zacks Investor Collection

Zacks Investor Collection is a set of actively managed portfolios and lists of recommendations compiled by Zacks personnel. Each portfolio is tailored to certain kinds of stocks and ETFs with different time frames and profiles, though they’re all aimed at the same thing: making you as much money as possible. Some of the portfolios include:

ETF Investor: Uses Zacks Industry Rank, Zacks ETF Rank, and other factors to identify and ride emerging trends through select ETFs. Designed to target strong returns with smoother trajectories than individual stocks.

Home Run Investor: A portfolio that identifies, compiles, and recommends smaller and mid-cap companies that have fallen under the radar in spite of their robust earnings growth momentum. Intended to deliver outsize returns from companies with repeated quarterly earnings surprises. For more information, read our Zacks Home Run Investor review.

Income Investor: Targets stocks with strong fundamentals and histories of consistent dividend payments. Designed to deliver strong, consistent returns with minimal risk.

Stocks Under $10: Pretty self-explanatory.

Value Investor: Uses Zacks Rank and value metrics to find underpriced stocks and recommend them before the market recognizes their potential. Designed to ride underpriced stocks to the top of the market.

Plus Two More

The Investor Collection membership also offers access to two more things that could be useful: Zacks Confidential and Zacks Top 10 Stocks.

Zacks Confidential: A set of private briefings and market insights delivered weekly by Zacks’ executive vice president that delves into the best and most successful trades in all of Zacks’ investment portfolios.

Zacks Top 10 Stocks: Again, pretty self-explanatory. It’s a portfolio of 10 stocks hand-picked by Zacks’ director of research. Includes a blend of small, medium, and large-cap stocks picked for their combination of intrinsic value and growth potential. Stocks in this portfolio have delivered three times the returns as the S&P 500 since 2012

The Investor Collection is packed full of potential moneymakers, and Zacks has priced it accordingly.

Zacks Investor Collection Pricing

- $59/month

- $495/year

Now, if we subtract the price of Premium ($249/year) to isolate the value Zacks puts on the other Investor Collection, you get $246.

And when we subtract the Investor Collection (all $495) from the price of Zacks Ultimate ($2,995/year) you get $2,500. That means Zacks thinks its Ultimate membership minus the other memberships is worth $2,500 a year.

That’s a Lot. Or is It?

Zacks Ultimate includes a lot of stuff even if you take out everything from the two lower-tier memberships. You won’t find that many new features, per se, but you will get access to a ton more actively managed portfolios. Portfolios like:

Alternative Energy Innovators: Tracks companies making strides in all forms of alternative energy.

Black Box Trader: AI-driven portfolio that uses a secret blend of factors to find the 10 highest-quality stocks with the biggest potential price growth. Updated every Monday. Includes market commentary and automatic email buy and sell alerts.

Blockchain Innovators: Tracks blockchain-related stocks and identifies opportunities for profitable trades. Includes commentary and alerts.

Commodity Innovators: Uses Zacks Rank and other factors to find the best commodity-related stocks and ETFs to give you a way into the commodities markets.

Counterstrike: Watches markets for selloffs caused by high frequency traders and buys affected stocks at the bottom of the market.

Headline Trader: Watches for and trades on the back of breaking news.

Healthcare Innovators: Finds the best and most promising stocks in the healthcare and biotech sectors.

Insider Trader: Finds companies with lots of insider stock-buying (employees/executives buying) and identifies potentially undervalued companies.

Large-Cap Trader: Trades large-cap companies with significant upside potential.

Marijuana Innovators: Targets securities related to the marijuana industry and identifies potential growth opportunities.

Options Trader: Structures options trades for maximum potential profits and minimal risk.

Short Sell List: AI-driven list of companies that are prime targets for short selling.

Surprise Trader: “Listens” to chatter among analysts and identifies credible buying and selling opportunities.

TAZR: Uses technical analysis and Zacks Rank to find the right stocks to buy and sell at the right time.

Technology Innovators: Uses Zacks Rank to find tech companies with the right combination of earnings momentum and growth potential.

Pro Tip:

Zacks #1 Strong Buy ranked stocks have more than doubled the market’s performance since 1988. When you sign up for Zacks Ultimate, you get access to all the features included in Zacks Premium, PLUS more than 15 actively managed portfolios that target returns in different sectors and asset classes. Click here to get a 30-day trial of Zacks Ultimate for just $1!

Conclusion

Zacks Ultimate includes a wealth of trading ideas and insights. The data they have on hand shows that their methods work with startling regularity, and if the trend continues it seems like following their directions is a surefire way to boost your net worth.

Whether Zacks Ultimate will be worth it to you is largely dependent on how much money you have invested or are willing to invest, as you essentially need to earn an additional $3,000 every year if you want to turn a profit. It’s a matter of economies of scale.

If your portfolio is big enough then earning an additional $3,000+ a year won’t be a big deal. If you’re like the rest of us, though, you might want to start with Zacks Premium and work your way up.

We are paid subscribers to dozens of stock newsletters. We actively track every recommendation from all of these services, calculate performance, and share the results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Excess Return" which is their return above that of the S&P500. So, based on last 3 years ending June 29, 2025:The Best Stock Newsletters as of June 29, 2025

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks

Rank Stock Newsletter Stock

PicksAverage

ReturnExcess

ReturnPercent

ProfitableMax %

Return1. ![]()

Alpha Picks76 63% 40% 73% 969% Summary: 2 picks/month based on Seeking Alpha's Quant Rating; Retail Price is $499/yr. See details in our Alpha Picks Review. July, 2025 Promotion:

Save $502. ![]()

Moby.co308 43.3% 12.3% 74% 1764% Summary: 60-150 stock picks per year, segmented by industry; Retail Price is $199/yr. Read our Moby Review. July, 2025 Promotion:Next pick free! 3. ![]()

Stock Advisor72 41.2% 6.9% 78% 258% Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr.

Read our Motley Fool Review.July, 2025 Promotion: Get $100 Off 4. ![]()

Value Investor39 17.5% 6.1% 38% 410% Summary: 10-25 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. July, 2025 PROMOTION:$1, then $495/yr 5. ![]()

Rule Breakers66 40.0% 4.7% 61% 311% Summary: 2 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. Current Promotion: Save $200 6.

TipRanks SmartInvestor121 10.6% 3.7% 55% 340% Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. Current Promotion: Save $180 7.

Action Alerts Plus394 20.0% 3.4% 57% 220% Summary: 100-150 trades per year, lots of buying and selling and short term trades. Read our Jim Cramer Review. Current Promotion: None 8. ![]()

Stock Advisor Canada36 32.3% 0.5% 69% 378% Summary: 1 pick/month from the Toronto stock exchange; Retail Price is CD$199/yr. Read our Motley Fool Canada Stock Advisor Review. July, 2025 Promotion: Save $100 Top Ranking Stock Newsletters based on their last 3 years of stock picks' performance through May 31, 2025 as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF.