ALERT: Are you a U.S. citizen? If not, then you will unfortunately not be able to sign up for a Robinhood account. CLICK HERE TO LEARN ABOUT OUR #1 RECOMMENDED BROKER FOR NON-U.S. CUSTOMERS!

Robinhood Cash Management Review

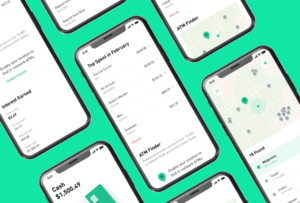

Robinhood Cash Management is a feature available to existing Robinhood brokerage account holders that allows them to earn interest on their uninvested cash while gaining access to a Robinhood debit card. Let’s get into how Robinhood Cash Management works and why it matters!

Looking for our review of the Robinhood app? Check it out here.

What is Robinhood Cash Management?

The Robinhood Cash Management feature acts as a sort of hybrid between a savings account and a checking account. It’s similar to a savings account in that it provides a decently high APY (higher than the national average), and it’s similar to a checking account in that you receive a debit card you can use for purchases and to withdraw cash at over 75,000 ATMs worldwide.

When you sign up for a Robinhood Cash Management account, you agree to let Robinhood take your uninvested money (the “cash” balance in your brokerage account) and deposit it in one of their program banks. You will receive interest on your cash at a rate similar to what a high-yield savings account would pay. As of August 2022, the APY is 1.5%, which is more than 1% over the national average. (APY, which stands for annual percentage yield, is a measure of interest that takes into account the effects of compound interest.)

In addition to earning interest on your uninvested cash, you will receive a debit card that you can use for purchases and to withdraw cash from ATMs. This is where the Cash Management account is a mix between both a savings account and a checking account; it’s not often that you can achieve such a high APY while also having such quick access to your money.

Where Does My Cash Go?

Here are Robinhood’s current partner banks:

- Goldman Sachs Bank USA

- HSBC Bank USA, N.A.

- Wells Fargo Bank, N.A.

- Citibank, N.A.

- Bank of Baroda

- U.S. Bank, N.A.

- Amerant Bank, N.A.

Who is Robinhood Cash Management For?

Robinhood Cash Management has some specific features that can make it ideal or less than ideal for certain Robinhood customers. At a basic level, Cash Management can be great for users who want a paperless experience that includes a good APY, as well as users who travel internationally and want to avoid foreign transaction fees. If this sounds like you, but you don’t already have a Robinhood account, sign up here for FREE stock worth up to $200, PLUS earn up to $1500 per year in free stock by referring friends!

Customer Service:

Email at support@robinhood.com

ROBINHOOD SUMMARY

What You Get:

- Professional Brokerage for Trading Stocks and Crypto

- Market Research and Stock News

- Cash Management Program for Uninvested Cash

The Robinhood Appeal:

- Industry-Leading App and Desktop Platform

- Led the Push Towards Commission-Free Investing

Robinhood Pricing:

- Robinhood is completely commission-FREE

- Cash Management program is also free to use

Robinhood Cash Management may not be desirable for customers who want an in-person experience at brick-and-mortar financial branches, need to deposit cash or physical paychecks, or need to execute wire transfers. Now, let’s dive deeper into these pros and cons.

Firstly, the Robinhood Cash Management account is paperless and completely digital. Existing Robinhood users know that the brokerage does not have any physical branches; all investing is done through the mobile app as well as the company’s website. This is also true for Robinhood Cash Management – Robinhood is not a bank and there are no physical locations you can go to in order to do your banking in person. Instead, you can handle all transactions digitally. The only time you would need to do anything in person would be when you want to withdraw cash from an ATM at a partner bank.

Additionally, there is no way to deposit cash or to cash a physical paycheck; all deposits must be done digitally through direct deposit or transferred from another bank. The virtual nature of Robinhood Cash Management can be great for those who are technologically savvy and want to keep their banking experience in the palm of their hand. This may come as a con, however, to those customers who want the ability to deposit cash into their accounts or deposit physical paychecks.

You can use the Robinhood Cash Management debit card to withdraw cash at over 75,000 ATMs around the world right from your brokerage account. When you use the card at one of these in-network ATMs, you will not be charged any ATM fees.

If you choose to withdraw cash at an out-of-network ATM, Robinhood will not charge you any ATM fees, but you might be charged by the bank that owns the ATM. Robinhood will not reimburse you for these fees, so make sure to stay in-network when withdrawing cash.

There are no foreign transaction fees for purchases made abroad using the Robinhood debit card. There is also no account minimum, no monthly fees, and no maintenance fees, regardless of your account balance.

In all, the Robinhood Cash Management account does not charge you any fees and lets you use your debit card at home and abroad while withdrawing cash from both U.S. and foreign ATMs.

If you try to overdraw your cash management account, Robinhood will simply reject the transaction. To overdraw your account means to make a purchase that leaves your account with a negative balance.

Many banks will charge you an overdraft fee for overdrawing your account and demand that you return to a positive balance immediately. Instead of letting customers overdraw their accounts, Robinhood will deny any transaction that would result in a negative balance.

This may be a positive thing for users who want the security of knowing that they will never be charged an overdraft fee. But for users who want the ability to overdraw their accounts when necessary, the overdraft protection may be an issue.

Is My Money Insured?

Yes! All of Robinhood’s partner banks are FDIC-insured. The Federal Deposit Insurance Corporation is a government agency that insures your bank deposits up to $250,000 per bank.

Keep in mind that your $250,000 limit per bank includes the amount that robinhood has swept for you, so you might want to keep track of the amount you have in each bank. The limit for the amount of Robinhood Cash Management money that will be insured through the FDIC is $1.25 milion.

Robinhood is also a member of the Securities Investor Protection Corporation, which protects the securities and uninvested cash that investors have in their brokerage accounts. If Robinhood were to go bankrupt, the securities and cash you have in your account would be protected up to $500,000.

How Robinhood Makes Money through Robinhood Cash Management

When Robinhood issues debit cards to its users, it receives an interchange fee from Sutton Bank, the bank that provides the card for the cash management account. The company also receives fees from its partner banks in exchange for sweeping funds to them.

In other words, Robinhood makes money from the bank that issues its debit cards and the banks to which it sends your uninvested cash. Neither of these funds come out of your pocket, so you can rest assured that Robinhood is not charging you for using the Robinhood Cash Management feature.

If you want to learn about the fees Robinhood charges for its other services, check out our article here.

Before You Sign Up

Some users might be uncomfortable working with Robinhood after the controversy that occurred with their platform in early 2021.

On January 28, the company decided to freeze all buying on certain stocks such as GameStop and AMC, effectively preventing its clients from buying into these companies. While some supported this move and saw it as an effort to prevent inexperienced investors from losing money on inflated stocks, others criticized it as an elitist play that aimed to prevent institutional investors from losing money on their short sales.

Additionally, the SEC charged Robinhood with misleading their customers about their trade execution practices in 2020. It may be worth reading up on these stories before making a decision.

Final Thoughts

While Robinhood Cash Management may not be for everyone, it can be the ideal feature for customers who already have a brokerage account through the company and want to earn higher-than-average interest on their uninvested cash while being able to spend money directly from their Robinhood accounts. If you don’t mind going digital for your banking and you like having your money accessible from one app, then Robinhood Cash Management is for you!

If you want to learn more about Robinhood, you can read our Robinhood vs eTrade review or read the answer to the question: how does Robinhood make money?

Or if you want to look into another program for cash management, read our Cash App Cash Card review.

We are experienced users of dozens of stock trading platforms. We stay up to date on these platforms' service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for U.S.-based investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers. ✅ U.S. stocks, ETFs, options, and cryptos $3 monthly sub 10k in assets Growth $3; + $9 Month Bronze $3; Silver $6; Gold $12 a monthThe Best U.S. Brokerages as of June 30, 2025

Ranking of Top U.S. Stock Brokerages Based on Fees, Features, and Sign-Up Bonuses

Rank

Brokerage

Fees

Features

Sign-Up Bonus

Read Our Review

1.

$0

✅ Now 23,000,000 users

✅ Cash management account and credit cardFree stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Robinhood Review

2.

Moomoo

$0

✅ Free Level 2 Nasdaq quotes for advanced traders

✅ Access to U.S. and Hong Kong markets

✅ Learning tools built in60 free stocks with $5k deposit; or 25 free stocks with $2k deposit

Moomoo Review

3.

Interactive Brokers

$0

✅ Access 150+ global stock exchanges

✅ IBKR Lite & Pro tiers for different experience levels

✅ SmartRouting™ and deep analytics for executionRefer a Friend and Get $200

Interactive Brokers Review

4.

M1 Finance

✅ Automated investing “Pies” with fractional shares

✅ Integrated banking & low-interest borrowing

✅ No trading fees with scheduled trades$75-$500 Tiered Sign-up bonus

M1 Finance Review

5.

Webull

$0

✅ Extended-hours trading premarket and after-hours

✅ Built-in technical charts, screeners, and indicators

✅ Commission-free options trading$10 and a 30-day complimentary subscription to Webull premium;

$200-$30,0000 Tiered Sign up bonusWebull Review

6.

Public

$0

✅ Fractional shares of U.S. stocks and ETFs

✅ No payment for order flow (PFOF) model

✅ “Alpha” tool with earnings calls and sentiment data$100-$10,000 Tiered Cash Account Transfer Bonus

Public Review

7.

Composer

$32 a month

✅ Invest in fully automated stock strategies

✅ Build custom strategies with our no-code builder

✅ IRAs$49 per successful referral with no limit on the number of referrals

Composer Review

8.

Stash

✅ Stock-Back® debit card rewards in fractional shares

✅ Auto-invest and budgeting tools for beginners

✅ Curated theme portfolios for retail investors$5 when you invest $5

Stash Review

9.

Acorns

✅ Automated investing portfolios

✅ ESG curated portfolios

✅ Retirement Accounts

✅ Acorns Early Invest for Kids' AccountsGet a $20 bonus when you start saving & investing

Acorns Review

10.

Etoro

$0

✅ CopyTrading™ feature to follow top traders

✅ Trade U.S. stocks, ETFs, and crypto in one app

✅ Commission-free trades with themed portfolios$10 Crypto Sign-Up Bonus

Etoro Review

11.

Robinhood Gold

$5

✅ 4% APY on cash

✅ 3% IRA match

✅ Level II data; Morningstar

✅ No interest on first $1,000 of margin Save with Annual Fee

Robinhood Gold Review

12.

Cash App

$0

✅ U.S. stocks and bitcoin; $1 minimum

✅ Peer-to-peer payments

✅ Beginner-friendly financial ecosystemUp to $200 in free overdraft coverage and earn 4% on cash

Cash App Review

Fees, features, sign-up bonuses, and referral bonuses are accurate as of May 31, 2025. All information listed above is subject to change.