Seeking Alpha and Morningstar are popular sites for investors to research investments, choose stocks and ETFs to buy, and monitor investments in their portfolios.

Other services may have better charting tools, cover more securities, or use AI for trading opportunities, but Seeking Alpha and Morningstar always seem to be in the mix when people talk about the best stock research platforms.

To the untrained eye, Seeking Alpha and Morningstar look like they do a lot of the same things.

Both have a wealth of information and research. Both are well-known and highly regarded. And both provide investors with an array of investment analysis tools.

Since they have so much in common, it may be challenging to compare Seeking Alpha vs Morningstar, but we’re here to simplify the process and help you choose the right research platform for your needs.

In this review, we’ll talk about features, including what’s new, and help you understand which platform is best suited for your investment style. For example, we’ll explain who creates the content, and who can benefit the most from using it: experienced investors who like to do extensive research, or those who want a quick overview.

Will Seeking Alpha or Morningstar give you the biggest bang for your buck? Which offers more value and which will help you max out the returns on your investments?

Let’s compare Seeking Alpha and Morningstar to choose the best tool for your investment portfolio.

Seeking Alpha vs Morningstar: Overview

If you’re someone who likes to research investments before you buy, both Seeking Alpha and Morningstar have something to offer. Here’s our quick overview of each.

Seeking Alpha offers a huge volume of analysis from community members and experts. It bills itself as the world’s largest investment community.

Premium members get access to unlimited community-created content. Not all community content is vetted, but Seeking Alpha’s author ratings make it easy to separate the wheat from the chaff.

It’s easy to do a deep dive on investments with Seeking Alpha. In addition to tons of analysis, there are also research tools such as pre-set and custom screeners, watchlists, investing groups, Portfolio Health Scores (a new feature), and Seeking Alpha’s proprietary Quant ratings, which have an impressive record when compared to the S&P 500. (If you want to do a deep, deep, deep dive into this read our Seeking Alpha Quant Rating Review).

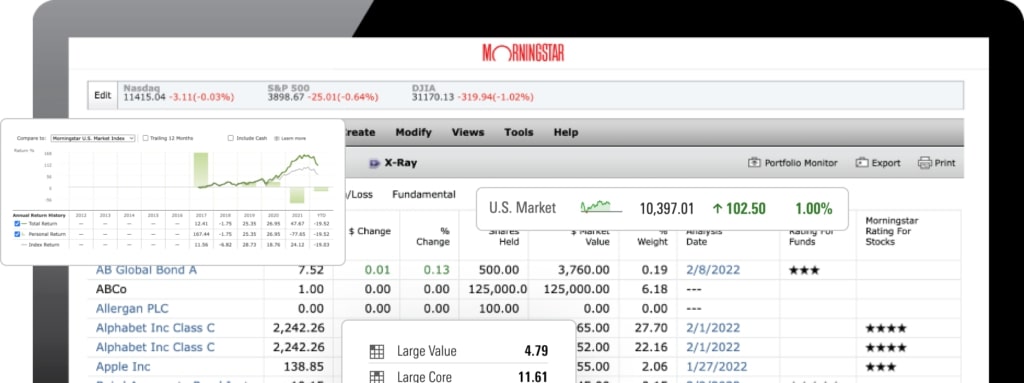

Morningstar offers analysis from a select group of ~150 analysts but lacks the community aspect of Seeking Alpha. It also offers screeners, professional ratings with transparent methodology, portfolio X-ray, and account integration. That last one is something Seeking Alpha lacks.

Seeking Alpha vs Morningstar: How Do They Work?

Part of the evaluation process when choosing an investment research platform is reviewing how each platform works and its core functions. Both Morningstar and Seeking Alpha have a lot to offer, but there are some important differences that may help investors decide which to spend their money on.

Core Functionality Points for Seeking Alpha

We’ll start with Seeking Alpha, which has some unique offerings you won’t be able to find anywhere else.

- Crowdsourced investment insights. Seeking Alpha is, above all, an investment community. Any community member can post analysis and articles for fellow members to read. Community members can rate one another’s content.

- Quant Ratings for detailed stock evaluations. Seeking Alpha’s Quant Ratings are on a scale of 1 to 5, with a 1 being a “Strong Sell” and a 5 being a “Strong Buy.”

- Expert articles and opinions. In addition to community articles, Seeking Alpha offers expert articles and opinions written by vetted Authors.

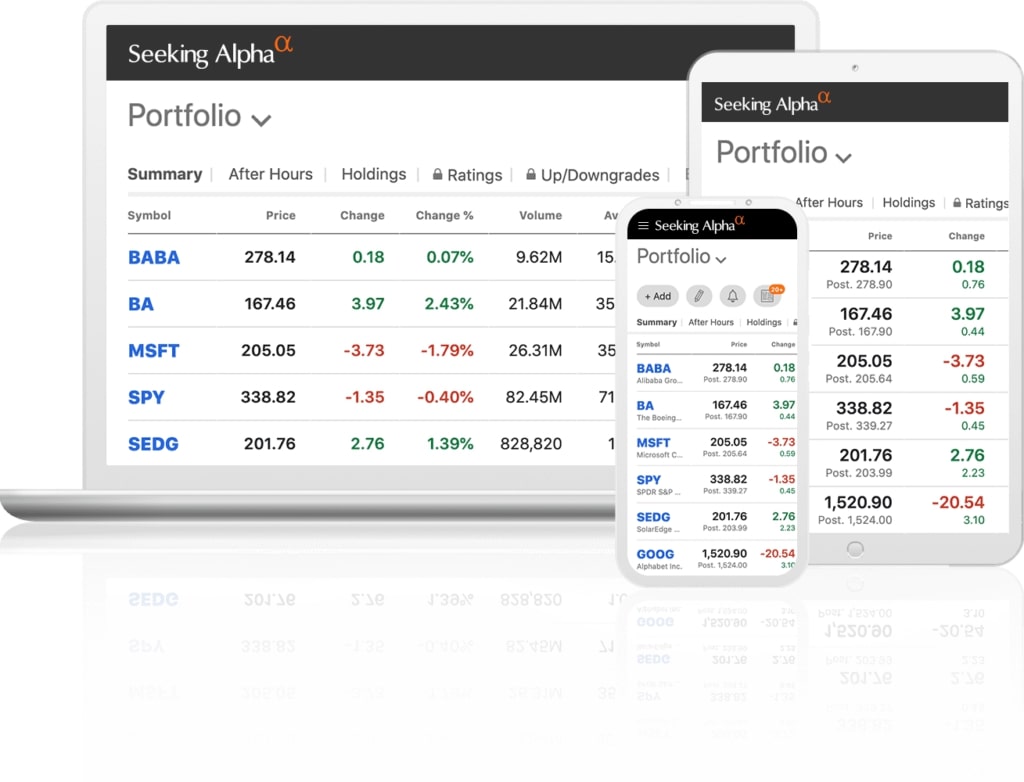

- Personalized stock alerts and watchlists. Any Seeking Alpha subscriber has the option to create a portfolio and set up personalized alerts and watchlists to stay abreast of market developments. (We should note that you can’t link to a portfolio with Seeking Alpha; instead, you’ll create a portfolio to mirror your actual investments.)

- Portfolio management tools including a Portfolio Health Score and the ability to link your portfolio and get instant updates when your stocks Quan Rating changes.

Our take is that Seeking Alpha is ideal for intermediate to advanced investors who want access to as much research as possible to help them make decisions about what to buy and sell.

Core Functionality Points for Morningstar

Morningstar takes a different approach to investment research, with a focus on expert-created content. Here’s what you’ll find if you decide to subscribe.

- Comprehensive financial data. If you’re someone who wants access to financials, stock performance, and more, you can find a lot of the data you need on Morningstar. That includes data on bonds and mutual funds, neither of which are available on Seeking Alpha.

- Analyst ratings and reports. You can get access to tons of analyst ratings and reports on Morningstar, There’s a lot of data and analysis to be found, including articles written by 150+ professionals whose job it is to help subscribers get the information they need about stocks, ETFs, mutual funds, and bonds.

- Portfolio management tools. Morningstar subscribers get access to an array of portfolio management tools, including the Portfolio X-Ray tool, which makes it easy to balance your portfolio and avoid overinvesting in any one stock or sector.

Comparing Morningstar and Seeking Alpha, we’d say that Seeking Alpha’s most unique features are its investment community and Quant ratings, while Morningstar offers research on some investments that Seeking Alpha doesn’t.

Seeking Alpha vs. Morningstar: Key Features

We can’t tell you what investment research features to prioritize.

What we can do is provide you with the key features of both Seeking Alpha and Morningstar, so you can get a handle on what’s available and decide what you want to do.

Key Features for Seeking Alpha

Let’s start with Seeking Alpha. We’ll provide a list of the features of each, then give you a comparison table so you can make an evaluation.

Here are the key features for Seeking Alpha subscribers.

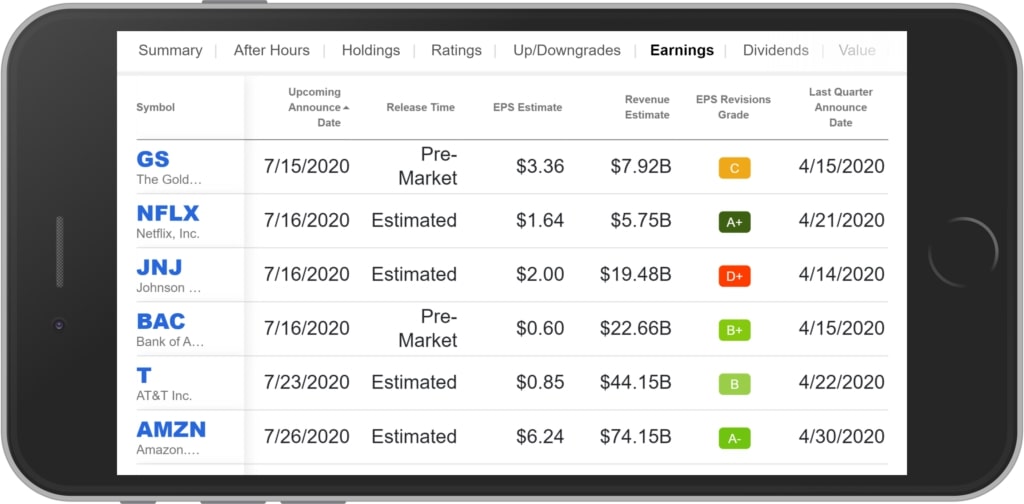

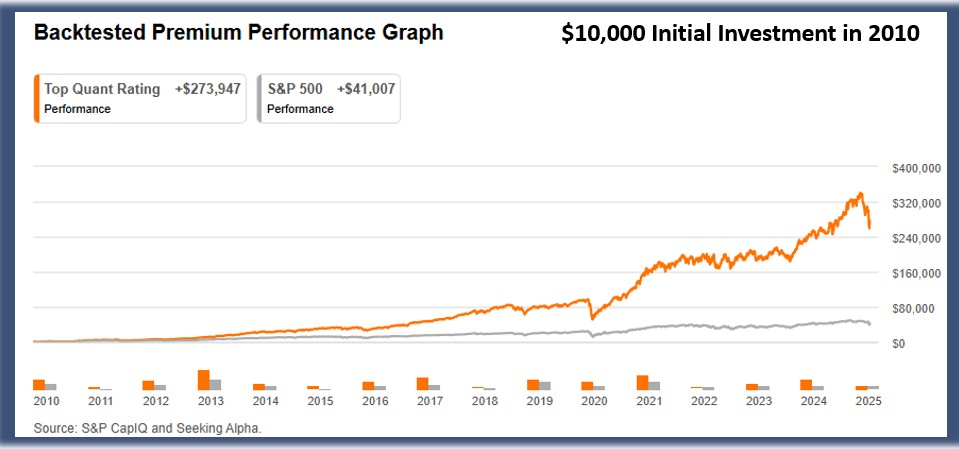

- Quant Ratings are Seeking Alpha’s proprietary ratings, based on an investment’s value, growth, profitability, EPS Revisions, and price momentum. Investments that have received a “Strong Buy” rating have outperformed the S&P 500 by almost 7x.

- Dividend Safety Ratings are an evaluation that lets investors know how dividend stocks have performed over time and how likely they are to deliver earnings in the future.

- Portfolio management tools include ratings & price alerts, a Portfolio Health Grade, stock screeners, and watchlists.

- Access to 10 years of financials and earnings call transcripts provides investors with the option to take a deep dive into a company’s performance.

- Quant rating and price alerts allow subscribers to get notified when an investment’s Quant rating or price changes based on their specifications.

- Customizable watchlists make it easy to keep an eye on investments and act quickly when necessary.

- Personalized article alerts allow users to follow their favorite authors and never miss what they post.

Seeking Alpha offers 2 paid service. Their Premium service allows you access to their Quant Ratings on each stock. Here you see a recent quote of Apple and is Quant Rating.

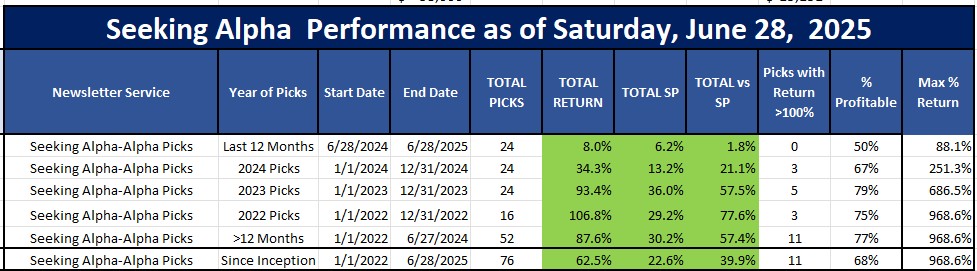

And they also offer a stock recommendation service that gives you their 2 highest rated stocks each month. This service is called Alpha Picks and it has performed phenomenally since its launch in mid 2022.

To compare the differences between the two, read our Seeking Alpha Premium vs Alpha Picks article.

Key Features for Morningstar

Subscribers to Morningstar also get access to a host of useful features. Here are the most important.

- Comprehensive financial data on stocks, ETF, bonds, and mutual funds, including detailed information about performance and earnings.

- Independent analyst ratings and reports, including Morningstar’s proprietary ratings and professional analysis to help subscribers evaluate potential investments.

- Portfolio management tools, including watchlists, alerts, and Portfolio X-Ray.

- Stock and fund screeners to make it easy to find investments.

- Investment planning tools.

Here’s our side-by-side comparison:

| Feature | Seeking Alpha | Morningstar |

| Proprietary Ratings | Y | Y |

| Investment Community | Y | N |

| Expert Analysis | Y | Y |

| Stock Screeners | Y | Y |

| Watchlists | Y | Y |

| Stock and Rating Alerts | Y | Y |

| Investing Groups | Y | N |

| Portfolio Management Tools | Y | Y |

| Professional Analysis | Y | Y |

| Dividend Safety Ratings | Y | N |

Seeking Alpha vs. Morningstar: Pricing and Subscription Plans

Seeking Alpha has four subscription tiers, as follows.

- Free plan: Limited features allow users to create a portfolio, set up alerts, check real-time stock prices, get access to some community articles, and read one Premium article per month.

- Premium plan: Get access to Quant ratings, all community-created and most expert-created content, screeners, watchlists, investment groups, rankings of top stocks and ETFs, and Portfolio Health Score. There’s a one-week free trial. After that, the annual subscription for first-timers is $299.

- Pro plan: Get access to everything in the Premium plan plus top analyst insights, top stock rankings, VIP customer service, short ideas, and upgrades & downgrades. There’s a $99 one-month trial, after that the annual cost is $2,400.

- Alpha Picks: This is their stock recommendation service where you get 2 picks a month and they charge $499 a year for this service, but as you saw above it is really worth it.

Act Today; Offer Ends July 4th

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They just launched their biggest discount of the year on June 11th that runs for a limited time.

Here's you chance to save 20% AND get their Top Stocks for the 2nd Half of 2025 report.

- Save $60 on Seeking Alpha Premium; usually

$299now only $239/year — Learn more.- Save $100 on Alpha Picks; usually

$499now only $399/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

Now let’s look at Morningstar. It comes with a free trial, and the cost is $249 if you pay annually, which represents a 41% savings over the monthly cost of $34.95.

Morningstar doesn’t have a free plan. You can get full access to premium features with the free trial, which lasts for 7 days.

Seeking Alpha vs. Morningstar: User Experience

Morningstar and Seeking Alpha offer different things when it comes to the user experience. We’ve seen some investment research sites that are overly cluttered and difficult to navigate.

Let’s start with Seeking Alpha, which has a nice, clean interface that’s simple to navigate. The overall rating given by Trustpilot users is 4 out of 5 stars, and many mention that the site is easy to navigate. There are some issues with the lack of vetting of community-created content. We think it’s important to note that Seeking Alpha does vet any community content it chooses to highlight, and all Authors and author content is vetted.

Trustpilot reviewers weren’t as kind to Morningstar, awarding only 1.6 out of 5 stars. Some users complained that after years, they still didn’t feel confident navigating the site. Others mentioned slow or unhelpful customer service.

Seeking Alpha vs. Morningstar: Pros and Cons

Here are some pros and cons of each service, starting with Seeking Alpha.

- PRO: Extensive financials and analysis, including over 1 million community “ideas” and 10 years of financials

- PRO: Pre-set and custom screeners

- PRO: Pre-set and custom watchlists

- PRO: Quant ratings have consistently outperformed the S&P 500

- PRO: Excellent choice for expert investors who want access to the most data

- CON: Past performance of “Strong Buy” stocks isn’t a guarantee of future performance

- CON: Can’t link to actual portfolio

Now for Morningstar:

- PRO: Expert analysis on stocks, ETFs, bonds, and mutual funds

- PRO: A decent selection of screeners and graphics to help investors evaluate before they buy or sell

- CON: The interface leaves something to be desired

- CON: Customer service could be better

Overall, we think the Pros of Seeking Alpha make it the superior choice. Even investors who don’t want to do a deep research dive can find value in the Quant Ratings, Portfolio Health Grade, Screeners, Watchlists, and other features.

Seeking Alpha vs. Morningstar: Conclusion

While Seeking Alpha and Morningstar have a lot in common, there are some differences that make it possible for investors to choose between the two. Morningstar is slightly less expensive, but it offers fewer features. While Morningstar is a respected company, there are quite a few complaints about the interface and customer service.

Overall, we believe that Seeking Alpha Premium and their Alpha Picks services are the best choice for most investors. While beginners may have to work through a bit of a learning curve, the Quant ratings alone may make the cost of a subscription worthwhile.

Get a $30 discount on Seeking Alpha!

Act Today; Offer Ends July 4th

Seeking Alpha has become so successful in the last few years that they rarely discount their services, so when you see a sale you should take advantage of it. They just launched their biggest discount of the year on June 11th that runs for a limited time.

Here's you chance to save 20% AND get their Top Stocks for the 2nd Half of 2025 report.

- Save $60 on Seeking Alpha Premium; usually

$299now only $239/year — Learn more.- Save $100 on Alpha Picks; usually

$499now only $399/year — Learn more.- Save $160 on their Bundle to get both; usually

$798only $638/year — Learn more.

FAQs

Which is better, Seeking Alpha or Morningstar?

We think Seeking Alpha offers the better value for the money, with more extensive research, an investment community, investing groups, and widely respected Quant Ratings with a proven track record of beating the S&P 500.

Is it worth paying for Seeking Alpha?

We think it is. The free version offers an extremely limited set of features, but with the Premium plan, you’ll get access to everything you need to research investments and make smart choices. Plus, the free trial gives you a full 7 days to try out Seeking Alpha’s Premium features before you commit to the annual subscription.

Does Seeking Alpha outperform the market?

Historically, the answer is yes. Stocks with a “Strong Buy” Quant rating (anything over 4.5) have outperformed the S&P 500 by more than 400% over the past 14 years. Keep in mind that past performance isn’t a promise of future results.

Their Seeking Alpha Picks service is also crushing the market. See our Alpha Picks Review.

Do people make money on Seeking Alpha?

No investment research platform can promise results, but people who focus on buying Seeking Alpha’s “Strong Buy” picks consistently have done very well.

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. ✅ U.S. stocks, ETFs, options, and cryptos $3 monthly sub 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

$0

✅ Now 23,000,000 users

✅ Cash management account and credit cardFree stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes for advanced traders

✅ Access to U.S. and Hong Kong markets

✅ Learning tools built in60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for different experience levels

✅ SmartRouting™ and deep analytics for executionRefer a Friend and Get $200

Interactive Brokers Review

4.

M1 Finance

✅ Automated investing “Pies” with fractional shares

✅ Integrated banking & low-interest borrowing

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

5.

Webull

$0

✅ Extended-hours trading premarket and after-hours

✅ Built-in technical charts, screeners, and indicators

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

6.

Public

$0

✅ Fractional shares of U.S. stocks and ETFs

✅ No payment for order flow (PFOF) model

✅ “Alpha” tool with earnings calls and sentiment data$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

7.

Composer

$32 a month

✅ Invest in fully automated stock strategies

✅ Build custom strategies with our no-code builder

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

8.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools for beginners

✅ Curated theme portfolios for retail investors$5 when you invest $5

Stash Review

9.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Retirement Accounts

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

10.

Etoro

$0

✅ CopyTrading™ feature to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto in one app

✅ Commission-free trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

11.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data; Morningstar

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.