If you’re looking for a new place to get investment research, Seeking Alpha and Moby are two of the best.

Though they may seem like similar services on the surface, they’re two totally different products with different ways of bringing you investment advice.

By the end of this article, one should stand out to you as the clearly better option for you based on what type of investor you are and what type of service you’re looking for.

Summary Comparison: Seeking Alpha vs Moby

| Seeking Alpha Premium | Seeking Alpha Alpha Picks | Moby Premium | |

| Overall rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service type | Investment research | Stock picking | Stock picking and investment research |

| Best for | Intermediate investors | Momentum-based, hands-off investing | Emerging market research & stock strategy |

| Cost | $299/year | $499/year | $199/year |

| Special offer | February Sale: Save $30 & Get 7-day Free Trial | Save $50 | Get 1 FREE Pick or 50% off first year, try it for $99 |

Seeking Alpha has 2 paid products whereas Moby is an all-in-one subscription. I break down all 3 of these products in more detail and how they compare to one another in the rest of the article.

About Seeking Alpha

David Jackson, a former analyst at Morgan Stanley, founded Seeking Alpha in 2004.

Jackson began by writing articles providing analysis on technology stocks and launched Seeking Alpha as a platform to share his ideas. After quickly amassing an audience, he realized how badly individual investors wanted high-quality stock research. A business model formed in his head.

As an analyst at Morgan Stanley, his and his coworkers’ analysis was distributed internally and to Morgan Stanley’s clients. What if he launched a platform that did the same thing but for retail investors?

Seeking Alpha was born.

Now, almost 20 years later, Seeking Alpha is one of the most popular investment research platforms in the world. It is used by more than 10 million people each month.

At the heart of the platform are its contributors. To date, more than 18,000 have become contributors and published analysis on Seeking Alpha. In 2022, these contributors published 55,000 articles and covered 10,000 tickers and investment ideas.

Over the years, Seeking Alpha has added a variety of features including financial history, charting, and a number of proprietary ratings tools like Factor Grades, Dividend Ratings, and Author Ratings.

More recently, Seeking Alpha launched Quant Ratings which grades stocks on a variety of quantitative measures. This is quickly becoming one of its most popular features and now serves as the cornerstone of Alpha Picks, its newly launched stock picking newsletter.

While you can have a basic account to Seeking Alpha and read a few articles per month for free, you’ll quickly bump into a paywall to unlock unlimited access to its best features. I cover both of its premium service offerings in the sections below.

Seeking Alpha Premium

A subscription to Seeking Alpha Premium will get you 3 things:

- Unlimited access to all of Seeking Alpha’s analysis, news, research reports, stock screeners, financial data, charting, and more

- Seeking Alpha’s proprietary ratings tools like Ratings Summary, Factor Grades, Dividend Grades, Author Ratings, and more

- Quant Ratings

When logging in to Seeking Alpha, you can start either on its home page or by looking up a specific stock. If you search for a stock with a free account, your quote will look like this:

As a free user, you will be limited to the number of reports you can read in a month and you will not be able to access the Quant Ranking section (other than seeing the summary view as pictured).

If you’re a Premium member, the same quote will look like this:

What’s also included in this view is the Ratings Summary (aggregated contributor ratings, Wall Street analyst ratings, and the stock’s Quant rating), the stock’s current Factor Grades (which scores each stock based on valuation, growth, profitability, momentum, and EPS revisions) and more.

As mentioned above, Seeking Alpha’s Quant Rating model is quickly becoming one of users’ favorite features. When backtested since 2010, its “Strong Buy” recommendations have crushed the S&P:

The algorithm sorts stocks by the strongest collective value, growth, profitability, EPS revisions, and momentum metrics relative to the stock’s sector. These attributes are then assigned grades and are weighted based on their predictive value.

Not only have Strong Buy stocks wildly outperformed, the model’s Strong Sell stocks have underperformed by a wide margin:

That means you can use this model to 1) find stocks likely to outperform and 2) avoid stocks likely to underperform.

For even more information on Seeking Alpha, check out our other Seeking Alpha Premium review!

Seeking Alpha’s Alpha Picks

If everything included in Seeking Alpha Premium sounds overwhelming, you’re not alone.

In fact, due to the overwhelming number of requests Seeking Alpha received for aggregating everything on their platform into a more streamlined, actionable solution, the company launched Alpha Picks.

Alpha Picks is a stock picking newsletter service which delivers members 2 new stock picks each month. The investment team leans heavily on quantitative analysis and uses the company’s Quant Ratings and other algorithms to find stocks most likely to outperform.

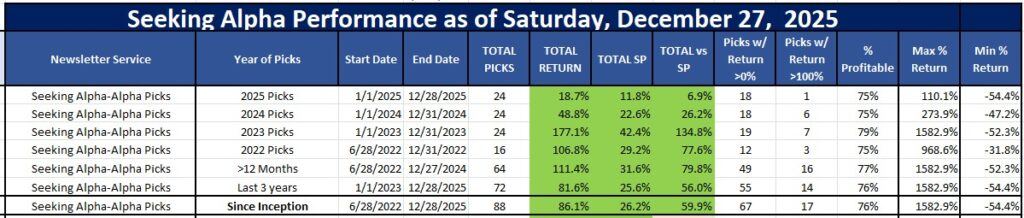

So far, the team has done just that:

Here's a summary of the performance of all of their picks as of December 27, 2025 so you can see how their picks performed at calendar year-end.

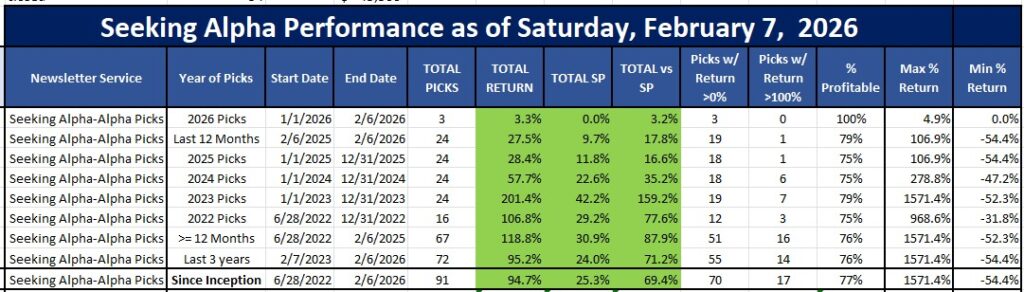

And here's a little teaser of their performance so far as of February 7, 2026 to give you an idea if it is worth it. My analysis is pretty convincing as these returns prove it has definitely been providing huge gains over the S&P since its launch.

Compared to Seeking Alpha Premium, Alpha Picks is much more hands-off and, if you believe in their stock picking system, a much easier way to benefit from the scores of investment research on its main site. To compare the two, read our Seeking Alpha Picks vs Premium article.

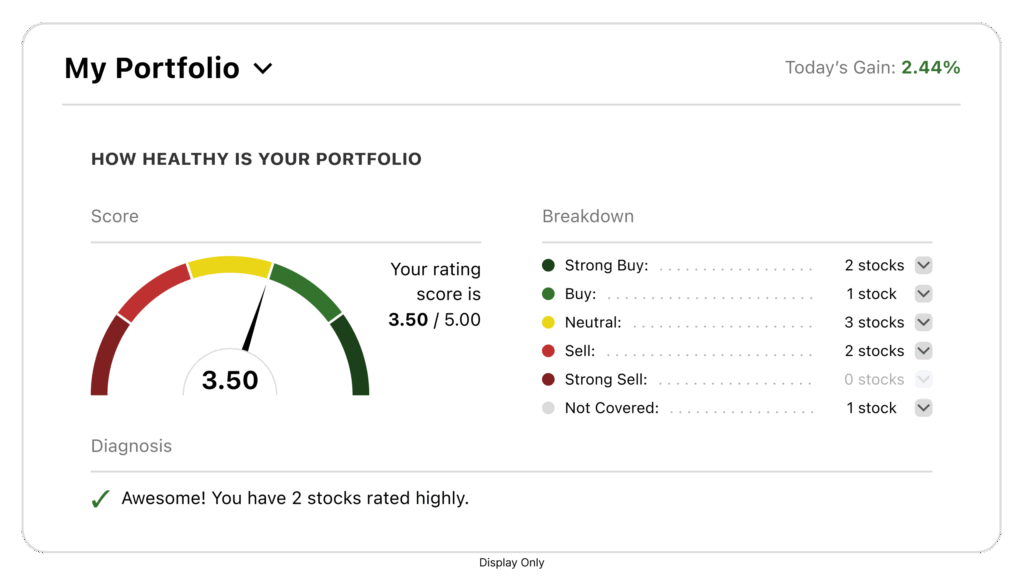

Imagine if you could plug your entire portfolio into a data-driven tool that flags buys and warns you when to sell.

One of Seeking Alpha's most powerful features is their Quant Rating on each stock. This system grades every stock daily using over 100 fundamental and technical metrics. Since 2017, the “Strong Buy” stocks have consistently outperformed both Wall Street analysts and the overall market. Just look at 2024: Quant Strong Buys gained 37.15%, compared to just 12.75% for the S&P 500:

The Quant Rating is an incredible stock screener on its own, but the real game-changer is pairing it with the My Portfolio tool.

Using Seeking Alpha Premium, I connect my brokerage accounts and track Quant Ratings across my entire portfolio in one simple dashboard. That means I get instant alerts when any of my holdings drop to a “Sell” or “Strong Sell.” I personally use it to know when it’s time to take profits—or tighten stop-losses—before a stock turns into dead weight.

It looks like this:

The combination of proven outperforming stock picks and personalized portfolio monitoring is why so many investors swear by Seeking Alpha Premium.

Stop guessing and start tracking: If you want to try this strategy for yourself, check out Seeking Alpha Premium and Quant Ratings!

About Moby

Founded in 2021, Moby is an investment research platform that is now being used by more than 5 million stock and cryptocurrency investors worldwide.

Like Seeking Alpha, Moby provides investment research, market news, stock picks, economic updates, and more. However, unlike Seeking Alpha which crowdsources all of its research from thousands of contributors all over the world, Moby is driven by a team of in-house experts.

Moby sourced these experts from 2 places. They assembled their team of analysts from well-known financial institutions like Morgan Stanley and Goldman Sachs and put together a group of journalists from financial media companies. Together, this group produces high-quality investment analysis in a jargon-free writing style.

While Seeking Alpha primarily targets intermediate-and-above investors, Moby is much easier for new investors or those who aren’t spending all of their free time poring over complex financial statements.

Whereas Seeking Alpha is primarily website-based, Moby houses everything in an easy-to-use app.

Moby Premium

Moby combines both investment research and stock picking into its subscription.

Moby’s team provides 3 stock recommendations per week (as opposed to 2 per month with Alpha Picks), and each new pick comes with a summary report on why it’s being recommended. Each of these reports is also recorded in audio format, so you can listen to it on your commute to work.

Its team of analysts use both qualitative and quantitative analysis to identify new stocks. To help filter potential stocks, the company uses machine learning and a series of algorithms. This system has uncovered a long list of winners, including 75 stocks which have returned more than 100%.

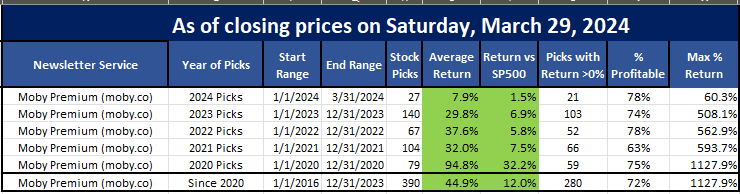

I’ve personally taken a deep dive across all of Moby’s stock pick, assessing each one individually so I would be able to come up with a summary of the last 4 years of their picks, as of March 29, 2024 prices :

That is quite impressive that:

- EVERY year their picks are beating the market,

- that the average beat is 12% over the last 4 years over 390 picks,

- and that 72% of their picks are profitable.

Moby is currently offering 50% off for new subscribers.

Click on the WallStreetSurvivor Exclusive offer on this page & & get 1 year for only $99.

Remember: They have 30 day money back guarantee (so you can test it out for free basically).

A few of its former picks are:

- Tesla, up 560+% since 2020

- Nvidia, up 460+% since 2020

- Meta, up 199% since 2022

- Elf Beauty, up 400+% since 2022

These aren’t the only stocks that have outperformed. The average Moby Premium stock pick has returned 250%.

In addition to its stock picks, Moby also comes with other features like:

- Model Portfolios: Start investing right away with Moby’s 4 Model Portfolios. The 4 portfolios are Flagship (which invests in undervalued technology companies), Dividend, Offshore (which invests in growth businesses in emerging markets), and ESG (which invests in companies with environmental initiatives).

- Political Trades: Politicians are aware of non-public information which can materially move markets. If one or more of them are selling your favorite stock, it’s good to be aware of it.

- Asset Lookup: Quickly check a stock’s price chart and any analysis the Moby team has compiled on it.

- Economic Calendar: Keep tabs on past and upcoming economic events.

- Crypto Screener: Filter and sort by more than 480 cryptocurrencies.

- Educational Resources: Fast-track your investing acumen with Moby’s investment course and other educational materials.

While all of this may seem overwhelming, it’s pretty easy to stay on top of everything new the Moby team posts once you familiarize yourself with the app and do the initial legwork.

Moby is currently offering 50% off for new subscribers.

Click on the WallStreetSurvivor Exclusive offer on this page & & get 1 year for only $99.

Remember: They have 30 day money back guarantee (so you can test it out for free basically).

Similarities & Differences: Moby vs Seeking Alpha

1. Service Type / Number of Products

Both Seeking Alpha and Moby are investment research platforms which help individual investors make more informed decisions. Both companies also have done-for-you stock picking services.

Seeking Alpha divides these 2 services into 2 products, Premium and Alpha Picks, whereas Moby provides everything in an all-in-one subscription which you can access from its app.

The investment research, stock recommendations, and all analysis provided is unique to each platform.

Learn why we have a breakdown comparison of why Motley Fool vs. Moby might be two of the best stock picking services in the market today.

2. Years in Business

Seeking Alpha was founded in 2004 while Moby was launched in 2021.

Seeking Alpha is used by more than 10 million investors each month while Moby has been used by 5 million.

3. Source of Analysis

Another primary difference between Moby and Seeking Alpha is where the two companies source their investment analysis.

Seeking Alpha crowdsources all of its research from thousands of professional and retail investors all over the world. This system allows it to publish countless articles with varied opinions each month.

On the flip side, Moby has its own in-house team of analysts that publishes all of the content and investment recommendations.

Seeking Alpha follows a similar format for its Alpha Picks service – all stock recommendations are made by the Alpha Picks team.

4. Pricing

Seeking Alpha has 2 products. Seeking Alpha Premium is $299/year (Save $30 through our link) and Alpha Picks is $$499/year ($449 through our link).

Moby combines its investment research and stock recommendations in one subscription which costs $199/year, only ($99 through our link).

Summary: Moby vs Seeking Alpha

As I stated in the intro, while the two platforms have the same objective (bring you high-quality investment research), they do it in two unique ways. Hopefully it’s clear by now which one is better for you.

If you’re a more advanced, hands-on investor and want to do your own research, Seeking Alpha Premium is probably for you.

If you’re a hands-off investor and are interested in Seeking Alpha’s Quant Ratings and momentum-based stock picking, then Alpha picks might be worth it for you.

If you’d rather outsource your investing and research to a team of ex-Wall Street analysts, sign up for Moby Premium.

| Seeking Alpha Premium | Seeking Alpha Alpha Picks | Moby Premium | |

| Overall rating | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ |

| Service type | Investment research | Stock picking | Stock picking and investment research |

| Best for | Intermediate investors | Momentum-based, hands-off investing | Emerging market research & stock strategy |

| Cost | $299/year | $499/year | $199/year |

| Special offer | February Sale: Save $30 & Get 7-day Free Trial | Save $50 | Get 1 FREE Pick or 50% off first year, try it for $99 |

As you can tell, the 2 Seeking Alpha products and Moby Premium have excellent historical track records and should help you beat the market over the long run. Given their 30 day money back guarantees, you can’t go wrong just trying them both.

Ranking of Top Stock Newsletters Based on Last 3 Years of Stock Picks as of December 27, 2025

We are paid subscribers to dozens of stock and option newsletters. We actively track every recommendation from all of these services, calculate performance, and share our results of the top performing stock newsletters whose subscriptions fees are under $500. The main metric to look for is "Return vs S&P500" which is their return above that of the S&P500. So, based on December 27, 2025 prices:

Best Stock Newsletters Last 3 Years' Performance

| Rank | Stock Newsletter | Picks Return | Return vs S&P500 | Picks w Profit | Max % Return | Current Promotion |

|---|---|---|---|---|---|---|

| 1. |  Alpha Picks | 82% | 56% | 76% | 1,583% | February SALE: SAVE $50 NOW |

| Summary: 2 picks per month based on Seeking Alpha's Quant Rating; consistently beating the market every year since launch; tells you when to sell and they have sold almost half. See complete details in our full Alpha Picks review. Or get their Premium service to get their QUANT RATINGS on your stocks to better manage your current portfolio--read our Is Seeking Alpha Worth It? article to learn more about their Quant Ratings. | ||||||

| 2. |  Zacks Value Investor | 60% | 40% | 54% | 692% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services including those below. Read our Zacks Review. | ||||||

| 3. |  Moby.co | 50% | 16% | 74% | 2,569% | February Promotion: Next pick free! |

| Summary: 60-150 stock picks per year, segmented by industry; consistently beating the market every year; retail price is $199/yr. Read our full Moby Review. | ||||||

| 4. |  Zacks Top 10 | 36% | 15% | 71% | 170% | February Promotion: $1, then $495/yr |

| Summary: 10 stock picks per year on January 1st based on Zacks' Quant Rating; Retail Price is $495/yr and includes 6 different services. Read our Zacks Review. | ||||||

| 5. |  TipRanks SmartInvestor | 20% | 9% | 62% | 464% | Current Promotion: Save $180 |

| Summary: About 1 pick/week focusing on short term trades; Lifetime average return of 355% vs S&P500's 149% since 2015. Retail Price is $379/yr. Read our TipRanks Review. | ||||||

| 6. |  Action Alerts Plus | 27% | 5% | 66% | 208% | Current Promotion: None |

| Summary: 100-150 trades per year, lots of buying and selling and short-term trades. Read our Jim Cramer Review. | ||||||

| 7. |  Zacks Home Run Investor | 5% | -0.4% | 45% | 241% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 8. | Dogs of the Dow Strategy | 16% | -1.8% | 43% | 44% | Current Promotion: None |

| Summary: Buy the 10 highest yielding dividends stocks in the Dow Jones Industrial Average on January 1st and sell on Dec 31st each year. | ||||||

| 9. | IBD Leaderboard ETF | 11.4% | -1.8% | n/a | n/a | February Promotion: NONE |

| Summary: Maintains top 50 stocks to invest in based on IBD algorithm; Retail Price is $495/yr. Read our Investors Business Daily Review. | ||||||

| 10. |  Stock Advisor | 34% | -3.9% | 75% | 289% | February Promotion: Get $100 Off |

| Summary: 2 picks/month and 2 Best Buy Stocks lists focusing on high growth potential stocks over 5 years; Retail Price is $199/yr. Read our Motley Fool Review. | ||||||

| 11. |  Zacks Under $10 | -0.2% | -4% | -4.3 | 263% | February Promotion: $1, then $495/yr |

| Summary: 40-50 stock picks per year based on Zacks' Quant Rating; Retail Price is $495/yr. Read our Zacks Review. | ||||||

| 12. |  Rule Breakers | 34% | -5.1% | 69% | 320% | Current Promotion: Save $200 |

| Summary: Rule Breakers is included with the Fool's Epic Service. Get 5 picks/month focusing on disruptive technology and business models; Lifetime average return of 355% vs S&P500's 149% since 2005; Now part of Motley Fool Epic. Read our Motley Fool Epic Review. | ||||||

| Top Ranking Stock Newsletters based on their last 3 years of stock picks covering 2025, 2024, and 2023 performance as compared to S&P500. S&P500's return is based on average return of S&P500 from date each stock pick is released. NOTE: To get these results you must buy equal dollar amounts of each pick on the date the stock pick is released. Investor Business Daily Top 50 based on performance of FFTY ETF. Performance as of December 27, 2025. | ||||||