In today’s global economy, sending money abroad should be easy, fast, and affordable—and that’s exactly what Remitly aims to deliver. With a strong focus on serving immigrants and their families, Remitly offers international money transfers that are cost-effective and user-friendly, supported by a wide range of payout options.

Whether you’re sending funds for family support, emergencies, or gifts, this platform delivers convenience with transparent pricing.

In this 2025 Remitly review, we’ll explore how the platform works, break down fees and features, and help you decide whether it’s the right tool for your international money transfers.

What Is Remitly?

Remitly is an online money transfer service designed for sending money from countries like the United States, Canada, the UK, and Australia to over 170 destinations around the world.

Unlike traditional wire services or banks, Remitly was built from the ground up with mobile-first functionality and a deep understanding of the remittance market. Founded in 2011, it now serves millions of customers and specializes in helping immigrants send money back home quickly, securely, and affordably.

In the U.S., Remitly is registered as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), ensuring compliance with anti-money laundering regulations and financial security standards.

How Remitly Works

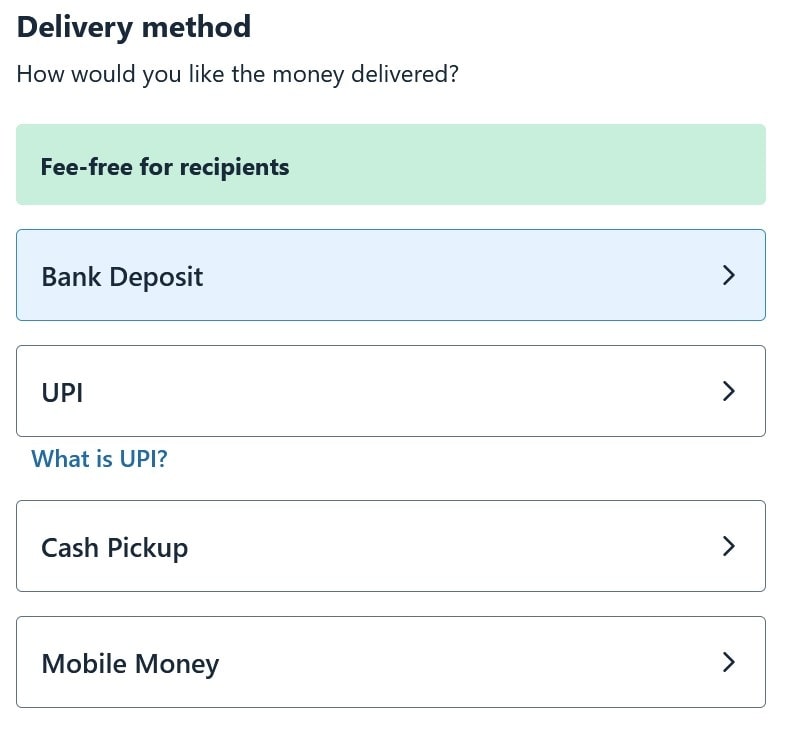

Remitly lets you transfer money internationally through its website or mobile app. You choose the amount, select the country and delivery method (bank deposit, cash pickup, mobile money, or home delivery), and fund your transfer using a debit card, credit card, or bank account.

Recipients can receive money in local currency through supported banks, mobile money providers, or trusted payout locations like Western Union agents and partner banks.

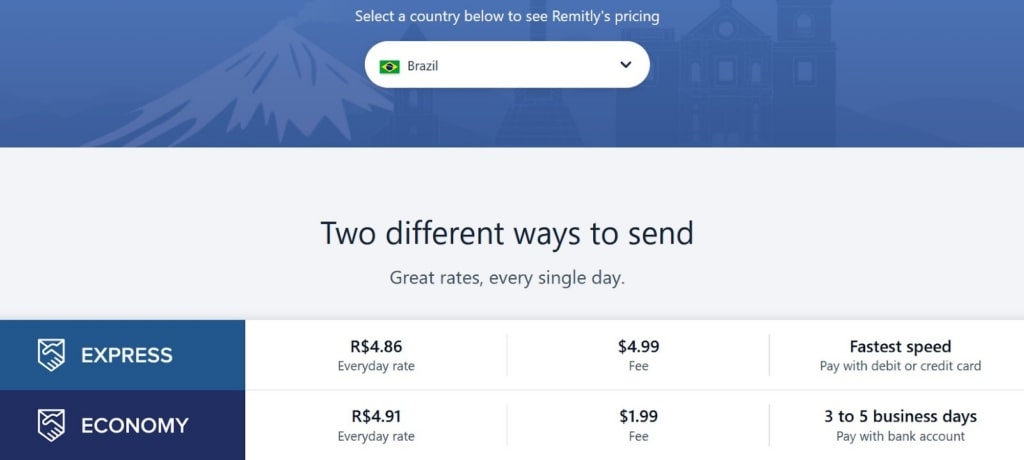

One of Remitly’s standout features is the ability to choose between two delivery speeds:

- Express: Faster delivery with higher fees (often minutes)

- Economy: Lower fees with slightly slower delivery (1–5 business days)

Both options offer full transparency and tracking, ensuring you know exactly when your money arrives.

Fees and Exchange Rates

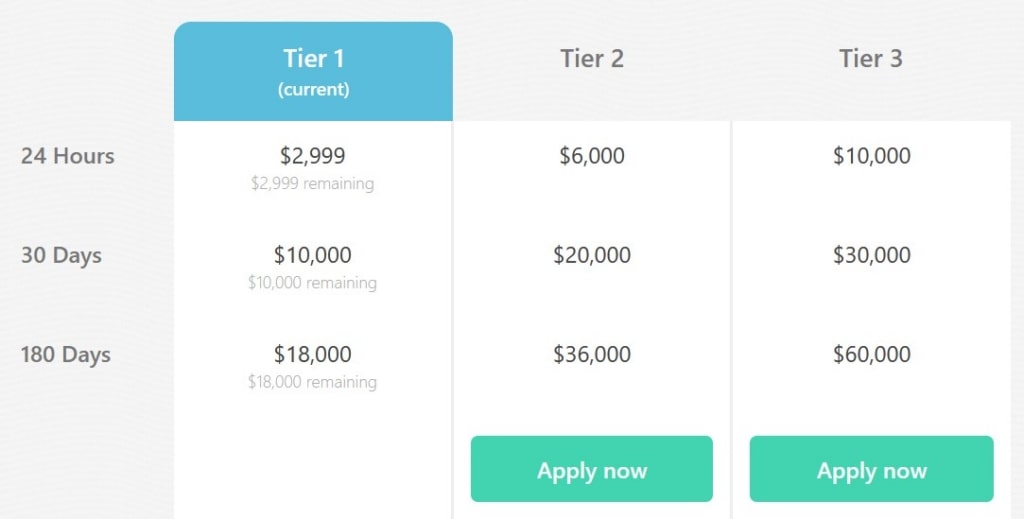

Remitly is known for offering competitive fees and strong exchange rates. The actual cost of your transfer will depend on factors like:

- Your sending and receiving countries

- The amount you send

- Your chosen delivery speed

- Your payment method

Debit card payments usually offer a balance between speed and cost, while credit card payments may incur higher fees. Bank transfers are usually the cheapest payment method, especially when using the Economy option.

Exchange rates are clearly displayed before you confirm your transfer, so there are no surprises. While some providers hide fees in unfavorable exchange rates, Remitly gives users full visibility, with rates updated in real time.

Pro Tip:

Need to send money across borders quickly? Try Remitly now and enjoy low fees with fast delivery.

Updated Remitly Review Fees (April 2025)

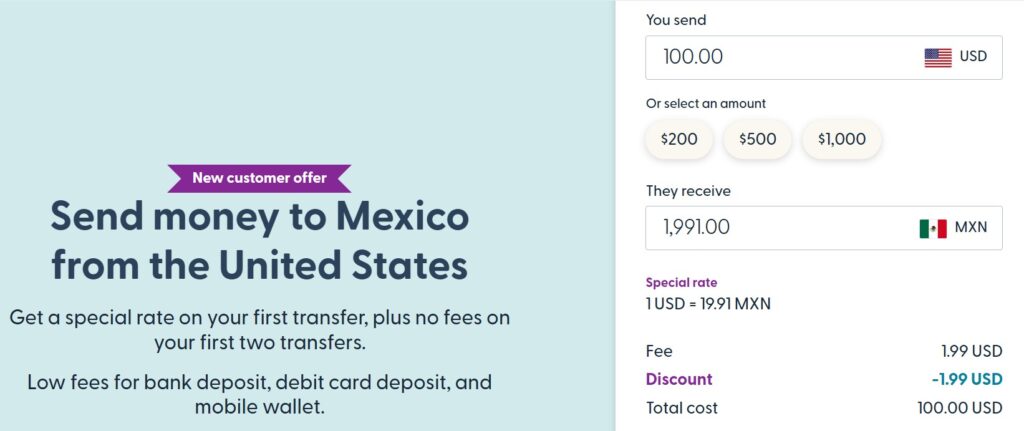

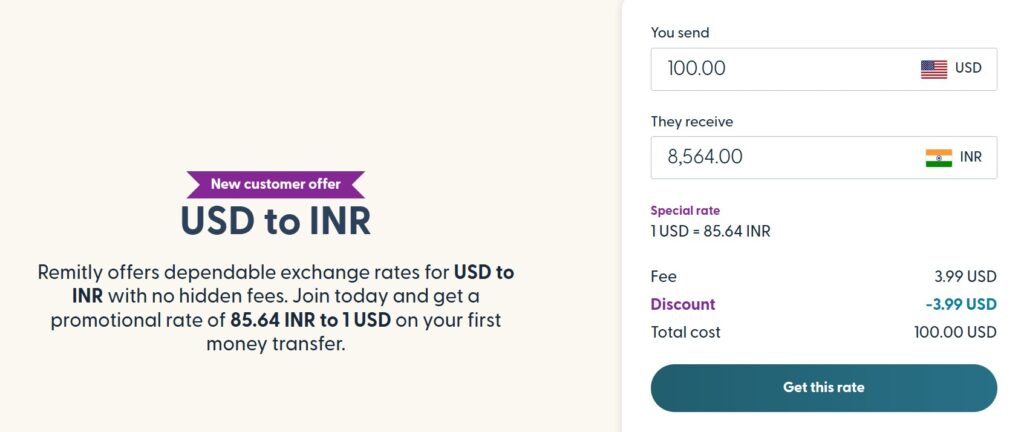

Fees vary widely depending on the country corridor, payment method, and delivery speed. Here’s a snapshot of Remitly’s fee structure as of April 2025:

- Express transfers (U.S. to Mexico): ~$3.99 using a debit card, ~$9.99 using a credit card

- Economy transfers (U.S. to India): $0 when sending from a bank account

- Express transfers (U.S. to the Philippines): ~$3.99 with a debit card

- Bank account transfers to most countries: Often free or under $1 for Economy speed

- Credit card payments: Typically carry additional fees of 3% or more

- Exchange rate margins: Competitive, typically 1–2% below mid-market rate, displayed upfront

Always check Remitly’s platform before sending, as fees and rates can change based on promotional offers, currency fluctuations, or country-specific updates.

Transfer and Delivery Options

Remitly’s delivery network spans over 170 countries and includes thousands of partner banks and cash pickup locations. Depending on the recipient’s country, your money can be delivered through:

- Bank deposit

- Cash pickup

- Mobile wallets (e.g., M-Pesa, GCash)

- Home delivery (available in select countries)

This flexibility is ideal for families and friends who may not have a bank account or internet access. The platform’s robust network includes major financial partners in regions like Latin America, Africa, Southeast Asia, and Eastern Europe.

Security Measures

Remitly takes user protection seriously. Transfers are safeguarded by encryption, two-factor authentication, and strict verification processes. The company is registered with financial regulatory authorities in the countries it operates and partners only with vetted financial institutions.

In addition, Remitly offers a delivery guarantee—if your money doesn’t arrive by the promised time, your fee may be refunded.

Remitly App Experience

The Remitly mobile app is designed for ease of use, security, and real-time control over international money transfers. Available on iOS and Android, the app supports secure biometric login, multilingual functionality, and instant push notifications that keep users informed of each step in the process.

Transfers can be initiated and tracked entirely within the app, making it accessible for users on the go. Whether sending funds to a bank account or opting for cash pickup, users benefit from real-time tracking and the ability to make quick adjustments if needed. The app also provides 24/7 access to customer support, ensuring assistance is always a tap away.

Pros and Cons

Remitly shines for users who value speed, flexibility, and transparency when sending money across borders. Its support for various payout methods and commitment to affordable, secure transfers makes it a standout.

However, users should be aware that fast delivery comes at a higher cost, and not all features are available in every country. The platform is best suited for users who need dependable options with low fees and are comfortable with ID verification and app-based services.

Who Should Use Remitly?

Remitly is ideal for people who need to send money internationally with speed and confidence—especially immigrants supporting family in countries where mobile money or cash pickup is preferred.

It’s also great for anyone who wants flexible options and low fees without sacrificing security.

Pro Tip:

Remitly lets you send money to over 145 countries around the world, with plenty of options for transfer speed and delivery method. Get started with Remitly!

Remitly vs. Traditional Banks

Traditional banks have long dominated the international transfer space—but not without drawbacks. Banks often charge hefty wire transfer fees, tack on hidden exchange rate markups, and require recipients to have a bank account. Transfers through banks can also take several business days to complete and may involve complex documentation.

In contrast, Remitly offers faster transfers and a greater variety of payout methods, including mobile wallets and cash pickup. The platform is also significantly more transparent about fees and exchange rates, with no surprise charges at the end.

For users who prioritize speed, flexibility, and lower costs, Remitly often outperforms traditional financial institutions.

How Remitly Compares to Other Transfer Services

Remitly stacks up well against competitors like Wise, Western Union, and Xoom. While Wise may offer better rates for bank-to-bank transfers in some regions, Remitly wins with mobile wallet support and broader pickup options. Compared to legacy services like Western Union, Remitly is typically more affordable and easier to use.

Pro Tip:

Receive a zero fee bonus on your first new user transfer with Remitly, Get started today.

First-Time Senders: What to Expect

If you’re making your first money transfer with Remitly, the process is simple.

After creating your account, you’ll choose the destination country, input recipient details, and select your delivery method and funding source. New Remitly users often receive promotional discounts or great rates for their first money transfer, which adds additional value.

Once you’ve verified your ID, you can track your transaction from start to finish through the app or website. The entire process is designed to be seamless, even for those who have never made an international transfer before.

Hidden Fees and Transparency

One of Remitly’s strengths is its commitment to pricing transparency. Unlike traditional banks or legacy providers that bury costs in exchange rate markups or unlisted service charges, Remitly spells out the full cost of each transfer before you hit send.

There are no hidden fees added at the receiving end, and even currency conversion rates are provided upfront. The clarity in pricing builds trust and allows users to compare options with confidence. For users who value simplicity and honesty in financial transactions, this sets Remitly apart from competitors.

Send Money Worldwide with Confidence

Remitly supports transfers to over 170 countries and allows users to send money worldwide with just a few clicks. Whether you’re transferring funds to Latin America, Southeast Asia, or Africa, the platform’s reach ensures reliable delivery.

Local partnerships with trusted banks and payout agents increase reliability, and multiple payment methods—from debit cards to mobile money—allow users to fund transfers in the way that works best for them.

Whether you’re sending funds to a friend in El Salvador or a family member in Ghana, Remitly’s network of partners ensures dependable coverage across borders.

Final Verdict: Is Remitly the Best?

Remitly is a standout option for international money transfers in 2025, particularly for individuals supporting family and friends across borders. With transparent pricing, fast delivery options, and a user-friendly app experience, it simplifies the often-complicated world of remittances.

Users benefit from features like mobile wallet transfers, instant cash pickup, and multi-language support, making it an inclusive tool for global families.

With flexible payment methods, low-cost economy options, and an intuitive interface, Remitly continues to meet the needs of millions. If you’re looking for a remittance service that puts transparency, speed, and convenience first, Remitly remains a trusted choice.

For crypto-based or investment-focused transfers, however, you might want to explore options like eToro for broader functionality beyond remittances.

FAQs

Yes. Remitly uses bank-level encryption and complies with international regulatory standards. It also offers two-factor authentication and delivery guarantees.

Fees vary based on transfer speed, destination country, and payment method. Economy transfers funded by bank account are usually the cheapest.

Bank deposits, cash pickups, mobile wallets, and home delivery in select countries.

Yes. You’ll get updates via app notifications, SMS, or email, and can see the status in your dashboard.

Yes. 24/7 support is available through its help center and live chat.