Eventually we’ll all be authorizing purchases by submitting to retina scans or letting the clerk at Kroger scan the chip Elon Musk wants to implant in all our heads.

It’ll be a beautiful world where even using your Google Pay to buy stuff will get the same reaction that seeing an old woman write a paper check does today.

But we aren’t there yet.

As much as we’d all like to transition away from cash and cards, neither the technology nor the economy are ready for all that.

We still need to get cash to pay for stuff without leaving a paper trail, many stores don’t have the equipment to accept smartphone payments, and we still need debit cards in case our phones die.

These are (probably) the things that Block’s Cash App had in mind when they introduced their Cash App Cash Cards.

If you haven’t heard of the Cash App cards, well, they’re pretty much just normal debit cards.

Except instead being connected to Wells Fargo or whatever they’re connected to a payment app that Roddy Rich, 22Gz, Louie Ray, Doe Boy Feat. Key Glock, and a ton of other artists have rapped about: Cash App

That’s right. Finance people can like rap, too. We contain multitudes.

So what’s the deal with the Cash App Cash Card? How does it work? Is it worth checking out?

Let’s take a look.

It’s Actually Pretty Cool

Jack Dorsey probably wasn’t thinking of helping un and underbanked people when his company launched Cash App.

Regardless of initial intent, however, Cash App quickly caught on among people who were most likely to not have traditional savings or checking accounts.

Before long Cash App had essentially become millions of people’s primary solution for storing their money in digital form, and the company clearly took notice.

If you take a look at Cash App’s current slate of functionality (read our full Cash App Review) it’s pretty clear how their overall ethos has developed over the years.

Quick and easy digital payments are still Cash App’s bread and butter, of course, but their ancillary services have obviously grown from curiosities to actual selling points that are actually useful to the populations they serve.

If you’re curious as to what we mean by all that, good. That means you have to keep reading.

Pro Tip:

Cash App has a referral program that can earn you FREE cash in your Cash App account. All you have to do is sign up and refer friends!

Cash, Card or Cash Card?

Let’s start with the easy stuff.

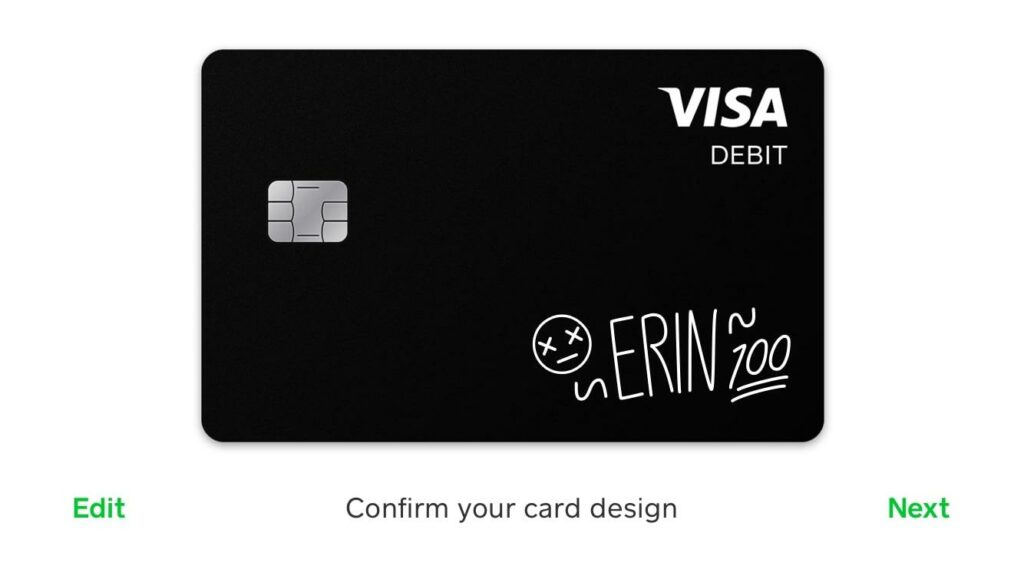

The Cash App Cash Card is just a debit card that’s connected to your Cash App account.

You don’t get it automatically—you can’t download a physical debit card from your app, duh—but you can request it for free through a very visible link on the Cash App app.

The Cash App site says it takes about 10 business days for the card to arrive, but that’s a very conservative estimate.

Once the card arrives, all you have to do to activate it is open your Cash App and use the built-in QR code scanner to read the code attached to the card.

And boom, there you go. It’s that easy with Cash App.

You can also pull up the card details in Cash App and immediately start using it through Apple Pay or Google Pay, but that seems wrong for some reason.

After you activate it, the Cash App Cash Card acts just like any other debit card.

It has a chip, a PIN that you select upon activation, and a strip for swiping at the card reader if the chip thingy isn’t working.

Boosts and Such

If you browse through the tabs on your Cash App you’ll quickly stumble upon a bunch of “Boosts,” which folks might recognize as “coupons” or “discounts.”

These discounts, meager though they may be in most cases, are some of the perks that come built into your Cash App account.

All the deals are pretty modest as far as we can tell, but it’s still nice that Cash App gives you the chance to save on products from participating stores.

A careful digital coupon clipper can save a few bucks here and there with Cash App on clothes, sporting goods, food, and so on, which can definitely add up to some decent savings over time…provided you were already going to buy those things, of course.

Real Savings

At some point Cash App added what amounts to an interest-free savings account insured up to $250k by the Federal Deposit Insurance Corporation (FDIC) into the app’s functionality. Did we mention that starting November 8, 2024, Cash App’s savings APY offer will be changing to 4% APY?

It’s not the most useful feature on its own—interest is really the only reason to keep a savings account instead of a checking account—but the Cash App savings account does have a couple of neat things going for it.

If you want you can turn on a feature that rounds up to the next dollar every time you make a transaction on Cash App and funnels the extra cents to one of three places: A savings account, a stock account, or a Bitcoin account.

If you’re the kind of person who makes a bunch of transactions on Cash App, activating the rounding up feature and having it sent to a Cash App savings account can be very helpful.

It’s hard for most of us to save considering how insanely low wages are and how ridiculously expensive everything is.

But you know what’s easy?

Saving money without changing your behavior at all.

The Cash App savings accounts also let you do a things like setting savings targets—think “I want to save $X for a vacation,” etc—and the app will keep track of how far you are from your goals.

Again, not really useful, but kind of neat and potentially helpful for some folks.

Pro Tip:

Cash App has a referral program that can earn you FREE cash in your Cash App account. All you have to do is sign up and refer friends!

Deposits Made Easy

Cash App isn’t a bank, so they don’t have any brick and mortar locations where you can deposit cash into your Cash App account.

What Cash App does have, however, is partnerships with a ton of different vendors around the country.

If you want to deposit cash all you have to do is go into a participating store and ask the person behind the counter to deposit it to your Cash App account for you.

It’s quick and easy—though you’ll want to look up which stores are participating in the Cash App program beforehand.

Cash App also lets you use it as a direct deposit destination, something that only used to be possible with actual checking or savings accounts.

If you get it set up properly—and it’s not exactly clear how to do it—you can also get access to your paycheck up to two days before it gets direct deposited to your Cash App.

And sure, that just lets you borrow two days’ worth of money from your next paycheck, but it’s still kind of neat, right?

Finally, if you have over $300 direct deposited each month Cash App will reimburse any withdrawal fees you incur when you use your Cash Card to withdraw money from in-network ATMs.

It’s a nice feature, especially if you make frequent cash withdrawals.

Those fees add up pretty quickly.

More Finance, Please

And last but not least, Cash App offers a couple of services designed to help everyone get accustomed to and participate in the whole financial system.

Taxes

First: Taxes.

No one likes doing or paying taxes, but we kind of need them if we want to have roads and schools and Tomahawk missiles.

Doing your taxes can be kind of complicated and expensive if you don’t know what you’re doing.

Cash App knows all of this, so they were kind enough to build a tax preparation and filing feature into their app.

Cash App’s tax feature is available on either your phone or your computer, it doesn’t charge fees of any kind, and it even lets you fill out your information by snapping a picture of your W-2 with your phone.

Cash App claims it only takes five minutes or so, which must have enraged CPAs across the nation.

You’re guaranteed a fee-free experience, a promise of the biggest possible refund, and you can get your refund deposited into your Cash App account up to six days early.

Not bad, huh?

Investing

Remember that stuff about rounding up on every purchase and depositing it into a savings account?

The money doesn’t have to go to a savings account.

Cash App also has a built-in stock portfolio and Bitcoin wallet, both of which can be the automatic recipients of any rounded-up cents from your purchases.

The functionality leaves a lot to be desired, but it’s a very nice little introduction into the world of investing for users who may have never bothered with it otherwise.

Pro Tip:

Cash App has a referral program that can earn you FREE cash in your Cash App account. All you have to do is sign up and refer friends!

Conclusion

Over the years Cash App has grown from simple digital payment app to pseudo-bank and introduction to the financial system.

Cash App still does payments, but now it’s also home to savings accounts, stock portfolios, Bitcoin wallets, free tax preparation services, and more.

The Cash App Cash Card is really just a debit card connected to your Cash App account.

There’s nothing too special about it.

But that’s kind of the point.

It’s not special. It’s a normal personal finance tool that many of us take for granted, and may have been long out of reach for others.

There are still millions of Americans who don’t have any kind of bank account.

Those people are essentially locked out of the financial system, and participating in the financial system isn’t optional in 2023.

So let’s be grateful to Cash App for that, at the very least…

…and for all the awesome songs it inspired.

If you’re looking for a way to send money internationally, read our Remitly review!